Question: The following information is based on an

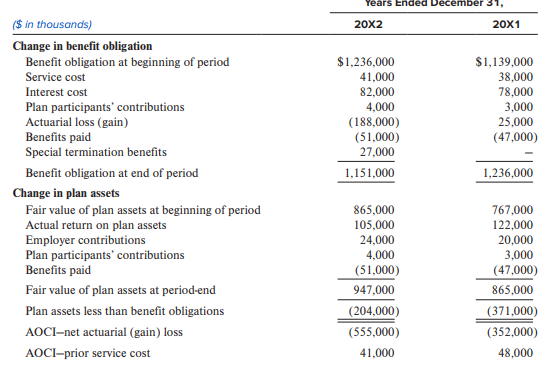

The following information is based on an actual annual report. Different names and years are being used. Bond and some of its subsidiaries provide certain postretirement medical, dental, and visioncare and life insurance for retirees and their dependents and for the surviving dependents of eligible employees and retirees. Generally, the employees become eligible for postretirement benefits if they retire no earlier than age 55 with 10 years of service. The liability for postretirementbenefits is funded through trust funds based on actuarially determined contributions that consider the amount deductible for income tax purposes. The health care plans are contributory,funded jointly by the companies and the participating retirees. The December 31, 20X2and 20X1, postretirement benefit liabilities and related data were determined using the January 1,20X2, actuarial valuations. Information related to the accumulated postretirement benefit obligation plan for the years 20X2 and 20X1 follows:

The assumed discount rates used to determine the benefit obligation as of December 31,

20X2 and 20X1, were 7.75% and 6.75%, respectively. The fair value of plan assets excludes

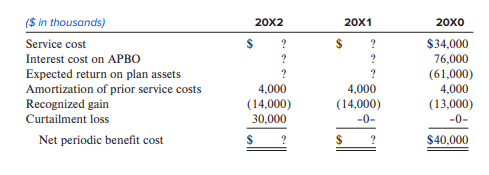

$9 million and $7 million held in a grantor trust as of December 31, 20X2 and 20X1, respectively, for the payment of postretirement medical benefits. The components of other postretirement benefit costs, portions of which were recorded ascomponents of construction costs for the years 20X2, 20X1, and 20X0, follow:

The other postretirement benefit curtailment losses in December 20X2 represent the recognition of $3,000 of additional prior service costs and a $27,000 increase in the benefit obligations resulting from special termination benefits. The health care cost trend rates used to measure the expected cost of the postretirementmedical benefits are assumed to be 8.0% for pre-Medicare recipients and 6.0% for Medicarerecipients for 20X2. Those rates are assumed to decrease in 0.5% annual increments to 5% forthe years 20X5 and 20X4, respectively, and to remain level thereafter. The health care costtrend rates, used to measure the expected cost of postretirement dental and vision benefits, area level 3.5% and 2.0% per year, respectively. Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans.

Required:

1. Assuming an expected rate of return on plan assets for 20X2 and 20X1 of 8.8% and 9%, respectively, compute the missing amounts in the first table and determine the Net Âperiodic benefit cost for years 20X2 and 20X1. (Round amounts to nearestmillion.)

2. Assuming that the employer submitted the $4,000,000 of participant contributions directlyto the trust, show the journal entry that Bond would make to record its 20X2 company(employer) contribution, Net periodic benefit cost, and AOCI effects.

3. Show that the 20X2 journal entries result in a balance sheet pension asset (liability) equalto the funded status. Assume that the beginning 20X2 balance equals the ending 20X1funded status.

> Following is selected information from the balance sheet for Flaps Inc. Solve for the missing amounts for each of the five years.

> The following is the pre closing trial balance of Ralph Retailers, Inc.: The following additional information is provided: a. The company paid a salary advance of $5,000 to one of its employees, a total that was debited to the Salaries expense account. T

> a. On January 1, 20X1, Frances Corporation started doing business and the owners contributed $200,000 capital in cash. b. The company paid $24,000 to cover the rent for the office space for the 24-month period from January 1, 20X1, to December 31, 20X2.

> The following income statement and balance sheet information is available for the operating segments of Bogart, Inc. The segments do not sell goods or services to one another. The Flynn and Cagney segments have similar economic characteristics, products,

> Refer to the facts in problem P18-7. Required: 1. Translate Mavrogenes’s 20X1 Income Statement into U.S. dollars using the temporal method. 2. Translate Mavrogenes’s 20X1 Statement of Retained Earnings into U.S. dollars using the temporal method. 3. Tra

> Mavrogenes Corporation is a wholly owned Canadian subsidiary of a U.S. parent company. Mavrogenes was formed on January 1, 20X1, when the parent invested C$40 million and Mavrogenes issued 100 shares of common stock. The following are Mavrogenesâ&#

> Refer to Darvish Company in problem P18-5. Use the same information, except assume Cubbie translates Darvish’s financial statements into U.S. dollars using the temporal method. Required: 1. What is the amount of Darvish’s translation exposure at Decembe

> Darvish Company is a European subsidiary of Cubbie Corporation, a U.S. company. Darvish had the following balance sheet at December 31, 20X1: There are no differences between local GAAP and U.S. GAAP for Darvish. Cubbie Translates Darvishâ€

> Neville Company decides at the beginning of 20X3 to adopt the FIFO method of inventory valuation. It had used the LIFO method for financial reporting since its inception on January 1, 20X1, and had maintained records that are sufficient to retrospectivel

> Nagy Corporation’s International Division consists of two of Nagy’s subsidiaries. One of the subsidiaries operates in the United Kingdom and the other on the European continent. The U.K. subsidiary had identical sales revenue amounts, as measured in Brit

> Mack Company is a European subsidiary of Bear Down Corporation, a U.S. company. Mack had the following balance sheets at December 31, 20X2, and December 31, 20X1. Also provided above are the U.S. dollar amounts that appeared in Mack’s t

> Maples Corporation is a Canadian subsidiary of a U.S. parent company. Shown below is the company’s local currency income statement for 20X1. All transactions the company entered into should be considered to have occurred evenly througho

> Wilde Company acquired 30% of Micki, Inc., on January 1, 20X1, at a cost of $40 million. At the time, Micki’s balance sheet was as follows: Only one of Micki’s separately identifiable assets and liabilities had a fair

> On January 1, 20X1, Pluto Company acquired all of Saturn Company’s common stock for $1,000,000 cash. On that date, Saturn had retained earnings of $200,000 and common stock of $600,000. The book values of Saturn’s asse

> The following are the balance sheets for Plate and Salad immediately prior to Plate’s September 1, 20X1, acquisition of Salad: Consider the following cases: Case 1 Plate buys 100% of Salad’s common stock for $180,000 c

> Prince Corp. and Sprite Corp. reported the following balance sheets at January 1, 20X1: On January 2, 20X1, Prince issued $36,000 of stock and used the proceeds to purchase 90% of Sprite’s common stock. The excess of the purchase price

> On January 1, 20X1, Delta Inc. acquired 80% of Sigma Company’s outstanding stock for $80,000 cash. Following are the balance sheets for Delta and Sigma immediately before the acquisition, as well as fair value information regarding Sigm

> On January 1, 20X1, Newyork Capital Corporation purchased 30% of the outstanding common shares of Delta Crating Corp. for $250 million and accounts for this investment under the equity method. The following information is available regarding Delta Cratin

> On December 31, 20X1, Pate Corporation acquired 80% of Starmont Corporation’s common stock for $900,000 cash. Assume that the fair values of Starmont’s identifiable assets and liabilities equaled book values on the acq

> Following are Crash Zone Corporation’s balance sheet at the end of 20X0 and its cash flow statement for 20X1. Crash Zone manufactures safety equipment for race cars. Structure of the Balance Sheet and Statement of Cash Flows Additional

> Second National Insurance Company provided this information for its minority-passive equity securities: Required: 1. Provide the journal entries to record the fair value adjustment on December 31, 20X1. Assume that Second National uses an account entitl

> Amiel Company acquired 90% of the common stock of Talia Corporation on December 31, 20X0. The balance sheets of the two companies immediately after the acquisition was made are shown below: The following are the two companies’ income st

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Agranoff Corporation purchased two zero-coupon bonds on January 1, 20X1. The first bond was issued by Lilah Company. It had a face amount of $100,000 and was scheduled to mature on December 31, 20X5. Agranoff paid $80,245, resulting in an effective inter

> Terry Corporation reported fair values for its minority-passive equity investment portfolio at the last four year-ends as shown in the table below. The company did not buy or sell any investments in 20X1, 20X2, or 20X3. No dividends are paid on any of th

> On January 1, 20X1, Fig land Company purchased for cash 40% of Irene Company’s 300,000 shares of voting common stock for $1,800,000. At the time, 40% of the book value of the underlying equity in Irene’s net assets was $1,400,000; $50,000 of the excess w

> Rite Aid Corporation operates retail drugstores in the United States. It is one of the country’s largestretail drugstore chains with 3,333 stores in operation as of March 3, 20X3. The company’s drugstoresâ€&

> Omega Corporation’s comparative balance sheet accounts worksheet at December 31, 20X1and 20X0, follow, together with a column showing the increase (decrease) from 20X0 to 20X1. Additional Information: • On December 31

> The balance sheet and income statement for Bertha’s Bridal Boutique are presented along with some additional information about the accounts. You are to answer the questions that follow concerning cash flows for the period. a. All accoun

> A statement of cash flows for Friendly Markets, Inc., for 20X1 appears below. Required: Prepare the worksheet entry that would be made to prepare a cash flow statement for each ofthe numbered line items. For example, the worksheet entry for item (1) is

> Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 20X1and 20X0. Additional Information: • On January 2, 20X1, Bergen sold all of its marketable investment securities for $95,000 cash. â€&c

> The balance sheets of Global Trading Company follow: Additional Information: • The company reported a net loss of $279,500 during 20X1. • There are no income taxes. • Goodwill as of December 31, 20X0

> Neighborhood Supermarkets is preparing to go public, and you are asked to assist the firm bypreparing its statement of cash flows for 20X1. Neighborhood’s balance sheets at December 31, 20X0, and December 31, 20X1, and its income statem

> The following are selected balance sheet accounts of Zach Corporation at December 31, 20X1and 20X0, as well as the increases or decreases in each account from 20X0 to 20X1. Also presented is selected income statement information for the year ended Decemb

> The Barden Corporation’s comparative balance sheets for 20X1 and 20X0 are presented below. Additional Information: a. On January 11, 20X1, Barden purchased land for $170,000 cash. b. On January 23, 20X1, Barden extinguished long-term bo

> Karr, Inc., reported net income of $300,000 for 20X1. Changes occurred in several balance sheet accounts as follows: Additional Information: a. During 20X1, Karr sold equipment costing $25,000, with accumulated depreciation of $12,000, for a gain of $5,

> The management of Banciu Corporation provides you with comparative balance sheets at December 31, 20X1, and December 31, 20X0, appearing below. Supplemental Information: a. The following table presents a comparative analysis of retained earnings as of De

> Recall the Rombaurer Metals example in the chapter: On October 1, 20X1, Rombaurer has 10 million pounds of copper inventory on hand at an average cost of $0.65 a pound. The spotprice for copper is $0.90 a pound. Instead of selling copper now, Rombaurer d

> On January 1, 20X1, Four Brothers Manufacturing borrowed $10 million from Guiffrie Bankby signing a three-year, 8.0% fixed-rate note. The note calls for interest to be paid annually on December 31. The company then entered into an interest rate swap agre

> Provided below are excerpts from The Walt Disney Company Form 10-K for the fiscal year ended October 3, 2015. Description of the Business and Segment Information The Walt Disney Company, together with the subsidiaries through which businesses are conduct

> Basie Business Forms borrowed $5 million on July 1, 20X1, from First Kansas City Bank. Theloan required annual interest payments at the LIBOR rate, reset annually each June 30. Theloan principal is due in five years. The LIBOR rate for the first year is

> Newton Grains plans to sell 100,000 bushels of corn from its current inventory in March 20X2. The company paid $1 million for the corn during the fall 20X1 harvest season. On October 1, 20X1, Newton writes a forward contract to sell 100,000 bushels of co

> Silverado Inc. buys titanium from a supplier that requires a six-month firm commitment on allpurchases. On January 1, 20X1, Silverado signs a contract with the supplier to purchase 10,000 pounds of titanium at the current forward rate of $310 per pound w

> Exhibit 19.1 describes Chalk Hill’s use of an interest rate swap to hedge its cash flow exposureto interest rate risk from variable rate debt. The journal entries in the exhibit illustrate howspecial “hedge accounting” rules apply to the swap. Suppose in

> On July 1, 20X1, Stan Getz, Inc., bought call option contracts for 500 shares of Selmer Manufacturing common stock. The contracts cost $200, expire on September 15, and have anexercise price of $40 per share. The market price of Selmer’s stock that day w

> George Corporation has a defined benefit pension plan for its employees. The following information is available for 20X1: Required: 1. What was the January 1, 20X1, fair value of the plan assets? 2. What is the expected dollar return on plan assets for 2

> The following information pertains to the pension plan of Beatty Business Group: Note that the information in Columns (2) and (3) are as of the beginning of the year, whereasthe information in Column (4) is measured over the year. The AOCIâ€&#

> Use the same set of facts as in P15-5. In addition, assume that based on ERISA rules, Magee Corporation must contribute the following amounts to the pension fund: Magee intends to fund the pension plan only to the extent required by ERISA rules. Assumeth

> On January 1, 20X1, Magee Corporation started doing business by hiring R. Walker as an employeeat an annual salary of $50,000, with an annual salary increment of $10,000. Based on his currentage and the company’s retirement program, Walker is required to

> Excerpts from IBM’s 2012 segment disclosures are given below. Business Segments and Capabilities The company’s major operations consist of five business segments: Global Technology Services and Global Business Services

> You have the following information related to Chalmers Corporation’s pension plan: a. Defined benefit, noncontributory pension plan. b. Plan initiation, January 1, 20X3 (no credit given for prior service). c. Retirement benefits paid at

> Puhlman Inc. provides a defined benefit pension plan to its employees. It’s a smoothrecognition of its gains and losses when computing its market-related value to compute expected return. Additional information follows: During 20X1, the

> Turner Inc. provides a defined benefit pension plan to its employees. The company has 150employees. The remaining amortization period at December 31, 20X0, for prior service cost is 5 years. The average remaining service life of employees is 11 years at

> Berle Corp. has a defined benefit pension plan that features the following data: January 1, 20X1 (beginning of fiscal year): The CFO of Berle Corp. devises a plan to inflate artificially net income by using an estimate for expected return on plan assets

> Selected pension information extracted from the retirement benefits note that appeared in Green’s 20X1 annual report follows. (These numbers have been modified but are based on theactivities of a real company whose name has been disguis

> On January 1, 20X1, Cello Co. established a defined benefit pension plan for its employees. At January 1, 20X1, Cello estimated the service cost for 20X1 to be $45,000. At January 1, 20X2,it estimated 20X2 service cost to be $49,000. On the plan inceptio

> The following information pertains to Sparta Company’s defined benefit pension plan for 20X1: Service cost for 20X1 was $90,000. The Sparta pension plan did not receive any employercontributions or pay any benefits during the year. Spar

> In 20X1, Phillips Company reported $10,000,000 of pre-tax book income and also had $10,000,000 of taxable income. It incurred a $1,000,000 book expense that it deducted on itstax return. Assuming a 21% tax rate, this deduction results in a $210,000 tax b

> Mozart Inc.’s $98,000 taxable income for 20X1 will be taxed at the 21% corporate tax rate. Fortax purposes, its depreciation expense exceeded the depreciation used for financial reportingpurposes by $27,000. Mozart has $45,000 of purchased goodwill on it

> Bryan Trucking Corporation began business on January 1, 20X1, and consists of the parententity, domiciled and operating in Country X, and a subsidiary operating in Country Y. Bryanis required, as a listed company in Country X, to prepare financial statem

> The following is an excerpt from McDonald’s Corporation’s 2015 Management Discussion and Analysis. The MD&A, which is included in the Form 10-K annual report to the SEC, provides insight into the financial statemen

> On January 1, 20X1, the Dolan Company purchased a new office building in Las Vegas for $6,100,000, which it holds for rentals and capital appreciation. Dolan estimated the buildingwould have a useful life of 25 years and a residual value of $1,100,000. D

> Metge Corporation’s worksheet for calculating taxable income for 20X1 follows: The enacted tax rate for 20X1 is 21%, but it is scheduled to increase to 25% in 20X2 and subsequent years. All temporary differences are originating differen

> Nelson Inc. purchased machinery at the beginning of 20X1 for $90,000. Management used thestraight-line method to depreciate the cost for financial reporting purposes and the sum-of the years’ digits method to depreciate the cost for tax purposes. The lif

> For financial statement reporting, Lexington Corporation recognizes royalty income accordingto GAAP. However, royalties are taxed when collected. At December 31, 20X0, deferred royaltyincome of $400,000 was included in Lexington’s balance sheet. All of t

> Early in 2017, Altuve Corporation forecasted that it would report a deferred tax liability of $70million at December 31, 2017, representing the additional tax that would be due to U.S. authorities if its un repatriated foreign earnings were to be repatri

> The following information pertains to Ramesh Company for 20X1: The company has one permanent difference and one temporary difference between book andtaxable income. Required: 1. Calculate the amount of temporary difference for 20X1 and indicate whether

> In early 2017, Quintana Corporation prepared the following forecast of its earnings for 2017and 2018: Quintana’s pre-tax income forecasts include $40 million of nontaxable income in 2017 and $30million of nontaxable income in 2018. Thes

> Current tax law limits the amount of interest expense that corporations may deduct to the sumof (a) taxable interest income and (b) 30% of taxable income (excluding taxable interestincome) before any deductions for interest, depreciation, amortization, o

> Bortles Corporation’s U.S. operations have been in “steady state” for several years, whereby itspre-tax income has been constant (at $400 million each year) and its originating temporarydifferences and reversing temporary differences exactly offset. At D

> Trevathan Corporation has only one source of temporary differences—warranties. At December 31,2016, 2017, and 2018, the amounts of cumulative temporary differences were as follows: Temporary differences related to warranties arise becau

> The disclosure rules for business combinations complicate financial analysis. Trend analysis becomes difficult because comparative financial statements are not retroactively adjusted to include data for the acquired company for periods prior to the acqui

> Devers Corporation began operations in 20X1 and had the following partial income statements, which are complete only down to pre-tax income. Devers had no book-tax differences except for the effects of its net operating loss carryforward. The corporate t

> Cishek Corporation sold $100 million of gift cards in 20X1. The gift cards may be used to purchase goods from Cishek in the future. The gift cards never expire, and Cishek expects that none of the gift cards will go unused. Cishek projects the gift cards

> Goff Corporation has only one temporary difference, which is related to the use of accelerateddepreciation for income tax purposes and straight-line depreciation for financial reporting. Goff had the following amounts of cumulative temporary difference a

> Boers Corporation and Bernstein, Inc. both project pre-tax income of $100 million in 20X1. Both also expect there to be no change in their cumulative temporary differences during the year. However, the two companies are in very different deferred tax pos

> Flower Company started doing business on January 1, 20X0. For the year ended December 31, 20X1, it reported $450,000 pre-tax book income on its income statement. Flower is subject toa 21% corporate tax rate for this year and the foreseeable future. Addit

> In 20X1, MB Inc. is subject to a 21% tax rate. For book purposes, it expenses $1,500,000 ofexpenditures. MB intends to deduct these expenditures on its 20X1 tax return despite tax lawprecedent that makes it less than 50% probable that the deduction will

> Moss Inc. follows GAAP for financial reporting purposes and appropriately uses the installment method of accounting for income tax purposes. It reported $250,000 of pre-tax incomeunder GAAP, but it will report the corresponding taxable income in the foll

> On July 1, 20X1, Burgundy Studios leases camera equipment from Corning stone Corporation. Corning stone had to make significant changes to the equipment to meet Burgundy’s needs, andit would be significantly costly to modify the equipment for alternative

> On December 31, 20X1, Thomas Henley, financial vice president of Kingston Corporation, signed a no cancelable three-year lease for an excavator. The lease calls for annual payments of $41,635 per year due at the end of each of the next three years. The l

> Using the data in P13–6, prepare the journal entries required by Coleman Inc. on January 1, 20X1, assuming that (a) Trask does not guarantee the residual value and (b) Trask doesguarantee it. Coleman paid $325,000 to acquire the office equipment several

> The following information is based on a real company whose name has been disguised. Opus One operates in a single business segment, the retailing and servicing of home audio, car audio, and video equipment. Its operations are conducted in Texas through 2

> On January 1, 20X1, Trask Co.signs an agreement to lease office equipment from Coleman Inc. forthree years with payments of $193,357 beginning December 31, 20X1. The equipment’s fair value is$500,000 with an expected useful life of four years. At the end

> On January 1, 20X1, Bare Trees Company signed a three-year non cancelable lease with Dreams Inc. The lease calls for three payments of $62,258.09 to be made at each year-end. The leasepayments include $3,000 of executory costs related to service. The lea

> On January 1, 20X1, Bill Inc. leases manufacturing equipment from Beatrix Corporation. The lease covers seven years and requires annual lease payments of $51,000, beginning on January 1, 20X1. The unguaranteed residual value at the end of seven years is

> On January 1, 20X1, Seven Wonders Inc. signed a five-year non cancelable lease with Moss Company. The lease calls for five payments of $277,409.44 to be made at the end of each year. The leased asset has a fair value of $1,200,000 on January 1, 20X1. Sev

> Mason Company has a machine with a cost and fair value of $100,000. On January 1, 20X1, itleases the machine for a 10-year period to Drake Company. The machine has a 12-year expectedeconomic life. Payments are received at the beginning of each year. The

> On January 1, 20X1, Bonduris Company leases warehouse space in Oakland, CA. The lease isfor six years with payments to be made at the beginning of each year. The lease calls for Bonduris to pay $15,000 on January 1, 20X1. The lease calls for subsequent l

> On January 1, 20X1, Dwyer Company leases space for a donut shop. The lease is for five yearswith payments to be made at the beginning of each year. The lease calls for Dwyer to pay $10,000 on January 1, 20X1; $11,000 on January 1, 20X2; $12,500 on Januar

> On October 1, 20X1, Brady Consulting leases unmodified equipment from Damon Corporation. The lease covers four years and requires lease payments of $73,046, beginning on September 30, 20X2. The unguaranteed residual value is $200,000. On October 1, 20X1,

> On January 1, 20X1, Merchant Co. sold a tractor to Swanson Inc. and simultaneously leased itback for five years. The tractor’s fair value is $300,000, but its carrying value on Merchant’sbooks prior to the transaction was $200,000. The tractor has a seve

> On January 1, 20X1, Overseas Leasing Inc. (the lessor) purchased five used oil tankers from Seven Seas Shipping Company at a price of $99,817,750. Overseas immediately leased the oiltankers to Pacific Ocean Oil Company (the lessee) on the same date. The

> The income statement for the year ended December 31, 20X1, as well as the balance sheets asof December 31, 20X1, and December 31, 20X0, for Lucky Lady Inc. follow. This informationis taken from the financial statements of a real company whose name has be

> Assume that on January 1, 20X1, Trans Global Airlines leases two used Boeing 737s from Aircraft Lessors Inc. The eight-year lease calls for payments of $10,000,000 at each year-end. On January 1, 20X1, the Boeing 737s have a total fair value of $60,000,0

> Moore Company sells and leases its computers. Moore’s cost and sales price per machine are $1,200 and $3,000, respectively. At the end of three years, the expected residual value is $400,which is guaranteed by the lessee. Moore leases 20 of these machine

> Refer to the information in P13–10. Assume that at the commencement of the lease, collectability of the payments is not probable and the lessor uses the straight-line depreciation method. Required: 1. Prepare the necessary journal entries for Railcar fo

> On January 1, 20X1, Railcar Leasing Inc. (the lessor) purchased 10 used boxcars from Railroad Equipment Consolidators at a price of $8,749,520. Railcar leased the boxcars to the Reading Railroad Company (the lessee) on the same date. The lease is for eig