Question: For 2012, Ontario Manufacturing Company provided

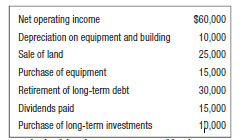

For 2012, Ontario Manufacturing Company provided the following accounting information:

a. Which of the above are sources of funds?

b. Which of the above are uses of funds?

c. What is the overall increase or decrease in cash?

Transcribed Image Text:

Net operating income $60,000 Depreciation on equipment and building 10,000 Sale of land 25,000 Purchase of equipment 15,000 Retirement of long-term debt 30,000 Dividends paid 15,000 Purchase of long-term investments 1p.000

> State the principle of the optimal cash balance.

> The current stock price of Abacus is $50. For the past 20 years, the firm has paid an annual dividend of $5. On July 26, it announced a dividend of $6 payable on September 10 to shareholders of record at the close of business on September 1. a. What do y

> A dividend‐paying company has a current dividend yield of 8 percent and a stock price of $100. The company has paid the same dividend for the past 15 years and it is not expected to change. Alice believes that the company is an excellent investment oppor

> MCC Corporation currently has cash flow from operations of $10 million, capital expenditures of $8 million, and pays a dividend of $2 million (all are perpetuities). The firm has no growth prospects or debt, and shareholders expect an annual return of 5

> A firm’s next‐period market value of equity is $3 million and there are 100,000 shares outstanding, with K = 12%. a. What is the current stock price if the firm pays $600,000 in cash dividends? b. What is the number of shares outstanding if a firm spends

> Assume that the shareholders of a firm pay a net tax of 30 percent on cash dividends received. After‐tax earnings have been constant at $10 per share. The firm pays out all earnings in dividends at the end of each year. The market requires a 15 percent r

> A firm has one million shares outstanding. After‐tax earnings have been constant at $8 per share. The firm pays out all earnings in dividends at the end of each year. The shareholders’ required rate of return is 15 percent. a. Calculate the current share

> CGC Company is considering its dividend policy. Currently CGC pays no dividends, has cash flows from operations of $10 million per year (perpetual), and needs $8 million for capital expenditures. The firm has no debt and there is no tax. The firm has 2 m

> Describe the implication of releasing the assumptions of no transactions costs.

> How do personal taxes affect preference for high versus low dividend yields?

> According to John Lintner, what is the adjustment factor ß? Interpret the calculated adjustment factor.

> Explain the transactions motive.

> Discuss the “bird in the hand” argument in support of dividend payments.

> Explain the implications of M&M’s homemade dividend argument.

> Describe the difference between a stock dividend and a cash dividend plus a DRIP.

> What does real-world evidence imply about how firms manage their dividend payments?

> Explain the similarities and differences of DRIPs, stock dividends, and stock splits.

> Define four important dates that arise with respect to dividend payments.

> What obvious question arises when we examine cross-sectional patterns in the dividend payouts of individual companies?

> What obvious question arises when we examine historical patterns in aggregate dividend payouts?

> List the main reasons why firms repurchase shares.

> A company has announced an increase in its quarterly dividend from $0.30 to $0.42 per share. If an investor who owns 1,500 shares is in the 25 percent tax bracket, calculate the amount by which the investor ’ s tax would increase annually due to the divi

> Why do securitizations require credit enhancements?

> Describe possible reactions from the market of the following dividend payout changes. a. Dividend initiation b. Dividend increase c. Dividend decrease

> What factors may influence a firm’s decision to enter into share repurchases?

> Why can share repurchases be viewed as an alternative to paying a cash dividend?

> Calculate the cash conversion cycle (CCC) for the company examined in questions 4 to 6. Round to the nearest day. Cash $ 500,000 Marketable securities 800,500 Accounts receivable 700,000 Inventory 1,003,000 Short-term loans 100,000 Accounts payable 8

> How is net working capital calculated?

> State the characteristics of sound net working capital management.

> Reconcile the predictions of M&M with Gordon’s arguments about dividend policy.

> Explain the “bird in the hand” argument about dividends.

> MB Corporation has a receivables turnover of 10, an inventory turnover of 15, and a payables turnover of 5. Calculate its cash conversion cycle. What does a negative cash conversion cycle tell you about MB Corporation’s business?

> Atlantic Transport collects 75 percent of its monthly sales immediately and the rest at the end of the month; has production costs that are 60 percent of sales; pays 50 percent of its bills immediately and the rest at the end of the month; and has four m

> What is the cost of 3/15 net 60 trade credit?

> A firm collects 60 percent of its monthly sales immediately and the rest a month later; its production costs are 80 percent of sales, and it holds two months of sales in inventory. It pays 40 percent of its bills immediately and the remainder after 30 da

> A firm has estimated its sales, purchases from suppliers, and wages and miscellaneous operating cash outlays for the first four months of next year as follows: It estimates that 50 percent of its sales will be for cash, and that it will receive the remai

> Christmas Inc. is a wholesaler of Christmas decorations and wrapping paper. It is a seasonal business and, due to the timing of cash inflows and outflows, it frequently experiences a cash shortfall in the fourth quarter of the year, before it can liquida

> Use the information in the financial statements below to answer the following. a. Calculate the current ratio, quick ratio, and net working capital. b. Calculate the inventory turnover (using revenues), receivable turnover, and payables turnover. c. Calc

> Determine the operating cycle and cash conversion cycle for a company with inventory turnover of 6.25 times per year, receivables turnover of 8 times per year, and an average days of revenues in payables (ADRP) of 40 days.

> Manitoba Services is considering undertaking a new order that would cause its average days of revenues in payables (ADRP) to decrease from 58 days to 48 days, while its average collection period (ACP) will remain at 90 days and its average days revenues

> Great Northern Manufacturing presently has net working capital of $100,000 and sales of $125,000. It is considering entering into a new project that would increase next year’s sales by $15,000. The project would result in a decrease in the average collec

> Explain the difference between the quick ratio and the current ratio.

> Explain the difference between the operating cycle (OC) and the cash conversion cycle (CCC).

> Discuss measures businesses can implement to improve working capital management.

> What are the drawbacks to using the turnover ratio to measure inventory policy?

> Explain the difference between the receivables turnover ratio and the average collection period (ACP).

> a. What can you conclude if a firm’s planned sales growth exceeds its break‐even sales growth rate? b. What can you conclude if a firm’s planned sales growth is less than its break‐even sales growth rate?

> Would each of the following changes increase or decrease the break‐even sales growth rate? a. An increase in the amount of inventory held b. An increase in the proportion of invoices that are paid immediately c. A decrease in the amount of inventory held

> Calculate the ending cash balance of the current month for the following opening cash balance and current month’s cash flows: Beginning cash $ 20,000 Prior month sales 50,000 Current month sales 100,000 Current purchases 35,000 Prio

> What is the connection between cash budgets and pro forma financial statements?

> Describe the types of cash inflows and outflows in a cash budget.

> Why is the efficient utilization of net working capital important?

> Habitant Maple Syrup Sweets Company just issued $25 million of 180‐day commercial paper for net proceeds of $24.5 million. What is the commercial paper’s quoted yield?

> When a firm is deciding whether or not to extend credit to an applicant, what two things need to be established about the applicant?

> What is the difference between a BA and commercial paper?

> What is the purpose of credit analysis and how is it accomplished?

> Explain the function of a factor in working capital management.

> What are three major sources of float? What are some common methods that address float?

> What are the operating cycle and the cash conversion cycle, and how are they related to working capital policy?

> What are the limitations of the current ratio and the quick ratio as measures of working capital management?

> What is an aged accounts receivable report?

> What does 2/10 net 30 mean, and what is the implicit interest cost?

> What are the four C’s of credit?

> Why is trade credit different from bank credit?

> What is the effective annual cost if a firm issues $10 million of 180‐day BAs at a quoted rate of 5.5 percent, and the bank charges it a 0.4 percent stamping fee? Compare the effective annual cost of 180‐day commercial paper issued at $10 million face va

> What additional services does a factor provide over a bank?

> Calculate the effective annual cost of a one‐year $2‐million operating line of credit. The firm borrowed $1.2 million for the first four months of the year and reduced the loan amount to $500,000 for the rest of the year. The quoted interest rate is 6 pe

> A firm engaged a one‐year, monthly pay, $100,000 line of credit at 9 percent plus a 0.25 percent commitment fee on the unused portion of the line. The firm used 75 percent of the line for the first half year and reduced the loan amount to 60 percent for

> Calculate the effective annual cost of issuing 270‐day BAs at a quoted rate of 5 percent with a face value of $10 million. The bank charges a 0.6 percent stamping fee.

> ABC Inc. grants credit terms of net 25. It is considering a new policy that involves more stringent credit terms: net 20. As a result, the price of its product will stay the same at $45. The expected sales will decrease by 2,000 per year to 10,000 units.

> EastShore Inc. has an ACP of 60 days and daily credit sales of $75,000. A factor offers a 60‐day accounts receivable loan equal to 90 percent of accounts receivable. The quoted interest rate is 10 percent and the commission fee is 1.5 percent of accounts

> Suppose that ABC Inc. (see Practice Problem 30) switches to 3/10 net 30 from net 30. It is 80 percent of customers will take advantage of the discount, while the remaining 20 percent will pay on day 30. The price will increase from $52 to $53 per unit; u

> ABC Inc. currently grants no credit, but it is considering offering new credit terms of net 30. As a result, the price of its product will increase by $2 per unit. The original price per unit is $50. Expected sales will increase by 1,000 units per year.

> What is float and why is it important to the firm?

> Why do firms hold cash?

> Explain how trade credit allows firms to use their suppliers as sources of short‐term funds.

> Why should all firms prepare a cash budget?

> What is the difference between profit and cash flow from operations?

> 1. Which of the following is not a warning sign of potential liquidity problems? a. Declines in working capital and daily cash flows b. Increases in accounts receivable and longer collection periods c. Decreases in debt and debt ratios d. A buildup of in

> Why does cash flow from operations increase if the firm speeds up the collection of receivables, delays paying its bills, or increases its inventory turnover ratio?

> What is the relationship between the break-even sales growth rate and a firm’s collection policy, payables policy, and inventory policy?

> Investor A ’ s personal tax rate is 30 percent while Investor B ’ s is 22 percent. Investor A owns 1,000 shares of SNS Company and receives an annual dividend of $1.75 per share. Investor B owns 1,000 shares of CGC Company and receives an annual dividend

> A company receives an average of $100,000 in cheques per day from its customers. It takes the company an average of five days to receive and deposit these cheques. The company is considering a lockbox arrangement that would reduce its collection float ti

> Explain why firms do not simply pay out dividends as a fixed portion of their profits. What do most firms do in terms of dividend policy?

> A firm follows a strict residual dividend policy. This firm will have profits of $800,000 this year. After screening all available investment projects, the firm has decided to take three out of the 10 projects and those three will cost $600,000. The curr

> Currently a firm has an operating cash flow of $42 million and there is a promising project available, which costs $30 million. There are 5 million shares outstanding with a current price of $64 per share. The firm is expected to pay out a dividend of $5

> Describe split shares, and explain what their popularity implies about investor preferences for dividends in the real world.

> Explain why dividend policy will be relevant in the presence of transactions costs, informational asymmetry and agency problems, and taxes.

> According to equity market capitalization, what is the cost of capital for the stock of the following firm? Current market value of the equity is $1.8 million with 150,000 shares outstanding. The stock price is expected grow 6 percent in a year, and the

> What is the market price per share if the next period’s dividend = $2.50, P 1 = $30, and K = 16%?

> A firm has a dividend yield of 3.8 percent and a payout ratio of 36 percent. If its earnings are $22 million and there are 6 million shares outstanding, what is the price per share?

> 1. Dividend‐payout ratio is defined as: a. the dividend yield plus the capital gains yield. b. dividends per share divided by earnings per share. c. dividends per share divided by income per share. d. dividends per share divided by current price per shar

> Briefly describe the notion of homemade dividends as it relates to M&M’s irrelevancy argument.

> There are two suppliers of one input for a factory. Supplier A offers a selling price of $1,000 with terms of 1/10 net 30, while Supplier B offers $1,100 with 3/10 net 60. Which supplier offers the lower effective annual cost?

> Explain the relationship between M&M’s argument and the use of a residual dividend policy.

> Explain how and under what assumptions M&M show that dividends are irrelevant.

> Calculate ROE and ROI given the following.

> Explain how the existence of informational asymmetries and agency problems may lead firms to follow a pecking order to financing.

> 1. What is the invested capital given the following? Accounts receivable = $50,000; current assets = $200,000; total assets = $700,000; shareholders’ equity = $450,000; accounts payable = $10,000; short-term debt = $90,000; and long-term debt = $200,000.

> What are the main determinants of capital structure?