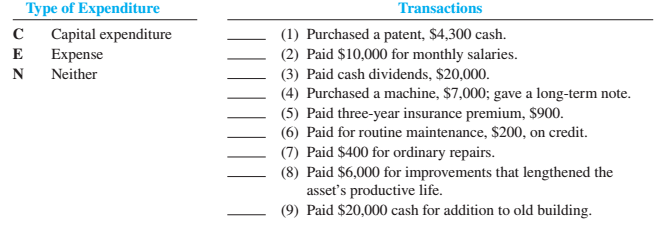

Question: For each of the following items, enter

For each of the following items, enter the correct letter to the left to show the type of expenditure. Use the following:

Transcribed Image Text:

Type of Expenditure Transactions Capital expenditure Expense (1) Purchased a patent, $4,300 cash. (2) Paid $10,000 for monthly salaries. (3) Paid cash dividends, $20,000. (4) Purchased a machine, $7,000; gave a long-term note. (5) Paid three-year insurance premium, $900. (6) Paid for routine maintenance, $200, on credit. E N Neither (7) Paid $400 for ordinary repairs. (8) Paid $6,000 for improvements that lengthened the asset's productive life. (9) Paid $20,000 cash for addition to old building.

> You are a personal financial planner working with a married couple in their early 40s who have decided to invest $100,000 in corporate bonds. You have found two bonds that you think will interest your clients. One is a zero coupon bond issued by PepsiCo

> Lemond Corporation is planning to issue bonds with a face value of $200,000 and a coupon rate of 10 percent. The bonds mature in three years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year

> On January 1 of this year, Gateway Company issued bonds with a face value of $1 million and a coupon rate of 9 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. When the bonds were issued, the annual marke

> On January 1 of this year, Houston Company issued a bond with a face value of $10,000 and a coupon rate of 5 percent. The bond matures in three years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 4

> Park Corporation is planning to issue bonds with a face value of $2,000,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. P

> Park Corporation is planning to issue bonds with a face value of $2,000,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. P

> The annual report of American Airlines contained the following note: The Company recorded the issuance of $775 million in bonds (net of $25 million discount) as long-term debt on the consolidated balance sheet. The bonds bear interest at fixed rates, wit

> Santa Corporation issued a bond on January 1 of this year with a face value of $1,000. The bond’s coupon rate is 6 percent and interest is paid once a year on December 31. The bond matures in three years. The annual market rate of inter

> On January 1 of this year, Ikuta Company issued a bond with a face value of $100,000 and a coupon rate of 5 percent. The bond matures in three years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 6 p

> On January 1 of this year, Avaya Corporation issued bonds with a face value of $2,000,000 and a coupon rate of 6 percent. The bonds mature in five years and pay interest annually on December 31. When the bonds were sold, the annual market rate of interes

> Apple recently issued a series of bonds with various maturity dates. The information below pertains to one of Apple’s bonds: Explain why investors would care about knowing the coupon rate and yield percentages. Assume that over the nex

> On January 1 of this year, Bidden Corporation sold bonds with a face value of $100,000 and a coupon rate of 10 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. Bidden uses the effective-interest amortiz

> On January 1 of this year, Trucks R Us Corporation issued bonds with a face value of $2,000,000 and a coupon rate of 10 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. When the bonds were sold, the ann

> After completing a long and successful career as senior vice president for a large bank, you are preparing for retirement. Visiting the human resources office, you find that you have several retirement options: (1) you can receive an immediate cash payme

> On January 1, Ellsworth Company completed the following transactions (use an 8% annual interest rate for all transactions): a. Borrowed $2,000,000 to be repaid in five years. Agreed to pay $150,000 interest each year for the five years. b. Established a

> Tootsie Roll Industries, Inc., is engaged in the manufacture and sale of confectionery products. Last year, Tootsie Roll reported cost of goods sold of $352 million. This year, cost of goods sold was $342 million. Accounts payable was $9 million at the e

> Ford Motor Company is one of the world’s largest companies, with annual sales of cars and trucks in excess of $144 billion. A recent annual report for Ford contained the following note: Warranties Estimated warranty costs are accrued for at the time the

> Using data from problem Alternate Problem-1, complete the following: Data given in Alternate Problem-1: Sturgis Company completed the following transactions during Year 1. Sturgis’s fiscal year ends on December 31. Required: For each

> Sturgis Company completed the following transactions during Year 1. Sturgis’s fiscal year ends on December 31. Required: 1. Prepare journal entries for each of these transactions. 2. Prepare all adjusting entries required on December 3

> On January 1 of Year 1, Austin Auto Company decided to start a fund to build an addition to its plant. Austin will deposit $320,000 in the fund at each year-end, starting on December 31 of Year 1. The fund will earn 9% annual interest, which will be adde

> Carey Corporation has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: a. Goodw

> Jones Soda is a regional soda manufacturer in the Pacific Northwest. Jones is currently facing three lawsuits, summarized below: a. A customer is suing Jones for $1 million because he claims to have found a piece of glass in his soda. Management deems th

> During the current year ending December 31, Nguyen Corporation completed the following transactions: a. On January 1, purchased a license for $7,200 cash (estimated useful life, four years). b. On January 1, repaved the parking lot of the building leased

> During the current year ended December 31, Rank Company disposed of three different assets. On January 1 of the current year, prior to their disposal, the asset accounts reflected the following: The machines were disposed of during the current year in t

> The Gap, Inc., is a global specialty retailer of casual wear and personal products for women, men, children, and babies under the Gap, Banana Republic, Old Navy, Athleta, and Intermix brands. The Company operates approximately 3,200 stores across the glo

> At the beginning of the year, Ramos Inc. bought three used machines from Santaro Corporation. The machines immediately were overhauled, installed, and started operating. The machines were different; therefore, each had to be recorded separately in the ac

> A recent annual report for AMERCO, the holding company for U-Haul International, Inc., included the following note: NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Note 3. Accounting Policies Property, Plant and Equipment Property, plant and equipment are sta

> On June 1, the Wallace Corp. bought a machine for use in operations. The machine has an estimated useful life of six years and an estimated residual value of $2,000. The company provided the following expenditures: a. Invoice price of the machine, $60,00

> What is the book value of a bond?

> Define deferred revenue. Why is it a liability?

> What is the difference between an unsecured and a secured bond?

> From the perspective of the issuer, what are some advantages of issuing bonds instead of stock?

> Skullcandy designs, markets, and distributes audio and gaming headphones, earbuds, and speakers. Last year, Skullcandy reported cost of goods sold of $158 million. This year, cost of goods sold was $117 million. Accounts payable was $23 million at the en

> Lemond Corporation is planning to issue bonds with a face value of $200,000 and a coupon rate of 10 percent. The bonds mature in three years and pay interest semiannually every June 30 and December 31. All the bonds were sold on January 1 of this year. L

> What is a bond covenant?

> What does the accounts payable turnover ratio tell you about a company? How is the ratio computed?

> In their balance sheets, what do companies call obligations to pay suppliers in the near future?

> What financial statement is the primary source of information about the liabilities of a company?

> When calculating the present value of a bond’s future cash flows, do investors use the coupon rate or market interest rate as the discount rate?

> Differentiate between a bond indenture and a bond prospectus.

> How is the debt-to-equity ratio computed? What does the debt-to-equity ratio tell you?

> Define annuity.

> Explain the concept of the time value of money.

> What is asset impairment? How is it accounted for?

> You work for a small company that is considering investing in a new Internet business. Financial projections suggest that the company will be able to earn in excess of $40 million per year on an investment of $100 million. The company president suggests

> When a company signs a capital lease, does it record an asset and/or a liability on its balance sheet?

> Define working capital. How is working capital computed?

> Define liability. Differentiate between a current liability and a long-term liability.

> Determine whether each of the following would be reported in the financing activities section of the statement of cash flows and, if so, specify whether it is a cash inflow or outflow. 1. Sale of bonds at a discount. 2. Payment of interest on a bond at m

> In what section of the statement of cash flows would you find cash paid for principal when a bond matures? In what section would you find cash paid for interest each period?

> For each of the following items, specify whether the information would be found in the balance sheet, the income statement, the statement of cash flows, or the notes to the statements. 1. The amount of a bond liability. 2. A description of any bond coven

> What assets should be amortized using the straight-line method? a. Intangible assets with definite lives c. Natural resources b. Intangible assets with indefinite lives d. All of the above

> A bond with a face value of $100,000 is sold on January 1. The bond has a coupon rate of 10 percent and matures in 10 years. When the bond was issued, the market rate of interest was 10 percent. On December 31, the market rate of interest increased to 11

> When using the effective-interest method of amortization, interest expense reported in the income statement is impacted by the a. Face value of the bonds. b. Coupon rate stated in the bond certificate. c. Market rate of interest on the date the bonds wer

> A State Lottery Commission ran the following advertisement: The Lotto jackpot for this month’s drawing is $10 million, which will be paid out to the winning ticket in equal installments at the end of each year over the next 20 years. Do you agree that th

> To determine whether a bond will be sold at a premium, at a discount, or at face value, one must know which of the following pairs of information? a. Face value and the coupon rate on the date the bond is issued. b. Face value and the market rate of inte

> A bond with a face value of $100,000 was issued for $93,500 on January 1 of this year. The stated rate of interest was 8 percent and the market rate of interest was 10 percent when the bond was sold. Interest is paid annually. How much interest will be p

> Which of the following is false when a bond is issued at a premium? a. The bond will issue for an amount above its par value. b. Bonds payable will be credited for an amount greater than the bond’s face value. c. Interest expense will exceed the cash int

> Which account would not be included in the debt-to-equity ratio calculation? a. Unearned Revenue. b. Retained Earnings. c. Income Taxes Payable. d. All of the above are included.

> A bond with a face value of $100,000 has a coupon rate of 8 percent. The bond matures in 10 years. When the bond is issued, the market rate of interest is 10 percent. What amount will investors pay for this bond? a. $100,000 b. $87,707 c. $49,157 d. $113

> Which of the following is not an advantage of issuing bonds when compared to issuing additional shares of stock in order to obtain additional capital? a. Stockholders maintain proportionate ownership percentages. b. Interest expense reduces taxable incom

> When using the effective-interest method of amortization, the book value of a bond changes by what amount on each interest payment date? a. Interest expense b. Cash interest payment c. The difference between interest expense and the cash interest payment

> Annual interest expense for a single bond issue continues to increase over the life of the bonds. Which of the following explains this? a. The market rate of interest has increased since the bonds were sold. b. The coupon rate has increased since the bon

> SmallFish Company borrowed $100,000 at 8% interest for three months. How much interest does the company owe at the end of three months? a. $8,000 b. $2,000 c. $800 d. $200

> The present value of an annuity of $10,000 per year for 10 years discounted at 8% is what amount? a. $5,002 b. $67,101 c. $53,349 d. $80,000

> You are a financial analyst charged with evaluating the asset efficiency of companies in the hotel industry. Recent financial statements for Marriott International include the following note: 12. PROPERTY AND EQUIPMENT We record property and equipment at

> How is working capital calculated? a. Current assets multiplied by current liabilities. b. Current assets plus current liabilities. c. Current assets minus current liabilities. d. Current assets divided by current liabilities.

> Which of the following transactions would usually cause accounts payable turnover to increase? a. Payment of cash to a supplier for merchandise previously purchased on credit. b. Collection of cash from a customer. c. Purchase of merchandise on credit. d

> A company is facing a lawsuit from a customer. It is possible, but not probable, that the company will have to pay a settlement that management estimates to be $2,000,000. How would this fact be reported in the financial statements to be issued at the en

> BigFish Company has borrowed $100,000 from the bank to be repaid over the next five years, with payments beginning next month. Which of the following best describes the presentation of this debt in the balance sheet as of today (the date of borrowing)? a

> Which of the following best describes accrued liabilities? a. Long-term liabilities. b. Current amounts owed to suppliers of inventory. c. Current liabilities to be recognized as revenue in a future period. d. Current amounts owed, but not yet paid, to v

> The university golf team needs to buy a car to travel to tournaments. A dealership in Lockhart has agreed to the following terms: $4,000 down plus 20 monthly payments of $750. A dealership in Leander will agree to $1,000 down plus 20 monthly payments of

> Fred received a gift from his grandmother of $100,000. She has promised to pay Fred the $100,000 in equal installments at the end of each year for the next 10 years. Fred wants to know how much the $100,000 is worth in today’s dollars. Which of the follo

> What is the present value factor for an annuity of five periods and an interest rate of 10%? a. 0.62092 b. 4.32948 c. 3.79079 d. 7.72173

> Irish Industries purchased a machine for $65,000 and is depreciating it with the straight-line method over a life of 10 years, using a residual value of $3,000. At the beginning of the sixth year, a major overhaul was made costing $5,000, and the total e

> When recording depreciation, which of the following statements is true? a. Total assets increase and stockholders’ equity increases. b. Total assets decrease and total liabilities increase. c. Total assets decrease and stockholders’ equity increases. d.

> Assume you work as a staff member in a large accounting department for a multinational public company. Your job requires you to review documents relating to the company’s equipment purchases. Upon verifying that purchases are properly approved, y

> Company X is going to retire equipment that is fully depreciated with no residual value. The equipment will simply be disposed of, not sold. Which of the following statements is false? a. Total assets will not change as a result of this transaction. b. N

> How many of the following statements regarding goodwill are true? ∙ Goodwill is not reported unless purchased in an exchange. ∙ Goodwill must be reviewed annually for possible impairment. ∙ Impairment of goodwill results in a decrease in net income. a. T

> A company wishes to report the highest earnings possible for financial reporting purposes. Therefore, when calculating depreciation, a. It will follow the MACRS depreciation tables prescribed by the IRS. b. It will select the shortest lives possible for

> For each of the following transactions, determine whether cash flows from operating activities will increase, decrease, or remain the same: a. Purchased merchandise for cash. b. Paid salaries and wages that were earned last period, but not paid last peri

> Under what method(s) of depreciation is an asset’s net book value the depreciable base (the amount to be depreciated)? a. Straight-line method b. Declining-balance method c. Units-of-production method d. All of the above

> Maks, Inc., uses straight-line depreciation for all of its depreciable assets. Maks sold a used piece of machinery on December 31, 2017, that it purchased on January 1, 2016, for $10,000. The asset had a five-year life, zero residual value, and $2,000 ac

> Leslie, Inc., followed the practice of depreciating its building on a straight-line basis. A building was purchased in 2016 and had an estimated useful life of 25 years and a residual value of $20,000. The company’s depreciation expense for 2016 was $15,

> Miga Company and Porter Company both bought a new delivery truck on January 1, 2014. Both companies paid exactly the same cost, $30,000, for their respective vehicles. As of December 31, 2017, the net book value of Miga’s truck was less than Porter Compa

> Explain what determines whether a bond is issued at a discount or a premium.

> Differentiate between a bond coupon rate and the market rate of interest.

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Ass

> What are the primary characteristics of a bond? For what purposes are bonds usually issued?

> When market interest rates increase, do bond prices increase or decrease?

> What is the formula used for calculating the cash payment bond investors will receive for interest each period? What is the formula used to calculate interest expense each period?

> Define contingent liability. What conditions must be met in order for a contingent liability to be reported on a company’s balance sheet?

> Define note payable. When must a company reclassify a long-term note payable as a current liability?

> Why is depreciation expense added to net income (indirect method) on the statement of cash flows?

> Define goodwill. When is it appropriate to record goodwill as an intangible asset?

> Define intangible asset. What period should be used to amortize an intangible asset with a definite life?

> When equipment is sold for more than net book value, how is the transaction recorded? For less than net book value? What is net book value?

> Define accrued liability. What is an example of an accrued liability?

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Poo

> Over what period should an addition to an existing long-lived asset be depreciated? Explain.