Question: Assume you work as a staff member

Assume you work as a staff member in a large accounting department for a multinational public company. Your job requires you to review documents relating to the company’s equipment purchases. Upon verifying that purchases are properly approved, you prepare journal entries to record the equipment purchases in the accounting system. Typically, you handle equipment purchases costing $100,000 or less.

This morning, you were contacted by the executive assistant to the chief financial officer (CFO). She says that the CFO has asked to see you immediately in his office. Although your boss’s boss has attended a few meetings where the CFO was present, you have never met the CFO during your three years with the company. Needless to say, you are anxious about the meeting.

Upon entering the CFO’s office, you are warmly greeted with a smile and friendly handshake. The CFO compliments you on the great work that you’ve been doing for the company. You soon feel a little more comfortable, particularly when the CFO mentions that he has a special project for you. He states that he and the CEO have negotiated significant new arrangements with the company’s equipment suppliers, which require the company to make advance payments for equipment to be purchased in the future. The CFO says that, for various reasons that he didn’t want to discuss, he will be processing the payments through the operating division of the company rather than the equipment accounting group. Given that the payments will be made through the operating division, they will initially be classified as operating expenses of the company. He indicates that clearly these advance payments for property and equipment should be recorded as assets, so he will be contacting you at the end of every quarter to make an adjusting journal entry to capitalize the amounts inappropriately classified as operating expenses. He advises you that a new account, called Prepaid Equipment, has been established for this purpose. He quickly wraps up the meeting by telling you that it is important that you not talk about the special project with anyone. You assume he doesn’t want others to become jealous of your new important responsibility.

A few weeks later, at the end of the first quarter, you receive a voicemail from the CFO stating, “The adjustment that we discussed is $771,000,000 for this quarter.” Before deleting the message, you replay it to make sure you heard it right. Your company generates over $8 billion in revenues and incurs $6 billion in operating expenses every quarter, but you’ve never made a journal entry for that much money. So, just to be sure there’s not a mistake, you send an e-mail to the CFO confirming the amount. He phones you back immediately to abruptly inform you, “There’s no mistake. That’s the number.” Feeling embarrassed that you may have annoyed the CFO, you quietly make the adjusting journal entry.

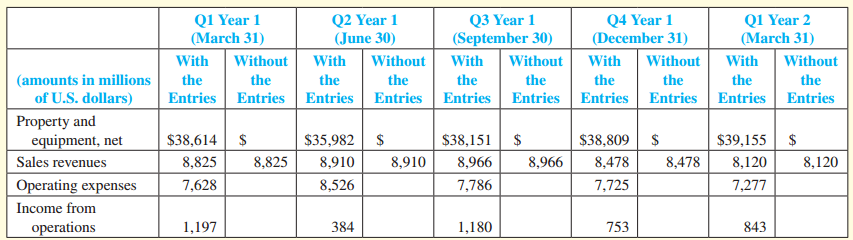

For each of the remaining three quarters in that year and for the first quarter in the following year, you continue to make these end-of-quarter adjustments. The “magic number,” as the CFO liked to call it, was $560,000,000 for Q2, $742,745,000 for Q3, $941,000,000 for Q4, and $818,204,000 for Q1 of the following year. During this time, you’ve had several meetings and lunches with the CFO where he provides you the magic number, sometimes supported with nothing more than a Post-it note with the number written on it. He frequently compliments you on your good work and promises that you’ll soon be in line for a big promotion.

Despite the CFO’s compliments and promises, you are growing increasingly uncomfortable with the journal entries that you’ve been making. Typically, whenever an ordinary equipment purchase involves an advance payment, the purchase is completed a few weeks later. At that time, the amount of the advance is removed from an Equipment Deposit account and transferred to the appropriate equipment account. This hasn’t been the case with the CFO’s special project. Instead, the Prepaid Equipment account has continued to grow, now standing at over $3.8 billion. There’s been no discussion about how or when this balance will be reduced, and no depreciation has been recorded for it.

Just as you begin to reflect on the effect the adjustments have had on your company’s fixed assets, operating expenses, and operating income, you receive a call from the vice president for internal audit. She needs to talk with you this afternoon about “a peculiar trend in the company’s fixed asset turnover ratio and some suspicious journal entries that you’ve been making.”

Required:

1. Complete the following table to determine what the company’s accounting records would have looked like had you not made the journal entries as part of the CFO’s special project. Comment on how the decision to capitalize amounts, which were initially recorded as operating expenses, has affected the level of income from operations in each quarter.

2. Using the publicly reported numbers (which include the special journal entries that you recorded), compute the fixed asset turnover ratio (rounded to two decimal places) for the periods ended Q2–Q4 of Year 1 and Q1 of Year 2. What does the trend in this ratio suggest to you? Is this consistent with the changes in operating income reported by the company?

3. Before your meeting with the vice president for internal audit, you think about the above computations and the variety of peculiar circumstances surrounding the “special project” for the CFO. What in particular might have raised your suspicion about the real nature of your work?

4. Your meeting with internal audit was short and unpleasant. The vice president indicated that she had discussed her findings with the CFO before meeting with you. The CFO claimed that he too had noticed the peculiar trend in the fixed asset turnover ratio, but that he hadn’t had a chance to investigate it further. He urged internal audit to get to the bottom of things, suggesting that perhaps someone might be making unapproved journal entries. Internal audit had identified you as the source of the journal entries and had been unable to find any documents that approved or substantiated the entries. She ended the meeting by advising you to find a good lawyer. Given your current circumstances, describe how you would have acted earlier had you been able to foresee where it might lead you.

5. In the real case on which this one is based, the internal auditors agonized over the question of whether they had actually uncovered a fraud or whether they were jumping to the wrong conclusion. The Wall Street Journal mentioned this on October 30, 2002, by stating, “it was clear . . . that their findings would be devastating for the company. They worried about whether their revelations would result in layoffs. Plus, they feared that they would somehow end up being blamed for the mess.” Beyond the personal consequences mentioned in this quote, describe other potential ways in which the findings of the internal auditors would likely be devastating for the publicly traded company and those associated with it.

> What is the book value of a bond?

> Define deferred revenue. Why is it a liability?

> What is the difference between an unsecured and a secured bond?

> From the perspective of the issuer, what are some advantages of issuing bonds instead of stock?

> Skullcandy designs, markets, and distributes audio and gaming headphones, earbuds, and speakers. Last year, Skullcandy reported cost of goods sold of $158 million. This year, cost of goods sold was $117 million. Accounts payable was $23 million at the en

> Lemond Corporation is planning to issue bonds with a face value of $200,000 and a coupon rate of 10 percent. The bonds mature in three years and pay interest semiannually every June 30 and December 31. All the bonds were sold on January 1 of this year. L

> What is a bond covenant?

> What does the accounts payable turnover ratio tell you about a company? How is the ratio computed?

> In their balance sheets, what do companies call obligations to pay suppliers in the near future?

> What financial statement is the primary source of information about the liabilities of a company?

> When calculating the present value of a bond’s future cash flows, do investors use the coupon rate or market interest rate as the discount rate?

> Differentiate between a bond indenture and a bond prospectus.

> How is the debt-to-equity ratio computed? What does the debt-to-equity ratio tell you?

> Define annuity.

> Explain the concept of the time value of money.

> What is asset impairment? How is it accounted for?

> You work for a small company that is considering investing in a new Internet business. Financial projections suggest that the company will be able to earn in excess of $40 million per year on an investment of $100 million. The company president suggests

> When a company signs a capital lease, does it record an asset and/or a liability on its balance sheet?

> Define working capital. How is working capital computed?

> Define liability. Differentiate between a current liability and a long-term liability.

> Determine whether each of the following would be reported in the financing activities section of the statement of cash flows and, if so, specify whether it is a cash inflow or outflow. 1. Sale of bonds at a discount. 2. Payment of interest on a bond at m

> For each of the following items, enter the correct letter to the left to show the type of expenditure. Use the following: Type of Expenditure Transactions Capital expenditure Expense (1) Purchased a patent, $4,300 cash. (2) Paid $10,000 for monthly s

> In what section of the statement of cash flows would you find cash paid for principal when a bond matures? In what section would you find cash paid for interest each period?

> For each of the following items, specify whether the information would be found in the balance sheet, the income statement, the statement of cash flows, or the notes to the statements. 1. The amount of a bond liability. 2. A description of any bond coven

> What assets should be amortized using the straight-line method? a. Intangible assets with definite lives c. Natural resources b. Intangible assets with indefinite lives d. All of the above

> A bond with a face value of $100,000 is sold on January 1. The bond has a coupon rate of 10 percent and matures in 10 years. When the bond was issued, the market rate of interest was 10 percent. On December 31, the market rate of interest increased to 11

> When using the effective-interest method of amortization, interest expense reported in the income statement is impacted by the a. Face value of the bonds. b. Coupon rate stated in the bond certificate. c. Market rate of interest on the date the bonds wer

> A State Lottery Commission ran the following advertisement: The Lotto jackpot for this month’s drawing is $10 million, which will be paid out to the winning ticket in equal installments at the end of each year over the next 20 years. Do you agree that th

> To determine whether a bond will be sold at a premium, at a discount, or at face value, one must know which of the following pairs of information? a. Face value and the coupon rate on the date the bond is issued. b. Face value and the market rate of inte

> A bond with a face value of $100,000 was issued for $93,500 on January 1 of this year. The stated rate of interest was 8 percent and the market rate of interest was 10 percent when the bond was sold. Interest is paid annually. How much interest will be p

> Which of the following is false when a bond is issued at a premium? a. The bond will issue for an amount above its par value. b. Bonds payable will be credited for an amount greater than the bond’s face value. c. Interest expense will exceed the cash int

> Which account would not be included in the debt-to-equity ratio calculation? a. Unearned Revenue. b. Retained Earnings. c. Income Taxes Payable. d. All of the above are included.

> A bond with a face value of $100,000 has a coupon rate of 8 percent. The bond matures in 10 years. When the bond is issued, the market rate of interest is 10 percent. What amount will investors pay for this bond? a. $100,000 b. $87,707 c. $49,157 d. $113

> Which of the following is not an advantage of issuing bonds when compared to issuing additional shares of stock in order to obtain additional capital? a. Stockholders maintain proportionate ownership percentages. b. Interest expense reduces taxable incom

> When using the effective-interest method of amortization, the book value of a bond changes by what amount on each interest payment date? a. Interest expense b. Cash interest payment c. The difference between interest expense and the cash interest payment

> Annual interest expense for a single bond issue continues to increase over the life of the bonds. Which of the following explains this? a. The market rate of interest has increased since the bonds were sold. b. The coupon rate has increased since the bon

> SmallFish Company borrowed $100,000 at 8% interest for three months. How much interest does the company owe at the end of three months? a. $8,000 b. $2,000 c. $800 d. $200

> The present value of an annuity of $10,000 per year for 10 years discounted at 8% is what amount? a. $5,002 b. $67,101 c. $53,349 d. $80,000

> You are a financial analyst charged with evaluating the asset efficiency of companies in the hotel industry. Recent financial statements for Marriott International include the following note: 12. PROPERTY AND EQUIPMENT We record property and equipment at

> How is working capital calculated? a. Current assets multiplied by current liabilities. b. Current assets plus current liabilities. c. Current assets minus current liabilities. d. Current assets divided by current liabilities.

> Which of the following transactions would usually cause accounts payable turnover to increase? a. Payment of cash to a supplier for merchandise previously purchased on credit. b. Collection of cash from a customer. c. Purchase of merchandise on credit. d

> A company is facing a lawsuit from a customer. It is possible, but not probable, that the company will have to pay a settlement that management estimates to be $2,000,000. How would this fact be reported in the financial statements to be issued at the en

> BigFish Company has borrowed $100,000 from the bank to be repaid over the next five years, with payments beginning next month. Which of the following best describes the presentation of this debt in the balance sheet as of today (the date of borrowing)? a

> Which of the following best describes accrued liabilities? a. Long-term liabilities. b. Current amounts owed to suppliers of inventory. c. Current liabilities to be recognized as revenue in a future period. d. Current amounts owed, but not yet paid, to v

> The university golf team needs to buy a car to travel to tournaments. A dealership in Lockhart has agreed to the following terms: $4,000 down plus 20 monthly payments of $750. A dealership in Leander will agree to $1,000 down plus 20 monthly payments of

> Fred received a gift from his grandmother of $100,000. She has promised to pay Fred the $100,000 in equal installments at the end of each year for the next 10 years. Fred wants to know how much the $100,000 is worth in today’s dollars. Which of the follo

> What is the present value factor for an annuity of five periods and an interest rate of 10%? a. 0.62092 b. 4.32948 c. 3.79079 d. 7.72173

> Irish Industries purchased a machine for $65,000 and is depreciating it with the straight-line method over a life of 10 years, using a residual value of $3,000. At the beginning of the sixth year, a major overhaul was made costing $5,000, and the total e

> When recording depreciation, which of the following statements is true? a. Total assets increase and stockholders’ equity increases. b. Total assets decrease and total liabilities increase. c. Total assets decrease and stockholders’ equity increases. d.

> Company X is going to retire equipment that is fully depreciated with no residual value. The equipment will simply be disposed of, not sold. Which of the following statements is false? a. Total assets will not change as a result of this transaction. b. N

> How many of the following statements regarding goodwill are true? ∙ Goodwill is not reported unless purchased in an exchange. ∙ Goodwill must be reviewed annually for possible impairment. ∙ Impairment of goodwill results in a decrease in net income. a. T

> A company wishes to report the highest earnings possible for financial reporting purposes. Therefore, when calculating depreciation, a. It will follow the MACRS depreciation tables prescribed by the IRS. b. It will select the shortest lives possible for

> For each of the following transactions, determine whether cash flows from operating activities will increase, decrease, or remain the same: a. Purchased merchandise for cash. b. Paid salaries and wages that were earned last period, but not paid last peri

> Under what method(s) of depreciation is an asset’s net book value the depreciable base (the amount to be depreciated)? a. Straight-line method b. Declining-balance method c. Units-of-production method d. All of the above

> Maks, Inc., uses straight-line depreciation for all of its depreciable assets. Maks sold a used piece of machinery on December 31, 2017, that it purchased on January 1, 2016, for $10,000. The asset had a five-year life, zero residual value, and $2,000 ac

> Leslie, Inc., followed the practice of depreciating its building on a straight-line basis. A building was purchased in 2016 and had an estimated useful life of 25 years and a residual value of $20,000. The company’s depreciation expense for 2016 was $15,

> Miga Company and Porter Company both bought a new delivery truck on January 1, 2014. Both companies paid exactly the same cost, $30,000, for their respective vehicles. As of December 31, 2017, the net book value of Miga’s truck was less than Porter Compa

> Explain what determines whether a bond is issued at a discount or a premium.

> Differentiate between a bond coupon rate and the market rate of interest.

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Ass

> What are the primary characteristics of a bond? For what purposes are bonds usually issued?

> When market interest rates increase, do bond prices increase or decrease?

> What is the formula used for calculating the cash payment bond investors will receive for interest each period? What is the formula used to calculate interest expense each period?

> Define contingent liability. What conditions must be met in order for a contingent liability to be reported on a company’s balance sheet?

> Define note payable. When must a company reclassify a long-term note payable as a current liability?

> Why is depreciation expense added to net income (indirect method) on the statement of cash flows?

> Define goodwill. When is it appropriate to record goodwill as an intangible asset?

> Define intangible asset. What period should be used to amortize an intangible asset with a definite life?

> When equipment is sold for more than net book value, how is the transaction recorded? For less than net book value? What is net book value?

> Define accrued liability. What is an example of an accrued liability?

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Poo

> Over what period should an addition to an existing long-lived asset be depreciated? Explain.

> What type of depreciation expense pattern is used under each of the following methods and when is its use appropriate? a. The straight-line method. b. The units-of-production method. c. The double-declining-balance method.

> The estimated useful life and residual value of a long-lived asset relate to the current owner or user rather than all potential users. Explain this statement.

> In computing depreciation, three values must be known or estimated; identify and explain the nature of each.

> Distinguish among depreciation, depletion, and amortization.

> Distinguish between ordinary repairs and improvements. How is each accounted for?

> Describe the relationship between the expense recognition principle and accounting for long-lived assets.

> Under the cost measurement concept, what amounts should be included in the acquisition cost of a long-lived asset?

> What are the classifications of long-lived assets? Explain each.

> How is the fixed asset turnover ratio computed? Explain its meaning.

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. Assume Pool Corporation purchased for cash new loading equipment for the warehouse on January 1 of Year 1, at an invoice price of $72,000. It al

> Define long-lived assets. Why are they considered to be a “bundle of future services”?

> Cron Corporation is planning to issue bonds with a face value of $700,000 and a coupon rate of 13 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. C

> Claire Corporation is planning to issue bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on Jan

> Claire Corporation is planning to issue bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on Jan

> PowerTap Utilities is planning to issue bonds with a face value of $1,000,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year.

> On January 1 of this year, Cunningham Corporation issued bonds with a face value of $200,000 and a coupon rate of 6 percent. The bonds mature in 10 years and pay interest annually every December 31. When the bonds were sold, the annual market rate of int

> Rosh Corporation is planning to issue bonds with a face value of $800,000 and a coupon rate of 8 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. All of the bonds will be sold on January 1 of this year.

> On January 1 of this year, Barnett Corporation sold bonds with a face value of $500,000 and a coupon rate of 7 percent. The bonds mature in 10 years and pay interest annually on December 31. Barnett uses the effective-interest amortization method. Ignore

> On January 1 of this year, Nowell Company issued bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. When the bonds were sold, the annual market r

> Electrolux Corporation manufactures electrical test equipment. The company’s board of directors authorized a bond issue on January 1 of this year with the following terms: Face (par) value: $800,000 Coupon rate: 8 percent payable each December 31 Maturit

> French energy giant GDF Suez recently issued a zero coupon bond. This bond issuance garnered attention because it was the first time in 14 years that a zero coupon bond had been issued in euros. The zero coupon bond has a face value of €500 million and m

> Serotta Corporation is planning to issue bonds with a face value of $300,000 and a coupon rate of 12 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on J

> Serotta Corporation is planning to issue bonds with a face value of $300,000 and a coupon rate of 12 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on J

> On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule bel

> Last year, Arbor Corporation reported the following: BALANCE SHEET Total Assets…………………………………………………. $800,000 Total Liabilities ……………………………………………….500,000 Total Shareholders’ Equity …………………………….$300,000 This year, Arbor is considering whether to issue mo

> For each of the following situations, determine whether the company should (a) report a liability on the balance sheet, (b) disclose a contingent liability in the footnotes, or (c) not report the situation. Justify your conclusions. 1. An automobile comp

> PepsiCo, Inc., is a dominant player in the beverage, snack food, and restaurant businesses. A recent PepsiCo annual report included the following note: At year-end, $3.5 billion of short-term borrowings were reclassified as long-term, reflecting PepsiCo’

> Columbia Sportswear is an outdoor and active lifestyle apparel and footwear company. Last year, Columbia reported cost of goods sold of $941 million. This year, cost of goods sold was $1,146 million. Accounts payable was $174 million at the end of last y