Question: Formatone plc produced the following trial balance

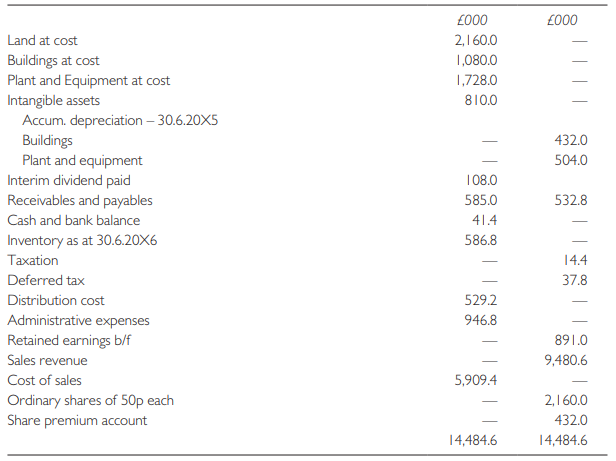

Formatone plc produced the following trial balance as at 30 June 20X6:

The following information is available:

(i) A revaluation of the Land and Buildings on 1 July 20X5 resulted in an increase of £3,240,000 in the Land and £972,000 in the Buildings. This has not yet been recorded in the books.

(ii) Depreciation: Plant and Equipment are depreciated at 10% using the reducing balance method. Intangible assets are to be written down by £540,000. Buildings have an estimated life of 30 years from date of the revaluation.

(iii) Taxation The current tax is estimated at £169,200. There had been an overprovision in the previous year. Deferred tax is to be increased by £27,000.

(iv) Capital

150,000 shares were issued and recorded on 1 July 20X5 for 80p each. A further dividend of 5p per share has been declared on 30 June 20X6.

Required:

Prepare for the year ended 30 June 20X6 the statement of comprehensive income, statement of changes in equity and statement of financial position.

Transcribed Image Text:

£000 £000 Land at cost 2,160.0 1,080.0 Buildings at cost Plant and Equipment at cost Intangible assets Accum. depreciation – 30.6.20X5 Buildings Plant and equipment Interim dividend paid Receivables and payables 1,728.0 810.0 432.0 504.0 108.0 585.0 532.8 Cash and bank balance 41.4 Inventory as at 30.6.20X6 586.8 Taxation 14.4 Deferred tax 37.8 Distribution cost 529.2 Administrative expenses 946.8 Retained earnings b/f 891.0 Sales revenue 9,480.6 Cost of sales 5,909.4 Ordinary shares of 50p each Share premium account 2,160.0 432.0 14,484.6 14,484.6

> Sweden acquired 100% of the equity shares of Oslo on 1 March 20X1 and gained control. At that date the balances on the reserves of Oslo were as follows: Revaluation reserve ………â€&brv

> Bleu plc acquired 80% of the shares of Verte plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Required: Prepare a consolidated statement of financial position for Bleu plc

> Set out below is the summarized statement of financial position of Berlin plc at 1 January 20X0. On 1/1/20X0 Berlin acquired 100% of the shares of Hanover for £100,000 and gained control. Required: Prepare the statement of financial posit

> Ham plc acquired 100% of the common shares of Burg plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Notes: 1 The fair value is the same as the book value. 2 â‚&

> Rouge plc acquired 100% of the common shares of Noir plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Required: Prepare a consolidated statement of financial position for

> On 1 January 20X7 Parent Ltd acquired 75% of the ordinary shares in Daughter Ltd for £9,000 cash. The fair value of the net assets in Daughter Ltd was their book value. Assume in each case that the non controlling interest is measured using

> On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £6,000 cash. The fair value of the net assets in Daughter Ltd was their book value. Required: Prepare the statements of financial position of Parent Ltd and t

> (a) On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £16,200 cash. The fair value of the net assets in Daughter Ltd was £12,000. (b) The purchase consideration was satisfied by the issue of 5,400

> Simple SA has just purchased a roasting/salting machine to produce roasted walnuts. The finance director asks for your advice on how the company should calculate the depreciation on this machine. Details are as follows: Cost of machine ……………………………………….S

> (a) On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £16,200 cash. The fair value of the net assets in Daughter Ltd was their book value. (b) The purchase consideration was satisfied by the issue of 5,400 new

> (a) In 20X3 Arthur is a large loan creditor of X Ltd and receives interest at 20% p.a. on this loan. He also has a 24% shareholding in X Ltd. Until 20X1 he was a director of the company and left after a disagreement. The remaining 76% of the shares are h

> (a) Assume that on 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £10,800 cash. The fair value of the net assets in Daughter Ltd was their book value. (b) The purchase consideration was satisfied by the issue

> Backwater Construction Company is reviewing a major contract which is in serious difficulty. The contract price is €10,000,000. The project involves the construction of four buildings of equal size and complexity. The first building has been completed an

> During 2006, Jack Matelot set up a company, JTM, to construct and refurbish marinas in various ports around Europe. The company’s first accounting period ended on 31 October 2006 and during that period JTM won a contract to refurbish a

> The following information relates to Deferred plc: ● EBITDA (earnings before interest, tax, depreciation and amortization) for year ended 31.12.20X1 is £300,000 ● No interest payable in 20X1 ● No amortization ● Equipment cost £100,000 at 1.1.20X1 ● Depre

> Quick build Ltd entered into a two-year contract on 1 January 20X7 at a contract price of £250,000. The estimated cost of the contract was £150,000. At the end of the first year the following information was available: ● contract costs incurred totaled £

> Newbild SA commenced work on the construction of a block of flats on 1 July 20X0. During the period ended 31 March 20X1 contract expenditure was as follows: € Materials issued from stores …………………….13,407 Materials delivered direct to site ………………73,078 W

> At 31 October 20X9, Lytax Ltd was engaged in the following five long-term contracts. In each contract Lytax was building cold storage warehouses on five sites where the land was owned by the customer. Details are given below: It is not expected that an

> Beta Ltd commenced business on 1 January and is making up its first year’s accounts. The company uses standard costs. The company owns a variety of raw materials and components for use in its manufacturing business. The accounting recor

> HK Ltd has prepared its draft trial balance to 30 June 20X1, which is shown below. The following information is available: (a) The authorised share capital is 4,000,000 9% preference shares of $1 each and 18,000,000 ordinary shares of 50c each. (b) Pro

> Purchases of a certain product during July were: Units sold during the month were: Required: Assuming no opening inventories: (a) Determine the cost of goods sold for July under three different valuation methods. (b) Discuss the advantages and/or dis

> Sunhats Ltd manufactures patent hats. It carries inventory of these and sells to wholesalers and retailers via a number of salespeople. The following expenses are charged in the profit and loss account: Required: Which of these expenses can reasonably

> The following list of balances has been extracted from the records of Cowgale company as at 31 October 2011, the end of Cowgale’s most recent financial year: The following additional information is available: 1 Following an impairment

> James Bright has just taken up the position of managing director following the unsatisfactory achievements of the previous incumbent. James arrives as the accounts for the previous year are being finalised. James wants the previous performance to look po

> Brands plc is preparing its accounts for the year ended 31 October 20X8 and the following information is available relating to various intangible assets acquired on the acquisition of Countrywide plc: (a) A milk quota of 2,000,000 litres at 30p per litre

> Under IAS 22, the depletion of equity reserves caused by the accounting treatment for purchased goodwill resulted in some companies capitalizing brands on their statements of financial position. This practice was started by Rank Hovis McDougall (RHM) – a

> Hanson Products Ltd is a newly formed company. The company commenced trading on 1 January 20X1 when it purchased an item of plant and equipment for $240,000. The plant and equipment has an expected life of five years with zero residual value, and will be

> Ross Neale is the divisional accountant for the Research and Development division of Critical Pharmaceuticals PLC. He is discussing the third-quarter results with Tina Snedden who is the manager of the division. The conversation focuses on the fact that

> Oxlag plc, a manufacturer of pharmaceutical products, has the following research and development projects on hand at 31 January 20X2: (A) A general survey into the long-term effects of its sleeping pill Chalcedon upon human resistance to infections. At t

> As chief accountant at Italin NV, you have been given the following information by the director of research: The board of directors considers that this project is similar to the other projects that the company undertakes, and is confident of a successf

> Environmental Engineering plc is engaged in the development of an environmentally friendly personal transport vehicle. This will run on an electric motor powered by solar cells, supplemented by passenger effort in the form of pedal assistance. At the end

> Basalt plc is a wholesaler. The following is its trial balance as at 31 December 20X0. The following additional information is supplied: (i) Depreciate plant and machinery 20% on straight-line basis. (ii) Inventory at 31 December 20X0 is £

> IAS 38 Intangible Assets was issued primarily in order to identify the criteria that need to be present before expenditure on intangible items can be recognized as an asset. The standard also prescribes the subsequent accounting treatment of intangible a

> Under a contract between a customer, Charlie (C) and a freight carrier Solutions Ltd (S), S provides C with 10 rail cars for five years. The cars, which are owned by S, are specified in the contract. C determines when, where and which goods are to be tra

> Delta owned two assets which were sold on 1 April 20X1 – the first day of Delta’s accounting period. Both assets were sold for their fair value. Details of the sales are as follows: Asset 1 Asset 1 was sold for £500,000 and leased back on a five-year le

> Bertie prepares financial statements to 31 December each year. On 1 January 20X1 Bertie purchased a machine for £200,000 and immediately leased the machine to Carter. The lease term was five years – equal to the expected useful life of the asset. Bertie

> On 1 April 20Y1 Smarty (see question 2) reassessed its future strategy and concluded that it would take up the option to lease the machine for a further two years from 1 October 20Y2. This was regarded as a modification to the original lease and Smarty r

> Austin Mitchell MP proposed an Early Day Motion in the House of Commons on 17 May 2005 as follows: That this House urges the Government to clamp down on artificial tax avoidance schemes and end the . . . tax avoidance loop-holes that enable millionaires

> (a) When accounting for leases, accountants prefer to overlook legal form in favour of commercial substance. Required: Discuss the above statement in the light of the requirements of IFRS 16 Leases. (b) State briefly how you would distinguish between a f

> On 1 January 20X8, Grabbit plc entered into an agreement to lease a widgeting machine for general use in the business. The agreement, which may not be terminated by either party to it, runs for six years and provides for Grabbit to make an annual rental

> International Financial Reporting Standards (IFRS) support the use of fair values when reporting the values of assets wherever practical. This involves periodic re measurements of assets and the consequent recognition of gains and losses in the financial

> The Blissopia Leisure Group consists of three divisions: Blissopia 1, which operates mainstream bars; Blissopia 2, which operates large restaurants; and Blissopia 3, which operates one hotel – the Eden. Divisions 1 and 2 have been tradi

> Infinite Leisure Group owns and operates a number of pubs and clubs across Europe and South East Asia. Since inception the group has made exclusive use of the cost model for the purpose of its annual financial reporting. This has led to a number of share

> Discuss the arguments for and against discounting the deferred tax charge.

> For the following years, capital allowances are likely to continue to be in excess of depreciation for the foreseeable future. (d) Corporation tax is to be taken at 21%. Required: Calculate the deferred tax charges or credits for the next six years, com

> The following information is given in respect of Unambitious plc: (a) Non-current assets consist entirely of plant and machinery. The net book value of these assets as at 30 June 2010 is £100,000 in excess of their tax written-down value. (b

> A non-current asset (a machine) was purchased by Adjourn plc on 1 July 20X2 at a cost of £25,000. The company prepares its annual accounts to 31 March in each year. The policy of the company is to depreciate such assets at the rate of 15% straight line (

> In your capacity as chief assistant to the financial controller, your managing director has asked you to explain to him the differences between tax planning, tax avoidance and tax evasion. He has also asked you to explain to him your feelings as a profes

> George plc will need to adopt IFRS 9 from accounting periods beginning on or after 1 January 2018. George has three different instruments whose accounting George is concerned will change as a result of the adoption of the standard. The three instruments

> On 1 October 20X1, Little Raven plc issued 50,000 debentures, with a par value of £100 each, to investors at £80 each. The debentures are redeemable at par on 30 September 20X6 and have a coupon rate of 6%, which was significant

> Creasy plc needs to raise €20 million and is considering two different instruments that could be issued: (i) A 7% debenture with a par value of €20 million, repayable at par in five years. Interest is paid annually in arrears. (ii) A 5% convertible deben

> Milner Ltd issues a 6% cumulative preference share for €1 million that is repayable in cash at par 10 years after issue. The only condition on the dividends is that if the directors declare an ordinary dividend the preference dividend (and any arrears of

> On 1 October year 1, RPS plc issued one million £1 5% redeemable preference shares. The shares were issued at a discount of £50,000 and are due to be redeemed on 30 September Year 5. Dividends are paid on 30 September each year. Required: Show the accou

> Scott Ross, CFO of Ryan Industries PLC, is discussing the publication of the annual report with his managing director Nathan Davison. Graydon says: ‘The law requires us to comply with accounting standards and at the same time to provide a true and fair v

> On 1 January 2009 Henry Ltd issued a convertible debenture for €200 million carrying a coupon interest rate of 5%. The debenture is convertible at the option of the holders into 10 ordinary shares for each €100 of debenture stock on 31 December 2013. Hen

> Isabelle Limited borrows £100,000 from a bank on the following terms: (i) arrangement fees of £2,000 are charged by the bank and deducted from the initial proceeds on the loan; (ii) interest is payable at 5% for the first three years of the loan and then

> Fairclough plc borrowed €10 million from a bank on 1 January 2011. Fees of €100,000 were charged by the bank which were paid by Fairclough plc at inception of the loan. The terms of the loan are: Interest ● Interest of 6% until 31 December 2013 ● Interes

> The approach in IAS 39 to the impairment of financial assets was flawed because it did not allow financial institutions to recognize the true losses they expected on loans at the time they had made the loans. How does the final version of IFRS 9 address

> Procter Limited, a UK private company has the following financial assets and liabilities in the accounts: (i) An equity investment in Milner plc, a UK listed company. Procter recognises the investment as an ‘available for sale’ investment under IAS 39 Fi

> (a) IAS 16 Property, Plant and Equipment requires that where there has been a permanent diminution in the value of property, plant and equipment, the carrying amount should be written down to the recoverable amount. The phrase ‘recoverable amount’ is def

> At the start of the year Cornish plc entered into a number of financial instruments and is considering how to classify these instruments under IFRS 9. The instruments are as follows (a) Investment in listed 3% government bonds for €2 million. Cornish acq

> Tan plc has the following assets originated on 1 January 2016: (i) A loan receivable generated from lending £100,000 to a customer of the company. The loan carries interest at 7% per annum payable in arrears and is classified at amortized cost. The 12-mo

> Charles plc is applying IAS 32 and IFRS 9 for the first time this year and is uncertain about the application of the standard. Charles plc’s balance sheet is as follows: Note The forward contracts have been revalued to fair value in t

> A company borrows on a floating-rate loan, but wishes to hedge against interest variations so swaps the interest for fixed rate. The swap should be perfectly effective and has zero fair value at inception. Interest rates increase and therefore the swap b

> Baudvin Ltd has an equity investment that cost €1 million on 1 January 2008. The investment is classified as an available-for-sale investment under IAS 39. The value of the investment at each period-end is: 31 December 2008 ……………………………€950,000 31 Decemb

> The following is an extract from the trial balance of Imecet at 31 October 2005: Other relevant information: (i) One million $1 ordinary shares were issued 1 May 2005 at the market price of $1.75 per ordinary share. (ii) The inventory at 31 October 200

> On 1 January 2009 Hazell plc borrows €5 million on terms with interest of 3% fixed for the period to 31 December 2009, going to variable rate thereafter (at inception the variable rate is 6%). The loan is repayable at Hazell plc’s option between 31 Decem

> On 1 April year 1, a deep discount bond was issued by DDB AG. It had a face value of £2.5 million and covered a five-year term. The lenders were granted a discount of 5%. The coupon rate was 10% on the principal sum of £2.5 million, payable annually in a

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 30 September 2008 are being prepared. Your assistant, who has prepared the first draft of the statements, is unsure ab

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 31 March 2009 are being prepared. The board of directors is responsible for all key financial and operating decisions,

> The finance director of Small Machine Parts Ltd is considering the acquisition of a lease of a small workshop in a warehouse complex that is being redeveloped by City Redevelopers Ltd at a steady rate over a number of years. City Redevelopers are grantin

> On 1 April 20W9 Kroner began to lease an office block on a 20-year lease. The useful economic life of the office buildings was estimated at 40 years on 1 April 20W9. The supply of leasehold properties exceeded the demand on 1 April 2009 so as an incentiv

> Suktor is an entity that prepares financial statements to 30 June each year. On 30 April 20X1 the directors decided to discontinue the business of one of Suktor’s operating divisions. They decided to cease production on 31 July 20X1, with a view to dispo

> Easy View Ltd had started business publishing training resource material in ring binder format for use in primary schools. Later it diversified into the hiring out of videos and had opened a chain of video hire shops. With the growing popularity of a mai

> In 20X6 Alpha AS made the decision to close a loss-making department in 20X7. The company proposed to make a provision for the future costs of termination in the 20X6 profit or loss. Its argument was that a liability existed in 20X6 which should be recog

> Plasma Ltd, a manufacturer of electrical goods, guarantees them for 12 months from the date of purchase by the customer. If a fault occurs after the guarantee period but is due to faulty manufacture or design of the product, the company repairs or replac

> On 20 December 20X6 one of Incident plc’s lorries was involved in an accident with a car. The lorry driver was responsible for the accident and the company agreed to pay for the repair to the car. The company put in a claim to its insurers on 17 January

> Olive A/S, incorporated with an authorised capital consisting of one million ordinary shares of €1 each, employs 64 persons, of whom 42 work at the factory and the rest at the head office. The trial balance extracted from its books as at

> (a) Provisions are particular kinds of liabilities. It therefore follows that provisions should be recognized when the definition of a liability has been met. The key requirement of a liability is a present obligation and thus this requirement is critica

> Delta Ltd has been developing a lightweight automated wheelchair. The research costs written off have been far greater than originally estimated and the equity and preference capital has been eroded as seen on the statement of financial position. The fol

> Speedster Ltd commenced trading in 1986 as a wholesaler of lightweight travel accessories. The company was efficient and traded successfully until 2000 when new competitors entered the market selling at lower prices which Speedster could not match. The c

> In the year to 31 December 20X9, Amy bought a new machine and made the following payments in relation to it: Required: (a) State and justify the cost figure which should be used as the basis for depreciation. (b) What does depreciation do, and why is i

> Discuss the advantages to a company of: (a) purchasing and cancelling its own shares; (b) purchasing and holding its own shares in treasury.

> A summary of the statement of financial position of Doxin plc, as at 31 December 20X0, is given below: During 20XI, the company: (i) issued 200,000 ordinary shares of £I each at a premium of I0p per share (a specific issue to redeem prefer

> The following is the statement of financial position of Alpha Ltd as on 30 June 20X8: The following information is relevant: 1 There are contingent liabilities in respect of (i) a guarantee given to bankers to cover a loan of £30,000 made

> The draft statement of financial position of Telin plc at 30 September 20X5 was as follows: Preference shares of the company were originally issued at a premium of 2p per share. The directors of the company decided to redeem these shares at the end of

> Complete Computer Services (CCS) sells computer packages which include supply of a computer which carries the normal warranty against faulty parts plus a two-year assistance package covering problems encountered using any software sold or supplied with t

> Assume that in Question 3 you had also been told that cars without the inclusion of free services are typically sold by other sales outlets for €40,000. Required: Re-do the entries for the sale and the servicing. (Ignore interest as the timing of the se

> Assume the facts as per Question 6 with the following additional costs: There is a five euro cost to add a customer to the phone system and those who buy the phone outright do not default on payments for the phone or the service contract, but those who h

> The following are criticisms made of the IASB’s 2015 exposure draft proposing updates to its Conceptual Framework. 1 The framework does not consider the meaning of the term ‘true and fair view’ despite this being a fundamental characteristic discussed in

> Five G Telephones enters into telephone contracts on the following terms and options: Xyz mobile phones …………………………………..€1,000 Basic Y phones ……………………………………………€200 Basic connection service options: A ……………………………………………..€40 per month B ……………………………….€15

> Assume the same facts as in Question 4(b) but add the presence of a 7.5% value added tax on the sales and a 1% transaction cost paid to the supplier of credit card transactions. Required: (a) Show the entries to record the transactions associated with t

> You have been given the task, by one of the partners of the firm of accountants for which you work, of assisting in the preparation of a trend statement for a client, Mercury. Mercury has been in existence for four years. Figures for the three preceding

> TYV is a manufacturing entity and produces a range of products in several factories. TYV’s trial balance at 30 September 2014 is shown below Notes: (i) On 1 October 2013 two of TYV’s factories, factory A and factory

> Facts: Henry Falk subscribes to an online monthly gardening magazine and selects the option of a three-year subscription from the following options: One issue ……………………………..………..€12 Twelve issues ……………………….……..€120 Twenty-four issues ………………………€200 Thirty

> Penrith European Car Sales plc sells a new car with ‘free’ 5,000 kilometre and 20,000 kilometre services for a combined price of €41,500. The cost of the car from the manufacturer is €30,000. The two services normally cost €400 and €600 to do and are cha

> Strayway PLC sells two planes to Elliott & Elliott Budget Airlines PLC for 5 million euros each payable in two years’ time on presentation of an accepted bill of exchange to be presented through Lloyds Bank. The face value of the bill is €10,000,000. Fur

> Renee Aluminum Products plc enters into an agreement to supply Skyline Window Installers plc with standard window frames at the retail prices at the time less 40%. Renee supplies 300 windows a month at £66 each. However, the agreement provides for price

> New Management plc is a pharmaceutical company selling to wholesalers and retail pharmacies. The new CEO was appointed at the start of the financial year and was full of enthusiasm. For the first six months her new ideas created a 10% increase in sales a

> Exess Steel plc specialises in steelmaking and is located in the northwest of the country. Due to an unexpected downturn in demand for its steel products it has excess coking coal. South East Steel Products plc has also been caught by the unexpected econ