Question: The following list of balances has been

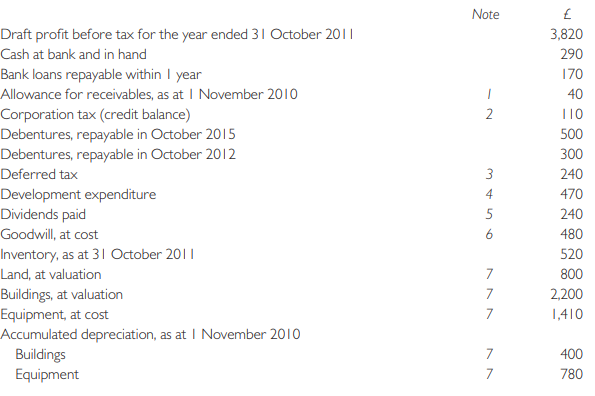

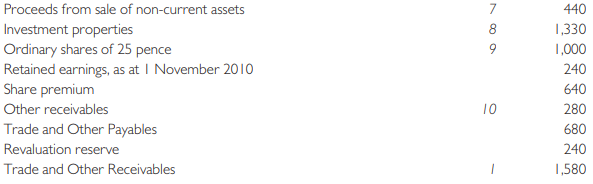

The following list of balances has been extracted from the records of Cowgale company as at 31 October 2011, the end of Cowgale’s most recent financial year:

The following additional information is available:

1 Following an impairment review of receivables as at 31 October 2011 specific invoices totalling £320,000 are to be written off, but no allowance for doubtful debts is to be made on trade receivables as at 31 October 2011.

2 The balance on the corporation tax account represents an over provision for corporation tax for the financial year ended 31 October 2011. Corporation tax payable for the year ended 31 October 2011 has been estimated at £600,000.

3 The balance on the deferred tax account is to be adjusted for corporation tax of £135,000 payable on taxable temporary differences arising during the year ended 31 October 2011.

There were no reversing temporary differences during the year.

4 The balance on development expenditure as at 31 October 2011 comprises:

◠£120,000 spent during the year on the initial training of staff for a proposed customer call centre in an overseas country with low labour costs. Following social unrest and increasing political instability in that country, Cowgale decided in September 2011 not to proceed any further with this project.

◠£350,000 spent during the year to make the company’s packaging process cheaper, more efficient and more environmentally responsible. Cowgale expects to incur further development costs of £107,000 but is on target to introduce the new packaging process in January 2012. The new process will significantly cut costs, increase output and will recover all its development costs.

5 During the year ended 31 October 2011 Cowgale paid the final dividend of 3 pence per share for the year ended 31 October 2010 and an interim dividend of 3 pence per share for the year ended 31 October 2011. The directors of Cowgale will be proposing a final dividend of 4 pence per share at its annual general meeting which will be held in January 2012 and the shareholders are expected to approve the proposal.

6 The goodwill arose on 1 November 2010 when Cowgale purchased and absorbed another business as a going concern. The economic life of the goodwill was estimated as 20 years from 1 November 2010. The directors have been advised that the fair value of the goodwill was £350,000 as at 31 October 2011.

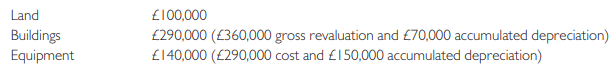

7 The proceeds on sale of non-current assets account records £440,000 cash received from the sale of tangible non-current assets during the year ended 31 October 2011. The £440,000 was also debited to bank account but no other entries in connection with the disposals have been made. The carrying values of the assets sold during the year were:

Cowgale uses the revaluation model for land and buildings and the revaluation reserve includes £90,000 of revaluation surpluses relating to the land and buildings sold during the year.

Cowgale’s depreciation policies are:

Land …………………………………………………………..no depreciation

Buildings ……………………………..5% straight-line, full-year basis

Equipment …………………30% reducing balance, full-year basis

depreciation for the year ended 31 October 2011 is still to be charged on all assets in use at the end of the financial year.

8 Cowgale uses the fair value model for investment properties. The market value of the company’s investment properties was estimated at £1,400,000 as at 31 October 2011.

9 Cowgale used the share premium account to finance a bonus issue of 1 for 4 shares on 31 October 2011. This has not yet been recorded in the accounts. The bonus shares will qualify for all dividends paid after 31 October 2011.

10 The Other Receivables balance represents the excess of value added tax on inputs (purchases) over value added tax on outputs (sales) for the last quarter of the financial year.

11 Cowgale vacated some office property it was leasing on 1 August 2011 in order to rationalize its administration procedures. Under the lease agreement Cowgale was committed as at 31 October 2011 to making further payments totaling £108,000 on the lease until 31 July 2012. Cowgale is allowed to sublease the premises but this has proved difficult because of redevelopment plans for the area and a local recession. The only offer that Cowgale has received has been from a charity which wants to rent the offices for four months for a total of £22,000. Cowgale has decided to accept this offer. The lease is being accounted for as an operating lease.

Required:

(a) Prepare the Statement of Financial Position of Cowgale as at 31 October 2011.

(b) Prepare a calculation of retained earnings as at 31 October 2011 starting with the draft profit before tax of £3,820,000 for the year ended 31 October 2011 and using the additional information in notes 1 to 11 above.

Transcribed Image Text:

Note Draft profit before tax for the year ended 31 October 2011 3,820 Cash at bank and in hand 290 Bank loans repayable within I year 170 Allowance for receivables, as at I November 2010 40 Corporation tax (credit balance) Debentures, repayable in October 2015 Debentures, repayable in October 2012 2 T10 500 300 Deferred tax 240 Development expenditure Dividends paid Goodwill, at cost 4 470 5 240 6 480 Inventory, as at 31 October 2011 520 Land, at valuation 7 800 Buildings, at valuation Equipment, at cost Accumulated depreciation, as at I November 2010 Buildings Equipment 7 2,200 7 1,410 7 400 7 780 Proceeds from sale of non-current assets 7 440 Investment properties Ordinary shares of 25 pence Retained earnings, as at I November 201O Share premium Other receivables 8 1,330 1,000 240 640 10 280 Trade and Other Payables 680 Revaluation reserve 240 Trade and Other Receivables 1,580 Land £100,000 Buildings Equipment £290,000 (£360,000 gross revaluation and £70,000 Accumulated depreciation) £140,000 (£290,000 cost and £150,000 accumulated depreciation)

> Agriculture is a key business activity in many parts of the world, particularly in developing countries. Following extensive discussions with, and funding from, the World Bank, the International Accounting Standards Committee (IASC) developed an accounti

> The statement of income of Bottom, a manufacturing company, for the year ending 31 January 20X2 is as follows: Bottom has used the LIFO method of inventory valuation but the directors wish to assess the implications of using the FIFO method. Relevant d

> The following is the statement of financial position of Alpha Ltd as on 30 June 20X8: The following information is relevant: 1 There are contingent liabilities in respect of (i) a guarantee given to bankers to cover a loan of £30,000 made

> The following are the financial statements of the parent company Swish plc, a subsidiary company Broom and an associate company Handle. Swish acquired 90% of the shares in Broom on 1 January 20X1 when the balance on the retained earnings of Broom was

> The following are the statements of financial position of Garden plc, its subsidiary Rose Ltd and its associate Petal Ltd: On 1 January 20X3 Garden plc acquired 75% of Rose Ltd for £300,000 when Rose’s share capital and r

> The following are the financial statements of the parent company Alpha plc, a subsidiary company Beta and an associate company Gamma. On 1 January 20X5 Alpha plc acquired 80% of Beta plc for £216,000 when Beta plc’s share

> The statements of comprehensive income for Highway plc, Road Ltd and Lane Ltd for the year ended 31 December 20X9 were as follows: Highway plc acquired 80% of Road Ltd for $160,000 on 1.1.20X6 when Road Ltd’s share capital was $64,000

> The statements of income for Continent plc, Island Ltd and River Ltd for the year ended 31 December 20X9 were as follows: Continent plc acquired 80% of Island Ltd for €27,500 on 1 January 20X3, when Island Ltd’s retai

> Rumpus plc is a public listed manufacturing company. Its summarized consolidated financial statements for the year ended 31 March 2014 (and 2013 comparatives where relevant) are as follows: The following additional information is available: (i) The g

> H Ltd has one subsidiary, S Ltd. The company has held a controlling interest for several years. The latest financial statements for the two companies and the consolidated financial statements for the H Group are as shown below: Required: (a) Calculate

> The statements of financial position of Red Ltd and Pink Ltd at 31 December 20X2 are as follows: Statements of comprehensive income for the year ended 31 December 20x2 Red Ltd acquired 75% of the shares in Pink Ltd on 1 January 20X0 when Pink Ltd&aci

> The statements of financial position of Mars plc and Jupiter plc at 31 December 20X2 are as follows: Statements of comprehensive income for the year ended 31 December 20x2 Mars acquired 80% of the shares in Jupiter on 1 January 20X0 when Jupiter&acir

> Gamma is a company that manufactures power tools. Gamma was established by Mr Lee, who owns all of Gamma’s shares. Mrs Lee, Mr Lee’s wife, owns a controlling interest in Delta, a distributor of power tools. Delta is on

> Donna, Inc. operates a defined benefit pension scheme for staff. The pension scheme has been operating for a number of years but not following IAS 19. The finance director is unsure of which accounting policy to adopt under IAS 19 because he has heard ve

> River plc acquired 90% of the common shares and 10% of the 5% bonds in Pool Ltd on 31 March 20X1. All income and expenses are deemed to accrue evenly through the year. On 31 January 20X1 River sold Pool goods for £6,000 plus a markup of one-

> Morn Ltd acquired 90% of the shares in Eve Ltd on 1 January 20X1 for £90,000 when Eve Ltd’s accumulated profits were £50,000. On 10 January 20X1 Morn Ltd received a dividend of £10,800 from Eve Ltd

> Bill plc acquired 80% of the common shares and 10% of the preferred shares in Ben plc on 31 December three years ago when Ben’s retained profits were €45,000. During the year Bill sold Ben goods for €8,

> Forest plc acquired 80% of the ordinary shares of Bulwell plc some years ago. At acquisition, the fair values of the assets of Bulwell plc were the same as their carrying value. Bulwell plc manufacture plant and equipment. On 1 January 20X3, Bulwell sold

> The following are the summarized financial statements of two companies, Peel and Caval, for the financial year ended 31 October 2011. The following information is available: (i) Peel purchased 90% of the ordinary shares in Caval for £240m

> Hyson plc acquired 75% of the shares in Green plc on 1 January 20X0 for £6 million when Green plc’s accumulated profits were £4.5 million. At acquisition, the fair value of Green’s non-current

> The following accounts are the consolidated statement of financial position and parent company statement of financial position for Alpha Ltd as at 30 June 20X2: Notes: 1 There was only one subsidiary, called Beta Ltd. 2 There were no capital reserves i

> On 1 January 20X0 Hill plc purchased 70% of the ordinary shares of Valley plc for £1.3 million. The fair value of the non-controlling interest at that date was £0.5 million. At the date of acquisition, Valley’s

> Prop and Flap have produced the following statements of financial position as at 31 October 2008: The following information is relevant to the preparation of the financial statements of the Prop Group: 1 Prop acquired 80% of the issued ordinary share c

> On 30 September 20X0 Gold plc acquired 75% of the equity shares, 30% of the preferred shares and 20% of the bonds in Silver plc and gained control. The balance of retained earnings on 30 September 20X0 was £16,000. The fair value of the land

> A plc issues 50,000 share options to its employees on 1 January 2008 which the employees can only exercise if they remain with the company until 31 December 2010. The options have a fair value of £5 each on 1 January 2008. It is expected that the holders

> Maxpool plc, a listed company, owned 60% of the shares in Ching Ltd. Bay plc, a listed company, owned the remaining 40% of the £1 ordinary shares in Ching Ltd. The holdings of shares were acquired on 1 January 20X0. On 30 November 20X0 Ching Ltd sold a f

> Summer plc acquired 60% of the equity shares of Winter Ltd on 30 September 20X1 and gained control. At the date of acquisition, the balance of retained earnings of Winter was €35,000. At 31 December 20X1 the statements of financial posit

> Sweden acquired 100% of the equity shares of Oslo on 1 March 20X1 and gained control. At that date the balances on the reserves of Oslo were as follows: Revaluation reserve ………â€&brv

> Bleu plc acquired 80% of the shares of Verte plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Required: Prepare a consolidated statement of financial position for Bleu plc

> Set out below is the summarized statement of financial position of Berlin plc at 1 January 20X0. On 1/1/20X0 Berlin acquired 100% of the shares of Hanover for £100,000 and gained control. Required: Prepare the statement of financial posit

> Ham plc acquired 100% of the common shares of Burg plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Notes: 1 The fair value is the same as the book value. 2 â‚&

> Rouge plc acquired 100% of the common shares of Noir plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Required: Prepare a consolidated statement of financial position for

> On 1 January 20X7 Parent Ltd acquired 75% of the ordinary shares in Daughter Ltd for £9,000 cash. The fair value of the net assets in Daughter Ltd was their book value. Assume in each case that the non controlling interest is measured using

> On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £6,000 cash. The fair value of the net assets in Daughter Ltd was their book value. Required: Prepare the statements of financial position of Parent Ltd and t

> (a) On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £16,200 cash. The fair value of the net assets in Daughter Ltd was £12,000. (b) The purchase consideration was satisfied by the issue of 5,400

> Simple SA has just purchased a roasting/salting machine to produce roasted walnuts. The finance director asks for your advice on how the company should calculate the depreciation on this machine. Details are as follows: Cost of machine ……………………………………….S

> (a) On 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £16,200 cash. The fair value of the net assets in Daughter Ltd was their book value. (b) The purchase consideration was satisfied by the issue of 5,400 new

> (a) In 20X3 Arthur is a large loan creditor of X Ltd and receives interest at 20% p.a. on this loan. He also has a 24% shareholding in X Ltd. Until 20X1 he was a director of the company and left after a disagreement. The remaining 76% of the shares are h

> (a) Assume that on 1 January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £10,800 cash. The fair value of the net assets in Daughter Ltd was their book value. (b) The purchase consideration was satisfied by the issue

> Backwater Construction Company is reviewing a major contract which is in serious difficulty. The contract price is €10,000,000. The project involves the construction of four buildings of equal size and complexity. The first building has been completed an

> During 2006, Jack Matelot set up a company, JTM, to construct and refurbish marinas in various ports around Europe. The company’s first accounting period ended on 31 October 2006 and during that period JTM won a contract to refurbish a

> The following information relates to Deferred plc: ● EBITDA (earnings before interest, tax, depreciation and amortization) for year ended 31.12.20X1 is £300,000 ● No interest payable in 20X1 ● No amortization ● Equipment cost £100,000 at 1.1.20X1 ● Depre

> Quick build Ltd entered into a two-year contract on 1 January 20X7 at a contract price of £250,000. The estimated cost of the contract was £150,000. At the end of the first year the following information was available: ● contract costs incurred totaled £

> Newbild SA commenced work on the construction of a block of flats on 1 July 20X0. During the period ended 31 March 20X1 contract expenditure was as follows: € Materials issued from stores …………………….13,407 Materials delivered direct to site ………………73,078 W

> At 31 October 20X9, Lytax Ltd was engaged in the following five long-term contracts. In each contract Lytax was building cold storage warehouses on five sites where the land was owned by the customer. Details are given below: It is not expected that an

> Beta Ltd commenced business on 1 January and is making up its first year’s accounts. The company uses standard costs. The company owns a variety of raw materials and components for use in its manufacturing business. The accounting recor

> HK Ltd has prepared its draft trial balance to 30 June 20X1, which is shown below. The following information is available: (a) The authorised share capital is 4,000,000 9% preference shares of $1 each and 18,000,000 ordinary shares of 50c each. (b) Pro

> Purchases of a certain product during July were: Units sold during the month were: Required: Assuming no opening inventories: (a) Determine the cost of goods sold for July under three different valuation methods. (b) Discuss the advantages and/or dis

> Sunhats Ltd manufactures patent hats. It carries inventory of these and sells to wholesalers and retailers via a number of salespeople. The following expenses are charged in the profit and loss account: Required: Which of these expenses can reasonably

> James Bright has just taken up the position of managing director following the unsatisfactory achievements of the previous incumbent. James arrives as the accounts for the previous year are being finalised. James wants the previous performance to look po

> Brands plc is preparing its accounts for the year ended 31 October 20X8 and the following information is available relating to various intangible assets acquired on the acquisition of Countrywide plc: (a) A milk quota of 2,000,000 litres at 30p per litre

> Under IAS 22, the depletion of equity reserves caused by the accounting treatment for purchased goodwill resulted in some companies capitalizing brands on their statements of financial position. This practice was started by Rank Hovis McDougall (RHM) – a

> Hanson Products Ltd is a newly formed company. The company commenced trading on 1 January 20X1 when it purchased an item of plant and equipment for $240,000. The plant and equipment has an expected life of five years with zero residual value, and will be

> Ross Neale is the divisional accountant for the Research and Development division of Critical Pharmaceuticals PLC. He is discussing the third-quarter results with Tina Snedden who is the manager of the division. The conversation focuses on the fact that

> Oxlag plc, a manufacturer of pharmaceutical products, has the following research and development projects on hand at 31 January 20X2: (A) A general survey into the long-term effects of its sleeping pill Chalcedon upon human resistance to infections. At t

> As chief accountant at Italin NV, you have been given the following information by the director of research: The board of directors considers that this project is similar to the other projects that the company undertakes, and is confident of a successf

> Environmental Engineering plc is engaged in the development of an environmentally friendly personal transport vehicle. This will run on an electric motor powered by solar cells, supplemented by passenger effort in the form of pedal assistance. At the end

> Basalt plc is a wholesaler. The following is its trial balance as at 31 December 20X0. The following additional information is supplied: (i) Depreciate plant and machinery 20% on straight-line basis. (ii) Inventory at 31 December 20X0 is £

> IAS 38 Intangible Assets was issued primarily in order to identify the criteria that need to be present before expenditure on intangible items can be recognized as an asset. The standard also prescribes the subsequent accounting treatment of intangible a

> Under a contract between a customer, Charlie (C) and a freight carrier Solutions Ltd (S), S provides C with 10 rail cars for five years. The cars, which are owned by S, are specified in the contract. C determines when, where and which goods are to be tra

> Delta owned two assets which were sold on 1 April 20X1 – the first day of Delta’s accounting period. Both assets were sold for their fair value. Details of the sales are as follows: Asset 1 Asset 1 was sold for £500,000 and leased back on a five-year le

> Bertie prepares financial statements to 31 December each year. On 1 January 20X1 Bertie purchased a machine for £200,000 and immediately leased the machine to Carter. The lease term was five years – equal to the expected useful life of the asset. Bertie

> On 1 April 20Y1 Smarty (see question 2) reassessed its future strategy and concluded that it would take up the option to lease the machine for a further two years from 1 October 20Y2. This was regarded as a modification to the original lease and Smarty r

> Austin Mitchell MP proposed an Early Day Motion in the House of Commons on 17 May 2005 as follows: That this House urges the Government to clamp down on artificial tax avoidance schemes and end the . . . tax avoidance loop-holes that enable millionaires

> (a) When accounting for leases, accountants prefer to overlook legal form in favour of commercial substance. Required: Discuss the above statement in the light of the requirements of IFRS 16 Leases. (b) State briefly how you would distinguish between a f

> On 1 January 20X8, Grabbit plc entered into an agreement to lease a widgeting machine for general use in the business. The agreement, which may not be terminated by either party to it, runs for six years and provides for Grabbit to make an annual rental

> International Financial Reporting Standards (IFRS) support the use of fair values when reporting the values of assets wherever practical. This involves periodic re measurements of assets and the consequent recognition of gains and losses in the financial

> The Blissopia Leisure Group consists of three divisions: Blissopia 1, which operates mainstream bars; Blissopia 2, which operates large restaurants; and Blissopia 3, which operates one hotel – the Eden. Divisions 1 and 2 have been tradi

> Infinite Leisure Group owns and operates a number of pubs and clubs across Europe and South East Asia. Since inception the group has made exclusive use of the cost model for the purpose of its annual financial reporting. This has led to a number of share

> Discuss the arguments for and against discounting the deferred tax charge.

> For the following years, capital allowances are likely to continue to be in excess of depreciation for the foreseeable future. (d) Corporation tax is to be taken at 21%. Required: Calculate the deferred tax charges or credits for the next six years, com

> The following information is given in respect of Unambitious plc: (a) Non-current assets consist entirely of plant and machinery. The net book value of these assets as at 30 June 2010 is £100,000 in excess of their tax written-down value. (b

> A non-current asset (a machine) was purchased by Adjourn plc on 1 July 20X2 at a cost of £25,000. The company prepares its annual accounts to 31 March in each year. The policy of the company is to depreciate such assets at the rate of 15% straight line (

> In your capacity as chief assistant to the financial controller, your managing director has asked you to explain to him the differences between tax planning, tax avoidance and tax evasion. He has also asked you to explain to him your feelings as a profes

> George plc will need to adopt IFRS 9 from accounting periods beginning on or after 1 January 2018. George has three different instruments whose accounting George is concerned will change as a result of the adoption of the standard. The three instruments

> Formatone plc produced the following trial balance as at 30 June 20X6: The following information is available: (i) A revaluation of the Land and Buildings on 1 July 20X5 resulted in an increase of £3,240,000 in the Land and £9

> On 1 October 20X1, Little Raven plc issued 50,000 debentures, with a par value of £100 each, to investors at £80 each. The debentures are redeemable at par on 30 September 20X6 and have a coupon rate of 6%, which was significant

> Creasy plc needs to raise €20 million and is considering two different instruments that could be issued: (i) A 7% debenture with a par value of €20 million, repayable at par in five years. Interest is paid annually in arrears. (ii) A 5% convertible deben

> Milner Ltd issues a 6% cumulative preference share for €1 million that is repayable in cash at par 10 years after issue. The only condition on the dividends is that if the directors declare an ordinary dividend the preference dividend (and any arrears of

> On 1 October year 1, RPS plc issued one million £1 5% redeemable preference shares. The shares were issued at a discount of £50,000 and are due to be redeemed on 30 September Year 5. Dividends are paid on 30 September each year. Required: Show the accou

> Scott Ross, CFO of Ryan Industries PLC, is discussing the publication of the annual report with his managing director Nathan Davison. Graydon says: ‘The law requires us to comply with accounting standards and at the same time to provide a true and fair v

> On 1 January 2009 Henry Ltd issued a convertible debenture for €200 million carrying a coupon interest rate of 5%. The debenture is convertible at the option of the holders into 10 ordinary shares for each €100 of debenture stock on 31 December 2013. Hen

> Isabelle Limited borrows £100,000 from a bank on the following terms: (i) arrangement fees of £2,000 are charged by the bank and deducted from the initial proceeds on the loan; (ii) interest is payable at 5% for the first three years of the loan and then

> Fairclough plc borrowed €10 million from a bank on 1 January 2011. Fees of €100,000 were charged by the bank which were paid by Fairclough plc at inception of the loan. The terms of the loan are: Interest ● Interest of 6% until 31 December 2013 ● Interes

> The approach in IAS 39 to the impairment of financial assets was flawed because it did not allow financial institutions to recognize the true losses they expected on loans at the time they had made the loans. How does the final version of IFRS 9 address

> Procter Limited, a UK private company has the following financial assets and liabilities in the accounts: (i) An equity investment in Milner plc, a UK listed company. Procter recognises the investment as an ‘available for sale’ investment under IAS 39 Fi

> (a) IAS 16 Property, Plant and Equipment requires that where there has been a permanent diminution in the value of property, plant and equipment, the carrying amount should be written down to the recoverable amount. The phrase ‘recoverable amount’ is def

> At the start of the year Cornish plc entered into a number of financial instruments and is considering how to classify these instruments under IFRS 9. The instruments are as follows (a) Investment in listed 3% government bonds for €2 million. Cornish acq

> Tan plc has the following assets originated on 1 January 2016: (i) A loan receivable generated from lending £100,000 to a customer of the company. The loan carries interest at 7% per annum payable in arrears and is classified at amortized cost. The 12-mo

> Charles plc is applying IAS 32 and IFRS 9 for the first time this year and is uncertain about the application of the standard. Charles plc’s balance sheet is as follows: Note The forward contracts have been revalued to fair value in t

> A company borrows on a floating-rate loan, but wishes to hedge against interest variations so swaps the interest for fixed rate. The swap should be perfectly effective and has zero fair value at inception. Interest rates increase and therefore the swap b

> Baudvin Ltd has an equity investment that cost €1 million on 1 January 2008. The investment is classified as an available-for-sale investment under IAS 39. The value of the investment at each period-end is: 31 December 2008 ……………………………€950,000 31 Decemb

> The following is an extract from the trial balance of Imecet at 31 October 2005: Other relevant information: (i) One million $1 ordinary shares were issued 1 May 2005 at the market price of $1.75 per ordinary share. (ii) The inventory at 31 October 200

> On 1 January 2009 Hazell plc borrows €5 million on terms with interest of 3% fixed for the period to 31 December 2009, going to variable rate thereafter (at inception the variable rate is 6%). The loan is repayable at Hazell plc’s option between 31 Decem

> On 1 April year 1, a deep discount bond was issued by DDB AG. It had a face value of £2.5 million and covered a five-year term. The lenders were granted a discount of 5%. The coupon rate was 10% on the principal sum of £2.5 million, payable annually in a

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 30 September 2008 are being prepared. Your assistant, who has prepared the first draft of the statements, is unsure ab

> Epsilon is a listed entity. You are the financial controller of the entity and its consolidated financial statements for the year ended 31 March 2009 are being prepared. The board of directors is responsible for all key financial and operating decisions,

> The finance director of Small Machine Parts Ltd is considering the acquisition of a lease of a small workshop in a warehouse complex that is being redeveloped by City Redevelopers Ltd at a steady rate over a number of years. City Redevelopers are grantin

> On 1 April 20W9 Kroner began to lease an office block on a 20-year lease. The useful economic life of the office buildings was estimated at 40 years on 1 April 20W9. The supply of leasehold properties exceeded the demand on 1 April 2009 so as an incentiv

> Suktor is an entity that prepares financial statements to 30 June each year. On 30 April 20X1 the directors decided to discontinue the business of one of Suktor’s operating divisions. They decided to cease production on 31 July 20X1, with a view to dispo