Question: Garfield Inc. manufactures entry and dining room

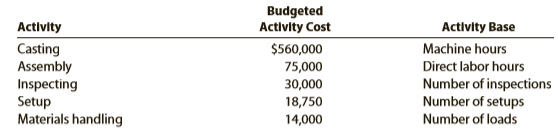

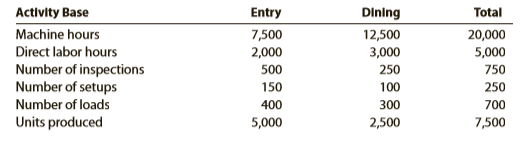

Garfield Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows:

Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow:

A. Determine the activity rate for each activity.

B. Use the activity rates in (A) to determine the total and per-unit activity costs associated with each product.

Transcribed Image Text:

Budgeted Activity Cost Activity Activity Base Casting Assembly Inspecting Setup Materials handling $560,000 Machine hours 75,000 Direct labor hours Number of inspections Number of setups 30,000 18,750 14,000 Number of loads Activity Base Entry Dining Total Machine hours 7,500 12,500 20,000 Direct labor hours 2,000 3,000 5,000 Number of inspections Number of setups Number of loads 500 250 750 150 100 250 400 300 700 Units produced 5,000 2,500 7,500

> On November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: If the fixed manufacturing costs were $960,000 and the fixed selling and administrative expe

> On December 31, the end of the first year of operations, Frankenreiter Inc. manufactured 25,600 units and sold 24,000 units. The following income statement was prepared, based on the variable costing concept: Determine the unit cost of goods manufactur

> The management of East Coast Railroad Company introduced in Exercise 20 improved the profitability of the Atlanta/Baltimore route in May by reducing the price of a railcar from $600 to $500. This price reduction increased the demand for rail services. Th

> Shawnee Motors Inc. assembles and sells snowmobile engines. The company began operations on August 1 and operated at 100% of capacity during the first month. The following data summarize the results for August: A. Prepare an income statement according

> Based on the data in Exercise 18 prepare a contribution margin analysis of the variable costs for Romero Products Inc. for the year ended December 31. Data from Exercise 18: The following data for Romero Products Inc. are available: Prepare an analys

> The following data for Romero Products Inc. are available: Prepare an analysis of the sales quantity and unit price factors. Difference- Increase or For the Year Ended December 31 Actual Planned (Decrease) Sales.... $8,360,000 $8,200,000 $ 160,000

> Select Audio Inc. sells electronic equipment. Management decided early in the year to reduce the price of the speakers in order to increase sales volume. As a result, for the year ended December 31, the sales increased by $31,875 from the planned level o

> The cash account for Collegiate Sports Co. on November 1, 20Y9, indicated a balance of $81,145. During November, the total cash deposited was $293,150, and checks written totaled $307,360. The bank statement indicated a balance of $112,675 on November 30

> The operating revenues of the three largest business segments for T i me War ner , I nc. , for a recent year follow. Each segment includes a number of businesses, examples of which are indicated in parentheses. Time Warner, Inc. Segment Revenues (in mil

> The marketing segment sales for Cater pillar, Inc., for a year follow: In addition, assume the following information: A. Use the sales information and the additional assumed information to prepare a contribution margin by segment report. Round to two

> Havasu Off-Road Inc. manufactures and sells a variety of commercial vehicles in the Northeast and Southwest regions. There are two salespersons assigned to each territory. Higher commission rates go to the most experienced salespersons. The following sal

> Coast to Coast Surfboards Inc. manufactures and sells two styles of surfboards, Atlantic Wave and Pacific Pounder. These surfboards are sold in two regions, East Coast and West Coast. Information about the two surfboards is as follows: The sales unit v

> Power Train Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Mountain Monster and Desert Dragon, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit inform

> Head Pops Inc. manufactures two models of solar-powered, noise-canceling headphones: Sun Sound and Ear Bling models. The company is operating at less than full capacity. Market research indicates that 28,000 additional Sun Sound and 30,000 additional Ear

> Winslow Inc. manufactures and sells three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: In addition, you have determined the following information with respect to allocated fixed

> At the end of the first year of operations, 6,400 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Direct materials…………………………………….$75 Direct labor……………………………………………..35 Fixed factory overhead……

> A. Young Company budgets sales of $112,900,000, fixed costs of $25,000,000, and variable costs of $66,611,000. What is the contribution margin ratio for Young Company? B. If the contribution margin ratio for Martinez Company is 40%, sales were $34,800,00

> Select Foods Inc. uses activity-based costing to determine product costs. For each activity listed in the left column, match an appropriate activity base from the right column. You may use items in the activity-base list more than once or not at all.

> The unadjusted trial balance of Recessive Interiors at January 31, 2018, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (A) Supplies on hand at January 31 are $2,850. (B) Insurance premiums expired durin

> Ziegler Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced…………………………Total Costs 80,000………………………………

> Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 25,000 to 100,000 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Complete the cost schedule,

> Performance Gloves, Inc. produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cu

> Elliott Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Elliott Engines has a very simple production process and product line and uses a single plant wide factory overhe

> For a major university, match each cost in the following table with the activity base most appropriate to it. An activity base may be used more than once or not used at all. Cost: Activity Base: A. Number of enrollment applications B. Number of stud

> The Converting Department of Tender Soft Tissue Company uses the average cost method and had 1,900 units in work in process that were 60% complete at the beginning of the period. During the period, 15,800 units were completed and transferred to the Packi

> Safety First Insurance Company carries three major lines of insurance: auto, workers’ compensation, and homeowners. The company has prepared the following report: Management is concerned that the administrative expenses may make some

> Name the following chart, and identify the items represented by the letters (A) through (F): $150,000 $100,000 E $50,000 F A $(50,000) $(100,000) $(150,000) - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Units of Sales B Op

> Mozart Music Inc. makes three musical instruments: trumpets, tubas, and trombones. The budgeted factory overhead cost is $3,469,400. Factory overhead is allocated to the three products on the basis of direct labor hours. The products have the following b

> Name the following chart, and identify the items represented by the letters (A) through (F): $200,000 $150,000 F E $100,000 D $50,000 B 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Units of Sales Sales and Costs

> The unadjusted trial balance of La Mesa Laundry at August 31, 2018, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (A) Wages accrued but not paid at August 31 are $2,200. (B) Depreciation of equip

> Naper Inc. manufactures power equipment. Naper has two primary products—generators and air compressors. The following report was prepared by the controller for Naper’s senior marketing management for the year ended Dec

> Gordon Gecco Furniture Company has two major product lines with the following characteristics: • Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity â

> Whirlpool Corporation conducted an activity-based costing study of its Evansville, Indiana, plant in order to identify its most profitable products. Assume that we select three representative refrigerators (out of 333): one low-, one medium-, and one hig

> The management of Four Finger Appliance Company in Exercise 14 has asked you to use activity-based costing instead of direct labor hours to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from eac

> The Junior League of Yadkinville, California, collected recipes from members and published a cookbook entitled Food for Everyone. The book will sell for $18 per copy. The chairwoman of the cookbook development committee estimated that the club needed to

> Currently, the unit selling price of a product is $1,500, the unit variable cost is $1,200, and the total fixed costs are $4,500,000. A proposal is being evaluated to increase the unit selling price to $1,600. A. Compute the current break-even sales (uni

> Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity co

> For the current year ended October 31, Friedman Company expects fixed costs of $14,300,000, a unit variable cost of $250, and a unit selling price of $380. A. Compute the anticipated break-even sales (units). B. Compute the sales (units) required to real

> For a recent year, McDonald’s company-owned restaurants had the following sales and expenses (in millions): Sales…………………………………………………………………..$18,169.3 Food and packaging……………………………………………..$ 6,129.7 Payroll……………………………………………………………………4,756.0 Occupancy (rent

> Nixon Machine Parts Inc.’s Fabrication Department incurred $560,000 of factory overhead cost in producing gears and sprockets. The two products consumed a total of 8,000 direct machine hours. Of that amount, sprockets consumed 5,150 direct machine hours.

> The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no service department charges, and the division operates as an investment

> Nozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $540,000 and 60,000 sales orders are estimated to be processed. A. Determine the activity rate of the sales ord

> The management of Firebolt Industries Inc. manufactures gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the compan

> Pineapple Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plant wide factory overhead rate for a

> Salty Sensations Snacks Company manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation……&aci

> Crosswinds Hospital plans to use activity-based costing to assign hospital indirect costs to the care of patients. The hospital has identified the following activities and activity rates for the hospital indirect costs: Activity…&aci

> Schneider Electric manufactures power distribution equipment for commercial customers, such as hospitals and manufacturers. Activity-based costing was used to determine customer profitability. Customer service activities were assigned to individual custo

> Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as

> Digital Storage Concept Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 3,750 direct labor

> Atlas Enterprises Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the

> Product pricing and product costs vary significantly depending on company and industry. Three such companies, their industries, and an associated product are: In teams of three, assign each person in your group to one of the companies listed above. Go

> In groups of two to four people, visit a sit-down restaurant and do a lead time study. If more than one group chooses to visit the same restaurant, choose different times for your visits. Note the time when you walk in the door of the restaurant and the

> Kellogg Company manufactures cold cereal products, such as Frosted Flakes. Assume that the inventory in process on March 1 for the Packing Department included 1,200 pounds of cereal in the packing machine hopper (enough for 800 24-oz. boxes) and 800 empt

> A. Based upon the data in Exercise 17-7, determine the following for March: 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during March 4. Cost of units started and c

> The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. A. Determine the number of units in work in process inventory at March 31. B. Determine the equ

> Units of production data for the two departments of Pacific Cable and Wire Company for November of the current fiscal year are as follows: If all direct materials are placed in process at the beginning of production, determine the direct materials and

> The Converting Department of Hopkinsville Company had 1,200 units in work in process at the beginning of the period, which were 25% complete. During the period, 16,000 units were completed and transferred to the Packing Department. There were 2,000 units

> The cost accountant for Kenner Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $3,000,000, and total direct labor costs would be $2,400,000. During May, the actual di

> Domino Foods, Inc. , manufactures a sugar product by a continuous process, involving three production departments—Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first

> The following are some quotes provided by a number of managers at Hawkeye Machining Company regarding the company’s planned move toward a lean manufacturing system: Director of Sales: I’m afraid we’ll miss some sales if we don’t keep a large stock of ite

> Madison Electric Company uses a fossil fuel (coal) plant for generating electricity. The facility can generate 900 megawatts (million watts) per hour. The plant operates 600 hours during March. Electricity is used as it is generated; thus, there are no i

> Flcoa Inc. is the world’s largest producer of aluminum products. One product that Alcoa manufactures is aluminum sheet products for the aerospace industry. The entire output of the Smelting Department is transferred to the Rolling Department. Part of the

> Danielle Hastings was recently hired as a cost analyst by CareNet Medical Supplies Inc. One of Danielle’s first assignments was to perform a net present value analysis for a new warehouse. Danielle performed the analysis and calculated a present value in

> Lighthouse Paper Company manufactures newsprint. The product is manufactured in two departments, Papermaking and Converting. Pulp is first placed into a vessel at the beginning of papermaking production. The following information concerns production in t

> AccuBlade Castings Inc. casts blades for turbine engines. Within the Casting Department, alloy is first melted in a crucible, then poured into molds to produce the castings. On May 1, there were 230 pounds of alloy in process, which were 60% complete as

> The Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. A. Prepare a cost of production report for the Cutting Department. B. Compute and evaluate th

> The debits to Work in Process—Roasting Department for Morning Brew Coffee Company for August, together with information concerning production, are as follows: All direct materials are placed in process at the beginning of production.

> Based on the data in Exercise 17-14, determine the following: A. Cost of beginning work in process inventory completed in November B. Cost of units transferred to the next department during November C. Cost of ending work in process inventory on November

> The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventor

> Napco Refining Company processes gasoline. On June 1 of the current year, 6,400 units were 3⁄⁄5 completed in the Blending Department. During June, 55,000 units entered the Blending Department from the Refining Departme

> A. Based on the data in Exercise 17-11, determine the following: 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per

> The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Determine the following: A. T

> Georgia Products Inc. completed and transferred 89,000 particle board units of production from the Pressing Department. There was no beginning inventory in process in the department. The ending in-process inventory was 2,400 units, which were 3⁄ 5 comple

> The Southern Division manager of Texcaliber Inc. is growing concerned that the division will not be able to meet its current period income objectives. The division uses absorption costing for internal profit reporting and had an appropriate level of inve

> The Hershey Company manufactures chocolate confectionery products. The three largest raw materials are cocoa, sugar, and dehydrated milk. These raw materials first go into the Blending Department. The blended product is then sent to the Molding Departmen

> Sundance Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine

> Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 11-101…………………………………………………$6,240 Job 11-102…………………………………………………..9,000 Job 11-103…………………

> The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: The direct labor rate earned per hour by the three employees is as follows: Tom Couro……â€&b

> A summary of the time tickets for the current month follows: Journalize the entry to record the factory labor costs. Job No. Amount Job No. Amount 100 $ 3,500 Indirect $ 9,100 101 6,650 111 8,620 104 21,900 115 2,760 108 14,440 117 18,550

> GenX Furnishings Company manufactures designer furniture. GenX Furnishings uses a job order cost system. Balances on June 1 from the materials ledger are as follows: Fabric………â€&brvb

> Materials issued for the current month are as follows: Journalize the entry to record the issuance of materials. Requisition No. Material Job No. Amount 201 Aluminum 500 $88,700 202 Plastic 503 27,600 203 Rubber 504 3,650 204 Glue Indirect 2,250 20

> An incomplete subsidiary ledger of materials inventory for May is as follows: A. Complete the materials issuances and balances for the materials subsidiary ledger under FIFO. B. Determine the materials inventory balance at the end of May. C. Journalize

> On the basis of the following data, (A) journalize the adjusting entries at December 31, the end of the current fiscal year, and (B) journalize the reversing entries on January 1, the first day of the following year: 1. Sales salaries are uniformly $11,7

> Scott Company had sales of $12,350,000 and related cost of goods sold of $7,500,000. Scott provides customers a refund for any returned or damaged merchandise. At the end of the year, Scott estimates that customers will request refunds for 0.8% of sales

> In teams, visit the Web site of a company that uses the balanced scorecard to evaluate the company’s performance. Identify the performance measures used by the company on its balanced scorecard. For each measure, identify whether the measure best fits th

> Anson Industries, Inc. reported the following information on its 20Y1 income statement: Sales ............................................................................ $4,000,000 Cost of goods sold ....................................................

> Based on the following data, estimate the cost of the ending inventory: Sales………………………………………………………..$9,250,000 Estimated gross profit rate…………………………………..36% Beginning inventory…………………………………….$ 180,000 Purchases (net)…………………………………………..5,945,000 Merchandis

> Journalize the entries to record the following: A. Check No. 12-375 is issued to establish a petty cash fund of $750. B. The amount of cash in the petty cash fund is now $80. Check No. 12-476 is issued to replenish the fund, based on the following summar

> On the basis of the following data, estimate the cost of the inventory at June 30 by the retail method: Cost Retail $ 165,000 $ 275,000 3,800,000 June 1 Inventory Purchases (net) June 1-30 2,361,500 June 1-30 Sales 3,550,000

> The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: A. Determine the price-earnings ratio and dividend yield for the three companies. (Round ratios and percentages to one deci

> The series of five transactions, A through E, recorded in the following T accounts were related to a sale to a customer on account and the receipt of the amount owed. Briefly describe each transaction. Cash Notes Recelvable 76,500 75,000 D E 75,000

> On January 1 of 20Y2, Hebron Company issued a $175,000, five-year, 8% installment note to Ventsam Bank. The note requires annual payments of $43,830, beginning on December 31 of 20Y2. Journalize the entries to record the following: 20Y2 Jan. 1. Issued th

> The following information is available for the first year of operations of Engle Inc., a manufacturer of fabricating equipment: Sales…………………………………………………………..$7,270,000 Gross profit…………………………………………………….1,450,000 Indirect labor……………………………………………………330,000 I

> On the first day of the fiscal year, Shiller Company borrowed $85,000 by giving a seven–year, 7% installment note to Soros Bank. The note requires annual payments of $15,772, with the first payment occurring on the last day of the fiscal year. The first

> The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Sales………………………………………………………………………..$792,000 Gross profit………………………………………………………………..462,000 Cost of goods manufactured……………………

> Bon Jager Inc. manufactures and sells medical devices used in cardiovascular surgery. The sales team consists of two salespeople, Dean and Martin. A contribution margin report by salesperson was prepared as follows: Write a brief memo to Anna Berenson,

> The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured……………………………………$4,490,000 Selling expenses………………………………………………………….530,000 Administrative expenses………………………………………………340,000

> The Fly Company provides advertising services for clients across the nation. The Fly Company is presently working on four projects, each for a different client. The Fly Company accumulates costs for each account (client) on the basis of both direct costs

> The law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. The following transactions occurred during July: July 3. Charged 175 hours of professional (lawyer) time to the Obsidian Co. breech of co

> The following events took place for Chi-Lite Inc. during June, the first month of operations as a producer of road bikes: • Purchased $400,000 of materials. • Used $343,750 of direct materials in production. • Incurred $295,000 of direct labor wages. • A