Question: Safety First Insurance Company carries three major

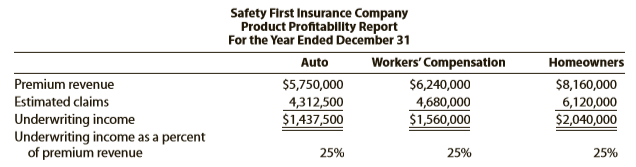

Safety First Insurance Company carries three major lines of insurance: auto, workers’ compensation, and homeowners. The company has prepared the following report:

Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows:

Activity…………………………………………….…………..Activity Rates

New policy processing…………………………………………………..$120 per new policy

Cancellation processing………………………………………………$175 per cancellation

Claim audits……………………………………………………………….$320 per claim audit

Claim disbursements processing……………………………..$104 per disbursement

Premium collection processing………………………….$ 24 per premium collected

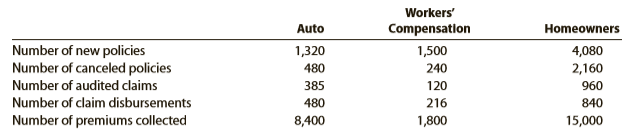

Activity-base usage data for each line of insurance were retrieved from the corporate records as follows:

A. Complete the product profitability report through the administrative activities. Determine the income from operations as a percent of premium revenue, rounded to the nearest whole percent.

B. Interpret the report.

Transcribed Image Text:

Safety First Insurance Company Product Profitablity Report For the Year Ended December 31 Auto Workers' Compensation Homeowners Premium revenue $5,750,000 $6,240,000 $8,160,000 Estimated claims 4,312,500 $1,437,500 4,680,000 $1,560,000 6,120,000 $2,040,000 Underwriting income Underwriting income as a percent of premium revenue 25% 25% 25% Workers' Auto Compensation Homeowners Number of new policies Number of canceled policies Number of audited claims 1,500 240 1,320 4,080 480 2,160 385 120 960 Number of claim disbursements 480 216 840 Number of premiums collected 8,400 1,800 15,000

> The following data relate to factory overhead cost for the production of 10,000 computers: If productive capacity of 100% was 15,000 hours and the total factory overhead cost budgeted at the level of 14,000 standard hours was $356,000, determine the va

> Anticipated sales for Safety Grip Company were 42,000 passenger car tires and 19,000 truck tires. Rubber and steel belts are used in producing passenger car and truck tires as follows: The purchase prices of rubber and steel are $1.20 and $0.80 per pou

> Partially completed budget performance reports for Garland Company, a manufacturer of light duty motors, follow: A. Complete the budget performance reports by determining the correct amounts for the lettered spaces. B. Compose a memo to Cassandra Reid,

> La Batre Bicycle Company manufactures commuter bicycles from recycled materials. The following data for July of the current year are available: Quantity of direct labor used…………………………….5,050 hrs. Actual rate for direct labor………………………….$16.80 per hr. Bic

> Heinz Company uses standards to control its materials costs. Assume that a batch of ketchup (3,128 pounds) has the following standards: The actual materials in a batch may vary from the standard due to tomato characteristics. Assume that the actual qua

> Weightless Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows: The finished goods inventory estimated for October 1, for the Bath and Gym scale models is 18,000

> East Coast Railroad Company transports commodities among three routes (city-pairs): Atlanta/Baltimore, Baltimore/Pittsburgh, and Pittsburgh/Atlanta. Significant costs, their cost behavior, and activity rates for April are as follows: Operating statisti

> Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March………………………………………..$52,400 April…………………………………………….64,200 May……………………………………………..68,900

> The data related to Shunda Enterprises Inc.’s factory overhead cost for the production of 100,000 units of product are as follows: Productive capacity at 100% of normal was 130,000 hours, and the factory overhead cost budgeted at the

> Gen-X Ads Co. produces advertising videos. During the current year ending December 31, Gen-X Ads received the following notes: Instructions: 1. Determine for each note (A) the due date and (B) the amount of interest due at maturity, identifying each no

> The controller of MingWare Ceramics Inc. wishes to prepare a cost of goods sold budget for September. The controller assembled the following information for constructing the cost of goods sold budget: Use the preceding information to prepare a cost of

> At the beginning of the school year, Priscilla Wescott decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the sam

> Romano’s Frozen Pizza Inc. has determined from its production budget the following estimated production volumes for 12" and 16" frozen pizzas for September: There are three direct materials used in producing the two types of pizza. Th

> Based on the data in Exercise 7 and assuming that the average compensation per hour for staff is $45 and for partners is $140, prepare a professional labor cost budget for each department for Rollins and Cohen, CPAs, for the year ending December 31, 20Y8

> Rollins and Cohen, CPAs, offer three types of services to clients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending December 31, 20Y8: Billable H

> On March 31, the end of the first month of operations, Sullivan Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing. Sullivan Equipment Company Varia

> Units of production data for the two departments of Atlantic Cable and Wire Company for July of the current fiscal year are as follows: Each department uses the average cost method. A. Determine the number of whole units to be accounted for and to be a

> Pet Place Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May…………………………………………$134,000 June………………………………………….155,000 July……………………………………………169,000 All sales

> Delaware Chemical Company uses oil to produce two types of plastic products, P1 and P2. Delaware budgeted 35,000 barrels of oil for purchase in June for $90 per barrel. Direct labor budgeted in the chemical process was $240,000 for June. Factory overhead

> Ace Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models. The production budget for July for the two rackets is as follows: Both rackets are produced in two departments, Forming and Assembly. The direct labor hours

> The cash account for Stone Systems at July 31, 20Y5, indicated a balance of $17,750. The bank statement indicated a balance of $33,650 on July 31, 20Y5. Comparing the bank statement and the accompanying canceled checks and memos with the records reveals

> Ansara Company had the following abbreviated income statement for the year ended December 31, 20Y2: (in millions) Sales.................................................................................................. $18,769 Cost of goods sold.........

> Prior to the first month of operations ending October 31, Marshall Inc. estimated the Prior to the first month of operations ending October 31, Marshall Inc. estimated the Prior following operating results: Sales (40,000 × $90) .........................

> The following data were adapted from a recent income statement of Procter & Gamble Company: Assume that the variable amount of each category of operating costs is as follows: A. Based on the data given, prepare a variable costing income statement

> On November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: If the fixed manufacturing costs were $960,000 and the fixed selling and administrative expe

> On December 31, the end of the first year of operations, Frankenreiter Inc. manufactured 25,600 units and sold 24,000 units. The following income statement was prepared, based on the variable costing concept: Determine the unit cost of goods manufactur

> The management of East Coast Railroad Company introduced in Exercise 20 improved the profitability of the Atlanta/Baltimore route in May by reducing the price of a railcar from $600 to $500. This price reduction increased the demand for rail services. Th

> Shawnee Motors Inc. assembles and sells snowmobile engines. The company began operations on August 1 and operated at 100% of capacity during the first month. The following data summarize the results for August: A. Prepare an income statement according

> Based on the data in Exercise 18 prepare a contribution margin analysis of the variable costs for Romero Products Inc. for the year ended December 31. Data from Exercise 18: The following data for Romero Products Inc. are available: Prepare an analys

> The following data for Romero Products Inc. are available: Prepare an analysis of the sales quantity and unit price factors. Difference- Increase or For the Year Ended December 31 Actual Planned (Decrease) Sales.... $8,360,000 $8,200,000 $ 160,000

> Select Audio Inc. sells electronic equipment. Management decided early in the year to reduce the price of the speakers in order to increase sales volume. As a result, for the year ended December 31, the sales increased by $31,875 from the planned level o

> The cash account for Collegiate Sports Co. on November 1, 20Y9, indicated a balance of $81,145. During November, the total cash deposited was $293,150, and checks written totaled $307,360. The bank statement indicated a balance of $112,675 on November 30

> The operating revenues of the three largest business segments for T i me War ner , I nc. , for a recent year follow. Each segment includes a number of businesses, examples of which are indicated in parentheses. Time Warner, Inc. Segment Revenues (in mil

> The marketing segment sales for Cater pillar, Inc., for a year follow: In addition, assume the following information: A. Use the sales information and the additional assumed information to prepare a contribution margin by segment report. Round to two

> Havasu Off-Road Inc. manufactures and sells a variety of commercial vehicles in the Northeast and Southwest regions. There are two salespersons assigned to each territory. Higher commission rates go to the most experienced salespersons. The following sal

> Coast to Coast Surfboards Inc. manufactures and sells two styles of surfboards, Atlantic Wave and Pacific Pounder. These surfboards are sold in two regions, East Coast and West Coast. Information about the two surfboards is as follows: The sales unit v

> Power Train Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Mountain Monster and Desert Dragon, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit inform

> Head Pops Inc. manufactures two models of solar-powered, noise-canceling headphones: Sun Sound and Ear Bling models. The company is operating at less than full capacity. Market research indicates that 28,000 additional Sun Sound and 30,000 additional Ear

> Winslow Inc. manufactures and sells three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: In addition, you have determined the following information with respect to allocated fixed

> At the end of the first year of operations, 6,400 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Direct materials…………………………………….$75 Direct labor……………………………………………..35 Fixed factory overhead……

> A. Young Company budgets sales of $112,900,000, fixed costs of $25,000,000, and variable costs of $66,611,000. What is the contribution margin ratio for Young Company? B. If the contribution margin ratio for Martinez Company is 40%, sales were $34,800,00

> Select Foods Inc. uses activity-based costing to determine product costs. For each activity listed in the left column, match an appropriate activity base from the right column. You may use items in the activity-base list more than once or not at all.

> The unadjusted trial balance of Recessive Interiors at January 31, 2018, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (A) Supplies on hand at January 31 are $2,850. (B) Insurance premiums expired durin

> Ziegler Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced…………………………Total Costs 80,000………………………………

> Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 25,000 to 100,000 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Complete the cost schedule,

> Performance Gloves, Inc. produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cu

> Elliott Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Elliott Engines has a very simple production process and product line and uses a single plant wide factory overhe

> For a major university, match each cost in the following table with the activity base most appropriate to it. An activity base may be used more than once or not used at all. Cost: Activity Base: A. Number of enrollment applications B. Number of stud

> The Converting Department of Tender Soft Tissue Company uses the average cost method and had 1,900 units in work in process that were 60% complete at the beginning of the period. During the period, 15,800 units were completed and transferred to the Packi

> Name the following chart, and identify the items represented by the letters (A) through (F): $150,000 $100,000 E $50,000 F A $(50,000) $(100,000) $(150,000) - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Units of Sales B Op

> Mozart Music Inc. makes three musical instruments: trumpets, tubas, and trombones. The budgeted factory overhead cost is $3,469,400. Factory overhead is allocated to the three products on the basis of direct labor hours. The products have the following b

> Name the following chart, and identify the items represented by the letters (A) through (F): $200,000 $150,000 F E $100,000 D $50,000 B 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Units of Sales Sales and Costs

> The unadjusted trial balance of La Mesa Laundry at August 31, 2018, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (A) Wages accrued but not paid at August 31 are $2,200. (B) Depreciation of equip

> Naper Inc. manufactures power equipment. Naper has two primary products—generators and air compressors. The following report was prepared by the controller for Naper’s senior marketing management for the year ended Dec

> Gordon Gecco Furniture Company has two major product lines with the following characteristics: • Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity â

> Whirlpool Corporation conducted an activity-based costing study of its Evansville, Indiana, plant in order to identify its most profitable products. Assume that we select three representative refrigerators (out of 333): one low-, one medium-, and one hig

> The management of Four Finger Appliance Company in Exercise 14 has asked you to use activity-based costing instead of direct labor hours to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from eac

> The Junior League of Yadkinville, California, collected recipes from members and published a cookbook entitled Food for Everyone. The book will sell for $18 per copy. The chairwoman of the cookbook development committee estimated that the club needed to

> Currently, the unit selling price of a product is $1,500, the unit variable cost is $1,200, and the total fixed costs are $4,500,000. A proposal is being evaluated to increase the unit selling price to $1,600. A. Compute the current break-even sales (uni

> Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity co

> For the current year ended October 31, Friedman Company expects fixed costs of $14,300,000, a unit variable cost of $250, and a unit selling price of $380. A. Compute the anticipated break-even sales (units). B. Compute the sales (units) required to real

> For a recent year, McDonald’s company-owned restaurants had the following sales and expenses (in millions): Sales…………………………………………………………………..$18,169.3 Food and packaging……………………………………………..$ 6,129.7 Payroll……………………………………………………………………4,756.0 Occupancy (rent

> Nixon Machine Parts Inc.’s Fabrication Department incurred $560,000 of factory overhead cost in producing gears and sprockets. The two products consumed a total of 8,000 direct machine hours. Of that amount, sprockets consumed 5,150 direct machine hours.

> The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no service department charges, and the division operates as an investment

> Nozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $540,000 and 60,000 sales orders are estimated to be processed. A. Determine the activity rate of the sales ord

> The management of Firebolt Industries Inc. manufactures gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the compan

> Pineapple Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plant wide factory overhead rate for a

> Salty Sensations Snacks Company manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation……&aci

> Crosswinds Hospital plans to use activity-based costing to assign hospital indirect costs to the care of patients. The hospital has identified the following activities and activity rates for the hospital indirect costs: Activity…&aci

> Schneider Electric manufactures power distribution equipment for commercial customers, such as hospitals and manufacturers. Activity-based costing was used to determine customer profitability. Customer service activities were assigned to individual custo

> Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as

> Digital Storage Concept Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 3,750 direct labor

> Garfield Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Corporate records were obtained

> Atlas Enterprises Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the

> Product pricing and product costs vary significantly depending on company and industry. Three such companies, their industries, and an associated product are: In teams of three, assign each person in your group to one of the companies listed above. Go

> In groups of two to four people, visit a sit-down restaurant and do a lead time study. If more than one group chooses to visit the same restaurant, choose different times for your visits. Note the time when you walk in the door of the restaurant and the

> Kellogg Company manufactures cold cereal products, such as Frosted Flakes. Assume that the inventory in process on March 1 for the Packing Department included 1,200 pounds of cereal in the packing machine hopper (enough for 800 24-oz. boxes) and 800 empt

> A. Based upon the data in Exercise 17-7, determine the following for March: 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during March 4. Cost of units started and c

> The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. A. Determine the number of units in work in process inventory at March 31. B. Determine the equ

> Units of production data for the two departments of Pacific Cable and Wire Company for November of the current fiscal year are as follows: If all direct materials are placed in process at the beginning of production, determine the direct materials and

> The Converting Department of Hopkinsville Company had 1,200 units in work in process at the beginning of the period, which were 25% complete. During the period, 16,000 units were completed and transferred to the Packing Department. There were 2,000 units

> The cost accountant for Kenner Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $3,000,000, and total direct labor costs would be $2,400,000. During May, the actual di

> Domino Foods, Inc. , manufactures a sugar product by a continuous process, involving three production departments—Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first

> The following are some quotes provided by a number of managers at Hawkeye Machining Company regarding the company’s planned move toward a lean manufacturing system: Director of Sales: I’m afraid we’ll miss some sales if we don’t keep a large stock of ite

> Madison Electric Company uses a fossil fuel (coal) plant for generating electricity. The facility can generate 900 megawatts (million watts) per hour. The plant operates 600 hours during March. Electricity is used as it is generated; thus, there are no i

> Flcoa Inc. is the world’s largest producer of aluminum products. One product that Alcoa manufactures is aluminum sheet products for the aerospace industry. The entire output of the Smelting Department is transferred to the Rolling Department. Part of the

> Danielle Hastings was recently hired as a cost analyst by CareNet Medical Supplies Inc. One of Danielle’s first assignments was to perform a net present value analysis for a new warehouse. Danielle performed the analysis and calculated a present value in

> Lighthouse Paper Company manufactures newsprint. The product is manufactured in two departments, Papermaking and Converting. Pulp is first placed into a vessel at the beginning of papermaking production. The following information concerns production in t

> AccuBlade Castings Inc. casts blades for turbine engines. Within the Casting Department, alloy is first melted in a crucible, then poured into molds to produce the castings. On May 1, there were 230 pounds of alloy in process, which were 60% complete as

> The Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. A. Prepare a cost of production report for the Cutting Department. B. Compute and evaluate th

> The debits to Work in Process—Roasting Department for Morning Brew Coffee Company for August, together with information concerning production, are as follows: All direct materials are placed in process at the beginning of production.

> Based on the data in Exercise 17-14, determine the following: A. Cost of beginning work in process inventory completed in November B. Cost of units transferred to the next department during November C. Cost of ending work in process inventory on November

> The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventor

> Napco Refining Company processes gasoline. On June 1 of the current year, 6,400 units were 3⁄⁄5 completed in the Blending Department. During June, 55,000 units entered the Blending Department from the Refining Departme

> A. Based on the data in Exercise 17-11, determine the following: 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per

> The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Determine the following: A. T

> Georgia Products Inc. completed and transferred 89,000 particle board units of production from the Pressing Department. There was no beginning inventory in process in the department. The ending in-process inventory was 2,400 units, which were 3⁄ 5 comple

> The Southern Division manager of Texcaliber Inc. is growing concerned that the division will not be able to meet its current period income objectives. The division uses absorption costing for internal profit reporting and had an appropriate level of inve

> The Hershey Company manufactures chocolate confectionery products. The three largest raw materials are cocoa, sugar, and dehydrated milk. These raw materials first go into the Blending Department. The blended product is then sent to the Molding Departmen

> Sundance Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine