Question: Hann, Murphey, and Ryan have operated a

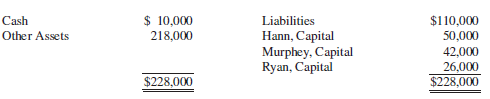

Hann, Murphey, and Ryan have operated a retail furniture store for the past 30 years. Their business has been unprofitable for several years, since several large discount furniture stores opened in their sales territory. The partners recognize that they will be unable to compete with the larger chain stores and decide that since all the partners are near retirement, they should liquidate their business before it is necessary to declare bankruptcy. Account balances just before the liquidation process began were as follows:

The partners share profits in the ratio of 5:3:2, respectively.

Rather than selling all the assets in a forced liquidation and incurring selling expenses, the partners agree that some of the noncash assets may be withdrawn in partial settlement of their capital interest. The partners agree that if the market value of a withdrawn asset is less than book value, the difference should be allocated to all partners in their loss ratio. If market value is greater than book value, the asset is to be adjusted to its market value before recording the withdrawal. All the partners are personally solvent and can make additional cash investment in the partnership up to $20,000 each. The following is a schedule of transactions that occurred during 2014 in the liquidation process.

Required:

Prepare a schedule of partnership realization and liquidation in accordance with the sequence of the foregoing events. Compute a safe payment to support your cash distribution to partners.

Transcribed Image Text:

$ 10,000 218,000 $110,000 50,000 42,000 26,000 $228,000 Cash Liabilities Hann, Capital Murphey, Capital Ryan, Capital Other Assets $228,000 March 15, 2014 During liquidation sale, noncash assets with a book value of $90,000 were sold for $80,000. March 16, 2014 Sold accounts receivable with a book value of $30,000 to a factory for $26,000. March 16, 2014 Paid all recorded partnership creditors. March 18, 2014 Distributed all but $1,000 of available cash to partners. March 19, 2014 Murphey withdrew from inventory furniture with a book value of $10,000 and a market value of $13,000 to satisfy part of his capital interest. March 21, 2014 Sold remainder of inventory with a book value of $50,000 to a discount furniture store for $30,000 cash. March 25, 2014 Assigned for $12,000 cash the remaining term of the lease on the warehouse. The lease was accounted for as an operating lease. March 25, 2014 Distributed all available cash to partners. April 1, 2014 Hann agreed to accept two vehicles with a book value of $10,000 and a market value of $8,000 in partial settlement of his capital interest. April 5, 2014 April 6, 2014 April 6, 2014 All remaining assets were sold for $4,000. Received additional cash from partners with debit capital balances. Distributed available cash to partners.

> Use the information provided in Exercise 13-4. Exercise 13-4: On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a p

> Select the best answer for each of the following. 1. A forward contract is a hedge of an identifiable foreign currency commitment if (a) The forward contract is designated as, and is effective as, a hedge of a foreign currency commitment. (b) The foreign

> On December 1, 2014, Tuscano Corp. entered into a transaction to import raw materials from a foreign company. The account is to be settled on February 1 with the payment of 60,000 foreign currency units (FCU). On December 1, Tuscano also entered into a f

> A U.S. firm carried a receivable for 100,000 yen. Assuming that the direct exchange rate declined from $.009 at the date of the transaction to $.006 at the balance sheet date, compute the transaction gain or loss. What balance would be reported for the r

> LAX Inc. has the following income before income tax and estimated effective annual income tax rates for the first three quarters of 2014. Required: What should be LAX’s income tax provision in the third-quarter income statement? (AICP

> Select the best answer for each of the following. 1. A sale of goods by a U.S. company was denominated in a foreign currency. The sale resulted in a receivable that was fixed in terms of the amount of foreign currency that would be received. Exchange rat

> Select the best answer for each of the following items: 1. Which of the following should be included in the current funds revenue of a not-for-profit private university? 2. The current funds group of a not-for-profit private university includes which o

> During 2015 volunteer pinstripers donated their services to General Hospital at no cost. The staff at General Hospital was in control of the pinstripers’ duties. If regular employees had provided the services rendered by the volunteers, their salaries wo

> Select the best answer for each of the following items: 1. An unrestricted pledge from an annual contributor to a not-for-profit hospital made in December 2014 and paid in cash in March 2015 would generally be credited to (a) Nonoperating revenue in 2014

> Select the best answer for each of the following items: 1. Which NNOs must record depreciation on exhaustible assets? (a) Hospitals. (b) VHWOs. (c) ONNOs. (d) All of the above. 2. Which statement relating to VHWOs is most nearly correct? (a) Use modified

> Mane Company operates in five identifiable segments, V, W, X, Y, and Z. During the past year, sales to unaffiliated customers and intersegment sales for each segment were as follows: Required: Applying the revenue test, determine which of the segments

> Select the best answer for each of the following items: 1. Cura Foundation, a voluntary health and welfare organization, supported by contributions from the general public, included the following costs in its statement of functional expenses for the year

> Select the best answer choice for each of the following items: 1. Which of the following receipts is properly recorded as unrestricted current funds on the books of a university? (a) Tuition. (b) Student laboratory fees. (c) Housing fees. (d) Research gr

> A $36,000 cash gift was received by a college during the year. Required: A. In which fund should the gift be recorded if there were no restrictions on the use of the cash? B. In which fund should the gift be recorded if the donor specified that the cash

> Select the best answer for each of the following: 1. Premiums received on general obligation bonds are generally transferred to what fund or group of accounts? (a) Debt Service. (b) General. (c) Special Revenue. 2. Of the items listed below, those most l

> Select the best answer for each of the following: 1. The activities of a municipal golf course that receives three-fourths of its total revenue from a special tax levy should be accounted for in (a) An Enterprise Fund. (b) The General Fund. (c) A Trust F

> Select the best answer for each of the following: 1. The City of Apache should use a Capital Projects Fund to account for (a) Structures and improvements constructed with the proceeds of a special assessment. (b) Special Revenue funds set aside to acquir

> The following transactions take place: 1. A commitment was made to transfer general revenues to the entity in charge of providing transportation for all government agencies. 2. Construction bonds were issued at a premium. The premium is to be included in

> In 2015, Bay City purchased supplies valued at $350,000. At the end of the year, $65,000 of the supplies were still in the inventory. No supplies were on hand at the beginning of the year. The city uses the purchases method to account for supplies. Requ

> The preclosing trial balance for the General Fund of the City of Springfield is presented below. Note 1: Includes $35,000 of encumbrances from 2014. Required: Prepare the closing entries for the General Fund. City of Springfield The General Fund G

> Select the best answer for each of the following items: 1. When used in fund accounting, the term “fund” usually refers to (a) A sum of money designated for a special purpose. (b) A liability to other governmental units. (c) The equity of a municipality

> The following transactions take place: 1. A cement mixer was purchased with resources of the general fund. 2. A contract was signed for the construction of a new civic center. 3. Bonds were issued to finance the construction of the new civic center. 4. C

> The administrators of the City of Lyons have obtained approval from the City Council to centralize the computer facility as of January 1, 2015. An internal service fund is created to account for the activities of the computer facility. The City Council h

> The City of Dayville has undertaken a sidewalk construction project. The project is being financed by the proceeds from the issue on July 1, 2015, of $500,000 of 7% special assessment debt. One quarter of the principal plus interest is payable on June 30

> The Town of Green River authorized a municipal building to be constructed at a cost of $175,000. The construction will be financed from the proceeds from the issue of $175,000 of 6% bonds. Any difference between the par value of the bonds and the proceed

> On January 1, 2007, the city of Nashvegas issued an 8% annual, 10-year, $10,000 bond for $11,472 (an effective yield of 6%). The bonds become due on December 31, 2016. On June 30, 2015, the city of Nashvegas issued an 8% annual, 10-year, $10,000 bond to

> Circus City issued an 8%, 10-year $2,000,000 bond to build a monorail mass transit system. The city received $1,754,217 cash from the bond issuance on January 1, 2015. The bond yield is 10%. Interest is paid annually on December 31 of each year. Disclosu

> The following information is available about Gotham’s City government funds. Required: Using the information about the government’s funds, determine which funds qualify as “major”

> The City of Minden entered into the following transactions during the year 2016. 1. A bond issue was authorized by vote to provide funds for the construction of a new municipal building, which it was estimated would cost $1,000,000. The bonds are to be p

> Describe the conditions under which a firm can change one of its accounting principles. What is the preferred accounting treatment for a change in accounting principle? List the relevant paragraphs in the Codification.

> See the information from AFS11-1. The statement of comprehensive income is stated as: AFS11-1: In its 10-K amended filing on April 30, 2010, Bronco Drilling reported the financial statements of Challenger Limited (an unconsolidated subsidiary) for its

> The following transactions represent practical situations frequently encountered in accounting for municipal governments. Each transaction is independent of the others. 1. The City Council of Bernardville adopted a budget for the general operations of th

> Select the best answer for each of the following items. Questions 1 and 2 are based on the following condensed balance sheet for the partnership of Caine, Davis, and Jones. The partners share income and loss in the ratio of 5:3:2, respectively. 1. Assu

> On January 1, 2015, the City of Cape May authorized and issued $200,000 of 5%, three-year term bonds. Interest is payable annually on December 31. A debt service fund is established to accumulate the necessary resources to pay the annual interest on the

> The following summary of transactions was taken from the accounts of the Madras School District General Fund before the books were closed for the fiscal year ended June 30, 2016: Additional Information: 1. Property taxes in the amount of $2,870,000 wer

> The January 1, 2015, trial balance, the calendar-year 2015 budget, and the 2015 transactions of the City of Roseburg are presented here: City of Roseburg Budget for General Fund Calendar Year 2015 Estimated Revenue City vehicle and retail license fees

> Hunnington Township’s adjusted trial balance for the General Fund at the close of its fiscal year ended June 30, 2016, is presented here: Note 1: The current tax roll and accounts receivable, recorded on the accrual basis as sources o

> The trial balance for the General Fund of the City of Fairfield as of December 31, 2015, is presented here: Transactions for the year ended December 31, 2016, are summarized as follows: 1. The City Council adopted a budget for the year with estimated r

> The trial balance for the General Fund of the City of Monte Vista as of December 31, 2015, is presented here: Transactions of the General Fund for the year ended December 31, 2016, are summarized as follows: 1. The City Council adopted the following bu

> The following account balances, among others, were included in the preclosing trial balance of the General Fund of the City of Madison on December 31, 2016. Appropriations …………………………………………………………………….. $3,488,000 Cash ………………………………………………………………………………………….

> The following account balances, among others, were included in the preclosing trial balance of the General Fund of the City of Lynchburg on December 31, 2016. Estimated Revenue ………………………………………………………………… $630,000 Expenditures …………………………………………………………………………

> The general ledger trial balance of the General Fund of the City of Bedford on January 1, 2015, shows the following: A summary of activities and transactions for the General Fund during 2015 is presented here: 1. The City Council adopted a budget for t

> In the appendix to the chapter, partial financial statements are presented. Required: 1. What is the institution’s largest source of unrestricted revenue? What is the largest source of total revenue? 2. What is the largest asset on the statement of fina

> Pete, Tom, and Zack have operated a laundromat for 10 years. The partners, who share profits 4:3:3, respectively, decide to liquidate the partnership. The firm’s balance sheet just before the partners sell the other assets for $30,000 i

> Alan Norwood is currently a senior associate with the law firm of Butler, Starns, and Madden (BSM). His compensation currently includes a salary of $155,000, and benefits valued at $5,000. BSM is considered among the strongest of local firms, with assets

> Jan and Sue have engaged successfully as partners in their law firm for a number of years. Soon after their state’s incorporation laws are changed to allow professionals to incorporate, the partners decide to organize a corporation to t

> Mark Malone, Pete Patton, and Sally Spencer formed a partnership on January 1, 2014. Their original capital investments (all cash) were $140,000, $160,000, and $100,000, respectively. During the first year of operations, Mark withdrew $30,000, and the pa

> Part A Baker, Strong, and Weak have called on you to assist them in winding up the affairs of their partnership. You are able to gather the following information. 1. The trial balance of the partnership at June 30, 2014, is as follows. 2. The partners

> Mary, Paula, and Ray have operated a retail store for 20 years. The partners share profits and losses in the ratio of 4:3:3, respectively. The partnership is unable to meet its obligations and the partners decide to liquidate the partnership. The firm&ac

> Nelson, Parker, and Rice are partners who share profits 4:3:3, respectively. Parker decides that it would be more profitable for him to operate as a sole proprietor. Nelson and Rice are in agreement that life would be more rewarding if Parker were to ent

> The Discount Partnership is being liquidated. The current balance sheet is shown here. Discount Partnership Balance Sheet January 14, 2014 Assets Cash …………………………………………………………………………………………….. $ 25,000 Other assets …………………………………………………………………………………… 120,000 T

> The partnerships of Up & Down and Back & Forth started in business on July 1, 2011; each partnership owns one retail appliance store. It was agreed as of June 30, 2014, to combine the partnerships to form a new partnership to be known as Discount

> Brian Snow and Wendy Waite formed a partnership on July 1, 2013 Brian invested $20,000 cash, inventory valued at $15,000, and equipment valued at $67,000. Wendy invested $50,000 cash and land valued at $120,000. The partnership assumed the $40,000 mortga

> Following is the balance sheet of the BDO Partnership: The partners share income 40:40:20, respectively. Assume that 70% of the receivables are collected and that inventory with a book value of $15,000 is sold for $10,000. All cash available at this ti

> America Service Group Inc. (ASG) contracts to provide and/or administer managed healthcare services to over 140 correctional facilities throughout the United States. The partial statement of operations for the years ending December 31, 2010, 2009, and 20

> Neal, Palmer, and Ruppe are partners in a real estate company. Their respective capital balances and profitsharing ratios are as follows: Neal wishes to withdraw from the partnership on January 1, 2015, Palmer and Ruppe have agreed to pay Neal $300,000

> The December 31, 2014, balance sheet of the Datamation Partnership is shown below. Datamation Partnership Balance Sheet December 31, 2014 Assets Cash ……………………………………………………………………………………………. $ 80,000 Accounts Receivable ………………………………………………………………………… 80,000 I

> The CAB Partnership, although operating profitably, has had a cash flow problem. Unable to meet its current commitments, the firm borrowed $34,000 from a bank giving a long-term note. During a recent meeting, the partners decided to obtain additional cas

> Brown and Coss have been operating a tax accounting service as a partnership for five years. Their current capital balances are $92,000 and $88,000, respectively, and they share profits in a 60:40 ratio. Because of the growth in their tax business, they

> The partnership of Cain, Gallo, and Hamm engaged you to adjust its accounting records and convert them uniformly to the accrual basis in anticipation of admitting Kerns as a new partner. Some accounts are on the accrual basis and some are on the cash bas

> Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed January 1, 2014, with each partner investing $45,000. They agreed that profits and losses are to be shared as follows: 1. Divided in the ratio of 40:30:30 if net i

> Day and Night formed an accounting partnership in 2014. Capital transactions for Day and Night during 2014 are as follows: Partnership net income for the year ended December 31, 2014; is $68,400 before considering salaries or interest. Required: Determ

> The following statement is an excerpt from ASC 270–10–45–1, 2 [paragraphs 9 and 10 of APB Opinion No. 28, “Interim Financial Reporting”]: “Interim financial information is essential to provide investors and others with timely information as to the progre

> Actual quarterly earnings and quarterly estimates of annual earnings for Sloan Company for the year ended December 31, 2014 are as follows: The combined state and federal tax rate for 2014 is 30%. Sloan Company estimated it would have permanent differe

> The ABC Partnership is in the process of liquidation. The account balances prior to liquidation are given below: The partners share profits in the following ratio: Amos, 1/5; Boone, 2/5; Childs, 2/5. Required: Prepare a schedule showing the calculatio

> Bismac Industries is a diversified company whose operations are conducted in five product lines, L, M, N, O, and P. Segmented financial information is to be included with the December 31, 2014 annual report. Financial information pertaining to each segme

> Examine the Statement of Activities in the appendix to this chapter. 1. For each of the six governmental activities listed (from general government to Parks, Recreation, and Cultural Activities), did the program revenue exceed program expenses? List the

> Branson Industries conducts operations in five major industries, A, B, C, D, and E. Financial data relevant to each industry for the year ending December 31, 2014, are as follows: Included in the sales of segments C and E are intersegment sales of $120

> Perez Industries, a publicly held corporation, consists of several companies, each of which provides an array of products and services to unaffiliated customers. In your opinion, each of these companies qualifies as a separate operating segment. The corp

> Pacheco Industries is comprised of four separate profit centers, which are distributed throughout the United States. Relevant data for each profit center are summarized for 2014: You determine that intersegment sales are distributed as follows: Commo

> Bacon Industries operates in seven different segments. Information concerning the operations of these segments for the most recent fiscal period follows: Required: Determine which of the segments must be treated as reportable segments. Орerating Se

> On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company. On January 2, 2014, SFr Company reported a retained earnings balance of 480,000 francs. SFr’s books are maintained in fra

> Babbit, Inc., a multinational corporation based in the United States, owns an 80% interest in Nakima Company, which is located in Sydney, Australia. The acquisition occurred on January 1, 2014. The difference between the implied value of 810,625 Australi

> P Company holds an 80% interest in SFr Company, a Swiss company. A trial balance for P Company and SFr Company at December 31, 2015, and other data are given in Problems 13-3 and 13-4. Ignore deferred income taxes in the assignment of the difference betw

> For this problem, refer to the information provided in Problem 13-3 for P Company and SFr Company. Ignore deferred income taxes in the assignment of the difference between implied and book value. Required: A. If you have not already done so, prepare a w

> John, Jake, and Joe are partners with capital accounts of $90,000, $78,000, and $64,000 respectively. They share profits and losses in the ratio of 30:40:30. When the partners decide to liquidate, the business has $70,000 in cash, noncash assets totaling

> Pasquale Company is a manufacturer of oil drilling equipment located in Canada. The company is 90% owned by a U.S. parent company. The accounting department of Pasquale Company accumulated the following 2014 information for the company’

> Use the information provided in Problem 13-3 for P Company and SFr Company. Problem 13-3: On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2014, SFr Compan

> Examine the appendixes in both Chapter 17 and this chapter (specifically the reconciliation between the Governmental Fund Balance Sheet and the Government-wide Statement of Net Position. 1. What are the top two categories of reconciling differences betwe

> On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2014, SFr Company reported a retained earnings balance of 480,000 francs. SFr’s books are

> Refer to the information given in Problem 13-1. Problem 13-1: On January 1, 2014, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. Al

> P Company holds an 80% interest in SFr Company, a Swiss company. A trial balance for P Company and SFr Company at December 31, 2015, and other data are given in Problems 13-9 and 13-10. The following numbers should change, however, from the amounts state

> For this problem, refer to the information provided in Problem 13-9 for P Company and SFr Company. Ignore deferred income taxes in the allocation of the difference between implied and book value. Problem 13-9: On January 2, 2014, P Company, a U.S.-base

> Use the information provided in Problem 13-9 for P Company and SFr Company. Problem 13-9: On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company. On January 2, 2014, SFr Company reported a reta

> On January 1, 2014, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2014, wa

> Centennial Exchange of St. Louis, Missouri, imports and exports grains. The company has a September 30 fiscal year-end. The periodic inventory system and the weighted-average cost flow method are used by the company to account for inventory cost. The com

> The trial balance for the MAD Partnership is as follows just before declaring bankruptcy. Partners share profits in the ratio 45:30:25. Required: A. Prepare a schedule to show how available cash would be distributed to the partners after creditors are

> Crystal Exporting Co. is a U.S. wholesaler engaged in foreign trade. The following transactions are representative of its business dealings. The company uses a periodic inventory system and is on a calendar-year basis. All exchange rates are direct quota

> GAF manufactures electrical cells at its St. Louis facility. The company’s fiscal year-end is September 30. It has adopted the perpetual inventory cost flow method to control inventory costs. The company entered into the following trans

> On October 1, 2014, Fairchange Corporation ordered some equipment from a supplier for 300,000 euros. Delivery and payment are to occur on November 15, 2014. The spot rates on October 1 and November 15, 2014, are $1.20 and $1.30, respectively. Required:

> Examine the financial statements for the City of Atlanta in the appendix to this chapter. 1. The balance in unrestricted net position can be positive or negative. A negative balance would indicate that the government owes more than it owns. What is the b

> On October 1, 2014, Fairchange Corporation ordered some equipment from a supplier for 300,000 euros. Delivery is to occur on November 15, 2014, while payment is expected to occur on December 15, 2014. The spot rates on October 1, November 15, and Decembe

> On October 1, 2014, Fairchange Corporation ordered some equipment from a supplier for 300,000 euros. Delivery and payment are to occur on November 15, 2014. The spot rates on October 1 and November 15, 2014, are $1.20 and $1.30, respectively. Required:

> Consider the following information: 1. On December 1, 2011, a U.S. firm plans to sell a piece of equipment [with an asking price of 200,000 units of a foreign currency (FC)] during January of 2012. The transaction is probable, and the transaction is to b

> Slocome Travel owns a travel agency that operates in London. Account balances in pounds for the subsidiary are summarized below: Exchange rates for 2014 were as follows: January 1 ………â&#

> Refer to the data provided in Exercise 13-7 for Dorsey Corporation and Lansing Company. Exercise 13-7: Dorsey Corporation purchased 90% of the common stock of Lansing Company on January 1, 2008. The cost of the investment was equal to the book value in

> Dorsey Corporation purchased 90% of the common stock of Lansing Company on January 1, 2008. The cost of the investment was equal to the book value interest acquired. Lansing Company operates two retail stores and an exporting business in London that spec

> Refer to Exercise 13-4. Using the same information, assume that the Brazilian real is identified as the functional currency of the subsidiary. Exercise 13-4: On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in

> On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a purchase transaction. The 2014 financial statements stated in Swi

> Select the best answer choice for each of the following items. 1. Perez Company’s operations are unrelated to the operations of its subsidiary. Certain balance sheet accounts of the foreign subsidiary at December 31, 2014, have been tra