Question: HighTech Inc. and OldTime Co. compete within

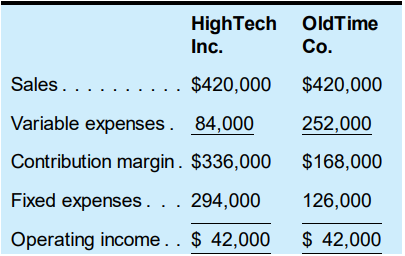

HighTech Inc. and OldTime Co. compete within the same industry and had the following operating results in 2022:

Required:

a. Calculate the breakeven point for each firm in terms of revenue.

b. What observations can you draw by examining the breakeven point of each firm given that they earned an equal amount of operating income on identical sales volumes in 2022?

c. Calculate the amount of operating income (or loss) that you would expect each firm to report in 2023 if sales were to

1. Increase by 20%.

2. Decrease by 20%.

d. Using the amounts computed in requirement c, calculate the increase or decrease in the amount of operating income expected in 2023 from the amount reported in 2022.

e. Explain why an equal percentage increase (or decrease) in sales for each firm would have such differing effects on operating income.

f. Calculate the ratio of contribution margin to operating income for each firm in 2022.

g. Multiply the expected increase in sales of 20% for 2023 by the ratio of contribution margin to operating income for 2022 computed in requirement f for each firm.

h. Multiply your answer in requirement g by the operating income of $42,000 reported in 2022 for each firm.

i. Compare your answer in requirement h with your answer in requirement d. What conclusions can you draw about the effects of operating leverage from the steps you performed in requirements f, g, and h?

> The financial statements of Simon Co. include the following items (amounts in thousands): Required: a. Calculate the net cash flow provided by operations for Simon Co. for the year ended December 31, 2023. b. Explain why net income is different from the

> On April 8, 2022, a flood destroyed the warehouse of Marmaron Distributing Co. From the waterlogged records of the company, management was able to determine that the firm’s gross profit ratio had averaged 45% for the past several years and that the inven

> Franklin Co. has experienced gross profit ratios for 2022, 2021, and 2020 of 41%, 38%, and 40%, respectively. On April 6, 2023, the firm’s plant and all its inventory were destroyed by a tornado. Accounting records for 2023, which were

> The following information is available from the accounting records of Spenser Co. for the year ended December 31, 2022: Required: a. Calculate the operating income for Spenser Co. for the year ended December 31, 2022. b. Calculate the companyâ€

> The following information is available from the accounting records of Manahan Co. for the year ended December 31, 2022: Required: a. Calculate the operating income for Manahan Co. for the year ended December 31, 2022. b. Calculate the companyâ€

> A review of the accounting records at Corless Co. revealed the following information concerning the company’s liabilities that were outstanding at December 31, 2023 and 2022, respectively: Required: a. Corless Co. has not yet made an ad

> Bacon Inc. has the following stockholders’ equity section in its May 31, 2022, comparative balance sheets: Required: a. Calculate the amount that should be shown on the balance sheet for common stock at May 31, 2022. b. The only transac

> Francis Inc. has the following stockholders’ equity section in its November 30, 2022, balance sheet: Required: a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be s

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or min

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or mi

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or mi

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or min

> On January 1, 2022, Metco Inc. reported 411,050 shares of $5 par value common stock as being issued and outstanding. On March 24, 2022, Metco Inc. purchased for its treasury 3,600 shares of its common stock at a price of $37 per share. On August 19, 2022

> On March 3, 2022, Docker Inc. purchased 800 shares of its own common stock in the market at a price of $10.75 per share. On August 29, 2022, 500 of these shares were sold in the open market at a price of $11.50 per share. There were 33,600 shares of Dock

> Permabilt Corp. was incorporated on January 1, 2022, and issued the following stock for cash: 2,000,000 shares of no-par common stock were authorized; 750,000 shares were issued on January 1, 2022, at $35 per share. 800,000 shares of $100 par value, 7.5

> Homestead Oil Corp. was incorporated on January 1, 2022, and issued the following stock for cash: - 600,000 shares of no-par common stock were authorized; 120,000 shares were issued on January 1, 2022, at $26 per share. - 100,000 shares of $100 par value

> You have been approached by Gary Gerrard, president and CEO of Gerrard Construction Co., who would like your advice on a number of business and accounting related matters. Your conversation with Mr. Gerrard, which took place in February 2023, proceeded a

> On January 1, 2022, Learned, Inc., issued $105 million face amount of 20- year, 14% stated rate bonds when market interest rates were 16%. The bonds pay interest semiannually each June 30 and December 31 and mature on December 31, 2041. Required: a. Usin

> On January 1, 2022, Drennen, Inc., issued $6 million face amount of 10-year, 14% stated rate bonds when market interest rates were 12%. The bonds pay semiannual interest each June 30 and December 31 and mature on December 31, 2031. Required: a. Using the

> Hurley Co. has outstanding $420 million face amount of 9% bonds that were issued on January 1, 2010, for $409,500,000. The 20-year bonds mature on December 31, 2029, and are callable at 102 (i.e., they can be paid off at any time by paying the bondholder

> Hayden Co. has outstanding $50 million face amount of 6% bonds that were issued on January 1, 2015, for $50,750,000. The 20-year bonds mature on December 31, 2034, and are callable at 102 (that is, they can be paid off at any time by paying the bondholde

> The following summary data for the payroll period ended December 27, 2021, are available for Cayman Coating Co.: Additional information - For employees, FICA tax rates for 2021 were 7.65% on the first $142,800 of each employee’s annual

> The following summary data for the payroll period ended on July 14, 2021, are available for Brac Construction Ltd.: Required: a. Calculate the missing amounts and then determine the FICA tax withholding percentage. b. Use the horizontal model (or write t

> Evans Ltd. publishes a monthly newsletter for retail marketing managers and requires its subscribers to pay $60 in advance for a one-year subscription. During the month of August 2022, Evans Ltd. sold 500 one-year subscriptions and received payments in a

> On November 1, 2022, Gordon Co. collected $31,800 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on April 30, 2023, at which time the contract may be renewed. Required: a. Use the horizontal mode

> Using a present value table, your calculator, or a computer program present value function, answer the following questions: Required: a. What is the present value of nine annual cash payments of $58,000, to be paid at the end of each year using an intere

> Renter Co. acquired the use of a machine by agreeing to pay the manufacturer of the machine $7,500 per year for 10 years. At the time the lease was signed, the interest rate for a 10-year loan was 12%. Required: a. Use the appropriate factor from Table 6

> Answer the following questions using data from the Campbell Soup Company 2020 annual report: Required: a. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell’s. Explain why the particular method is used for the

> Ambrose Co. has the option of purchasing a new delivery truck for $63,450 or leasing the truck for $13,725 per year, payable at the end of each year for six years. The truck also has a useful life of six years and will be depreciated on a straight-line b

> On January 1, 2022, Carey Inc. entered into a noncancelable lease agreement, agreeing to pay $21,000 at the end of each year for four years to acquire a new computer system having a market value of $61,200. The expected useful life of the computer system

> The balance sheets of HiROE Inc. showed the following at December 31, 2023 and 2022: Required: a. If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amou

> The balance sheets of Tully Corp. showed the following at December 31, 2023 and 2022: Required: a. If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amo

> Moyle Co. acquired a machine on January 1, 2022, at a cost of $1,500,000. The machine is expected to have a five-year useful life, with a salvage value of $300,000. The machine is capable of producing 1,500,000 units of product in its lifetime. Actual pr

> Grove Co. acquired a production machine on January 1, 2022, at a cost of $720,000. The machine is expected to have a four-year useful life, with a salvage value of $120,000. The machine is capable of producing 100,000 units of product in its lifetime. Ac

> Porter Inc. acquired a machine that cost $720,000 on October 1, 2022. The machine is expected to have a four-year useful life and an estimated salvage value of $80,000 at the end of its life. Porter uses the calendar year for financial reporting. Depreci

> Freedom Co. purchased a new machine on July 2, 2022, at a total installed cost of $198,000. The machine has an estimated life of five years and an estimated salvage value of $27,000. Required: a. Calculate the depreciation expense for each year of the as

> Early in January 2022, Tellco Inc. acquired a new machine and incurred $100,000 of interest, installation, and overhead costs that should have been capitalized but were expensed. The company earned net operating income of $750,000 on average total assets

> During the first month of its current fiscal year, Green Co. incurred repair costs of $30,000 on a machine that had five years of remaining depreciable life. The repair cost was inappropriately capitalized. Green Co. reported operating income of $182,000

> You were asked to obtain the most recent annual report of a company that you were interested in reviewing throughout this term. Required: Please review the note disclosures provided in your focus company’s annual report and discuss what you’ve learned ab

> Following are condensed income statements for Uncle Bill’s Home Improvement Center for the years ended December 31, 2023 and 2022: Uncle Bill was concerned about the operating results for 2023 and asked his recently hired accountant, &a

> a. If the beginning balance of the Inventory account and the cost of items purchased or made during the period are correct, but an error resulted in overstating the firm’s ending inventory balance by $12,000, how would the firm’s cost of goods sold be af

> The inventory records of Cushing Inc. reflected the following information for the year ended December 31, 2022: Required: a. Assume that Cushing, Inc., uses a periodic inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIF

> The inventory records of Kuffel Co. reflected the following information for the year ended December 31, 2022: Required: a. Assume that Kuffel Co. uses a periodic inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO. b.

> The following data are available for Sellco for the fiscal year ended on January 31, 2023: Required: a. Calculate cost of goods sold and ending inventory under the following cost flow assumptions (using a periodic inventory system): 1. FIFO. 2. LIFO. 3.

> Mower-Blower Sales Co. started business on January 20, 2022. Products sold were snow blowers and lawn mowers. Each product sold for $1,400. Purchases during 2022 were as follows: The December 31, 2022, inventory included 10 blowers and 20 mowers. Assume

> A portion of the current assets section of the December 31, 2022, balance sheet for Gibbs Co. is presented here: The company’s accounting records revealed the following information for the year ended December 31, 2023: Required: Calcula

> A portion of the current assets section of the December 31, 2023, balance sheet for Carr Co. is presented here: The company’s accounting records revealed the following information for the year ended December 31, 2023: Required: Using th

> The following is a portion of the current asset section of the balance sheets of HiROE Co., at December 31, 2023 and 2022: Required: a. Describe how the allowance amount at December 31, 2023, was most likely determined. b. If bad debts expense for 2023 t

> The following is a portion of the current assets section of the balance sheets of Avanti’s, Inc., at December 31, 2023 and 2022: Required: a. If $9,100 of accounts receivable were written off during 2023, what was the amount of bad debt

> Branson Co. received its bank statement for the month ending May 31, 2022, and reconciled the statement balance to the May 31, 2022, balance in the Cash account. The reconciled balance was determined to be $36,400. The reconciliation recognized the follo

> Beckett Co. received its bank statement for the month ending June 30, 2022, and reconciled the statement balance to the June 30, 2022, balance in the Cash account. The reconciled balance was determined to be $5,800. The reconciliation recognized the foll

> Big Blue Rental Corp. provides rental agent services to apartment building owners. Big Blue Rental Corp.’s preliminary income statement for August 2022 and its August 31, 2022, preliminary balance sheet did not reflect the following: a.

> Set up a horizontal model in the following format: Required: a. Enter the beginning (July 28, 2019) and ending (August 2, 2020) account balances for Accounts Receivable, Inventories, and Payable to Suppliers and Others. Find these amounts on the Consolid

> Calco Inc. rents its store location. Rent is $9,000 per month, payable quarterly in advance. On July 1, a check for $27,000 was issued to the landlord for the July–September quarter. Required: Use the horizontal model to show the effects on the financia

> On January 10, 2022, the first day of the spring semester, the cafeteria of The Defiance College purchased for cash enough paper napkins to last the entire 16-week semester. The total cost was $3,600. Required: Use the horizontal model to show the effect

> Selected information taken from the financial statements of Fordstar Co. for the year ended December 31, 2022, follows: a. Calculate income from operations (operating income) for the year ended December 31, 2022. b. Calculate net income for the year ende

> Selected information taken from the financial statements of Verbeke Co. for the year ended December 31, 2022, follows: a. Calculate income from operations (operating income) for the year ended December 31, 2022. (Hint: You may want to review Exhibit 2-2.

> Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 800,000 shares of $5-par-value common stock for $400,000 in cash. b. B

> Charlie’s Furniture Store has been in business for several years. The firm’s owners have described the store as a “high-price, high-service” operation that provides lots of assistance to its customers. Margin has averaged a relatively high 40% per year f

> The concept of financial leverage was introduced and expanded. You were asked to describe the risks associated with financial leverage. Required: a. Describe the risks associated with operating leverage. b. Outline the similarities and differences betwee

> Following are the current asset and current liability sections of the balance sheets for Around square Inc. at August 31, 2023 and 2022 (in millions): Required: a. Calculate the working capital and current ratio at each balance sheet date. Round your cur

> Following are the current asset and current liability sections of the balance sheets for Freedom Inc. at January 31, 2023 and 2022 (in millions): Required: a. Calculate the working capital and current ratio at each balance sheet date. Round your current

> Presented here are the comparative balance sheets of Hames Inc. at December 31, 2023 and 2022. Sales for the year ended December 31, 2023, totaled $1,700,000. Required: a. Calculate ROI for 2023. Round your percentage answer to two decimal places. b. Cal

> Calculate profitability measures using annual report data Using data from the financial statements of Campbell Soup Company in the appendix, calculate the following: a. ROI for 2020. Round your percentage answer to one decimal place. b. ROE for 2020. Rou

> Selected data from the September 26, 2020, and September 28, 2019, consolidated balance sheets and income statements (statements of operations) for the years then ended for Apple Inc. follow. All amounts are reported in millions. Required: a. Calculate t

> The following selected data are adapted from the February 2, 2020, and February 3, 2019, consolidated balance sheets and income statements for the years then ended for The Home Depot, Inc. All amounts are reported in millions. Required: Calculate the mis

> Following is a partially completed balance sheet for Epsico Inc. at December 31, 2022, together with comparative data for the year ended December 31, 2021. From the statement of cash flows for the year ended December 31, 2022, you determine the following

> A partially completed balance sheet for Blue Co. Inc. as of October 31, 2022, is presented. Where amounts are shown for various items, the amounts are correct. Required: Using the following data, complete the balance sheet. a. Blue Co.’

> Rudy Gandolfi owns and operates Rudy’s Furniture Emporium Inc. The balance sheet totals for assets, liabilities, and stockholders’ equity at August 1, 2022, are as indicated. Described here are several transactions ent

> Mindspin Labs Inc. is a manufacturing firm that has experienced strong competition in its traditional business. Management is considering joining the trend to the “service economy” by eliminating its manufacturing operations and concentrating on providin

> Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31, 2022, financial statements: At December 31, 2021, total assets were $246,000 and total stockholders’ equi

> The following information was obtained from the records of Shae Inc.: / Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities that occurred

> The information on the following page was obtained from the records of Breanna Inc.: Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities

> Gary’s TV had the following accounts and amounts in its financial statements on December 31, 2022. Assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities

> Pope’s Garage had the following accounts and amounts in its financial statements on December 31, 2022. Assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activi

> Kimber Co. is in the process of liquidating and going out of business. The firm’s accountant has provided the following balance sheet and additional information: It is estimated that all but 20 percent of the accounts receivable can be

> Circle-Square Ltd. is in the process of liquidating and going out of business. The firm’s balance sheet shows $50,000 in cash, accounts receivable of $240,000, inventory totaling $110,000, plant and equipment of $500,000, and total liabilities of $620,00

> Selected balance sheet accounts for Tibbetts Company on September 30, 2022, are as follows: Required: a. Calculate the working capital, current ratio, and acid-test ratio for Tibbetts Company as of September 30, 2022. b. Summarized here are the transacti

> During the year, cost of goods sold was $120,000; income from operations was $114,000; income tax expense was $24,000; interest expense was $18,000; and selling, general, and administrative expenses were $66,000. Required: Calculate net sales, gross prof

> During the year, net sales were $400,000; gross profit was $160,000; net income was $60,000; income tax expense was $15,000; and selling, general, and administrative expenses were $73,000. Required: Calculate cost of goods sold, income from operations, i

> Use the information presented for Lakeside Inc. Required: Calculate the payback period and the accounting rate of return for the new production equipment.

> DeBauge Realtors Inc. is a realty firm owned by Jeff and Kristi DeBauge. The DeBauge family owns 100% of the corporation’s stock. The following summarized data (in thousands) are taken from the December 31, 2022, financial statements: A

> Use the information presented for Lakeside Inc. and your calculation of the net present value of the new production equipment. Required: Calculate the present value ratio of the new production equipment, and comment on the internal rate of return of this

> Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology that will allow production cost savings of $7,500 per month. The new equipment will have a five-year life and cost $320,000, with an estimated salvage value

> Lakeside Inc. produces Product A and Product B that require special machining time. Machine time capacity is 10,000 machine hours per month. Lakeside estimates April demand for each product and provides additional information as follows: Required: Determ

> Lakeside Inc. is considering whether to enter the market to produce and sell Product X. The market selling price for Product X is well established at $300 per unit, and Lakeside requires a profit margin of 25% on product lines. Required: Calculate the ta

> In addition to the product cost information for Lakeside Inc., product engineering has determined that a certain part of the product conversion process could be outsourced. Raw material costs would not be affected, but direct labor and variable overhead

> In addition to the product cost information for Lakeside Inc. in Mini-Exercise 16.1, Lakeside has received an offer from a nonprofit organization to buy 6,000 units at $56 per unit. Lakeside currently has unused production capacity. Required: Should Lake

> Lakeside Inc. produces a product that currently sells for $72 per unit. Current production costs per unit include direct materials, $20; direct labor, $24; variable overhead, $10; and fixed overhead, $10. Product engineering has determined that certain p

> ABC Company operates two divisions with the following operating information for the month of May: Division 1: sales, $240,000; operating income, $72,000; operating assets, $600,000. Division 2: sales, $160,000; operating income, $80,000; operating assets

> ABC Company operates two divisions with the following sales and expense information for the month of May: Division 1: sales, $240,000; contribution margin ratio, 50%; direct fixed expenses, $48,000. Division 2: sales, $160,000; contribution margin ratio,

> In addition to the information for Acme Company, the standard fixed overhead application rate per unit consists of $2 per machine hour and each unit is allowed a standard of 1 hour of machine time. Required: Calculate the fixed overhead budget variance a

> Form a group of three or four students to research, evaluate, and report on software solutions available to support the budgeting needs of an organization. Choose three planning/budgeting products from the following list of company websites, and review t

> Refer to the corporate governance disclosures provided on Campbell Soup Company’s website. Visit campbellsoupcompany.com; select the “Investors” shortcut from the “About Us” menu, then click on “Governance Documents” from the “Governance” drop down menu.

> In addition to the information for Acme Company, the standard variable overhead rate per unit consists of $6 per machine hour and each unit is allowed a standard of 1 hour of machine time. During August, $115,940 of actual variable overhead cost was incu

> In addition to the information for Acme Company, the standard direct labor cost per unit consists of 0.5 hour of labor time at $20 per hour. During August, $160,650 of actual labor cost was incurred for 7,650 direct labor hours. Required: Calculate the l

> In addition to the information for Acme Company in Mini-Exercises 15.1 and 15.2, the standard direct material cost per unit consists of 10 pounds of raw material at $0.80 per pound. During August, 187,000 pounds of raw material were used that were purcha

> In addition to the information for Acme Company in Mini-Exercise 15.1, actual unit component costs incurred during August include direct materials, $8.25; direct labor, $9.45; variable overhead, $6.82. Actual fixed overhead was $33,500. Required: Prepare

> Acme Company’s production budget for August is 17,500 units and includes the following component unit costs: direct materials, $8; direct labor, $10; variable overhead, $6. Budgeted fixed overhead is $35,000. Actual production in August was 17,000 units.

> In addition to the information presented in Mini-Exercises 14.2 and 14.3, ABC Company currently pays a standard rate of $2 per pound for raw materials. Each unit should be produced in 15 minutes of direct labor time at a standard direct labor rate of $16