Question: In preparing for next year, on December

In preparing for next year, on December 1, Thad Feldman hired two hourly employees to assist with some troubleshooting and repair work.

More information:

a. The following accounts have been added to the chart of accounts: Wages Payable #2010, FICA OASDI Payable #2020, FICA Medicare Payable #2030, FIT Payable #2040, State Income Tax Payable #2050, FUTA Tax Payable #2060, SUTA Tax Payable #2070, Wages Expense #5110, and Payroll Tax Expense #5120.

b. Assume FICA OASDI is taxed at 6.2% up to $117,000 in earnings, and Medicare is taxed at 1.45% on all earnings.

c. State income tax is 2% of gross pay.

d. None of the employees has federal income tax taken out of his or her pay.

e. Each employee earns $10 an hour and is paid 1 1/2 times salary for hours worked in excess of 40 weekly.

As December comes to an end, Thad Feldman wants to take care of his payroll obligations. He will complete Form 941 for the fourth quarter of the current year and Form 940 for federal unemployment taxes. Thad will make the necessary deposits and payments associated with his payroll.

Assignment

1. Prepare the payroll register for the three pay periods.

2. Using the payroll registers, record the December payrolls and the payment of the payrolls in the general journal and post them to the general ledger.

3. Using the payroll registers, record payroll tax expense for the fourth quarter in the general journal. Use December 31 as the date of the journal entry to record the payroll tax expense for the entire quarter. The FUTA tax ceiling is $7,000, and the SUTA tax ceiling is $7,000 in cumulative wages for each employee. The Smith Computer Center’s FUTA rate is 0.6% and the SUTA rate is 2.5%. Post the entry to the general ledger.

4. Record the payment of each tax liability in the general journal and post each entry to the general ledger. Smith Computer Center is classified as a monthly depositor. The company wishes to pay all payroll taxes on December 31 even if no deposits are required.

5. Prepare Form 941 for the fourth quarter. Smith Computer Center’s employer identification number is 35-4132588.

6. Complete Form 940 for Smith Computer Center. The state reporting number is 025-025-2.

Hint: Sometimes the amount of Social Security taxes paid by the employee for the quarter will not equal the employee’s tax liability because of rounding. Any difference should be reported on line 7 of Form 941.

Transcribed Image Text:

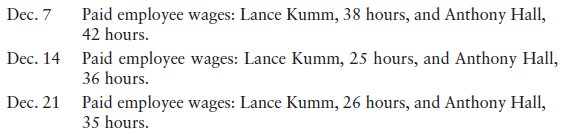

Paid employee wages: Lance Kumm, 38 hours, and Anthony Hall, 42 hours. Dec. 7 Dec. 14 Paid employee wages: Lance Kumm, 25 hours, and Anthony Hall, 36 hours. Paid employee wages: Lance Kumm, 26 hours, and Anthony Hall, 35 hours. Dec. 21

> Revenue is an asset. True or false? Please explain.

> Using the worksheet in Chapter 11 for Smith Computer Center, journalize and post the adjusting entries and prepare the financial statements.

> A balance sheet tells a company where it is going and how well it performs. True or false? Please explain.

> The total of the left-hand side of the accounting equation must equal the total of the right-hand side. True or false? Please explain.

> Define capital.

> List the three elements of the basic accounting equation.

> How has technology affected the role of the bookkeeper?

> How are businesses classified?

> Define, compare, and contrast sole proprietorships, partnerships, and corporations.

> What is the end product of the accounting process?

> What is an operating cycle?

> Footings are used in balancing all accounts. True or false? Please explain.

> Why is the left-hand side of an account called a debit?

> The first 6 months of the year have concluded for Smith Computer Center, and Thad wants to make the necessary adjustments to his accounts to prepare accurate financial statements. Assignment To prepare these adjustments, use the trial balance in Figure

> Compare the financial statements prepared from the expanded accounting equation with those prepared from a trial balance.

> Define a ledger.

> The statement of owner’s equity only calculates ending withdrawals. True or false? Please explain.

> What does an income statement show?

> As expenses increase they cause owner’s equity to increase. Defend or reject.

> A withdrawal is a business expense. True or false? Please explain.

> Owner’s equity is subdivided into what categories?

> What is the difference between current assets and plant and equipment?

> What are the functions of accounting?

> Explain how overhead may be applied.

> What is the purpose of a bill of lading?

> The following is an updated schedule of accounts payable as of January 31, 201X. Schedule of Accounts Payable The Staple Store ………………

> What tickets become the basis for transferring costs between departments to finished goods inventory?

> Explain the purpose of receiving reports as well as materials requisitions.

> What are the three major inventories of a manufacturing firm?

> Direct labor includes the wages of those personnel whose efforts indirectly change the quality or characteristics of the product. Agree or disagree? Please explain.

> Dot Lovet works in the receiving department of a leading publishing company. She has become good friends with many of the suppliers. At 4:00 p.m., Joe Andrews delivered a truckload of art supplies. Joe was in a hurry and asked Dot to accept the order. He

> Compare and contrast the structure of a worksheet for a merchandise company and a manufacturing company.

> Explain how operating expenses can be broken down into different categories.

> Into what three elements can manufacturing costs be broken?

> Explain why a company might prepare an income statement showing each department’s contribution margin.

> An income statement showing departmental income before tax does not list individual operating expenses for each department. Agree or disagree? Please explain.

> Square footage is often used to allocate indirect costs to various departments within a company. Agree or disagree?

> To assist you in recording these transactions for the month of January, at the end of this problem is the schedule of accounts receivable as of December 31 and an updated chart of accounts with the current balance listed for each account. Assignment 1.

> Explain how advertising expense could be both a direct cost and an indirect cost for a company.

> Compare and contrast indirect expenses and direct expenses.

> Special journals are not used in departmental accounting. Agree or disagree? Please explain.

> Explain how gross profit is calculated.

> What is the difference between a cost center and a profit center?

> Explain the components of cost of goods sold.

> Explain how partial payments would be recorded in the voucher register.

> Once a voucher is recorded, it cannot be canceled. Agree or disagree? Why?

> Why is an accounts payable ledger eliminated in the voucher system?

> Posting to a voucher register is quite different from posting to other special journals. Agree or disagree? Why?

> Why are vouchers filed by due dates?

> Compare a voucher register to a purchases journal.

> What source documents are attached to a voucher?

> List the five components of a voucher system.

> What is the structure of a voucher?

> Which columns of the worksheet aid in the preparation of the income statement?

> What could a low accounts receivable turnover rate indicate?

> What current asset accounts are deleted in the calculation of the acid test ratio? Why?

> Explain the following types of ratios: a. Liquidity b. Asset management c. Debt management d. Profitability

> How can ratios be expressed?

> Why is a base year chosen in trend analysis?

> Common-size statements use horizontal analysis. Agree or disagree? Please explain.

> During the month of November, the following transactions occurred. Assignment 1. Record the following transactions in the general journal and post them to the general ledger. 2. Prepare a trial balance as of November 30, 201X. Assume the following transa

> What is meant by vertical analysis?

> Horizontal analysis cannot be presented on comparative financial statements. Agree or disagree? Please explain.

> Rate of return on assets is affected by return on sales and asset turnover. Agree or disagree?

> Why do many Unearned Revenue accounts have to be adjusted?

> What does possible liquidation have to do with the ratio of debt to total assets?

> Stockouts could easily result if inventory is higher than it should be. Agree or disagree? Please explain.

> Compare and contrast the needs of investors, creditors, and management as they relate to financial statement analysis.

> Explain why depreciation is added to net income when using the indirect method.

> Explain what is meant by financing activities.

> The issuance of stock is an investing activity. Agree or disagree? Why?

> Explain how net cash flows from operating activities is calculated using the direct method.

> The books have been closed for the first year of business for Smith Computer Center. The company ended up with a marginal profit for the first three months in operation. Thad expects faster growth as he enters a busy season. Following is a list of transa

> Explain how net cash flows from operating activities is calculated using the indirect method.

> List the three main sections of the statement of cash flows.

> What is the purpose of an inventory sheet?

> What is the carrying value of a bond?

> The straight-line method of amortizing a bond discount or premium will result in an uneven amount of discount or premium that increases or decreases expense each period. Agree or disagree? Why?

> Premium on Bonds Payable will cause total interest expense to be reduced. True or false?

> Why isn’t Discount on Bonds Payable an immediate expense?

> Explain why a bond may sell at a premium.

> Accrued interest results in the seller paying extra for bonds. True or false? Explain.

> Dividends reduce earnings before taxes. True or false? Explain.

> What is the difference between a secured bond and a debenture bond?

> Thad decided to end the Smith Computer Center’s first year as of September 30, 201X. Following is an updated chart of accounts. Assets …………………………….…………………………………………………. Revenue 1000 Cash …………………..…………………………………. 4000 Service Revenue 1020 Accounts Receivab

> Alice wants to buy bonds, but her husband, Pete, thinks stocks would be a better deal. Pete was watching a finance show on TV that said stocks would be going up and that now is the time to buy stock. He called Alice over and said, “I told you so.” Alice

> In a periodic system of inventory, the balance of beginning inventory will remain unchanged during the period. True or false?

> What is the purpose of a bond sinking fund?

> Why does the interest method of amortizing a discount or premium use the market rate in calculating interest expense to be recorded?

> Explain the selling price of a bond quoted at 99.

> All treasury stock is recognized as issued and outstanding for dividends. True or false? Please explain.

> Treasury stock is really an asset. Defend or reject. Support your argument.

> Common Stock Dividend Distributable is a liability. Agree or disagree? Defend your position.

> Explain some possible reasons a company may declare a stock dividend instead of a cash dividend.

> Why is no journal entry needed at the date of record?

> List the three important dates that are associated with the dividend process.

> At the end of September, Thad took a complete inventory of his supplies and found the following: 3 dozen 1 /4" screws at a cost of $5.00 a dozen 6 dozen 1 /2" screws at a cost of $10.00 a dozen 5 cartons of computer inventory paper at a cost of $8 a cart

> Explain why Unearned Revenue is a liability account.

> Before Adjustment Given: At year end, depreciation on Equipment is $1,700. a. Which of these three T accounts is not affected? b. Which account is a contra-asset? c. Complete a transaction analysis box for this adjustment. d. What will be the balance o

> Alan Homes serves on the board of directors of Flynn Company. The president of Flynn told him that in three weeks the corporation would announce a 25% increase in dividends. Alan called his neighbor to tell him to buy some stock. The neighbor told his fr