Question: The books have been closed for the

The books have been closed for the first year of business for Smith Computer Center. The company ended up with a marginal profit for the first three months in operation. Thad expects faster growth as he enters a busy season.

Following is a list of transactions for the month of October. Petty Cash account #1010 and Miscellaneous Expense account #5100 have been added to the chart of accounts.

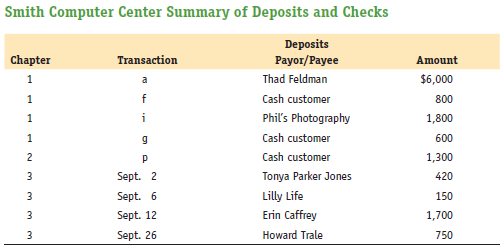

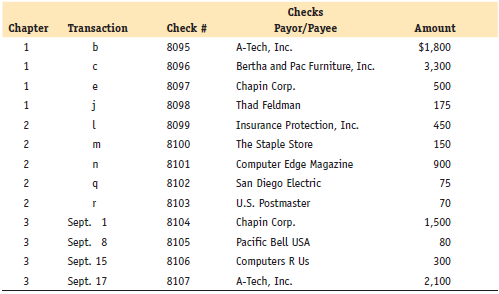

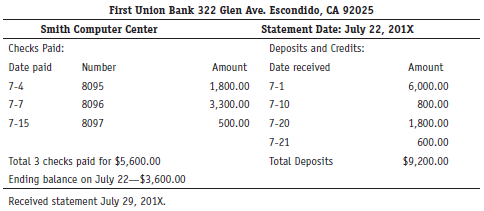

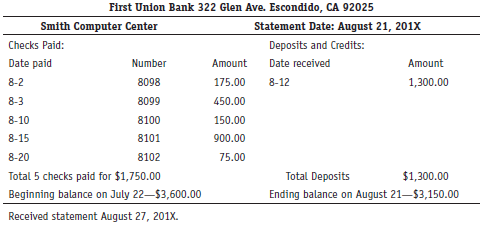

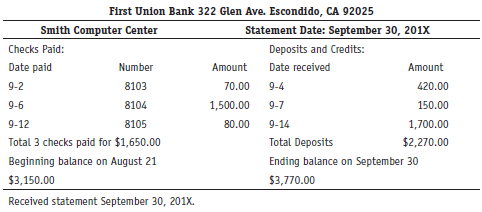

three months of bank statements. A list of all deposits and checks written for the past three months (each entry is identified by chapter, transaction date, or transaction letter) and the bank statements for July through September are provided. The statement for October won’t arrive until the first week of November.

Assignment

1. Record the transactions in general journal and auxiliary petty cash record.

2. Post the transactions to the general ledger accounts.

3. Prepare a trial balance.

4. Compare the Smith Computer Center’s deposits and checks with the bank statements and complete a bank reconciliation as of September 30, 201X.

Bank Statement

Bank Statement

Bank Statement

Transcribed Image Text:

Oct. 1 Paid rent for November, December, and January, $1,500 (check no. 8108). 2 Established a petty cash fund for $300. 4 Collected $4,600 from a cash customer for building five systems. 5 Collected $2,700, the amount due from Dr. Michael Turiono's invoice no. 12674, customer on account. 6 Purchased $40 worth of stamps using petty cash voucher no. 101. 7 Withdrew $900 (check no. 8109) for personal use. 8 Purchased $25 worth of supplies using petty cash voucher no. 102. 12 Paid the newspaper carrier $15 using petty cash voucher no. 103. Paid the amount due on the August phone bill, $35 (check no. 8110). (Recorded on Sept. 20) Paid the amount due on the August electric bill, $85 (check no. 8111). (Recorded on Sept. 22) 16 17 22 Performed computer services for Phil's Photography; billed the client $5,400 (invoice no. 12675). 23 Paid $20 for computer paper using petty cash voucher no. 104. 30 Took $15 out of petty cash for lunch, voucher no. 105. 31 Replenished the petty cash. Coin and currency in drawer total $185. Smith Computer Center Summary of Deposits and Checks Deposits Payor/Payee Chapter Transaction Amount 1 Thad Feldman $6,000 a 1 f Cash customer 800 Phil's Photography 1 i 1,800 1 Cash customer 600 2 Cash customer 1,300 3 Sept. 2 Tonya Parker Jones 420 Sept. 6 Lilly Life 150 3 3 Sept. 12 Erin Caffrey 1,700 Sept. 26 Howard Trale 750 Checks Chapter Transaction Check # Payor/Payee Amount 1 b 8095 A-Tech, Inc. $1,800 8096 Bertha and Pac Furniture, Inc. 3,300 1 1 8097 Chapin Corp. 500 e 1 8098 Thad Feldman 175 2 8099 Insurance Protection, Inc. 450 2 8100 The Staple Store 150 2 8101 Computer Edge Magazine 900 2 8102 San Diego Electric 75 U.S. Postmaster r 8103 70 Sept. 1 8104 Chapin Corp. 1,500 3 Sept. 8 8105 Pacific Bell USA 80 3 Sept. 15 8106 Computers R Us 300 3 Sept. 17 8107 A-Tech, Inc. 2,100 2. 3. First Union Bank 322 Glen Ave. Escondido, CA 92025 Smith Computer Center Statement Date: July 22, 201X Checks Paid: Deposits and Credits: Date paid Number Аmount Date received Amount 7-4 8095 1,800.00 7-1 6,000.00 7-7 8096 3,300.00 7-10 800.00 7-15 8097 500.00 7-20 1,800.00 7-21 600.00 Total 3 checks paid for $5,600.00 Total Deposits $9,200.00 Ending balance on July 22–$3,600.00 Received statement July 29, 201X. First Union Bank 322 Glen Ave. Escondido, CA 92025 Smith Computer Center Statement Date: August 21, 201X Checks Paid: Deposits and Credits: Date paid Number Amount Date received Amount 8-2 8098 175.00 8-12 1,300.00 8-3 8099 450.00 8-10 8100 150.00 8-15 8101 900.00 8-20 8102 75.00 Total 5 checks paid for $1,750.00 Total Deposits $1,300.00 Beginning balance on July 22–$3,600.00 Ending balance on August 21–$3,150.00 Received statement August 27, 201X. First Union Bank 322 Glen Ave. Escondido, CA 92025 Smith Computer Center Statement Date: September 30, 201x Checks Paid: Deposits and Credits: Date paid Number Amount Date received Amount 9-2 8103 70.00 9-4 420.00 9-6 8104 1,500.00 9-7 150.00 9-12 8105 80.00 9-14 1,700.00 Total 3 checks paid for $1,650.00 Total Deposits $2,270.00 Beginning balance on August 21 Ending balance on September 30 $3,150.00 $3,770.00 Received statement September 30, 201X.

> What is the purpose of a bill of lading?

> The following is an updated schedule of accounts payable as of January 31, 201X. Schedule of Accounts Payable The Staple Store ………………

> What tickets become the basis for transferring costs between departments to finished goods inventory?

> Explain the purpose of receiving reports as well as materials requisitions.

> What are the three major inventories of a manufacturing firm?

> Direct labor includes the wages of those personnel whose efforts indirectly change the quality or characteristics of the product. Agree or disagree? Please explain.

> Dot Lovet works in the receiving department of a leading publishing company. She has become good friends with many of the suppliers. At 4:00 p.m., Joe Andrews delivered a truckload of art supplies. Joe was in a hurry and asked Dot to accept the order. He

> Compare and contrast the structure of a worksheet for a merchandise company and a manufacturing company.

> Explain how operating expenses can be broken down into different categories.

> Into what three elements can manufacturing costs be broken?

> Explain why a company might prepare an income statement showing each department’s contribution margin.

> An income statement showing departmental income before tax does not list individual operating expenses for each department. Agree or disagree? Please explain.

> Square footage is often used to allocate indirect costs to various departments within a company. Agree or disagree?

> To assist you in recording these transactions for the month of January, at the end of this problem is the schedule of accounts receivable as of December 31 and an updated chart of accounts with the current balance listed for each account. Assignment 1.

> Explain how advertising expense could be both a direct cost and an indirect cost for a company.

> Compare and contrast indirect expenses and direct expenses.

> Special journals are not used in departmental accounting. Agree or disagree? Please explain.

> Explain how gross profit is calculated.

> What is the difference between a cost center and a profit center?

> Explain the components of cost of goods sold.

> Explain how partial payments would be recorded in the voucher register.

> Once a voucher is recorded, it cannot be canceled. Agree or disagree? Why?

> Why is an accounts payable ledger eliminated in the voucher system?

> Posting to a voucher register is quite different from posting to other special journals. Agree or disagree? Why?

> Why are vouchers filed by due dates?

> In preparing for next year, on December 1, Thad Feldman hired two hourly employees to assist with some troubleshooting and repair work. More information: a. The following accounts have been added to the chart of accounts: Wages Payable #2010, FICA OASD

> Compare a voucher register to a purchases journal.

> What source documents are attached to a voucher?

> List the five components of a voucher system.

> What is the structure of a voucher?

> Which columns of the worksheet aid in the preparation of the income statement?

> What could a low accounts receivable turnover rate indicate?

> What current asset accounts are deleted in the calculation of the acid test ratio? Why?

> Explain the following types of ratios: a. Liquidity b. Asset management c. Debt management d. Profitability

> How can ratios be expressed?

> Why is a base year chosen in trend analysis?

> Common-size statements use horizontal analysis. Agree or disagree? Please explain.

> During the month of November, the following transactions occurred. Assignment 1. Record the following transactions in the general journal and post them to the general ledger. 2. Prepare a trial balance as of November 30, 201X. Assume the following transa

> What is meant by vertical analysis?

> Horizontal analysis cannot be presented on comparative financial statements. Agree or disagree? Please explain.

> Rate of return on assets is affected by return on sales and asset turnover. Agree or disagree?

> Why do many Unearned Revenue accounts have to be adjusted?

> What does possible liquidation have to do with the ratio of debt to total assets?

> Stockouts could easily result if inventory is higher than it should be. Agree or disagree? Please explain.

> Compare and contrast the needs of investors, creditors, and management as they relate to financial statement analysis.

> Explain why depreciation is added to net income when using the indirect method.

> Explain what is meant by financing activities.

> The issuance of stock is an investing activity. Agree or disagree? Why?

> Explain how net cash flows from operating activities is calculated using the direct method.

> Explain how net cash flows from operating activities is calculated using the indirect method.

> List the three main sections of the statement of cash flows.

> What is the purpose of an inventory sheet?

> What is the carrying value of a bond?

> The straight-line method of amortizing a bond discount or premium will result in an uneven amount of discount or premium that increases or decreases expense each period. Agree or disagree? Why?

> Premium on Bonds Payable will cause total interest expense to be reduced. True or false?

> Why isn’t Discount on Bonds Payable an immediate expense?

> Explain why a bond may sell at a premium.

> Accrued interest results in the seller paying extra for bonds. True or false? Explain.

> Dividends reduce earnings before taxes. True or false? Explain.

> What is the difference between a secured bond and a debenture bond?

> Thad decided to end the Smith Computer Center’s first year as of September 30, 201X. Following is an updated chart of accounts. Assets …………………………….…………………………………………………. Revenue 1000 Cash …………………..…………………………………. 4000 Service Revenue 1020 Accounts Receivab

> Alice wants to buy bonds, but her husband, Pete, thinks stocks would be a better deal. Pete was watching a finance show on TV that said stocks would be going up and that now is the time to buy stock. He called Alice over and said, “I told you so.” Alice

> In a periodic system of inventory, the balance of beginning inventory will remain unchanged during the period. True or false?

> What is the purpose of a bond sinking fund?

> Why does the interest method of amortizing a discount or premium use the market rate in calculating interest expense to be recorded?

> Explain the selling price of a bond quoted at 99.

> All treasury stock is recognized as issued and outstanding for dividends. True or false? Please explain.

> Treasury stock is really an asset. Defend or reject. Support your argument.

> Common Stock Dividend Distributable is a liability. Agree or disagree? Defend your position.

> Explain some possible reasons a company may declare a stock dividend instead of a cash dividend.

> Why is no journal entry needed at the date of record?

> List the three important dates that are associated with the dividend process.

> At the end of September, Thad took a complete inventory of his supplies and found the following: 3 dozen 1 /4" screws at a cost of $5.00 a dozen 6 dozen 1 /2" screws at a cost of $10.00 a dozen 5 cartons of computer inventory paper at a cost of $8 a cart

> Explain why Unearned Revenue is a liability account.

> Before Adjustment Given: At year end, depreciation on Equipment is $1,700. a. Which of these three T accounts is not affected? b. Which account is a contra-asset? c. Complete a transaction analysis box for this adjustment. d. What will be the balance o

> Alan Homes serves on the board of directors of Flynn Company. The president of Flynn told him that in three weeks the corporation would announce a 25% increase in dividends. Alan called his neighbor to tell him to buy some stock. The neighbor told his fr

> What elements make up the statement of retained earnings?

> Appropriation of retained earnings is always done for a contractual reason. Agree or disagree? Defend your position.

> Explain the purpose of the account Paid-In Capital from Treasury Stock.

> What is the normal balance and the category of the account Discount on Common Stock?

> Preferred stock can never be cumulative and nonparticipating. True or false? Support your answer.

> What does preemptive right mean?

> What is the maximum number of shares a company may legally issue?

> Explain the difference between Paid-In Capital and retained earnings.

> Happy Carpet Cleaning, Inc., collects FIT, OASDI, and Medicare from its employees by withholding these taxes from its employees’ pay. However, Happy does not pay these amounts to the federal government until the end of the calendar year so that it can ma

> What is the normal balance of Purchases Discount?

> How are discounts recorded in a perpetual system?

> Employer A has a FUTA tax liability of $67.49 on March 31 of the current year. When does the employer have to make the deposit for this liability?

> What is the normal balance of cost of goods sold?

> What new account is used in a perpetual system compared to the periodic system?

> Explain why a trade discount is not a cash discount.

> Why would the purchaser issue a debit memorandum?

> Explain the difference between merchandise and equipment.

> Explain how net purchases is calculated.

> When is a (✓) used?

> Why is the accounts receivable subsidiary ledger organized in alphabetical order?

> Compare and contrast the Controlling Account—Accounts Receivable to the accounts receivable subsidiary ledger.

> What category is Sales Discount in?

> Paul Kloss, accountant for Lowe & Co., traveled to New York on company business. His total expenses came to $350. Paul felt that because the trip extended over the weekend he would “pad” his expense account with an additional $100 of expenses. After all,

> Explain the terms: a. 2/10, n/30 b. n/10, EOM