Question: In recent years, Avery Transportation purchased

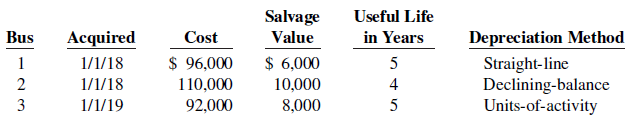

In recent years, Avery Transportation purchased three used buses. Because of frequent turnover in the accounting department, a diff erent accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is summarized as follows.

For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 120,000. Actual miles of use in the first 3 years were 2019, 24,000; 2020, 34,000; and 2021, 30,000.

Instructions

a. Compute the amount of accumulated depreciation on each bus at December 31, 2020.

b. If Bus 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2018 and (2) 2019?

Transcribed Image Text:

Salvage Useful Life in Years Depreciation Method Straight-line Declining-balance Units-of-activity Bus Acquired Cost Value 1 1/1/18 $ 96,000 $ 6,000 5 2 1/1/18 110,000 92,000 10,000 8,000 4 3 1/1/19 5

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> RLF Company sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 days of the inv

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. How are receivables defined in the Codification? b. What are the conditions under which losses from uncollectible receivables (Bad Debt Expense)

> How does the average-cost method of inventory costing diff er between a perpetual inventory system and a periodic inventory system?

> Credit card usage in the United States is substantial. Many startup companies use credit cards as a way to help meet short-term financial needs. The most common forms of debt for startups are use of credit cards and loans from relatives. Suppose that you

> Jill Epp, a friend of yours, overheard a discussion at work about changes her employer wants to make in accounting for uncollectible accounts. Jill knows little about accounting, and she asks you to help make sense of what she heard. Specifically, she as

> Carol and Sam Foyle own Campus Fashions. From its inception Campus Fashions has sold merchandise on either a cash or credit basis, but no credit cards have been accepted. During the past several months, the Foyles have begun to question their sales polic

> Purpose: To learn more about factoring. Instructions Search the Internet under “commercial capital factoring” and then go to the corresponding Commercial Capital LLC website. Click on Invoice Factoring and answer the following questions. a. What are som

> Pinson Company and Estes Company are two proprietorships that are similar in many respects. One difference is that Pinson Company uses the straight-line method and Estes Company uses the declining-balance method at double the straight-line rate. On Janua

> In this chapter, you learned about a basic manual accounting information system. Computerized accounting systems range from the very basic and inexpensive to the very elaborate and expensive. However, even the most sophisticated systems are based on the

> Jill Locey, a classmate, has a part-time bookkeeping job. She is concerned about the ineffi ciencies in journalizing and posting transactions. Ben Newell is the owner of the company where Jill works. In response to numerous complaints from Jill and othe

> Ermler & Trump is a wholesaler of small appliances and parts. Ermler & Trump is operated by two owners, Jack Ermler and Andrea Trump. In addition, the company has one employee, a repair specialist, who is on a fixed salary. Revenues are earned through th

> Sage 50 provides some of the leading accounting software packages. Information related to its products is found at its website. Instructions Review the features related to its products and then be ready to discuss them with the class.

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. What is the definition of current liabilities? b. What is the definition of a contingent liability? c. What guidance does the Codification provi

> Give some examples of appropriate general journal transactions for an organization using special journals.

> Gonzalez Company has been in business several years. At the end of the current year, the ledger shows the following: Accounts Receivable …………………………… $ 310,000 Dr. Sales Revenue ……………………………………. 2,200,000 Cr. Allowance for Doubtful …………………… Accounts 6,100

> Medical costs are substantial and rising. But will they be the most substantial expense over your lifetime? Not likely. Will it be housing or food? Again, not likely. The answer is taxes. On average, Americans work 107 days to aff ord their taxes. Compan

> Mike Falcon, president of the Brownlee Company, has recently hired a number of additional employees. He recognizes that additional payroll taxes will be due as a result of this hiring, and that the company will serve as the collection agent for other tax

> Cunningham Processing Company performs word-processing services for business clients and students in a university community. The work for business clients is fairly steady throughout the year. The work for students peaks significantly in December and May

> Amazon.com Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal- Mart, including the notes to the financial sta

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions Refer to Apple’s fin

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> The Feature Story at the beginning of the chapter discussed the company Rent-A-Wreck. Note that the trade name Rent-A-Wreck is a very important asset to the company, as it creates immediate product identification. As indicated in the chapter, companies i

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions Refer to Apple’s fin

> What inventory cost flow does Apple use for its inventories?

> Morgan Company’s balance sheet at December 31, 2019, is presented below. During January 2020, the following transactions occurred. (Morgan Company uses the perpetual inventory system.) 1. Morgan paid $250 interest on the note payable

> Robert Eberle owns and manages Robert’s Restaurant, a 24-hour restaurant near the city’s medical complex. Robert employs 9 full-time employees and 16 part-time employees. He pays all of the full-time employees by check, the amounts of which are determine

> On January 1, 2020, the ledger of Accardo Company contains the following liability accounts. Accounts Payable ……………………………….. $52,000 Sales Taxes Payable ………………………………. 7,700 Unearned Service Revenue …………………. 16,000 During January, the following selected t

> For the year ended December 31, 2020, Denkinger Electrical Repair Company reports the following summary payroll data. Denkinger’s payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable

> The following payroll liability accounts are included in the ledger of Harmon Company on January 1, 2020. FICA Taxes Payable ………………………………….. $ 760.00 Federal Income Taxes Payable ………………….. 1,204.60 State Income Taxes Payable ………………………… 108.95 Federal Un

> Mann Hardware has four employees who are paid on an hourly basis plus time-and-ahalf for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2020, are presented below. Abel and Hager are married. They claim 0 and 4 withho

> The following are selected transactions of Blanco Company. Blanco prepares financial statements quarterly. Jan. 2 Purchased merchandise on account from Nunez Company, $30,000, terms 2/10, n/30. (Blanco uses the perpetual inventory system.) Feb. 1 Issued

> You are provided with the following information for Gobler Inc. Gobler Inc. uses the periodic method of accounting for its inventory transactions. March 1 Beginning inventory 2,000 liters at a cost of 60¢ per liter. March 3 Purchased 2,500 liters at a co

> You are provided with the following information for Koetteritz Inc. for the month ended June 30, 2020. Koetteritz uses the periodic method for inventory. Instructions a. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profi t, and

> The management of Gresa Inc. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2020 if either the FIFO or the LIFO metho

> Give an example of a transaction in the general journal that causes an entry to be posted twice (i.e., to two accounts), one in the general ledger, the other in the subsidiary ledger. Does this affect the debit/credit equality of the general ledger?

> Sekhon Company had a beginning inventory on January 1 of 160 units of Product 4-18-15 at a cost of $20 per unit. During the year, the following purchases were made. Mar. 15 400 units at $23 Sept. 4 330 units at $26 July 20 250 units at $24 Dec. 2 100

> Glee Distribution markets CDs of the performing artist Unique. At the beginning of October, Glee had in beginning inventory 2,000 of Unique’s CDs with a unit cost of $7. During October, Glee made the following purchases of Unique’s CDs. Oct. 3 2,500 @ $8

> Houghton Limited is trying to determine the value of its ending inventory as of February 28, 2020, the company’s year-end. The following transactions occurred, and the accountant asked your help in determining whether they should be recorded or not. a. O

> LaPorta Company and Lott Corporation, two corporations of roughly the same size, are both involved in the manufacture of in-line skates. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial state

> Due to rapid turnover in the accounting department, a number of transactions involving intangible assets were improperly recorded by Goins Company in 2020. 1. Goins developed a new manufacturing process, incurring research and development costs of $136,0

> The intangible assets section of Sappelt Company at December 31, 2020, is presented below. Patents ($70,000 cost less $7,000 amortization) ……………………………………….. $63,000 Franchises ($48,000 cost less $19,200 amortization) ………………………………….. 28,800 Total ……………………

> Ceda Co. has equipment that cost $80,000 and that has been depreciated $50,000. Instructions Record the disposal under the following assumptions. a. It was scrapped as having no value. b. It was sold for $21,000. c. It was sold for $31,000.

> At December 31, 2020, Grand Company reported the following as plant assets. During 2021, the following selected cash transactions occurred. April 1 Purchased land for $2,130,000. May 1 Sold equipment that cost $750,000 when purchased on January 1, 2017

> At the beginning of 2018, Mazzaro Company acquired equipment costing $120,000. It was estimated that this equipment would have a useful life of 6 years and a salvage value of $12,000 at that time. The straight-line method of depreciation was considered t

> On January 1, 2020, Evers Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine was $48,000. Related expenditures included: sales tax $1,700, shipping costs $150, insurance during shippi

> Dreher Company’s balance sheet shows Inventory $162,800. What additional disclosures should be made?

> The adjusted trial balance of Feagler Company for the year ended December 31, 2020, is as follows. Instructions Prepare a multiple-step income statement and retained earnings statement for 2020, and a classified balance sheet as of December 31, 2020.

> Venable Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. // Instructions Analyze the foregoing transactions using the following column headings.

> The adjusted trial balance of Gibson Company for the year ended December 31, 2020, is as follows: Instructions Prepare a multiple-step income statement, retained earnings statement, and a classified balance sheet. The notes payable is due on January 10

> Suppose the amounts presented here are basic financial information (in millions) from the 2020 annual reports of Nike and adidas. Instructions Calculate the accounts receivable turnover and average collection period for both companies. Comment on the d

> On January 1, 2020, Harter Company had Accounts Receivable $139,000, Notes Receivable $25,000, and Allowance for Doubtful Accounts $13,200. The note receivable is from Willingham Company. It is a 4-month, 9% note dated December 31, 2019. Harter Company p

> At December 31, 2020, the trial balance of Darby Company contained the following amounts before adjustment. Instructions a. Based on the information given, which method of accounting for bad debts is Darby Company using— the direct wr

> Rigney Inc. uses the allowance method to estimate uncollectible accounts receivable. The company produced the following aging of the accounts receivable at year-end. Instructions a. Calculate the total estimated bad debts based on the information provi

> Presented below is an aging schedule for Halleran Company. At December 31, 2020, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,000. Instructions a. Journalize and post the adjusting entry for bad debts at December 31, 20

> Information related to Mingenback Company for 2020 is summarized below. Total credit sales …………………………………. $2,500,000 Accounts receivable at December ………… 31 875,000 Bad debts written off …………………………………. 33,000 Instructions a. What amount of bad debt expen

> Sayaovang Company discovers in 2020 that its ending inventory at December 31, 2019, was $7,000 understated. What effect will this error have on (a) 2019 net income, (b) 2020 net income, and (c) the combined net income for the 2 years?

> At December 31, 2019, House Co. reported the following information on its balance sheet. Accounts receivable ……………………………………………………………. $960,000 Less: Allowance for doubtful accounts ……………………………………. 80,000 During 2020, the company had the following transac

> Daisey Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeep

> Timmins Company of Emporia, Kansas, spreads herbicides and applies liquid fertilizer for local farmers. On May 31, 2020, the company’s Cash account per its general ledger showed a balance of $6,738.90. The bank statement from Emporia St

> The bank portion of the bank reconciliation for Langer Company at November 30, 2020, was as follows. The adjusted cash balance per bank agreed with the cash balance per books at November 30. The December bank statement showed the following checks and d

> On July 31, 2020, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank se

> The post-closing trial balance for Horner Co. is shown below. The subsidiary ledgers contain the following information: (1) accounts receivable—B. Hannigan $2,500, I. Kirk $7,500, and T. Hodges $5,000; (2) accounts payableâ€

> Presented below are the purchases and cash payments journals for Fornelli Co. for its first month of operations. In addition, the following transactions have not been journalized for July. The cost of all merchandise sold was 65% of the sales price. Ju

> Selected accounts from the chart of accounts of Mercer Company are shown below. 101 Cash ………………...………………...401 Sales Revenue 112 Accounts Receivable ……………412 Sales Returns and Allowances 120 Inventory ………………...…………414 Sales Discounts 126 Supplies

> The chart of accounts of LR Company includes the following selected accounts. 112 Accounts Receivable ………………...………………...401 Sales Revenue 120 Inventory ………………...………………...………………412 Sales Returns and Allowances 126 Supplies ………………...………………...………………...

> Reineke Company’s chart of accounts includes the following selected accounts. 101 Cash ………………...………………...201 Accounts Payable 120 Inventory ………………...…………306 Owner’s Drawings 130 Prepaid Insurance ………………...505Cost of Goods Sold 157 Equipment On October 1,

> Warnke Stores has 20 toasters on hand at the balance sheet date. Each costs $27. The net realizable value is $30 per unit. Under the lower-of-cost-or-net realizable value basis of accounting for inventories, what value should Warnke report for the toaste

> Kozma Company’s chart of accounts includes the following selected accounts. 101 Cash ………………...………………...………………...401 Sales Revenue 112 Accounts Receivable ………………...…………….414 Sales Discounts 120Inventory ………………...………………...………….505 Cost of Goods Sold 301

> Rayre Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available for two of its departments at October 31, 2020. At December 31, Rayre Books takes a physical inventory at retail. The actual

> Bao Company lost all of its inventory in a fi re on December 26, 2020. The accounting records showed the following gross profit data for November and December. Bao is fully insured for fi re losses but must prepare a report for the insurance company.

> Wittmann Co. began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Instructions a. Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving

> Dempsey Inc. is a retailer operating in British Columbia. Dempsey uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transac

> The management of Danica Co. asks your help in determining the comparative effects of the FIFO and LIFO inventory cost flow methods. For 2020, the accounting records provide the following data. Inventory, January 1 (10,000 units) $ 47,000 Cost of 100,

> Elsa’s Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Elsa’s purchases of Xpert snowboards during September is shown below. During the same month, 121 Xpert snowboa

> On December 1, Kiyak Electronics Ltd. has three DVD players left in stock. All are identical, all are priced to sell at $150. One of the three DVD players left in stock, with serial #1012, was purchased on June 1 at a cost of $100. Another, with serial #

> On September 1, the balance of the Accounts Receivable control account in the general ledger of Montgomery Company was $10,960. The customers’ subsidiary ledger contained account balances as follows: Hurley $1,440, Andino $2,640, Fowler $2,060, and Sogar

> Kari Downs, an auditor with Wheeler CPAs, is performing a review of Depue Company’s inventory account. Depue did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-

> Hendrix Entertainment Center has 5 TVs on hand at the balance sheet date that cost $400 each. The net realizable value is $380 per unit. Under the lower-of-cost-or-net realizable value basis of accounting for inventories, what value should Hendrix report

> Nex Company uses both special journals and a general journal as described in this chapter. On June 30, after all monthly postings had been completed, the Accounts Receivable control account in the general ledger had a debit balance of $340,000; the Accou

> Maria Garza’s regular hourly wage rate is $16, and she receives a wage of 1½ times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period, Maria worked 42 hours. Her gross earnings prior to the current week were $6,000.

> Suppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). Instructions a. Calculate the current ratio and working capital for 3M for 2019 and 2020. b. Suppose that at the end of 2020, 3M management used $

> Younger Online Company has the following liability accounts after posting adjusting entries: Accounts Payable $73,000, Unearned Ticket Revenue $24,000, Warranty Liability $18,000, Interest Payable $8,000, Mortgage Payable $120,000, Notes Payable $80,000,

> Gallardo Co. is involved in a lawsuit as a result of an accident that took place September 5, 2020. The lawsuit was filed on November 1, 2020, and claims damages of $1,000,000. Instructions a. At December 31, 2020, Gallardo’s attorneys feel it is remote

> Betancourt Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Betancourt estimates that 3% of the units sold will become defective during the warranty period. Management estimates that the ave

> Moreno Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $20 per year. During November 2020, Moreno sells 15,000 subscriptions beginning with the December issue. Moreno prepares financial statements quarterl

> In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Poole Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $30,000 and

> On June 1, Merando Company borrows $90,000 from First Bank on a 6-month, $90,000, 8% note. Instructions a. Prepare the entry on June 1. b. Prepare the adjusting entry on June 30. c. Prepare the entry at maturity (December 1), assuming monthly adjusting

> Podsednik Corporation has 20 employees who each earn $140 a day. The following information is available. 1. At December 31, Podsednik recorded vacation benefits. Each employee earned 5 vacation days during the year. 2. At December 31, Podsednik recorded

> Kyle Adams is studying for the next accounting mid-term examination. What should Kyle know about (a) departing from the cost basis of accounting for inventories and (b) the meaning of “net realizable value” in the lower-of-cost-or-net realizable value me

> Mayberry Company has two fringe benefit plans for its employees: 1. It grants employees 2 days’ vacation for each month worked. Ten employees worked the entire month of March at an average daily wage of $140 per employee. 2. In its pension plan, the comp

> According to a payroll register summary of Frederickson Company, the amount of employees’ gross pay in December was $850,000, of which $80,000 was not subject to Social Security taxes of 6.2% and $750,000 was not subject to state and federal unemployment

> Selected data from a February payroll register for Sutton Company are presented below. Some amounts are intentionally omitted. FICA taxes are 7.65%. State income taxes are 4% of gross earnings. Instructions a. Fill in the missing amounts. b. Journaliz

> Ramirez Company has the following data for the weekly payroll ending January 31. Employees are paid 1½ times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the fi rst $127,200 of gross

> Employee earnings records for Slaymaker Company reveal the following gross earnings for four employees through the pay period of December 15. For the pay period ending December 31, each employee’s gross earnings is $4,500. The FICA ta

> C.S. Lewis Company had the following transactions involving notes payable. July 1, 2020 Borrows $50,000 from First National Bank by signing a 9-month, 8% note. Nov. 1, 2020 Borrows $60,000 from Lyon County State Bank by signing a 3-month, 6% note. Dec.

> Presented below are selected transactions at Ridge Company for 2020. Jan.1 Retired a piece of machinery that was purchased on January 1, 2010. The machine cost $62,000 on that date. It had a useful life of 10 years with no salvage value. June 30 Sold a c

> Terry Wade, the new controller of Hellickson Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2020. His findings are as follows. All assets are depreciated by the straight-line method