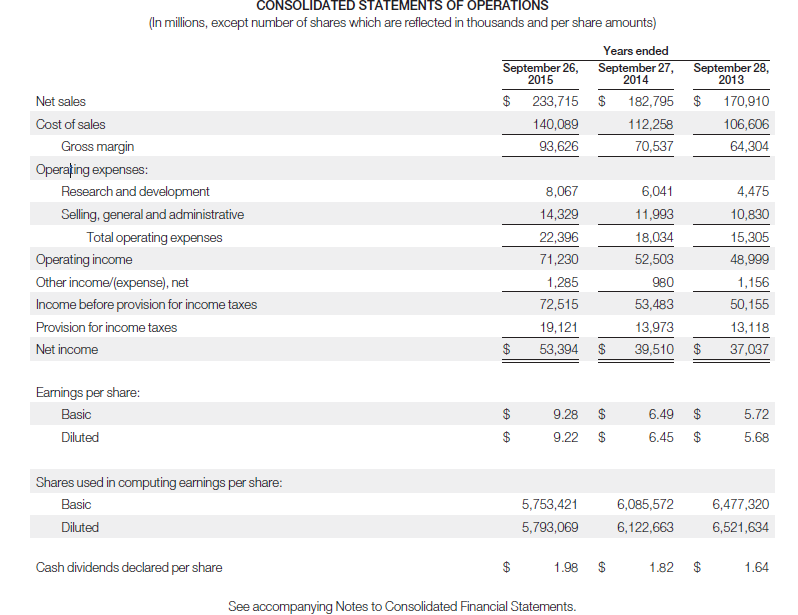

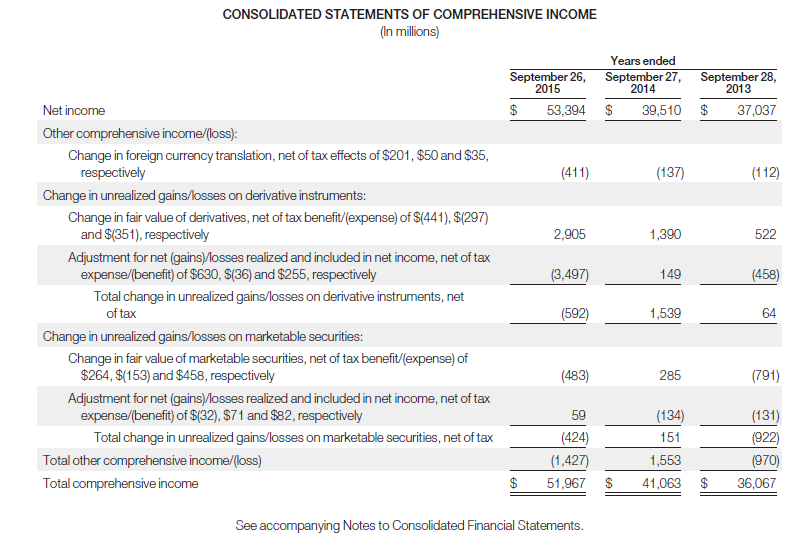

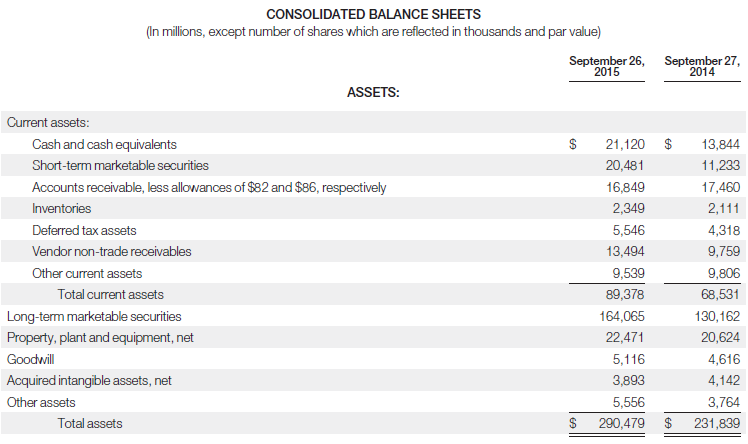

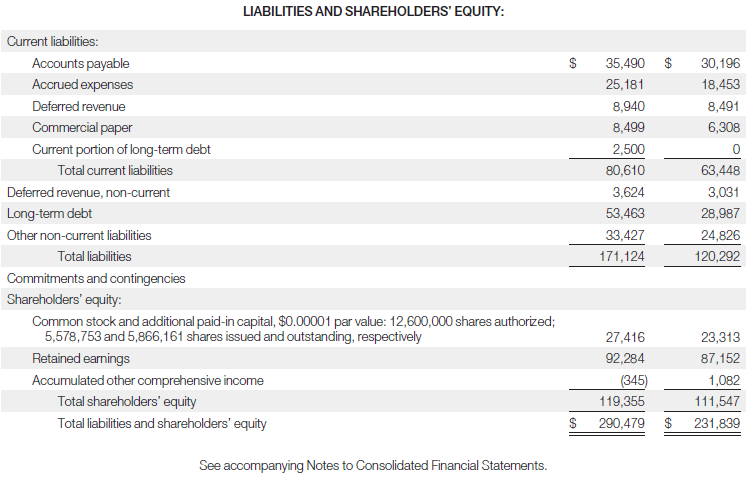

Question: The financial statements of Apple Inc. are

The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website.

Instructions

Refer to Apple’s financial statements and answer the following questions.

a. What was the total cost and book value of property, plant, and equipment at September 26, 2015?

b. What was the amount of depreciation and amortization expense for each of the three years 2013–2015?

c. Using the statement of cash flows, what is the amount of capital spending in 2015 and 2014? (Ignore business acquisitions and intangible assets.)

d. Where does the company disclose its intangible assets, and what types of intangibles did it have at September 26, 2015?

Apple’s financial statements from Appendix A:

//

//

Transcribed Image Text:

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 26, 2015 September 27, 2014 September 28, 2013 Net sales $ 233,715 182,795 170,910 Cost of sales 140,089 112,258 106,606 Gross margin 93,626 70,537 64,304 Operațing expenses: Research and development 8,067 6,041 4,475 Selling, general and administrative 14,329 11,993 10,830 Total operating expenses 22,396 18,034 15,305 Operating income 71,230 52,503 48,999 Other income/(expense), net 1,285 980 1,156 Income before provision for income taxes 72,515 53,483 50,155 Provision for income taxes 19,121 13,973 13,118 Net income $ 53,394 $ 39,510 $ 37,037 Earnings per share: Basic 9.28 $ 6.49 5.72 Diluted 2$ 9.22 $ 6.45 5.68 Shares used in computing earnings per share: Basic 5,753,421 6,085,572 6,477,320 Diluted 5,793,069 6,122,663 6,521,634 Cash dividends declared per share $ 1.98 1.82 1.64 See accompanying Notes to Consolidated Financial Statements. %24 24 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 26, September 27, 2015 September 28, 2013 2014 Net income $ 53,394 $ 39,510 $ 37,037 Other comprehensive income/loss): Change in foreign currency translation, net of tax effects of $201, $50 and $35, respectively (411) (137) (112) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(441), $(297) and $(351), respectively 2,905 1,390 522 Adjustment for net (gains)losses realized and included in net income, net of tax expense/(benefit) of $630, S(36) and $255, respectively (3,497) 149 (458) Total change in unrealized gains/losses on derivative instruments, net of tax (592) 1,539 64 Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/(expense) of $264, $(153) and $458, respectively (483) 285 (791) Adjustment for net (gains)losses realized and included in net income, net of tax expense/(benefit) of $(32), $71 and $82, respectively (131) (922) 59 (134) Total change in unrealized gains/losses on marketable securities, net of tax (424) 151 Total other comprehensive income/(loss) (1,427) 1,553 (970) Total comprehensive income $ 51,967 $ 41,063 $ 36,067 See accompanying Notes to Consolidated Financial Statements. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 26, 2015 September 27, 2014 ASSETS: Current assets: Cash and cash equivalents 21,120 13,844 Short-term marketable securities 20,481 11,233 Accounts receivable, less allowances of $82 and $86, respectively 16,849 17,460 Inventories 2,349 2,111 Deferred tax assets 5,546 4,318 Vendor non-trade receivables 13,494 9,759 Other current assets 9,539 9,806 Total current assets 89,378 68,531 Long-term marketable securities 164,065 130,162 Property, plant and equipment, net 22,471 20,624 Goodwill 5,116 4,616 Acquired intangible assets, net 3,893 4,142 Other assets 5,556 3,764 Total assets $ 290,479 $ 231,839 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable $ 35,490 30,196 Accrued expenses 25,181 18,453 Deferred revenue 8,940 8,491 Commercial paper 8,499 6,308 Current portion of long-term debt 2,500 Total current liabilities 80,610 63,448 Deferred revenue, non-current 3,624 3,031 Long-term debt 53,463 28,987 Other non-current liabilities 33,427 24,826 Total liabilities 171,124 120,292 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 5,578,753 and 5,866,161 shares issued and outstanding, respectively 27,416 23,313 Retained earnings 92,284 87,152 Accumulated other comprehensive income (345) 1,082 Total shareholders' equity 119,355 111,547 Total liabilities and shareholders' equity $ 290,479 $ 231,839 See accompanying Notes to Consolidated Financial Statements. 24

> Indicate the maturity date of each of the following promissory notes: Date of Note Terms a. March 13 one year after date of note b. Мay 4 c. June 20 d. July 1 3 months after date 30 days after date 60 days after date

> Westside Textiles decides to sell $800,000 of its accounts receivable to First Factors Inc. First Factors assesses a service charge of 3% of the amount of receivables sold. Prepare the journal entry that Westside Textiles makes to record this sale.

> Cinderella Shoe Shop had goods available for sale in 2020 with a retail price of $120,000. The cost of these goods was $84,000. If sales during the period were $80,000, what is the ending inventory at cost using the retail inventory method?

> Pawlowski Company has net sales of $400,000 and cost of goods available for sale of $300,000. If the gross profit rate is 35%, what is the estimated cost of the ending inventory? Show computations.

> You are the controller of Small Toys Inc. Pamela Bames, the president, recently mentioned to you that she found an error in the 2019 financial statements which she believes has corrected itself. She determined, in discussions with the Purchasing Departme

> Both the gross profit method and the retail inventory method are based on averages. For each method, indicate the average used, how it is determined, and how it is applied.

> On April 10, 2020, fire damaged the office and warehouse of Corvet Company. Most of the accounting records were destroyed, but the following account balances were determined as of March 31, 2020: Inventory (January 1, 2020), $80,000; Sales Revenue (Janua

> All organizations should have systems of internal control to combat fraud. Instructions Go to the Association of Certified Fraud Examiner (ACFE) website, search “Report to the Nations on Occupational Fraud and Abuse,” click Costs, and then answer the fo

> McBride Company has the following opening account balances in its general and subsidiary ledgers on January 1 and uses the periodic inventory system. All accounts have normal debit and credit balances. In addition, the following transactions have not b

> Wiemers Products Company operates three divisions, each with its own manufacturing plant and marketing/sales force. The corporate headquarters and central accounting office are in Wiemers, and the plants are in Freeport, Rockport, and Bayport, all within

> On December 1, 2020, Fullerton Company had the following account balances. During December, the company completed the following transactions. Dec. 7 Received $3,600 cash from customers in payment of account (no discount allowed). 12 Purchased merchan

> Jeter Co. uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledgers for Jeter are indicated in the working papers presented below. A

> On December 1, 2020, Annalise Company had the account balances shown below. The following transactions occurred during December. Dec. 3 Purchased 4,000 units of inventory on account at a cost of $0.74 per unit. 5 Sold 4,400 units of inventory on acco

> Hassellhouf Company’s trial balance at December 31, 2020, is as follows. All 2020 transactions have been recorded except for the items described following the trial balance. // Unrecorded transactions: 1. On May 1, 2020, Hassellhouf purchased equipment

> Winter Company’s balance sheet at December 31, 2019, is presented below. During January 2020, the following transactions occurred. Winter uses the perpetual inventory method. Jan. 1 Winter accepted a 4-month, 8% note from Merando Comp

> Turner Container Company is suffering declining sales of its principal product, nonbiodegradeable plastic cartons. The president, Robert Griffin, instructs his controller, Alexis Landrum, to lengthen asset lives to reduce depreciation expense. A processi

> An article recently appeared in the Wall Street Journal indicating that companies are selling their receivables at a record rate. Why are companies selling their receivables?

> The controller of Diaz Co. believes that the yearly allowance for doubtful accounts for Diaz Co. should be 2% of its accounts receivable balance at the end of the year. The president of Diaz Co., nervous that the owners might expect the company to sustai

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> LaTour Inc. is based in France and prepares its financial statements (in euros) in accordance with IFRS. In 2020, it reported cost of goods sold of €578 million and average inventory of €154 million. Briefly discuss how analysis of LaTour’s inventory tur

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Using the notes to the company&acir

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. What were the total current liab

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> RLF Company sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 days of the inv

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. How are receivables defined in the Codification? b. What are the conditions under which losses from uncollectible receivables (Bad Debt Expense)

> How does the average-cost method of inventory costing diff er between a perpetual inventory system and a periodic inventory system?

> Credit card usage in the United States is substantial. Many startup companies use credit cards as a way to help meet short-term financial needs. The most common forms of debt for startups are use of credit cards and loans from relatives. Suppose that you

> Jill Epp, a friend of yours, overheard a discussion at work about changes her employer wants to make in accounting for uncollectible accounts. Jill knows little about accounting, and she asks you to help make sense of what she heard. Specifically, she as

> Carol and Sam Foyle own Campus Fashions. From its inception Campus Fashions has sold merchandise on either a cash or credit basis, but no credit cards have been accepted. During the past several months, the Foyles have begun to question their sales polic

> Purpose: To learn more about factoring. Instructions Search the Internet under “commercial capital factoring” and then go to the corresponding Commercial Capital LLC website. Click on Invoice Factoring and answer the following questions. a. What are som

> Pinson Company and Estes Company are two proprietorships that are similar in many respects. One difference is that Pinson Company uses the straight-line method and Estes Company uses the declining-balance method at double the straight-line rate. On Janua

> In this chapter, you learned about a basic manual accounting information system. Computerized accounting systems range from the very basic and inexpensive to the very elaborate and expensive. However, even the most sophisticated systems are based on the

> Jill Locey, a classmate, has a part-time bookkeeping job. She is concerned about the ineffi ciencies in journalizing and posting transactions. Ben Newell is the owner of the company where Jill works. In response to numerous complaints from Jill and othe

> Ermler & Trump is a wholesaler of small appliances and parts. Ermler & Trump is operated by two owners, Jack Ermler and Andrea Trump. In addition, the company has one employee, a repair specialist, who is on a fixed salary. Revenues are earned through th

> Sage 50 provides some of the leading accounting software packages. Information related to its products is found at its website. Instructions Review the features related to its products and then be ready to discuss them with the class.

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. What is the definition of current liabilities? b. What is the definition of a contingent liability? c. What guidance does the Codification provi

> Give some examples of appropriate general journal transactions for an organization using special journals.

> Gonzalez Company has been in business several years. At the end of the current year, the ledger shows the following: Accounts Receivable …………………………… $ 310,000 Dr. Sales Revenue ……………………………………. 2,200,000 Cr. Allowance for Doubtful …………………… Accounts 6,100

> Medical costs are substantial and rising. But will they be the most substantial expense over your lifetime? Not likely. Will it be housing or food? Again, not likely. The answer is taxes. On average, Americans work 107 days to aff ord their taxes. Compan

> Mike Falcon, president of the Brownlee Company, has recently hired a number of additional employees. He recognizes that additional payroll taxes will be due as a result of this hiring, and that the company will serve as the collection agent for other tax

> Cunningham Processing Company performs word-processing services for business clients and students in a university community. The work for business clients is fairly steady throughout the year. The work for students peaks significantly in December and May

> Amazon.com Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal- Mart, including the notes to the financial sta

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions Refer to Apple’s fin

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> The Feature Story at the beginning of the chapter discussed the company Rent-A-Wreck. Note that the trade name Rent-A-Wreck is a very important asset to the company, as it creates immediate product identification. As indicated in the chapter, companies i

> What inventory cost flow does Apple use for its inventories?

> Morgan Company’s balance sheet at December 31, 2019, is presented below. During January 2020, the following transactions occurred. (Morgan Company uses the perpetual inventory system.) 1. Morgan paid $250 interest on the note payable

> Robert Eberle owns and manages Robert’s Restaurant, a 24-hour restaurant near the city’s medical complex. Robert employs 9 full-time employees and 16 part-time employees. He pays all of the full-time employees by check, the amounts of which are determine

> On January 1, 2020, the ledger of Accardo Company contains the following liability accounts. Accounts Payable ……………………………….. $52,000 Sales Taxes Payable ………………………………. 7,700 Unearned Service Revenue …………………. 16,000 During January, the following selected t

> For the year ended December 31, 2020, Denkinger Electrical Repair Company reports the following summary payroll data. Denkinger’s payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable

> The following payroll liability accounts are included in the ledger of Harmon Company on January 1, 2020. FICA Taxes Payable ………………………………….. $ 760.00 Federal Income Taxes Payable ………………….. 1,204.60 State Income Taxes Payable ………………………… 108.95 Federal Un

> Mann Hardware has four employees who are paid on an hourly basis plus time-and-ahalf for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2020, are presented below. Abel and Hager are married. They claim 0 and 4 withho

> The following are selected transactions of Blanco Company. Blanco prepares financial statements quarterly. Jan. 2 Purchased merchandise on account from Nunez Company, $30,000, terms 2/10, n/30. (Blanco uses the perpetual inventory system.) Feb. 1 Issued

> You are provided with the following information for Gobler Inc. Gobler Inc. uses the periodic method of accounting for its inventory transactions. March 1 Beginning inventory 2,000 liters at a cost of 60¢ per liter. March 3 Purchased 2,500 liters at a co

> You are provided with the following information for Koetteritz Inc. for the month ended June 30, 2020. Koetteritz uses the periodic method for inventory. Instructions a. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profi t, and

> The management of Gresa Inc. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2020 if either the FIFO or the LIFO metho

> Give an example of a transaction in the general journal that causes an entry to be posted twice (i.e., to two accounts), one in the general ledger, the other in the subsidiary ledger. Does this affect the debit/credit equality of the general ledger?

> Sekhon Company had a beginning inventory on January 1 of 160 units of Product 4-18-15 at a cost of $20 per unit. During the year, the following purchases were made. Mar. 15 400 units at $23 Sept. 4 330 units at $26 July 20 250 units at $24 Dec. 2 100

> Glee Distribution markets CDs of the performing artist Unique. At the beginning of October, Glee had in beginning inventory 2,000 of Unique’s CDs with a unit cost of $7. During October, Glee made the following purchases of Unique’s CDs. Oct. 3 2,500 @ $8

> Houghton Limited is trying to determine the value of its ending inventory as of February 28, 2020, the company’s year-end. The following transactions occurred, and the accountant asked your help in determining whether they should be recorded or not. a. O

> LaPorta Company and Lott Corporation, two corporations of roughly the same size, are both involved in the manufacture of in-line skates. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial state

> Due to rapid turnover in the accounting department, a number of transactions involving intangible assets were improperly recorded by Goins Company in 2020. 1. Goins developed a new manufacturing process, incurring research and development costs of $136,0

> The intangible assets section of Sappelt Company at December 31, 2020, is presented below. Patents ($70,000 cost less $7,000 amortization) ……………………………………….. $63,000 Franchises ($48,000 cost less $19,200 amortization) ………………………………….. 28,800 Total ……………………

> Ceda Co. has equipment that cost $80,000 and that has been depreciated $50,000. Instructions Record the disposal under the following assumptions. a. It was scrapped as having no value. b. It was sold for $21,000. c. It was sold for $31,000.

> At December 31, 2020, Grand Company reported the following as plant assets. During 2021, the following selected cash transactions occurred. April 1 Purchased land for $2,130,000. May 1 Sold equipment that cost $750,000 when purchased on January 1, 2017

> At the beginning of 2018, Mazzaro Company acquired equipment costing $120,000. It was estimated that this equipment would have a useful life of 6 years and a salvage value of $12,000 at that time. The straight-line method of depreciation was considered t

> On January 1, 2020, Evers Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine was $48,000. Related expenditures included: sales tax $1,700, shipping costs $150, insurance during shippi

> Dreher Company’s balance sheet shows Inventory $162,800. What additional disclosures should be made?

> In recent years, Avery Transportation purchased three used buses. Because of frequent turnover in the accounting department, a diff erent accountant selected the depreciation method for each bus, and various methods were selected. Information concerning

> The adjusted trial balance of Feagler Company for the year ended December 31, 2020, is as follows. Instructions Prepare a multiple-step income statement and retained earnings statement for 2020, and a classified balance sheet as of December 31, 2020.

> Venable Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. // Instructions Analyze the foregoing transactions using the following column headings.

> The adjusted trial balance of Gibson Company for the year ended December 31, 2020, is as follows: Instructions Prepare a multiple-step income statement, retained earnings statement, and a classified balance sheet. The notes payable is due on January 10

> Suppose the amounts presented here are basic financial information (in millions) from the 2020 annual reports of Nike and adidas. Instructions Calculate the accounts receivable turnover and average collection period for both companies. Comment on the d

> On January 1, 2020, Harter Company had Accounts Receivable $139,000, Notes Receivable $25,000, and Allowance for Doubtful Accounts $13,200. The note receivable is from Willingham Company. It is a 4-month, 9% note dated December 31, 2019. Harter Company p

> At December 31, 2020, the trial balance of Darby Company contained the following amounts before adjustment. Instructions a. Based on the information given, which method of accounting for bad debts is Darby Company using— the direct wr

> Rigney Inc. uses the allowance method to estimate uncollectible accounts receivable. The company produced the following aging of the accounts receivable at year-end. Instructions a. Calculate the total estimated bad debts based on the information provi

> Presented below is an aging schedule for Halleran Company. At December 31, 2020, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,000. Instructions a. Journalize and post the adjusting entry for bad debts at December 31, 20

> Information related to Mingenback Company for 2020 is summarized below. Total credit sales …………………………………. $2,500,000 Accounts receivable at December ………… 31 875,000 Bad debts written off …………………………………. 33,000 Instructions a. What amount of bad debt expen

> Sayaovang Company discovers in 2020 that its ending inventory at December 31, 2019, was $7,000 understated. What effect will this error have on (a) 2019 net income, (b) 2020 net income, and (c) the combined net income for the 2 years?

> At December 31, 2019, House Co. reported the following information on its balance sheet. Accounts receivable ……………………………………………………………. $960,000 Less: Allowance for doubtful accounts ……………………………………. 80,000 During 2020, the company had the following transac

> Daisey Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeep

> Timmins Company of Emporia, Kansas, spreads herbicides and applies liquid fertilizer for local farmers. On May 31, 2020, the company’s Cash account per its general ledger showed a balance of $6,738.90. The bank statement from Emporia St

> The bank portion of the bank reconciliation for Langer Company at November 30, 2020, was as follows. The adjusted cash balance per bank agreed with the cash balance per books at November 30. The December bank statement showed the following checks and d

> On July 31, 2020, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank se

> The post-closing trial balance for Horner Co. is shown below. The subsidiary ledgers contain the following information: (1) accounts receivable—B. Hannigan $2,500, I. Kirk $7,500, and T. Hodges $5,000; (2) accounts payableâ€

> Presented below are the purchases and cash payments journals for Fornelli Co. for its first month of operations. In addition, the following transactions have not been journalized for July. The cost of all merchandise sold was 65% of the sales price. Ju

> Selected accounts from the chart of accounts of Mercer Company are shown below. 101 Cash ………………...………………...401 Sales Revenue 112 Accounts Receivable ……………412 Sales Returns and Allowances 120 Inventory ………………...…………414 Sales Discounts 126 Supplies

> The chart of accounts of LR Company includes the following selected accounts. 112 Accounts Receivable ………………...………………...401 Sales Revenue 120 Inventory ………………...………………...………………412 Sales Returns and Allowances 126 Supplies ………………...………………...………………...

> Reineke Company’s chart of accounts includes the following selected accounts. 101 Cash ………………...………………...201 Accounts Payable 120 Inventory ………………...…………306 Owner’s Drawings 130 Prepaid Insurance ………………...505Cost of Goods Sold 157 Equipment On October 1,

> Warnke Stores has 20 toasters on hand at the balance sheet date. Each costs $27. The net realizable value is $30 per unit. Under the lower-of-cost-or-net realizable value basis of accounting for inventories, what value should Warnke report for the toaste

> Kozma Company’s chart of accounts includes the following selected accounts. 101 Cash ………………...………………...………………...401 Sales Revenue 112 Accounts Receivable ………………...…………….414 Sales Discounts 120Inventory ………………...………………...………….505 Cost of Goods Sold 301

> Rayre Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available for two of its departments at October 31, 2020. At December 31, Rayre Books takes a physical inventory at retail. The actual

> Bao Company lost all of its inventory in a fi re on December 26, 2020. The accounting records showed the following gross profit data for November and December. Bao is fully insured for fi re losses but must prepare a report for the insurance company.

> Wittmann Co. began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Instructions a. Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving

> Dempsey Inc. is a retailer operating in British Columbia. Dempsey uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transac

> The management of Danica Co. asks your help in determining the comparative effects of the FIFO and LIFO inventory cost flow methods. For 2020, the accounting records provide the following data. Inventory, January 1 (10,000 units) $ 47,000 Cost of 100,