Question: Instant Brake Inc.’s comparative balance sheet

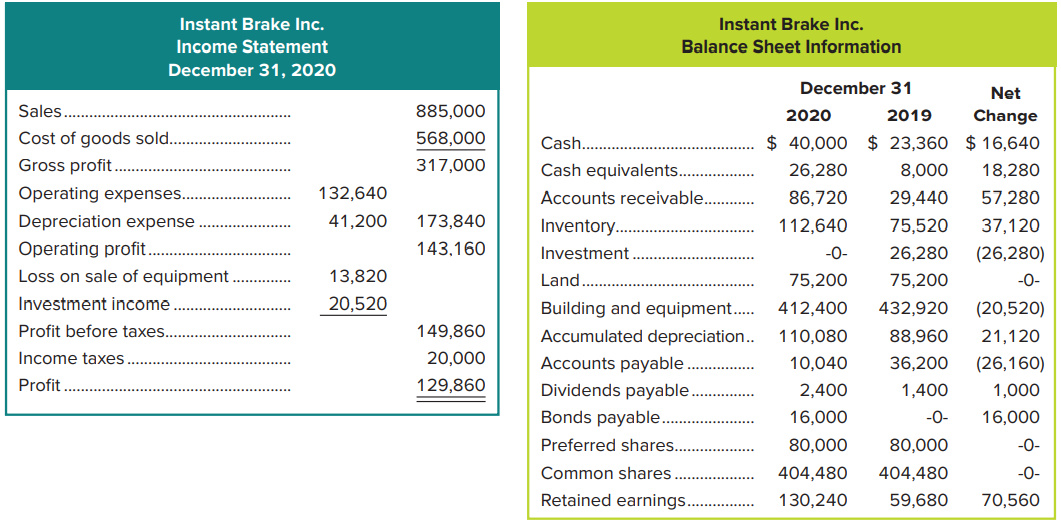

Instant Brake Inc.’s comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020, are as follows:

During 2020, the following transactions occurred:

1. Purchased equipment for $21,000 cash.

2. Sold the investment on January 1, 2020, for $46,800, resulting in investment income of $20,520.

3. Sold equipment for $7,620 cash that had originally cost $41,520 and had $20,080 of accumulated depreciation.

4. Issued $16,000 of bonds payable at face value.

Required

1. How much cash was paid in dividends?

2. Prepare a statement of cash flows for Instant Brake for the year ended December 31, 2020, using the indirect method.

Analysis Component: The net increase in cash during 2020 for Instant Brake was $16,640. Briefly explain what caused this change using the statement of cash flows prepared in part 2 above.

> On September 3, 2020, Reynolds Retailers, operating out of Nunavut, sold $14,700 of goods for cash with a cost of $12,380. Record Reynolds’s entries, including all appropriate sales taxes.

> Hinton Designers, located in Quebec, provided $7,300 of services on credit to a client on May 7, 2020. Record Hinton’s entry, including the appropriate GST and PST. (Hint: Refer to Exhibit 10.6 for PST rates.)

> Suppose Mink Makeup sells $5,600 of makeup (merchandise with a cost of $4,800) for cash on September 30. The sales tax law requires Mink to collect 13% harmonized sales tax on every dollar of merchandise sold. Record Mink’s entries for the $5,600 sale an

> MetroConcerts receives $2,000,000 in advance cash ticket sales for a four-date tour for Diana Krall. Record the advance ticket sales as a lump sum as of October 31, 2020. The concerts sold out and no additional ticket sales have been recorded. Record the

> On January 1, 2020, La Petite Macaron, a local French bakery, borrowed $84,000 from the bank. Interest is calculated at the rate of 4% and the term of the note is four years. Four equal annual payments will be made in the amount of $23,141 each December

> The following legal claims exist for the Doucet Advertising Agency. Classify the required accounting treatment for each legal situation as (a) a liability should be recorded, or (b) the legal claim need only be described in the notes to the financial sta

> During 2020, Victory Bubble Tea House recorded $36,000 in estimated income taxes on the last day of each month and made the payment on the 15th of the following month. On December 31, 2020, Victory’s year-end, it was determined that total income tax expe

> Wang Corp. estimates income tax expense to be $285,600 for the year 2020. Record estimated income tax for January on January 31, 2020, and the payment on February 1, 2020.

> On December 20, 2020, The Net Department Store sold a computer for $3,500 with a one-year warranty that covers parts and labour. Warranty expense was estimated at 2% of sales dollars. On March 2, 2021, the computer was taken in for repairs covered under

> Vision Wear’s product warranties state that defective glasses will be replaced free of charge for the life of the product. Vision Wear estimates that 2% of the pairs of glasses sold will require replacement. Each pair of glasses costs Vision Wear on aver

> Refer to the amortization schedule prepared in Problem 14-3B. Assume a January 31 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on September 1, 2020 b. Adjusting entry to accrue bond interest and premium amortization on

> Which of the following items should normally be classified as a current liability for Prairie Brewing Company? Prairie has a 15-month operating cycle. a. A note payable due in 18 months. b. Salaries payable. c. A payable that matures in two years. d. A n

> Flint Solar Energy showed the following information in its Property, Plant, and Equipment subledger regarding a machine. On September 1, 2020, the motor was replaced with a new one costing $60,000; it was purchased on account. The new motor had an estima

> Assume Barrick Gold Corporation purchased mineral rights for a gold mine in Peru on October 1, 2020, by paying cash of $5,000,000 and incurring a non-current note payable for the $30,000,000 balance. Barrick also paid $4,000,000 cash for water rights nee

> On January 4, 2020, Amber’s Boutique paid cash of $95,000 for a 10-year franchise. Prepare the entry to record the purchase of the franchise and the adjusting entry at December 31, 2020.

> On March 1, 2020, Wallace Company purchased a new machine with a suggested retail price of $123,000. The new machine was to replace an old machine that originally cost $90,000 and had $36,000 of accumulated depreciation at the time of the exchange. The r

> Dean Carpet Stores owned an automobile with a $15,000 cost that had $13,500 accumulated depreciation as of December 31, 2020. Its fair value on this date was $3,000. On the same day, Dean exchanged this auto for a computer with a fair value of $5,800. De

> Huang Furniture Company showed the following adjusted account balances on September 30, 2020: Prepare the entries to record the following on October 1, 2020: a. Equipment was sold for cash of $17,000. b. Machinery was sold for cash of $27,000. c. Deliver

> Phantom Company was preparing the annual financial statements and, as part of its year-end procedures, prepared the following alphabetized schedule based on adjusted values at March 31, 2020: What, if any, impairment losses need to be accounted for? Assu

> Class Act Catering Company had a deluxe, portable barbecue with a book value of $7,000 at its December 31, 2019, year-end. The barbecue had an estimated remaining useful life of five years and a $200 residual value. On January 3, 2020, a customized elect

> On January 1, 2020, Kaldex Company purchased for $35,720 equipment with an estimated useful life of eight years and an estimated residual value at the end of its life of $4,200. Early in January 2023, it was determined that the total estimated useful lif

> On September 1, 2020, Messner Corp. issued a $400,000, 15%, four-year bond. Interest is payable semiannually beginning March 1, 2021. Required a. Calculate the bond issue price assuming a market interest rate of 13.5% on the date of issue. b. Using the e

> AbeCo, a luggage manufacturing company, borrowed $75,000 from the bank to purchase a machine that was estimated to produce 120,000 suitcases; its expected residual value is $15,000. During 2020 and 2021, the machine produced 20,000 and 28,000 units, resp

> Refer to the information in QS 9-10. Assume the equipment is depreciated using the double-declining-balance method. Calculate depreciation for 2020 and 2021: a. To the nearest whole month b. Using the half-year convention Data from QS 9-10: Equipment wi

> Equipment with an estimated life of 10 years and no expected residual value was purchased on account for $60,000 on March 6, 2020. Assuming a year-end of December 31, calculate depreciation for 2020 and 2021 using the straight-line method: a. To the near

> Crystal Cleaners is an eco-friendly dry cleaner. The following excerpt from its PPE subledger shows the component details regarding the dry cleaning equipment: Calculate depreciation on the dry cleaning equipment for the year ended December 31, 2020. Ass

> Patty’s Pies acquired a delivery truck on January 1, 2020, for $86,000. It is expected to last five years and then sell for about $16,000. Calculate depreciation for each year of the truck’s life using the double declining balance method. Patty’s Pies’ y

> Papaya, a specialty greeting card company, purchased a photocopier costing $45,000 on January 1, 2020. The equipment is expected to produce a total of 4,000,000 copies over its productive life. Its residual value at the end of its useful life is estimate

> On January 2, 2020, Crossfire acquired sound equipment for concert performances at a cost of $55,900. The rock band estimated that it would use this equipment for four years, and then sell the equipment for $1,900. Calculate depreciation for each year of

> TechCom has provided the following selected account information, in alphabetical order, from its adjusted trial balance at October 31, 2020 (assume normal balances): Prepare the asset section of the classified balance sheet at October 31, 2020.

> The adjusted balances at December 31, 2020, for Derlak Enterprises are shown in alphabetical order below: Required: Prepare a comparative classified balance sheet at December 31, 2020. Analysis Component: Are Derlak’s assets financed ma

> On March 31, 2020, Capital Investment Advisers paid $4,570,000 for land with two buildings on it. The plan was to demolish Building 1 and build a new store (Building 3) in its place. Building 2 was to be used as a company office and was appraised at a va

> Wind-Electric Corp. issued $940,000 of bonds that pay 9.7% annual interest with two semiannual payments. The date of issuance was January 1, 2020, and the interest is paid on June 30 and December 31. The bonds mature after 10 years and were issued at the

> You have been given the opportunity to assist the board members of a charitable organization with their decision to invest excess funds into either Hemp Yoga Clothing Limited or Western Sport Clothing Inc., which are both clothing retailers. A number of

> Web Structure Inc. calculated the ratios shown below for 2020 and 2019: Required 1. Identify whether the change in the ratios from 2019 to 2020 is favourable (F) or unfavourable (U). 2. Assess whether the 2020 ratios are favourable or unfavourable in com

> Alberta Playground Inc. produces, markets, distributes, and installs durable playground equipment. It is a new, growing playground distributor in Canada, and is hoping to expand to other provinces shortly. Its head office is in Edmonton, Alberta, and its

> On December 31, 2020, University Security Inc. showed the following: Required Part 1: Calculate book value per common share and preferred share at December 31, 2020, assuming no dividends were declared for the years ended December 31, 2019 or 2020, and t

> The 2020 financial statements of Outdoor Waterworks Inc. follow: Assume all sales were on credit. Also assume the long-term note payable is due in 2023, with no current portion. On the December 31, 2019, balance sheet, the assets totalled $432,720, commo

> North Exploration Inc. and Eagle Minerals Inc. are similar firms that operate within the same industry. The following information is available: Required The controller of your company has asked you to analyze the above two companies, so a decision can be

> Halifax Fisheries Inc. began the month of March with $760,000 of current assets, a current ratio of 2.5 to 1, and a quick ratio of 1.1 to 1. During the month, it completed the following transactions: Mar. 6 Bought $86,000 of merchandise on account. (The

> The condensed statements of Independent Auto Inc. follow: Required Rounding calculations to two decimal places: 1. Calculate each year’s current ratio. 2. Express the income statement data in common-size percentages. 3. Express the bala

> The condensed comparative statements of Uranium Mining Corporation follow: Required: Calculate trend percentages for the items of the statements using 2014 as the base year. Analysis Component: Analyze and comment on the situation shown in the statements

> Lock & Key Inc. began operations on January 1, 2019. Its post-closing trial balance at December 31, 2019 and 2020, is shown below along with some other information. Other information regarding Lock & Key Inc. and its activities during 2020: 1. As

> Peerless Carpet Corp. leased a machine on January 1, 2020, under a contract calling for six annual payments of $60,000 on December 31, 2020 through 2025. The machine becomes the property of the lessee after the sixth payment. The machine was predicted to

> Required: Refer to the information in Problem 16-7A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All accounts payable balances result from merchan

> Paddleboard Inc. began operations on January 1, 2019. Its post-closing trial balance at December 31, 2019 and 2020, is shown below along with some other information. Other information regarding Paddleboard Inc. and its activities during 2020: 1. Assume a

> Refer to the information in Problem 16-5A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All sales are credit sales. b. All credits to accounts rece

> ICE Drilling Inc.’s balance sheet information and income statement are as follows: Additional information regarding ICE Drilling’s activities during 2020: 1. Loss on sale of equipment is $11,480. 2. Paid $70,280 to red

> Refer to the information in Problem 16-3A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All sales are credit sales. b. All credits to accounts rece

> Refer to the information in Problem 16-1A. Other information regarding LAG Network Inc.: a. All sales are credit sales. b. All credits to accounts receivable are receipts from customers. c. All purchases of merchandise are on credit. d. All debits to acc

> Required: Refer to the information in Problem 16-11A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All accounts payable balances result from mercha

> Sunny Technologies Inc. began operations on January 1, 2019. Its post-closing trial balance at December 31, 2019, and 2020 is shown below along with some other information. Other information regarding Sunny and its activities during 2020: 1. Assume all a

> Required: Refer to the information in Problem 16-9A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All accounts payable balances result from merchan

> On May 31, 2020, Iceflow Technologies Inc. borrowed $400,000 from a bank by signing a four-year installment note bearing interest at 14%. The terms of the note require equal semiannual payments each year beginning on November 30, 2020. Required 1. Calcul

> LAG Network Inc.’s balance sheet and income statement are as follows: Additional information regarding LAG Network Inc.’s activities during 2020: a. Equipment is purchased for $14,400 cash. b. 8,200 common shares are i

> Heritage Ltd. was organized on January 2, 2020. The following investment transactions and events occurred during the following months: Assume that Heritage has a significant influence over Port with its 20% share. Required 1. Give the entries to record t

> Johnson Inc.’s non-strategic investment portfolio at December 31, 2019, consisted of the following: Johnson had no other debt and equity investments at December 31, 2019, other than those shown above. During 2020, Johnson engaged in the

> On January 1, 2020, Liu Corporation paid $241,960 to acquire bonds of Singh Investment Corp with a par value of $240,000. The annual contract rate on the bonds is 6% and interest is paid semiannually on June 30 and December 31. The bonds mature after thr

> On January 1, 2020, Swift Current Corporation paid $2,540,240 to acquire bonds of Jasper Investment Corp with a par value of $2,520,000. The annual contract rate on the bonds is 7% and interest is paid semiannually on June 30 and December 31. The bonds m

> Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to be held as non-strategic investments: On December 31, 2020, the fair values of the investments held by Safety Development Corporation wer

> Live Large Inc. had the following transactions involving non-strategic investments during 2020. Required 1. Prepare an amortization schedule for the Space Explore bond showing only 2020 and 2021. Round your intermediate and final answers to the nearest w

> On March 1, 2020, Quinto Mining Inc. issued a $600,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020. Required Part 1 a. Calculate the bond issue price assuming a market interest rate of 7% on the date of issue. b. Us

> Calculations Marketing Inc. issued 8.5% bonds with a par value of $450,000 and a five-year life on January 1, 2020, for $459,125. The bonds pay interest on June 30 and December 31. The market interest rate was 8% on the original issue date. Required 1. C

> Refer to the amortization schedule prepared in Problem 14-6A. Assume Shebandowan Investors Inc. has a January 31 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c

> Dimensional Media Inc. has a December 31 year-end. It showed the following partial amortization schedules regarding its two bond issues: Bond Issue 1: Bond Issue 2: Required Answer the following for each bond issue: a. Were the bonds issued at a premium

> On June 1, 2020, Shebandowan Investors Inc. issued a $4,900,000, 7%, three-year bond. Interest is to be paid semiannually beginning December 1, 2020. Required a. Calculate the issue price of the bond assuming a market interest rate of 8%. b. Using the ef

> On April 1, 2020, ET Inc. has available for issue $820,000 bonds due in four years. Interest at the rate of 4.50% is to be paid quarterly. Calculate the issue price if the market interest rate is: a. 5.50% b. 4.50% c. 3.50% Part 2 On October 1, ET Inc. h

> Refer to the amortization schedule prepared in Problem 14-3A. Assume JetCom Inventors Inc. has a January 31 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c. Adj

> On June 1, 2020, JetCom Inventors Inc. issued a $540,000, 12%, three-year bond. Interest is to be paid semiannually beginning December 1, 2020. Required a. Calculate the issue price of the bond assuming a market interest rate of 13%. b. Using the effecti

> Banjo Education Corp. issued a 4%, $150,000 bond that pays interest semiannually each June 30 and December 31. The date of issuance was January 1, 2020. The bonds mature after four years. The market interest rate was 6%. Banjo Education Corp.’s year-end

> Laporte Engineering Company leased a machine on January 1, 2020, under a contract calling for four annual payments of $30,000 on December 31, 2020 through 2023. The machine becomes the property of the lessee after the fourth payment. The machine was pred

> On November 30, 2020, Calla Resources Ltd. borrowed $100,000 from a bank by signing a four year installment note bearing interest at 12%. The terms of the note require equal payments each year on November 30, starting November 30, 2021. Required 1. Calcu

> Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A: Bond Issue B: Required Answer the following for each bond issue: a. Were the bonds issued at a premium and/

> Queen Energy Inc. issued bonds on January 1, 2020, that pay interest semiannually on June 30 and December 31. The par value of the bonds is $270,000, the annual contract rate is 10%, and the bonds mature in 10 years. Required: For each of these three sit

> Kaye Biotech Inc. had the following equity account balances at December 31, 2019: On February 1, 2020, 5,100 preferred shares were issued at $7.80 each. The board of directors declared and paid the annual cash dividend on the preferred shares on June 30,

> Goth Inc. issued a group of bonds on January 1, 2020, that pay interest semiannually on June 30 and December 31. The par value of the bonds is $100,000, the annual contract rate is 10%, and the bonds mature in 10 years. Required For each of these three s

> La Mancha Enterprises completed all of its March 31, 2020, adjustments in preparation for compiling its financial statements, which resulted in the following trial balance. Other information: 1. All accounts have normal balances. 2. $34,200 of the mortga

> The income statement for Weatherford International Inc.’s year ended December 31, 2020, was prepared by an inexperienced bookkeeper. As the new accountant, your immediate priority is to correct the statement. All amounts included in the

> The equity section from the December 31, 2020 balance sheet of Kentucky Corporation appeared as follows: The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Kentucky) Required 1. How many shares were ou

> The following table shows the balances from various accounts in the adjusted trial balance for UniLink Telecom Corp. as of December 31, 2020: Required 1. Assuming that the company’s income tax rate is 30%, what are the tax effects and a

> Pet Boutique Corp. reported $2,952,010 of profit for 2020. On November 2, 2020, it declared and paid the annual preferred dividends of $203,000. On January 1, 2020, Pet Boutique had 104,000 and 520,000 outstanding preferred and common shares, respectivel

> Zen Aerospace Corporation reported the following equity account balances on December 31, 2019: In 2020, the company had the following transactions affecting shareholders and the shareholders’ equity accounts: Required 1. Prepare journal

> AIM Inc. showed the following equity account balances on the December 31, 2019, balance sheet: Common shares, unlimited authorized shares, 640,000 shares issued and outstanding = $5,760,000 Retained earnings = 2,130,000 During 2020, the following selecte

> Range Energy Corp.’s financial statements for the current year ended December 31, 2020, have been completed and submitted to you for review. The equity account balances a year ago, at December 31, 2019, are as follows: The only share tr

> The equity section from the December 31, 2020 and 2021, balance sheets of Westburne Corporation appeared as follows: The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Westburne): Required 1. How many

> Except for the earnings per share statistics, the 2021, 2020, and 2019 income statements for Ace Group Inc. were originally presented as follows: Required 1. Calculate the 11 missing amounts. 2. Calculate the weighted-average number of common shares out

> The balance sheet for Tactex Controls Inc., provincially incorporated in 2018, reported the following components of equity on December 31, 2019. In 2020 and 2021, the company had the following transactions affecting shareholders and the equity accounts:

> Venir Exchange Corp. had the following equity account balances at December 31, 2019: On November 1, 2020, the board of directors declared and paid the current year’s cash dividend on the preferred shares plus the two years of dividends

> Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.40 non-cumulative preferred shares. The following transacti

> CHECK FIGURES: 2. Retained earnings, December 31, 2021 = $394,400; 3. Total equity = $861,680 The balance sheet for Umi Sustainable Seafood Inc. reported the following components of equity on December 31, 2019: In 2020, Umi had the following transactions

> Garda World Security Corporation has the following shares, taken from the equity section of its balance sheet dated December 31, 2020. During its first three years of operations, Garda World Security Corporation declared and paid total dividends as shown

> Analyzing equity, dividend allocation Use the information provided below to answer the following questions. Other information: • All of the shares were issued during the first year of operations (year ended October 31, 2019). â

> Convertible preferred shares Walking Bear Resources Inc. Equity Section of the Balance Sheet March 31, 2020 Required Refer to the equity section above. Assume that the preferred are convertible into common at a rate of eight common shares for each share

> The equity sections from the 2020 and 2021 balance sheets of Fab-Form Industries Inc. appeared as follows: On March 16, June 15, September 5, and November 22, 2021, the board of directors declared $0.20 per share cash dividends on the outstanding common

> CHECK FIGURES: Total assets = $546,400; Total equity = $301,800 Required: Using the information from the alphabetized post-closing trial balance below, prepare a classified balance sheet for Sassy Pharmaceuticals Inc. as at March 31, 2020. Be sure to use

> Trish Craig and Ted Smith have a bio-energy and consulting business and share profit and losses in a 3:1 ratio. They decide to liquidate their partnership on December 31, 2020, when the balance sheet shows the following: Required Prepare the entries on D

> Lui, Montavo, and Johnson plan to liquidate their Premium Pool and Spa business. They have always shared profit and losses in a 1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Required: Part 1 Under the assumption

> Gale, McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows: Gale, $97,000; McLean, $95,000; and Lux, $160,000. The partners share profit and losses in a 3:2:5 ratio. McLean decides to withdraw from the partnership. Pr

> After returning from vacation, the accountant of Online Hearing Inc. was dismayed to discover that the income statement for the year ended December 31, 2020, was prepared incorrectly. All amounts included in the statement are before tax (assume a rate of

> On June 1, 2020, Jill Bow and Aisha Adams formed a partnership to open a gluten-free commercial bakery, contributing $292,000 cash and $384,000 of equipment, respectively. The partnership also assumed responsibility for a $52,000 note payable associated