Question: The equity section from the December 31,

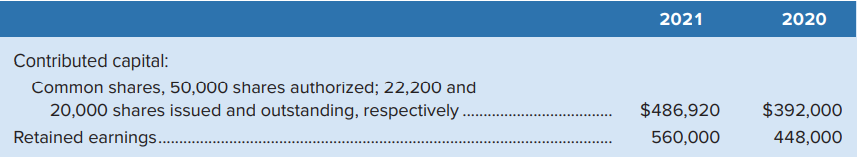

The equity section from the December 31, 2020 and 2021, balance sheets of Westburne Corporation appeared as follows:

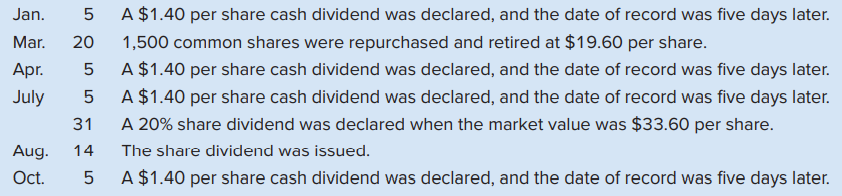

The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Westburne):

Required

1. How many shares were outstanding on each of the cash dividend dates?

2. How much profit did the company earn during 2021?

> On December 31, 2020, University Security Inc. showed the following: Required Part 1: Calculate book value per common share and preferred share at December 31, 2020, assuming no dividends were declared for the years ended December 31, 2019 or 2020, and t

> The 2020 financial statements of Outdoor Waterworks Inc. follow: Assume all sales were on credit. Also assume the long-term note payable is due in 2023, with no current portion. On the December 31, 2019, balance sheet, the assets totalled $432,720, commo

> North Exploration Inc. and Eagle Minerals Inc. are similar firms that operate within the same industry. The following information is available: Required The controller of your company has asked you to analyze the above two companies, so a decision can be

> Halifax Fisheries Inc. began the month of March with $760,000 of current assets, a current ratio of 2.5 to 1, and a quick ratio of 1.1 to 1. During the month, it completed the following transactions: Mar. 6 Bought $86,000 of merchandise on account. (The

> The condensed statements of Independent Auto Inc. follow: Required Rounding calculations to two decimal places: 1. Calculate each year’s current ratio. 2. Express the income statement data in common-size percentages. 3. Express the bala

> The condensed comparative statements of Uranium Mining Corporation follow: Required: Calculate trend percentages for the items of the statements using 2014 as the base year. Analysis Component: Analyze and comment on the situation shown in the statements

> Lock & Key Inc. began operations on January 1, 2019. Its post-closing trial balance at December 31, 2019 and 2020, is shown below along with some other information. Other information regarding Lock & Key Inc. and its activities during 2020: 1. As

> Peerless Carpet Corp. leased a machine on January 1, 2020, under a contract calling for six annual payments of $60,000 on December 31, 2020 through 2025. The machine becomes the property of the lessee after the sixth payment. The machine was predicted to

> Required: Refer to the information in Problem 16-7A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All accounts payable balances result from merchan

> Paddleboard Inc. began operations on January 1, 2019. Its post-closing trial balance at December 31, 2019 and 2020, is shown below along with some other information. Other information regarding Paddleboard Inc. and its activities during 2020: 1. Assume a

> Refer to the information in Problem 16-5A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All sales are credit sales. b. All credits to accounts rece

> ICE Drilling Inc.’s balance sheet information and income statement are as follows: Additional information regarding ICE Drilling’s activities during 2020: 1. Loss on sale of equipment is $11,480. 2. Paid $70,280 to red

> Refer to the information in Problem 16-3A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All sales are credit sales. b. All credits to accounts rece

> Instant Brake Inc.’s comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020, are as follows: During 2020, the following transactions occurred: 1. Purchased equi

> Refer to the information in Problem 16-1A. Other information regarding LAG Network Inc.: a. All sales are credit sales. b. All credits to accounts receivable are receipts from customers. c. All purchases of merchandise are on credit. d. All debits to acc

> Required: Refer to the information in Problem 16-11A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All accounts payable balances result from mercha

> Sunny Technologies Inc. began operations on January 1, 2019. Its post-closing trial balance at December 31, 2019, and 2020 is shown below along with some other information. Other information regarding Sunny and its activities during 2020: 1. Assume all a

> Required: Refer to the information in Problem 16-9A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. Other information: a. All accounts payable balances result from merchan

> On May 31, 2020, Iceflow Technologies Inc. borrowed $400,000 from a bank by signing a four-year installment note bearing interest at 14%. The terms of the note require equal semiannual payments each year beginning on November 30, 2020. Required 1. Calcul

> LAG Network Inc.’s balance sheet and income statement are as follows: Additional information regarding LAG Network Inc.’s activities during 2020: a. Equipment is purchased for $14,400 cash. b. 8,200 common shares are i

> Heritage Ltd. was organized on January 2, 2020. The following investment transactions and events occurred during the following months: Assume that Heritage has a significant influence over Port with its 20% share. Required 1. Give the entries to record t

> Johnson Inc.’s non-strategic investment portfolio at December 31, 2019, consisted of the following: Johnson had no other debt and equity investments at December 31, 2019, other than those shown above. During 2020, Johnson engaged in the

> On January 1, 2020, Liu Corporation paid $241,960 to acquire bonds of Singh Investment Corp with a par value of $240,000. The annual contract rate on the bonds is 6% and interest is paid semiannually on June 30 and December 31. The bonds mature after thr

> On January 1, 2020, Swift Current Corporation paid $2,540,240 to acquire bonds of Jasper Investment Corp with a par value of $2,520,000. The annual contract rate on the bonds is 7% and interest is paid semiannually on June 30 and December 31. The bonds m

> Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to be held as non-strategic investments: On December 31, 2020, the fair values of the investments held by Safety Development Corporation wer

> Live Large Inc. had the following transactions involving non-strategic investments during 2020. Required 1. Prepare an amortization schedule for the Space Explore bond showing only 2020 and 2021. Round your intermediate and final answers to the nearest w

> On March 1, 2020, Quinto Mining Inc. issued a $600,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020. Required Part 1 a. Calculate the bond issue price assuming a market interest rate of 7% on the date of issue. b. Us

> Calculations Marketing Inc. issued 8.5% bonds with a par value of $450,000 and a five-year life on January 1, 2020, for $459,125. The bonds pay interest on June 30 and December 31. The market interest rate was 8% on the original issue date. Required 1. C

> Refer to the amortization schedule prepared in Problem 14-6A. Assume Shebandowan Investors Inc. has a January 31 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c

> Dimensional Media Inc. has a December 31 year-end. It showed the following partial amortization schedules regarding its two bond issues: Bond Issue 1: Bond Issue 2: Required Answer the following for each bond issue: a. Were the bonds issued at a premium

> On June 1, 2020, Shebandowan Investors Inc. issued a $4,900,000, 7%, three-year bond. Interest is to be paid semiannually beginning December 1, 2020. Required a. Calculate the issue price of the bond assuming a market interest rate of 8%. b. Using the ef

> On April 1, 2020, ET Inc. has available for issue $820,000 bonds due in four years. Interest at the rate of 4.50% is to be paid quarterly. Calculate the issue price if the market interest rate is: a. 5.50% b. 4.50% c. 3.50% Part 2 On October 1, ET Inc. h

> Refer to the amortization schedule prepared in Problem 14-3A. Assume JetCom Inventors Inc. has a January 31 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c. Adj

> On June 1, 2020, JetCom Inventors Inc. issued a $540,000, 12%, three-year bond. Interest is to be paid semiannually beginning December 1, 2020. Required a. Calculate the issue price of the bond assuming a market interest rate of 13%. b. Using the effecti

> Banjo Education Corp. issued a 4%, $150,000 bond that pays interest semiannually each June 30 and December 31. The date of issuance was January 1, 2020. The bonds mature after four years. The market interest rate was 6%. Banjo Education Corp.’s year-end

> Laporte Engineering Company leased a machine on January 1, 2020, under a contract calling for four annual payments of $30,000 on December 31, 2020 through 2023. The machine becomes the property of the lessee after the fourth payment. The machine was pred

> On November 30, 2020, Calla Resources Ltd. borrowed $100,000 from a bank by signing a four year installment note bearing interest at 12%. The terms of the note require equal payments each year on November 30, starting November 30, 2021. Required 1. Calcu

> Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A: Bond Issue B: Required Answer the following for each bond issue: a. Were the bonds issued at a premium and/

> Queen Energy Inc. issued bonds on January 1, 2020, that pay interest semiannually on June 30 and December 31. The par value of the bonds is $270,000, the annual contract rate is 10%, and the bonds mature in 10 years. Required: For each of these three sit

> Kaye Biotech Inc. had the following equity account balances at December 31, 2019: On February 1, 2020, 5,100 preferred shares were issued at $7.80 each. The board of directors declared and paid the annual cash dividend on the preferred shares on June 30,

> Goth Inc. issued a group of bonds on January 1, 2020, that pay interest semiannually on June 30 and December 31. The par value of the bonds is $100,000, the annual contract rate is 10%, and the bonds mature in 10 years. Required For each of these three s

> La Mancha Enterprises completed all of its March 31, 2020, adjustments in preparation for compiling its financial statements, which resulted in the following trial balance. Other information: 1. All accounts have normal balances. 2. $34,200 of the mortga

> The income statement for Weatherford International Inc.’s year ended December 31, 2020, was prepared by an inexperienced bookkeeper. As the new accountant, your immediate priority is to correct the statement. All amounts included in the

> The equity section from the December 31, 2020 balance sheet of Kentucky Corporation appeared as follows: The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Kentucky) Required 1. How many shares were ou

> The following table shows the balances from various accounts in the adjusted trial balance for UniLink Telecom Corp. as of December 31, 2020: Required 1. Assuming that the company’s income tax rate is 30%, what are the tax effects and a

> Pet Boutique Corp. reported $2,952,010 of profit for 2020. On November 2, 2020, it declared and paid the annual preferred dividends of $203,000. On January 1, 2020, Pet Boutique had 104,000 and 520,000 outstanding preferred and common shares, respectivel

> Zen Aerospace Corporation reported the following equity account balances on December 31, 2019: In 2020, the company had the following transactions affecting shareholders and the shareholders’ equity accounts: Required 1. Prepare journal

> AIM Inc. showed the following equity account balances on the December 31, 2019, balance sheet: Common shares, unlimited authorized shares, 640,000 shares issued and outstanding = $5,760,000 Retained earnings = 2,130,000 During 2020, the following selecte

> Range Energy Corp.’s financial statements for the current year ended December 31, 2020, have been completed and submitted to you for review. The equity account balances a year ago, at December 31, 2019, are as follows: The only share tr

> Except for the earnings per share statistics, the 2021, 2020, and 2019 income statements for Ace Group Inc. were originally presented as follows: Required 1. Calculate the 11 missing amounts. 2. Calculate the weighted-average number of common shares out

> The balance sheet for Tactex Controls Inc., provincially incorporated in 2018, reported the following components of equity on December 31, 2019. In 2020 and 2021, the company had the following transactions affecting shareholders and the equity accounts:

> Venir Exchange Corp. had the following equity account balances at December 31, 2019: On November 1, 2020, the board of directors declared and paid the current year’s cash dividend on the preferred shares plus the two years of dividends

> Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.40 non-cumulative preferred shares. The following transacti

> CHECK FIGURES: 2. Retained earnings, December 31, 2021 = $394,400; 3. Total equity = $861,680 The balance sheet for Umi Sustainable Seafood Inc. reported the following components of equity on December 31, 2019: In 2020, Umi had the following transactions

> Garda World Security Corporation has the following shares, taken from the equity section of its balance sheet dated December 31, 2020. During its first three years of operations, Garda World Security Corporation declared and paid total dividends as shown

> Analyzing equity, dividend allocation Use the information provided below to answer the following questions. Other information: • All of the shares were issued during the first year of operations (year ended October 31, 2019). â

> Convertible preferred shares Walking Bear Resources Inc. Equity Section of the Balance Sheet March 31, 2020 Required Refer to the equity section above. Assume that the preferred are convertible into common at a rate of eight common shares for each share

> The equity sections from the 2020 and 2021 balance sheets of Fab-Form Industries Inc. appeared as follows: On March 16, June 15, September 5, and November 22, 2021, the board of directors declared $0.20 per share cash dividends on the outstanding common

> CHECK FIGURES: Total assets = $546,400; Total equity = $301,800 Required: Using the information from the alphabetized post-closing trial balance below, prepare a classified balance sheet for Sassy Pharmaceuticals Inc. as at March 31, 2020. Be sure to use

> Trish Craig and Ted Smith have a bio-energy and consulting business and share profit and losses in a 3:1 ratio. They decide to liquidate their partnership on December 31, 2020, when the balance sheet shows the following: Required Prepare the entries on D

> Lui, Montavo, and Johnson plan to liquidate their Premium Pool and Spa business. They have always shared profit and losses in a 1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Required: Part 1 Under the assumption

> Gale, McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows: Gale, $97,000; McLean, $95,000; and Lux, $160,000. The partners share profit and losses in a 3:2:5 ratio. McLean decides to withdraw from the partnership. Pr

> After returning from vacation, the accountant of Online Hearing Inc. was dismayed to discover that the income statement for the year ended December 31, 2020, was prepared incorrectly. All amounts included in the statement are before tax (assume a rate of

> On June 1, 2020, Jill Bow and Aisha Adams formed a partnership to open a gluten-free commercial bakery, contributing $292,000 cash and $384,000 of equipment, respectively. The partnership also assumed responsibility for a $52,000 note payable associated

> On April 1, 2019, Guy Comeau and Amelie Lavoi formed a partnership in Ontario. Net Income during the year was $560,000 and was in the Income Summary account. On April 1, 2020 Travis Roberts invested $138,000 and was admitted to the partnership for a 20%

> Zeller, Acker, and Benton are partners with capital balances as follows: Zeller, $95,000; Acker, $80,000; and Benton, $158,000. The partners share profit and losses in a 3:2:5 ratio. Dent is admitted to the partnership on May 1, 2020, with a 25% equity.

> Ben Conway, Ida Chan, and Clair Scott formed CCS Consulting by making capital contributions of $245,000, $280,000, and $175,000, respectively. They anticipate annual profit of $360,000 and are considering the following alternative plans of sharing profit

> Phillip and Case are in the process of forming a partnership to import Belgian chocolates, to which Phillip will contribute one-third time and Case full time. They have discussed the following alternative plans for sharing profit and losses. a. In the ra

> Jenkins, Willis, and Trent invested $100,000, $175,000, and $225,000, respectively, in a partnership. During its first year, the firm recorded profit of $300,000. Required: Prepare entries to close the firm’s Income Summary account as of December 31 and

> Eyelash Extension Co.’s liabilities as reported on the June 30, 2020, balance sheet are shown below, along with its statement of changes in equity. Jan is selling the business. A potential buyer has hired an accountant to review the acc

> Western Refrigeration borrowed $230,000 to purchase inventory on September 15, 2020 for 45 days at 6% interest by signing a note. On December 6, 2020, Western Refrigeration sold an industrial fridge for cash of $12,000 (cost $9,400) with a two-year parts

> Modern Electronics Company purchases merchandise inventory from several suppliers. On April 1, 2020, Modern Electronics purchased from Speedy Supplies $100,000 of inventory on account. On May 15, 2020, Modern Electronics sold inventory to a Jones Apartme

> White Water Adventure is a travel adventure business that operates from about April to October each year. The company has an outstanding reputation for the quality of its tours and as a result pre-books customers a full year in advance. Customers must pa

> The equity section from the December 31, 2020 balance sheet of Candace Candy Corporation appeared as follows: The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Candace Candy): Feb. 10 A $1.50 per shar

> Okanagan Refrigeration manufactures and markets commercial refrigeration systems for food trucks and specialized transport trucks. It was disclosed in notes to the company’s financial statements that estimated warranty costs are accrued at the time produ

> On November 10, 2020, Singh Electronics began to buy and resell scanners for $55 each. Singh uses the perpetual system to account for inventories. The scanners are covered under a warranty that requires the company to replace any non-working scanner with

> Zing Cell Phone Company entered into the following transactions involving current liabilities during 2020 and 2021: Required 1. Determine the maturity dates of the three notes just described. 2. Present journal entries for each of the preceding dates.

> Quebec Construction Company purchased some equipment on September 10, 2020, that had a cost of $190,000 (ignore GST/PST). Show the journal entries that would record this purchase and payment under these three separate situations: a. The company paid cash

> Golden Wedding Dress Company designs custom wedding dresses for brides to be. The person preparing the adjusting entries at year-end was unable to complete the adjustments due to illness. You have been given the following unadjusted trial balance along w

> On January 2, 2020, Brook Company acquired machinery by issuing a 3%, $360,000 note due in five years on December 31, 2024. Annual payments are $78,608 each December 31. The payment schedule is: Required: Using the information provided, complete the foll

> Ocean Fishers Ltd. had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2012, for $77,000. The PPE subledger shows the following information regarding the boat: On June 27, 2020, $63,000 cash was paid for a new motor to replace

> Copper Explorations recently acquired the rights to mine a new site. Equipment and a truck were purchased to begin mining operations at the site. Details of the mining assets follow: Copper’s year-end is December 31 and it uses the stra

> On October 1, 2020, Kingsway Broadcasting purchased for $288,000 the copyright to publish the music composed by a local Celtic group. Kingsway expects the music to be sold over the next three years. The company uses the straight-line method to amortize i

> Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an installed cost of $52,900. Its useful life was estimated to be six years with a $4,300 trade-in value. Straight-line

> The following table shows the balances from various accounts in the adjusted trial balance for Decoma International Corp. as of December 31, 2020: Required 1. Assuming that the company’s income tax rate is 25%, what are the tax effects

> In 2020, Staged Home Ltd. completed the following transactions involving delivery trucks: July 5: Traded in an old truck and paid $25,600 in cash for furniture. The accounting records on July 1 showed the cost of the old truck at $36,000 and related accu

> Vita Water purchased a used machine for $116,900 on January 2, 2020. It was repaired the next day at a cost of $4,788 and installed on a new platform that cost $1,512. The company predicted that the machine would be used for six years and would then have

> Endblast Productions showed the following selected asset balances on December 31, 2020: Required: Prepare the entries for each of the following (round final calculations to the nearest whole dollar). 1. The land and building were sold on September 27, 20

> Safety-First Company completed all of its October 31, 2020, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance. Other information: 1. All accounts have normal balances. 2. $26,400 of the note

> Pete’s Propellers Company showed the following information in its Property, Plant, and Equipment subledger regarding Machine #5027. On January 7, 2020, the machine blade cracked and it was replaced with a new one costing $10,400 purchas

> The December 31, 2020, adjusted trial balance of Maritime Manufacturing showed the following information: Early in 2021, the company made a decision to stop making the items produced by the machinery and buy the items instead. As a result, the remaining

> NeverLate Ltd. completed the following transactions involving delivery trucks: Required: Prepare journal entries to record the transactions.

> At December 31, 2020, Halifax Servicing’s balance sheet showed capital asset information as detailed in the schedule below. Halifax calculates depreciation to the nearest whole month. Required Complete the schedule (round only your fina

> A machine that cost $504,000, with a four-year life and an estimated $48,000 residual value, was installed in Haley Company’s factory on September 1, 2020. The factory manager estimated that the machine would produce 475,000 units of pr

> Logic Co. recently negotiated a lump-sum purchase of several assets from a company that was going out of business. The purchase was completed on March 1, 2020, at a total cash price of $1,260,000 and included a building, land, certain land improvements,

> Fitz Products Inc. reported $1,075,049 profit in 2020 and declared preferred dividends of $75,100. The following changes in common shares outstanding occurred during the year. Jan. 1 78,000 common shares were outstanding. Mar. 1 Declared and issued a 30%

> CHECK FIGURES: 1. Dr. Depreciation Expense, Building $53,000. 1. Dr. Depreciation Expense, Equipment $77,184. 2. Total PPE = $1,144,736 Required 1. Calculate and record depreciation for the year just ended April 30, 2021, for both the building and equipm

> Refer to the information in Problem 9-5A. Redo the question assuming that depreciation for partial periods is calculated using the half-year convention. Data from Problem 9-5: West Coast Tours runs boat tours along the West Coast of British Columbia. On

> West Coast Tours runs boat tours along the West Coast of British Columbia. On March 5, 2020, it purchased, with cash, a cruising boat for $828,000, having a useful life of 10 years or 13,250 hours, with a residual value of $192,000. The companyâ

> Yorkton Company purchased for $415,000 equipment having an estimated useful life of 10 years with an estimated residual value of $25,000. Depreciation is calculated to the nearest month. The company has a December 31 year-end. Required: Complete the fol