Question: It’s late Tuesday evening, and you’

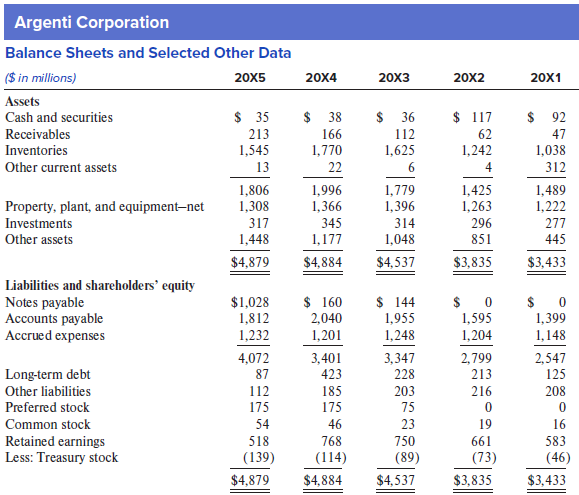

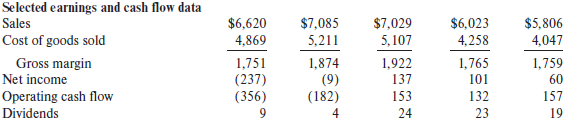

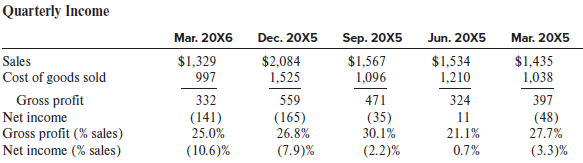

It’s late Tuesday evening, and you’ve just received a phone call from Dennis Whiting, your boss at GE Capital. Dennis wants to know your reaction to the Argenti loan request before tomorrow’s loan committee meeting. Here’s what he tells you: We’ve provided seasonal loans to Argenti for the past 20 years, and they’ve always been a first rate customer, but I’m troubled by several recent events. For instance, the company just reported a $141 million loss for the first quarter of 20X6. This loss comes on top of a $237 million loss in 20X5 and a $9 million loss in 20X4. What’s worse, Argenti changed inventory accounting methods last year, and this change reduced the 20X5 loss by $22 million. I can’t tell if the company’s using other accounting tricks to prop up earnings, but I doubt it. I believe Argenti’s problem lies in its core business—customers just aren’t buying its merchandise these days. Management’s aggressive price discount program in the fourth quarter of 20X5 helped move inventory, but Argenti doesn’t have the cost structure needed to be competitive as a discounter. Take a look at the financials I’m sending over, and let me know what you think. Argenti Corporation operates a national chain of retail stores (Argenti’s) selling appliances and electronics, home furnishings, automotive parts, apparel, and jewelry. The company’s first store opened in New York City in 1904. Today, the company owns or leases more than 900 stores located in downtown areas of large cities and in suburban shopping malls. Customer purchases are financed in house using Argenti Credit cards. The company employs more than 58,000 people. The Seasonal Credit Agreement with GE Capital—dated October 4, 20X5—provides a revolving loan facility in the principal amount of $165 million. The purpose of this facility is to provide backup liquidity as Argenti reduces its inventory levels. Under the credit agreement, Argenti may select among several interest rate options, which are based on market rates. Unless GE Capital agrees, loans may be made under the seasonal credit facility only after the commitments under the company’s other debt agreements are fully used.

Argenti management has asked GE Capital for a $1.5 billion refinancing package that would be used to pay off all or a substantial portion of its outstanding debt. Excerpts from the company’s financial statement notes follow. Management Discussion and Analysis (20X5 Annual Report) The company has obtained waivers under the Long-Term Credit Agreement and the Short- Term Credit Agreement with respect to compliance for the fiscal quarter ending March 29, 20X5—with covenants requiring maintenance of minimum consolidated shareholders’ equity, a maximum ratio of debt to capitalization, and minimum earnings before interest, taxes, depreciation, amortization, and rent (EBITDAR). These waivers and amendments reduce the maximum amount of debt permitted to be incurred, and the maturity of the Long-Term Agreement was changed from February 28, 20X7, to August 29, 20X5. The company is currently in discussions with financing sources with a view toward both a longer term solution to its liquidity problems and obtaining refinancing for all or a substantial portion of its outstanding indebtedness, including a total of $1,008 million, which will mature on or about August 29, 20X5. This would include repayment of the current bank borrowings and amounts outstanding under the Note Purchase Agreements. The company’s management is highly confident that the indebtedness can be refinanced. Its largest shareholder, GE Capital, also expects the company to be able to refinance such indebtedness. However, there can be no assurance that such refinancing can be obtained or that amendments or waivers required to maintain compliance with the previous agreements can be obtained. Note to Financial Statements (20X5 Annual Report) The company intends to improve its financial condition and reduce its dependence on borrowing by slowing expansion, controlling expenses, closing certain unprofitable stores, and continuing to implement its inventory reduction program. Management is in the process of reevaluating the company’s merchandising, marketing, store operations, and real estate strategies. The company is also considering the sale of certain operating units as a means of generating cash. Future cash is also expected to continue to be provided by ongoing operations, sale of receivables under the Accounts Receivable Purchase Agreement with GE capital, borrowings under revolving loan facilities, and vendor financing programs.

Required:

1. Why did Argenti need to increase its notes payable borrowing to more than $1 billion in 20X5?

2. What recommendation would you make regarding the company’s request for a $1.5 billion refinancing package?

> Pogrund Vacation Properties sells real estate in Florida. Pogrund requires potential buyers who are interested in a property to remit a $10,000 deposit to show good faith before receiving detailed information about a property. The deposit is fully refund

> Lemon Corporation and Morley, Inc., have entered into an arrangement whereby Lemon will supply materials and 1,000 hours of its scientists’ time for a project to be undertaken at Morley’s research facility in Austin, TX. Morley will also contribute its s

> On October 1, 20X1, Bulls eye Company sold 250,000 gallons of diesel fuel to Schmidt Co. at $3 per gallon. On November 8, 20X1, 150,000 gallons were delivered; on December 27, 20X1. another 50,000 gallons were delivered; and on January 15, 20X2, the rema

> In 20X1, its first year of operations, Regal Department Store sells $250,000 of gift certificates redeemable for store merchandise that expire one year after their issuance. With a high degree of certainty, Regal believes 10% of the gift certificates wil

> For each of the following independent situations, determine the point at which a contract exists and is subject to application of the five-step revenue recognition model by Amiel Corporation. 1. A regular customer of Amiel’s always places an order on the

> Prior to being acquired by Amazon.com, Whole Foods Market provided that its Compensation Committee would determine a portion of executive bonuses by selecting from a list of 13 performance metrics. For the fiscal year 2014, the Compensation Committee sel

> Ashley Stores, Inc., sells gift cards for use at its stores. The following data pertain to 20X1, 20X2, and 20X3, the company’s first three years of operation: As of December 31, 20X1, Ashley estimates that 1.0% of its gift cards will ne

> Amiel Company reported sales revenue of $20.3 million and expenses of $11.1 million in 20X1, excluding the results of its 80%-owned subsidiary, Talia Company. Talia had $7.0 million of sales revenue and $3.0 million of expenses in 20X1. Ignore income tax

> JDW Corporation reported the following for 20X1: net sales $2,929,500; cost of goods sold $1,786,995; selling and administrative expenses $585,900; unrealized holding loss on available for- sale securities (considered other comprehensive income) $22,000;

> Hentzel Landscaping commenced its business on January 1, 20X1. 1. During its first year of operations, Hentzel purchased supplies in the amount of $12,000 (debited to Supplies inventory), and of this amount, $3,000 were unused as of December 31, 20X1. 2.

> On September 1, 20X1, Revsine Co. approved a plan to dispose of a segment of its business. Revsine expected that the sale would occur on March 31, 20X2, at an estimated pre-tax gain of $375,000. The segment had actual and estimated pre-tax operating prof

> Munnster Corporation’s income statements for the years ended December 31, 20X2 and 20X1, included the following information before adjustments: On January 1, 20X2, Munnster Corporation agreed to sell the assets and product line of one o

> Hoffman Engineering Company is a young and growing producer of pre-stressed concrete manufacturing equipment. You have been retained by the company to advise it in the preparation ofa statement of cash flows. Hoffman uses the direct method in reporting n

> Metro Inc. reported net income of $150,000 for 20X1. Changes occurred in several balancesheet accounts during 20X1 as follows: Required: Determine the reported net cash provided by operating activities for Metro in 20X1.

> Selected financial statements for Ralston Company, a sole proprietorship, are as follows: Additional Information: a. During 20X1, equipment having accumulated depreciation of $4,500 was sold for a $4,000 gain. b. A $3,550 lease payment was made in 20X1,

> Alp Inc. had the following activities during 20X1: • Acquired 2,000 shares of stock in Maybel Inc. for $26,000. • Sold an investment in Rate Motors for $35,000 when the carrying value was $33,000. • Acquired a $50,000, four-year certificate of deposit f

> Margaret Magee has served both as an outside director of MX Manufacturing for the past 10 years and as a member of the company’s compensation committee for the past 5 years. Margaret has been reviewing MX’s 20X1 prelim

> Superfine Company collected the following data in preparing its cash flow statement for theyear ended December 31, 20X1: Required: Determine the following amounts that should be reported in Super fine’s 20X1 statement of cash flows. 1.

> Karr Inc. reported net income of $300,000 for 20X1. Changes occurred in several balancesheet accounts as follows: Additional Information: a. During 20X1, Karr sold equipment that cost $25,000 and had accumulated depreciationof $12,000, for a gain of $5,

> During 20X1, King Corporation wrote off accounts receivable totaling $25,000 and made sales,all on account, of $710,000. Other information about the company’s sales activities follows: In addition, in February 20X1, King accepted a $6,0

> Lino Company’s worksheet for the preparation of its 20X1 statement of cash flows included the following information: Required: What amount should Lino include as net cash that is provided by operating activities in thestatement of cash

> During 20X1, Xan Inc. had the following activities related to its financial operations: Required: In Xan’s 20X1 statement of cash flows, how much should net cash used in financing activities be?

> On January 1, 20X1, Hitchcock Corporation entered into a five-year interest rate swap agreement. The agreement uses a notional value of $500,000 and calls for the company to receivefixed interest of 9% and to make payments based on a floating interest ra

> On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixedand pay variable on a notional amount of $5,000,000. The contract calls for cash settlement ofthe net interest amount at December 31 of each year. The yield cur

> Maynard Corporation buys 1,000 call options to buy 1,000 shares of Rossman, Inc., commonstock on December 1, 20X1. At the time of the purchase, the option price is $5.00, the Rossman stock price is $30.00, and the exercise price is $32.00. On December 31

> Callahan, Inc., sells a forward on ounces of gold to remove uncertainty regarding the revenueit will recognize when it sells its gold inventory. The forward represents a perfect cash flowhedge. When Callahan settles the forward, it pays $100,000 to the c

> On January 1, 20X1, East Corporation adopted a defined benefit pension plan. At plan inception, the prior service cost was $60,000. In 20X1, East incurred service cost of $150,000 andamortized $12,000 of prior service cost. On December 31, 20X1, East con

> This case illustrates how the abnormal earnings valuation model described in Appendix 7A of this chapter can be combined with security analysts’ published earnings forecasts and used to spot potentially overvalued stocks. Required: 1. Use the abnormal e

> Dell Company adopted a defined benefit pension plan on January 1, 20X1. Dell amortizes theinitial prior service cost of $1,334,400 over 16 years. It assumes a 7% discount rate and an 8%expected rate of return. The following additional data are available

> The following information pertains to Kane Company’s defined benefit pension plan: Kane has no net actuarial gains or losses in AOCI at January 1, 20X1. Required: In its December 31, 20X1, balance sheet, what amount should Kane report

> The following information pertains to Gali Company’s defined benefit pension plan for 20X1: Required: What was the dollar amount of actual return on Gali Company’s plan assets in 20X1?

> Use the facts given in E15-4. Repeat the requirements assuming that the discount and earningsrate is 11% instead of 8%.

> Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor offarm implements. Abbott plans to retire on her 65th birthday, five years from January 1, 20X1. Her salary at January 1, 20X1, is $48,000 per year, and her projected

> On January 2, 20X1, Loch Company established a defined benefit plan covering all employeesand contributed $1,000,000 to the plan. At December 31, 20X1, Loch determined that the 20X1 service and interest costs totaled $620,000. The expected and the actual

> At December 31, 20X1, Kerr Corporation’s pension plan administrator provided the followinginformation: Required: What amount of the pension liability should be shown on Kerr’s December 31, 20X1, balancesheet?

> At January 1, 20X1, Archer Co.’s PBO is $500,000 and the fair value of its pension plan assetsis $630,000. The average remaining service period of Archer’s employees is 12 years. The AOCI—net actuaria

> At January 1, 20X1, Milo Co.’s projected benefit obligation is $300,000, and the fair value ofits pension plan assets is $340,000. The average remaining service period of Milo’s employeesis 10 years. Milo Co. uses the

> Bonny Corp. has a defined benefit pension plan for its employees who have an average remaining service life of 10 years. The following information is available for 20X1 and 20X2 related tothe pension plan: Bonny Corp. had no beginning balance in its AOCI

> Sunny Day Stores operates convenience stores throughout much of the United States. The industry is highly competitive, with low profit margins. The company’s competition includes national, regional, and local supermarkets; oil companies

> Zeff Manufacturing provides the following information about its postretirement health careplan for 20X1: Required: 1. Determine Zeff’s postretirement health care expense in 20X1. 2. Determine the fair value of plan assets at December 3

> Jones Company has a postretirement benefit (health care) plan for its employees. On January 1, 20X1, the balance in the Accumulated postretirement benefit obligation account was $300 million. The assumed discount rate—for purposes of determining postreti

> Cummings Inc. had the following reconciliation at December 31, 20X0: Required: 1. Compute pension expense for 20X1. 2. Compute the fair value of plan assets at December 31, 20X1. 3. Compute the PBO at December 31, 20X1. 4. Compute AOCI—

> Bostonian Company provided the following information related to its defined benefit pension plan for 20X1: Required: 1. What amount of pension expense should Bostonian report for 20X1? 2. What is the fair value of plan assets at December 31, 20X1? 3. Wh

> The following information pertains to Lee Corporation’s defined benefit pension plan for 20X1: Required: Determine the pension expense that Lee Corporation would include in its 20X1 net income.

> Hukle Company has provided the following information pertaining to its postretirement planfor 20X1: Required: Calculate Hukle Company’s 20X1 net postretirement benefit cost.

> Nome Company sponsors a defined benefit plan covering all employees. Benefits are based onyears of service and compensation levels at the time of retirement. Nome has a September 30fiscal year-end. It determined that as of September 30, 20X1, its ABO was

> The following information pertains to Seda Company’s pension plan for 20X1: Required: If no change in actuarial estimates occurred during 20X1, how much would Seda’s projected benefit obligation be at December 31, 20X

> Quinn Company reported a net deferred tax asset of $6,300 in its December 31, 20X0, balancesheet. For 20X1, Quinn reported pre-tax financial statement income of $300,000. Temporarydifferences of $100,000 resulted in taxable income of $200,000 for 20X1. A

> Black Company, organized on January 2, 20X1, had pre-tax accounting income of $500,000and taxable income of $800,000 for the year ended December 31, 20X1. The only temporary difference is accrued product warranty costs, which are expected to be paid as f

> West Corporation leased a building and received the $36,000 annual rental payment on July 15, 20X1. The beginning of the lease period was August 1, 20X1. Rental income is taxablewhen received. West had no other permanent or temporary differences. West’s

> Kent Inc.’s reconciliation between financial statement and taxable income for 20X1 follows: Required: 1. In its December 31, 20X1, balance sheet, what amount should Kent report as its deferredtax liability? 2. In its 20X1 income statem

> Dunn Company’s 20X1 income statement reported $90,000 income before provision forincome taxes. To aid in the computation of the provision for federal income taxes, the following 20X1 data are provided: Required: What amount of taxes mus

> For the year ended December 31, 20X1, Tyre Company reported pre-tax financial statement income of $750,000. Its taxable income was $650,000. The difference was due to theuse of accelerated depreciation for income tax purposes and straight-line for financ

> Mill Company began operations on January 1, 20X1, and recognized income fromconstruction-type contracts under different methods for tax purposes and financial reportingpurposes. Information concerning income recognition under each method is as follows: R

> In its 20X1 income statement, Tow Inc. reported proceeds from an officer’s life insurance policyof $90,000 and depreciation of $250,000. Tow was the owner and beneficiary of the life insurance on its officer. Tow deducted depreciation o

> Collins Company incurs a $1,000 book expense that it deducts on its tax return. The tax law is unclear whether this expense is deductible, so the deduction leads to an uncertain tax position. Assuming a 21% tax rate, the deduction results in a $210 uncer

> Millie Co. completed its first year of operations on December 31, 20X1, with pre-tax financialincome of $400,000. Millie accrued a contingent liability of $900,000 for financial reportingpurposes; however, no tax deduction is permitted until a payment is

> On December 31, 20X0, Toms River Rafting, Inc. (TRR), has a deferred tax asset related to a $250,000 net operating loss carryforward. The enacted tax rate (and substantively enacted taxrate) at the time was 21%. When it recognized this deferred tax asset

> In Figland Company’s first year of operations (20X1), the company had pre-tax book incomeof $500,000 and taxable income of $800,000. Figland’s only temporary difference is foraccrued product warranty costs, which are e

> Crocs designs, develops, and manufactures consumer products from specialty resins. The company’s primary product line is Crocs-branded footwear for men, women, and children. It sells its products through traditional retail channels, inc

> Melissa Corporation is domiciled in Germany and is listed on both the Frankfurt and New York Stock Exchanges. Melissa has chosen to prepare consolidated financial statements inaccordance with U.S. GAAP for filing with the U.S. Securities and Exchange Com

> As of December 31, 20X1, Colt Corporation has a loss carryforward of $180,000 available tooffset future taxable income. At December 31, 20X1, the company believes that realization ofthe tax benefit related to the loss carryforward is probable. The tax ra

> Dix Company reported operating income (loss) before income tax in its first three years ofoperations as follows: Dix had no permanent or temporary differences between book income and taxable income inthese years. Assume a 21% tax rate for all years, and

> On January 2, 20X1, Allen Company purchased a machine for $70,000. This machine has a five year useful life, has a residual value of $10,000, and is depreciated using the straight line method for financial statement purposes. For tax purposes, depreciati

> On October 1, 20X1, Vaughn, Inc., leased a machine from Fell Leasing Company for five years. The lease requires five annual payments of $10,000 beginning September 30, 20X2. Vaughn’sincremental borrowing rate is 11%, and it uses a calendar year for repor

> On December 31, 20X1, Day Company leased a new machine from Parr with the followingpertinent information: The lease is not renewable, and the machine reverts to Parr at the termination of the lease. Thecost of the machine on Parr’s acco

> Refer to the facts in E13-8. Required: Based on the relation between the lease life and economic life, the lessees will classify theleases as finance leases. For each lease, compute the lessee’s amortization expense for the firstyear of the lease. Assum

> Benedict Company leased equipment to Mark Inc. on January 1, 20X1. The lease is for aneight-year period, expiring December 31, 20X8. The first of eight equal annual payments of $600,000 was made on January 1, 20X1. Benedict had purchased the equipment on

> On January 1, 20X1, Beard Company purchased a machine for $620,000. The machine isexpected to have a 10-year life, with no salvage value, and will be depreciated by the straight line method. On January 1, 20X1, it leased the machine to Child Company for

> On December 31, 20X1, Ball Company leased a machine from Cook for a 10-year period, expiring December 30, 20Y1. Annual payments of $100,000 are due on December 31. The first payment was made on December 31, 20X1, and the second payment was made on Decemb

> McDonald’s Corporation franchises and operates more than 36,000 fast-service restaurants around the world. Buffalo Wild Wings franchises and operates more than 1,000 restaurants in North America. Buffalo Wild Wings features chicken wing

> East Company leased a new machine from North Company on May 1, 20X1, under a leasewith the following information: East has the option to purchase the machine on May 1, 20Y1, by paying $50,000, whichapproximates the expected fair value of the machine on t

> In its long-term liabilities section of its balance sheet at December 31, 20X1, Columbo Company reports a long-term operating lease liability of $82,004, net of the current portion of $13,327. Columbo makes $20,000 lease payments on December 31, 20X2, De

> On January 1, 20X1, Walker, Inc., signs a 5-year lease for two floors of a 20-floor building. The building has an expected remaining life of 20 years. The space is available immediately, and Walker agrees to make annual payments of $325,000 on December 3

> On January 1, 20X1, Draper Inc. signed a five-year non cancelable lease with Thorn hill Company for custom-made equipment. The lease calls for five payments of $161,364.70 to bemade at the beginning of each year. The leased asset has a fair value of $900

> Mickelson reports on a calendar-year basis. On January 1, 20X1, Mickelson Corporation entersinto a three-year lease with annual payments of $30,000. The first payment will be due on December 31, 20X1. The present value of the payments at 8% is $77,313. I

> On December 31, 20X1, Lane, Inc., sold equipment to Nolte and simultaneously leased it backfor 12 years. Pertinent information at this date is as follows: Required: 1. At December 31, 20X1, should Lane report a gain from the sale of the equipment? 2. If

> On December 31, 20X1, Roe Company leased a machine from Colt for a five-year period. Equal annual payments under the lease are $105,000 (including $5,000 annual executory costsfor servicing) and are due on December 31 of each year. The first payment was

> On January 1, 20X1, Babson, Inc., leased two automobiles for executive use. The lease requires Babson to make five annual payments of $13,000, beginning January 1, 20X1. At the end of thelease term on December 31, 20X5, Babson guarantees that the residua

> Monk Company, a dealer in machinery and equipment, leased equipment with a 10-year life to Leland Inc. on July 1, 20X1. The fair value of the leased equipment at July 1, 20X1, is $1,849,591. The lease is appropriately accounted for as a sale by Monk and

> On January 1, 20X0, Roland Inc. issued $125 million of 8% bonds at par. The bonds pay interest semiannually on June 30 and December 31 of each year, and they mature in 15 years. OnDecember 31, 20X1 (before the interest payment is made), the bonds are tra

> First Solar, Inc., adopted the new revenue recognition standard, ASC Topic 606, in 2017. The following are condensed versions of First Solar’s balance sheet, income statement, and cash flow statement, as they were presented in the company’s 2017 annual r

> On January 1, 20X1, Brooks Energy issued $200 million of 15-year, floating-rate debentures atpar value. The debentures pay interest on June 30 and December 31 of each year. The floatinginterest rate is set equal to “LIBOR plus 6%” on January 1 of each ye

> Zero coupon bonds pay no interest—the only cash investors receive is the lump-sum principalpayment at maturity. On January 1, 20X1, The Ledge Inc. issued $250 million of zero couponbonds at a market yield rate of 12%. The bonds mature in 20 years. Requi

> Webb Company has outstanding a 7% annual, 10-year, $100,000 face value bond that it hadissued several years ago. It originally sold the bond to yield 6% annual interest. Webb uses theeffective interest rate method to amortize the bond premium. On June 30

> On February 1, 20X1, Davis Corporation issued 12%, $1,000,000 par, 10-year bonds for $1,117,000. Davis reacquired all of these bonds at 102% of par, plus accrued interest, on May 1, 20X3, and retired them. The unamortized bond premium on that date was $7

> On January 2, 20X1, West Company issued 9%, 10-year bonds in the amount of $500,000 thatmature on December 31, 20X9. The bonds were issued for $469,500 to yield 10%. Interest ispayable annually on December 31. West uses the effective interest method of a

> On January 1, 20X1, when the market interest rate was 14%, Luba Corporation issued 10-yearbonds in the face amount of $500,000 with interest at 12% payable semiannually. The bondsmature on December 31, 20X9. Required: Calculate the bond discount at issu

> By July 1, 20X2, the market yield on the Akers Company bonds described in E12-1 had risento 10%. Required: What was the bonds’ market price on July 1, 20X2?

> On January 1, 20X1, Tusk Company issued $300 million of bonds with a 6% coupon interestrate. The bonds mature in 10 years and pay interest annually on December 31 of each year. Themarket rate of interest on January 1, 20X1, for bonds of this risk class w

> On July 1, 20X1, Mirage Company issued $250 million of bonds with an 8% coupon interestrate. The bonds mature in 10 years and pay interest semiannually on June 30 and December 31of each year. The market rate of interest on July 1, 20X1, for bonds of this

> Akers Company sold bonds on July 1, 20X1, with a face value of $100,000. These bonds aredue in 10 years. The stated annual interest rate is 6% per year, payable semiannually on June 30and December 31. These bonds were sold to yield 8%. Required: How muc

> The following events and transactions related to David Company occurred after the balance sheet date of December 31, 20X1, and before the financial statements were issued in 20X2. None of the items is reflected in the financial statements as of December

> Raytheon Company’s 2018 Form 10-K states that sales to the U.S. government comprise 68% of its 2018 total net sales and sales to foreign governments through the U.S. government comprise 13% of its 2018 total net sales. Required: 1. Why does the SEC requ

> Describe the four successful rounds of venture financing (A through D) achieved by Spatial Technology in terms of sources and amounts. What additional financing sources have been used?

> Table 4 presents Eco-Products’ statement of cash flows for 2007. Was the firm building or burning cash in its operating activities? When also considering cash flows from investing activities, was Eco-Products in a net cash build or burn

> Discuss the competition faced by Spatial Technology in conjunction with 3D modeling technology in general and specifically with its ACIS product.

> Tables 2 and 3 present Eco-Products’ financial statement information for 2005, 2006, and 2007. Prepare a ratio analysis of the firm’s financial performance over the 2005–2007 period. Data from Table

> Describe Spatial Technology’s pricing and marketing strategy.

> What is the size of the domestic and global markets for food service disposable packaging? Who are the major competitors producing/selling environmentally friendly food service products? What intellectual property or competitive advantages does Eco Produ