Question: Mickelson reports on a calendar-year basis.

Mickelson reports on a calendar-year basis. On January 1, 20X1, Mickelson Corporation entersinto a three-year lease with annual payments of $30,000. The first payment will be due on

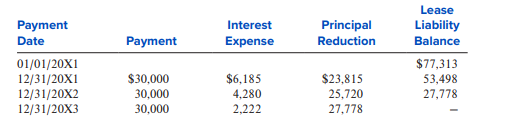

December 31, 20X1. The present value of the payments at 8% is $77,313. If the lease is classifiedas a finance lease, the following amortization table would be used to record interest expense:

Required:

1. Assume the lease is classified as a short-term lease. Show for each year the effects on theoperating, investing, and financing activities sections of the statement of cash flows (directmethod).

2. Assume the lease is classified as a finance lease. Show for each year the effects on theoperating, investing, and financing activities sections of the statement of cash flows (directmethod). Assume that the leased asset is amortized over three years.

3. Assume the lease is classified as an operating lease. Show for each year the effects on the operating, investing, and financing activities sections of the statement of cash flows (direct method).

> This case illustrates how the abnormal earnings valuation model described in Appendix 7A of this chapter can be combined with security analysts’ published earnings forecasts and used to spot potentially overvalued stocks. Required: 1. Use the abnormal e

> Dell Company adopted a defined benefit pension plan on January 1, 20X1. Dell amortizes theinitial prior service cost of $1,334,400 over 16 years. It assumes a 7% discount rate and an 8%expected rate of return. The following additional data are available

> The following information pertains to Kane Company’s defined benefit pension plan: Kane has no net actuarial gains or losses in AOCI at January 1, 20X1. Required: In its December 31, 20X1, balance sheet, what amount should Kane report

> The following information pertains to Gali Company’s defined benefit pension plan for 20X1: Required: What was the dollar amount of actual return on Gali Company’s plan assets in 20X1?

> Use the facts given in E15-4. Repeat the requirements assuming that the discount and earningsrate is 11% instead of 8%.

> Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor offarm implements. Abbott plans to retire on her 65th birthday, five years from January 1, 20X1. Her salary at January 1, 20X1, is $48,000 per year, and her projected

> On January 2, 20X1, Loch Company established a defined benefit plan covering all employeesand contributed $1,000,000 to the plan. At December 31, 20X1, Loch determined that the 20X1 service and interest costs totaled $620,000. The expected and the actual

> At December 31, 20X1, Kerr Corporation’s pension plan administrator provided the followinginformation: Required: What amount of the pension liability should be shown on Kerr’s December 31, 20X1, balancesheet?

> At January 1, 20X1, Archer Co.’s PBO is $500,000 and the fair value of its pension plan assetsis $630,000. The average remaining service period of Archer’s employees is 12 years. The AOCI—net actuaria

> At January 1, 20X1, Milo Co.’s projected benefit obligation is $300,000, and the fair value ofits pension plan assets is $340,000. The average remaining service period of Milo’s employeesis 10 years. Milo Co. uses the

> Bonny Corp. has a defined benefit pension plan for its employees who have an average remaining service life of 10 years. The following information is available for 20X1 and 20X2 related tothe pension plan: Bonny Corp. had no beginning balance in its AOCI

> Sunny Day Stores operates convenience stores throughout much of the United States. The industry is highly competitive, with low profit margins. The company’s competition includes national, regional, and local supermarkets; oil companies

> Zeff Manufacturing provides the following information about its postretirement health careplan for 20X1: Required: 1. Determine Zeff’s postretirement health care expense in 20X1. 2. Determine the fair value of plan assets at December 3

> Jones Company has a postretirement benefit (health care) plan for its employees. On January 1, 20X1, the balance in the Accumulated postretirement benefit obligation account was $300 million. The assumed discount rate—for purposes of determining postreti

> Cummings Inc. had the following reconciliation at December 31, 20X0: Required: 1. Compute pension expense for 20X1. 2. Compute the fair value of plan assets at December 31, 20X1. 3. Compute the PBO at December 31, 20X1. 4. Compute AOCI—

> Bostonian Company provided the following information related to its defined benefit pension plan for 20X1: Required: 1. What amount of pension expense should Bostonian report for 20X1? 2. What is the fair value of plan assets at December 31, 20X1? 3. Wh

> The following information pertains to Lee Corporation’s defined benefit pension plan for 20X1: Required: Determine the pension expense that Lee Corporation would include in its 20X1 net income.

> Hukle Company has provided the following information pertaining to its postretirement planfor 20X1: Required: Calculate Hukle Company’s 20X1 net postretirement benefit cost.

> Nome Company sponsors a defined benefit plan covering all employees. Benefits are based onyears of service and compensation levels at the time of retirement. Nome has a September 30fiscal year-end. It determined that as of September 30, 20X1, its ABO was

> The following information pertains to Seda Company’s pension plan for 20X1: Required: If no change in actuarial estimates occurred during 20X1, how much would Seda’s projected benefit obligation be at December 31, 20X

> Quinn Company reported a net deferred tax asset of $6,300 in its December 31, 20X0, balancesheet. For 20X1, Quinn reported pre-tax financial statement income of $300,000. Temporarydifferences of $100,000 resulted in taxable income of $200,000 for 20X1. A

> Black Company, organized on January 2, 20X1, had pre-tax accounting income of $500,000and taxable income of $800,000 for the year ended December 31, 20X1. The only temporary difference is accrued product warranty costs, which are expected to be paid as f

> It’s late Tuesday evening, and you’ve just received a phone call from Dennis Whiting, your boss at GE Capital. Dennis wants to know your reaction to the Argenti loan request before tomorrow’s loan com

> West Corporation leased a building and received the $36,000 annual rental payment on July 15, 20X1. The beginning of the lease period was August 1, 20X1. Rental income is taxablewhen received. West had no other permanent or temporary differences. West’s

> Kent Inc.’s reconciliation between financial statement and taxable income for 20X1 follows: Required: 1. In its December 31, 20X1, balance sheet, what amount should Kent report as its deferredtax liability? 2. In its 20X1 income statem

> Dunn Company’s 20X1 income statement reported $90,000 income before provision forincome taxes. To aid in the computation of the provision for federal income taxes, the following 20X1 data are provided: Required: What amount of taxes mus

> For the year ended December 31, 20X1, Tyre Company reported pre-tax financial statement income of $750,000. Its taxable income was $650,000. The difference was due to theuse of accelerated depreciation for income tax purposes and straight-line for financ

> Mill Company began operations on January 1, 20X1, and recognized income fromconstruction-type contracts under different methods for tax purposes and financial reportingpurposes. Information concerning income recognition under each method is as follows: R

> In its 20X1 income statement, Tow Inc. reported proceeds from an officer’s life insurance policyof $90,000 and depreciation of $250,000. Tow was the owner and beneficiary of the life insurance on its officer. Tow deducted depreciation o

> Collins Company incurs a $1,000 book expense that it deducts on its tax return. The tax law is unclear whether this expense is deductible, so the deduction leads to an uncertain tax position. Assuming a 21% tax rate, the deduction results in a $210 uncer

> Millie Co. completed its first year of operations on December 31, 20X1, with pre-tax financialincome of $400,000. Millie accrued a contingent liability of $900,000 for financial reportingpurposes; however, no tax deduction is permitted until a payment is

> On December 31, 20X0, Toms River Rafting, Inc. (TRR), has a deferred tax asset related to a $250,000 net operating loss carryforward. The enacted tax rate (and substantively enacted taxrate) at the time was 21%. When it recognized this deferred tax asset

> In Figland Company’s first year of operations (20X1), the company had pre-tax book incomeof $500,000 and taxable income of $800,000. Figland’s only temporary difference is foraccrued product warranty costs, which are e

> Crocs designs, develops, and manufactures consumer products from specialty resins. The company’s primary product line is Crocs-branded footwear for men, women, and children. It sells its products through traditional retail channels, inc

> Melissa Corporation is domiciled in Germany and is listed on both the Frankfurt and New York Stock Exchanges. Melissa has chosen to prepare consolidated financial statements inaccordance with U.S. GAAP for filing with the U.S. Securities and Exchange Com

> As of December 31, 20X1, Colt Corporation has a loss carryforward of $180,000 available tooffset future taxable income. At December 31, 20X1, the company believes that realization ofthe tax benefit related to the loss carryforward is probable. The tax ra

> Dix Company reported operating income (loss) before income tax in its first three years ofoperations as follows: Dix had no permanent or temporary differences between book income and taxable income inthese years. Assume a 21% tax rate for all years, and

> On January 2, 20X1, Allen Company purchased a machine for $70,000. This machine has a five year useful life, has a residual value of $10,000, and is depreciated using the straight line method for financial statement purposes. For tax purposes, depreciati

> On October 1, 20X1, Vaughn, Inc., leased a machine from Fell Leasing Company for five years. The lease requires five annual payments of $10,000 beginning September 30, 20X2. Vaughn’sincremental borrowing rate is 11%, and it uses a calendar year for repor

> On December 31, 20X1, Day Company leased a new machine from Parr with the followingpertinent information: The lease is not renewable, and the machine reverts to Parr at the termination of the lease. Thecost of the machine on Parr’s acco

> Refer to the facts in E13-8. Required: Based on the relation between the lease life and economic life, the lessees will classify theleases as finance leases. For each lease, compute the lessee’s amortization expense for the firstyear of the lease. Assum

> Benedict Company leased equipment to Mark Inc. on January 1, 20X1. The lease is for aneight-year period, expiring December 31, 20X8. The first of eight equal annual payments of $600,000 was made on January 1, 20X1. Benedict had purchased the equipment on

> On January 1, 20X1, Beard Company purchased a machine for $620,000. The machine isexpected to have a 10-year life, with no salvage value, and will be depreciated by the straight line method. On January 1, 20X1, it leased the machine to Child Company for

> On December 31, 20X1, Ball Company leased a machine from Cook for a 10-year period, expiring December 30, 20Y1. Annual payments of $100,000 are due on December 31. The first payment was made on December 31, 20X1, and the second payment was made on Decemb

> McDonald’s Corporation franchises and operates more than 36,000 fast-service restaurants around the world. Buffalo Wild Wings franchises and operates more than 1,000 restaurants in North America. Buffalo Wild Wings features chicken wing

> East Company leased a new machine from North Company on May 1, 20X1, under a leasewith the following information: East has the option to purchase the machine on May 1, 20Y1, by paying $50,000, whichapproximates the expected fair value of the machine on t

> In its long-term liabilities section of its balance sheet at December 31, 20X1, Columbo Company reports a long-term operating lease liability of $82,004, net of the current portion of $13,327. Columbo makes $20,000 lease payments on December 31, 20X2, De

> On January 1, 20X1, Walker, Inc., signs a 5-year lease for two floors of a 20-floor building. The building has an expected remaining life of 20 years. The space is available immediately, and Walker agrees to make annual payments of $325,000 on December 3

> On January 1, 20X1, Draper Inc. signed a five-year non cancelable lease with Thorn hill Company for custom-made equipment. The lease calls for five payments of $161,364.70 to bemade at the beginning of each year. The leased asset has a fair value of $900

> On December 31, 20X1, Lane, Inc., sold equipment to Nolte and simultaneously leased it backfor 12 years. Pertinent information at this date is as follows: Required: 1. At December 31, 20X1, should Lane report a gain from the sale of the equipment? 2. If

> On December 31, 20X1, Roe Company leased a machine from Colt for a five-year period. Equal annual payments under the lease are $105,000 (including $5,000 annual executory costsfor servicing) and are due on December 31 of each year. The first payment was

> On January 1, 20X1, Babson, Inc., leased two automobiles for executive use. The lease requires Babson to make five annual payments of $13,000, beginning January 1, 20X1. At the end of thelease term on December 31, 20X5, Babson guarantees that the residua

> Monk Company, a dealer in machinery and equipment, leased equipment with a 10-year life to Leland Inc. on July 1, 20X1. The fair value of the leased equipment at July 1, 20X1, is $1,849,591. The lease is appropriately accounted for as a sale by Monk and

> On January 1, 20X0, Roland Inc. issued $125 million of 8% bonds at par. The bonds pay interest semiannually on June 30 and December 31 of each year, and they mature in 15 years. OnDecember 31, 20X1 (before the interest payment is made), the bonds are tra

> First Solar, Inc., adopted the new revenue recognition standard, ASC Topic 606, in 2017. The following are condensed versions of First Solar’s balance sheet, income statement, and cash flow statement, as they were presented in the company’s 2017 annual r

> On January 1, 20X1, Brooks Energy issued $200 million of 15-year, floating-rate debentures atpar value. The debentures pay interest on June 30 and December 31 of each year. The floatinginterest rate is set equal to “LIBOR plus 6%” on January 1 of each ye

> Zero coupon bonds pay no interest—the only cash investors receive is the lump-sum principalpayment at maturity. On January 1, 20X1, The Ledge Inc. issued $250 million of zero couponbonds at a market yield rate of 12%. The bonds mature in 20 years. Requi

> Webb Company has outstanding a 7% annual, 10-year, $100,000 face value bond that it hadissued several years ago. It originally sold the bond to yield 6% annual interest. Webb uses theeffective interest rate method to amortize the bond premium. On June 30

> On February 1, 20X1, Davis Corporation issued 12%, $1,000,000 par, 10-year bonds for $1,117,000. Davis reacquired all of these bonds at 102% of par, plus accrued interest, on May 1, 20X3, and retired them. The unamortized bond premium on that date was $7

> On January 2, 20X1, West Company issued 9%, 10-year bonds in the amount of $500,000 thatmature on December 31, 20X9. The bonds were issued for $469,500 to yield 10%. Interest ispayable annually on December 31. West uses the effective interest method of a

> On January 1, 20X1, when the market interest rate was 14%, Luba Corporation issued 10-yearbonds in the face amount of $500,000 with interest at 12% payable semiannually. The bondsmature on December 31, 20X9. Required: Calculate the bond discount at issu

> By July 1, 20X2, the market yield on the Akers Company bonds described in E12-1 had risento 10%. Required: What was the bonds’ market price on July 1, 20X2?

> On January 1, 20X1, Tusk Company issued $300 million of bonds with a 6% coupon interestrate. The bonds mature in 10 years and pay interest annually on December 31 of each year. Themarket rate of interest on January 1, 20X1, for bonds of this risk class w

> On July 1, 20X1, Mirage Company issued $250 million of bonds with an 8% coupon interestrate. The bonds mature in 10 years and pay interest semiannually on June 30 and December 31of each year. The market rate of interest on July 1, 20X1, for bonds of this

> Akers Company sold bonds on July 1, 20X1, with a face value of $100,000. These bonds aredue in 10 years. The stated annual interest rate is 6% per year, payable semiannually on June 30and December 31. These bonds were sold to yield 8%. Required: How muc

> The following events and transactions related to David Company occurred after the balance sheet date of December 31, 20X1, and before the financial statements were issued in 20X2. None of the items is reflected in the financial statements as of December

> Raytheon Company’s 2018 Form 10-K states that sales to the U.S. government comprise 68% of its 2018 total net sales and sales to foreign governments through the U.S. government comprise 13% of its 2018 total net sales. Required: 1. Why does the SEC requ

> Describe the four successful rounds of venture financing (A through D) achieved by Spatial Technology in terms of sources and amounts. What additional financing sources have been used?

> Table 4 presents Eco-Products’ statement of cash flows for 2007. Was the firm building or burning cash in its operating activities? When also considering cash flows from investing activities, was Eco-Products in a net cash build or burn

> Discuss the competition faced by Spatial Technology in conjunction with 3D modeling technology in general and specifically with its ACIS product.

> Tables 2 and 3 present Eco-Products’ financial statement information for 2005, 2006, and 2007. Prepare a ratio analysis of the firm’s financial performance over the 2005–2007 period. Data from Table

> Describe Spatial Technology’s pricing and marketing strategy.

> What is the size of the domestic and global markets for food service disposable packaging? Who are the major competitors producing/selling environmentally friendly food service products? What intellectual property or competitive advantages does Eco Produ

> Describe the experience and expertise characteristics of the management team. Answer: The management team has a founder that is well known in the field with previous successful experience. The operations and financing members of the team have been sub

> Discuss Eco-Products’ revenue growth-based “business model” that evolved over the 2004 through early 2008 period in terms of (a) production versus distribution, (b) product line development, (c) branding, etc.

> What intellectual properly, if any, does Spatial Technology possess?

> Describe Eco-Products’ early history (1990–2003). Would you view the firm during that period as being a lifestyle business, an entrepreneurial venture, or something else? Why?

> From the Headlines—Sustainable Northwest: Describe Sustainable Northwest’s short-term inflows and outflows of cash. What would you expect to be the main ingredients of each part of the cash conversion cycle?

> Describe Spatial Technology’s business model in terms of revenues, profits, and cash flows.

> Francine Delgado has developed a business plan for producing and selling a new hair care product that emits nutrients to the scalp when used. The product residues have been judged to be environmentally safe. Following are her projected partial financial

> Refer to the information on the three ventures in Problem 2. A. If each venture had net sales of $10 million, calculate the dollar amount of net profit and total assets for Venture XX, Venture YY, and Venture ZZ. B. Which venture would have the largest d

> The Biometrix Corporation has been in operation for one full year (2019). Financial statements follow. Biometrix’s management is interested in determining the value of the venture as of the end of 2019. Sales are expected to grow at a 2

> The Minoso Corporation anticipates a 20 percent increase in sales for 2020, 2021, and 2022. Minoso is currently operating at full capacity and thus expects to increase its investment in both current and fixed assets in order to support the increase in fo

> Artero Corporation, discussed in Problems 7 and 12, is a retailer of toy products. This is a continuation of Problem 12. The firm’s management team recently extended the monthly sales forecasts through the last six months of 2021. Arter

> Artero Corporation, discussed in Problem 7, is a retailer of toy products. The firm’s management team recently extended the monthly sales forecasts that were prepared for the last three months of 2020 for an additional six months in 202

> Short-term financial planning for the PDC Company was described earlier in this chapter. Refer to the PDC Company’s projected monthly operating schedules in Table 6.2. PDC’s monthly sales for the remainder of 2020 are

> Several years ago, Dick and Barbara Harris were asked to attend an organizational meeting for a newly forming neighborhood babysitting cooperative. The idea was simple. Concerned and caring parents would join together in the cooperative and exchange baby

> Interact Systems, Inc., has developed software tools that help hotel chains solve application integration problems. Interact’s application integration server (AIS) provides a two-way interface between a central reservations system (CRS) and a property ma

> As your venture has moved from the development stage to the startup stage, a number of trade secrets have been developed along with an extensive client list. You are in the business of developing and installing computer networks for law firms. A. Your ma

> LearnRite.com offers e-commerce service for children’s edutainment products and services. The word edutainment is used to describe software that combines educational and entertainment components. Valuable product information and detaile

> Interact Systems, Inc., has developed software tools that help hotel chains solve application integration problems. Interact’s application integration server (AIS) provides a two-way interface between central reservations systems (CRS) and property manag

> Brian Motley founded MiniDiscs Corporation at the end of 2014 with a $1 million investment. After nearly one year of development, the venture produced an optical storage disk (about the size of a silver dollar) that could store more than 500 megabytes of

> Wok Yow Imports, Inc., is a rapidly growing, closely held corporation that imports and sells Asian style furniture and accessories at several retail outlets. The equity owners are considering selling the venture and want to estimate the enterprise or ent

> In 2019, Jennifer (Jen) Liu and Larry Mestas founded Jen and Larry’s Frozen Yogurt Company, which was based on the idea of applying the microbrew or microbatch strategy to the production and sale of frozen yogurt. Jen and Larry began producing small quan

> Interact Systems, Inc., has developed software tools that help hotel chains solve application integration problems. Interact’s application integration server (AIS) provides a two-way interface between central reservations systems (CRS) and property manag

> The SoftTec Products Company is a successful, small, rapidly growing, closely held corporation. The equity owners are considering selling the firm to an outside buyer and want to estimate the value of the firm. Following is last year’s

> The Pharma Biotech Corporation spent several years working on developing a DHA product that can be used to provide a fatty-acid supplement to a variety of food products. DHA stands for docosahexaenoic acid, an omega-3 fatty acid found naturally in cold-w

> The Alpha One Software Corporation was organized to develop software products that would provide Internet-based firms with information about their customers. As a result of initial success, the venture’s premier product allows firms wit

> The Castillo Products Company was started in 2017. The company manufactures components for personal digital assistant (PDA) products and for other handheld electronic products. A difficult operating year, 2018, was followed by a profitable 2019. The foun

> Compare and contrast (a) balance sheet insolvency and (b) cash flow insolvency.