Question: JED Capital Inc. makes investments in trading

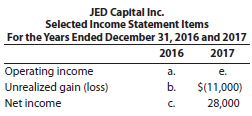

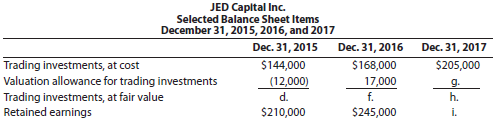

JED Capital Inc. makes investments in trading securities. Selected income statement items for the years ended December 31, 2016 and 2017, plus selected items from comparative balance sheets, are as follows:

There were no dividends.

Determine the missing lettered items.

Transcribed Image Text:

JED Capltal Inc. Selected Income Statement Items For the Years Ended December 31, 2016 and 2017 2016 2017 Operating income Unrealized gain (loss) a. e. b. $(11,000) Net income C. 28,000 JED Capltal Inc. Selected Balance Sheet Items December 31, 2015, 2016, and 2017 Dec. 31, 2015 Dec. 31, 2016 Dec. 31, 2017 $168,000 Trading investments, at cost Valuation allowance for trading investments $144,000 $205,000 (12,000) 17,000 g. h. Trading investments, at fair value Retained earnings d. f. $210,000 $245,000 i.

> For a recent year, Best Buy reported sales of $50,705 million. Its gross profit was $12,573 million. What was the amount of Best Buy’s cost of merchandise sold?

> Big Sky Mining Co. acquired mineral rights for $42,000,000. The mineral deposit is estimated at 20,000,000 tons. During the current year, 1,850,000 tons were mined and sold. a. Determine the amount of depletion expense for the current year. b. Journalize

> Master Designs Decorators issued a 180-day, 6% note for $75,000, dated May 14, 2016, to Morgan Furniture Company on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entries to record the follo

> Using the data presented in Exercise 7-18, journalize the entry or entries that should be made by the company. Exercise 7-18: The following data were accumulated for use in reconciling the bank account of Zek’s Co. for May 2016: 1. Cash balance accordi

> Using the data in Exercise 8-11, assume that the allowance for doubtful accounts for Selby’s Bike Co. had a debit balance of $7,200 as of December 31, 2016. Journalize the adjusting entry for uncollectible accounts as of December 31, 20

> The following revenue and expense account balances were taken from the ledger of Wholistic Health Services Co. after the accounts had been adjusted on February 29, 2016, the end of the fiscal year: Prepare an income statement. Depreciation Expense

> The debits and credits from four related transactions are presented in the following T accounts. Describe each transaction. Cash Accounts Payable (2) 300 (3) 3,920 (1) 20,580 (4) 16,660 (4) 16,660 Merchandise Inventory (1) 20,580 (3) 3,920 (2) 300

> In a recent balance sheet, Microsoft Corporation reported Property, Plant, and Equipment of $19,231 million and Accumulated Depreciation of $10,962 million. a. What was the book value of the fixed assets? b. Would the book value of Microsoft Corporation’

> Based on the data in Exercise 6-15 and assuming that cost was determined by the FIFO method, show how the merchandise inventory would appear on the balance sheet. Exercise 6-15: On the basis of the following data, determine the value of the inventory a

> The actual cash received from cash sales was $33,854 and the amount indicated by the cash register total was $33,866. Journalize the entry to record the cash receipts and cash sales.

> Lily Flower’s weekly gross earnings for the week ended October 20 were $2,500, and her federal income tax withholding was $517.24. Assuming the social security rate is 6% and Medicare is 1.5% of all earnings, what is Flower’s net pay?

> At the end of the current year, $22,650 of fees have been earned but have not been billed to clients. a. Journalize the adjusting entry to record the accrued fees. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry

> Paragon Tire Co.’s perpetual inventory records indicate that $2,780,000 of merchandise should be on hand on March 31, 2016. The physical inventory indicates that $2,734,800 of merchandise is actually on hand. Journalize the adjusting entry for the invent

> An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct. La Casa Services Co. Post-Closing Trial Balance M

> The units of an item available for sale during the year were as follows: There are 104 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by t

> The total assets and total liabilities (in millions) of Dollar Tree Inc. and Target Corporation follow: Determine the stockholders’ equity of each company. Dollar Tree Target Corporation $2,329 Assets $46,630 Liabilities 984 30,80

> Zell Company had sales of $1,800,000 and related cost of merchandise sold of $1,150,000 for its first year of operations ending December 31, 2016. Zell Company provides customers a refund for any returned or damaged merchandise. At the end of the year, Z

> Apex Systems Co. offers its services to residents in the Seattle area. Selected accounts from the ledger of Apex Systems Co. for the fiscal year ended December 31, 2016, are as follows: Prepare a retained earnings statement for the year. Retained E

> The prepaid insurance account had a balance of $7,000 at the beginning of the year. The account was debited for $24,000 for premiums on policies purchased during the year. Journalize the adjusting entry required under each of the following alternatives f

> The balance in the supplies account, before adjustment at the end of the year, is $5,330. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $1,875.

> After all revenue and expense accounts have been closed at the end of the fiscal year, Income Summary has a debit of $798,400 and a credit of $955,300. At the same date, Retained Earnings has a credit balance of $1,439,000, and Dividends has a balance of

> At the end of the current year, Accounts Receivable has a balance of $1,975,000; Allowance for Doubtful Accounts has a credit balance of $19,670; and sales for the year total $28,550,000. Bad debt expense is estimated at ¾ of 1% of sales. Determine (a).

> Ocular Realty Co. pays weekly salaries of $16,600 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends (a) on Wednesday and (b) on Thursday.

> Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2016, are as follows: Prepare a retained earnings statement for the year. Retained Earnings 31,200 | May 1 (2015) 475,500 Dividends Apr. 30 Sept. 30 1,250 Ap

> The following account balances were taken from the adjusted trial balance for Laser Messenger Service, a delivery service firm, for the fiscal year ended April 30, 2016: Prepare an income statement. $ 8,650 674,000 Depreciation Expense $ 60,000 Ren

> Determine the missing amount for each of the following: Liabilities + Stockholders' Equity $376,000 + Assets а. X $895,000 b. $1,375,000 $855,000 $863,500 $211,000 + с. =

> The balance in the unearned fees account, before adjustment at the end of the year, is $36,950. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $14,440.

> The unadjusted and adjusted trial balances for American Leaf Company on October 31, 2016, follow: Journalize the five entries that adjusted the accounts at October 31, 2016. None of the Accounts were affected by more than one adjusting entry. Ameri

> The balance in the equipment account is $28,650,000, and the balance in the accumulated depreciation—equipment account is $16,430,000. a. What is the book value of the equipment? b. Does the balance in the accumulated depreciation account mean that the e

> For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $598 million. The income before taxes for The Campbell Soup Company for the year was $1,106 million. a. Assume the adjusting entry for $598 million of accrued

> Classify the following items as (a) prepaid expense, (b) unearned revenue, (c) accrued revenue, or (d) accrued expense: 1. A two-year premium paid on a fire insurance policy. 2. Fees earned but not yet received. 3. Fees received but not yet earned. 4. Sa

> On December 31, 2015, Valur Co. had the following available-for-sale investment disclosure within the Current Assets section of the balance sheet: There were no purchases or sales of available-for-sale investments during 2016. On December 31, 2016, the

> The following data were gathered to use in reconciling the bank account of Eves Company: a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Eves Company based on the bank reconciliation. Balance per

> On May 12, 2016, Chewco Co. purchased 2,000 shares of Jedi Inc. for $112 per share, including the brokerage commission. The Jedi investment was classified as an available-for-sale security. On December 31, 2016, the fair value of Jedi Inc. was $124 per s

> For a recent period, the balance sheet for Costco Wholesale Corporation reported accrued expenses of $2,890 million. For the same period, Costco reported income before income taxes of $2,767 million. Assume that the adjusting entry for $2,890 million of

> During 2016, El Dorado Inc. has monthly cash expenses of $168,500. On December 31, 2016, the cash balance is $1,415,400. a. Compute the ratio of cash to monthly cash expenses. b. Based on (a), what are the implications for El Dorado Inc.?

> At the market close on March 28 of a recent year, McDonald’s Corporation had a closing stock price of $99.69. In addition, McDonald’s Corporation had a dividend per share of $2.87 during the previous year. Determine McDonald’s Corporation’s dividend yiel

> During 2016, Copernicus Corporation held a portfolio of available-for-sale securities having a cost of $185,000. There were no purchases or sales of investments during the year. The market values at the beginning and end of the year were $225,000 and $16

> Junkyard Arts, Inc., had earnings of $316,000 for 2016. The company had 40,000 shares of common stock outstanding during the year. In addition, the company issued 15,000 shares of $50 par value preferred stock on January 9, 2016. The preferred stock has

> Two items are omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter. Sales $463,400 (a) (b) $1,295,000 (d) 900,000 Cost of merchandise sold 410,000 (c) Gross prof

> The following data (in thousands) were taken from recent financial statements of Under Armour, Inc.: a. Compute the working capital and the current ratio as of December 31, Year 2 and Year 1. Round to two decimal places. b. What conclusions concerning

> The cost of merchandise sold for Kohl’s Corporation for a recent year was $11,625 million. The balance sheet showed the following current account balances (in millions): Determine the amount of cash payments for merchandise. Balan

> Highland Industries Inc. makes investments in available-for-sale securities. Selected income statement items for the years ended December 31, 2016 and 2017, plus selected items from comparative balance sheets, are as follows: There were no dividends.

> Beginning inventory, purchases, and sales for Item Zebra 9x are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a). the cost of merchandise sold on April 27 and (b). the inventory on April 3

> During the current year, merchandise is sold for $615,000 cash and $4,110,000 on account. The cost of the merchandise sold is $2,835,000. What is the amount of the gross profit?

> The income statement for Delta-tec Inc. for the year ended December 31, 2016, was as follows: Delta-tec Inc. Income Statement (selected items) For the Year Ended December 31, 2016 Income from operations ………………………………………………………. $299,700 Gain on sale of in

> Sumter Pumps Corporation, a manufacturer of industrial pumps, reports the following results for the year ended January 31, 2016: Prepare a retained earnings statement for the fiscal year ended January 31, 2016. Retained earnings, February 1, 20o15.

> Jets Bancorp Inc. purchased a portfolio of trading securities during 2016. The cost and fair value of this portfolio on December 31, 2016, was as follows: On May 10, 2017, Jets Bancorp Inc. purchased 1,000 shares of Giants Inc. at $24 per share plus a

> Loomis, Inc. reported the following on the company’s income statement in 2016 and 2015: a. Determine the number of times interest charges were earned for 2016 and 2015. Round to one decimal place. b. Is the number of times interest ch

> The actual cash received from cash sales was $51,175 and the amount indicated by the cash register total was $50,997. Journalize the entry to record the cash receipts and cash sales.

> A John Deere tractor acquired on January 4 at a cost of $120,000 has an estimated useful life of 25 years. Assuming that it will have no residual value, determine the depreciation for each of the first two years (a) by the straight-line method and (b) by

> On January 1, 2016, Hebron Company issued a $175,000, five-year, 8% installment note to Ventsam Bank. The note requires annual payments of $43,380, beginning on December 31, 2016. Journalize the entries to record the following: 2016 Jan. 1. Issued the no

> Using data in Exercise 8-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of $6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Exercise 8-9: T

> Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issued $15,000,000 of 20-year, 9% callable bonds on May 1, 2016 at their face amount, with interest payable on May 1 and November 1. The fiscal year of the co

> The following accounts appear in an adjusted trial balance of San Jose Consulting. Indicate whether each account would be reported in the (a) current asset; (b) property, plant, and equipment; (c) current liability; (d) long-term liability; or (e) stockh

> Yerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during 2016: Feb. 2. Purchased for cash 5,300 shares of Wong Inc. stock for $20 per share plus

> Data on the physical inventory of Katus Products Co. as of December 31, 2016, follows: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions: Determine t

> Rodgers Corporation produces and sells football equipment. On July 1, 2016, Rodgers Corporation issued $65,000,000 of 10-year, 12% bonds at a market (effective) interest rate of 10%, receiving cash of $73,100,469. Interest on the bonds is payable semiann

> On July 1, 2016, Livingston Corporation, a wholesaler of manufacturing equipment, issued $46,000,000 of 20-year, 10% bonds at a market (effective) interest rate of 11%, receiving cash of $42,309,236. Interest on the bonds is payable semiannually on Decem

> The following bond investment transactions were completed during 2016 by Starks Company: Jan. 31. Purchased 75, $1,000 government bonds at 100 plus 30 days’ accrued interest. The bonds pay 6% annual interest on July 1 and January 1. July 1. Received semi

> The beginning inventory for Funky Party Supplies and data on purchases and sales for a three-month period are shown in Problem 6-1A. Problem 6-1A: The beginning inventory at Funky Party Supplies and data on purchases and sales for a three-month period

> Griffin Enterprises issues a $660,000, 45-day, 4% note to Romo Industries for merchandise inventory. a. Journalize Griffin Enterprises’ entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. b. Journalize Romo Industries’

> During the current year, merchandise is sold for $4,885,000. The cost of the merchandise sold is $3,028,700. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross profit divided by sales). c. Will the income statement n

> The following information about the payroll for the week ended December 30 was obtained from the records of Qualitech Co.: Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer onl

> Finders Investigative Services is an investigative services firm that is owned and operated by Stacy Tanner. On June 30, 2016, the end of the fiscal year, the accountant for Finders Investigative Services prepared an end-of-period spreadsheet, a part of

> Prepare a journal entry on March 16 for fees earned on account, $9,450.

> Kimberly Manis, an architect, organized Manis Architects on January 1, 2016. During the month, Manis Architects completed the following transactions: a. Issued common stock to Kimberly Manis in exchange for $18,000. b. Paid January rent for office and wo

> The Colby Group has the following unadjusted trial balance as of August 31, 2016: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was understated by $6,000. b. A cash receipt of $5

> The beginning inventory for Funky Party Supplies and data on purchases and sales for a three-month period are shown in Problem 6-1A. Problem 6-1A: The beginning inventory at Funky Party Supplies and data on purchases and sales for a three-month period

> Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Apr. 1. Paid rent on off

> On July 1, 2016, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: a. Opened a business bank account with a deposit of $25,000 in exchange for common stock. b. Purchased office supplies on account,

> Selected account balances before adjustment for Alantic Coast Realty at July 31, 2016, the end of the current year, are as follows: Data needed for year-end adjustments are as follows: a. Unbilled fees at July 31, $11,150. b. Supplies on hand at July 3

> Selected transactions for Capers Company during October of the current year are listed in Problem 5-1A. Problem 5-1A: The following selected transactions were completed by Capers Company during October of the current year: Oct. 1. Purchased merchandise

> The financial statements at the end of Wolverine Realty’s first month of operations are as follows: Instructions: By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) throug

> The following transactions, adjusting entries, and closing entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. 2014 Jan.

> Flush Mate Co. wholesales bathroom fixtures. During the current fiscal year, Flush Mate Co. received the following notes: Instructions: 1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note b

> Arrowhead Delivery Service is owned and operated by Gates Deeter. The following selected transactions were completed by Arrowhead Delivery Service during August: 1. Received cash in exchange for common stock, $25,000. 2. Paid creditors on account, $3,750

> Saverin Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin Inc. issued $62,500,000 of 10-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of $66,747,178. Interest on the bonds is payable semiannually on December

> On July 1, 2016, Livingston Corporation, a wholesaler of manufacturing equipment, issued $46,000,000 of 20-year, 10% bonds at a market (effective) interest rate of 11%, receiving cash of $42,309,236. Interest on the bonds is payable semiannually on Decem

> Gaelic Industries Inc. is an athletic foot ware company that began operations on January 1, 2016. The following transactions relate to debt investments acquired by Gaelic Industries Inc., which has a fiscal year ending on December 31: 2016 May 1. Purchas

> The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following: a. If sales for the current year were $753,500 and accounts receivable decreased by $48,400 during the year, what was the

> List the errors you find in the following statement of cash flows. The cash balance at the beginning of the year was $240,000. All other amounts are correct, except the cash balance at the end of the year. Shasta Inc. Statement of Cash Flows For the

> Equipment acquired on January 8, 2013, at a cost of $140,000, has an estimated useful life of 16 years, has an estimated residual value of $8,000, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31,

> Iacouva Company reported the following on the company’s income statement for 2016 and 2015: a. Determine the number of times interest charges are earned for 2016 and 2015. Round to one decimal place. b. What conclusions can you draw?

> The investments of Charger Inc. include a single investment: 14,500 shares of Raiders Inc. common stock purchased on February 24, 2016, for $38 per share including brokerage commission. These shares were classified as trading securities. As of the Decemb

> Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted.’ Exercise 2-13: Wyoming Tours Co. is a travel agency. The nine transactions rec

> Hawkeye Company’s balance sheet reported, under the equity method, its long-term investment in Raven Company for comparative years as follows: In addition, the 2017 Hawkeye Company income statement disclosed equity earnings in the Rav

> Huluduey Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $160,000 for changes in operating assets and liabilities to arrive at net cash flow from operating activities.

> On January 6, 2016, Bulldog Co. purchased 34% of the outstanding stock of Gator Co. for $212,000. Gator Co. paid total dividends of $24,000 to all shareholders on June 30. Gator had a net loss of $56,000 for 2016. a. Journalize Bulldog’s purchase of the

> Selby’s Bike Co. is a wholesaler of motorcycle supplies. An aging of the company’s accounts receivable on December 31, 2016, and a historical analysis of the percentage of uncollectible accounts in each age category ar

> At a total cost of $6,300,000, Veravo Corporation acquired 210,000 shares of Strado Corp. common stock as a long-term investment. Veravo Corporation uses the equity method of accounting for this investment. Strado Corp. has 700,000 shares of common stock

> Diego Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: * For hourly employees, overtime is paid for hours worked in excess of 40 h

> Occupational Products Inc., a wholesaler of office products, was organized on March 1 of the current year, with an authorization of 25,000 shares of preferred 2% stock, $100 par and 500,000 shares of $10 par common stock. The following selected transacti

> The income statement disclosed the following items for 2016: Balances of the current assets and current liability accounts changed between December 31, 2015, and December 31, 2016, as follows: a. Prepare the Cash Flows from Operating Activities secti

> The net income reported on the income statement for the current year was $320,000. Depreciation recorded on equipment and a building amounted to $96,000 for the year. Balances of the current asset and current liability accounts at the beginning and end o

> The net income reported on the income statement for the current year was $400,000. Depreciation recorded on store equipment for the year amounted to $16,000. Balances of the current asset and current liability accounts at the beginning and end of the yea

> United States Steel’s 7.375% bonds due in 2020 were reported as selling for 103.00. Were the bonds selling at a premium or at a discount? Why is United States Steel able to sell its bonds at this price?

> Bocelli Co. purchased $120,000 of 6%, 20-year Sanz County bonds on May 11, 2016, directly from the county, at their face amount plus accrued interest. The bonds pay semiannual interest on April 1 and October 1. On October 31, 2016, Bocelli Co. sold $30,0

> Alpenrose Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $207,000 for changes in operating assets and liabilities to arrive at net cash flow from operating activities.

> Kalyagin Investments acquired $220,000 of Jerris Corp., 7% bonds at their face amount on October 1, 2016. The bonds pay interest on October 1 and April 1. On April 1, 2017, Kalyagin sold $80,000 of Jerris Corp. bonds at 103. Journalize the entries to rec