Question: Jorge Company bottles and distributes B-Lite,

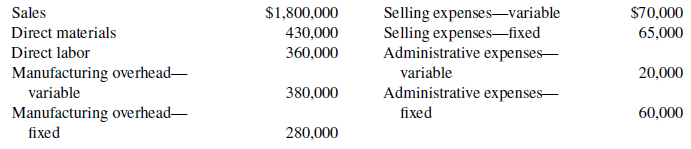

Jorge Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers. For the year 2020, management estimates the following revenues and costs.

Instructions

a. Prepare a CVP income statement for 2020 based on management’s estimates.

b. Compute the break-even point in

(1) units and

(2) dollars.

c. Compute the contribution margin ratio and the margin of safety ratio.

d. Determine the sales dollars required to earn net income of $180,000.

Transcribed Image Text:

Selling expenses–variable Selling expenses–fixed Administrative expenses- $1,800,000 $70,000 65,000 Sales Direct materials 430,000 Direct labor 360,000 Manufacturing overhead- variable variable 20,000 380,000 Administrative expenses- Manufacturing overhead- fixed fixed 60,000 280,000

> Suppose selected financial data of Target and Wal-Mart for 2020 are presented here (in millions). Instructions a. For each company, compute the following ratios. 1. Current ratio. 2. Accounts receivable turnover. 3. Average collection period. 4. Inv

> Alex Company reported the following information for 2020. Additional information: 1. Operating expenses include depreciation expense of $40,000. 2. Land was sold at its book value for cash. 3. Cash dividends of $85,000 were declared and paid in 2020.

> The following financial information is for Priscoll Company. Additional information: 1. Inventory at the beginning of 2019 was $115,000. 2. Accounts receivable (net) at the beginning of 2019 were $86,000. 3. Total assets at the beginning of 2019 were $

> The comparative statements of Wahlberg Company are presented here. All sales were on account. Net cash provided by operating activities for 2020 was $220,000. Capital expenditures were $136,000, and cash dividends were $70,000. Instructions Compute t

> Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019. Instructions a. Prepare a vertical analysis of the 2020 income statement data for Duke Co

> Zumbrunn Company’s income statement contained the following condensed information. Zumbrunn’s balance sheets contained the comparative data at December 31, shown below. Accounts payable pertain to operating expenses

> Data for Whitlock Company are presented in P17.3A. Instructions Prepare the operating activities section of the statement of cash flows using the direct method. Data from P17.3A: The income statement of Whitlock Company is presented here. Whitloc

> Diane Buswell is preparing the 2020 budget for one of Current Designs’ rotomolded kayaks. Extensive meetings with members of the sales department and executive team have resulted in the following unit sales projections for 2020. Quarter 1 …………………….… 1,0

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> Green Pastures is a 400-acre farm on the outskirts of the Kentucky Bluegrass, specializing in the boarding of broodmares and their foals. A recent economic downturn in the thoroughbred industry has made the boarding business extremely competitive. To mee

> Harding Financial Services Company holds a large portfolio of debt and equity securities as an investment. The total fair value of the portfolio at December 31, 2020, is greater than total cost. Some securities have increased in value and others have dec

> Ken Iwig is the president, founder, and majority owner of Olathe Medical Corporation, an emerging medical technology products company. Olathe is in dire need of additional capital to keep operating and to bring several promising products to fi nal develo

> Refer to P19.5A and add the following requirement. Prepare a letter to the president of the company, Shelly Phillips, describing the changes you made. Explain clearly why net income is different after the changes. Keep the following points in mind as you

> (IMA) is an organization dedicated to excellence in the practice of management accounting and financial management. Instructions Go to the IMA’s website to locate the answers to the following questions. a. How many members does the IMA have, and what ar

> The income statement of Whitlock Company is presented here. Additional information: 1. Accounts receivable increased $200,000 during the year, and inventory decreased $500,000. 2. Prepaid expenses increased $150,000 during the year. 3. Accounts payable

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. Use the Master Glossary for determining the proper definitions. a. Discontinued operations. b. Comprehensive income.

> Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Apple’s financial statements are presented in Appendix A. The complete annual report,

> You are a loan officer for White Sands Bank of Taos. Paul Jason, president of P. Jason Corporation, has just left your office. He is interested in an 8-year loan to expand the company’s operations. The borrowed funds would be used to pu

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca- Cola, including the notes to the financial statement

> Wendall Company specializes in producing fashion outfits. On July 31, 2020, a tornado touched down at its factory and general office. The inventories in the warehouse and the factory were completely destroyed as was the general office nearby. Next mornin

> Wesley Corp. is a medium-sized wholesaler of automotive parts. It has 10 stockholders who have been paid a total of $1 million in cash dividends for 8 consecutive years. The board’s policy requires that, for this dividend to be declared, net cash provide

> Quigley Corporation’s trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for the items described below. Unrecorded transactions and adjustments: 1. On January 1, 2020, Quigley issue

> Seacrest Company’s overhead rate was based on estimates of $200,000 for overhead costs and 20,000 direct labor hours. Seacrest’s standards allow 2 hours of direct labor per unit produced. Production in May was 900 units, and actual overhead incurred in M

> Indicate two behavioral principles that pertain to (a) the manager being evaluated and (b) top management.

> The following account balances relate to the stockholders’ equity accounts of Kerbs Corp. at year-end. A small stock dividend was declared and issued in 2020. The result of the stock dividend was to decrease retained earnings by $10,5

> The information shown below was taken from the annual manufacturing overhead cost budget of Connick Company. Variable manufacturing overhead costs ………………………………. $34,650 Fixed manufacturing overhead costs ………………………………….. $19,800 Normal production level i

> Data for Levine Inc. are given in E26.7. Instructions Journalize the entries to record the materials and labor variances. Data from E26.7: Levine Inc., which produces a single product, has prepared the following standard cost sheet for one unit of the

> How do direct fixed costs differ from indirect fixed costs? Are both types of fixed costs controllable?

> How does the output of manufacturing operations differ from that of service operations?

> How do responsibility reports differ from budget reports?

> Using the data in Question 14, what are (a) the total cost of work in process and (b) the cost of goods manufactured? Data from Question 14: Tate Inc. has beginning work in process $26,000, direct materials used $240,000, direct labor $220,000, total ma

> The flexible budget formula is fixed costs $50,000 plus variable costs of $4 per direct labor hour. What is the total budgeted cost at (a) 9,000 hours and (b) 12,345 hours?

> Kaiser Industries carries no inventories. Its product is manufactured only when a customer’s order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2020, Kaiser’s break-even point was $1.3 million. On sa

> Bryant Company has a factory machine with a book value of $90,000 and a remaining useful life of 5 years. It can be sold for $30,000. A new machine is available at a cost of $400,000. This machine will have a 5-year useful life with no salvage value. The

> Jerry Lang is unclear as to the difference between the balance sheets of a merchandising company and a manufacturing company. Explain the difference to Jerry.

> You are provided with the following information regarding events that occurred at Moore Corporation during 2020 or changes in account balances as of December 31, 2020. a. Depreciation expense was $80,000. b. Interest Payable account increased $5,000. c

> Viejol Corporation has collected the following information after its first year of sales. Sales were $1,600,000 on 100,000 units, selling expenses $250,000 (40% variable and 60% fixed), direct materials $490,000, direct labor $290,000, administrative exp

> NuComp Company operates in a state where corporate taxes and workers’ compensation insurance rates have recently doubled. NuComp’s president has just assigned you the task of preparing an economic analysis and making a recommendation relative to moving t

> What factors should be considered in setting (a) the direct materials price standard and (b) the direct materials quantity standard?

> Explain the primary difference between line positions and staff positions, and give examples of each.

> Zeller Company estimates that 2020 sales will be $40,000 in quarter 1, $48,000 in quarter 2, and $58,000 in quarter 3. Cost of goods sold is 50% of sales. Management desires to have ending finished goods inventory equal to 10% of the next quarter’s expec

> Refer back to E27.9 to address the following. Instructions Prepare a memo to Maria Fierro, your supervisor. Show your calculations from E27.9 (a) and (b). In one or two paragraphs, discuss important nonfinancial considerations. Make any assumptions you

> Pine Street Inc. makes unfinished bookcases that it sells for $62. Production costs are $36 variable and $10 fixed. Because it has unused capacity, Pine Street is considering finishing the bookcases and selling them for $70. Variable finishing costs are

> Tanek Corp.’s sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 500,000 units of product: sales $2,500,000,

> During the current month, Standard Corporation completed Job 310 and Job 312. Job 310 cost $70,000 and Job 312 cost $50,000. Job 312 was sold on account for $90,000. Journalize the entries for the completion of the two jobs and the sale of Job 312.

> Manson Industries incurs unit costs of $8 ($5 variable and $3 fixed) in making an assembly part for its finished product. A supplier offers to make 10,000 of the assembly part at $6 per unit. If the offer is accepted, Manson will save all variable costs

> On January 1, 2020, Jade Company issued $2,000,000 face value, 7%, 10-year bonds at $2,147,202. This price resulted in a 6% effective-interest rate on the bonds. Jade uses the effective-interest method to amortize bond premium or discount. The bonds pay

> Match the descriptions that follow with the corresponding terms. Descriptions: 1. Inventory system in which goods are manufactured or purchased just as they are needed for sale. 2. A method of allocating overhead based on each product’s use of activitie

> Founded in 1983 and foreclosed in 1996 Beverly Hills Fan Company was located in Woodland Hills, California. With 23 employees and sales of less than $10 million, the company was relatively small. Management felt that there was potential for growth in the

> A job order cost sheet for Ryan Company is shown below. Instructions a. On the basis of the foregoing data, answer the following questions. 1. What was the balance in Work in Process Inventory on January 1 if this was the only unfinished job? 2. If man

> Pargo Company is preparing its budgeted income statement for 2020. Relevant data pertaining to its sales, production, and direct materials budgets can be found in DO IT! 24.2. In addition, Pargo budgets 0.3 hours of direct labor per unit, labor costs at

> At Bargain Electronics, it costs $30 per unit ($20 variable and $10 fixed) to make an MP3 player that normally sells for $45. A foreign wholesaler off ers to buy 3,000 units at $25 each. Bargain Electronics will incur special shipping costs of $3 per uni

> How may a budget report for the second quarter differ from a budget report for the first quarter?

> How do the content of reports and the verification of reports differ between managerial and financial accounting?

> The Assembly Department for Right pens has the following production data for the current month. Materials are entered at the beginning of the process. The ending work in process units are 70% complete as to conversion costs. Compute the equivalent unit

> Washburn Company produces earbuds. During the year, manufacturing overhead costs are estimated to be $200,000. Estimated machine usage is 2,500 hours. The company assigns overhead based on machine hours. Job No. 551 used 90 machine hours. Compute the pre

> On January 1, 2020, Lock Corporation issued $1,800,000 face value, 5%, 10-year bonds at $1,667,518. This price resulted in an effective-interest rate of 6% on the bonds. Lock uses the effective interest method to amortize bond premium or discount. The bo

> Wise Photography reported net income of $130,000 for 2020. Included in the income statement were depreciation expense of $6,000, amortization expense of $2,000, and a gain on disposal of plant assets of $3,600. Wise’s comparative balanc

> The following information is available for Tomlin Company. Prepare the cost of goods manufactured schedule for the month of April. April 1 April 30 Raw materials inventory Work in process inventory $10,000 $14,000 5,000 3,500 $ 98,000 Materials pur

> Prater Corporation issued $400,000 of 10-year bonds at a discount. Prior to maturity, when the carrying value of the bonds was $390,000, the company redeemed the bonds at 99. Prepare the entry to record the redemption of the bonds.

> Financial Statement Eubank Corporation issues $500,000 of bonds for $520,000. (a) Prepare the journal entry to record the issuance of the bonds, and (b) show how the bonds would be reported on the balance sheet at the date of issuance.

> Vin Diesel owns the Fredonia Barber Shop. He employs four barbers and pays each a base rate of $1,250 per month. One of the barbers serves as the manager and receives an extra $500 per month. In addition to the base rate, each barber also receives a comm

> Pargo Company is preparing its master budget for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are as follows. Sales. Sales for the year are expected to total 1,000,000 units. Quarterly sales are 20%, 25%, 25%, and

> The controller of Rather Production has collected the following monthly expense data for analyzing the cost behavior of electricity costs. Instructions a. Determine the fixed- and variable-cost components using the high-low method. b. What electricity

> Indicate whether the following statements are true or false. 1. Managerial accounting reports focus on manufacturing and nonmanufacturing costs. 2. Financial accounting reports pertain to subunits of the business and are very detailed. 3. Managerial acco

> Natalie has been approached by Ken Thornton, a shareholder of The Beanery Coffee Inc. Ken wants to retire and would like to sell his 1,000 shares in The Beanery Coffee, which represents 30% of all shares issued. The Beanery is currently operated by Ken’s

> The condensed income statement for the Peri and Paul partnership for 2020 is as follows. A cost behavior analysis indicates that 75% of the cost of goods sold are variable, 42% of the selling expenses are variable, and 40% of the administrative expense

> In order to better serve their rural patients, Drs. Joe and Rick Parcells (brothers) began giving safety seminars. Especially popular were their “emergency-preparedness” talks given to farmers. Many people asked whethe

> The following is taken from the Colaw Company balance sheet. Interest is payable annually on January 1. The bonds are callable on any annual interest date. Colaw uses straight-line amortization for any bond premium or discount. From December 31, 2020,

> The Institute of Management Accountants (IMA) sponsors a certification for management accountants, allowing them to obtain the title of Certified Management Accountant. Instructions Go to the IMA website, choose About IMA, choose CMA Certification, and

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> Tom Epps and Mary Jones are examining the following statement of cash flows for Guthrie Company for the year ended January 31, 2020. Tom claims that Guthrie’s statement of cash flows is an excellent portrayal of a superb first year wi

> Florida Beach Company manufactures sunscreen, called NoTan, in 11-ounce plastic bottles. NoTan is sold in a competitive market. As a result, management is very cost-conscious. NoTan is manufactured through two processes: mixing and fi lling. Materials ar

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. What was the amount of net cash pro

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports for Amazon and Wal-Mart, including the notes to the financial st

> The Securities and Exchange Commission (SEC) is the primary regulatory agency of U.S. financial markets. Its job is to ensure that the markets remain fair for all investors. Instructions a. Go to the SEC website and find the definition of the following

> Most publicly traded companies are examined by numerous analysts. These analysts often don’t agree about a company’s future prospects. In this exercise, you will find analysts’ ratings about companies and make comparisons over time and across companies i

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> The following data, presented in alphabetical order, are taken from the records of Nieto Corporation. Accounts payable …………………………………………………………………………………………….. $ 260,000 Accounts receivable …………………………………………………………………………………………….. 140,000 Accumulated deprecia

> The annual report of Apple Inc. is presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. Determine the percentage increase for (1) s

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following: a. What is the definition of long-term obligation? b. What guidance does the Codification provide for the disclosure of long-term obligations?

> Sam Masasi, president of Masasi Corporation, is considering the issuance of bonds to finance an expansion of his business. He has asked you to (1) discuss the advantages of bonds over common stock financing, (2) indicate the types of bonds he might issue

> On January 1, 2018, Glover Corporation issued $2,400,000 of 5-year, 8% bonds at 95. The bonds pay interest annually on January 1. By January 1, 2020, the market rate of interest for bonds of risk similar to those of Glover Corporation had risen. As a res

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. What were Apple’s

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. What is the definition of a trading security? b. What is the definition of an available-for-sale security? c. What is definition of a holding ga

> Will Hardin, the owner-president of Computer Services Company, is unfamiliar with the statement of cash flows that you, as his accountant, prepared. He asks for further explanation. Instructions Write him a brief memo explaining the form and content of

> Fegan Corporation has purchased two securities for its portfolio. The first is a stock investment in Plummer Corporation, one of its suppliers. Fegan purchased 10% of Plummer with the intention of holding it for a number of years, but has no intention of

> The following securities are in Frederick Company’s portfolio of long-term securities at December 31, 2020. On December 31, 2020, the total cost of the portfolio equaled total fair value. Frederick had the following transactions relat

> At the beginning of the question-and-answer portion of the annual stockholders’ meeting of Neosho Corporation, stockholder John Linton asks, “Why did management sell the holdings in JMB Company at a loss when this company has been very profitable during

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> Ratzlaff Company issues (in euros) €2 million, 10-year, 8% bonds at 97, with interest payable annually on January 1. Instructions a. Prepare the journal entry to record the sale of these bonds on January 1, 2020. b. Assuming instead that the above bonds

> Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2020. Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The j

> U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company&

> The wages payable related to the factory workers for Larkin Company during the month of January are $76,000. The employer’s payroll taxes for the factory payroll are $8,000. The fringe benefits to be paid by the employer on this payroll are $6,000. Of th

> An incomplete cost of goods manufactured schedule is presented below. Instructions Complete the cost of goods manufactured schedule for Hobbit Company. Work in process (1/1) $210,000 Direct materials $ ? Raw materials inventory (1/1) Add: Raw mater