Question: The financial statements of Apple Inc. are

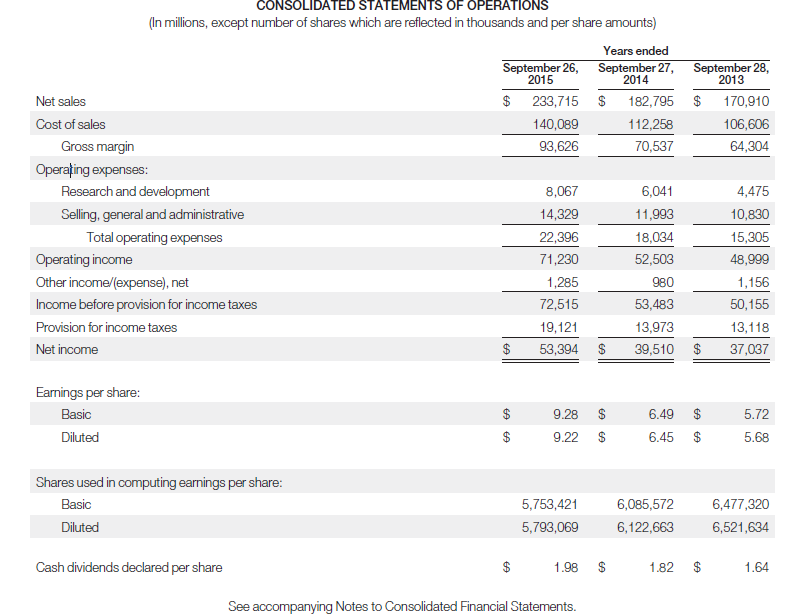

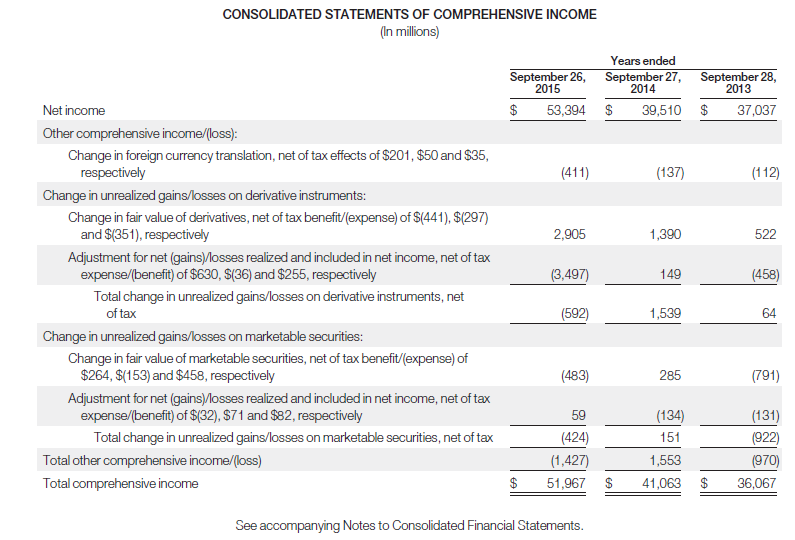

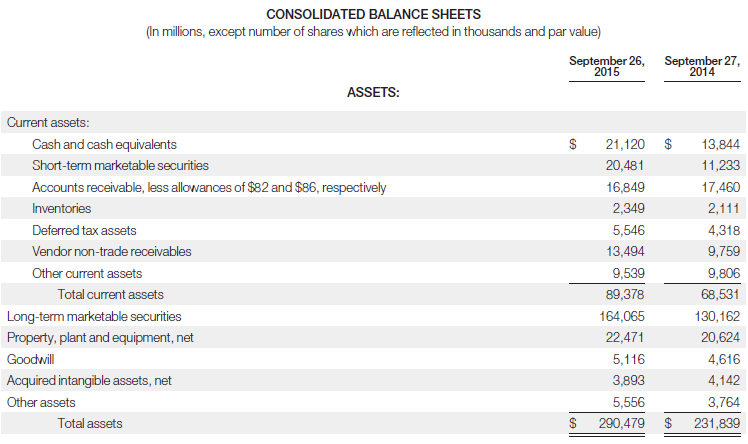

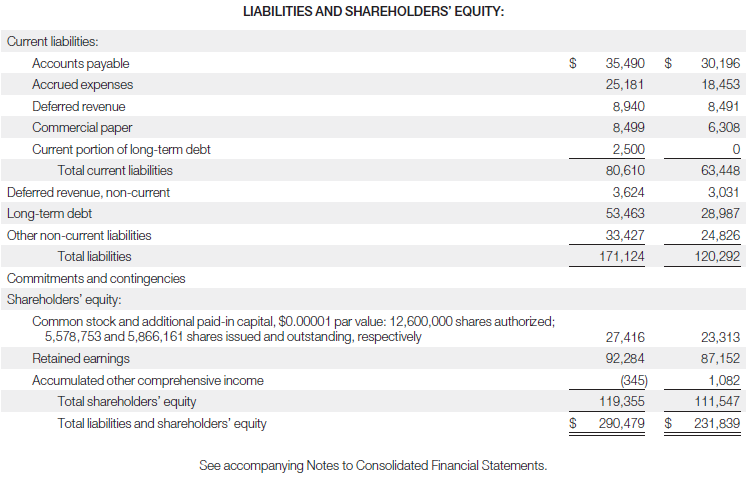

The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website.

Instructions

a. What was the amount of net cash provided by operating activities for the year ended September 26, 2015? For the year ended September 27, 2014?

b. What was the amount of increase or decrease in cash and cash equivalents for the year ended September 26, 2015? For the year ended September 27, 2014?

c. Which method of computing net cash provided by operating activities does Apple use?

d. From your analysis of the 2015 statement of cash flows, did the change in accounts receivable increase or decrease cash? Did the change in inventories increase or decrease cash? Did the change in accounts payable increase or decrease cash?

e. What was the net outflow or inflow of cash from investing activities for the year ended September 26, 2015?

f. What was the amount of income taxes paid in the year ended September 26, 2015?

Apple’s financial statements from Appendix A:

//

//

Transcribed Image Text:

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 26, 2015 September 27, 2014 September 28, 2013 Net sales $ 233,715 182,795 170,910 Cost of sales 140,089 112,258 106,606 Gross margin 93,626 70,537 64,304 Operațing expenses: Research and development 8,067 6,041 4,475 Selling, general and administrative 14,329 11,993 10,830 Total operating expenses 22,396 18,034 15,305 Operating income 71,230 52,503 48,999 Other income/(expense), net 1,285 980 1,156 Income before provision for income taxes 72,515 53,483 50,155 Provision for income taxes 19,121 13,973 13,118 Net income $ 53,394 $ 39,510 $ 37,037 Earnings per share: Basic 9.28 $ 6.49 5.72 Diluted 2$ 9.22 $ 6.45 5.68 Shares used in computing earnings per share: Basic 5,753,421 6,085,572 6,477,320 Diluted 5,793,069 6,122,663 6,521,634 Cash dividends declared per share $ 1.98 1.82 1.64 See accompanying Notes to Consolidated Financial Statements. %24 24 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 26, September 27, 2015 September 28, 2013 2014 Net income $ 53,394 $ 39,510 $ 37,037 Other comprehensive income/loss): Change in foreign currency translation, net of tax effects of $201, $50 and $35, respectively (411) (137) (112) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(441), $(297) and $(351), respectively 2,905 1,390 522 Adjustment for net (gains)losses realized and included in net income, net of tax expense/(benefit) of $630, S(36) and $255, respectively (3,497) 149 (458) Total change in unrealized gains/losses on derivative instruments, net of tax (592) 1,539 64 Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/(expense) of $264, $(153) and $458, respectively (483) 285 (791) Adjustment for net (gains)losses realized and included in net income, net of tax expense/(benefit) of $(32), $71 and $82, respectively (131) (922) 59 (134) Total change in unrealized gains/losses on marketable securities, net of tax (424) 151 Total other comprehensive income/(loss) (1,427) 1,553 (970) Total comprehensive income $ 51,967 $ 41,063 $ 36,067 See accompanying Notes to Consolidated Financial Statements. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 26, 2015 September 27, 2014 ASSETS: Current assets: Cash and cash equivalents 21,120 13,844 Short-term marketable securities 20,481 11,233 Accounts receivable, less allowances of $82 and $86, respectively 16,849 17,460 Inventories 2,349 2,111 Deferred tax assets 5,546 4,318 Vendor non-trade receivables 13,494 9,759 Other current assets 9,539 9,806 Total current assets 89,378 68,531 Long-term marketable securities 164,065 130,162 Property, plant and equipment, net 22,471 20,624 Goodwill 5,116 4,616 Acquired intangible assets, net 3,893 4,142 Other assets 5,556 3,764 Total assets $ 290,479 $ 231,839 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable $ 35,490 30,196 Accrued expenses 25,181 18,453 Deferred revenue 8,940 8,491 Commercial paper 8,499 6,308 Current portion of long-term debt 2,500 Total current liabilities 80,610 63,448 Deferred revenue, non-current 3,624 3,031 Long-term debt 53,463 28,987 Other non-current liabilities 33,427 24,826 Total liabilities 171,124 120,292 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 5,578,753 and 5,866,161 shares issued and outstanding, respectively 27,416 23,313 Retained earnings 92,284 87,152 Accumulated other comprehensive income (345) 1,082 Total shareholders' equity 119,355 111,547 Total liabilities and shareholders' equity $ 290,479 $ 231,839 See accompanying Notes to Consolidated Financial Statements. 24

> The information shown below was taken from the annual manufacturing overhead cost budget of Connick Company. Variable manufacturing overhead costs ………………………………. $34,650 Fixed manufacturing overhead costs ………………………………….. $19,800 Normal production level i

> Data for Levine Inc. are given in E26.7. Instructions Journalize the entries to record the materials and labor variances. Data from E26.7: Levine Inc., which produces a single product, has prepared the following standard cost sheet for one unit of the

> How do direct fixed costs differ from indirect fixed costs? Are both types of fixed costs controllable?

> How does the output of manufacturing operations differ from that of service operations?

> How do responsibility reports differ from budget reports?

> Using the data in Question 14, what are (a) the total cost of work in process and (b) the cost of goods manufactured? Data from Question 14: Tate Inc. has beginning work in process $26,000, direct materials used $240,000, direct labor $220,000, total ma

> The flexible budget formula is fixed costs $50,000 plus variable costs of $4 per direct labor hour. What is the total budgeted cost at (a) 9,000 hours and (b) 12,345 hours?

> Kaiser Industries carries no inventories. Its product is manufactured only when a customer’s order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2020, Kaiser’s break-even point was $1.3 million. On sa

> Bryant Company has a factory machine with a book value of $90,000 and a remaining useful life of 5 years. It can be sold for $30,000. A new machine is available at a cost of $400,000. This machine will have a 5-year useful life with no salvage value. The

> Jerry Lang is unclear as to the difference between the balance sheets of a merchandising company and a manufacturing company. Explain the difference to Jerry.

> You are provided with the following information regarding events that occurred at Moore Corporation during 2020 or changes in account balances as of December 31, 2020. a. Depreciation expense was $80,000. b. Interest Payable account increased $5,000. c

> Viejol Corporation has collected the following information after its first year of sales. Sales were $1,600,000 on 100,000 units, selling expenses $250,000 (40% variable and 60% fixed), direct materials $490,000, direct labor $290,000, administrative exp

> NuComp Company operates in a state where corporate taxes and workers’ compensation insurance rates have recently doubled. NuComp’s president has just assigned you the task of preparing an economic analysis and making a recommendation relative to moving t

> What factors should be considered in setting (a) the direct materials price standard and (b) the direct materials quantity standard?

> Explain the primary difference between line positions and staff positions, and give examples of each.

> Zeller Company estimates that 2020 sales will be $40,000 in quarter 1, $48,000 in quarter 2, and $58,000 in quarter 3. Cost of goods sold is 50% of sales. Management desires to have ending finished goods inventory equal to 10% of the next quarter’s expec

> Refer back to E27.9 to address the following. Instructions Prepare a memo to Maria Fierro, your supervisor. Show your calculations from E27.9 (a) and (b). In one or two paragraphs, discuss important nonfinancial considerations. Make any assumptions you

> Pine Street Inc. makes unfinished bookcases that it sells for $62. Production costs are $36 variable and $10 fixed. Because it has unused capacity, Pine Street is considering finishing the bookcases and selling them for $70. Variable finishing costs are

> Tanek Corp.’s sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 500,000 units of product: sales $2,500,000,

> During the current month, Standard Corporation completed Job 310 and Job 312. Job 310 cost $70,000 and Job 312 cost $50,000. Job 312 was sold on account for $90,000. Journalize the entries for the completion of the two jobs and the sale of Job 312.

> Manson Industries incurs unit costs of $8 ($5 variable and $3 fixed) in making an assembly part for its finished product. A supplier offers to make 10,000 of the assembly part at $6 per unit. If the offer is accepted, Manson will save all variable costs

> On January 1, 2020, Jade Company issued $2,000,000 face value, 7%, 10-year bonds at $2,147,202. This price resulted in a 6% effective-interest rate on the bonds. Jade uses the effective-interest method to amortize bond premium or discount. The bonds pay

> Match the descriptions that follow with the corresponding terms. Descriptions: 1. Inventory system in which goods are manufactured or purchased just as they are needed for sale. 2. A method of allocating overhead based on each product’s use of activitie

> Jorge Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers. For the year 2020, management estimates the following revenues and costs. Instructions a. Prepare a CVP income statemen

> Founded in 1983 and foreclosed in 1996 Beverly Hills Fan Company was located in Woodland Hills, California. With 23 employees and sales of less than $10 million, the company was relatively small. Management felt that there was potential for growth in the

> A job order cost sheet for Ryan Company is shown below. Instructions a. On the basis of the foregoing data, answer the following questions. 1. What was the balance in Work in Process Inventory on January 1 if this was the only unfinished job? 2. If man

> Pargo Company is preparing its budgeted income statement for 2020. Relevant data pertaining to its sales, production, and direct materials budgets can be found in DO IT! 24.2. In addition, Pargo budgets 0.3 hours of direct labor per unit, labor costs at

> At Bargain Electronics, it costs $30 per unit ($20 variable and $10 fixed) to make an MP3 player that normally sells for $45. A foreign wholesaler off ers to buy 3,000 units at $25 each. Bargain Electronics will incur special shipping costs of $3 per uni

> How may a budget report for the second quarter differ from a budget report for the first quarter?

> How do the content of reports and the verification of reports differ between managerial and financial accounting?

> The Assembly Department for Right pens has the following production data for the current month. Materials are entered at the beginning of the process. The ending work in process units are 70% complete as to conversion costs. Compute the equivalent unit

> Washburn Company produces earbuds. During the year, manufacturing overhead costs are estimated to be $200,000. Estimated machine usage is 2,500 hours. The company assigns overhead based on machine hours. Job No. 551 used 90 machine hours. Compute the pre

> On January 1, 2020, Lock Corporation issued $1,800,000 face value, 5%, 10-year bonds at $1,667,518. This price resulted in an effective-interest rate of 6% on the bonds. Lock uses the effective interest method to amortize bond premium or discount. The bo

> Wise Photography reported net income of $130,000 for 2020. Included in the income statement were depreciation expense of $6,000, amortization expense of $2,000, and a gain on disposal of plant assets of $3,600. Wise’s comparative balanc

> The following information is available for Tomlin Company. Prepare the cost of goods manufactured schedule for the month of April. April 1 April 30 Raw materials inventory Work in process inventory $10,000 $14,000 5,000 3,500 $ 98,000 Materials pur

> Prater Corporation issued $400,000 of 10-year bonds at a discount. Prior to maturity, when the carrying value of the bonds was $390,000, the company redeemed the bonds at 99. Prepare the entry to record the redemption of the bonds.

> Financial Statement Eubank Corporation issues $500,000 of bonds for $520,000. (a) Prepare the journal entry to record the issuance of the bonds, and (b) show how the bonds would be reported on the balance sheet at the date of issuance.

> Vin Diesel owns the Fredonia Barber Shop. He employs four barbers and pays each a base rate of $1,250 per month. One of the barbers serves as the manager and receives an extra $500 per month. In addition to the base rate, each barber also receives a comm

> Pargo Company is preparing its master budget for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are as follows. Sales. Sales for the year are expected to total 1,000,000 units. Quarterly sales are 20%, 25%, 25%, and

> The controller of Rather Production has collected the following monthly expense data for analyzing the cost behavior of electricity costs. Instructions a. Determine the fixed- and variable-cost components using the high-low method. b. What electricity

> Indicate whether the following statements are true or false. 1. Managerial accounting reports focus on manufacturing and nonmanufacturing costs. 2. Financial accounting reports pertain to subunits of the business and are very detailed. 3. Managerial acco

> Natalie has been approached by Ken Thornton, a shareholder of The Beanery Coffee Inc. Ken wants to retire and would like to sell his 1,000 shares in The Beanery Coffee, which represents 30% of all shares issued. The Beanery is currently operated by Ken’s

> The condensed income statement for the Peri and Paul partnership for 2020 is as follows. A cost behavior analysis indicates that 75% of the cost of goods sold are variable, 42% of the selling expenses are variable, and 40% of the administrative expense

> In order to better serve their rural patients, Drs. Joe and Rick Parcells (brothers) began giving safety seminars. Especially popular were their “emergency-preparedness” talks given to farmers. Many people asked whethe

> The following is taken from the Colaw Company balance sheet. Interest is payable annually on January 1. The bonds are callable on any annual interest date. Colaw uses straight-line amortization for any bond premium or discount. From December 31, 2020,

> The Institute of Management Accountants (IMA) sponsors a certification for management accountants, allowing them to obtain the title of Certified Management Accountant. Instructions Go to the IMA website, choose About IMA, choose CMA Certification, and

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> Tom Epps and Mary Jones are examining the following statement of cash flows for Guthrie Company for the year ended January 31, 2020. Tom claims that Guthrie’s statement of cash flows is an excellent portrayal of a superb first year wi

> Florida Beach Company manufactures sunscreen, called NoTan, in 11-ounce plastic bottles. NoTan is sold in a competitive market. As a result, management is very cost-conscious. NoTan is manufactured through two processes: mixing and fi lling. Materials ar

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports for Amazon and Wal-Mart, including the notes to the financial st

> The Securities and Exchange Commission (SEC) is the primary regulatory agency of U.S. financial markets. Its job is to ensure that the markets remain fair for all investors. Instructions a. Go to the SEC website and find the definition of the following

> Most publicly traded companies are examined by numerous analysts. These analysts often don’t agree about a company’s future prospects. In this exercise, you will find analysts’ ratings about companies and make comparisons over time and across companies i

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> The following data, presented in alphabetical order, are taken from the records of Nieto Corporation. Accounts payable …………………………………………………………………………………………….. $ 260,000 Accounts receivable …………………………………………………………………………………………….. 140,000 Accumulated deprecia

> The annual report of Apple Inc. is presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. Determine the percentage increase for (1) s

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following: a. What is the definition of long-term obligation? b. What guidance does the Codification provide for the disclosure of long-term obligations?

> Sam Masasi, president of Masasi Corporation, is considering the issuance of bonds to finance an expansion of his business. He has asked you to (1) discuss the advantages of bonds over common stock financing, (2) indicate the types of bonds he might issue

> On January 1, 2018, Glover Corporation issued $2,400,000 of 5-year, 8% bonds at 95. The bonds pay interest annually on January 1. By January 1, 2020, the market rate of interest for bonds of risk similar to those of Glover Corporation had risen. As a res

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. What were Apple’s

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. What is the definition of a trading security? b. What is the definition of an available-for-sale security? c. What is definition of a holding ga

> Will Hardin, the owner-president of Computer Services Company, is unfamiliar with the statement of cash flows that you, as his accountant, prepared. He asks for further explanation. Instructions Write him a brief memo explaining the form and content of

> Fegan Corporation has purchased two securities for its portfolio. The first is a stock investment in Plummer Corporation, one of its suppliers. Fegan purchased 10% of Plummer with the intention of holding it for a number of years, but has no intention of

> The following securities are in Frederick Company’s portfolio of long-term securities at December 31, 2020. On December 31, 2020, the total cost of the portfolio equaled total fair value. Frederick had the following transactions relat

> At the beginning of the question-and-answer portion of the annual stockholders’ meeting of Neosho Corporation, stockholder John Linton asks, “Why did management sell the holdings in JMB Company at a loss when this company has been very profitable during

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> Ratzlaff Company issues (in euros) €2 million, 10-year, 8% bonds at 97, with interest payable annually on January 1. Instructions a. Prepare the journal entry to record the sale of these bonds on January 1, 2020. b. Assuming instead that the above bonds

> Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2020. Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The j

> U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company&

> The wages payable related to the factory workers for Larkin Company during the month of January are $76,000. The employer’s payroll taxes for the factory payroll are $8,000. The fringe benefits to be paid by the employer on this payroll are $6,000. Of th

> An incomplete cost of goods manufactured schedule is presented below. Instructions Complete the cost of goods manufactured schedule for Hobbit Company. Work in process (1/1) $210,000 Direct materials $ ? Raw materials inventory (1/1) Add: Raw mater

> National Express reports the following costs and expenses in June 2020 for its delivery service. Instructions Determine the total amount of (a) delivery service (product) costs and (b) period costs. $ 6,400 11,200 Advertising Indirect materials Dri

> Gala Company is a manufacturer of laptop computers. Various costs and expenses associated with its operations are as follows. 1. Property taxes on the factory building. 2. Production superintendents’ salaries. 3. Memory boards and chips used in assemblin

> Heidebrecht Design acquired 20% of the outstanding common stock of Quayle Company on January 1, 2020, by paying $800,000 for the 30,000 shares. Quayle declared and paid $0.30 per share cash dividends on March 15, June 15, September 15, and December 15, 2

> Keisha Tombert, the bookkeeper for Washington Consulting, a political consulting firm, has recently completed a managerial accounting course at her local college. One of the topics covered in the course was the cost of goods manufactured schedule. Keisha

> Incomplete manufacturing cost data for Horizon Company for 2020 are presented as follows for four different situations. Instructions a. Indicate the missing amount for each letter. b. Prepare a condensed cost of goods manufactured schedule for situatio

> Justin Bleeber has prepared the following list of statements about managerial accounting, financial accounting, and the functions of management. 1. Financial accounting focuses on providing information to internal users. 2. Staff positions are directly i

> Lendell Company has these comparative balance sheet data: Additional information for 2020: 1. Net income was $25,000. 2. Sales on account were $375,000. Sales returns and allowances amounted to $25,000. 3. Cost of goods sold was $198,000. 4. Net cash p

> Nordstrom, Inc. operates department stores in numerous states. Suppose selected financial statement data (in millions) for 2020 are presented below. For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash

> Suppose the comparative balance sheets of Nike, Inc. are presented here. Instructions a. Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as well.) b. Prepare a vertical an

> Here is financial information for Glitter Inc. Instructions Prepare a schedule showing a horizontal analysis for 2020, using 2019 as the base year. December 31, 2020 December 31, 2019 Current assets $106,000 $ 90,000 Plant assets (net) 400,000 350,

> Lorance Corporation issued $400,000, 7%, 20-year bonds on January 1, 2020, for $360,727. This price resulted in an effective-interest rate of 8% on the bonds. Interest is payable annually on January 1. Lorance uses the effective-interest method to amorti

> Gridley Company issued $800,000, 11%, 10-year bonds on December 31, 2019, for $730,000. Interest is payable annually on December 31. Gridley Company uses the straight-line method to amortize bond premium or discount. Instructions Prepare the journal ent

> Comparative balance sheets for International Company are presented as follows. Additional information: 1. Net income for 2020 was $135,000. 2. Cash dividends of $70,000 were declared and paid. 3. Bonds payable amounting to $50,000 were redeemed for ca

> On December 31, 2020, Turnball Associates owned the following securities, held as a long-term investment. The securities are not held for influence or control of the investee. On December 31, 2020, the total fair value of the securities was equal to it

> The following information is taken from the 2020 general ledger of Swisher Company. Instructions In each case, compute the amount that should be reported in the operating activities section of the statement of cash flows under the direct method. Re

> The condensed financial statements of Ness Company for the years 2019 and 2020 are presented below. Compute the following ratios for 2020 and 2019. a. Current ratio. b. Inventory turnover. (Inventory on December 31, 2018, was $340.) c. Profit margin.

> Panza Corporation experienced a fire on December 31, 2020, in which its financial records were partially destroyed. It has been able to salvage some of the records and has ascertained the following balances. Additional information: 1. The inventory tur

> Here is the income statement for Myers, Inc. Additional information: 1. Common stock outstanding January 1, 2020, was 32,000 shares, and 40,000 shares were outstanding at December 31, 2020. 2. The market price of Myers stock was $14 at December 31, 202

> For its fiscal year ending October 31, 2020, Haas Corporation reports the following partial data shown below. The loss on discontinued operations was comprised of a $50,000 loss from operations and a $70,000 loss from disposal. The income tax rate is 2

> Here are comparative balance sheets for Velo Company. indirect method Additional information: 1. Net income for 2020 was $93,000. 2. Cash dividends of $35,000 were declared and paid. 3. Bonds payable amounting to $50,000 were redeemed for cash $50,000.

> Rojas Corporation’s comparative balance sheets are presented below. Additional information: 1. Net income was $22,630. Dividends declared and paid were $19,500. 2. No noncash investing and financing activities occurred during 2020. 3.

> The following three accounts appear in the general ledger of Herrick Corp. during 2020. Instructions From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The loss on disposa

> The following information is available for Stamos Corporation for the year ended December 31, 2020. Beginning cash balance …………………………………………………………. $ 45,000 Accounts payable decrease …………………………………………………………. 3,700 Depreciation expense ……………………………………………………

> The current sections of Scoggin Inc.’s balance sheets at December 31, 2019 and 2020, are presented here. Scoggin’s net income for 2020 was $153,000. Depreciation expense was $24,000. Instructions Prepare the net cash

> In January 2020, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and equity securities. During the year, the following transactions occurred. Feb. 1 Purchased 600 shares of Muninger com

> Gutierrez Company reported net income of $225,000 for 2020. Gutierrez also reported depreciation expense of $45,000 and a loss of $5,000 on the disposal of plant assets. The comparative balance sheet shows a decrease in accounts receivable of $15,000 for