Question: Journalize the adjusting entry needed on December

Journalize the adjusting entry needed on December 31, the end of the current accounting period, for each of the following independent cases affecting Tiger Corp. Include an explanation for each entry.

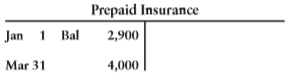

a. Details of Prepaid Insurance are shown in the account:

Tiger prepays insurance on March 31 each year. At December 31, $1,800 is still prepaid.

b. Tiger pays employees each Friday. The amount of the weekly payroll is $5,900 for a ï¬ve-day work week. The current accounting period ends on Thursday.

c. Tiger has a note receivable. During the current year, Tiger has earned accrued interest revenue of $500 that it will collect next year.

d. The beginning balance of supplies was $3,100. During the year, Tiger purchased supplies costing $6,100, and at December 31 supplies on hand total $2,300.

e. Tiger is providing services for Dolphin Investments, and the owner of Dolphin paid Tiger $11,500 as the annual service fee. Tiger recorded this amount as Unearned Service Revenue. Tiger estimates that it has earned 70% of the total fee during the current year.

f. Depreciation for the current year includes Office Furniture, $3,800, and Equipment, $6,100. Make a compound entry.

Transcribed Image Text:

Prepaid Insurance Jan 1 Bal 2,900 Mar 31 4,000

> Northeastern Energy Company’s balance sheet includes the asset Iron Ore Rights. Northeastern Energy paid $2.9 million cash for the right to work a mine that contained an estimated 225,000 tons of ore. The company paid $68,000 to remove unwanted buildings

> Hometown Sales, Inc., sells electronics and appliances. The excerpts that follow are adapted from Hometown Sales’ financial statements for 2016 and 2015: Requirements 1. How much was Hometown Sales’s cost of plant

> On January 2, 2016, Smythe Co. paid $255,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,500, sales tax of $6,600, and $31,900 for a special platform on which to place the computer. Smythe’s manageme

> Tucker, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Tucker completed the following transactions: Requirement 1. Record the transactions

> Donatello Lake Resort reported the following on its balance sheet at December 31, 2016: In early July 2017, the resort expanded operations and purchased additional equipment for cash at a cost of $109,000. The company depreciates buildings by the strai

> Assume Royale House, Inc., opened an office in Urbana, Illinois. Royale House incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: Assume Royale House depreciates buildings ov

> Cook Corporation reported the following related to property and equipment (all in millions): From the balance sheets: From the investing activities section of the 2016 cash flow statement: Cash used to purchase property and equipmentâ€&brvba

> Shopper’s World operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending December 31, 2015: Requirements 1. Compute net profit margin ratio

> At the end of 2015, Chesapeake Energy had total assets of $17.2 billion and total liabilities of $9.8 billion. Included among the assets were property, plant, and equipment with a cost of $4.7 billion and accumulated depreciation of $2.8 billion. Chesape

> Southwestern Energy Company’s balance sheet includes the asset Iron Ore Rights. Southwestern Energy paid $2.2 million cash for the right to work a mine that contained an estimated 190,000 tons of ore. The company paid $61,000 to remove unwanted buildings

> Sweet Stores, Inc., sells electronics and appliances. The excerpts that follow are adapted from Sweet Stores’ financial statements for 2016 and 2015. Requirements 1. How much was Sweet Stores’ cost of plant assets

> On January 3, 2016, Wayne Co. paid $280,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,900, sales tax of $7,000, and $28,600 for a special platform on which to place the computer. Wayne’s management

> Carr, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Carr completed the following transactions: Requirement 1. Record the transactions in Ca

> Romano Lake Resort reported the following on its balance sheet at December 31, 2016: In early July 2017, the resort expanded operations and purchased additional equipment for cash at a cost of $105,000. The company depreciates buildings by the straight

> Assume Bowler Supply, Inc., opened an office in Dublin, Ohio. Bowler Supply incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: Assume Bowler Supply depreciates buildings ove

> The accounting records of Columbia Home Store show these data (in millions). The shareholders are very happy with Columbia’s steady increase in net income. Auditors discovered that the ending inventory for 2014 was understated by $6 m

> Maroney’s Convenience Stores’ income statement for the year ended December 31, 2015, and its balance sheet as of December 31, 2015, reported the following: The business is organized as a proprietorship, so it pays

> Assume Thompson Company, a camera store, lost some inventory in a fire on July 15. To file an insurance claim, Thompson Company must estimate its July 15 inventory by the gross profit method. Assume that for t

> Frosted Donut, Inc., and Coffee Bean Corporation are both specialty food chains. The two companies reported these figures, in millions: Requirements 1. Compute the gross profit percentage and the rate of inventory turnover for Frosted

> Mahtomedi Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Mahtomedi’s suppliers to lower the prices that Mahtomedi will pay when it

> The records of Buzz Aviation include the following accounts for inventory of aviation parts at July 31 of the current year: Requirements 1. Prepare a partial income statement through gross profit under the average, FIFO, and LIFO methods. Round averag

> Military Surplus began May 2016 with 80 stoves that cost $20 each. During the month, Military Surplus made the following purchases at cost: Military Surplus sold 286 stoves, and at May 31, the ending inventory consists of 64 stoves. The sale price of e

> Assume a Cross Country Sports outlet store began March 2016 with 49 pairs of running shoes that cost the store $35 each. The sale price of these shoes was $70. During March, the store completed these inventory transactions: Requirements 1. The precedin

> Super Value purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Super Value ends each January 31. Assume you are dealing with a single Super Value store in Madison, Wisconsin. The Madison sto

> The accounting records of Brilliant Home Store show these data (in millions). The shareholders are very happy with Brilliant’s steady increase in net income. Auditors discovered that the ending inventory for 2014 was understated by $4

> Gary’s Convenience Stores’ income statement for the year ended December 31, 2015, and its balance sheet as of December 31, 2015, reported the following: The business is organized as a proprietorship, so it pays no c

> Assume Watertown Company, a camera store, lost some inventory in a fire on March 15. To file an insurance claim, Watertown Company must estimate its March 15 inventory by the gross profit method. Assume that f

> Pastry People, Inc., and Captain Coffee Corporation are both specialty food chains. The two companies reported these figures, in millions: Requirements 1. Compute the gross profit percentage and the rate of inventory turnover for Past

> Dixson Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Dixson’s suppliers to lower the prices that Dixson will pay when it replaces

> The records of Aldrin Aviation include the following accounts for inventory of aviation parts at July 31 of the current year: Requirements 1. Prepare a partial income statement through gross profit under the average, FIFO, and LIFO methods. Round aver

> Armed Forces Surplus began March 2016 with 80 tents that cost $15 each. During the month, Armed Forces Surplus made the following purchases at cost: Armed Forces Surplus sold 296 tents, and at March 31, the ending inventory consists of 54 tents. The sa

> Assume a Watercrest Sports outlet store began October 2016 with 47 pairs of running shoes that cost the store $38 each. The sale price of these shoes was $67. During October, the store completed these inventory transactions: Requirements 1. The preced

> Big Box purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Big Box ends each January 31. Assume you are dealing with a single Big Box store in Rosedale, Minnesota. The Rosedale store began t

> The comparative financial statements of Gold Pools, Inc., for 2017, 2016, and 2015 included the following select data: Requirements 1. Compute these ratios for 2017 and 2016: a. Current ratio b. Quick (acid-test) ratio c. Daysâ

> Quick Meals completed the following selected transactions: Requirements 1. Record the transactions in Quick Meals’ journal. Assume that no sales returns are expected. Round all amounts to the nearest dollar. Explanations are not requ

> Assume Spahr and Kennedy, the accounting firm, advises Arctic Seafood that its financial statement must be changed to conform to GAAP. At December 31, 2016, Arctic’s accounts include the following: The ac

> The September 30, 2017, records of Media Communications include these accounts: During the year, Media Communications estimates doubtful-account expense at 1% of credit sales. At year-end (December 31), the company ages its receivables and adjusts the

> This problem takes you through the accounting for sales, receivables, uncollectibles, and notes receivable for Henderson Shipping Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At

> Carson Computer Solutions makes all sales on account, so virtually all cash receipts arrive in the mail. Jeannette Carson, the company president, has just returned from a trade association meeting with new ideas for the business. Among other things, Cars

> During the fourth quarter of 2016, Zinner, Inc., generated excess cash, which the company invested in trading securities as follows: Requirements 1. Open T-accounts for Cash (including its beginning balance of $15,000), Investment in Trading Securitie

> The comparative financial statements of Kenmore Pools, Inc., for 2017, 2016, and 2015 included the following select data: Requirements 1. Compute these ratios for 2017 and 2016: a. Current ratio b. Quick (acid-test) ratio c. Days&aci

> Hughes Foods completed the following selected transactions. Requirements 1. Record the transactions in Hughes Foods’ journal. Assume that no sales returns are expected. Round all amounts to the nearest dollar. Explanations are not re

> During the fourth quarter of 2016, Abbott, Inc., generated excess cash, which the company invested in trading securities as follows: Requirements 1. Open T-accounts for Cash (including its beginning balance of $19,000), Investment in Trading Securitie

> This problem demonstrates the effects of transactions on the current ratio and the debt ratio of Digger Company. Digger’s condensed and adapted balance sheet at December 31, 2015, follows: Assume that during the first quarter of the f

> Refer back to Problem 3-72B. Requirements 1. Use the Spa View Services data in Problem 3-72B to prepare the company’s classified balance sheet at January 31, 2016. Show captions for total assets, total liabilities, and stockholders’ equ

> The accounts of Spa View Service, Inc., at January 31, 2016, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Spa View’s clo

> The adjusted trial balance for the year of Schneider Corporation at December 31, 2016, follows: Requirements 1. Prepare Schneider Corporation’s 2016 single-step income statement, statement of retained earnings, and balance sheet. Lis

> Peppertree Rentals, Inc.’s, unadjusted and adjusted trial balances at June 30, 2016, follow: Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute Peppertree Rentals&a

> Consider the unadjusted trial balance of Edison, Inc., at December 31, 2016, and the related month-end adjustment data. Adjustment data at December 31, 2016, include the following: a. Accrued service revenue at December 31, $2,780. b. Prepaid rent ex

> Whittaker Consulting had the following selected transactions in July: Requirements 1. Show how each transaction would be handled (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Compute July income (loss)

> This problem demonstrates the effects of transactions on the current ratio and the debt ratio of Hartford Company. Hartford’s condensed and adapted balance sheet at December 31, 2016, follows: Assume that during the first quarter of t

> Refer back to Problem 3-64A. Requirements 1. Use the Granger Services data in Problem 3-64A to prepare the company’s classified balance sheet at January 31, 2016. Show captions for total assets, total liabilities, and total liabilities and st

> The accounts of Granger Services, Inc., at January 31, 2016, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Granger’s clo

> The adjusted trial balance for the year of Nicholl Corporation at October 31, 2016, follows. Requirements 1. Prepare Nicholl Corporation’s 2016 single-step income statement, statement of retained earnings, and balance sheet. List exp

> Lemontree Rentals, Inc.’s, unadjusted and adjusted trial balances at June 30, 2016, follow. Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute Lemontree Rentals&aci

> Consider the unadjusted trial balance of Spateness, Inc., at December 31, 2016, and the related month-end adjustment data. Adjustment data at December 31, 2016: a. Accrued service revenue at December 31, $3,960. b. Prepaid rent expired during the mon

> Journalize the adjusting entry needed on December 31, the end of the current accounting period, for each of the following independent cases affecting Woolton Corporation. Include an explanation for each entry. a. Details of Prepaid Insurance are shown i

> Masters Consulting had the following selected transactions in October: Requirements 1. Show how each transaction would be handled (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Compute October income (l

> accounts; construct and use a trial balance) During the first month of operations (May 2016), Spahr Music Corporation completed the following selected transactions: a. The business received cash of $50,000 and a building with a fair value of $106,000.

> During the first month of operations, Gagne Services, Inc., completed the following transactions: Requirements 1. Record each transaction in the journal. Be sure to record the date in each entry. Explanations are not required. 2. Post

> This problem can be used in conjunction with Problem 2-66B. Refer to Problem 2-66B. Requirements 1. Journalize the transactions of Willis Computing, Inc. Explanations are not required. 2. Prepare T-accounts for each account. Insert in each T-account

> The following amounts summarize the financial position of Willis Computing, Inc., on October 31, 2016: During November 2016, the business completed these transactions: a. The business received cash of $3,900 and issued common stock. b

> The trial balance of Larrabee Design, Inc., follows: Amy Swoboda, your best friend, is considering making an investment in Larrabee Design, Inc. Amy seeks your advice in interpreting the company’s information. Specifica

> During the first month of operations (April 2016), Stein Music Services Corporation completed the following selected transactions: a. The business received cash of $44,000 and a building with a fair value of $106,000. The corporation issued common stock

> During the first month of operations, Martinson Services, Inc., completed the following transactions: Requirements 1. Record each transaction in the journal. Be sure to record the date in each entry. Explanations are not required. 2. P

> This problem can be used in conjunction with Problem 2-61A. Refer to Problem 2-61A. Requirements 1. Journalize the October transactions of Rodriguez Computing, Inc. Explanations are not required. 2. Prepare T-Accounts for each account. Insert in each

> The following amounts summarize the financial position of Rodriguez Computing, Inc., on September 30, 2016: During October 2016, Rodriguez Computing completed these transactions: a. The business received cash of $3,800 and issued common

> The trial balance of Amusement Specialties, Inc., follows: Vicki Gutierrez, your best friend, is considering investing in Amusement Specialties, Inc. Vicki seeks your advice in interpreting the company’s information. Speciï¬&

> Summarized versions of Nettleton Corporation’s financial statements are given for two recent years: Requirement 1. Complete Nettleton Corporation’s financial statements by determining the missing amou

> The following data come from the financial statements of Salem Water Company for the year ended March 31, 2017 (in millions): Requirements 1. Prepare a cash flow statement for the year ended March 31, 2017. Not all the items given appea

> The assets and liabilities of Blue Moon Products, Inc., as of December 31, 2016, and revenues and expenses for the year ended on that date follow: Beginning retained earnings was $364,500, and dividends declared totaled $108,000 for the year. Requirem

> Billy Higgins is a realtor. He organized his business as a corporation on June 16, 2017. The business received $65,000 from Higgins and issued common stock. Consider these facts as of June 30, 2017. a. Higgins has $14,000 in his personal bank account an

> The manager of Candace Design, Inc., prepared the company’s balance sheet as of June 30, 2016, while the accountant was ill. The balance sheet contains numerous errors. In particular, the manager knew that the balance sheet should balan

> Compute the missing amount (?) for each company—amounts in millions. Which company has the ■highest net income? ■highest percent of net income to revenues? Pearl Co. Loomis Co. Bryant Corp.

> Summarized versions of Santos Corporation’s financial statements are given for two recent years. Requirement 1. Complete Santos Corporation’s financial statements by determining the missing amounts de

> The following data come from the financial statements of Riley Company for the year ended March 31, 2017 (in millions): Requirements 1. Prepare a cash flow statement for the year ended March 31, 2017. Not all items given appear on the c

> The assets and liabilities of Beckwith Garden Supply, Inc., as of December 31, 2016, and revenues and expenses for the year ended on that date follow: Beginning retained earnings was $364,200, and dividends declared totaled $106,000 for the year. Req

> Caden Healey is a realtor. He organized the business as a corporation on December 16, 2017. The business received $60,000 cash from Healey and issued common stock. Consider the following facts as of December 31, 2017: a. Healey has $12,000 in his person

> The manager of Salem News, Inc., prepared the company’s balance sheet as of October 31, 2016, while the accountant was ill. The balance sheet contains numerous errors. In particular, the manager knew that the balance sheet should balanc

> Compute the missing amount (?) for each company—amounts in millions. At the end of the year, which company has the ■highest net income? ■highest percent of net income to revenues? Crystal Co

> Assume Williams & Sellers, the accounting firm, advises Ocean Mist Seafood that its financial statements must be changed to conform to GAAP. At December 31, 2016, Ocean Mist’s accounts include the follo

> The September 30, 2017, records of First Data Communications include these accounts: During the year, First Data Communications estimates doubtful-account expense at 1% of credit sales. At year-end (December 31), the company ages its receivables and ad

> This problem takes you through the accounting for sales, receivables, uncollectibles, and notes receivable for Bates Delivery Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At Oct

> Bogoda Industries makes all sales on account. Ian Holt, accountant for the company, receives and opens incoming mail. Company procedure requires Holt to separate customer checks from the remittance slips, which list the amounts that Holt posts as credits

> Mark Farmer, chief financial officer of Carvel Wireless, is responsible for the company’s budgeting process. Farmer’s staff is preparing the Carvel cash budget for 2017. A key input to the budgeting proc

> The cash data of Duffy Automotive for July 2016 follow: Duffy Automotive received the following bank statement on July 31, 2016: Additional data for the bank reconciliation include the following: a. The EFT deposit was a receipt of monthly rent. Th

> Each of the following situations reveals an internal control weakness: Situation a. In evaluating the internal control over cash payments of Arlington Manufacturing, an auditor learns that the purchasing agent is responsible for purchasing diamonds for

> Swedish Imports is an importer of silver, brass, and furniture items from Sweden. Sandra Gustafson is the general manager of Swedish Imports. Gustafson employs two other people in the business. Mandy Martin serves as the buyer for Swedish Imports. In her

> Julia Beecher, chief financial officer of Keller Wireless, is responsible for the company’s budgeting process. Beecher’s staff is preparing the Keller Wireless cash budget for 2017. A key input to the bu

> The cash data of Dunlap Automotive for June 2016 follow: Dunlap Automotive received the following bank statement on June 30, 2016: Additional data for the bank reconciliation include the following: a. The EFT deposit was a receipt of monthly rent.

> Each of the following situations reveals an internal control weakness: a. In evaluating the internal control over cash payments of Judd Manufacturing, an auditor learns that the purchasing agent is responsible for purchasing diamonds for use in the comp

> Irish Imports is an importer of silver, brass, and furniture items from Ireland. Patricia O’Malley is the general manager of Irish Imports. O’Malley employs two other people in the business. Maureen Kennedy serves as the buyer for Irish Imports. In her w

> The notes are part of the financial statements. They give details that would clutter the statements. This case will help you learn to use a company’s inventory notes. Refer to Apple Inc.’s consolidated financial statements and related notes in Appendix A a

> Refer to Apple Inc.’s consolidated financial statements in Appendix A and online in the filings section of http://www.sec.gov. Requirements 1. Examine the account “Short-term marketable securities” in the consolidated balance sheets, as well as related

> Refer to Under Armour, Inc.’s, consolidated financial statements in Appendix B and online in the filings section of http://www.sec.gov. These financial statements report a number of liabilities. Requirements 1. The current liability section of Under Armo

> This case is based on the consolidated financial statements of Under Armour, Inc., given in Appendix B and online in the filings section of http://www.sec.gov. Requirements 1. Read Note 16—Segment Data and Related Information. What are Under Armour, Inc

> Refer to the Under Armour, Inc., Consolidated Financial Statements in Appendix B and online in the filings section of http://www.sec.gov. This case leads you through an analysis of the activity for some of Under Armour, Inc.’s, long-term assets, as well

> inventory; compute and evaluate gross profit and inventory turnover) Refer to Under Armour, Inc.’s, consolidated financial statements in Appendix B and online in the filings section of http://www.sec.gov. Show amounts in millions and round to the nearest

> This case is based on Under Armour, Inc.’s, consolidated balance sheets, consolidated statements of income, and Note 2 of its financial statements (Significant Accounting Policies) in Appendix B and online in the filings section of http://www.sec.gov. Req

> Refer to the Under Armour, Inc., Financial Statements in Appendix B and online in the filings section of http://www.sec.gov. Requirements 1. Focus on cash and cash equivalents. Why did cash and cash equivalents change during 2014? The s