Question: Romano Lake Resort reported the following on

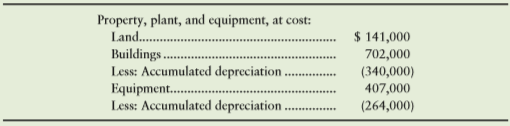

Romano Lake Resort reported the following on its balance sheet at December 31, 2016:

In early July 2017, the resort expanded operations and purchased additional equipment for cash at a cost of $105,000. The company depreciates buildings by the straight-line method over 20 years with residual value of $87,000. Due to obsolescence, the equipment has a useful life of only 10 years and is being depreciated by the double-declining-balance method with zero residual value.

Requirements

1. Journalize Romano Lake Resort’s plant asset purchase and depreciation transactions for 2017. 2. Report plant assets on the December 31, 2017, balance sheet.

Transcribed Image Text:

Property, plant, and equipment, at cost: Land. Buildings. Less: Accumulated depreciation Equipment. Less: Accumulated depreciation $ 141,000 702,000 (340,000) 407,000 (264,000) .........

> For each of the situations listed, identify which of three principles (integrity, objectivity and independence, or due care) from the AICPA Code of Professional Conduct is violated. Assume all persons listed in the situations are members of the AICPA. (N

> The accounting records of Brillhart Foods, Inc., include the following items at December 31, 2016: Requirements 1. Show how each relevant item would be reported on the Brillhart Foods, Inc., classified balance sheet, including headings and totals for

> Summit Medical Goods is embarking on a massive expansion. Assume the plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the company’s existing locations, offering more items of inventory and with

> On December 31, 2016, Zenith Corp. issues 7%, 10-year convertible bonds payable with a maturity value of $2,000,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 9%. Zenith Corp. amortizes bond discount by the ef

> The notes to the Friendship Ltd. financial statements reported the following data on December 31, Year 1 (end of the fiscal year): Friendship Ltd. amortizes bond discount by the effective-interest method and pays all inter

> Requirements 1. Journalize the following transactions of Lamothe Communications, Inc.: 2. At December 31, 2016, after all year-end adjustments, determine the carrying amount of Lamothe Communications bonds payable, net. 3. For the six months ended Ju

> On February 28, 2016, Marlin Corp. issues 8%, 10-year bonds payable with a face value of $900,000. The bonds pay interest on February 28 and August 31. Marlin Corp. amortizes bond discount by the straight-line method. Requirements 1. If the market int

> The board of directors of Laptops Plus authorizes the issue of $9,000,000 of 7%, 15-year bonds payable. The semiannual interest dates are May 31 and November 30. The bonds are issued on May 31, 2016, at par. Requirements 1. Journalize the following tra

> The following transactions of Signature Music Company occurred during 2016 and 2017: Requirement 1. Record the transactions in Signature Music Company’s journal. Explanations are not required. 2016 Purchased a piano (inventory) fo

> Sea Spray Marine experienced these events during the current year. a. December revenue totaled $130,000; and, in addition, Sea Spray collected sales tax of 5%. The tax amount will be sent to the state of Rhode Island early in January. b. On August 31,

> The accounting records of Brownfield Foods, Inc., include the following items at December 31, 2016: Requirements 1. Show how each relevant item would be reported on the Brownfield Foods, Inc., classified balance sheet, including heading

> Mountainside Medical Goods is embarking on a massive expansion. Assume plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the company’s existing locations, offering more items of inventory and wi

> On December 31, 2016, Rugaboo Corp. issues 6%, 10-year convertible bonds payable with a maturity value of $4,000,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 8%. Rugaboo Corp. amortizes bond discount by the

> The notes to the Mann Ltd. financial statements reported the following data on December 31, Year 1 (end of the fiscal year): Mann Ltd. amortizes bond discount by the effective-interest method and pays all interest amounts

> Requirements 1. Journalize the following transactions of Lamore Communications, Inc.: 2. At December 31, 2016, after all year-end adjustments, determine the carrying amount of Lamore Communications bonds payable, net. 3. For the six months ended July

> On February 28, 2016, Mackerel Corp. issues 6%, 20-year bonds payable with a face value of $1,800,000. The bonds pay interest on February 28 and August 31. Mackerel Corp. amortizes bond discount by the straight-line method. Requirements 1. If the mark

> The board of directors of Circuits Plus authorizes the issue of $9,000,000 of 8%, 25-year bonds payable. The semiannual interest dates are May 31 and November 30. The bonds are issued on May 31, 2016, at par. Requirements 1. Journalize the following t

> The following transactions of Smooth Notes Music Company occurred during 2016 and 2017: Requirement 1. Record the transactions in Smooth Notes’ journal. Explanations are not required. 2016 Purchased a piano (inventory) for $50,00

> Salt Air Marine experienced these events during the current year. a. December revenue totaled $110,000; and, in addition, Salt Air collected sales tax of 5%. The tax amount will be sent to the state of North Carolina early in January. b. On August 31,

> Assume that Lundgren Corporation has a subsidiary company based in Japan. Requirements 1. Translate into dollars the foreign-currency balance sheet of the Japanese subsidiary of Lundgren. When Lundgren acquired this subsidiary, the Japanese yen was wo

> Annual cash inflows from two competing investment opportunities are given. Each investment opportunity will require the same initial investment. Requirement 1. Assuming an 8% interest rate, which investment opportunity would you choose?

> Assume Robertson, Inc., paid $289,000 to acquire all the common stock of Dinette Corporation and Dinette owes Robertson $197,000 on a note payable. Immediately after the purchase on September 30, 2016, the two companies’ balance sheets

> This problem demonstrates the dramatic effect that consolidation accounting can have on a company’s ratios. Randall Motor Company (Randall) owns 100% of Randall Motor Credit Corporation (RMCC), its financing subsidiary. R

> The beginning balance sheet of Landeau Corporation included the following: Landeau Corporation completed the following investment transactions during the year: At year-end, the fair values of Landeau Corporation’s investments are as

> Utah Exchange Company completed the following long-term investment transactions during 2016: At year-end, the fair value of the Amsterdam stock is $30,900. The fair value of the Exeter stock is $652,000. Requirements 1. For which investment is fair

> Insurance companies and pension plans hold large quantities of bond investments. Variety Insurance Corp. purchased $3,900,000 of 4% bonds of Sherman, Inc., for 114 on January 1, 2016. These bonds pay interest on January 1 and July 1 each year. They matur

> Assume that Mason Corporation has a subsidiary company based in Japan. Requirements 1. Translate into dollars the foreign-currency balance sheet of the Japanese subsidiary of Mason. When Mason acquired this subsidiary, the Japanese yen was worth $0.00

> Annual cash inflows from two competing investment opportunities are given. Each investment opportunity will require the same initial investment. Requirement 1. Assuming a 14% interest rate, which investment opportunity would you choose?

> Assume Ronny, Inc., paid $362,000 to acquire all the common stock of Bircher Corporation and Bircher owes Ronny $194,000 on a note payable. Immediately after the purchase on September 30, 2016, the two companies’ balance sheets appear a

> This problem demonstrates the dramatic effect that consolidation accounting can have on a company’s ratios. Spindler Motor Company (Spindler) owns 100% of Spindler Motor Credit Corporation (SMCC), its financing subsidiary

> The beginning balance sheet of Robideau Corporation included the following: Robideau Corporation completed the following investment transactions during the year: At year-end, the fair values of Robideau Corporation’s investments are

> Delaware Exchange Company completed the following long-term investment transactions during 2016: At year-end, the fair value of the Columbus stock is $30,100. The fair value of the Nashua stock is $658,000. Requirements 1. For which investment is fa

> Insurance companies and pension plans hold large quantities of bond investments. Bolton Insurance Corp. purchased $2,800,000 of 9% bonds of Souza, Inc., for 112 on January 1, 2016. These bonds pay interest on January 1 and July 1 each year. They mature o

> Morgan Corporation reported the following related to property and equipment (all in millions): From the balance sheets: From the investing activities section of the 2016 cash flow statement: Cash used to purchase property and equipmentâ€&brv

> Bargain Hut Corporation operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending February 28, 2015: Requirements 1. Compute net profit margin ratio for Barga

> At the end of 2015, Standard Power had total assets of $17.5 billion and total liabilities of $9.6 billion. Included among the assets were property, plant, and equipment with a cost of $4.7 billion and accumulated depreciation of $2.9 billion. Standard P

> Northeastern Energy Company’s balance sheet includes the asset Iron Ore Rights. Northeastern Energy paid $2.9 million cash for the right to work a mine that contained an estimated 225,000 tons of ore. The company paid $68,000 to remove unwanted buildings

> Hometown Sales, Inc., sells electronics and appliances. The excerpts that follow are adapted from Hometown Sales’ financial statements for 2016 and 2015: Requirements 1. How much was Hometown Sales’s cost of plant

> On January 2, 2016, Smythe Co. paid $255,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,500, sales tax of $6,600, and $31,900 for a special platform on which to place the computer. Smythe’s manageme

> Tucker, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Tucker completed the following transactions: Requirement 1. Record the transactions

> Donatello Lake Resort reported the following on its balance sheet at December 31, 2016: In early July 2017, the resort expanded operations and purchased additional equipment for cash at a cost of $109,000. The company depreciates buildings by the strai

> Assume Royale House, Inc., opened an office in Urbana, Illinois. Royale House incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: Assume Royale House depreciates buildings ov

> Cook Corporation reported the following related to property and equipment (all in millions): From the balance sheets: From the investing activities section of the 2016 cash flow statement: Cash used to purchase property and equipmentâ€&brvba

> Shopper’s World operates general merchandise and food discount stores in the United States. The company reported the following information for the three years ending December 31, 2015: Requirements 1. Compute net profit margin ratio

> At the end of 2015, Chesapeake Energy had total assets of $17.2 billion and total liabilities of $9.8 billion. Included among the assets were property, plant, and equipment with a cost of $4.7 billion and accumulated depreciation of $2.8 billion. Chesape

> Southwestern Energy Company’s balance sheet includes the asset Iron Ore Rights. Southwestern Energy paid $2.2 million cash for the right to work a mine that contained an estimated 190,000 tons of ore. The company paid $61,000 to remove unwanted buildings

> Sweet Stores, Inc., sells electronics and appliances. The excerpts that follow are adapted from Sweet Stores’ financial statements for 2016 and 2015. Requirements 1. How much was Sweet Stores’ cost of plant assets

> On January 3, 2016, Wayne Co. paid $280,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,900, sales tax of $7,000, and $28,600 for a special platform on which to place the computer. Wayne’s management

> Carr, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Carr completed the following transactions: Requirement 1. Record the transactions in Ca

> Assume Bowler Supply, Inc., opened an office in Dublin, Ohio. Bowler Supply incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: Assume Bowler Supply depreciates buildings ove

> The accounting records of Columbia Home Store show these data (in millions). The shareholders are very happy with Columbia’s steady increase in net income. Auditors discovered that the ending inventory for 2014 was understated by $6 m

> Maroney’s Convenience Stores’ income statement for the year ended December 31, 2015, and its balance sheet as of December 31, 2015, reported the following: The business is organized as a proprietorship, so it pays

> Assume Thompson Company, a camera store, lost some inventory in a fire on July 15. To file an insurance claim, Thompson Company must estimate its July 15 inventory by the gross profit method. Assume that for t

> Frosted Donut, Inc., and Coffee Bean Corporation are both specialty food chains. The two companies reported these figures, in millions: Requirements 1. Compute the gross profit percentage and the rate of inventory turnover for Frosted

> Mahtomedi Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Mahtomedi’s suppliers to lower the prices that Mahtomedi will pay when it

> The records of Buzz Aviation include the following accounts for inventory of aviation parts at July 31 of the current year: Requirements 1. Prepare a partial income statement through gross profit under the average, FIFO, and LIFO methods. Round averag

> Military Surplus began May 2016 with 80 stoves that cost $20 each. During the month, Military Surplus made the following purchases at cost: Military Surplus sold 286 stoves, and at May 31, the ending inventory consists of 64 stoves. The sale price of e

> Assume a Cross Country Sports outlet store began March 2016 with 49 pairs of running shoes that cost the store $35 each. The sale price of these shoes was $70. During March, the store completed these inventory transactions: Requirements 1. The precedin

> Super Value purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Super Value ends each January 31. Assume you are dealing with a single Super Value store in Madison, Wisconsin. The Madison sto

> The accounting records of Brilliant Home Store show these data (in millions). The shareholders are very happy with Brilliant’s steady increase in net income. Auditors discovered that the ending inventory for 2014 was understated by $4

> Gary’s Convenience Stores’ income statement for the year ended December 31, 2015, and its balance sheet as of December 31, 2015, reported the following: The business is organized as a proprietorship, so it pays no c

> Assume Watertown Company, a camera store, lost some inventory in a fire on March 15. To file an insurance claim, Watertown Company must estimate its March 15 inventory by the gross profit method. Assume that f

> Pastry People, Inc., and Captain Coffee Corporation are both specialty food chains. The two companies reported these figures, in millions: Requirements 1. Compute the gross profit percentage and the rate of inventory turnover for Past

> Dixson Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Dixson’s suppliers to lower the prices that Dixson will pay when it replaces

> The records of Aldrin Aviation include the following accounts for inventory of aviation parts at July 31 of the current year: Requirements 1. Prepare a partial income statement through gross profit under the average, FIFO, and LIFO methods. Round aver

> Armed Forces Surplus began March 2016 with 80 tents that cost $15 each. During the month, Armed Forces Surplus made the following purchases at cost: Armed Forces Surplus sold 296 tents, and at March 31, the ending inventory consists of 54 tents. The sa

> Assume a Watercrest Sports outlet store began October 2016 with 47 pairs of running shoes that cost the store $38 each. The sale price of these shoes was $67. During October, the store completed these inventory transactions: Requirements 1. The preced

> Big Box purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Big Box ends each January 31. Assume you are dealing with a single Big Box store in Rosedale, Minnesota. The Rosedale store began t

> The comparative financial statements of Gold Pools, Inc., for 2017, 2016, and 2015 included the following select data: Requirements 1. Compute these ratios for 2017 and 2016: a. Current ratio b. Quick (acid-test) ratio c. Daysâ

> Quick Meals completed the following selected transactions: Requirements 1. Record the transactions in Quick Meals’ journal. Assume that no sales returns are expected. Round all amounts to the nearest dollar. Explanations are not requ

> Assume Spahr and Kennedy, the accounting firm, advises Arctic Seafood that its financial statement must be changed to conform to GAAP. At December 31, 2016, Arctic’s accounts include the following: The ac

> The September 30, 2017, records of Media Communications include these accounts: During the year, Media Communications estimates doubtful-account expense at 1% of credit sales. At year-end (December 31), the company ages its receivables and adjusts the

> This problem takes you through the accounting for sales, receivables, uncollectibles, and notes receivable for Henderson Shipping Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At

> Carson Computer Solutions makes all sales on account, so virtually all cash receipts arrive in the mail. Jeannette Carson, the company president, has just returned from a trade association meeting with new ideas for the business. Among other things, Cars

> During the fourth quarter of 2016, Zinner, Inc., generated excess cash, which the company invested in trading securities as follows: Requirements 1. Open T-accounts for Cash (including its beginning balance of $15,000), Investment in Trading Securitie

> The comparative financial statements of Kenmore Pools, Inc., for 2017, 2016, and 2015 included the following select data: Requirements 1. Compute these ratios for 2017 and 2016: a. Current ratio b. Quick (acid-test) ratio c. Days&aci

> Hughes Foods completed the following selected transactions. Requirements 1. Record the transactions in Hughes Foods’ journal. Assume that no sales returns are expected. Round all amounts to the nearest dollar. Explanations are not re

> During the fourth quarter of 2016, Abbott, Inc., generated excess cash, which the company invested in trading securities as follows: Requirements 1. Open T-accounts for Cash (including its beginning balance of $19,000), Investment in Trading Securitie

> This problem demonstrates the effects of transactions on the current ratio and the debt ratio of Digger Company. Digger’s condensed and adapted balance sheet at December 31, 2015, follows: Assume that during the first quarter of the f

> Refer back to Problem 3-72B. Requirements 1. Use the Spa View Services data in Problem 3-72B to prepare the company’s classified balance sheet at January 31, 2016. Show captions for total assets, total liabilities, and stockholders’ equ

> The accounts of Spa View Service, Inc., at January 31, 2016, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Spa View’s clo

> The adjusted trial balance for the year of Schneider Corporation at December 31, 2016, follows: Requirements 1. Prepare Schneider Corporation’s 2016 single-step income statement, statement of retained earnings, and balance sheet. Lis

> Peppertree Rentals, Inc.’s, unadjusted and adjusted trial balances at June 30, 2016, follow: Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute Peppertree Rentals&a

> Consider the unadjusted trial balance of Edison, Inc., at December 31, 2016, and the related month-end adjustment data. Adjustment data at December 31, 2016, include the following: a. Accrued service revenue at December 31, $2,780. b. Prepaid rent ex

> Journalize the adjusting entry needed on December 31, the end of the current accounting period, for each of the following independent cases affecting Tiger Corp. Include an explanation for each entry. a. Details of Prepaid Insurance are shown in the acc

> Whittaker Consulting had the following selected transactions in July: Requirements 1. Show how each transaction would be handled (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Compute July income (loss)

> This problem demonstrates the effects of transactions on the current ratio and the debt ratio of Hartford Company. Hartford’s condensed and adapted balance sheet at December 31, 2016, follows: Assume that during the first quarter of t

> Refer back to Problem 3-64A. Requirements 1. Use the Granger Services data in Problem 3-64A to prepare the company’s classified balance sheet at January 31, 2016. Show captions for total assets, total liabilities, and total liabilities and st

> The accounts of Granger Services, Inc., at January 31, 2016, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Granger’s clo

> The adjusted trial balance for the year of Nicholl Corporation at October 31, 2016, follows. Requirements 1. Prepare Nicholl Corporation’s 2016 single-step income statement, statement of retained earnings, and balance sheet. List exp

> Lemontree Rentals, Inc.’s, unadjusted and adjusted trial balances at June 30, 2016, follow. Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute Lemontree Rentals&aci

> Consider the unadjusted trial balance of Spateness, Inc., at December 31, 2016, and the related month-end adjustment data. Adjustment data at December 31, 2016: a. Accrued service revenue at December 31, $3,960. b. Prepaid rent expired during the mon

> Journalize the adjusting entry needed on December 31, the end of the current accounting period, for each of the following independent cases affecting Woolton Corporation. Include an explanation for each entry. a. Details of Prepaid Insurance are shown i

> Masters Consulting had the following selected transactions in October: Requirements 1. Show how each transaction would be handled (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Compute October income (l

> accounts; construct and use a trial balance) During the first month of operations (May 2016), Spahr Music Corporation completed the following selected transactions: a. The business received cash of $50,000 and a building with a fair value of $106,000.

> During the first month of operations, Gagne Services, Inc., completed the following transactions: Requirements 1. Record each transaction in the journal. Be sure to record the date in each entry. Explanations are not required. 2. Post

> This problem can be used in conjunction with Problem 2-66B. Refer to Problem 2-66B. Requirements 1. Journalize the transactions of Willis Computing, Inc. Explanations are not required. 2. Prepare T-accounts for each account. Insert in each T-account

> The following amounts summarize the financial position of Willis Computing, Inc., on October 31, 2016: During November 2016, the business completed these transactions: a. The business received cash of $3,900 and issued common stock. b

> The trial balance of Larrabee Design, Inc., follows: Amy Swoboda, your best friend, is considering making an investment in Larrabee Design, Inc. Amy seeks your advice in interpreting the company’s information. Specifica

> During the first month of operations (April 2016), Stein Music Services Corporation completed the following selected transactions: a. The business received cash of $44,000 and a building with a fair value of $106,000. The corporation issued common stock