Question: Jump Start Company ( JSC), a subsidiary of

Jump Start Company ( JSC), a subsidiary of Mason Industries, manufactures go-carts and other recreational vehicles. Family recreational centers that feature go-cart tracks along with miniature golf, batting cages, and arcade games have increased in popularity. As a result, JSC has been pressured by Mason management to diversify into some of these other recreational areas. Recreational Leasing, Inc. (RLI), one of the largest firms leasing arcade games to these family recreational centers, is looking for a friendly buyer. Mason’s top management believes that RLI’s assets could be acquired for an investment of $3.2 million and has strongly urged Bill Grieco, division manager of JSC, to consider acquiring RLI. Bill has reviewed RLI’s financial statements with his controller, Marie Donnelly, and they believe that the acquisition may not be in the best interest of JSC.

“If we decide not to do this, the Mason people are not going to be happy,†said Bill. “If we could convince them to base our bonuses on something other than return on investment, maybe this acquisition would look more attractive. How would we do if the bonuses were based on residual income using the company’s 15 percent cost of capital?â€

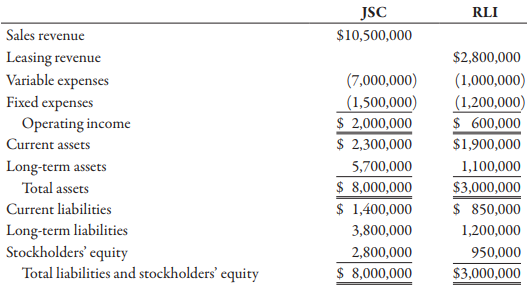

Mason has traditionally evaluated all of its divisions on the basis of ROI, which is defined as the ratio of operating income to total assets. The desired rate of return for each division is 20 percent. The management team of any division reporting an annual increase in the ROI is automatically eligible for a bonus. The management of divisions reporting a decline in the ROI must provide convincing explanations for the decline to be eligible for a bonus, and this bonus is limited to 50 percent of the bonus paid to divisions reporting an increase. The following condensed financial statements are for both JSC and RLI for the fiscal year ended May 31:

Required:

1. If Mason Industries continues to use ROI as the sole measure of division performance, explain why JSC would be reluctant to acquire RLI. Be sure to support your answer with appropriate calculations.

2. If Mason Industries could be persuaded to use residual income to measure the performance of JSC, explain why JSC would be more willing to acquire RLI. Be sure to support your answer with appropriate calculations.

3. Discuss how the behavior of division managers is likely to be affected by the use of:

a. ROI as a performance measure

b. Residual income as a performance measure (CMA adapted)

4. How is Bill using data analytic types—descriptive, diagnostic, predictive or prescriptive—to determine whether or not residual income should be used to affect manager behavior? Explain.

> After some detailed polling among the 60, four types of eaters were identified: two types of light eaters and two types of heavy eaters. The consumption patterns for each group are given (slices of pizza, glasses of root beer, and bowls of salad): Light

> Sixty employees (all CPAs) of a local public accounting firm eat lunch at least twice weekly at a very popular pizza restaurant. The pizza restaurant recently began offering discounts for groups of 15 or more. Groups would be seated in a separate room, s

> In 20x3, Jack Carter, president of Kartel, requested that environmental costs be assigned to the two major products produced by the company. He felt that knowledge of the environmental product costs would help guide the design decisions that would be nec

> In March, Nashler Company produced 163,200 units and had the following actual costs: Direct materials $1,170,000 Direct labor 258,000 Supplies 38,100 Maintenance 30,960 Power 29,300 Supervision 99,450 Depreciation 76,000 Other overhead 244,300 Required:

> The following environmental cost reports for 20x3, 20x4, and 20x5 (year end December 31) are for the Communications Products Division of Kartel, a telecommunications company. At the end of 20x2, Kartel committed itself to a continuous environmental impro

> In the environmental benefits section of the report, three types of benefits are listed: income, savings, and cost avoidance. Now, consider the following data for selected items for a four-year period: The engineering design costs were incurred to redesi

> The following items are listed in an environmental financial statement (issued as part of an environmental progress report): Environmental benefits (savings, income, and cost avoidance): • Ozone-depleting substances cost reductions • Hazardous waste disp

> At the beginning of 20x2, Heber Company, an international telecommunications company, embarked on an environmental improvement program. The company set a goal to have all its facilities ISO 14001 registered by 20x5. (There are 60 facilities worldwide.) T

> Iona Company, a large printing company, is in its fourth year of a five-year, quality improvement program. The program began in 20x0 with an internal study that revealed the quality costs being incurred. In that year, a five-year plan was developed to lo

> In 20x1, Antonio Flores, president of Carbondale Electronics, received a report indicating that quality costs were 31 percent of sales. Faced with increasing pressures from imported goods, Antonio resolved to take measures to improve the overall quality

> Paper Products Division produces paper diapers, napkins, and paper towels. The divisional manager has decided that quality costs can be minimized by distributing quality costs evenly among the four quality categories and reducing them to no more than 5 p

> In 20x5, Major Company initiated a full-scale, quality improvement program. At the end of the year, Amelia Hoxha, the president, noted with some satisfaction that the defects per unit of product had dropped significantly compared to the prior year. She w

> Recently, Ulrich Company received a report from an external consulting group on its quality costs. The consultants reported that the company’s quality costs total about 21 percent of its sales revenues. Somewhat shocked by the magnitude

> Wayne Johnson, president of Banshee Company, recently returned from a conference on quality and productivity. At the conference, he was told that many American firms have quality costs totaling 20 to 30 percent of sales. He, however, was skeptical about

> Nashler Company has the following budgeted variable costs per unit produced: Direct materials $7.20 Direct labor 1.54 Variable overhead: Supplies 0.23 Maintenance 0.19 Power 0.18 Budgeted fixed overhead costs per month include supervision of $98,000, dep

> Classify the following quality costs as prevention, appraisal, internal failure, or external failure. Also, label each cost as variable or fixed with respect to sales volume. 1. Quality engineering 2. Scrap 3. Product recalls 4. Returns and allowances be

> Gaston Company manufactures furniture. One of its product lines is an economy-line kitchen table. During the last year, Gaston produced and sold 100,000 units for $100 per unit. Sales of the table are on a bid basis, but Gaston has always been able to wi

> Panguitch Company manufactures a component for tablet computers. Weight and durability of the component are the two most important quality characteristics for the tablet manufacturers. With respect to the weight dimension, the component has a target valu

> Gabrielle Alvarez, president of Oliver Company, was concerned with the trend in sales and profitability. The company had been losing customers at an alarming rate. Furthermore, the company was barely breaking even. Investigation revealed that poor qualit

> At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. M

> Mulhall, Inc., has a JIT system in place. Each manufacturing cell is dedicated to the production of a single product or major subassembly. One cell, dedicated to the production of mopeds, has four operations: machining, finishing, assembly, and qualifyin

> Auf legger, Inc., manufactures a product that experiences the following activities (and times): Required: 1. Compute the MCE for this product. 2. A study lists the following root causes of the inefficiencies: poor quality components from suppliers, lack

> Lander Parts, Inc., produces various automobile parts. In one plant, Lander has a manufacturing cell with the theoretical capability to produce 450,000 fuel pumps per quarter. The conversion cost per quarter is $9,000,000. There are 150,000 production ho

> The following strategic objectives have been derived from a strategy that seeks to improve asset utilization by more careful development and use of its human assets and internal processes: a. Increase revenue from new products. b. Increase implementation

> Refer to the data in Problem 13-16. 1. Express Mejorar’s strategy as a series of if-then statements. What does this tell you about Balanced Scorecard measures? 2. Prepare a strategy map that illustrates the relationships among the likel

> Khloe Company imports gift items from overseas and sells them to gift shops and department stores throughout the United States. Khloe Company provided the following information: a. The October 31 balance in the cash account is $53,817. b. All sales are o

> Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 mov

> Kelly Gray, production manager, was upset with the latest performance report, which indicated that she was $100,000 over budget. Given the efforts that she and her workers had made, she was confident that they had met or beat the budget. Now, she was not

> Tidwell, Inc., has two plants that manufacture a line of wheelchairs. One is located in Dallas, and the other in Oklahoma City. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for $1,782. Sales

> Angie Ramirez, vice president of Dunn Company (a producer of plastic products), has been supervising the implementation of an activity-based cost management system. One of Angie’s objectives is to improve process efficiency by improving the activities th

> Joseph Hansen, president of Electronica, Inc., was concerned about the end-of-the-year marketing report that he had just received. According to Asha Kumar, marketing manager, a price decrease for the coming year was again needed to maintain the company&a

> Novo, Inc., wants to develop an activity f lexible budget for the activity of moving materials. Novo uses eight forklifts to move materials from receiving to stores. The forklifts are also used to move materials from stores to the production area. The fo

> Volante, Inc., supplies wheels for a large bicycle manufacturing company. The bicycle company has recently requested that Volante decrease its delivery time. Volante made a commitment to reduce the lead time for delivery from seven days to one day. To he

> Joseph Fox, controller of Thorpe Company, has been in charge of a project to install an activity based cost management system. This new system is designed to support the company’s efforts to become more competitive. For the past six wee

> Reddy Heaters, Inc., produces insert heaters that can be used for various applications, ranging from coffeepots to submarines. Because of the wide variety of insert heaters produced, Reddy uses a job-order costing system. Product lines are differentiated

> Southward Company has implemented a JIT flexible manufacturing system. Nia Johnson, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories. For one thing, she has decided to treat direct la

> Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: Quarter 1 $4,600,000 Quarter 2 5,100,000 Quarter 3 5,000,000 Quarter 4 7,600,000 In Shalimar’s experience, 10 percent of sales are paid in

> Mott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Mott’s two p

> Homer Manufacturing produces different models of 22-calibre rifles. The manufacturing costs assigned to its economy model rifle before and after installing JIT are given in the following table. Cell workers do all maintenance and are also responsible for

> Jolene Askew, manager of Feagan Company, has committed her company to a strategically sound cost reduction program. Emphasizing life-cycle cost management is a major part of this effort. Jolene is convinced that production costs can be reduced by paying

> Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics cos

> Pawnee Works makes machine parts for manufacturers of industrial equipment. Over the years, Pawnee has been a steady and reliable supplier of quality parts to medium- and small-machine manufacturers. Michael Murray, owner of Pawnee Works, once again was

> Maxwell Company produces a variety of kitchen appliances, including cooking ranges and dishwashers. Over the past several years, competition has intensified. In order to maintain—and perhaps increase—its market share,

> Moss Manufacturing produces several types of bolts. The products are produced in batches according to customer order. Although there are a variety of bolts, they can be grouped into three product families. The number of units sold is the same for each fa

> Cortalo, Inc., manufactures riding lawn mowers. Cortalo uses JIT manufacturing and carries insignificant levels of inventory. Cortalo manufactures everything needed for the riding lawn mowers except for the engines. Several sizes of mowers are produced.

> Evans, Inc., has a unit-based costing system. Evans’s Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The

> Phil DaStands is the athletic director at Rarelly Wynn University. The university experienced a decline in athletic event attendance over the past several years, resulting in decreasing Athletic Department revenues from ticket, concession, and merchandis

> Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of $15.9 million and cost of goods sold of $8.75 million. Advertising is a key part of Coral Seas’ business strategy, and total marketing expense fo

> Grate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of RO

> Renslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brake

> Greg Peterson has recently been appointed vice president of operations for Webster Corporation. Greg has a manufacturing background and previously served as operations manager of Webster’s Tractor Division. The business segments of Webster include the ma

> Corning Company has a decentralized organization with a divisional structure. Two of these divisions are the Appliance Division and the Manufactured Housing Division. Each divisional manager is evaluated on the basis of ROI. The Appliance Division produc

> Oriole, Inc., owns a number of food service companies. Two divisions are the Coffee Division and the Donut Shop Division. The Coffee Division purchases and roasts coffee beans for sale to supermarkets and specialty shops. The Donut Shop Division operates

> Ardmore, Inc., manufactures heating and air conditioning units in its six divisions. One division, the Components Division, produces electronic components that can be used by the other five. All the components produced by this division can be sold to out

> Leather Works is a family-owned maker of leather travel bags and briefcases located in the northeastern part of the United States. Foreign competition has forced its owner, Heather Gray, to explore new ways to meet the competition. One of her cousins, Wa

> Aspen Medical Laboratory performs comprehensive blood tests for physicians and clinics throughout the Southwest. Aspen uses a standard process-costing system for its comprehensive blood work. Skilled technicians perform the blood tests. Because Aspen use

> As part of its cost control program, Tracer Company uses a standard costing system for all manufactured items. The standard cost for each item is established at the beginning of the fiscal year, and the standards are not revised until the beginning of th

> Smart Strike Company manufactures and sells soccer balls for teams of children in elementary and high school. Smart Strike’s best-selling lines are the practice ball line (durable soccer balls for training and practice) and the match ba

> Ingles Company manufactures external hard drives. At the beginning of the period, the following plans for production and costs were revealed: Units to be produced and sold 25,000 Standard cost per unit: Direct materials $ 10 Direct labor 8 Variable overh

> Nuevo Company produces a single product. Nuevo employs a standard cost system and uses a flexible budget to predict overhead costs at various levels of activity. For the most recent year, Nuevo used a standard overhead rate equal to $6.25 per direct labo

> Energy Products Company produces a gasoline additive, Gas Gain. This product increases engine efficiency and improves gasoline mileage by creating a more complete burn in the combustion process. Careful controls are required during the production process

> Vet-Pro, Inc., also uses two different types of direct labor in producing the anti-anxiety mixture: mixing and drum-filling labor (the completed product is placed into 50-gallon drums). For each batch of 20,000 gallons of direct materials input, the foll

> Vet-Pro, Inc., produces a veterinary grade anti-anxiety mixture for pets with behavioral problems. Two chemical solutions, Aranol and Lendyl, are mixed and heated to produce a chemical that is sold to companies that produce the anti-anxiety pills. The mi

> Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is $1.60. The standard rate f

> Petrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs. @ $5.40)

> Misterio Company uses a standard costing system. During the past quarter, the following variances were computed: Variable overhead efficiency variance $ 24,000 U Direct labor efficiency variance 120,000 U Direct labor rate variance 10,400 U Misterio appl

> Rand Company produces dry fertilizer. At the beginning of the year, Rand had the following standard cost sheet: Direct materials (8 lbs. @ $1.30) $10.40 Direct labor (0.2 hr. @ $18.00) 3.60 Fixed overhead (0.2 hr. @ $3.00) 0.60 Variable overhead (0.20 hr

> Plimpton Company produces countertop ovens. Plimpton uses a standard costing system. The standard costing system relies on direct labor hours to assign overhead costs to production. The direct labor standard indicates that two direct labor hours should b

> Assume that Sunny Lane, Inc., uses the sales-value-at-split-off method of joint cost allocation and has provided the following information about the four grades of peaches: Total joint cost is $18,000. Required: 1. Allocate the joint cost to the four gra

> EZ Tees Corporation produces T-shirts. The company uses a standard costing system and has set the following standards for direct materials and direct labor (for one shirt): Fabric (0.8 yds. @ $1.60) $ 1.28 Direct labor (0.1 hr. @ $15) 1.50 Total prime co

> Norton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Norton’s accounting staff and is interested in learning as much as possible abou

> An effective budget converts the goals and objectives of an organization into data. The budget serves as a blueprint for management’s plans. The budget is also the basis for control. Management performance can be evaluated by comparing actual results wit

> Refer to Problem 8-35 for data. Required: 1. Run a multiple regression equation using machine hours, number of setups, and number of purchase orders as independent variables. Prepare a flexible budget for overhead for the 12 months using the results of t

> The controller for Muir Company’s Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there

> Friendly Freddie’s is an independently owned major appliance and electronics discount chain with seven stores located in a Midwestern metropolitan area. Rapid expansion has created the need for careful planning of cash requirements to e

> Laghari Company makes and sells high-quality glare filters for microcomputer monitors. John Tanaka, controller, is responsible for preparing Laghari’s master budget and has assembled the following data for the coming year. The direct la

> Bernard Creighton is the controller for Creighton Hardware Store. In putting together the cash budget for the fourth quarter of the year, he has assembled the following data. a. Sales July (actual) $100,000 August (actual) 120,000 September (estimated) 9

> Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below

> House Corporation Board (HCB) of Tri-Gamma Sorority is responsible for the operation of a two story sorority house on the State University campus. HCB has set a normal capacity of 60 women. At any given point in time, there are 100 members of the chapter

> Assume that Sunny Lane, Inc., uses the weighted average method of joint cost allocation and has assigned the following weights to the four grades of peaches: Total joint cost is $18,000. Required: 1. Allocate the joint cost to the four grades of peaches

> Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The

> Sonimad Sawmill, Inc. (SSI), purchases logs from independent timber contractors and processes them into the following three types of lumber products: 1. Studs for residential construction (e.g., walls and ceilings) 2. Decorative pieces (e.g., fireplace m

> Welcome Inns is a chain of motels serving business travelers in New Mexico and southwest Texas. The chain has grown from one motel several years ago to five motels. In 20x1, the owner of the company decided to set up an internal Accounting Department to

> Farleigh Petroleum, Inc., is a small company that acquires high-grade crude oil from low-volume production wells owned by individuals and small partnerships. The crude oil is processed in a single refinery into Two Oil, Six Oil, and impure distillates. F

> Macalister Corporation is developing departmental overhead rates based on direct labor hours for its two production departments—Molding and Assembly. The Molding Department employs 20 people, and the Assembly Department employs 80 peopl

> Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and ge

> AirBorne is a small airline operating out of Boise, Idaho. Its three f lights travel to Salt Lake City, Reno, and Portland. The owner of the airline wants to assess the full cost of operating each flight. As part of this assessment, the costs of two supp

> Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal

> Grayson Company produces an industrial chemical used for cleaning and lubricating machinery. In the Mixing Department, liquid and dry chemicals are blended to form slurry. Output is measured in gallons. In the Baking Department, the slurry is subjected t

> Mojada Toys, Inc., manufactures plastic water guns. Each gun’s left and right frames are produced in the Molding Department. The left and right frames are then transferred to the Assembly Department where the trigger mechanism is inserted and the halves

> Cuero Company produces leather strips for western belts using three processes: cutting, design and coloring, and punching. The weighted average method is used for all three departments. The following information pertains to the Design and Coloring Depart

> Sunny Lane, Inc., purchases peaches from local orchards and sorts them into four categories. Grade A are large blemish-free peaches that can be sold to gourmet fruit sellers. Grade B peaches are smaller and may be slightly out of proportion. These are pa

> Golding Manufacturing, a division of Farnsworth Sporting, Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handle. The limbs pass t

> Jacson Company produces two brands of a popular pain medication: regular strength and extra strength. Regular strength is produced in tablet form, and extra strength is produced in capsule form. All direct materials needed for each batch are requisitione

> Refer to the data in Problem 6-33. Required: Prepare a production report for each department using the FIFO method. Data from Problem 6-33: Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three

> Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the

> Refer to the data in Problem 6-31. Required: Repeat the requirements in Problem 6-31 using the FIFO method. Data from Problem 6-31: Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: M

> Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Departmen

> Hepworth Credit Corporation is a wholly owned subsidiary of a large manufacturer of computers. Hepworth is in the business of financing computers, software, and other services that the parent corporation sells. Hepworth has two departments that are invol

> Refer to the data in Problem 6-28. Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Data from Problem 6-28: Hatch Company produces a product that passes through three processes: Fabr