Question: Welcome Inns is a chain of motels

Welcome Inns is a chain of motels serving business travelers in New Mexico and southwest Texas. The chain has grown from one motel several years ago to five motels. In 20x1, the owner of the company decided to set up an internal Accounting Department to centralize control of financial information. (Previously, local CPAs handled each motel’s bookkeeping and financial reporting.) The accounting office was opened in January 20x1 by renting space adjacent to corporate headquarters in Ruidoso, New Mexico. All motels have been supplied with personal computers and internet access to transfer information to central accounting on a daily basis.

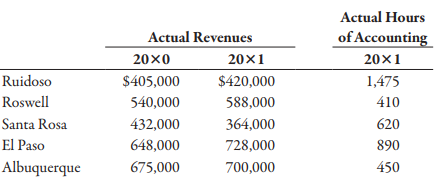

The Accounting Department has budgeted fixed costs of $135,000 per year. Variable costs are budgeted at $20 per hour. In 20x1, actual cost for the Accounting Department was $223,000. Further information is as follows:

Required:

1. Suppose the total actual costs of the Accounting Department are allocated on the basis of 20x1 sales revenue. How much will be allocated to each motel?

2. Suppose that Welcome Inns views 20x0 sales figures as a proxy for budgeted capacity of the motels. Thus, fixed Accounting Department costs are allocated on the basis of 20x0 sales, and variable costs are allocated according to 20x1 usage multiplied by the variable rate. How much Accounting Department cost will be allocated to each motel?

3. Comment on the two allocation schemes. Which motels would prefer the method in Requirement 1? The method in Requirement 2? Explain.

> Reddy Heaters, Inc., produces insert heaters that can be used for various applications, ranging from coffeepots to submarines. Because of the wide variety of insert heaters produced, Reddy uses a job-order costing system. Product lines are differentiated

> Southward Company has implemented a JIT flexible manufacturing system. Nia Johnson, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories. For one thing, she has decided to treat direct la

> Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: Quarter 1 $4,600,000 Quarter 2 5,100,000 Quarter 3 5,000,000 Quarter 4 7,600,000 In Shalimar’s experience, 10 percent of sales are paid in

> Mott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Mott’s two p

> Homer Manufacturing produces different models of 22-calibre rifles. The manufacturing costs assigned to its economy model rifle before and after installing JIT are given in the following table. Cell workers do all maintenance and are also responsible for

> Jolene Askew, manager of Feagan Company, has committed her company to a strategically sound cost reduction program. Emphasizing life-cycle cost management is a major part of this effort. Jolene is convinced that production costs can be reduced by paying

> Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics cos

> Pawnee Works makes machine parts for manufacturers of industrial equipment. Over the years, Pawnee has been a steady and reliable supplier of quality parts to medium- and small-machine manufacturers. Michael Murray, owner of Pawnee Works, once again was

> Maxwell Company produces a variety of kitchen appliances, including cooking ranges and dishwashers. Over the past several years, competition has intensified. In order to maintain—and perhaps increase—its market share,

> Moss Manufacturing produces several types of bolts. The products are produced in batches according to customer order. Although there are a variety of bolts, they can be grouped into three product families. The number of units sold is the same for each fa

> Cortalo, Inc., manufactures riding lawn mowers. Cortalo uses JIT manufacturing and carries insignificant levels of inventory. Cortalo manufactures everything needed for the riding lawn mowers except for the engines. Several sizes of mowers are produced.

> Evans, Inc., has a unit-based costing system. Evans’s Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The

> Phil DaStands is the athletic director at Rarelly Wynn University. The university experienced a decline in athletic event attendance over the past several years, resulting in decreasing Athletic Department revenues from ticket, concession, and merchandis

> Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of $15.9 million and cost of goods sold of $8.75 million. Advertising is a key part of Coral Seas’ business strategy, and total marketing expense fo

> Grate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of RO

> Jump Start Company ( JSC), a subsidiary of Mason Industries, manufactures go-carts and other recreational vehicles. Family recreational centers that feature go-cart tracks along with miniature golf, batting cages, and arcade games have increased in popul

> Renslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brake

> Greg Peterson has recently been appointed vice president of operations for Webster Corporation. Greg has a manufacturing background and previously served as operations manager of Webster’s Tractor Division. The business segments of Webster include the ma

> Corning Company has a decentralized organization with a divisional structure. Two of these divisions are the Appliance Division and the Manufactured Housing Division. Each divisional manager is evaluated on the basis of ROI. The Appliance Division produc

> Oriole, Inc., owns a number of food service companies. Two divisions are the Coffee Division and the Donut Shop Division. The Coffee Division purchases and roasts coffee beans for sale to supermarkets and specialty shops. The Donut Shop Division operates

> Ardmore, Inc., manufactures heating and air conditioning units in its six divisions. One division, the Components Division, produces electronic components that can be used by the other five. All the components produced by this division can be sold to out

> Leather Works is a family-owned maker of leather travel bags and briefcases located in the northeastern part of the United States. Foreign competition has forced its owner, Heather Gray, to explore new ways to meet the competition. One of her cousins, Wa

> Aspen Medical Laboratory performs comprehensive blood tests for physicians and clinics throughout the Southwest. Aspen uses a standard process-costing system for its comprehensive blood work. Skilled technicians perform the blood tests. Because Aspen use

> As part of its cost control program, Tracer Company uses a standard costing system for all manufactured items. The standard cost for each item is established at the beginning of the fiscal year, and the standards are not revised until the beginning of th

> Smart Strike Company manufactures and sells soccer balls for teams of children in elementary and high school. Smart Strike’s best-selling lines are the practice ball line (durable soccer balls for training and practice) and the match ba

> Ingles Company manufactures external hard drives. At the beginning of the period, the following plans for production and costs were revealed: Units to be produced and sold 25,000 Standard cost per unit: Direct materials $ 10 Direct labor 8 Variable overh

> Nuevo Company produces a single product. Nuevo employs a standard cost system and uses a flexible budget to predict overhead costs at various levels of activity. For the most recent year, Nuevo used a standard overhead rate equal to $6.25 per direct labo

> Energy Products Company produces a gasoline additive, Gas Gain. This product increases engine efficiency and improves gasoline mileage by creating a more complete burn in the combustion process. Careful controls are required during the production process

> Vet-Pro, Inc., also uses two different types of direct labor in producing the anti-anxiety mixture: mixing and drum-filling labor (the completed product is placed into 50-gallon drums). For each batch of 20,000 gallons of direct materials input, the foll

> Vet-Pro, Inc., produces a veterinary grade anti-anxiety mixture for pets with behavioral problems. Two chemical solutions, Aranol and Lendyl, are mixed and heated to produce a chemical that is sold to companies that produce the anti-anxiety pills. The mi

> Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is $1.60. The standard rate f

> Petrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs. @ $5.40)

> Misterio Company uses a standard costing system. During the past quarter, the following variances were computed: Variable overhead efficiency variance $ 24,000 U Direct labor efficiency variance 120,000 U Direct labor rate variance 10,400 U Misterio appl

> Rand Company produces dry fertilizer. At the beginning of the year, Rand had the following standard cost sheet: Direct materials (8 lbs. @ $1.30) $10.40 Direct labor (0.2 hr. @ $18.00) 3.60 Fixed overhead (0.2 hr. @ $3.00) 0.60 Variable overhead (0.20 hr

> Plimpton Company produces countertop ovens. Plimpton uses a standard costing system. The standard costing system relies on direct labor hours to assign overhead costs to production. The direct labor standard indicates that two direct labor hours should b

> Assume that Sunny Lane, Inc., uses the sales-value-at-split-off method of joint cost allocation and has provided the following information about the four grades of peaches: Total joint cost is $18,000. Required: 1. Allocate the joint cost to the four gra

> EZ Tees Corporation produces T-shirts. The company uses a standard costing system and has set the following standards for direct materials and direct labor (for one shirt): Fabric (0.8 yds. @ $1.60) $ 1.28 Direct labor (0.1 hr. @ $15) 1.50 Total prime co

> Norton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Norton’s accounting staff and is interested in learning as much as possible abou

> An effective budget converts the goals and objectives of an organization into data. The budget serves as a blueprint for management’s plans. The budget is also the basis for control. Management performance can be evaluated by comparing actual results wit

> Refer to Problem 8-35 for data. Required: 1. Run a multiple regression equation using machine hours, number of setups, and number of purchase orders as independent variables. Prepare a flexible budget for overhead for the 12 months using the results of t

> The controller for Muir Company’s Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there

> Friendly Freddie’s is an independently owned major appliance and electronics discount chain with seven stores located in a Midwestern metropolitan area. Rapid expansion has created the need for careful planning of cash requirements to e

> Laghari Company makes and sells high-quality glare filters for microcomputer monitors. John Tanaka, controller, is responsible for preparing Laghari’s master budget and has assembled the following data for the coming year. The direct la

> Bernard Creighton is the controller for Creighton Hardware Store. In putting together the cash budget for the fourth quarter of the year, he has assembled the following data. a. Sales July (actual) $100,000 August (actual) 120,000 September (estimated) 9

> Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below

> House Corporation Board (HCB) of Tri-Gamma Sorority is responsible for the operation of a two story sorority house on the State University campus. HCB has set a normal capacity of 60 women. At any given point in time, there are 100 members of the chapter

> Assume that Sunny Lane, Inc., uses the weighted average method of joint cost allocation and has assigned the following weights to the four grades of peaches: Total joint cost is $18,000. Required: 1. Allocate the joint cost to the four grades of peaches

> Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The

> Sonimad Sawmill, Inc. (SSI), purchases logs from independent timber contractors and processes them into the following three types of lumber products: 1. Studs for residential construction (e.g., walls and ceilings) 2. Decorative pieces (e.g., fireplace m

> Farleigh Petroleum, Inc., is a small company that acquires high-grade crude oil from low-volume production wells owned by individuals and small partnerships. The crude oil is processed in a single refinery into Two Oil, Six Oil, and impure distillates. F

> Macalister Corporation is developing departmental overhead rates based on direct labor hours for its two production departments—Molding and Assembly. The Molding Department employs 20 people, and the Assembly Department employs 80 peopl

> Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and ge

> AirBorne is a small airline operating out of Boise, Idaho. Its three f lights travel to Salt Lake City, Reno, and Portland. The owner of the airline wants to assess the full cost of operating each flight. As part of this assessment, the costs of two supp

> Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal

> Grayson Company produces an industrial chemical used for cleaning and lubricating machinery. In the Mixing Department, liquid and dry chemicals are blended to form slurry. Output is measured in gallons. In the Baking Department, the slurry is subjected t

> Mojada Toys, Inc., manufactures plastic water guns. Each gun’s left and right frames are produced in the Molding Department. The left and right frames are then transferred to the Assembly Department where the trigger mechanism is inserted and the halves

> Cuero Company produces leather strips for western belts using three processes: cutting, design and coloring, and punching. The weighted average method is used for all three departments. The following information pertains to the Design and Coloring Depart

> Sunny Lane, Inc., purchases peaches from local orchards and sorts them into four categories. Grade A are large blemish-free peaches that can be sold to gourmet fruit sellers. Grade B peaches are smaller and may be slightly out of proportion. These are pa

> Golding Manufacturing, a division of Farnsworth Sporting, Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handle. The limbs pass t

> Jacson Company produces two brands of a popular pain medication: regular strength and extra strength. Regular strength is produced in tablet form, and extra strength is produced in capsule form. All direct materials needed for each batch are requisitione

> Refer to the data in Problem 6-33. Required: Prepare a production report for each department using the FIFO method. Data from Problem 6-33: Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three

> Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the

> Refer to the data in Problem 6-31. Required: Repeat the requirements in Problem 6-31 using the FIFO method. Data from Problem 6-31: Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: M

> Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Departmen

> Hepworth Credit Corporation is a wholly owned subsidiary of a large manufacturer of computers. Hepworth is in the business of financing computers, software, and other services that the parent corporation sells. Hepworth has two departments that are invol

> Refer to the data in Problem 6-28. Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Data from Problem 6-28: Hatch Company produces a product that passes through three processes: Fabr

> Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs are added uniformly for all processes. The following information was obtained for the Fabrication Department for June: a.

> Refer to the data in Problem 6-26. Assume that the FIFO method is used. Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production for direct materials and conversion costs. 3. Compute unit cost. Round to three decimal pla

> Refer to Brief Exercise 7-3 and solve for the allocated costs to Fabricating and Assembly using the direct method of support department cost allocation. The Fabricating Department overhead rate is based on normal activity of 82,000 machine hours. The Ass

> Swasey Fabrication, Inc., manufactures frames for bicycles. Each frame passes through three processes: Cutting, Welding, and Painting. In September, the Cutting Department of the Tulsa, Oklahoma, plant reported the following data: a. In Cutting, all dire

> Nutratask, Inc., is a pharmaceutical manufacturer of amino-acid-chelated minerals and vitamin supplements. The company was founded in 1974 and is capable of performing all manufacturing functions, including packaging and laboratory functions. Currently,

> Dr. Alyx Hemmings is employed by Mesa Dental. Mesa Dental recently installed a computerized job-order costing system to help monitor the cost of its services. Each patient is assigned a job number when he or she checks in with the receptionist. The recep

> Sutton Construction Inc. is a privately held, family-founded corporation that builds single- and multiple-unit housing. Most projects Sutton Construction undertakes involve the construction of multiple units. Sutton Construction has adopted a job-order c

> Warren’s Sporting Goods Store sells a variety of sporting goods and clothing. In a back room, Warren’s has set up heat transfer equipment to personalize T-shirts for Little League teams. Typically, each team has the name of the individual player put on t

> Lieu Company is a specialty print shop. Usually, printing jobs are priced at standard cost plus 50 percent. Job 631 involved printing 400 wedding invitations with the following standard costs: Direct materials $240 Direct labor 60 Overhead 80 Total $38

> Cherise Ortega, marketing manager for Romer Company, was puzzled by the outcome of two recent bids. The company’s policy was to bid 150 percent of the full manufacturing cost. One job (labeled Job 97-28) had been turned down by a prospe

> Escuha Company produces two type of calculators: scientific and business. Both products pass through two producing departments. The business calculator is by far the most popular. The following data have been gathered for these two products: Required: 1.

> Refer to the data given in Problem 4-34 and suppose that the expected activity costs are reported as follows (all other data remain the same): Other overhead activities: The per unit overhead cost using the 14 activity-based drivers is $110.80 and $77.90

> For Reducir, Inc. Based on a recent internal study, the following information was also gathered and made available. The unit time information was gathered to allow the company to use TDABC. Cycle time was also calculated using historical production data.

> Refer to Brief Exercise 7-3. Now assume that Chekov Company uses the reciprocal method to allocate support department costs. Required: 1. Calculate the allocation ratios (rounded to four significant digits) for the four departments using the reciprocal m

> Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activitie

> Refer to the data in Problem 4-32. The clinic has identified three types of patients: those with no heart disease, those with mild heart disease, and those with severe heart disease. The following additional data are provided: Required: 1. Using the acti

> The Bienestar Cardiology Clinic has two major activities: diagnostic and treatment. The two activities use four resources: nursing, medical technicians, cardiologists, and equipment. Detailed interviews have provided the work distribution matrix shown be

> Autotech Manufacturing is engaged in the production of replacement parts for automobiles. One plant specializes in the production of two parts: Part #127 and Part #234. Part #127 produced the highest volume of activity, and for many years it was the only

> Glencoe First National Bank operated for years under the assumption that profitability can be increased by increasing dollar volumes. Historically, First National’s efforts were directed toward increasing total dollars of sales and tota

> Glencoe Medical Clinic operates a cardiology care unit and a maternity care unit. Cara Abadi, the clinic’s administrator, is investigating the charges assigned to cardiology patients. Currently, all cardiology patients are charged the s

> Fisico Company produces exercise bikes. One of its plants produces two versions: a standard model and a deluxe model. The deluxe model has a wider and sturdier base and a variety of electronic gadgets to help the exerciser monitor heartbeat, calories bur

> Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates

> Kimball Company has developed the following cost formulas: Material usage: Ym = $80X; r = 0.95 Labor usage (direct): Yl = $20X; r = 0.96 Overhead activity: Yo = $350,000 + $100X; r = 0.75 Selling activity: Ys = $50,000 + $10X; r = 0.93 Where; X = Direct

> Big Mike’s, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controller’s department, believes that overhead activities and

> Refer to Brief Exercise 7-3. Now assume that Chekov Company uses the sequential method to allocate support department costs. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Calculate the allocation ratios (rounded

> St. Teresa’s Medical Center (STMC) offers a number of specialized medical services, including neuroscience, cardiology, and oncology. STMC’s strong reputation for quality medical care allowed it to branch out into othe

> Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The com

> Thames Assurance Company sells a variety of life and health insurance products. Recently, Thames developed a long-term care policy for sale to members of university and college alumni associations. Thames estimated that the sale and service of this type

> Harriman Industries manufactures engines for the aerospace industry. It has completed manufacturing the first unit of the new ZX-9 engine design. Management believes that the 1,000 labor hours required to complete this unit are reasonable and is prepared

> The Lockit Company manufactures door knobs for residential homes and apartments. Lockit is considering the use of simple (single-driver) and multiple regression analyses to forecast annual sales because previous forecasts have been inaccurate. The new sa

> Randy Harris, controller, has been given the charge to implement an advanced cost management system. As part of this process, he needs to identify activity drivers for the activities of the firm. During the past four months, Randy has spent considerable

> Friendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complet

> Weber Valley Regional Hospital has collected data on all of its activities for the past 16 months. Data for cardiac nursing care follow: Required: 1. Using the high-low method, calculate the variable rate per hour and the fixed cost for the nursing care

> DeMarco Company is developing a cost formula for its packing activity. Discussion with the workers in the Packing Department has revealed that packing costs are associated with the number of customer orders, the size of the orders, and the relative fragi