Question: Refer to the data in Problem 4-

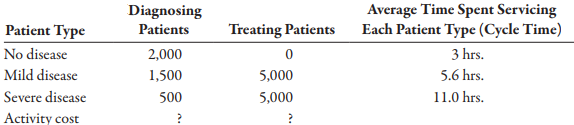

Refer to the data in Problem 4-32. The clinic has identified three types of patients: those with no heart disease, those with mild heart disease, and those with severe heart disease. The following additional data are provided:

Required:

1. Using the activity costs calculated from Requirement 1 of Problem 4-32 (or calculate them if necessary), calculate the unit cost of servicing each type of patient using traditional ABC.

2. Using TDABC-derived activity rates, calculate the unit cost of servicing each type of patient.

3. Using DBC, calculate the unit cost of servicing each type of patient.

4. Suppose that a medical consultant proposes a new patient-processing system that will shorten diagnostic and treatment times but would require more skilled nurses and technicians as well as an equipment upgrade. However, the total practical capacity would remain the same, at 20,000 hours. Total resource costs are predicted to increase by $100,000. The consultant estimates that the cycle times for each patient type would be reduced from 3 to 2 hours, 5.6 to 4.5 hours, and 11 to 9 hours. The physicians that own the clinic have expressed a willingness to implement the changes, provided that the unit cost of servicing each patient type decreases. Use DBC to estimate the new unit costs. Should the clinic implement the new system? Discuss the advantages of DBC for this analysis over ABC and TDABC. Finally, identify the data analytic types (descriptive, diagnostic, predictive, or prescriptive) that apply for this analysis (see Exhibits 2.5 and 2.6, pp. 37, 40, for a review of data analytic types). Note: More than one analytic type might apply

> Rand Company produces dry fertilizer. At the beginning of the year, Rand had the following standard cost sheet: Direct materials (8 lbs. @ $1.30) $10.40 Direct labor (0.2 hr. @ $18.00) 3.60 Fixed overhead (0.2 hr. @ $3.00) 0.60 Variable overhead (0.20 hr

> Plimpton Company produces countertop ovens. Plimpton uses a standard costing system. The standard costing system relies on direct labor hours to assign overhead costs to production. The direct labor standard indicates that two direct labor hours should b

> Assume that Sunny Lane, Inc., uses the sales-value-at-split-off method of joint cost allocation and has provided the following information about the four grades of peaches: Total joint cost is $18,000. Required: 1. Allocate the joint cost to the four gra

> EZ Tees Corporation produces T-shirts. The company uses a standard costing system and has set the following standards for direct materials and direct labor (for one shirt): Fabric (0.8 yds. @ $1.60) $ 1.28 Direct labor (0.1 hr. @ $15) 1.50 Total prime co

> Norton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Norton’s accounting staff and is interested in learning as much as possible abou

> An effective budget converts the goals and objectives of an organization into data. The budget serves as a blueprint for management’s plans. The budget is also the basis for control. Management performance can be evaluated by comparing actual results wit

> Refer to Problem 8-35 for data. Required: 1. Run a multiple regression equation using machine hours, number of setups, and number of purchase orders as independent variables. Prepare a flexible budget for overhead for the 12 months using the results of t

> The controller for Muir Company’s Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there

> Friendly Freddie’s is an independently owned major appliance and electronics discount chain with seven stores located in a Midwestern metropolitan area. Rapid expansion has created the need for careful planning of cash requirements to e

> Laghari Company makes and sells high-quality glare filters for microcomputer monitors. John Tanaka, controller, is responsible for preparing Laghari’s master budget and has assembled the following data for the coming year. The direct la

> Bernard Creighton is the controller for Creighton Hardware Store. In putting together the cash budget for the fourth quarter of the year, he has assembled the following data. a. Sales July (actual) $100,000 August (actual) 120,000 September (estimated) 9

> Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below

> House Corporation Board (HCB) of Tri-Gamma Sorority is responsible for the operation of a two story sorority house on the State University campus. HCB has set a normal capacity of 60 women. At any given point in time, there are 100 members of the chapter

> Assume that Sunny Lane, Inc., uses the weighted average method of joint cost allocation and has assigned the following weights to the four grades of peaches: Total joint cost is $18,000. Required: 1. Allocate the joint cost to the four grades of peaches

> Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The

> Sonimad Sawmill, Inc. (SSI), purchases logs from independent timber contractors and processes them into the following three types of lumber products: 1. Studs for residential construction (e.g., walls and ceilings) 2. Decorative pieces (e.g., fireplace m

> Welcome Inns is a chain of motels serving business travelers in New Mexico and southwest Texas. The chain has grown from one motel several years ago to five motels. In 20x1, the owner of the company decided to set up an internal Accounting Department to

> Farleigh Petroleum, Inc., is a small company that acquires high-grade crude oil from low-volume production wells owned by individuals and small partnerships. The crude oil is processed in a single refinery into Two Oil, Six Oil, and impure distillates. F

> Macalister Corporation is developing departmental overhead rates based on direct labor hours for its two production departments—Molding and Assembly. The Molding Department employs 20 people, and the Assembly Department employs 80 peopl

> Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and ge

> AirBorne is a small airline operating out of Boise, Idaho. Its three f lights travel to Salt Lake City, Reno, and Portland. The owner of the airline wants to assess the full cost of operating each flight. As part of this assessment, the costs of two supp

> Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal

> Grayson Company produces an industrial chemical used for cleaning and lubricating machinery. In the Mixing Department, liquid and dry chemicals are blended to form slurry. Output is measured in gallons. In the Baking Department, the slurry is subjected t

> Mojada Toys, Inc., manufactures plastic water guns. Each gun’s left and right frames are produced in the Molding Department. The left and right frames are then transferred to the Assembly Department where the trigger mechanism is inserted and the halves

> Cuero Company produces leather strips for western belts using three processes: cutting, design and coloring, and punching. The weighted average method is used for all three departments. The following information pertains to the Design and Coloring Depart

> Sunny Lane, Inc., purchases peaches from local orchards and sorts them into four categories. Grade A are large blemish-free peaches that can be sold to gourmet fruit sellers. Grade B peaches are smaller and may be slightly out of proportion. These are pa

> Golding Manufacturing, a division of Farnsworth Sporting, Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handle. The limbs pass t

> Jacson Company produces two brands of a popular pain medication: regular strength and extra strength. Regular strength is produced in tablet form, and extra strength is produced in capsule form. All direct materials needed for each batch are requisitione

> Refer to the data in Problem 6-33. Required: Prepare a production report for each department using the FIFO method. Data from Problem 6-33: Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three

> Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the

> Refer to the data in Problem 6-31. Required: Repeat the requirements in Problem 6-31 using the FIFO method. Data from Problem 6-31: Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: M

> Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Departmen

> Hepworth Credit Corporation is a wholly owned subsidiary of a large manufacturer of computers. Hepworth is in the business of financing computers, software, and other services that the parent corporation sells. Hepworth has two departments that are invol

> Refer to the data in Problem 6-28. Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Data from Problem 6-28: Hatch Company produces a product that passes through three processes: Fabr

> Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs are added uniformly for all processes. The following information was obtained for the Fabrication Department for June: a.

> Refer to the data in Problem 6-26. Assume that the FIFO method is used. Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production for direct materials and conversion costs. 3. Compute unit cost. Round to three decimal pla

> Refer to Brief Exercise 7-3 and solve for the allocated costs to Fabricating and Assembly using the direct method of support department cost allocation. The Fabricating Department overhead rate is based on normal activity of 82,000 machine hours. The Ass

> Swasey Fabrication, Inc., manufactures frames for bicycles. Each frame passes through three processes: Cutting, Welding, and Painting. In September, the Cutting Department of the Tulsa, Oklahoma, plant reported the following data: a. In Cutting, all dire

> Nutratask, Inc., is a pharmaceutical manufacturer of amino-acid-chelated minerals and vitamin supplements. The company was founded in 1974 and is capable of performing all manufacturing functions, including packaging and laboratory functions. Currently,

> Dr. Alyx Hemmings is employed by Mesa Dental. Mesa Dental recently installed a computerized job-order costing system to help monitor the cost of its services. Each patient is assigned a job number when he or she checks in with the receptionist. The recep

> Sutton Construction Inc. is a privately held, family-founded corporation that builds single- and multiple-unit housing. Most projects Sutton Construction undertakes involve the construction of multiple units. Sutton Construction has adopted a job-order c

> Warren’s Sporting Goods Store sells a variety of sporting goods and clothing. In a back room, Warren’s has set up heat transfer equipment to personalize T-shirts for Little League teams. Typically, each team has the name of the individual player put on t

> Lieu Company is a specialty print shop. Usually, printing jobs are priced at standard cost plus 50 percent. Job 631 involved printing 400 wedding invitations with the following standard costs: Direct materials $240 Direct labor 60 Overhead 80 Total $38

> Cherise Ortega, marketing manager for Romer Company, was puzzled by the outcome of two recent bids. The company’s policy was to bid 150 percent of the full manufacturing cost. One job (labeled Job 97-28) had been turned down by a prospe

> Escuha Company produces two type of calculators: scientific and business. Both products pass through two producing departments. The business calculator is by far the most popular. The following data have been gathered for these two products: Required: 1.

> Refer to the data given in Problem 4-34 and suppose that the expected activity costs are reported as follows (all other data remain the same): Other overhead activities: The per unit overhead cost using the 14 activity-based drivers is $110.80 and $77.90

> For Reducir, Inc. Based on a recent internal study, the following information was also gathered and made available. The unit time information was gathered to allow the company to use TDABC. Cycle time was also calculated using historical production data.

> Refer to Brief Exercise 7-3. Now assume that Chekov Company uses the reciprocal method to allocate support department costs. Required: 1. Calculate the allocation ratios (rounded to four significant digits) for the four departments using the reciprocal m

> Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activitie

> The Bienestar Cardiology Clinic has two major activities: diagnostic and treatment. The two activities use four resources: nursing, medical technicians, cardiologists, and equipment. Detailed interviews have provided the work distribution matrix shown be

> Autotech Manufacturing is engaged in the production of replacement parts for automobiles. One plant specializes in the production of two parts: Part #127 and Part #234. Part #127 produced the highest volume of activity, and for many years it was the only

> Glencoe First National Bank operated for years under the assumption that profitability can be increased by increasing dollar volumes. Historically, First National’s efforts were directed toward increasing total dollars of sales and tota

> Glencoe Medical Clinic operates a cardiology care unit and a maternity care unit. Cara Abadi, the clinic’s administrator, is investigating the charges assigned to cardiology patients. Currently, all cardiology patients are charged the s

> Fisico Company produces exercise bikes. One of its plants produces two versions: a standard model and a deluxe model. The deluxe model has a wider and sturdier base and a variety of electronic gadgets to help the exerciser monitor heartbeat, calories bur

> Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates

> Kimball Company has developed the following cost formulas: Material usage: Ym = $80X; r = 0.95 Labor usage (direct): Yl = $20X; r = 0.96 Overhead activity: Yo = $350,000 + $100X; r = 0.75 Selling activity: Ys = $50,000 + $10X; r = 0.93 Where; X = Direct

> Big Mike’s, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controller’s department, believes that overhead activities and

> Refer to Brief Exercise 7-3. Now assume that Chekov Company uses the sequential method to allocate support department costs. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Calculate the allocation ratios (rounded

> St. Teresa’s Medical Center (STMC) offers a number of specialized medical services, including neuroscience, cardiology, and oncology. STMC’s strong reputation for quality medical care allowed it to branch out into othe

> Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The com

> Thames Assurance Company sells a variety of life and health insurance products. Recently, Thames developed a long-term care policy for sale to members of university and college alumni associations. Thames estimated that the sale and service of this type

> Harriman Industries manufactures engines for the aerospace industry. It has completed manufacturing the first unit of the new ZX-9 engine design. Management believes that the 1,000 labor hours required to complete this unit are reasonable and is prepared

> The Lockit Company manufactures door knobs for residential homes and apartments. Lockit is considering the use of simple (single-driver) and multiple regression analyses to forecast annual sales because previous forecasts have been inaccurate. The new sa

> Randy Harris, controller, has been given the charge to implement an advanced cost management system. As part of this process, he needs to identify activity drivers for the activities of the firm. During the past four months, Randy has spent considerable

> Friendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complet

> Weber Valley Regional Hospital has collected data on all of its activities for the past 16 months. Data for cardiac nursing care follow: Required: 1. Using the high-low method, calculate the variable rate per hour and the fixed cost for the nursing care

> DeMarco Company is developing a cost formula for its packing activity. Discussion with the workers in the Packing Department has revealed that packing costs are associated with the number of customer orders, the size of the orders, and the relative fragi

> The management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power c

> Chekov Company has two support departments, Human Resources and General Factory, and two producing departments, Fabricating and Assembly. The costs of the Human Resources Department are allocated on the basis of number of employees, and the costs of Gene

> Vasani House Company produces numerous fabrics for use in automobile, airplane, and boat seats. For last year, Vasani House reported the following: Last year, Vasani House produced 6,800 units and sold 7,000 units at $250 per unit. Required: 1. Prepare a

> Mason, Durant, and Santos (MDS) is a tax services firm. The firm is located in Oklahoma City and employs 15 professionals and eight staff. The firm does tax work for small businesses and well-to-do individuals. The following data are provided for the las

> Allright Test Design Company creates, produces, and sells Internet-based CPA and CMA review courses for individual use. Davis Webber, head of human resources, is convinced that question development employees must have strong analytical and problem-solvin

> Spencer Company produced 200,000 cases of sports drinks during the past calendar year. Each case of 1-liter bottles sells for $36. Spencer had 2,500 cases of sports drinks in finished goods inventory at the beginning of the year. At the end of the year,

> The actions listed next are associated with either an activity-based operational control system or a traditional operational control system: a. Budgeted costs for the maintenance department are compared with the actual costs of the maintenance department

> The following items are associated with a traditional cost accounting information system, an activity-based cost accounting information system, or both (i.e., some elements are common to the two systems): a. Usage of direct materials b. Direct materials

> Wright Plastic Products is a small company that specialized in the production of plastic dinner plates until several years ago. Although profits for the company had been good, they have been declining in recent years because of increased competition. Man

> Brody Company makes industrial cleaning solvents. Various chemicals, detergent, and water are mixed together and then bottled in 10-gallon drums. Brody provided the following information for last year: Last year, Brody completed 100,000 units. Sales reve

> Foto-Fast Copy Shop provides a variety of photocopying and printing services. On June 5, the owner invested in some computer-aided photography equipment that enables customers to reproduce a picture or illustration, input it digitally into the computer,

> Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Purchasing $40,000 Setups 37,500 Engineering 45,000 Other 40,000 Previously, Sanjay Bhatt, Firenza Company’s controller, had appli

> The expected costs for the Maintenance Department of Stazler, Inc., for the coming year include: Fixed costs (salaries, tools): $64,900 per year Variable costs (supplies): $1.35 per maintenance hour The Assembly and Packaging departments expect to use ma

> During May, the following transactions were completed and reported by Sylvana Company: a . Materials purchased on account, $60,100. b. Materials issued to production to fill job-order requisitions: direct materials, $51,000; indirect materials, $8,950. c

> Lawanna Davis graduated from State U with a major in accounting five years ago. She obtained a position with a well-known professional services firm upon graduation and has become one of their outstanding performers. In the course of her work, she has de

> Garcia Industries produces tool and die machinery for manufacturers. The company expanded vertically in 20x1 by acquiring one of its suppliers of alloy steel plates, Keimer Steel Company. To manage the two separate businesses, the operations of Keimer ar

> Reddy Industries is a vertically integrated firm with several divisions that operate as decentralized profit centers. Reddy’s Systems Division manufactures scientific instruments and uses the products of two of Reddy’s

> For each of the following scenarios, determine whether the specified variable would increase, decrease, or remain the same. Explain your choice. 1. If sales and average operating assets for Kayman Company for Year 2 are identical to their values in Year

> At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To

> Carson Wellington, president of Mallory Plastics, was considering a report sent to him by Emily Sorensen, vice president of operations. The report was a summary of the progress made by an activity-based management system that was implemented three years

> CableTech Bell Corporation (CTB) operates in the telecommunications industry. CTB has two divisions: the Phone Division and the Cable Service Division. The Phone Division manufactures telephones in several plants located in the Midwest. The product lines

> Elena Chavez is founder and CEO of Willowbank, Inc., which owns and operates several assisted-living facilities. The facilities are apartment-style buildings with 25 to 30 one- or two-bedroom apartments. While each apartment has its own complete kitchen,

> Jack Aerospace Technologies (JAT) researches, designs, manufactures, delivers, and services numerous product part components to the world’s largest aircraft companies. JAT produces approximately 120 aircraft products using numerous proc

> Refer to Brief Exercise 7-10. (Round percentages to four significant digits and cost allocations to the nearest dollar.) Required: 1. Calculate the total revenue, total costs, and total gross profit the company will earn on the sale of L-Ten, Triol, and

> Beauville Furniture Corporation produces sofas, recliners, and lounge chairs. Beauville is located in a medium-sized community in the southeastern part of the United States. It is a major employer in the community. In fact, the economic well-being of the

> Each of the following scenarios requires the use of accounting information to carry out one or more of the following managerial activities: (1) planning, (2) control and evaluation, (3) continuous improvement, or (4) decision making. a. MANAGER: At t

> Bill Christensen, the production manager, was grumbling about the new quality cost system the plant controller wanted to put into place. “If we start trying to track every bit of spoiled material, we’ll never get any work done. Everybody knows when they

> If I can increase my reported profit by $2 million, the actual earnings per share will exceed analysts’ expectations, and stock prices will increase. The stock options that I am holding will become more valuable. The extra income will also make me eligib

> Consider the following actions associated with a cost management information system: a. Eliminating a non-value-added activity b. Determining how much it costs to perform a heart transplant c. Calculating the cost of inspecting components from an outside

> Hepworth Communications produces cell phones. One of the four major electronic components is produced internally. The other three components are purchased from external suppliers. The electronic components and other parts are assembled (by the Assembly D

> Classify each of the following actions as either being associated with the financial accounting information system (FS) or the cost management information system (CMS): a. Determining the total compensation of the CEO of a public company b. Issuing a qua

> Refer to the data given in Exercise 10-8. Required: 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) 2. Compute the divisional residual income (rounded to the nearest dollar) for each of the following four alte

> At the end of Year 2, the manager of the Canned Foods Division is concerned about the division’s performance. As a result, he is considering the opportunity to invest in two independent projects. The first is juice boxes for elementary