Question: Kim retires from the KLM Partnership on

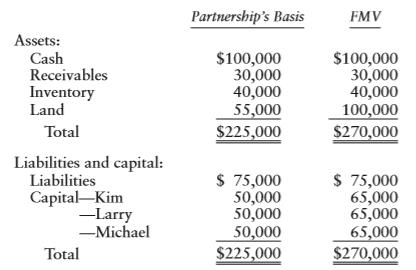

Kim retires from the KLM Partnership on January 1 of the current year. At that time, her basis in the partnership is $75,000, which includes her share of liabilities. The partnership reports the following balance sheet:

Explain the tax consequences (i.e., amount and character of gain or loss recognized and Kim’s basis for any assets received) of the partnership making the retirement payments described in the following independent situations. Kim’s share of liabilities is $25,000.

a. Kim receives $65,000 cash on January 1.

b. Kim receives $75,000 cash on January 1.

Transcribed Image Text:

Partnership's Basis FMV Assets: Cash Receivables Inventory Land $100,000 30,000 40,000 55,000 $100,000 30,000 40,000 100,000 $270,000 Total $225,000 Liabilities and capital: Liabilities Capital-Kim -Larry -Michael $ 75,000 50,000 50,000 50,000 $225,000 $ 75,000 65,000 65,000 65,000 $270,000 Total

> Karysa Co. operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus tax bills for 2010 are issued in May 2011 and are payable in July 2011. Required: a. Explain how the amount of tax expense for calen

> At March 31, 2010, the end of the first year of operations at Jaryd, Inc., the firm’s accountant neglected to accrue payroll taxes of $4,800 that were applicable to payrolls for the year then ended. Required: a. Use the horizontal model (or write the jo

> On August 1, 2010, Colombo Co.’s treasurer signed a note promising to pay $240,000 on December 31, 2010. The proceeds of the note were $232,000. Required: a. Calculate the discount rate used by the lender. b. Calculate the effective interest rate (APR)

> On April 15, 2010, Powell, Inc., obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $300,000. The interest rate charged by the bank was 9%. The bank made the loan on a discount basis. Require

> Pope’s Garage had the following accounts and amounts in its financial statements on December 31, 2010. Assume that all balance sheet items reflect account balances at December 31, 2010, and that all income statement items reflect activities that occurred

> Enter the following column headings across the top of a sheet of paper: Enter the transaction/adjustment letter in the first column and show the effect, if any, of each transaction/adjustment on the appropriate balance sheet category or on net income b

> Assume that Home and Office City, Inc., provided the following comparative data concerning long-term debt in the notes to its 2011 annual report (amounts in millions): Required: a. As indicated, Home and Office City’s 31â&

> A review of the accounting records at Corless Co. revealed the following information concerning the company’s liabilities that were outstanding at December 31, 2011, and 2010, respectively: Required: a. Corless Co. has not yet made an

> Ambrose Co. has the option of purchasing a new delivery truck for $28,200 in cash or leasing the truck for $6,100 per year, payable at the end of each year for six years. The truck also has a useful life of six years and will be depreciated on a straight

> On January 1, 2010, Carey, Inc., entered into a No cancellable lease agreement, agreeing to pay $3,500 at the end of each year for four years to acquire a new computer system having a market value of $10,200. The expected useful life of the computer syst

> The balance sheets of HiROE, Inc., showed the following at December 31, 2011, and 2010: Required: a. If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the

> The balance sheets of Tully Corp. showed the following at December 31, 2011, and 2010: Required: a. If there have not been any purchases, sales, or other transactions affecting this machine account since the machine was first acquired, what is the amou

> Moyle Co. acquired a machine on January 1, 2010, at a cost of $320,000. The machine is expected to have a five-year useful life, with a salvage value of $20,000. The machine is capable of producing 300,000 units of product in its lifetime. Actual product

> Grove Co. acquired a production machine on January 1, 2010, at a cost of $240,000. The machine is expected to have a four year useful life, with a salvage value of $40,000. The machine is capable of producing 50,000 units of product in its lifetime. Actu

> Porter, Inc., acquired a machine that cost $720,000 on October 1, 2010. The machine is expected to have a four-year useful life and an estimated salvage value of $80,000 at the end of its life. Porter, Inc., uses the calendar year for financial reporting

> The information presented here represents selected data from the December 31, 2010, balance sheets and income statements for the year then ended for three firms: Required: Calculate the missing amounts for each firm. Firm A Firm B Firm C Total asse

> Listed here are a number of financial statement captions. Indicate in the spaces to the right of each caption the category of each item and the financial statement(s) on which the item can usually be found. Use the following abbreviations: Category

> When Yuji died in March 2017, his gross estate was valued at $8 million. He owed debts totaling $300,000. Funeral and administration expenses were $12,000 and $120,000, respectively. The marginal estate tax rate exceeded his estate’s marginal income tax

> Fifteen years ago, Mrs. Cobb purchased land costing $80,000. She had the land titled in the names of Mr. and Mrs. Cobb, joint tenants with right of survivor ship. Mrs. Cobb died and was survived by Mr. Cobb. At Mrs. Cobb’s death, the land’s value was $20

> Five years ago, Andy and Sandy, siblings, pooled their resources and purchased a warehouse. Andy provided $50,000 of consideration, and Sandy furnished $100,000. Andy died and was survived by Sandy. The property, which they had titled in the names of And

> Ten years ago, Art purchased land for $60,000 and immediately titled it in the names of Art and Bart, joint tenants with right of survivorship. Bart paid no consideration. In 2017, Art died and was survived by Bart, his brother. The land’s value had appr

> Twelve years ago, Latoya transferred property to an irrevocable trust with a bank trustee. Latoya named Al to receive the trust income annually for life and Pat or Pat’s estate to receive the remainder upon Al’s death. Latoya reserved the power to design

> John owns all the stock of Lucas Corporation, an S corporation. John’s basis for the 1,000 shares is $130,000. On June 11 of the current year (assume a non-leap year), John gifts 100 shares of stock to his younger brother Michael, who has been working in

> Sue died on May 3, 2017. On October 1, 2015, Sue gave her son Tom land valued at $7,014,000. Sue applied a unified credit of $2,117,800 against the gift tax due on this transfer. On Sue’s date of death the land was valued at $9.4 million. a. With respec

> Mary died on April 3, 2017. As of this date, Mary’s gross estate was valued at $6.5 million. On October 3, Mary’s gross estate was valued at $5.8 million. The estate neither distributed nor sold any assets before October 3, 2017. Mary’s estate had no ded

> P Corporation purchases 100% of S Corporation’s stock for $2 million on January 1 of the current year. The corporations elect to file a consolidated tax return. During the current year, S reports $350,000 of taxable income and $30,000 of tax-exempt inter

> Giovanni died in 2017 with a gross estate of $6.9 million and debts of $30,000. He made post-1976 taxable gifts of $100,000, valued at $80,000 when Giovanni died. His estate paid state death taxes of $110,200. Calculate his estate tax base.

> Austin & Becker is an electing large partnership. During the current year, the partnership has the following income, loss, and deduction items: Ordinary income………………………………………………….$5,200,000 Rental loss…………………………………………………………(2,000,000) Longterm capital

> Maria Martinez died in 2017, survived by her spouse, Sergio, and two adult children. Her gross estate, all of which passed under her will, was valued at $7.2 million. She had Sec. 2053 deductions of $100,000. Her will left $200,000 to her church, 20% of

> Will, a bachelor, died in 2017. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as follows: a. What was Will’s estate tax base

> Maria purchased an interest in a real estate tax shelter many years ago and deducted losses from its operation for several years. The real property owned by the tax shelter when Maria made her investment has been fully depreciated on a straightline basi

> Beth died on May 3, 2017. Her executor elected date-of-death valuation. Beth’s gross estate included, among other properties, the items listed below. What is the estate tax value of each item? a. 4,000 shares of Highline Corporation stock, traded on a s

> Debra has operated a family counseling practice for a number of years as a sole proprietor. She owns the condominium office space that she occupies in addition to her professional library and office furniture. She has a limited amount of working capital

> Consider the following balance sheet for DEF Partnership: Suppose Daniel wishes to exit the partnership completely. After discussions with Edward and Frances, the partners agree to let Daniel choose one of three options: 1. Daniel takes a liquidating d

> Frank, Greta, and Helen each have a one­third interest in the FGH Partnership. On December 31, 2016, the partnership reported the following balance sheet: The partnership placed Asset 1 (seven­year property) in service in 2014 and

> Pedro owns a 60% interest in the PD General Partnership having a $40,000 basis and $200,000 FMV. His share of partnership liabilities is $100,000. Because he is nearing retirement age, he has decided to give away his partnership interest on June 15 of th

> Della retires from the BCD General Partnership when her basis in her partnership interest is $70,000 including her $10,000 share of liabilities. The partnership is in the business of providing house cleaning services for local residences. At the date of

> Arnie, Becky, and Clay are equal partners in the ABC General Partnership. The three individuals each have a $120,000 tax basis in their partnership interest. For business reasons, the partnership needs to be changed into the ABC Corporation, and all thre

> ABC Company, a limited liability company (LLC) organized in the state of Florida, reports using a calendar tax yearend. The LLC chooses to be taxed as a partnership. Alex, Bob, and Carrie (all calendar year taxpayers) own ABC equally, and each has a bas

> The JKL Partnership has three equal partners, Jingjing, Kevin, and Latisha. Latisha sells her interest to Larry for $690,000. The partnership does not have a Sec. 754 election in effect. Just before the sale of Latisha’s interest, the p

> Patty pays $100,000 cash for Stan’s one third interest in the STU Partnership. The partnership has a Sec. 754 election in effect. Just before the sale of Stan’s interest, STU’s balance sheet appears a

> For each of the following independent situations, determine which partnership(s) (if any) terminate and which partnership(s) (if any) continue. a. The KLMN Partnership is created when the KL Partnership merges with the MN Partnership. The ownership of t

> Tyra has a zero basis in her partnership interest and a share in partnership liabilities, which are quite large. Explain how these facts will affect the taxation of her departure from the partnership using the following methods of terminating her interes

> Wendy, Xenia, and Yancy own 40%, 8%, and 52%, respectively, of the WXY Partnership. For each of the following independent situations occurring in the current year, determine whether the WXY Partnership terminates and, if so, the date on which the termina

> Josh holds a general partnership interest in the JLK Partnership having a $40,000 basis and a $60,000 FMV. The JLK Partnership is a limited partnership that engages in real estate activities. Diana has an interest in the CDE Partnership having a $20,000

> Amy, a one­third partner, retires from the AJS Partnership on January 1 of the current year. Her basis in her partnership interest is $120,000 including her share of liabilities. Amy receives $160,000 in cash from the partnership for her inter

> John has a 60% capital and profits interest in the JAS Partnership with a basis of $333,600, which includes his share of liabilities, when he decides to retire. Andrew and Stephen want to continue the partnership’s business. On the date

> Bruce died on June 1 of the current year. On the date of his death, he held a one­third interest in the ABC Partnership, which had a $100,000 basis including his share of liabilities. Under the partnership agreement, Bruce’s

> When Jerry died on April 16 of the current year, he owned a 40% interest in the JM Partnership, and Michael owns the remaining 60% interest. All his assets are held in his estate for a two­year period while the estate is being settled. Jerry&a

> Brian owns 40% of the ABC Partnership before his retirement on April 15 of the current year. On that date, his basis in the partnership interest is $40,000 including his share of liabilities. The partnership’s balance sheet on that date

> Suzanne retires from the BRS Partnership when the basis of her one third interest is $105,000, which includes her share of liabilities. At the time of her retirement, the partnership had the following assets: The partnership has $60,000 of liabilities w

> Alice, Bob, and Charles are one­third partners in the ABC Partnership. The partners originally formed the partnership with cash contributions, so no partner has precontribution gains or losses. Prior to Alice’s sale of her pa

> Can a partner recognize both a gain and a loss on the sale of a partnership interest? If so, under what conditions?

> Clay owned 60% of the CAP Partnership and sold one-half of his interest (30%) to Steve for $75,000 cash. Before the sale, Clay’s basis in his entire partnership interest was $168,000 including his $30,000 share of partnership liabilitie

> Pat, Kelly, and Yvette are equal partners in the PKY Partnership before Kelly sells her partnership interest. On January 1 of the current year, Kelly’s basis in her partnership interest, including her share of liabilities, was $35,000.

> The LQD Partnership distributes the following property to Larry in a distribution that liquidates Larry’s interest in the partnership. Assume that no Sec. 754 election is in effect. Larry’s basis in his partnership int

> The AB Partnership pays its only liability (a $100,000 mortgage) on April 1 of the current year and terminates that same day. Alison and Bob were equal partners in the partnership but have partnership bases immediately preceding these transactions of $11

> Marinda is a one­third partner in the MWH Partnership before she receives $100,000 cash as a liquidating distribution. Immediately before Marinda receives the distribution, the partnership has the following assets: At the time of the distribu

> Assume the same four independent distributions as in Problem C:10­25. Fill in the blanks in that problem assuming the only change in the facts is that the distributions are now liquidating distributions instead of nonliquidating distributions.

> The CL Partnership has two partners, Cleo and Leo. Each partner’s basis in his or her partnership interest is $10,000 before any distribution. The partnership distributes $12,000 cash to Cleo and $8,000 cash to Leo. a. Assuming a current distribution, d

> The PQRS Partnership owns the following assets on December 30 of the current year: The partnership has no liabilities, and each partner’s basis in his or her partnership interest is $25,000. On December 30 of the current year, Paula re

> The JKLM Partnership owns the following assets on October 1 of the current year: a. Which partnership items are unrealized receivables? b. Is the partnership’s inventory substantially appreciated? c. Assume the JKLM Partnership has n

> The KLM Partnership owns the following assets on March 1 of the current year: a. Which partnership items are unrealized receivables? b. Is the partnership’s inventory substantially appreciated? c . Assume the KLM Partnership has no l

> What conditions are required for a partner to recognize a loss upon receipt of a distribution from a partnership?

> Happy Times Film Distributions is an electing large partnership. During the current year, the partnership has the following income, loss, and deduction items: Ordinary income……………………………………..$700,000 Passive income………………………………………..3,000,000 Sec. 1231 gai

> Anne decides to leave the ABC Partnership after owning the interest for many years. She owns a 52% capital, profits, and loss interest in the general partnership (which is not a service partnership). Anne’s basis in her partnership inte

> Refer to the facts in Comprehensive Problem C:654. Now assume the entity is a partnership named Lifecycle Partnership. Additional facts are as follows: • Except for precontribution gains and losses, the partners agree to share profits and losses in a

> P Corporation acquires all of S Corporation’s stock at the beginning of the current year in a transaction that qualifies as a Sec. 382 ownership change. P and S elect to file a consolidated tax return for the current year. At the time of the acquisition,

> P and S Corporations comprise an affiliated group that files separate tax returns. P and S had no intercompany inventory sales before the current year (Year 1). P and S use the first-in, first-out (FIFO) inventory method. During Year 1, S sells 40,000 wi

> P Corporation owns 100% of S Corporation’s stock, and S owns 100% of T Corporation’s stock. The three corporations have filed consolidated tax returns for several years. On January 1 of the current year, P’s basis for its S stock is $5 million, and S’s b

> Mark Green and his brother Michael purchased land in Orlando, Florida many years ago. At that time, they began their investing as Green Brothers Partnership with capital they obtained from placing second mortgages on their homes. Their investments have f

> P Corporation owns 100% of S Corporation’s stock, and they have filed consolidated tax returns for several years. P also has owned 49% of T Corporation’s stock for 10 years. On December 31 of the current year (Year 1), P purchases the other 51% of T’s st

> Bart, P’s sole shareholder, creates P on January 1 of Year 1. P purchases all of S1’s and S2’s stock on September 1 of Year 1, after both corporations are in operation for about six months. P, S1, and

> P Corporation acquires all of S Corporation’s stock at the close of business on December 31 of Year 1. The corporations, which file on the calendar year, begin filing a consolidated tax return for Year 2. The corporations report the fol

> Explain the conditions under which Sec. 751 has an impact on nonliquidating (current) distributions.

> P Corporation owns all the stock of S1 and S2 Corporations, and the group has filed consolidated tax returns on a calendar year basis for several years. In the current year (Year 1), S2 sells to S1 for $90,000 land S2 had purchased for $75,000. On Decemb

> P Corporation acquires all of S Corporation’s stock on January 1 of Year 2. In Year 1, the corporations were unrelated entities that filed separate returns. P and S report the following results: Ignore the Sec. 382 loss limitation that

> P Corporation owns all the stock of S Corporation, and P and S file a consolidated tax return. On January 1 of Year 2, P creates T Corporation and acquires all of its stock. P, S, and T report the following results for Years 1 through 3 (before any NOL d

> P Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 3, P sells all of its S2 stock. The group reports the following r

> P and S Corporations form in Year 1, with S as P’s wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results: The group does not elect to forego any NOL carryb

> Peoria and Salem Corporations have filed consolidated tax returns for several years. For the current year, consolidated adjusted current earnings are $750,000. Consolidated preadjustment alternative minimum taxable income is $400,000. Consolidated taxabl

> Dallas and Houston Corporations comprise an affiliated group that formed at the beginning of the current year. The following items pertain to Dallas and Houston for the current year: Determine each corporation’s AMT liability if they f

> Miami and Tampa Corporations comprise a parent-subsidiary controlled group. The corporations also comprise an affiliated group that has filed separate tax returns prior to the current year. In each case for the current year, determine each corporation’s

> P, S, and T Corporations have filed consolidated tax returns for several years. P, S, and T report taxable incomes or losses (without regard to any dividends received and dividends-received deductions) of $200,000, $(70,000), and $175,000, respectively,

> Alpha and Beta Corporations comprise an affiliated group that has filed separate tax returns prior to the current year. The corporations report the following amounts for the current year: Alpha’s long-term capital gains include a $4,40

> List five advantages and five disadvantages of making an S election. Briefly explain each item.

> Mobile, Newark, and Omaha Corporations comprise an affiliated group that has filed separate tax returns prior to the current year. The corporations report the following amounts for the current year: The corporations have no intercompany transactions, no

> Topeka and Wichita Corporations have filed consolidated tax returns for several years. Topeka and Wichita report current year taxable incomes (without regard to any dividend income received, charitable contribution deduction, or dividends-received deduct

> P and S Corporations have filed consolidated tax returns for several years. The group had no intercompany inventory sales before the current year (Year 1). P and S use the first-in, first-out (FIFO) inventory method. During Year 1, S sells 50,000 widgets

> P and S Corporations have filed consolidated tax returns for several years. In the current year (Year 1), P began selling inventory items to S. P and S use the first-in, first-out (FIFO) inventory method. P’s profits on its Year 1 inventory sales to S ar

> S and B corporations are members of an affiliated group that has filed consolidated tax returns for several years. S drills a water well for B in Year 1 and charges B $5,000 for the service. S incurs $4,400 of expenses when drilling the well. B capitaliz

> P and S Corporations have filed consolidated tax returns on a calendar year basis for several years. Both corporations use the accrual method of accounting. On January 1 of the current year, S begins renting a warehouse to P for $10,000 per month. P pays

> P and S Corporations have filed consolidated tax returns on a calendar year basis for several years. Both corporations use the accrual method of accounting. On August 1 of the current year (Year 1), P loans S $250,000 on a one-year note. P charges intere

> P Corporation owns all of S Corporation’s stock. Both corporations use the accrual method of accounting, and they file a consolidated tax return. S provides cleaning services to P. In so doing, S charges P $6,000 for the services and incurs $5,000 of exp

> P owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns for several years. In the current year (Year 1), S1 sells land to P for $100,000. S1 purchased the land several years earlier for $35,000. P sells the la

> P and S Corporations have filed consolidated tax returns for several years. In Year 1, P purchased land as an investment for $20,000. In Year 3, P sold the land to S for $60,000. S used the land for four years as additional parking space for its employee

> The AB Partnership purchases plastic components and assembles children’s toys. The assembly operation requires a number of special machines that are housed in a building the partnership owns. The partnership has depreciated all its property under MACRS.

> P Corporation owns all the stock of S1 and S2 Corporations, and the three corporations have filed consolidated tax returns on a calendar year basis for several years. P owns 2,400 shares of publicly traded stock it purchased several years ago for $30 per

> P Corporation owns all the stock of S and B Corporations. The three corporations have filed consolidated tax returns on a calendar year basis for several years. S owns property it had purchased for $40,000 several years ago. On August 1 of Year 1, S sell

> P, S1, and S2 Corporations have filed consolidated tax returns for several years. In the current year (Year 1), S1 sells land to S2 for $275,000. S1 purchased the land for $120,000 several years ago and has held it for possible expansion. S2 constructs a