Question: Kingston Company uses the dollar-value LIFO

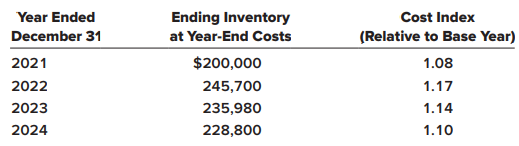

Kingston Company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending inventory to base year. The company began operations on January 1, 2021, with an inventory of $150,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows:

Required:

Calculate inventory amounts at the end of each year.

> All businesses have to continually engage in capital investment to improve and maintain processes, equipment and facilities. Governments also invest in infrastructure projects like roads, rail and utilities provision. Whether a private or public organi

> Each individual’s attitude to risk lies somewhere on a continuum with risk-seeking at one extreme and risk-averse at the other extreme. The same logic generally applies to organizations or even for that matter, national governments or political instit

> Management accountants would typically perform a risk assessment as follows: identify the risks, assess their impact and probability, and develop appropriate risk responses. Although very practical, it is uncertain as to how specific management accoun

> The CGMA website offers management accountants a collection of tools and resources which are useful to identify, assess and respond to (or manage) various types of risk faced by an organization. For example, it identifies the following four categories

> As reflected in RWVs 11.3, costing healthcare is a challenge. While ABC may offer some benefits to healthcare costing, the adoption rates of ABC are not high, and its implementation is often complex. To make matters simpler, time-driven ABC (TDABC) may

> The remuneration system that is applied in healthcare organizations in number of a countries (e.g. Australia, the USA, Switzerland, Spain and Italy) enables ABC profitability analysis to be applied in hospitals. These countries apply the Diagnosis Relate

> Fast fashion refers to clothes that are designed and manufactured quickly and sold to consumers at extremely low prices. New garments arrive in stores weekly, or even more frequently, and cost so little that consumers can fill their wardrobes with new

> Raab, Shoemaker and Mayer (2007) developed a workable ABC model for a restaurant operation in the USA that enabled previously undistributed indirect operating expenses to be traced to individual menu items. Menu prices were previously determined on a

> Until recently, Xu Ji Electric Co Ltd was a typical state-owned Chinese enterprise manufacturing electrical products such as relays. From an accounting point of view, this implied a manual bookkeeping system which was primarily designed to meet external

> From the perspective of a firm selling goods or providing services, not all customers are profitable, as some will cost a lot more to serve than others. Therefore, to be commercially viable, a business must acquire and retain a sufficient number of cust

> Eskom is a South African electricity public utility. In recent years, it has been subjected to some media coverage as the country faces energy infrastructure issues and the company deals with high debt. Eskom has power plants which burn coal. It entered

> Apple Inc. is well known for developing innovative products like the iPhone, iPad and iPod. Such devices are manufactured with complex electronic components and incur substantial design and development costs. The actual cost to manufacture these product

> Cloud computing describes the delivery of information systems without the purchase of physical hardware or even software in some instances. What this means for an average business is that they can purchase processing capability, data storage or content d

> Lidl and Aldi, the German discount supermarkets, have both announced significant expansion plans for the UK. Aldi expects to have 1,000 UK stores by 2022, an increase of over 230 on their current 762 stores; Lidl, which currently has 710 shops in th

> Many firms outsource manufacturing and other activities, but at the same time are increasingly aware that outsourcing may be best suited to non-core activities. Take packaging for example. In the craft brewing sector, a bottling line is a large invest

> As a result of the increasing accessibility of air travel, due to the emergence and popularity of low cost carriers such as Ryanair and easyJet, more people are now flying than ever before. Indeed, the demand for commercial air travel is such that airli

> Most developed economies have well-developed road and highway networks. From time to time new highways are built to relieve congested cities, but by and large most developed countries are not embarking on major road-building projects. Reducing government

> As technology has developed in recent decades, more time has been freed up for management accountants as they have less of the mundane transaction processing work to do. Technology has also enabled even the smallest businesses to take advantage of manage

> A headline in The Guardian of 23 September 2019 asked, ‘Why did Thomas Cook collapse after 178 years in business?’ The Thomas Cook Group collapsed in 2019, having been a leading British tour operator and airline. As reported in The Guardian, the immediat

> According to the International Air and Transport Association (IATA) airlines were expected to make around $6.12 profit from each passenger in 2019, which represents a decline from the 2018 projection of $6.85. Although carriers were expecting combined ne

> The break-even price of crude oil includes production costs, exploring or finding costs, oil well development costs, transportation costs, and selling and general administration expenses. A survey published in 2015 showed some interesting insights into t

> The Airbus A380 was the world’s first double decker aircraft. It can accommodate from 555 to 853 passengers depending on the class configuration. Long haul airlines such as Singapore Airlines were early adopters of the aircraft back in 2007. The 2018 lis

> According to a blog post by VWG Consulting, the key to successful and sustainable cost reduction in a manufacturing environment lies with variable costs. Indeed, in high-margin production firms such as Nike or Apple, as their variable costs may be a mult

> According to a survey undertaken by CIMA, variable (or marginal) costing is used by almost 40 per cent of firms. Management accountants from a wide range of sectors, including manufacturing and service firms, were questioned on how they use traditional t

> Each year, the paper and pulp industry produce millions of tonnes of sludge in the production of paper. This sludge is typically disposed of in landfill sites or incinerated. Both disposal methods are costly and environmentally undesirable. However, some

> South Africa is one of the top gold producers in the world, holding about 6,000 metric tonnes of reserves in mines as of 2019. Most mining operations have waste and by-products, some of which are disposable, reusable or even saleable; others are not. A

> Real World View 5.2 gave some insights in the process of distilling whiskey. Irish and Scotch whiskey producers operate in similar environments and their processes are quite likely to yield the same process losses due to evaporation – which is referred t

> Bushmills Irish Whiskey, a world-renowned brand of Diageo plc, is distilled in County Antrim in Northern Ireland. The Old Bushmills distillery has been in operation since 1608 and currently markets five distinct whiskeys under the Bushmills brand. Whiske

> The Internet of Things (IoT) refers to physical objects which are connected to the internet. This includes household devices and many business and industrial applications. Together with 5G networking technologies, the IoT has given way to a vast array of

> Almost all beer contains four basic ingredients – a grain (typically barley), water, hops and yeast. While the process of brewing can be complex, with potentially some variation in the ingredients used, the basic process generally follows a standard appr

> SAP is one of the global leaders in the provision of enterprise resource planning (ERP) software. While ERP software is complex, it must still incorporate basic transaction capturing modules to allow a business to gather data for more detailed analysis.

> Capturing labour costs accurately includes capturing time worked on customer orders, jobs or projects. In some cases, this is a reasonably easy task, such as in a supervised factory setting. In some cases, capturing hours worked accurately can be more di

> It was decided in the first quarter of fiscal 2016 that Commercial Metals Company Ltd would change the accounting method it used to value its inventories. This change would be for its Americas Mills, Americas Recycling and Americas Fabrication segments.

> Although there has always been a strong demand for tea in Malaysia, very few cafés actually offered bubble tea on their menus. However, in recent times, bubble tea cafés have become increasingly popular across the country, with many new chains being esta

> There are many factors which can influence the costing system choice of a business. In manufacturing, one factor is the nature of the industry itself and one way to classify the type of manufacturing is as an a-type industry (‘a’ representing assembly) o

> Allan Stratton is a cost management consultant with over 35 years of experience who shares the benefit of his experience providing tools and resources via the internet. In one of his articles he debunks three myths on cost allocation. All sorts of busine

> A questionnaire survey based on the responses of 272 practising UK management accountant who were members of the Chartered Institute of Management Accountants (CIMA) revealed that approximately 81 per cent of the respondent firms used absorption costing

> A distinguishing feature of today’s digital technology is that it is characterized by zero (or near zero) marginal costs. Once the investment needed to create a digital good has been incurred, it costs next to nothing to roll out and distribute millions

> The near collapse of the Irish banking sector in 2008, due to insolvency, led the Irish Government at the time to provide a blanket guarantee to cover the liabilities of all the financial institutions involved. This decision was taken in an attempt to ma

> Garrett Automative Ltd (GAL) is a UK subsidiary of a US parent company that manufactures turbochargers for the automative industry. GAL decided to begin its profit improvement programme by examining its factory throughput. Throughput was defined as t

> Decker Company has five products in its inventory. Information about the December 31, 2021, inventory follows. The cost to sell for each product consists of a 15 percent sales commission. Required: 1. Determine the carrying value of inventory at December

> Taylor Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company’s records under this system reveal the following inventory layers at the beginning of 2021 (listed in chronological order

> Caterpillar, Inc., is one of the world’s largest manufacturers of construction, mining, and forestry machinery. The following disclosure note is included in the company’s 2017 financial statements: D. Inventories ($ in millions) Inventories are stated at

> Carlson Auto Dealers Inc. sells a handmade automobile as its only product. Each automobile is identical; however, they can be distinguished by their unique ID number. At the beginning of 2021, Carlson had three cars in inventory, as follows: During 2021,

> Topanga Group began operations early in 2021. Inventory purchase information for the quarter ended March 31, 2021, for Topanga’s only product is provided below. The unit costs include the cost of freight. The company uses a periodic inv

> Ferris Company began January with 6,000 units of its principal product. The cost of each unit is $8. Merchandise transactions for the month of January are as follows: 8,000 units were on hand at the end of the month. Required: Calculate Januaryâ

> Johnson Corporation began the year with inventory of 10,000 units of its only product. The units cost $8 each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year: a. Purchased 50,00

> At the beginning of 2021, Quentin and Kopps (Q&K) adopted the dollar-value LIFO (DVL) inventory method. On that date the value of its one inventory pool was $84,000. The company uses an internally generated cost index to convert ending inventory to b

> On January 1, 2021, Avondale Lumber adopted the dollar-value LIFO inventory method. The inventory value for its one inventory pool on this date was $260,000. An internally generated cost index is used to convert ending inventory to base year. Year-end in

> Refer to the situation described in BE 11–14. Assume that 2019 depreciation was incorrectly recorded as $32,000. This error was discovered in 2021. (1) Record the journal entry needed in 2021 to correct the error. (2) What is depreciation on the building

> On January 1, 2021, the Taylor Company adopted the dollar-value LIFO method. The inventory value for its one inventory pool on this date was $400,000. Inventory data for 2021 through 2023 are as follows: Required: Calculate Taylor’s end

> Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, and tubular products. The company’s income statement for the 2021 fiscal year reported the following information ($ in millions): Sales =

> Cast Iron Grills, Inc., manufactures premium gas barbecue grills. The company reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. Cast Iron’s December 31, 2021, fiscal year-end inventory

> Cansela Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company began 2021 with inventory of 4,500 units of its only product. The beginning inventory balance of $64,000 consisted of th

> The following facts apply to Walken Company during December 2021: a. Walken began December with an accounts receivable balance (net of bad debts) of €25,000. b. Walken had credit sales of €85,000. c. Walken had cash collections of €30,000. d. Walken fact

> Samson Wholesale Beverage Company regularly factors its accounts receivable with the Milpitas Finance Company. On April 30, 2021, the company transferred $800,000 of accounts receivable to Milpitas. The transfer was made without recourse. Milpitas remits

> Lonergan Company occasionally uses its accounts receivable to obtain immediate cash. At the end of June 2021, the company had accounts receivable of $780,000. Lonergan needs approximately $500,000 to capitalize on a unique investment opportunity. On July

> Cypress Oil Company’s December 31, 2021, balance sheet listed $645,000 of notes receivable and $16,000 of interest receivable included in current assets. The following notes make up the notes receivable balance: Note 1: Dated 8/31/2021, principal of $300

> Avon Products, Inc., located in New York City, is one of the world’s largest producers of beauty and related products. The company’s consolidated balance sheets for the 2016 and 2015 fiscal years included the following

> Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company’s fiscal year-end. The 2020 balance sheet disclosed the following: Current

> Refer to the situation described in BE 11–14. Assume that instead of changing the useful life and residual value, in 2021 the company switched to the double-declining-balance depreciation method. How should Robotics account for the change? What is deprec

> Nike, Inc., is a leading manufacturer of sports apparel, shoes, and equipment. The company’s 2017 financial statements contain the following information ($ in millions): A note disclosed that the allowance for uncollectible accounts had

> EMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report, the balance sheet included the following information ($ in millions): In addition, the income statement reported sales revenue of $24,704 ($ in millio

> Rothschild Chair Company, Inc., was indebted to First Lincoln Bank under a $20 million, 10% unsecured note. The note was signed January 1, 2011, and was due December 31, 2024. Annual interest was last paid on December 31, 2019. At January 1, 2021, Rothsc

> El Gato Painting Company maintains a checking account at American Bank. Bank statements are prepared at the end of each month. The November 30, 2021, reconciliation of the bank balance is as follows: The company’s general ledger checkin

> The bank statement for the checking account of Management Systems Inc. (MSI) showed a December 31, 2021, balance of $14,632.12. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks were $1,320.25. b. Th

> Chamberlain Enterprises Inc. reported the following receivables in its December 31, 2021, year-end balance sheet: Current assets: Accounts receivable, net of $24,000 in allowance for uncollectible accounts = $218,000 Interest receivable = 6,800 Notes rec

> Descriptors are provided below for six situations involving notes receivable being discounted at a bank. In each case, the maturity date of the note is December 31, 2021, and the principal and interest are due at maturity. For each, determine the proceed

> Evergreen Company sells lawn and garden products to wholesalers. The company’s fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred: Feb. 28: Sold merchandise to Lennox, Inc., for $10,000 and accepted a

> Swathmore Clothing Corporation grants its customers 30 days’ credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amount

> Tran Technologies licenses its functional intellectual property to Lyon Industries. Terms of the arrangement require Lyon to pay Tran $500,000 on April 1, 2021, when Lyon first obtains access to Tran’s intellectual property, and then in the future to pay

> At the beginning of 2019, Robotics Inc. acquired a manufacturing facility for $12 million. $9 million of the purchase price was allocated to the building. Depreciation for 2019 and 2020 was calculated using the straight-line method, a 25-year useful life

> Supply Club, Inc., sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During July 2021 it started a loyalty program through which qualifying customers can accumulate points and redeem those

> Assume the same facts as in P 6–2, except that customer must pay $75 to purchase the extended warranty if they don’t purchase it with the $50 coupon that was included in the Protab Package. Creative estimates that 40% of customers will use the $50 coupon

> Citation Builders, Inc., builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10–20 homes and are typically so

> Curtiss Construction Company, Inc., entered into a fixed-price contract with Axelrod Associates on July 1, 2021, to construct a four-story office building. At that time, Curtiss estimated that it would take between two and three years to complete the pro

> Complete the requirements of P 6–10 assuming that Westgate Construction’s contract with Santa Clara County does not qualify for revenue recognition over time. Data from P 6-10: In 2021, the Westgate Construction Compa

> In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: Westgate recognizes revenue over time accord

> Fit & Slim (F&S) is a health club that offers members various gym services. Required: 1. Assume F&S offers a deal whereby enrolling in a new membership for $700 provides a year of unlimited access to facilities and also entitles the member to receive a v

> On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest bearing note requiring five annual payments of $20,000 on each December 31 beginning on December 31, 2021, and a lump-sum payment of $100,000 on Dece

> On January 1, 2021, the Montgomery Company agreed to purchase a building by making six payments. The first three are to be $25,000 each, and will be paid on December 31, 2021, 2022, and 2023. The last three are to be $40,000 each and will be paid on Dece

> Johnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. 1. On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $10,000 o

> On September 30, 2021, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2022, and the program was available for release on April 30, 2022.

> On the last day of its fiscal year ending December 31, 2021, the Sedgwick & Reams (S&R) Glass Company completed two financing arrangements. The funds provided by these initiatives will allow the company to expand its operations. 1. S&R issued 8% stated r

> Lowlife Company defaulted on a $250,000 loan that was due on December 31, 2021. The bank has agreed to allow Lowlife to repay the $250,000 by making a series of equal annual payments beginning on December 31, 2022. Required: Calculate the amount at which

> The Diversified Portfolio Corporation provides investment advice to customers. A condensed income statement for the year ended December 31, 2021, appears below: The following balance sheet information also is available: In addition, the following transac

> Duke Company’s records show the following account balances at December 31, 2021: Income tax expense has not yet been determined. The following events also occurred during 2021. All transactions are material in amount. 1. $300,000 in res

> The following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2021 ($ in thousands): sales revenue, $15,300; cost of goods sold, $6,200; selling expenses, $1,300; general

> Rembrandt Paint Company had the following income statement items for the year ended December 31, 2021 ($ in thousands): In addition, during the year, the company completed the disposal of its plastics business and incurred a loss from operations of $1.6

> Refer to the information presented in P 4–4. Prepare a revised income statement for 2021 reflecting the additional facts. Use a multiple-step format similar to Illustration 4–4 of this chapter to prepare income from co

> The preliminary 2021 income statement of Alexian Systems, Inc., is presented below: Additional Information: 1. Selling and administrative expense includes $26 million in restructuring costs. 2. Included in other income is $120 million in income from a di

> For the year ending December 31, 2021, Olivo Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should b

> The following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2021 and 2020: On October 15, 2021, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The div

> Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $6 million. Of this amount, $4 million was spent before technological feasibility was established. Excali

> Branson Electronics Company is a small, publicly traded company preparing its first quarter interim report to be mailed to shareholders. The following information for the quarter has been compiled: Fixed operating expenses include payments of $50,000 to

> Cadux Candy Company’s income statement for the year ended December 31, 2021, reported interest expense of $2 million and income tax expense of $12 million. Current assets listed in its balance sheet include cash, accounts receivable, an

> Financial statements for Askew Industries for 2021 are shown below (in thousands): Required: Calculate the following ratios for 2021. 1. Inventory turnover ratio 2. Average days in inventory 3. Receivables turnover ratio 4. Average collection period 5. A

> Presented below are the 2021 income statement and comparative balance sheets for Santana Industries. Additional information for the 2021 fiscal year ($ in thousands): 1. Cash dividends of $1,000 were declared and paid. 2. Equipment costing $4,000 was pur

> The chief accountant for Grandview Corporation provides you with the company’s 2021 statement of cash flows and income statement. The accountant has asked for your help with some missing figures in the company’s compar

> Selected information about income statement accounts for the Reed Company is presented below (the company’s fiscal year ends on December 31). On July 1, 2021, the company adopted a plan to discontinue a division that qualifies as a comp