Question: Knight Company reports the following costs and

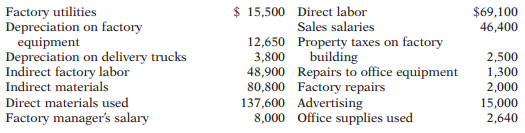

Knight Company reports the following costs and expenses in May.

Instructions:

From the information, determine the total amount of:

(a) Manufacturing overhead.

(b) Product costs.

(c) Period costs.

Transcribed Image Text:

$ 15,500 Direct labor Sales salaries Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials $69,100 46,400 12,650 Property taxes on factory 3,800 48,900 Repairs to office equipment 80,800 Factory repairs 137,600 Advertising 8,000 Office supplies used building 2,500 1,300 2,000 Direct materials used 15,000 2,640 Factory manager's salary

> Tate Inc. has beginning work in process $26,000, direct materials used $240,000, direct labor $220,000, total manufacturing overhead $180,000, and ending work in process $32,000. What are the total manufacturing costs?

> Sealy Company has beginning raw materials inventory $12,000, ending raw materials inventory $15,000, and raw materials purchases $170,000. What is the cost of direct materials used?

> Ratzlaff Company issues €2 million, 10-year, 8% bonds at 97, with interest payable on July 1 and January 1. Instructions: (a) Prepare the journal entry to record the sale of these bonds on January 1, 2014. (b) Assuming instead that the above bonds sold

> Ratzlaff Company issues €2 million, 10-year, 8% bonds at 97, with interest payable on July 1 and January 1. Instructions: (a) Prepare the journal entry to record the sale of these bonds on January 1, 2014. (b) Assuming instead that the above bonds sold

> (a) If Neer Company had net income of $300,000 in 2013 and it experienced a 24.5% increase in net income for 2014, what is its net income for 2014? (b) If 6 cents of every dollar of Neer’s revenue is net income in 2013, what is the dollar amount of 2013

> Kono Inc. has net income of $200,000, average shares of common stock outstanding of 40,000, and preferred dividends for the period of $20,000. What is Kono’s earnings per share of common stock? Tim Frye, the president of Kono, believes that the computed

> Vangundy Co. had the following transactions during the current period. June 12 Issued 60,000 shares of $1 par value ordinary shares for cash of $375,000. July 11 Issued 1,000 shares of $100 par value preference shares for cash at $110 per share. N

> Luther Corporation has the following accounts at December 31, 2014 (in euros): Share Capital—Ordinary, €10 par, 5,000 shares issued, €50,000; Share Premium—Ordinary €10,000; Retained Earnings €45,000; and Treasury Shares—Ordinary, 500 shares, €11,000. Pr

> On May 10, Barone Corporation issues 1,000 shares of $10 par value ordinary shares for cash at $18 per share. Journalize the issuance of the shares.

> On June 30, Reyes Corporation discontinued its operations in Mexico. On September 1, Reyes disposed of the Mexico facility at a pretax loss of $640,000. The applicable tax rate is 25%. Show the discontinued operations section of Reyes’s income statement.

> The following section is taken from Lyons Corp.’s balance sheet at December 31, 2013. Current liabilities Interest payable ……………………………………………………..$ 96,000 Long-term liabilities Bonds payable (8%, due January 1, 2018) ………………1,200,000 Interest is payable an

> The following section is taken from Lyons Corp.’s balance sheet at December 31, 2013. Current liabilities Interest payable ……………………………………………………..$ 96,000 Long-term liabilities Bonds payable (8%, due January 1, 2018) ………………1,200,000 Interest is payable an

> Summary financial information for Paragon Company is as follows Compute the amount and percentage changes in 2014 using horizontal analysis, assuming 2013 is the base year. Dec. 31, 2014 Dec. 31, 2013 $ 200,000 $ 220,000 Current assets Plant assets

> In its draft 2014 income statement, Sunflower Corporation reports income before income taxes $500,000, extraordinary loss due to earthquake $180,000, income taxes $200,000 (not including irregular items), and loss on disposal of discontinued music divisi

> Wyne Incorporated had the following transactions involving current assets and current liabilities during February 2014. Feb. 3 Collected accounts receivable of $15,000. 7 Purchased equipment for $23,000 cash. 11 Paid $3,000 for a 1-year insurance po

> The 2014 accounting records of Rogan Transport reveal these transactions and events. Instructions: Prepare the cash flows from operating activities section using the direct method Payment of interest Cash sales Receipt of dividend revenue Payment o

> Here is the income statement for Eberle, Inc. EBERLE, INC. Income Statement For the Year Ended December 31, 2014 Sales revenue ……………………………………………………………………………………. $400,000 Cost of goods sold ………………………………………………….....................................230,000 G

> Utech Company has income before irregular items of $310,000 for the year ended December 31, 2014. It also has the following items (before considering income taxes): (1) an extraordinary fire loss of $60,000 and (2) a gain of $30,000 from the disposal of

> In alphabetical order below are current asset items for Ruiz Company’s balance sheet at December 31, 2014. Prepare the current assets section (including a complete heading). Accounts receivable …………………………. $200,000 Cash ………………………………………………………62,000 Fini

> Francum Company has the following data: direct labor $209,000, direct materials used $180,000, total manufacturing overhead $208,000, and beginning work in process $25,000. Compute (a) total manufacturing costs and (b) total cost of work in process.

> The following T-account is a summary of the cash account of Kemper Company. What amount of net cash provided (used) by financing activities should be reported in the statement of cash flows? Čash (Summary Form) Balance, Jan. 1 Receipts from custome

> If Francona Company had net income of $382,800 in 2014 and it experienced a 16% increase in net income over 2013, what was its 2013 net income?

> Net income was $500,000 in 2012, $485,000 in 2013, and $518,400 in 2014. What is the percentage of change from (a) 2012 to 2013, and (b) from 2013 to 2014? Is the change an increase or a decrease?

> Using the data presented in BE13-4 for Ramirez Company, perform vertical analysis. Data given in BE13-4: December 31, 2014 December 31, 2013 $ 460,000 780,000 $ 400,000 650,000 2,800,000 Accounts receivable Inventory Total assets 3,164,000

> Using these data from the comparative balance sheet of Ramirez Company, perform horizontal analysis. December 31, 2014 December 31, 2013 $ 460,000 780,000 $ 400,000 650,000 2,800,000 Accounts receivable Inventory Total assets 3,164,000

> Voorhees Company has stockholders’ equity of $400,000 and net income of $72,000. It has a payout ratio of 18% and a return on assets of 20%. How much did Voorhees pay in cash dividends, and what were its average total assets?

> Staples, Inc. is one of the largest suppliers of office products in the United States. Suppose it had net income of $738.7 million and sales of $24,275.5 million in 2014. Its total assets were $13,073.1 million at the beginning of the year and $13,717.3

> Sellers Corporation reports operating expenses of $90,000, excluding depreciation expense of $15,000 for 2014. During the year, prepaid expenses decreased $7,200 and accrued expenses payable increased $4,400. Compute the cash payments for operating expen

> Kolmer Corporation reported income taxes of $370,000,000 on its 2014 income statement and income taxes payable of $277,000,000 at December 31, 2013, and $528,000,000 at December 31, 2014. What amount of cash payments were made for income taxes during 201

> Suppose Columbia Sportswear Company had accounts receivable of $299,585,000 at January 1, 2014, and $226,548,000 at December 31, 2014. Assume sales revenue was $1,244,023,000 for the year 2014. What is the amount of cash receipts from customers in 2014?

> An inexperienced accountant for Fielder Corporation showed the following in Fielder’s 2014 income statement: Income before income taxes $300,000; Income tax expense $72,000; Extraordinary loss from flood (before taxes) $80,000; and Net income $168,000. T

> Each of these items must be considered in preparing a statement of cash flows for Irvin Co. for the year ended December 31, 2014. For each item, state how it should be shown in the statement of cash flows for 2014. (a) Issued bonds for $200,000 cash. (b)

> Romine Company issued $350,000 of 8%, 20-year bonds on January 1, 2014, at face value. Interest is payable annually on January 1. Instructions: Prepare the journal entries to record the following events. (a) The issuance of the bonds. (b) The accrual of

> Assume that the following are independent situations recently reported in the Wall Street Journal. 1. General Electric (GE) 7% bonds, maturing January 28, 2015, were issued at 111.12. 2. Boeing 7% bonds, maturing September 24, 2029, were issued at 99.08.

> Riot Company issued $500,000, 15-year, 7% bonds at 96. Instructions: (a) Prepare the journal entry to record the sale of these bonds on January 1, 2014. (b) Suppose the remaining Discount on Bonds Payable was $12,000 on December 31, 2019. Show the balan

> Canyon Company issued $600,000, 10-year, 6% bonds at 103. Instructions: (a) Prepare the journal entry to record the sale of these bonds on January 1, 2014. (b) Suppose the remaining Premium on Bonds Payable was $10,800 on December 31, 2017. Show the bal

> During the month of March, Olinger Company’s employees earned wages of $64,000. Withholdings related to these wages were $4,896 for Social Security (FICA), $7,500 for federal income tax, $3,100 for state income tax, and $400 for union dues. The company i

> On August 1, 2014, Ortega Corporation issued $600,000, 7%, 10-year bonds at face value. Interest is payable annually on August 1. Ortega’s year-end is December 31. Instructions: Prepare journal entries to record the following events. (a) The issuance of

> On June 1, Fancher Company Ltd. borrows $60,000 from First Bank on a 6-month, $60,000, 8% note. The note matures on December 1. Instructions: (a) Prepare the entry on June 1. (b) Prepare the adjusting entry on June 30. (c) Prepare the entry at maturity

> On May 15, Criqui Outback Clothiers borrowed some money on a 4-month note to provide cash during the slow season of the year. The interest rate on the note was 8%. At the time the note was due, the amount of interest owed was $480. Instructions: (a) Det

> During the month of March, Olinger Company’s employees earned wages of $64,000. Withholdings related to these wages were $4,896 for Social Security (FICA), $7,500 for federal income tax, $3,100 for state income tax, and $400 for union dues. The company i

> Jenny Kane and Cindy Travis borrowed $15,000 on a 7-month, 8% note from Golden State Bank to open their business, KT’s Coffee House. The money was borrowed on June 1, 2014, and the note matures January 1, 2015. Instructions: (a) Prepare the entry to rec

> Data for Susan Braun are presented in BE10-5. Prepare the employer’s journal entries to record (a) Susan’s pay for the period and (b) the payment of Susan’s wages. Use January 15 for the end of the pay period and the payment date. Data for Susan Braun:

> On June 1, Fancher Company Ltd. borrows $60,000 from First Bank on a 6-month, $60,000, 8% note. The note matures on December 1. Instructions: (a) Prepare the entry on June 1. (b) Prepare the adjusting entry on June 30. (c) Prepare the entry at maturity

> On May 15, Criqui Outback Clothiers borrowed some money on a 4-month note to provide cash during the slow season of the year. The interest rate on the note was 8%. At the time the note was due, the amount of interest owed was $480. Instructions: (a) Det

> Jenny Kane and Cindy Travis borrowed $15,000 on a 7-month, 8% note from Golden State Bank to open their business, KT’s Coffee House. The money was borrowed on June 1, 2014, and the note matures January 1, 2015. Instructions: (a) Prepare the entry to rec

> An incomplete cost of goods manufactured schedule is presented below. Instructions: Complete the cost of goods manufactured schedule for Molina Company. MOLINA COMPANY Cost of Goods Manufactured Schedule For the Year Ended December 31, 2014 Work in

> Lopez Corporation incurred the following costs while manufacturing its product. Work in process inventory was $12,000 at January 1 and $15,500 at December 31. Finished goods inventory was $60,000 at January 1 and $45,600 at December 31. Instructions:

> Kwik Delivery Service reports the following costs and expenses in June 2014. Instructions: Determine the total amount of (a) delivery service (product) costs and (b) period costs. $ 5,400 Drivers' salaries 11,200 Advertising 5,000 Delivery equipm

> Ryan Corporation incurred the following costs while manufacturing its product Instructions: (a) Identify each of the above costs as direct materials, direct labor, manufacturing overhead, or period costs. (b) Explain the basic difference in accounting

> The following is a list of terms related to managerial accounting practices. 1. Activity-based costing. 2. Just-in-time inventory. 3. Balanced scorecard. 4. Value chain. Instructions: Match each of the terms with the statement below that best describes

> Buhler Motor Company manufactures automobiles. During September 2014, the company purchased 5,000 head lamps at a cost of $10 per lamp. Buhler withdrew 4,650 lamps from the warehouse during the month. Fifty of these lamps were used to replace the head la

> Data for Susan Braun are presented in BE10-5. Prepare the employer’s journal entries to record (a) Susan’s pay for the period and (b) the payment of Susan’s wages. Use January 15 for the end of the pay period and the payment date. Data for Susan Braun:

> An analysis of the accounts of Roberts Company reveals the following manufacturing cost data for the month ended June 30, 2014. Costs incurred: raw materials purchases $54,000, direct labor $47,000, manufacturing overhead $19,900. The specific overhead

> The following information is available for Aikman Company Instructions: (a) Compute cost of goods manufactured. (b) Prepare an income statement through gross profit. (c) Show the presentation of the ending inventories on the December 31, 2014, balance

> Joyce Tombert, the bookkeeper for Marks Consulting, a political consulting firm, has recently completed a managerial accounting course at her local college. One of the topics covered in the course was the cost of goods manufactured schedule. Joyce wonder

> Cepeda Corporation has the following cost records for June 2014. Instructions: (a) Prepare a cost of goods manufactured schedule for June 2014. (b) Prepare an income statement through gross profit for June 2014 assuming sales revenue is $92,100. $

> Incomplete manufacturing cost data for Colaw Company for 2014 are presented as follows for four different situations. Instructions: (a) Indicate the missing amount for each letter. (b) Prepare a condensed cost of goods manufactured schedule for situati

> Manufacturing cost data for Copa Company are presented below. Instructions: Indicate the missing amount for each letter (a) through (i). Case A Case B Case C Direct materials used Direct labor $ (a) 57,000 46,500 $68,400 86,000 81,600 $130,000 (g)

> Richard Larkin has prepared the following list of statements about managerial accounting and financial accounting. 1. Financial accounting focuses on providing information to internal users. 2. Analyzing cost-volume-profit relationships is part of manage

> Kinder Company has these comparative balance sheet data: Additional information for 2014: 1. Net income was $25,000. 2. Sales on account were $375,000. Sales returns and allowances amounted to $25,000. 3. Cost of goods sold was $198,000. 4. Net cash pr

> Nordstrom, Inc. operates department stores in numerous states. Suppose selected financial statement data (in millions) for 2014 are presented below. For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash

> Here are the comparative income statements of Eudaley Corporation. Instructions: (a) Prepare a horizontal analysis of the income statement data for Eudaley Corporation, using 2013 as a base. (Show the amounts of increase or decrease.) (b) Prepare a ver

> On January 1, 2014, Jenner Inc. changed from the LIFO method of inventory pricing to the FIFO method. Explain how this change in accounting principle should be treated in the company’s financial statements.

> Suppose the comparative balance sheets of Nike, Inc. are presented here Instructions: (a) Prepare a horizontal analysis of the balance sheet data for Nike, using 2013 as a base. (Show the amount of increase or decrease as well.) (b) Prepare a vertical

> Operating data for Jacobs Corporation are presented below. Instructions: Prepare a schedule showing a vertical analysis for 2014 and 2013. 2014 2013 Sales revenue Cost of goods sold Selling expenses Administrative expenses $800,000 520,000 $600,000

> Here is financial information for Spangles Inc. Instructions: Prepare a schedule showing a horizontal analysis for 2014, using 2013 as the base year. December 31, 2014 Current assets Plant assets (net) Current liabilities Long-term liabilities Comm

> The Wall Street Journal routinely publishes summaries of corporate quarterly and vannual earnings reports in a feature called the “Earnings Digest.” A typical “digest” report takes t

> The condensed financial statements of Elliott Company for the years 2013 and 2014 are presented below. Compute the following ratios for 2014 and 2013. (a) Current ratio. (b) Inventory turnover. (Inventory on December 31, 2012, was $340.) (c) Profit mar

> Santo Corporation experienced a fire on December 31, 2014 in which its financial records were partially destroyed. It has been able to salvage some of the records and has ascertained the following balances. Additional information: 1. The inventory turn

> Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Instructions: Compute the following ratios for 2014. (a) Profit margi

> Information for two companies in the same industry, Patton Corporation and Sager Corporation, is presented here. Instructions: Using the cash-based measures presented in this chapter, compare the (a) liquidity and (b) solvency of the two companies.

> Suppose presented below is 2014 information for PepsiCo, Inc. and The Coca-Cola Company. Instructions: Using the cash-based measures presented in this chapter, compare the (a) liquidity and (b) solvency of the two companies. ($ in millions) Net cas

> Shown below and on the next page are comparative balance sheets for Schmitt Company. Additional information: 1. Net income for 2014 was $93,000. 2. Depreciation expense was $34,000. 3. Cash dividends of $39,000 were declared and paid. 4. Bonds payable

> Manuel, Inc. reported net income of $2.5 million in 2014. Depreciation for the year was $160,000, accounts receivable decreased $350,000, and accounts payable decreased $280,000. Compute net cash provided by operating activities using the indirect approa

> The three accounts shown below appear in the general ledger of Lauber Corp. during 2014. Instructions: From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The loss on dispo

> The following information is available for Ramos Corporation for the year ended December 31, 2014. Beginning cash balance …………………………………………………. $ 45,000 Accounts payable decrease ……………………………………………………3,700 Depreciation expense ………………………………………………………. 162,00

> The current sections of Sanford Inc.’s balance sheets at December 31, 2013 and 2014, are presented here. Sanford’s net income for 2014 was $153,000. Depreciation expense was $27,000. Instructions: Prepare the net cas

> Cosi Company reported net income of $190,000 for 2014. Cosi also reported depreciation expense of $35,000 and a loss of $5,000 on the disposal of plant assets. The comparative balance sheet shows an increase in accounts receivable of $15,000 for the year

> The information in the table is from the statement of cash flows for a company at four different points in time (A, B, C, and D). Negative values are presented in parentheses. Instructions: For each point in time, state whether the company is most like

> The following information is taken from the 2014 general ledger of Praeger Company Instructions: In each case, compute the amount that should be reported in the operating activities section of the statement of cash flows under the direct method. Re

> The following information is available for Taliaferro Corp. for 2014. Cash used to purchase treasury stock ………………………………………………..$ 48,100 Cash dividends paid …………………………………………………………………………….21,800 Cash paid for interest …………………………………………………………………………..22,400

> Suppose the 2014 income statement for McDonald’s Corporation shows cost of goods sold $5,178.0 million and operating expenses (including depreciation expense of $1,216.2 million) $10,725.7 million. The comparative balance sheet for the year shows that in

> Metzger Company completed its first year of operations on December 31, 2014. Its initial income statement showed that Metzger had sales revenue of $198,000 and operating expenses of $83,000. Accounts receivable and accounts payable at year-end were $60,0

> The following stockholders’ equity accounts, arranged alphabetically, are in the ledger of Roder Corporation at December 31, 2014. Common Stock ($2 stated value) …………………………………………………..$1,600,000 Paid-in Capital in Excess of Par Value—Preferred Stock …………

> Andrea Hanlin is planning to start a business. Identify for Andrea the advantages and disadvantages of the corporate form of business organization.

> Wells Fargo & Company, headquartered in San Francisco, is one of the nation’s largest financial institutions. Suppose it reported the following selected accounts (in millions) as of December 31, 2014. Retained earnings …………………………………………………………………..$41,563

> On January 1, Vanessa Corporation had 60,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred. Apr. 1 Issued 9,000 additional shares of common stock

> Garcia Corporation recently hired a new accountant with extensive experience in accounting for partnerships. Because of the pressure of the new job, the accountant was unable to review what he had learned earlier about corporation accounting. During the

> The stockholders’ equity section of Leyland Corporation’s balance sheet at December 31 is presented here. Instructions: From a review of the stockholders’ equity section, answer the following questi

> Meranda Corporation is authorized to issue both preferred and common stock. The par value of the preferred is $50. During the first year of operations, the company had the following events and transactions pertaining to its preferred stock. Feb. 1 Issu

> Fagan Co. had these transactions during the current period. June 12 Issued 80,000 shares of $1 par value common stock for cash of $300,000. July 11 Issued 3,000 shares of $100 par value preferred stock for cash at $106 per share. Nov. 28 Purchased

> On January 1, 2014, Wilkens Corporation had $1,200,000 of common stock outstanding that was issued at par and retained earnings of $750,000. The company issued 30,000 shares of common stock at par on July 1 and earned net income of $400,000 for the year.

> Atlantic Airlines is considering these two alternatives for financing the purchase of a fleet of airplanes: 1. Issue 50,000 shares of common stock at $40 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) 2. Issue 12%,

> Korsak Corporation decided to issue common stock and used the $300,000 proceeds to redeem all of its outstanding bonds on January 1, 2014. The following information is available for the company for 2013 and 2014 Instructions: (a) Compute the return on

> The following accounts appear in the ledger of Polzin Inc. after the books are closed at December 31, 2014. Common Stock (no-par, $1 stated value, 400,000 shares authorized, 250,000 shares issued) ………………………………………………$ 250,000 Paid-in Capital in Excess o

> Linton Company has these obligations at December 31: (a) a note payable for $100,000 due in 2 years, (b) a 10-year mortgage payable of $200,000 payable in ten $20,000 annual payments, (c) interest payable of $15,000 on the mortgage, and (d) accounts

> Trayer Company obtains $20,000 in cash by signing a 9%, 6-month, $20,000 note payable to First Bank on July 1. Trayer’s fiscal year ends on September 30. What information should be reported for the note payable in the annual financial statements?

> Samuel Engels says that liquidity and solvency are the same thing. Is he correct? If not, how do they differ?

> Peggy Jantzen believes a current liability is a debt that can be expected to be paid in one year. Is Peggy correct? Explain.