Question: Landers Inc. is considering purchasing J&B

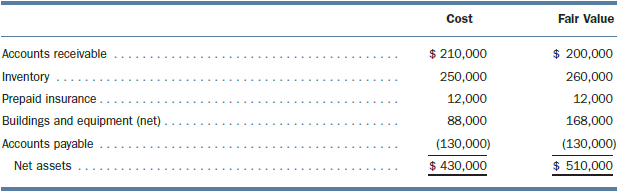

Landers Inc. is considering purchasing J&B Properties, which has the following assets and liabilities.

1. Make the journal entry necessary for Landers Inc. to record the purchase if the purchase price is $650,000 cash.

2. Assume that the purchase price is $320,000 cash. Make the journal entry necessary to record the purchase

Transcribed Image Text:

Cost Fair Value Accounts receivable $ 210,000 $ 200,000 Inventory 250,000 260,000 Prepaid insurance. 12,000 12,000 Buildings and equipment (net) . 88,000 168,000 Accounts payable (130,000) (130,000) Net assets $ 430,000 $ 510,000

> Progressive Company reported the following asset values in 2012 and 2013: In addition, in 2013, Progressive had sales of $4,800,000; cost of goods sold for the year was $2,900,000. As of the end of 2012, the fair value of Progressive’

> On July 1, 2013, McEnroe Company used receivables totaling $150,000 as collateral on a $100,000, 15% note from Standard One Bank. The transaction is not structured such that receivables are being sold. McEnroe will continue to collect the assigned receiv

> Beecher’s Boston Barbeque Company purchased a customer list and an ongoing research project for a total of $300,000. Beecher uses the expected cash flow approach for estimating the fair value of these two intangibles. The appropriate interest rate is 7%.

> The following data were taken from Tyrone Tardieff’s check register for the month of April. Tyrone’s bank reconciliation for March showed one outstanding check, Check No. 78 for $57.00 (written on March 23), and one de

> Trevor Company completed a program of expansion and improvement of its plant during 2013. You are provided with the following information concerning its buildings account: (a) On October 31, 2013, a 50-foot extension to the present factory building was c

> Using the following information, prepare a complete statement of cash flows. (a) Cash balance, beginning . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,500 (b) Cash paid to purchase inventory .

> The cash account of Abstract, Inc., disclosed a balance of $16,348.82 on October 31. The bank statement as of October 31 showed a balance of $19,711.75. Upon comparing the statement with the cash records, the following facts were developed. (a) Abstract&

> As of December 31, 2013, W. W. Cole Company’s total assets were $325 million and total liabilities were $180 million. Net income for 2013 was $38 million. During 2013, W. W. Cole’s chief executive officer had put extreme pressure on employees to meet the

> Krebsbach Company is negotiating a loan with FIS Bank. Krebsbach needs $900,000. As part of the loan agreement, FIS Bank will require Krebsbach to maintain a compensating balance of 15% of the loan amount on deposit in a checking account at the bank. Kre

> Santa Clarita Company reported interest expense in 2013 and 2012 of $470,000 and $410,000, respectively. The balance in Accrued Interest Payable at the end of 2013, 2012, and 2011 was $51,000, $59,000, and $46,000, respectively. In addition, a note to Sa

> The balance sheet for The Itex Corporation on December 31, 2012, includes the following cash and receivables balances. Current liabilities reported in the December 31, 2012, balance sheet included: Obligation on discounted notes receivable . . . . . .

> Aurora Corp. acquired Payette Company on December 31, 2013. The following information concerning Payette’s assets and liabilities was assembled on the acquisition date: Instructions: 1. Make the journal entry necessary for Aurora Corp

> Lafayette Corporation, a client, requests that you compute the appropriate balance of its estimated liability for product warranty account for a statement as of June 30, 2013. Lafayette Corporation manufactures television components and sells them with a

> Madison Company has purchased land that will serve as a temporary repository for nuclear waste. The site will function for 20 years, at which time Madison will be required to completely decontaminate the land. The purchase price for the land is $700,000.

> Sound Portal Corporation sells stereos under a 2-year warranty contract that requires Sound Portal to replace defective parts and provide free labor on all repairs. During 2012, 1,290 units were sold at $950 each. In 2013, Sound Portal sold an additional

> American Corporation received a $400,000 low bid from a reputable manufacturer for the construction of special production equipment needed by American in an expansion program. Because its own plant was not operating at capacity, American decided to const

> What type of asset value increases are recognized under IAS 41?

> The following costs were incurred in the most recent year: (a) Paid $30,000 to purchase a piece of equipment. In addition, paid $1,000 to have the equipment shipped to and installed in its final location. Spent $1,750 to have the equipment tested before

> Rainy Day Company, a wholesaler, uses the aging method to estimate bad debt losses. The following schedule of aged accounts receivable was prepared at December 31, 2013. Age of Accounts _________________________________________Amount 0–

> Oceanwide Enterprises, Inc., is involved in building and operating cruise ships. Each ship is identified as a separate discrete job in the accounting records. At the end of 2012, Oceanwide correctly reported $5,400,000 as Construction in Progress on the

> During 2013, Lacee Enterprises had gross sales of $247,000. At the end of 2013, Lacee had accounts receivable of $83,000 and a credit balance of $5,600 in Allowance for Bad Debts. Lacee has used the percentage-of-gross-sales method to estimate the bad de

> At December 31, 2012, Davis Company’s noncurrent operating asset accounts had the following balances: Category Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 280,

> Stockton Company sold goods on account with a sales price of $70,000 on August 17. The terms of the sale were 2/10, n/30. Instructions: 1. Record the sale using the gross method of accounting for cash discounts. 2. Record the sale using the net method o

> At December 31, 2012, certain accounts included in the Noncurrent Operating Assets section of Salvino Company’s balance sheet had the following balances: Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> The following transactions affecting the accounts receivable of Wonderland Corporation took place during the year ended January 31, 2013: Sales (cash and credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Powersoft Company is engaged in developing computer software for the small business and home computer market. Most of the computer programmers are involved in developmental work designed to produce software that will perform fairly specific tasks in a us

> The following selected information is provided for Lynez Company. All sales are credit sales and all receivables are trade receivables. Accounts receivable, January 1 net balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1

> Bridges Wholesale Company incurred the following costs in 2013 for a warehouse acquired on July 1, 2013, the beginning of its fiscal year: Cost of land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Refer to Practice 5-9. Prepare the Operating Cash Flow section of the statement of cash flows using the indirect method. In Practice 5-9 Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Abacus, Inc., purchased inventory costing $95,000. Terms of the purchase were 3/10, n/30. Abacus uses a perpetual inventory system. In order to take advantage of the cash discount, Abacus borrowed $75,000 from Commercial First Bank, signing a 2-month, 8%

> Transactions during 2013 of the newly organized Menlove Corporation included the following: Jan. 2 Paid legal fees of $15,000 and stock certificate costs of $8,300 to complete organization of the corporation. 15 Hired a clown to stand in front of the cor

> Zobell Corporation sells equipment with a book value of $8,000, receiving a non-interest bearing note due in three years with a face amount of $10,000. There is no established market value for the equipment. The interest rate on similar obligations is es

> In your audit of the books of Dyer Corporation for the year ended September 30, 2013, you found the following items in connection with the company’s patents account: (a) The company had spent $120,000 during its fiscal year ended September 30, 2012, for

> The following information was included in the bank reconciliation for Bryant, Inc., for June. What was the total of outstanding checks at the beginning of June? Assume all other reconciling items are listed. Checks and charges recorded by bank in June,

> Bylund Corporation was organized in June 2013. In auditing its books, you find the following land, buildings, and equipment account: An analysis of this account and of other accounts disclosed the following additional information: (a) The building acqu

> The accounting department supplied the following data in reconciling the September 30 bank statement for Clegg Auto. Ending cash balance per bank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $18,972.67 Endi

> The following transactions were completed by Millenial Toy Co. during 2013: Mar. 1 Purchased real property for $829,700, which included a charge of $29,700 representing property tax for March 1–June 30 that had been prepaid by the vendor; 25% of the purc

> Lewiston Corporation’s bank statement for the month of April included the following information: Bank service charge for April . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $110 Check deposited

> Skyline Corporation has decided to expand its operations and has purchased land in Salina for construction of a new manufacturing plant. The following costs were incurred in purchasing the property and constructing the building: Land purchase price . .

> Parkhurst Corporation acquires land and buildings valued at $250,000 as a gift from a local philanthropist. The president of the company maintains that because there was no cost for the acquisition, neither the cost of the facilities nor depreciation nee

> Ortiz Company had the following cash balances at December 31, 2013: Undeposited coin and currency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29,500 Unrestricted demand deposits . . . . . . . . . . . . .

> The accountant for Stansbury Development Company is uncertain how to record the following costs associated with the construction of a golf course. (a) Building artificial lakes. (b) Moving earth around to enhance the “hilliness” of the course. (c) Planti

> Baltic Group, Inc., operates Baltic Group resorts in the United States, Mexico, the Caribbean, Asia, the South Pacific, and the Indian Ocean Basin. Baltic Group routinely receives payment in advance from vacationers. In some countries, Baltic Group is re

> On December 31, 2013, Bridgeport Co. shows the following account for machinery it had assembled for its own use during 2013: Account: MACHINERY (Job Order #1329) An analysis of the details in the account disclosed the following: (a) The old machine, wh

> 1. Indicate how each of the items below should be reported using the following classifications: (a) Cash, (b) Restricted cash, (c) Temporary investment, (d) Receivable, (e) Liability, or (f) Office supplies. (1) Checking account at First Security

> Omniportal Company purchased Network Enterprises. The following fair values were associated with the items acquired in this business acquisition: The fair value associated with Network Enterprises’ government contacts is not based on

> Hitech Appliance Company’s accountant has been reviewing the firm’s past television sales. For the past two years, Hitech has been offering an extended service contract on all televisions sold. With the purchase of a t

> Taraz Company paid $500,000 to purchase the following portfolio of intangibles with estimated fair values as indicated: ____________________________________________Estimated Fair Value Internet domain name . . . . . . . . . . . . . . . . . . . . . . . .

> In 2012, Carver Electronics Co. began selling a new computer that carried a 2-year warranty against defects. Based on the manufacturer’s recommendations, Carver projects estimated warranty costs (as a percentage of dollar sales) as foll

> Using the following income statement and cash flow adjustment information, prepare the Operating Cash Flow section of the statement of cash flows using the direct method. Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Blanchard Company’s accounts receivable subsidiary ledger reveals the following information: Blanchard Company’s receivable collection experience indicates that, on average, losses have occurred as follows: Age of A

> Conglomerate Company purchased Individual Company for $935,000 cash. A schedule of the fair values of Individual’s assets and liabilities as of the purchase date follows. 1. Make the journal entry necessary for Conglomerate Company to

> Accounts Receivable of the Chalet Housing Co. on December 31, 2013, had a balance of $550,000. Allowance for Bad Debts had a $4,500 debit balance. Sales in 2013 were $3,450,000 less sales discounts of $51,000. Give the adjusting entry for estimated Bad D

> One of the most difficult problems facing an accountant is the determination of which expenditures should be capitalized and which should be immediately expensed. What position would you take in each of the following instances? (a) Painting partitions in

> On July 23, Louie Company sold goods costing $3,000 on account for $4,500. The terms of the sale were n/30. Payment in satisfaction of $3,000 of this amount was received on August 17. Also on August 17, the customer returned goods costing $1,000 (with a

> In 2013, the Slidell Corporation incurred research and development costs as follows: Materials and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $160,000 Personnel . . . . . . . . . . . .

> On November 1, Rosario Company sold goods on account for $7,000. The terms of the sale were 3/10, n/40. Payment in satisfaction of $3,000 of this amount was received on November 9. Payment in satisfaction of the remaining $4,000 was received on December

> Simpson Company purchased a nerve gas detoxification facility. The facility cost $900,000. The cost of cleaning up the routine contamination caused by the initial location of nerve gas on the property is estimated to be $1,300,000; this cost will be incu

> Classify each of the following items as: (A) Accounts Receivable, (B) Notes Receivable, (C) Trade Receivables, (D) Nontrade Receivables, or (E) Other (indicate nature of item). Because the classifications are not mutually exclusive, more than one cla

> For each of the situations described here, indicate when interest should be capitalized (C) and when it should not be capitalized (NC). (a) Queen Company is constructing a piece of equipment for its own use. Total construction costs are expected to be $4

> Refer to Practice 10-6. Assume that construction was not completed on December 31 of Year 1. Also assume that the same loans were outstanding for all of Year 2. The following expenditure was made during Year 2: July 1 . . . . . . . . . . . . . . . . . .

> Refer to Practice 7-22. Prepare the Operating Activities section of the statement of cash flows using the indirect method. In Practice 7-22. Ending Beginning Balances Balances Accounts receivable $ 9,500 $13,000 Allowance for bad debts 3,100 3,000

> Carver Department Stores, Inc., constructs its own stores. In the past, no cost has been added to the asset value for interest on funds borrowed for construction. Management has decided to correct its policy and desires to include interest as part of the

> Prepare the Operating Activities section of the statement of cash flows using the direct method.. Ending Beginning Balances Balances Accounts receivable $ 9,500 $13,000 Allowance for bad debts 3,100 3,000 Sales for the year. 75,000 Net income for th

> Brodhead Manufacturing Company has constructed its own special equipment to produce a newly developed product. A bid to construct the equipment by an outside company was received for $1,200,000. The actual costs incurred by Brodhead to construct the equi

> As payment for services rendered, the company received a 36-month note on January 1. The face amount of the note is $1,000; the note is non-interest-bearing. There is no reasonable basis for determining the cash price of the services rendered. The market

> Valdilla’s Music Store acquired land and an old building in exchange for 50,000 shares of its common stock, par $0.50, and cash of $80,000. The auditor ascertains that the company’s stock was selling for $15 per share when the purchase was made. The foll

> As payment for services rendered, the company received a 24-month note on January 1. The face amount of the note is $1,000; the note is non-interest-bearing. The cash price of the services rendered is $857. The market rate of interest is 8%, compounded a

> Sayer Co. enters into a contract with Bradford Construction Co. for construction of an office building at a cost of $680,000. Upon completion of construction, Bradford agrees to accept in full payment of the contract price Sayer Co.’s 10% bonds with a fa

> As payment for services rendered, the company received an 18-month note on January 1. The face amount of the note is $6,000, and the stated rate of interest is 9%, compounded annually. The 9% rate is equal to the market rate. The full amount of the note,

> On May 31, 2013, Julienne Corp. exchanged 20,000 shares of its $1 par common stock for the following assets: (a) A trademark valued at $183,000. (b) A building, including land, valued at $732,000 (20% of the value is for the land). (c) A franchise right.

> Refer to Practice 8-7. Assume that the company employs the efforts-expended method of estimating the percentage of completion. In particular, the company measures its progress by the number of support timbers laid in the trail. Compute the amount of reve

> Refer to Practice 7-15. Assume that Cammo received the entire $53,000 in cash immediately. Also assume that the transfer of receivables did not satisfy the three conditions contained in FASB ASC paragraph 860-10-40-5. Make the journal entry necessary on

> HiTech Industries purchases new electronic equipment for its telecommunication system. The contractual arrangement specifies 10 payments of $8,600 each to be made over a 10-year period. If HiTech had borrowed money to buy the equipment, it would have pai

> Cammo Company sold receivables (without recourse) for $53,000. Cammo received $50,000 cash immediately from the factor (the company to whom the receivables were sold). The remaining $3,000 will be received once the factor verifies that none of the receiv

> Custom Industries purchases new specialized manufacturing equipment on July 1, 2013. The equipment cash price is $96,000. Custom signs a deferred payment contract that provides for a down payment of $10,000 and a 10-year note for $112,420. The note is to

> You recently graduated from college with your accounting degree. Your father’s best friend is the director of the accounting department of a small manufacturing firm in the area, and you accepted a position on his staff. After a month on the job, you hav

> On St. Patrick’s Day 1992, Chambers Development Company, one of the largest landfill and waste management firms in the United States, announced that it had been improperly capitalizing costs associated with landfill development. Chambers announced that i

> In July 1990, U.S. federal regulators ordered U.S. banks to write off 20% of their $11.1 billion in loans to Brazil and also 20% of their $2.9 billion in loans to Argentina. The action significantly affected the loan loss reserves, that is, Allowance for

> Hunter Company has developed a computerized machine to assist in the production of appliances. It is anticipated that the machine will do well in the marketplace; however, the company lacks the necessary capital to produce the machine. Rosalyn Finch, sec

> Use the financial information for Wal-Mart Stores, Inc., given below, to answer the following questions: 1. For the most recent year given, compute Wal-Mart’s average collection period. 2. For the most recent year given, what percentage

> Locate the 2009 financial statements for The Walt Disney Company on the Internet. Use those financial statements and consider the following questions. 1. As illustrated in Exhibit 10-10, Interbrand estimates the value of the Disney brand name in 2009 at

> What characteristics must a construction project have before interest can be capitalized as part of the project cost?

> Locate the 2009 financial statements for The Walt Disney Company on the Internet. Use the information contained in these statements to answer the following questions: 1. Review The Walt Disney Company’s note disclosure to determine how the company recogn

> Rouse Company, a real estate developer, is well known as one of the few U.S. companies to have reported the current value of property and equipment in its financial statements. As mentioned in the text of the chapter, IAS 16 permits the inclusion of upwa

> Assume you are the treasurer for Fullmer Products Inc. and one of your responsibilities is to ensure that the company always takes available cash discounts on purchases. The corporation needs $150,000 within one week in order to take advantage of current

> In 1996, Financial World magazine estimated and ranked the most valuable brand names in the world. Number 11 in the ranking was Gillette with an estimated value of $10.3 billion. Financial World explained its brand value estimation process for Gillette a

> Jonathan Mitchell is the accountant for Mantua Service Company. Due to heavy investments in lottery tickets, Jonathan found himself short of cash and decided to “borrow” funds from Mantua. Jonathan received and deposited cash receipts, recorded the check

> In 1974, as the FASB considered requiring the expensing of all in-house research and development expenditures, the Board received many comments predicting that if firms were required to expense R&D, they would significantly cut back on research expenditu

> Bruno Johnson, chief financial officer of Tollerud Company, has determined that Tollerud should keep on hand $35 million in cash or near-cash assets in order to maintain proper liquidity. Bruno is now trying to determine how to allocate the $35 million a

> Far from being an exact science, accounting involves estimation and judgment. Consider the case of Dwight Nelson, chief financial officer of Pilot Enterprises. Pilot is a relatively young, privately held company with thoughts of going public in the near

> You are a finance and accounting analyst for Bunscar Company and have been with the firm for five years. Bunscar is a closely held corporation—all of the shares are owned by the founder, Ryan Brown, and by other longtime employees. Bunscar is preparing t

> Write a one-page paper identifying the benefits, both from an economic and a financial reporting perspective, that a company might reap through recognizing a big-bath restructuring charge.

> Refer to the information in Practice 5-6. Compute cash paid for inventory purchases. (All Accounts Payable relate to inventory purchases.) In Practice 5-6 Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> You are a senior credit analyst for Far West Bank. The president of Moran Auto Sales has asked you for a loan of $2,000,000. Moran’s accountant has compiled and submitted a current balance sheet and income statement. Moran has had moderate income over th

> The consolidated statement of income for Ford Motor Company appears below. 1. What do you notice about the way revenues and expenses are partitioned? 2. For the Automotive division, compute the ratio (Cost of sales/Sales) for each of the three years pr

> The following data were obtained from the cash flow statements (prepared using the indirect method) of The Coca-Cola Company from 2006 through 2009. All amounts are in millions of U.S. dollars. Instructions: 1. Using the information given, estimate the

> Apple Inc. is one of the country’s most successful computer technology companies. The company designs, manufactures, and sells computers, digital music devices, communication devices, and various software products. The companyâ

> Lockheed Martin Corporation is a well-known producer of advanced aircraft, missiles, and space hardware. Lockheed Martin is most famous for its super-secret research and development division, nicknamed the “Skunk Works.â€

> Wells Fargo & Company is the fourth largest bank in the U.S. (based on consolidated asset data gathered by the Federal Reserve as of March 31, 2010). Its consolidated statement of income follows. 1. How is this income statement different from all t