Question: Apple Inc. is one of the country’

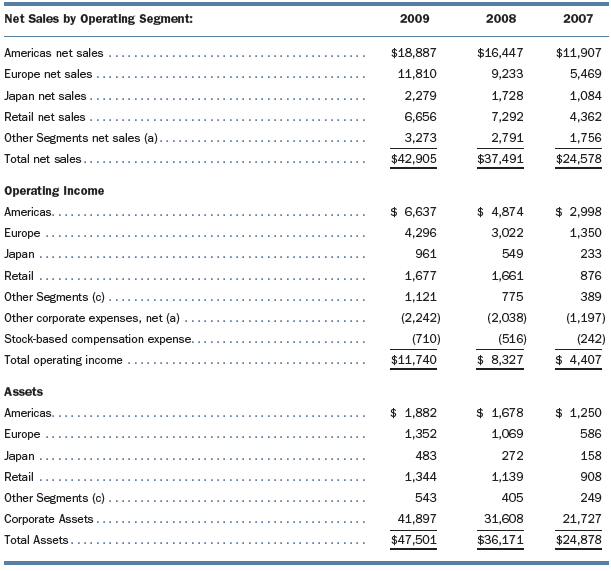

Apple Inc. is one of the country’s most successful computer technology companies. The company designs, manufactures, and sells computers, digital music devices, communication devices, and various software products. The company’s net income has increased each year since 2002, and in 2009, Apple sold 10.396 million computers, 54.132 million iPods, and 20.731 million iPhones. Information relating to the company’s business segments can be found in the company’s annual report, an excerpt of which follows.

1. Where does Apple generate most of its revenues? Its profits?

2. The profitability of each dollar of revenue is measured by the ratio (Operating income/Net sales). Compute this ratio for each of Apple’s five operating segments in 2009. Which segment has the highest profitability per dollar of revenue?

3. The extent to which a segment uses its assets to efficiently generate revenues is measured by the ratio (Net sales/Assets). Compute this asset turnover ratio for each of Apple’s five operating segments in 2009. Which segment has the highest number of dollars of revenue generated for each dollar of assets?

4. The return on assets ratio (Operating income/Assets) measures how well a segment combines profitability and efficiency to generate profits with the existing assets. Compute return on assets for each of Apple’s five operating segments in 2009. Which segment has the highest operating profit generated for each dollar of assets?

5. Based on your answers to parts (1) and (2), how critical is Apple’s Retail segment to the company’s overall success? Before you answer this question, think about how the company is able to sell and promote its computers and other products.

Transcribed Image Text:

Net Sales by Operating Segment: 2009 2008 2007 Americas net sales $18,887 $16,447 $11,907 Europe net sales . 11,810 9,233 5,469 Japan net sales . 2,279 1,728 1,084 Retail net sales 6,656 7,292 4,362 Other Segments net sales (a). 3,273 2,791 1,756 Total net sales.. $42,905 $37,491 $24,578 Operating Income Americas. $ 6,637 $ 4,874 $ 2,998 Europe 4,296 3,022 1,350 Japan 961 549 233 Retail 1,677 1,661 876 Other Segments (c). 1,121 775 389 Other corporate expenses, net (a) (2,242) (2,038) (1,197) Stock-based compensation expense. (710) (516) (242) Total operating income $11,740 $ 8,327 $ 4,407 Assets Americas. $ 1,882 $ 1,678 $ 1,250 Europe 1,352 1,069 586 Japan 483 272 158 Retail 1,344 1,139 908 Other Segments (c) . 543 405 249 Corporate Assets 41,897 31,608 21,727 Total Assets. $47,501 $36,171 $24,878

> Landers Inc. is considering purchasing J&B Properties, which has the following assets and liabilities. 1. Make the journal entry necessary for Landers Inc. to record the purchase if the purchase price is $650,000 cash. 2. Assume that the purchase p

> Using the following income statement and cash flow adjustment information, prepare the Operating Cash Flow section of the statement of cash flows using the direct method. Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Blanchard Company’s accounts receivable subsidiary ledger reveals the following information: Blanchard Company’s receivable collection experience indicates that, on average, losses have occurred as follows: Age of A

> Conglomerate Company purchased Individual Company for $935,000 cash. A schedule of the fair values of Individual’s assets and liabilities as of the purchase date follows. 1. Make the journal entry necessary for Conglomerate Company to

> Accounts Receivable of the Chalet Housing Co. on December 31, 2013, had a balance of $550,000. Allowance for Bad Debts had a $4,500 debit balance. Sales in 2013 were $3,450,000 less sales discounts of $51,000. Give the adjusting entry for estimated Bad D

> One of the most difficult problems facing an accountant is the determination of which expenditures should be capitalized and which should be immediately expensed. What position would you take in each of the following instances? (a) Painting partitions in

> On July 23, Louie Company sold goods costing $3,000 on account for $4,500. The terms of the sale were n/30. Payment in satisfaction of $3,000 of this amount was received on August 17. Also on August 17, the customer returned goods costing $1,000 (with a

> In 2013, the Slidell Corporation incurred research and development costs as follows: Materials and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $160,000 Personnel . . . . . . . . . . . .

> On November 1, Rosario Company sold goods on account for $7,000. The terms of the sale were 3/10, n/40. Payment in satisfaction of $3,000 of this amount was received on November 9. Payment in satisfaction of the remaining $4,000 was received on December

> Simpson Company purchased a nerve gas detoxification facility. The facility cost $900,000. The cost of cleaning up the routine contamination caused by the initial location of nerve gas on the property is estimated to be $1,300,000; this cost will be incu

> Classify each of the following items as: (A) Accounts Receivable, (B) Notes Receivable, (C) Trade Receivables, (D) Nontrade Receivables, or (E) Other (indicate nature of item). Because the classifications are not mutually exclusive, more than one cla

> For each of the situations described here, indicate when interest should be capitalized (C) and when it should not be capitalized (NC). (a) Queen Company is constructing a piece of equipment for its own use. Total construction costs are expected to be $4

> Refer to Practice 10-6. Assume that construction was not completed on December 31 of Year 1. Also assume that the same loans were outstanding for all of Year 2. The following expenditure was made during Year 2: July 1 . . . . . . . . . . . . . . . . . .

> Refer to Practice 7-22. Prepare the Operating Activities section of the statement of cash flows using the indirect method. In Practice 7-22. Ending Beginning Balances Balances Accounts receivable $ 9,500 $13,000 Allowance for bad debts 3,100 3,000

> Carver Department Stores, Inc., constructs its own stores. In the past, no cost has been added to the asset value for interest on funds borrowed for construction. Management has decided to correct its policy and desires to include interest as part of the

> Prepare the Operating Activities section of the statement of cash flows using the direct method.. Ending Beginning Balances Balances Accounts receivable $ 9,500 $13,000 Allowance for bad debts 3,100 3,000 Sales for the year. 75,000 Net income for th

> Brodhead Manufacturing Company has constructed its own special equipment to produce a newly developed product. A bid to construct the equipment by an outside company was received for $1,200,000. The actual costs incurred by Brodhead to construct the equi

> As payment for services rendered, the company received a 36-month note on January 1. The face amount of the note is $1,000; the note is non-interest-bearing. There is no reasonable basis for determining the cash price of the services rendered. The market

> Valdilla’s Music Store acquired land and an old building in exchange for 50,000 shares of its common stock, par $0.50, and cash of $80,000. The auditor ascertains that the company’s stock was selling for $15 per share when the purchase was made. The foll

> As payment for services rendered, the company received a 24-month note on January 1. The face amount of the note is $1,000; the note is non-interest-bearing. The cash price of the services rendered is $857. The market rate of interest is 8%, compounded a

> Sayer Co. enters into a contract with Bradford Construction Co. for construction of an office building at a cost of $680,000. Upon completion of construction, Bradford agrees to accept in full payment of the contract price Sayer Co.’s 10% bonds with a fa

> As payment for services rendered, the company received an 18-month note on January 1. The face amount of the note is $6,000, and the stated rate of interest is 9%, compounded annually. The 9% rate is equal to the market rate. The full amount of the note,

> On May 31, 2013, Julienne Corp. exchanged 20,000 shares of its $1 par common stock for the following assets: (a) A trademark valued at $183,000. (b) A building, including land, valued at $732,000 (20% of the value is for the land). (c) A franchise right.

> Refer to Practice 8-7. Assume that the company employs the efforts-expended method of estimating the percentage of completion. In particular, the company measures its progress by the number of support timbers laid in the trail. Compute the amount of reve

> Refer to Practice 7-15. Assume that Cammo received the entire $53,000 in cash immediately. Also assume that the transfer of receivables did not satisfy the three conditions contained in FASB ASC paragraph 860-10-40-5. Make the journal entry necessary on

> HiTech Industries purchases new electronic equipment for its telecommunication system. The contractual arrangement specifies 10 payments of $8,600 each to be made over a 10-year period. If HiTech had borrowed money to buy the equipment, it would have pai

> Cammo Company sold receivables (without recourse) for $53,000. Cammo received $50,000 cash immediately from the factor (the company to whom the receivables were sold). The remaining $3,000 will be received once the factor verifies that none of the receiv

> Custom Industries purchases new specialized manufacturing equipment on July 1, 2013. The equipment cash price is $96,000. Custom signs a deferred payment contract that provides for a down payment of $10,000 and a 10-year note for $112,420. The note is to

> You recently graduated from college with your accounting degree. Your father’s best friend is the director of the accounting department of a small manufacturing firm in the area, and you accepted a position on his staff. After a month on the job, you hav

> On St. Patrick’s Day 1992, Chambers Development Company, one of the largest landfill and waste management firms in the United States, announced that it had been improperly capitalizing costs associated with landfill development. Chambers announced that i

> In July 1990, U.S. federal regulators ordered U.S. banks to write off 20% of their $11.1 billion in loans to Brazil and also 20% of their $2.9 billion in loans to Argentina. The action significantly affected the loan loss reserves, that is, Allowance for

> Hunter Company has developed a computerized machine to assist in the production of appliances. It is anticipated that the machine will do well in the marketplace; however, the company lacks the necessary capital to produce the machine. Rosalyn Finch, sec

> Use the financial information for Wal-Mart Stores, Inc., given below, to answer the following questions: 1. For the most recent year given, compute Wal-Mart’s average collection period. 2. For the most recent year given, what percentage

> Locate the 2009 financial statements for The Walt Disney Company on the Internet. Use those financial statements and consider the following questions. 1. As illustrated in Exhibit 10-10, Interbrand estimates the value of the Disney brand name in 2009 at

> What characteristics must a construction project have before interest can be capitalized as part of the project cost?

> Locate the 2009 financial statements for The Walt Disney Company on the Internet. Use the information contained in these statements to answer the following questions: 1. Review The Walt Disney Company’s note disclosure to determine how the company recogn

> Rouse Company, a real estate developer, is well known as one of the few U.S. companies to have reported the current value of property and equipment in its financial statements. As mentioned in the text of the chapter, IAS 16 permits the inclusion of upwa

> Assume you are the treasurer for Fullmer Products Inc. and one of your responsibilities is to ensure that the company always takes available cash discounts on purchases. The corporation needs $150,000 within one week in order to take advantage of current

> In 1996, Financial World magazine estimated and ranked the most valuable brand names in the world. Number 11 in the ranking was Gillette with an estimated value of $10.3 billion. Financial World explained its brand value estimation process for Gillette a

> Jonathan Mitchell is the accountant for Mantua Service Company. Due to heavy investments in lottery tickets, Jonathan found himself short of cash and decided to “borrow” funds from Mantua. Jonathan received and deposited cash receipts, recorded the check

> In 1974, as the FASB considered requiring the expensing of all in-house research and development expenditures, the Board received many comments predicting that if firms were required to expense R&D, they would significantly cut back on research expenditu

> Bruno Johnson, chief financial officer of Tollerud Company, has determined that Tollerud should keep on hand $35 million in cash or near-cash assets in order to maintain proper liquidity. Bruno is now trying to determine how to allocate the $35 million a

> Far from being an exact science, accounting involves estimation and judgment. Consider the case of Dwight Nelson, chief financial officer of Pilot Enterprises. Pilot is a relatively young, privately held company with thoughts of going public in the near

> You are a finance and accounting analyst for Bunscar Company and have been with the firm for five years. Bunscar is a closely held corporation—all of the shares are owned by the founder, Ryan Brown, and by other longtime employees. Bunscar is preparing t

> Write a one-page paper identifying the benefits, both from an economic and a financial reporting perspective, that a company might reap through recognizing a big-bath restructuring charge.

> Refer to the information in Practice 5-6. Compute cash paid for inventory purchases. (All Accounts Payable relate to inventory purchases.) In Practice 5-6 Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> You are a senior credit analyst for Far West Bank. The president of Moran Auto Sales has asked you for a loan of $2,000,000. Moran’s accountant has compiled and submitted a current balance sheet and income statement. Moran has had moderate income over th

> The consolidated statement of income for Ford Motor Company appears below. 1. What do you notice about the way revenues and expenses are partitioned? 2. For the Automotive division, compute the ratio (Cost of sales/Sales) for each of the three years pr

> The following data were obtained from the cash flow statements (prepared using the indirect method) of The Coca-Cola Company from 2006 through 2009. All amounts are in millions of U.S. dollars. Instructions: 1. Using the information given, estimate the

> Lockheed Martin Corporation is a well-known producer of advanced aircraft, missiles, and space hardware. Lockheed Martin is most famous for its super-secret research and development division, nicknamed the “Skunk Works.â€

> Wells Fargo & Company is the fourth largest bank in the U.S. (based on consolidated asset data gathered by the Federal Reserve as of March 31, 2010). Its consolidated statement of income follows. 1. How is this income statement different from all t

> Locate the 2009 financial statements for The Walt Disney Company on the Internet and consider the following questions: 1. Does Disney use the direct method or the indirect method? Explain. 2. Analyze Disney’s overall cash flow picture for 2007, 2008, and

> The computation of comprehensive income for 2009 for Coca-Cola is presented in Exhibit 4-11. 1. Which is greater in 2009—Coca-Cola’s net income or comprehensive income? 2. With respect to the currencies in the count

> The case of W. T. Grant is a classic in cash flow analysis. During the 1960s and 1970s, Grant was one of the largest retailers in the United States, with more than 1,200 stores nationwide. Grant was a stable New York Stock Exchange firm that had paid cas

> Locate the 2009 financial statements for The Walt Disney Company on the Internet. 1. Did Disney have any below-the-line items in 2009? Explain. 2. Disney’s net income decreased from $4,427 million in 2008 to $3,307 million in 2009. Identify the major rea

> The company had the following loans outstanding for the entire year: The company began the self-construction of a building on January 1. The following expenditures were made during the year: January 1 . . . . . . . . . . . . . . . . . . . . . . . . .

> Kara Nemrow, a security analyst for Primer Mead & Co., asserts that she can tell more about a company’s financial condition by looking at the trends of the negative or positive cash flows in the three categories than from other info

> Shawn O’Neil owns two businesses, a drug store and a retail department store. Which business earns more income? Which business has the higher gross profit percentage? Return on sales? Which business would you consider more profitable?

> Early in the year 2014, John Roberts, a recent graduate of Southeast State College, delivers the financial statements shown below to Laura Dennis of Dennis, Inc. After a quick review, Dennis exclaims, “What do you mean I had net income

> Near the end of the fiscal year, preliminary financial results revealed that Stancomb Wills Company was in danger of not meeting corporate performance goals. According to an article in the business press, top executives at Stancomb Wills responded by def

> As the assistant controller of Do-It-Right Company, you have been given the assignment to study FASB ASC Topic 230 and make recommendations on how the company should prepare its statement of cash flows. Specifically, you are to indicate which method—the

> Flexisoft Company has had excellent success in developing business software for computers. Management has followed the accounting practice of deferring the research costs for the software until sufficient sales have developed to cover the software cost.

> Hot Lunch Delivery Service has always had a policy to pay stockholders annual dividends in an amount exactly equal to net income for the year. Joe Alberg, the company’s president, is confused because the Cash balance has been consistently increasing ever

> Management for Marlowe Manufacturing Company decided in 2012 to discontinue one of its unsuccessful product lines. (The product line does not meet the definition of a business component.) The planned discontinuance involved obsolete inventory, assembly l

> Price Auto Parts has hired you as a consultant to analyze the company’s financial position. One of the owners, DeeAnn Price, is in charge of the company’s financial affairs. She makes all deposits and pays the bills but has an accountant prepare a balanc

> Stan Crowfoot is a renowned sculptor who specializes in Native American sculptures. Typically, a cast is prepared for each work to permit the multiple reproduction of the pieces. A limited number of copies are made for each sculpture, and the mold is des

> Shop-at-Home Company operates a Web grocer. Customers submit their orders online to Shop-at-Home Company; Shop-at-Home then forwards the orders to a national grocery chain. The grocery chain arranges for assembly and shipment of the order. Shop-at-Home C

> Brad Berrett and Jim Wong are roommates in college. Berrett is an accounting major, and Wong is a finance major. Both recently studied the statement of cash flows in their classes. Wong’s finance professor stated that depreciation is a major source of ca

> Max Stevenson owns a local drug store. During the past few years, the economy has experienced a period of high inflation. Stevenson has had the policy of withdrawing cash from his business equal to 80% of the company’s reported net income. As the busines

> 1. Accounts Receivable has a beginning balance of $425,000 and an ending balance of $437,000. Cash collected from customers during the period was $1,263,000. Sales for the period were: (a) $1,251,000. (b) $1,263,000. (c) $1,275,000. (d) $1,287,000. 2. R

> During January 2013, Doe Corp. agreed to sell the assets and product line of its Hart division. The sale was completed on January 15, 2014; on that date, Doe recognized a gain on disposal of $900,000. Hart’s operating losses were $600,0

> Lorien Company wishes to prepare a forecasted income statement, a forecasted balance sheet, and a forecasted statement of cash flows for 2014. Lorien’s balance sheet and income statement for 2013 follow: Balance Sheet ___________________________________

> Lorien Company wishes to prepare a forecasted income statement and a forecasted balance sheet for 2014. Lorien’s balance sheet and income statement for 2013 follow. Balance Sheet ____________________________________________2013 Cash . . . . . . . . . .

> Following are data from the financial statements for Drury Lane Company: Instructions: 1. Compute the following for 2012 and 2013. (a) Return on sales (b) Return on assets (c) Return on equity (d) Cash-flow-to-net-income ratio (e) Cash flow adequacy ra

> The following information for the year ending December 31, 2013, has been provided for Calle Company. Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $530,00

> The following summary information is for Numbers Company: Instructions: 1. Compute net cash provided by (used in) operating activities for Numbers Company for the years 2010 through 2013. 2. One definition of cash flow often used in financial analysis

> Selected pre-adjustment account balances and adjusting information of Sunset Cosmetics Inc. for the year ended December 31, 2013, are as follows: Retained Earnings, January 1, 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> (a) Why is the “list price” of an asset often not representative of its fair market value? (b) Under these conditions, how should a fair value be determined?

> A company reports the following information as of the end of the year. Using the information, determine the total amount of cash and cash equivalents. (a) Investment securities of $10,000. These securities are common stock investments in 30 companies tha

> Why is the indirect order often preferred in letter reports?

> Which is the most useful way to organize data in a report? Why?

> What is the “you viewpoint” and how is it related to a courteous tone in your writing?

> What is the direct order in report writing? When should it be used?

> What is the difference between deductive and inductive paragraph organization? Give an example of each.

> What are some advantages of conversational writing? Give an example of conversational writing that you have observed.

> How can the format of a report reflect a writer’s strategic consideration of the situation?

> What are some disadvantages of using hackneyed phrases and jargon?

> Why should apologies be avoided in most negative situations?

> Which strategy should be used when the writer is uncertain of the reader’s reaction?

> What size is appropriate for a visual aid?

> What are some of the advantages of short words over long words?

> What is an effective way to end a directly organized memo report?

> How should the subject line be worded in an indirectly organized memorandum report?

> What are some forms of collaborative writing you are likely to encounter in business?

> In planning to write a document, what questions must a manager ask before putting words on paper? Should they all receive equal emphasis?

> What is the indirect order in report writing? When is it appropriate?

> Breakdowns in the written process are less difficult to locate than are breakdowns in the oral process. Discuss this statement.

> Pick one of the following scenarios and develop a 10-minute informative presentation. • For an audience of graduating seniors in business, discuss the topics of appropriate dress for employment interviews. • For an audience of business executives, discu

> This scenario provides a realistic opportunity for students to practice the negotiation principles explained in this chapter. Divide the class into groups of two—one is the job candidate and the other is the hiring agent. The negotiators should determi

> F. Clarify the following message by using paragraphs and transitions and by generally following the guidelines presented in this chapter. Most managers would agree that there are advantages to both the telephone and letters. Letters are more effective i