Question: Lehighton Chalk Company manufactures sidewalk

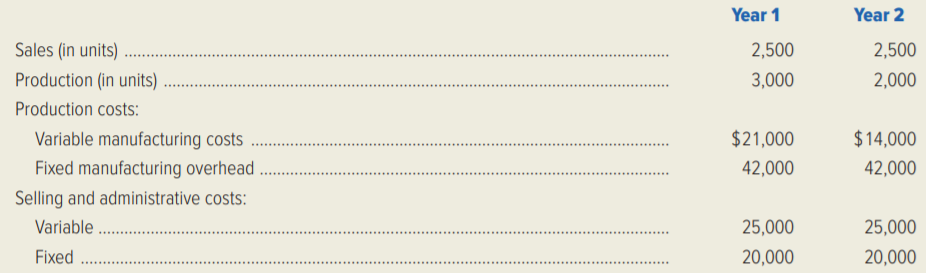

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $50 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehighton’s first two years of operation is as follows:

Required:

Lehighton Chalk Company had no beginning or ending work-in-process inventories for either year.

1. Prepare operating income statements for both years based on absorption costing.

2. Prepare operating income statements for both years based on variable costing.

3. Prepare a numerical reconciliation of the difference in income reported under the two costing

methods used in requirements 1 and 2.

> Explain how a non-profit organization like Doctors Without Borders might assign overhead costs to their operations in a particular refugee camp.

> Describe how a large retailer such as Lowes would assign overhead costs to the products it sells in its stores.

> Burlington Clock Works manufactures fine, handcrafted clocks. The firm uses a job-order costing system, and manufacturing overhead is applied on the basis of direct-labor hours. Estimated manufacturing overhead for the year is $240,000. The firm employs

> The following data refer to Twisto Pretzel Company for the year 20x1. Required: 1. Prepare Twisto Pretzel Company’s schedule of cost of goods manufactured for 20x1. 2. Prepare the company’s schedule of cost of goods s

> TeleTech Corporation manufactures two different colour printers for the business market. Cost estimates for the two models for the current year are as follows: Each model of printer requires 20 hours of direct labor. The basic system requires 5 hours in

> Patricia Eklund, controller in the division of social services for the state, recognizes the importance of the budgetary process for planning, control, and motivational purposes. She believes that a properly implemented participative budgetary process fo

> Conundrum Corporation manufactures furniture. Due to a fire in the administrative offices, the accounting records for November of the current year were partially destroyed. You have been able to piece together the following information from the ledger. U

> Refer to the problem 3-57 regarding Scholastic Brass Corporation. Complete the following job cost record for job number T81. (Assume that all of the direct-labor hours for job T81 occurred during the week of 3/8 through 3/12.) Data from Problem 3-57: Sc

> Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct-labor hours. The company’s

> Tiana Shar, the controller for Bondi Furniture Company, is in the process of analyzing the overhead costs for the month of November. She has gathered the following data for the month. The firm’s job-order costing system uses direct-labo

> Troy Electronics Company calculates its predetermined overhead rate on a quarterly basis. The following estimates were made for the current year. The firm’s main product, part number A200, requires $100 of direct material and 20 hours o

> Marc Jackson has recently been hired as a cost accountant by Offset Press Company, a privately held company that produces a line of offset printing presses and lithograph machines. During his first few months on the job, Jackson discovered that Offset ha

> Midnight Sun Apparel Company uses normal costing, and manufacturing overhead is applied to work-in-process on the basis of machine hours. On January 1 of the current year, there were no balances in work-in-process or finished-goods inventories. The follo

> Marco Polo Map Company’s cost of goods sold for March was $345,000. March 31 work-in-process inventory was 90 percent of March 1 work-in-process inventory. Manufacturing overhead applied was 50 percent of direct-labor cost. Other inform

> Refer to the schedule of cost of goods manufactured prepared for Huron Corporation in the problem 3-50. Required: 1. How much of the manufacturing costs incurred during 20x2 remained associated with work-in process inventory on December 31, 20x2? 2. Sup

> MarineCo, Inc., manufactures outboard motors and an assortment of other marine equipment. The company uses a job-order costing system. Normal costing is used, and manufacturing overhead is applied on the basis of machine hours. Estimated manufacturing ov

> City Racquetball Club (CRC) offers racquetball and other physical fitness facilities to its members. There are four of these clubs in the metropolitan area. Each club has between 1,800 and 2,500 members. Revenue is derived from annual membership fees and

> Garcia, Inc., uses a job-order costing system for its products, which pass from the Machining Department, to the Assembly Department, to finished-goods inventory. The Machining Department is heavily automated; in contrast, the Assembly Department perform

> JLR Enterprises provides consulting services throughout California and uses a job-order costing system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by JLR, but no

> Finlon Upholstery, Inc., uses a job-order costing system to accumulate manufacturing costs. The company’s work-in-process on December 31, 20x1, consisted of one job (no. 2077), which was carried on the year-end balance sheet at $156,800

> Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20x1: job no. 64 ($84,000) and job no. 65 ($53,500). The following information is available: a. The company applies manufacturing overhead on the basis of

> Perfecto Pizza Company produces microwavable pizzas. The following accounts appeared in Perfecto’s ledger as of December 31. Additional information: a. Accounts payable is used only for direct-material purchases. b. Under applied overhe

> Finley Educational Products started and finished job number B67 during June. The job required $4,600 of direct material and 40 hours of direct labor at $17 per hour. The predetermined overhead rate is $5 per direct-labor hour. Required: Prepare journal

> The controller for Tender Bird Poultry, Inc., estimates that the company’s fixed overhead is $100,000 per year. She also has determined that the variable overhead is approximately $.10 per chicken raised and sold. Since the firm has a single product, ove

> For each of the following companies, indicate whether job-order or process costing is more appropriate. 1. Manufacturer of swimming pool chemicals. 2. Manufacturer of custom hot tubs and spas. 3. Architectural firm. 4. Manufacturer of ceramic tile. 5. Pr

> Refer to the illustration of overhead application in the Small World Advertising example. Suppose the firm used a single cost driver, total staff compensation, to apply overhead costs to each advertising engagement. Required: 1. Compute the total budget

> Laramie Leatherworks, which manufactures saddles and other leather goods, has three departments. The Assembly Department manufactures various leather products, such as belts, purses, and saddlebags, using an automated production process. The Saddle Depar

> Refer to the information given in Case 8–42 for Lehighton Chalk Company. Selected information from Lehighton’s year-end balance sheets for its first two years of operation is as follows: Required: 1. Why is the year 1

> Design Arts Associates is an interior decorating firm in Berlin. The following costs were incurred in the firm’s contract to redecorate the mayor’s offices. The firm’s budget for the year included the

> Refer to the data for the preceding exercise for Oneida Restaurant Supply Company. Prepare a journal entry to add to work-in-process inventory the total manufacturing overhead cost for the year, assuming: 1. The firm uses actual costing. 2. The firm uses

> The following data pertain to the Oneida Restaurant Supply Company for the year just ended. Required: 1. Compute the firm’s predetermined overhead rate for the year using each of the following common cost drivers: (a) machine hours, (b

> Sweet Tooth Confectionary incurred $157,000 of manufacturing overhead costs during the year just ended. However, only $141,000 of overhead was applied to production. At the conclusion of the year, the following amounts of the year’s app

> Selected data concerning the past year’s operations of the Ozarks Manufacturing Company are as follows: Required: 1. What was the cost of raw materials purchased during the year? 2. What was the direct-labor cost charged to production

> Reimel Furniture Company, Inc., incurred the following costs during 20x2. Raw material used …………………â€&b

> Garrett Toy Company incurred the following costs in April to produce job number TB78, which consisted of 1,000 teddy bears that can walk, talk, and play cards. Direct Material: 4/1/20x0 Requisition number 101: 400 yards of fabric at $.80 per yard 4/5/20x

> McAllister, Inc., employs a normal costing system. The following information pertains to the year just ended. • Total manufacturing costs were $2,500,000. • Cost of goods manufactured was $2,425,000. • Applied manufacturing overhead was 30 percent of tot

> Bodin Company manufactures finger splints for kids who get tendonitis from playing video games. The firm had the following inventories at the beginning and end of the month of January. The following additional data pertain to January operations. The comp

> Crunchem Cereal Company incurred the following actual costs during 20x1. Direct material used …………………â€

> Refer to the information given in the case 8-42 for Lehighton Chalk Company. Required: 1. Reconcile Lehighton’s operating income reported under absorption and variable costing, during each year, by comparing the following two amounts o

> The following data refers to Huron Corporation for the year 20x2. Required: 1. Prepare Huron’s schedule of cost of goods manufactured for 20x2. 2. Prepare the company’s schedule of cost of goods sold for 20x2. The c

> The following information pertains to Trenton Glass Works for the year just ended. Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour. Actual direct-labor cost: 80,000 hours at $17.50 per hour. Budgeted manufacturing overhead:

> CompuFurn, Inc., manufactures furniture for computer work stations. CompuFurn uses a job-order costing system and employs absorption costing. ComuFurn’s work-in-process inventory on November 30 consisted of the following jobs. On Novemb

> FiberCom, Inc., a manufacturer of fibre optic communications equipment, uses a job-order costing system. Since the production process is heavily automated, manufacturing overhead is applied on the basis of machine hours using a predetermined overhead rat

> Travel craft Company manufactures a complete line of fiberglass suitcases and attaché cases. The firm has three manufacturing departments: Molding, Component, and Assembly. There are also two service departments: Power and Maintenance. The s

> Snake River Sawmill manufactures two lumber products from a joint milling process. The two products developed are mine support braces (MSB) and unseasoned commercial building lumber (CBL). A standard production run incurs joint costs of $300,000 and resu

> Celestial Artistry Company is developing departmental overhead rates based on direct-labor hours for its two production departments, Etching and Finishing. The Etching Department employs 20 people and the Finishing Department employs 80 people. Each pers

> Refer to the data given in the preceding problem 17-24. When Tampa Instrument Company established its service departments, the following long-run needs were anticipated. Required: Use dual cost allocation in conjunction with each of the following method

> Refer to the data given in Problem 17–26 for Celestial Artistry Company. Required: 1. Use the reciprocal-services method to allocate service department costs. Calculate the overhead rates per direct-labor hour for the Etching Departmen

> Lafayette Company manufactures two products out of a joint process: Compod and Ultrasene. The joint costs incurred are $250,000 for a standard production run that generates 120,000 gallons of Compod and 80,000 gallons of Ultrasene. Compod sells for $2.00

> Winchester Chemicals uses a joint process to produce VX-4, a chemical used in the manufacture of paints and varnishes; HD-10, a chemical used in household cleaning products; and FT-5, a by-product that is sold to fertilizer manufacturers. Joint productio

> Berger Company manufactures products Delta, Kappa, and Omega from a joint process. Production, sales, and cost data for July follow. Required: 1. Assuming that joint costs are allocated using the relative-sales-value method, what were the joint costs al

> Biondi Industries is a manufacturer of chemicals for various purposes. One of the processes used by Biondi produces HTP–3, a chemical used in hot tubs and swimming pools; PST–4, a chemical used in pesticides; and RJ&ac

> Refer to the data given in the preceding problem 16-57 for Pensacola Cablevision Company. Required: 1. Compute the price index for each year from 20x1 through 20x7, using 1.0000 as the index for 20x0. 2. Prepare a schedule of after-tax cash flows measur

> Pensacola Cablevision Company provides television cable service to two counties in the Florida panhandle. The firm’s management is considering the construction of a new satellite dish in December of 20x0. The new antenna would improve reception and the s

> Refer to the data for High Country Department Stores’ computerized checkout equipment decision given in Exhibit 16–11. Also refer to the net-present-value analysis presented in Exhibit 16–12. Require

> Liberty Bell Theater is a nonprofit enterprise in downtown Philadelphia. The board of directors is considering an expansion of the theater’s seating capacity, which will entail significant renovations to the existing facilities. The boa

> Refer to the data given in the preceding problem 16-53. The owner of Waco Waffle House will consider capital projects only if they have a payback period of six years or less. The owner also favors projects that exhibit an accounting rate of return of at

> The owner of Waco Waffle House is considering an expansion of the business. He has identified two alternatives, as follows: Build a new restaurant near the mall. Buy and renovate an old building downtown for the new restaurant. The projected cash flows f

> The management of Tri-County Air Taxi, Inc., is considering the replacement of an old machine used in its helicopter repair facility. It is fully depreciated but it can be used by the corporation through 20x5. If management decides to replace the old mac

> As a group, think carefully about the various activities and steps involved in the course registration process at your college or university. Required: 1. List the steps in the registration process in the sequence in which they occur. 2. Prepare an acti

> Refer to the data given in the preceding problem 16-50. Required: Compute the net present value of Scientific Frontiers Corporation’s proposed acquisition of robotic equipment. Data from Problem 16-50: Scientific Frontiers Corporation

> Scientific Frontiers Corporation manufactures scientific equipment for use in elementary schools. In December of 20x0 the company’s management is considering the acquisition of robotic equipment, which would radically change its manufac

> Philadelphia Fastener Corporation manufactures nails, screws, bolts, and other fasteners. Management is considering a proposal to acquire new material-handling equipment. The new equipment has the same capacity as the current equipment but will provide o

> Mind Challenge, Inc., publishes innovative science textbooks for public schools. The company’s management recently acquired the following two new pieces of equipment. Computer-controlled printing press: cost, $250,000; considered to be industrial equipme

> Refer to the data given in Problem 16–45. The County Board of Representatives believes that if the county conducts a promotional effort costing $20,000 per year, the proposed long runway will result in substantially greater economic dev

> Refer to the data given in the preceding problem 16-45. Required: 1. Prepare a net-present-value analysis of the proposed long runway. 2. Should the County Board of Representatives approve the runway? 3. Which of the data used in the analysis are likely

> Washington County’s Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the

> Refer to the data in the preceding problem 16-41. Required: Use the incremental-cost approach to prepare a net-present-value analysis of the chief ranger’s decision between the interior fire-control plan and the perimeter fire-control plan. Data from P

> The chief ranger of the state’s Department of Natural Resources is considering a new plan for fighting forest fires in the state’s forest lands. The current plan uses eight fire-control stations, which are scattered throughout the interior of the state f

> The supervisor of the county Department of Transportation (DOT) is considering the replacement of some machinery. This machinery has zero book value but its current market value is $800. One possible alternative is to invest in new machinery, which has a

> The management of Niagara National Bank is considering an investment in automatic teller machines. The machines would cost $124,200 and have a useful life of seven years. The bank’s controller has estimated that the automatic teller machines will save th

> Andrew and Fulton, Inc., uses 780 tons of a chemical bonding agent each year. Monthly demand fluctuates between 50 and 80 tons. The lead time for each order is one month, and the economic order quantity is 130 tons. Required: 1. Determine the safety sto

> Sounds Fine, Inc., manufactures two models of stereo speakers. Cost estimates for the two models for the coming year are as follows: Each stereo speaker requires 10 hours of direct labor. Each Basic Model unit requires two hours in Department I and eight

> Omaha Synthetic Fibers Inc. specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. The company has been in business for 20 years and has been profitable

> Southern Tier Heating, Inc., installs heating systems in new homes built in the southern tier counties of New York state. Jobs are priced using the time and materials method. The president of Southern Tier Heating, B. T. Ewing, is pricing a job involving

> Alexis Kunselman, president of Pharsalia Electronics (PE), is concerned about the prospects of one of its major products. The president has been reviewing a marketing report with Jeff Keller, marketing product manager, for their 10-disc car compact disc

> Danish Furniture (DF) manufactures easy-to-assemble wooden furniture for home and office. The firm is considering modification of a table to make it more attractive to individuals and businesses that buy products through online retailers. The table is sm

> For many years, Leno Corporation has used a straightforward cost-plus pricing system, marking its goods up approximately 25 percent of total cost. The company has been profitable; however, it has recently lost considerable business to foreign competitors

> MPE Inc. will soon enter a very competitive marketplace in which it will have limited influence over the prices that are charged. Management and consultants are currently working to fine-tune the company’s sole service, which hopefully will generate a 12

> North American Pharmaceuticals, Inc., specializes in packaging bulk drugs in standard dosages for local hospitals. The company has been in business for seven years and has been profitable since its second year of operation. Don Greenway, Assistant Contro

> Badger Valve and Fitting Company, located in southern Wisconsin, manufactures a variety of industrial valves and pipe fittings that are sold to customers in nearby states. Currently, the company is operating at about 70 percent capacity and is earning a

> Colonial Corporation manufactures two types of electric coffeemakers, Regular and Deluxe. The major difference between the two appliances is capacity. Both are considered top-quality units and sell for premium prices. Both coffeemakers pass through two m

> Scholastic Furniture, Inc., manufactures a variety of desks, chairs, tables, and shelf units that are sold to public school systems throughout the Midwest. The controller of the company’s Desk Division is currently preparing a budget fo

> Meals for Professionals, Inc., offers monthly service plans providing prepared meals that are delivered to the customers’ homes. The target market for these meal plans includes double-income families with no children and retired couples

> Deru Chocolate Company manufactures two popular candy bars, the Venus bar and the Comet bar. Both candy bars go through a mixing operation where the various ingredients are combined, and the Coating Department where the bars from the Mixing Department ar

> In addition to fine chocolate, International Chocolate Company also produces chocolate-covered pretzels in its Savannah plant. This product is sold in five-pound metal canisters, which also are manufactured at the Savannah facility. The plant manager, Ma

> Ozark Industries manufactures and sells three products, which are manufactured in a factory with four departments. Both labor and machine time are applied to the products as they pass through each department. The machines and labor skills required in eac

> Miami Industries received an order for a piece of special machinery from Jay Company. Just as Miami completed the machine, Jay Company declared bankruptcy, defaulted on the order, and forfeited the 10 percent deposit paid on the selling price of $72,500.

> Chenango Industries uses 10 units of part JR63 each month in the production of radar equipment. The cost of manufacturing one unit of JR63 is the following: Material handling represents the direct variable costs of the Receiving Department that are appli

> Upstate Mechanical, Inc., has been producing two bearings, components T79 and B81, for use in production. Data regarding these two components follow. Upstate Mechanical’s annual requirement for these components is 8,000 units of T79 and

> Manhattan Fashions, Inc., a high-fashion dress manufacturer, is planning to market a new cocktail dress for the coming season. Manhattan Fashions supplies retailers in the east and mid-Atlantic states. Four yards of material are required to lay out the d

> Connecticut Chemical Company is a diversified chemical processing company. The firm manufactures swimming pool chemicals, chemicals for metal processing, specialized chemical compounds, and pesticides. Currently, the Noorwood plant is producing two deriv

> The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corporation’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining

> The following selected information was extracted from the 20x1 accounting records of Lone Oak Products: Required: 1. Calculate Lone Oak’s manufacturing overhead for the year. 2. Calculate Lone Oak’s cost of goods manu

> Casting Technology Resources (CTR) has purchased 10,000 pumps annually from Kobec, Inc. Because the price keeps increasing and reached $68.00 per unit last year, CTR’s management has asked for an estimate of the cost of manufacturing th

> Carpenter’s Mate, Inc., manufactures electric carpentry tools. The Production Department has met all production requirements for the current month and has an opportunity to produce additional units of product with its excess capacity. U

> Johnson and Gomez, Inc., is a small firm involved in the production and sale of electronic business products. The company is well known for its attention to quality and innovation. During the past 15 months, a new product has been under development that

> Jupiter Corporation manufactures skateboards. Several weeks ago, the firm received a special-order inquiry from Venus, Inc. Venus desires to market a skateboard similar to one of Jupiter’s and has offered to purchase 11,000 units if the

> Kitchen Magician, Inc., has assembled the following data pertaining to its two most popular products. Past experience has shown that the fixed manufacturing overhead component included in the cost per machine hour averages $10. Kitchen Magicianâ

> Provo Consolidated Resources Company (PCRC) has several divisions. However, only two divisions transfer products to other divisions. The Mining Division refines toldine, which is then transferred to the Metals Division. The toldine is processed into an a