Question: Sounds Fine, Inc., manufactures two models of

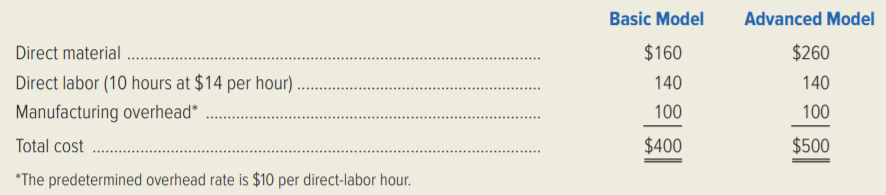

Sounds Fine, Inc., manufactures two models of stereo speakers. Cost estimates for the two models for the coming year are as follows:

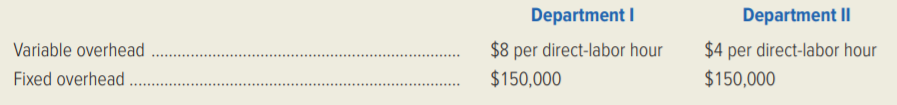

Each stereo speaker requires 10 hours of direct labor. Each Basic Model unit requires two hours in Department I and eight hours in Department II. Each unit of the Advanced Model requires eight hours in Department I and two hours in Department II. The manufacturing overhead costs expected during the coming year in Departments I and II are as follows:

The expected operating activity for the coming year is 37,500 direct-labor hours in each department.

Required:

1. Show how Sounds Fine, Inc., derived its plant wide predetermined overhead rate of $10 per direct labor hour.

2. What will be the price of each model stereo speaker if the company prices its products at absorption manufacturing cost plus 15 percent?

3. Suppose Sounds Fine, Inc., were to use departmental overhead rates. Compute these rates for

Departments I and II for the coming year.

4. Compute the absorption cost of each model stereo speaker using the departmental overhead rates computed in requirement 3.

5. Suppose management sticks with its policy of setting prices equal to absorption cost plus 15 percent. Compute the new price for each speaker model using the product costs developed in requirement 4.

6. Should Sounds Fine, Inc., use plant wide or departmental overhead rates? Explain your answer.

> For each of the following companies, indicate whether job-order or process costing is more appropriate. 1. Manufacturer of swimming pool chemicals. 2. Manufacturer of custom hot tubs and spas. 3. Architectural firm. 4. Manufacturer of ceramic tile. 5. Pr

> Refer to the illustration of overhead application in the Small World Advertising example. Suppose the firm used a single cost driver, total staff compensation, to apply overhead costs to each advertising engagement. Required: 1. Compute the total budget

> Laramie Leatherworks, which manufactures saddles and other leather goods, has three departments. The Assembly Department manufactures various leather products, such as belts, purses, and saddlebags, using an automated production process. The Saddle Depar

> Refer to the information given in Case 8–42 for Lehighton Chalk Company. Selected information from Lehighton’s year-end balance sheets for its first two years of operation is as follows: Required: 1. Why is the year 1

> Design Arts Associates is an interior decorating firm in Berlin. The following costs were incurred in the firm’s contract to redecorate the mayor’s offices. The firm’s budget for the year included the

> Refer to the data for the preceding exercise for Oneida Restaurant Supply Company. Prepare a journal entry to add to work-in-process inventory the total manufacturing overhead cost for the year, assuming: 1. The firm uses actual costing. 2. The firm uses

> The following data pertain to the Oneida Restaurant Supply Company for the year just ended. Required: 1. Compute the firm’s predetermined overhead rate for the year using each of the following common cost drivers: (a) machine hours, (b

> Sweet Tooth Confectionary incurred $157,000 of manufacturing overhead costs during the year just ended. However, only $141,000 of overhead was applied to production. At the conclusion of the year, the following amounts of the year’s app

> Selected data concerning the past year’s operations of the Ozarks Manufacturing Company are as follows: Required: 1. What was the cost of raw materials purchased during the year? 2. What was the direct-labor cost charged to production

> Reimel Furniture Company, Inc., incurred the following costs during 20x2. Raw material used …………………â€&b

> Garrett Toy Company incurred the following costs in April to produce job number TB78, which consisted of 1,000 teddy bears that can walk, talk, and play cards. Direct Material: 4/1/20x0 Requisition number 101: 400 yards of fabric at $.80 per yard 4/5/20x

> McAllister, Inc., employs a normal costing system. The following information pertains to the year just ended. • Total manufacturing costs were $2,500,000. • Cost of goods manufactured was $2,425,000. • Applied manufacturing overhead was 30 percent of tot

> Bodin Company manufactures finger splints for kids who get tendonitis from playing video games. The firm had the following inventories at the beginning and end of the month of January. The following additional data pertain to January operations. The comp

> Crunchem Cereal Company incurred the following actual costs during 20x1. Direct material used …………………â€

> Refer to the information given in the case 8-42 for Lehighton Chalk Company. Required: 1. Reconcile Lehighton’s operating income reported under absorption and variable costing, during each year, by comparing the following two amounts o

> The following data refers to Huron Corporation for the year 20x2. Required: 1. Prepare Huron’s schedule of cost of goods manufactured for 20x2. 2. Prepare the company’s schedule of cost of goods sold for 20x2. The c

> The following information pertains to Trenton Glass Works for the year just ended. Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour. Actual direct-labor cost: 80,000 hours at $17.50 per hour. Budgeted manufacturing overhead:

> CompuFurn, Inc., manufactures furniture for computer work stations. CompuFurn uses a job-order costing system and employs absorption costing. ComuFurn’s work-in-process inventory on November 30 consisted of the following jobs. On Novemb

> FiberCom, Inc., a manufacturer of fibre optic communications equipment, uses a job-order costing system. Since the production process is heavily automated, manufacturing overhead is applied on the basis of machine hours using a predetermined overhead rat

> Travel craft Company manufactures a complete line of fiberglass suitcases and attaché cases. The firm has three manufacturing departments: Molding, Component, and Assembly. There are also two service departments: Power and Maintenance. The s

> Snake River Sawmill manufactures two lumber products from a joint milling process. The two products developed are mine support braces (MSB) and unseasoned commercial building lumber (CBL). A standard production run incurs joint costs of $300,000 and resu

> Celestial Artistry Company is developing departmental overhead rates based on direct-labor hours for its two production departments, Etching and Finishing. The Etching Department employs 20 people and the Finishing Department employs 80 people. Each pers

> Refer to the data given in the preceding problem 17-24. When Tampa Instrument Company established its service departments, the following long-run needs were anticipated. Required: Use dual cost allocation in conjunction with each of the following method

> Refer to the data given in Problem 17–26 for Celestial Artistry Company. Required: 1. Use the reciprocal-services method to allocate service department costs. Calculate the overhead rates per direct-labor hour for the Etching Departmen

> Lafayette Company manufactures two products out of a joint process: Compod and Ultrasene. The joint costs incurred are $250,000 for a standard production run that generates 120,000 gallons of Compod and 80,000 gallons of Ultrasene. Compod sells for $2.00

> Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $50 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered int

> Winchester Chemicals uses a joint process to produce VX-4, a chemical used in the manufacture of paints and varnishes; HD-10, a chemical used in household cleaning products; and FT-5, a by-product that is sold to fertilizer manufacturers. Joint productio

> Berger Company manufactures products Delta, Kappa, and Omega from a joint process. Production, sales, and cost data for July follow. Required: 1. Assuming that joint costs are allocated using the relative-sales-value method, what were the joint costs al

> Biondi Industries is a manufacturer of chemicals for various purposes. One of the processes used by Biondi produces HTP–3, a chemical used in hot tubs and swimming pools; PST–4, a chemical used in pesticides; and RJ&ac

> Refer to the data given in the preceding problem 16-57 for Pensacola Cablevision Company. Required: 1. Compute the price index for each year from 20x1 through 20x7, using 1.0000 as the index for 20x0. 2. Prepare a schedule of after-tax cash flows measur

> Pensacola Cablevision Company provides television cable service to two counties in the Florida panhandle. The firm’s management is considering the construction of a new satellite dish in December of 20x0. The new antenna would improve reception and the s

> Refer to the data for High Country Department Stores’ computerized checkout equipment decision given in Exhibit 16–11. Also refer to the net-present-value analysis presented in Exhibit 16–12. Require

> Liberty Bell Theater is a nonprofit enterprise in downtown Philadelphia. The board of directors is considering an expansion of the theater’s seating capacity, which will entail significant renovations to the existing facilities. The boa

> Refer to the data given in the preceding problem 16-53. The owner of Waco Waffle House will consider capital projects only if they have a payback period of six years or less. The owner also favors projects that exhibit an accounting rate of return of at

> The owner of Waco Waffle House is considering an expansion of the business. He has identified two alternatives, as follows: Build a new restaurant near the mall. Buy and renovate an old building downtown for the new restaurant. The projected cash flows f

> The management of Tri-County Air Taxi, Inc., is considering the replacement of an old machine used in its helicopter repair facility. It is fully depreciated but it can be used by the corporation through 20x5. If management decides to replace the old mac

> As a group, think carefully about the various activities and steps involved in the course registration process at your college or university. Required: 1. List the steps in the registration process in the sequence in which they occur. 2. Prepare an acti

> Refer to the data given in the preceding problem 16-50. Required: Compute the net present value of Scientific Frontiers Corporation’s proposed acquisition of robotic equipment. Data from Problem 16-50: Scientific Frontiers Corporation

> Scientific Frontiers Corporation manufactures scientific equipment for use in elementary schools. In December of 20x0 the company’s management is considering the acquisition of robotic equipment, which would radically change its manufac

> Philadelphia Fastener Corporation manufactures nails, screws, bolts, and other fasteners. Management is considering a proposal to acquire new material-handling equipment. The new equipment has the same capacity as the current equipment but will provide o

> Mind Challenge, Inc., publishes innovative science textbooks for public schools. The company’s management recently acquired the following two new pieces of equipment. Computer-controlled printing press: cost, $250,000; considered to be industrial equipme

> Refer to the data given in Problem 16–45. The County Board of Representatives believes that if the county conducts a promotional effort costing $20,000 per year, the proposed long runway will result in substantially greater economic dev

> Refer to the data given in the preceding problem 16-45. Required: 1. Prepare a net-present-value analysis of the proposed long runway. 2. Should the County Board of Representatives approve the runway? 3. Which of the data used in the analysis are likely

> Washington County’s Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the

> Refer to the data in the preceding problem 16-41. Required: Use the incremental-cost approach to prepare a net-present-value analysis of the chief ranger’s decision between the interior fire-control plan and the perimeter fire-control plan. Data from P

> The chief ranger of the state’s Department of Natural Resources is considering a new plan for fighting forest fires in the state’s forest lands. The current plan uses eight fire-control stations, which are scattered throughout the interior of the state f

> The supervisor of the county Department of Transportation (DOT) is considering the replacement of some machinery. This machinery has zero book value but its current market value is $800. One possible alternative is to invest in new machinery, which has a

> The management of Niagara National Bank is considering an investment in automatic teller machines. The machines would cost $124,200 and have a useful life of seven years. The bank’s controller has estimated that the automatic teller machines will save th

> Andrew and Fulton, Inc., uses 780 tons of a chemical bonding agent each year. Monthly demand fluctuates between 50 and 80 tons. The lead time for each order is one month, and the economic order quantity is 130 tons. Required: 1. Determine the safety sto

> Omaha Synthetic Fibers Inc. specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. The company has been in business for 20 years and has been profitable

> Southern Tier Heating, Inc., installs heating systems in new homes built in the southern tier counties of New York state. Jobs are priced using the time and materials method. The president of Southern Tier Heating, B. T. Ewing, is pricing a job involving

> Alexis Kunselman, president of Pharsalia Electronics (PE), is concerned about the prospects of one of its major products. The president has been reviewing a marketing report with Jeff Keller, marketing product manager, for their 10-disc car compact disc

> Danish Furniture (DF) manufactures easy-to-assemble wooden furniture for home and office. The firm is considering modification of a table to make it more attractive to individuals and businesses that buy products through online retailers. The table is sm

> For many years, Leno Corporation has used a straightforward cost-plus pricing system, marking its goods up approximately 25 percent of total cost. The company has been profitable; however, it has recently lost considerable business to foreign competitors

> MPE Inc. will soon enter a very competitive marketplace in which it will have limited influence over the prices that are charged. Management and consultants are currently working to fine-tune the company’s sole service, which hopefully will generate a 12

> North American Pharmaceuticals, Inc., specializes in packaging bulk drugs in standard dosages for local hospitals. The company has been in business for seven years and has been profitable since its second year of operation. Don Greenway, Assistant Contro

> Badger Valve and Fitting Company, located in southern Wisconsin, manufactures a variety of industrial valves and pipe fittings that are sold to customers in nearby states. Currently, the company is operating at about 70 percent capacity and is earning a

> Colonial Corporation manufactures two types of electric coffeemakers, Regular and Deluxe. The major difference between the two appliances is capacity. Both are considered top-quality units and sell for premium prices. Both coffeemakers pass through two m

> Scholastic Furniture, Inc., manufactures a variety of desks, chairs, tables, and shelf units that are sold to public school systems throughout the Midwest. The controller of the company’s Desk Division is currently preparing a budget fo

> Meals for Professionals, Inc., offers monthly service plans providing prepared meals that are delivered to the customers’ homes. The target market for these meal plans includes double-income families with no children and retired couples

> Deru Chocolate Company manufactures two popular candy bars, the Venus bar and the Comet bar. Both candy bars go through a mixing operation where the various ingredients are combined, and the Coating Department where the bars from the Mixing Department ar

> In addition to fine chocolate, International Chocolate Company also produces chocolate-covered pretzels in its Savannah plant. This product is sold in five-pound metal canisters, which also are manufactured at the Savannah facility. The plant manager, Ma

> Ozark Industries manufactures and sells three products, which are manufactured in a factory with four departments. Both labor and machine time are applied to the products as they pass through each department. The machines and labor skills required in eac

> Miami Industries received an order for a piece of special machinery from Jay Company. Just as Miami completed the machine, Jay Company declared bankruptcy, defaulted on the order, and forfeited the 10 percent deposit paid on the selling price of $72,500.

> Chenango Industries uses 10 units of part JR63 each month in the production of radar equipment. The cost of manufacturing one unit of JR63 is the following: Material handling represents the direct variable costs of the Receiving Department that are appli

> Upstate Mechanical, Inc., has been producing two bearings, components T79 and B81, for use in production. Data regarding these two components follow. Upstate Mechanical’s annual requirement for these components is 8,000 units of T79 and

> Manhattan Fashions, Inc., a high-fashion dress manufacturer, is planning to market a new cocktail dress for the coming season. Manhattan Fashions supplies retailers in the east and mid-Atlantic states. Four yards of material are required to lay out the d

> Connecticut Chemical Company is a diversified chemical processing company. The firm manufactures swimming pool chemicals, chemicals for metal processing, specialized chemical compounds, and pesticides. Currently, the Noorwood plant is producing two deriv

> The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corporation’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining

> The following selected information was extracted from the 20x1 accounting records of Lone Oak Products: Required: 1. Calculate Lone Oak’s manufacturing overhead for the year. 2. Calculate Lone Oak’s cost of goods manu

> Casting Technology Resources (CTR) has purchased 10,000 pumps annually from Kobec, Inc. Because the price keeps increasing and reached $68.00 per unit last year, CTR’s management has asked for an estimate of the cost of manufacturing th

> Carpenter’s Mate, Inc., manufactures electric carpentry tools. The Production Department has met all production requirements for the current month and has an opportunity to produce additional units of product with its excess capacity. U

> Johnson and Gomez, Inc., is a small firm involved in the production and sale of electronic business products. The company is well known for its attention to quality and innovation. During the past 15 months, a new product has been under development that

> Jupiter Corporation manufactures skateboards. Several weeks ago, the firm received a special-order inquiry from Venus, Inc. Venus desires to market a skateboard similar to one of Jupiter’s and has offered to purchase 11,000 units if the

> Kitchen Magician, Inc., has assembled the following data pertaining to its two most popular products. Past experience has shown that the fixed manufacturing overhead component included in the cost per machine hour averages $10. Kitchen Magicianâ

> Provo Consolidated Resources Company (PCRC) has several divisions. However, only two divisions transfer products to other divisions. The Mining Division refines toldine, which is then transferred to the Metals Division. The toldine is processed into an a

> Cortez Enterprises has two divisions: Birmingham and Tampa. Birmingham currently sells a diode reducer to manufacturers of aircraft navigation systems for $775 per unit. Variable costs amount to $500, and demand for this product currently exceeds the div

> Clearview Window Company manufactures windows for the home-building industry. The window frames are produced in the Frame Division. The frames are then transferred to the Glass Division, where the glass and hardware are installed. The companyâ€

> All-Canadian, Ltd., is a multiproduct company with three divisions: Pacific Division, Plains Division, and Atlantic Division. The company has two sources of long-term capital: debt and equity. The interest rate on All-Canadian’s $400 mi

> Kenneth Washburn, head of the Sporting Goods Division of Reliable Products, has just completed a miserable nine months. “If it could have gone wrong, it did. Sales are down, income is down, inventories are bloated, and quite frankly, I&

> Emerson Corporation just completed its first year of operations. Planned and actual production equalled 10,000 units, and sales totalled 9,600 units at $72 per unit. Cost data for the year are as follows: Required: 1. Compute the companyâ€

> Megatronics Corporation, a massive retailer of electronic products, is organized in four separate divisions. The four divisional managers are evaluated at year-end, and bonuses are awarded based on ROI. Last year, the company as a whole produced a 13 per

> Refer to the data for Problem 13–36 regarding Long Beach Pharmaceutical Company. Required: Compute each division’s residual income for the year under each of the following assumptions about the firm’

> Refer to the problem 13-37 about Nevada Aggregates, Inc. Required: 1. Explain three ways the Division B manager could improve her division’s ROI. Use numbers to illustrate these possibilities. 2. Suppose Division A’s

> The following data pertain to three divisions of Nevada Aggregates, Inc. The company’s required rate of return on invested capital is 8 percent. Required: Fill in the blanks above.

> Long Beach Pharmaceutical Company has two divisions, which reported the following results for the most recent year. Required: Which was the more successful division during the year? Think carefully about this, and explain your answer.

> MedLine Equipment Corporation specializes in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately two years ago, Ben Harrington, president of MedLine, became concerned that the company’s

> MedTech, Inc., manufactures diagnostic testing equipment used in hospitals. The company practices JIT production management and has a state-of-the-art manufacturing system, including an FMS and an AMHS. The following nonfinancial data were collected biwe

> Pittsburgh Plastics Corporation manufactures a range of molded plastic products, such as kitchen utensils and desk accessories. The production process in the North Hills plant is a JIT system, which operates in four flexible manufacturing cells. An autom

> You are preparing for an internship interview with a startup company. It’s very important to be knowledgeable about the company, so: • Visit the company’s website. Spend some time exploring the website to learn about the company’s product or service, and

> Warriner Equipment Company, which is located in Ontario, Canada, manufactures heavy construction equipment. The company’s primary product, an especially powerful bulldozer, is among the best produced in North America. The company operat

> As a group, discuss the activities of your college or university (e.g., admission, registration, etc.). List as many activities as you can. Required: Make a presentation to your class that includes the following: 1. Your list of activities. 2. The hiera

> Building Services Co. (BSC) was started a number of years ago by Jim and Joan Forge to provide cleaning services to both large and small businesses in their home city. Over the years, as local businesses reduced underutilized building maintenance staffs,

> Buckeye Department Stores, Inc., operates a chain of department stores in Ohio. The company’s organization chart appears below. Operating data for 20x1 follow. The following fixed expenses are controllable at the divisional level: depre

> Show-Off, Inc., sells merchandise through three retail outlets—in Las Vegas, Reno, and Sacramento—and operates a general corporate headquarters in Reno. A review of the company’s income statement indi

> Rocky Mountain General Hospital serves three counties in Colorado. The hospital is a non-profit organization that is supported by patient billings, county and state funds, and private donations. The hospital’s organization is shown in t

> Cleveland Computer Accessory Company (CCAC) distributes keyboard trays to computer stores. The keyboard trays can be attached to the underside of a desk, effectively turning it into a computer table. The keyboard trays are purchased from a manufacturer t

> White Mountain Sled Company manufactures children’s snow sleds. The company’s performance report for November is as follows. The company uses sales variance analysis to explain the difference between budgeted and actua

> College Memories, Inc., publishes college yearbooks. A monthly flexible overhead budget for the firm follows. The planned monthly production is 6,400 yearbooks. The standard direct-labor allowance is .25 hours per book and overhead is budgeted and applie

> Montreal Scholastic Supply Company uses a standard-costing system. The firm estimates that it will operate its manufacturing facilities at 800,000 machine hours for the year. The estimate for total budgeted overhead is $2,000,000. The standard variable-o