Question: Lincoln Park was organized on April 1,

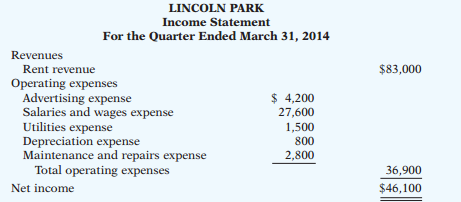

Lincoln Park was organized on April 1, 2013, by Judy Tercek. Judy is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Judy prepared the following income statement for the quarter that ended March 31, 2014.

Judy knew that something was wrong with the statement because net income had never exceeded $20,000 in any one quarter. Knowing that you are an experienced accountant, she asks you to review the income statement and other data.

You first look at the trial balance. In addition to the account balances reported in the income statement, the ledger contains these selected balances at March 31, 2014.

Supplies …………………………………..$ 4,500

Prepaid Insurance ………………………7,200

Notes Payable …………………………. 20,000

You then make inquiries and discover the following.

1. Rent revenue includes advanced rentals for summer-month occupancy, $21,000.

2. There were $600 of supplies on hand at March 31.

3. Prepaid insurance resulted from the payment of a 1-year policy on January 1, 2014.

4. The mail on April 1, 2014, brought the following bills: advertising for week of March 24, $110; repairs made March 10, $1,040; and utilities $240.

5. There are four employees who receive wages totaling $290 per day. At March 31, 3 days’ wages have been incurred but not paid.

6. The note payable is a 3-month, 7% note dated January 1, 2014.

Instructions:

With the class divided into groups, answer the following.

(a) Prepare a correct income statement for the quarter ended March 31, 2014.

(b) Explain to Judy the generally accepted accounting principles that she did not follow in preparing her income statement and their effect on her results.

Transcribed Image Text:

LINCOLN PARK Income Statement For the Quarter Ended March 31, 2014 Revenues Rent revenue $83,000 Operating expenses Advertising expense Salaries and wages expense Utilities expense Depreciation expense Maintenance and repairs expense Total operating expenses $ 4,200 27,600 1,500 800 2,800 36,900 Net income $46,100

> This information relates to Woodward Co. 1. On April 5, purchased merchandise from Cozart Company for $27,000, terms 2/10, n/30. 2. On April 6, paid freight costs of $1,200 on merchandise purchased from Cozart Company. 3. On April 7, purchased equipment

> Dorcas Corporation reported sales revenue of $257,000, net income of $45,300, cash of $9,300, and net cash provided by operating activities of $23,200. Accounts receivable have increased at three times the rate of sales during the last 3 years. Instruc

> Below is a series of cost of goods sold sections for companies A, L, N, and R. Instructions: Fill in the lettered blanks to complete the cost of goods sold sections. A L N R $ 120 $ 250 1,500 80 $ 700 (g) 290 $ (j) 43,590 (k) 42,290 2,240 (1) 49,53

> The trial balance of Sanchez Company at the end of its fiscal year, August 31, 2014, includes these accounts: Beginning Inventory $18,700; Purchases $154,000; Sales Revenue $190,000; Freight-In $8,000; Sales Returns and Allowances $3,000; Freight-Out$1,0

> Suppose in its income statement for the year ended June 30, 2014, The Clorox Company reported the following condensed data (dollars in millions). Instructions: (a) Prepare a multiple-step income statement. (b) Calculate the gross profit rate and the p

> In its income statement for the year ended December 31, 2014, Gavin Company reported the following condensed data. Instructions: (a) Prepare a multiple-step income statement. (b) Calculate the profit margin and gross profit rate. (c) In 2013, Gavin had

> Horne Inc. uses a periodic inventory system. Its records show the following for the month of May, in which 74 units were sold. Instructions: Calculate the ending inventory at May 31 using the (a) FIFO, (b) LIFO, and (c) average cost methods. (For av

> Delmott sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Below is information relating to Delmott’s purchases of Xpert snowboards during September. During the same month, 102 Xpert snowboards were sold. Delmott uses

> Beth Pitchford is the new owner of Brigham Co. She has heard about internal control but is not clear about its importance for her business. Explain to Beth the four purposes of internal control, and give her one application of each purpose for Brigham Co

> On June 10, Purcey Company purchased $9,000 of merchandise from Guyer Company, terms 3/10, n/30. Purcey pays the freight costs of $400 on June 11. Goods totaling $600 are returned to Guyer for credit on June 12. On June 19, Purcey Company pays Guyer Comp

> The following transactions are for Solarte Company. 1. On December 3, Solarte Company sold $500,000 of merchandise to Rooney Co., terms 1/10, n/30. The cost of the merchandise sold was $330,000. 2. On December 8, Rooney Co. was granted an allowance of $2

> This information relates to Crisp Co. 1. On April 5, purchased merchandise from Frost Company for $28,000, terms 2/10, n/30. 2. On April 6, paid freight costs of $700 on merchandise purchased from Frost. 3. On April 7, purchased equipment on account for

> Here are selected 2014 transactions of Cleland Corporation. Jan. 1 Retired a piece of machinery that was purchased on January 1, 2004. The machine cost $62,000 and had a useful life of 10 years with no salvage value. June 30 Sold a computer that wa

> Wang Co. has delivery equipment that cost $50,000 and has been depreciated $24,000. Instructions: Record entries for the disposal under the following assumptions. (a) It was scrapped as having no value. (b) It was sold for $37,000. (c) It was sold for $

> Danny Venable, the new controller of Seratelli Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2014. Here are his findings: All assets are depreciated by the straight-line method. Se

> Melissa Adduci has prepared the following list of statements about depreciation. 1. Depreciation is a process of asset valuation, not cost allocation. 2. Depreciation provides for the proper matching of expenses with revenues. 3. The book value of a plan

> Thornton Company has an old factory machine that cost $50,000. The machine has accumulated depreciation of $28,000. Thornton has decided to sell the machine. (a) What entry would Thornton make to record the sale of the machine for $25,000 cash? (b) What

> Relaford Corporation purchased a piece of equipment for $50,000. It estimated an 8-year life and $2,000 salvage value. At the end of year four (before the depreciation adjustment), it estimated the new total life to be 10 years and the new salvage value

> Shellhammer Company purchased a delivery truck. The total cash payment was $30,020, including the following items. Negotiated purchase price ………………$24,000 Installation of special shelving ……………. 1,100 Painting and lettering …………………………..900 Motor vehicle

> At December 31, 2013, Weiss Imports reported this information on its balance sheet. Accounts receivable ………………………………………………..$600,000 Less: Allowance for doubtful accounts …………………………. 37,000 During 2014, the company had the following transactions relate

> Lounow Distributors is a growing company whose ability to raise capital has not been growing as quickly as its expanding assets and sales. Lounow’s local banker has indicated that the company cannot increase its borrowing for the foreseeable future. Loun

> Berkman Wholesalers accepts from Almonte Stores a $6,200, 4-month, 9% note dated May 31 in settlement of Almonte’s overdue account. The maturity date of the note is September 30. What entry does Berkman make at the maturity date, assuming Almonte pays th

> Hull Corporation’s management wants to maintain a minimum monthly cash balance of $8,000. At the beginning of September, the cash balance is $12,270; expected cash receipts for September are $97,200; cash disbursements are expected to be $115,000. How mu

> Doug Nicklas owns Doug Blankets. Doug asks you to explain how he should treat the following reconciling items when reconciling the company’s bank account. 1. Outstanding checks 2. A deposit in transit 3. The bank charged to our account a check written by

> Jack Woodling is concerned with control over mail receipts at Yount Sporting Goods. All mail receipts are opened by Bill Morten. Bill sends the checks to the accounting department, where they are stamped “For Deposit Only.” The accounting department reco

> The accounting records of Tuel Electronics show the following data. Beginning inventory 3,000 units at …………………………..$5 Purchases 8,000 units at …………………………………………$7 Sales 9,400 units at ………………………………………………$10 Determine cost of goods sold during the period

> Early in 2014, Defoor Company switched to a just-in-time inventory system. Its sales and inventory amounts for 2013 and 2014 are shown below. Determine the inventory turnover and days in inventory for 2013 and 2014. Discuss the changes in the amount of

> The following information is available for Vogt Corp. for the year ended December 31, 2014: Prepare a multiple-step income statement for Vogt Corp. The company has a tax rate of 30%. Other revenues and gains Other expenses and losses Cost of goods

> Assume information similar to that in 5-1. That is: On October 5, Narveson Company buys merchandise on account from Rossi Company. The selling price of the goods is $5,000, and the cost to Rossi Company is $3,000. On October 8, Narveson returns defective

> Identify which control activity is violated in each of the following situations, and explain how the situation creates an opportunity for fraud or inappropriate accounting practices. 1. Once a month, the sales department sends sales invoices to the accou

> At December 31, 2013, Dustin Company reported this information on its balance sheet. Accounts receivable ………………………………………………$960,000 Less: Allowance for doubtful accounts ………………………...78,000 During 2014, the company had the following transactions related

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. (a) What does it mean to capitalize an item? (b) What is the definition provided for an intangible asset? (

> A company’s trade name is a very important asset to the company, as it creates immediate product identification. Companies invest substantial sums to ensure that their product is well known to the consumer. Test your knowledge of who owns some famous bra

> Fresh Air Anti-Pollution Company is suffering declining sales of its principal product, Non biodegradable plastic cartons. The president, Tyler Weber, instructs his controller, Robin Cain, to lengthen asset lives to reduce depreciation expense. A process

> The chapter presented some concerns regarding the current accounting standards for research and development expenditures. Instructions: Assume that you are either (a) the president of a company that is very dependent on ongoing research and development,

> Payton Furniture Corp. is nationally recognized for making high-quality products. Management is concerned that it is not fully exploiting its brand power. Payton’s production managers are also concerned because their plants are not oper

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. (a) What does it mean to capitalize an item? (b) What is the definition provided for an intangible asset? (

> Fresh Air Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Tyler Weber, instructs his controller, Robin Cain, to lengthen asset lives to reduce depreciation expense. A process

> The chapter presented some concerns regarding the current accounting standards for research and development expenditures. Instructions: Assume that you are either (a) the president of a company that is very dependent on ongoing research and development

> Payton Furniture Corp. is nationally recognized for making high-quality products. Management is concerned that it is not fully exploiting its brand power. Payton’s production managers are also concerned because their plants are not oper

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. Instructions: Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition

> Tiffee Company identifies the following items for possible inclusion in the physical inventory. Indicate whether each item should be included or excluded from the inventory taking. (a) 900 units of inventory shipped on consignment by Tiffee to another co

> Eaton Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Eaton’s chemical pesticides. During the coming year, Eaton will have environmentally safe and competitive

> Lincoln Park was organized on April 1, 2013, by Judy Tercek. Judy is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Judy prepared the following income statement for the quarter that ended March 31, 2014.

> Reagen Wholesale Corp. uses the LIFO cost flow method. In the current year, profit at Reagen is running unusually high. The corporate tax rate is also high this year, but it is scheduled to decline significantly next year. In an effort to lower the curre

> You are the controller of Fagan Inc. K. L. Howard, the president, recently mentioned to you that she found an error in the 2013 financial statements which she believes has corrected itself. She determined, in discussions with the purchasing department, t

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. (a) The primary basis for accounting for inventories is cost. How is cost defined in the Codification? (b)

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. Instructions: Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition

> Eaton Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Eaton’s chemical pesticides. During the coming year, Eaton will have environmentally safe and competitive r

> Kenseth Corporation’s unadjusted trial balance at December 1, 2014, is presented below. The following transactions occurred during December. Dec. 2 Purchased equipment for $16,000, plus sales taxes of $800 (paid in cash). 2 Kenseth

> Suppose this information is available for PepsiCo, Inc. for 2012, 2013, and 2014. Instructions: Calculate the inventory turnover, days in inventory, and gross profit rate for PepsiCo., Inc. for 2012, 2013, and 2014. Comment on any trends. (in milli

> What inventory cost flow method does Tootsie Roll Industries use for U.S. inventories? What method does it use for foreign inventories? Why does it use a different method for foreign inventories?

> What title does Tootsie Roll use for gross profit? How did it present gross profit? By how much did its total gross profit change, and in what direction, in 2011?

> Madson Corporation’s balance sheet at December 31, 2013, is presented below. During January 2014, the following transactions occurred. Madson uses the perpetual inventory method. Jan. 1 Madson accepted a 4-month, 8% note from Mathen

> Heineken Electronics has enjoyed tremendous sales growth during the last 10 years. However, even though sales have steadily increased, the company’s CEO, Beth Dains, is concerned about certain aspects of its performance. She has called

> Stan Koevner believes that the allocation of cost of goods available for sale should be based on the actual physical flow of the goods. Explain to Stan why this may be both impractical and inappropriate.

> Espinosa Corporation has been using the FIFO cost flow method during a prolonged period of inflation. During the same time period, Espinosa has been paying out all of its net income as dividends. What adverse effects may result from this policy?

> Scribner Company reports net sales of $800,000, gross profit of $560,000, and net income of $230,000. What are its operating expenses?

> What is the primary basis of accounting for inventories? What is the major objective in accounting for inventories?

> What does Tootsie Roll use as the estimated useful life on its buildings? On its machinery and equipment?

> Adriana is studying for the next accounting examination. She asks your help on two questions: (a) What is salvage value? (b) How is salvage value used in determining depreciable cost under the straight-line method? Answer Adriana’s questions.

> Nida Hat Shop received a shipment of hats for which it paid the wholesaler $2,940. The price of the hats was $3,000, but Nida was given a $60 cash discount and required to pay freight charges of $75. What amount should Nida include in inventory? Why?

> Malor Inc. needs to upgrade its diagnostic equipment. At the time of purchase, Malor had expected the equipment to last 8 years. Unfortunately, it was obsolete after only 4 years. Ronald Nolan, CFO of Malor Inc., is considering leasing new equipment rath

> Give an example of an industry that would be characterized by (a) a high asset turnover and a low profit margin, and (b) a low asset turnover and a high profit margin.

> Mrs. Betancourt is uncertain about how the historical cost principle applies to plant assets. Explain the principle to Mrs. Betancourt.

> On December 1, 2014, Havenhill Company had the following account balances. During December, the company completed the following transactions. Dec. 7 Received $3,600 cash from customers in payment of account (no discount allowed). 12 Purchased mer

> The Coca-Cola Company’s accounts receivable turnover was 9.05 in 2011, and its average amount of net receivables during the period was $3,424 million. What is the amount of its net credit sales for the period? What is the average collection period in day

> What types of receivables does Tootsie Roll report on its balance sheet? Does it use the allowance method or the direct write-off method to account for uncollectibles?

> Mendosa Company has a credit balance of $2,200 in Allowance for Doubtful Accounts before adjustment. The estimated uncollectibles under the percentage-ofreceivables basis is $5,100. Prepare the adjusting entry.

> Pine Corp. has experienced tremendous sales growth this year, but it is always short of cash. What is one explanation for this occurrence?

> Mitch Lang cannot understand why the cash realizable value does not decrease when an uncollectible account is written off under the allowance method. Clarify this point for Mitch.

> “The use of a bank contributes significantly to good internal control over cash.” Is this true? Why?

> Napoli Company’s internal controls over cash disbursements provide for the treasurer to sign checks imprinted by a check writer after comparing the check with the approved invoice. Identify the internal control principles that are present in these contro

> Dillard Co. has sales revenue of $100,000, cost of goods sold of $70,000, and operating expenses of $18,000. What is its gross profit?

> “To have maximum effective internal control over cash disbursements, all payments should be made by check.” Is this true? Explain.

> At Solis Wholesale Company, two mail clerks open all mail receipts. How does this strengthen internal control?

> On December 1, 2014, Harrisen Company had the account balances shown below. The following transactions occurred during December. Dec. 3 Purchased 4,000 units of inventory on account at a cost of $0.72 per unit. 5 Sold 4,400 units of inventory on acc

> Hoskins Inc. owns the following assets at the balance sheet date. Cash in bank—savings account ……………………………..$ 8,000 Cash on hand …………………………………………………………..1,100 Cash refund due from the IRS ………………………………..1,000 Checking account balance ……………………………………. 12,0

> Donald Bowen is reviewing the principle of segregation of duties. What are the two common applications of this principle?

> What was Tootsie Roll’s balance in cash and cash equivalents at December 31, 2011? Did it report any restricted cash? How did Tootsie Roll define cash equivalents?

> Chris Hite is confused about the lack of agreement between the cash balance per books and the balance per bank. Explain the causes for the lack of agreement to Chris and give an example of each cause.

> Marshall Company discovers in 2014 that its ending inventory at December 31, 2013, was $5,000 understated. What effect will this error have on (a) 2013 net income, (b) 2014 net income, and (c) the combined net income for the 2 years?

> Rondeli Music Center has five TVs on hand at the balance sheet date that cost $400 each. The current replacement cost is $350 per unit. Under the lowerof-cost-or-market basis of accounting for inventories, what value should Rondeli report for the TVs on

> Dipoto Company’s balance sheet shows Inventory $162,800. What additional disclosures should be made?

> George Mallein is considering investing in Wigginton Pet Food Company. Wigginton’s net income increased considerably during the most recent year even though many other companies in the same industry reported disappointing earnings. George wants to know w

> A local bank reported that it lost $150,000 as the result of employee fraud. Fred Raburn is not clear on what is meant by “employee fraud.” Explain the meaning of fraud to Fred and give an example of fraud that might occur at a bank.

> Megan Keen, a business major, is working on a case problem for one of her classes. In this case problem, the company needs to raise cash to market a new product it developed. Jeff Denton, an engineering major, takes one look at the company’s balance shee

> On December 1, 2014, Boline Distributing Company had the following account balances. During December, the company completed the following summary transactions. Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is

> Due to rapid employee turnover in the accounting department, the following transactions involving intangible assets were improperly recorded by Maxwell Corporation in 2014. 1. Maxwell developed a new manufacturing process, incurring research and developm

> Here is information related to Orson Company for 2014. Total credit sales ………………………………………………….$1,800,000 Accounts receivable at December 31 …………………………500,000 Bad debts written off ………………………………………………….15,000 Instructions: (a) What amount of bad debt exp

> Derose Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. Debit 1. Cost of real estate purchased as a plant site (land $200,000 and building $70,000

> Reinsch Company reported the following amounts (in euros) in 2014: Net income, €150,000; Unrealized gain related to revaluation of buildings, €10,000; and Unrealized loss on nontrading securities, €(35,000). Determine Reinsch’s total comprehensive income

> Franklin Company has the following four items in its ending inventory as of December 31, 2014. The company uses the lower-of-cost-or-net realizable value approach for inventory valuation following IFRS. Compute the lower-of-cost-or-net realizable value

> At April 30, the bank reconciliation of Longacre Company shows three outstanding checks: No. 254 $650, No. 255 $700, and No. 257 $410. The May bank statement and the May cash payments journal are given here. Instructions: Using step 2 in the reconcilia

> Petrino Company incurred the following costs. 1. Sales tax on factory machinery purchased……………………………………… $ 5,000 2. Painting of and lettering on truck immediately upon purchase ………………700 3. Installation and testing of factory machinery ……………………………………..2,

> Farwell Company sells three different categories of tools (small, medium and large). The cost and market value of its inventory of tools are as follows. Determine the value of the company’s inventory under the lower-of-cost-or-market

> Dobler Company just took its physical inventory on December 31. The count of inventory items on hand at the company’s business locations resulted in a total inventory cost of $300,000. In reviewing the details of the count and related inventory transacti

> Downs Company purchases a patent for $156,000 on January 2, 2014. Its estimated useful life is 6 years. (a) Prepare the journal entry to record amortization expense for the first year. (b) Show how this patent is reported on the balance sheet at the end

> Quinn Company sells office equipment on July 31, 2014, for $21,000 cash. The office equipment originally cost $72,000 and as of January 1, 2014, had accumulated depreciation of $42,000. Depreciation for the first 7 months of 2014 is $4,600. Prepare the j

> Suppose in its 2014 annual report, McDonald’s Corporation reports beginning total assets of $28.46 billion; ending total assets of $30.22 billion; net sales of $22.74 billion; and net income of $4.55 billion. (a) Compute McDonald’s return on assets. (b)