Question: Logan Realty loaned money and received the

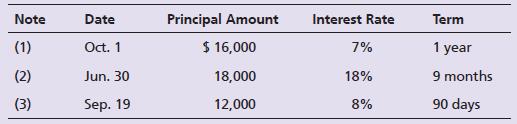

Logan Realty loaned money and received the following notes during 2018.

Requirements:

1. Determine the maturity date and maturity value of each note.

2. Journalize the entries to establish each Note Receivable and to record collection of principal and interest at maturity. Include a single adjusting entry on December 31, 2018, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. Round to the nearest dollar.

Transcribed Image Text:

Note Date Principal Amount Interest Rate Term (1) Oct. 1 $ 16,000 7% 1 year (2) Jun. 30 18,000 18% 9 months (3) Sep. 19 12,000 8% 90 days

> Western Bank & Trust purchased land and a building for the lump sum of $3,000,000. To get the maximum tax deduction, Western allocated 90% of the purchase price to the building and only 10% to the land. A more realistic allocation would have been 70% to

> Amber and Zack Wilson are continuing to review business practices. Currently, they are reviewing the company’s property, plant, and equipment and have gathered the following information: Requirements: 1. Calculate the amount of monthl

> Top Quality Appliance—Long Beach has just purchased a franchise from Top Quality Appliance (TQA). TQA is a manufacturer of kitchen appliances. TQA markets its products via retail stores that are operated as franchises. As a TQA franchis

> In 150 words or fewer, explain the different methods that can be used to calculate depreciation. Your explanation should include how to calculate depreciation expense using each method.

> Assume that Toys Galore store bought and sold a line of dolls during December as follows: Requirements: 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method. 2. Compute the co

> Sears Holdings Corporation is the parent company of Kmart Holding Corporation and Sears, Roebuck and Co. The corporation operates more than 1,600 retail stores in the United States and offers online shopping through both sears.com and kmart.com. Require

> On December 1, Kyle Corporation accepted a 60-day, 9%, $12,000 note receivable from J. Michael in exchange for his account receivable. Requirements: 1. Journalize the transaction on December 1. 2. Journalize the adjusting entry needed on December 31 to

> On June 6, Lakeland Bank & Trust lent $80,000 to Stephan Stow on a 30-day, 9% note. Requirements: 1. Journalize for Lakeland the lending of the money on June 6. 2. Journalize the collection of the principal and interest at maturity. Specify the date. Ro

> Surf and Sun had the following balances at December 31, 2018, before the year-end adjustments: Requirements: 1. Journalize Surf and Sun’s entry to record bad debts expense for 2018 using the aging-of-receivables method. 2. Prepare a T

> The Accounts Receivable balance for Lake, Inc. at December 31, 2017, was $20,000. During 2018, Lake earned revenue of $454,000 on account and collected $325,000 on account. Lake wrote off $5,600 receivables as uncollectible. Industry experience suggests

> During its first year of operations, Fall Wine Tour earned net credit sales of $311,000. Industry experience suggests that bad debts will amount to 3% of net credit sales. At December 31, 2018, accounts receivable total $44,000. The company uses the allo

> The Accounts Receivable balance and Allowance for Bad Debts for Signature Lamp Company at December 31, 2017, was $10,800 and $2,000 (credit balance), respectively. During 2018, Signature Lamp Company completed the following transactions: a. Sales revenu

> Record the following transactions for Summer Consulting. Explanations are not required. Apr. 15 Provided consulting services to Bob Jones and billed the customer $1,500. 18 Provided consulting services to Samantha Cruise and billed the customer $865

> Consider internal control over receivables collections. What job must be withheld from a company’s credit department in order to safeguard its cash? If the credit department does perform this job, what can a credit department employee do to hurt the comp

> Silver Clothiers reported the following selected items at April 30, 2018 (last year’s—2017—amounts also given as needed): Compute Silver’s (a) acid-test ratio, (b) accounts receiva

> Golf Unlimited carries an inventory of putters and other golf clubs. The sales price of each putter is $119. Company records indicate the following for a particular line of Golf Unlimited’s putters: Requirements: 1. Prepare Golf Unlim

> McKale Corporation has a three-month, $18,000, 9% note receivable from L. Peters that was signed on June 1, 2018. Peters defaults on the loan on September 1. Journalize the entry for McKale to record the default of the loan.

> A table of notes receivable for 2018 follows: For each of the notes receivable, compute the amount of interest revenue earned during 2018. Round to the nearest dollar. Principal Interest Rate Interest Period During 2018 Note 1 S 30,000 6% 6 months

> Spring Garden Greenhouse had trouble collecting its account receivable from Steve Stone. On June 19, 2018, Spring Garden Greenhouse finally wrote off Stone’s $600 account receivable. On December 31, Stone sent a $600 check to Spring Garden Greenhouse. Jo

> Shawna Valley is an attorney in Los Angeles. Valley uses the direct write-off method to account for uncollectible receivables. At April 30, 2018, Valley’s accounts receivable totaled $19,000. During May, she earned revenue of $22,000 on account and colle

> Why must companies record accrued interest revenue at the end of the accounting period?

> In accounting for bad debts, how do the income statement approach and the balance sheet approach differ?

> What is the difference between the percent-of-receivables and aging-of-receivables methods?

> How do the percent-of-receivables and aging-of-receivables methods compute bad debts expense?

> What are some limitations of using the direct write-off method?

> What occurs when a business pledges its receivables?

> Golf Unlimited carries an inventory of putters and other golf clubs. The sales price of each putter is $119. Company records indicate the following for a particular line of Golf Unlimited’s putters: Requirements: 1. Prepare Golf Unlim

> What occurs when a business factors its receivables?

> What is a critical element of internal control in the handling of receivables by a business? Explain how this element is accomplished.

> What is the difference between accounts receivable and notes receivable?

> What does the days’ sale in receivables indicate, and how is it calculated?

> What does the accounts receivable turnover ratio measure, and how is it calculated?

> How is the acid-test ratio calculated, and what does it signify?

> What is the formula to compute interest on a note receivable?

> How does the percent-of-sales method compute bad debts expense?

> When a receivable is written off under the allowance method, how does it affect the net realizable value shown on the balance sheet?

> When using the allowance method, what account is debited when writing off uncollectible accounts? How does this differ from the direct write-off method?

> Golf Unlimited carries an inventory of putters and other golf clubs. The sales price of each putter is $119. Company records indicate the following for a particular line of Golf Unlimited’s putters: Requirements: 1. Prepare a perpetua

> When using the allowance method, how are accounts receivable shown on the balance sheet?

> When is bad debts expense recorded when using the allowance method?

> When is bad debts expense recorded when using the direct write-off method?

> What is the expense account associated with the cost of uncollectible receivables called?

> What are some benefits to a business in accepting credit cards and debit cards?

> What type of account must the sum of all subsidiary accounts be equal to?

> When dealing with receivables, give an example of a subsidiary account.

> List some common examples of other receivables, besides accounts receivable and notes receivable.

> At September 30, 2018, the accounts of Spring Mountain Medical Center (SMMC) include the following: Accounts Receivable ………………â

> Consider the following transactions for TLC Company. Journalize all transactions for TLC Company. Round all amounts to the nearest dollar. 2018 Dec. 6 Received a $8,000, 90-day, 9% note in settlement of an overdue accounts receivable from Forest Mu

> Super Mart, a regional convenience store chain, maintains milk inventory by the gallon. The first month’s milk purchases and sales at its Freeport, Florida, location follow: Requirements: 1. Determine the amount that would be reported

> Relax Recliner Chairs completed the following selected transactions: Record the transactions in the journal of Relax Recliner Chairs. Explanations are not required. (Round to the nearest dollar.) 2018 Jul. 1 Sold merchandise inventory to Go-Mart, r

> Dialex Watches completed the following selected transactions during 2018 and 2019: Requirements: 1. Open T-accounts for Allowance for Bad Debts and Bad Debts Expense, assuming the accounts begin with a zero balance. Record the transactions in the gener

> On August 31, 2018, Forget-Me-Not Floral Supply had a $140,000 debit balance in Accounts Receivable and a $5,600 credit balance in Allowance for Bad Debts. During September, Forget-Me-Not made the following transactions: • Sales on account, $530,000. Ign

> The comparative financial statements of Newton Cosmetic Supply for 2018, 2017, and 2016 include the data shown here: Requirements: 1. Compute these ratios for 2018 and 2017: a. Acid-test ratio (Round to two decimals.) b. Accounts receivable turnover (R

> The comparative financial statements of Norfolk Cosmetic Supply for 2018, 2017, and 2016 include the data shown here: Requirements: 1. Compute these ratios for 2018 and 2017: a. Acid-test ratio (Round to two decimals.) b. Accounts receivable turnover (

> Consider the following transactions for CC Publishing. Journalize all transactions for CC Publishing. Round all amounts to the nearest dollar. 2018 Dec. 6 Received a $18,000, 90-day, 6% note in settlement of an overdue accounts receivable from Go G

> Carley Realty loaned money and received the following notes during 2018. Requirements: 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable and to record collection of principal and

> Sleepy Recliner Chairs completed the following selected transactions: Record the transactions in the journal of Sleepy Recliner Chairs. Explanations are not required. (Round to the nearest dollar.) 2018 Jul. 1 Sold merchandise inventory to Stan-Mar

> Delta Watches completed the following selected transactions during 2018 and 2019: Requirements: 1. Open T-accounts for Allowance for Bad Debts and Bad Debts Expense, assuming the accounts begin with a zero balance. Record the transactions in the genera

> Match the accounting terms with the corresponding definitions. 1. Specific identification a. Treats the oldest inventory purchases as the first units sold. 2. Materiality concept b. Requires that a company report enough information for 3. Last-in, f

> At September 30, 2018, the accounts of Green Terrace Medical Center (GTMC) include the following: Accounts Receivable ………………â&#

> On August 31, 2018, Bouquet Floral Supply had a $140,000 debit balance in Accounts Receivable and a $5,600 credit balance in Allowance for Bad Debts. During September, Bouquet made: • Sales on account, $550,000. Ignore Cost of Goods Sold. • Collections o

> Crystal Clear Cleaning uses the allowance method to estimate bad debts. Consider the following April 2019 transactions for Crystal Clear Cleaning: Requirements: 1. Prepare all required journal entries for Crystal Clear. Omit explanations. 2. Show how n

> Dylan worked for a propane gas distributor as an accounting clerk in a small Midwestern town. Last winter, his brother Mike lost his job at the machine plant. By January, temperatures were sub-zero, and Mike had run out of money. Dylan saw that Mike’s ac

> Use Target Corporation’s Fiscal 2015 Annual Report and the Note 9 data on “Credit Card Receivables Transaction” to answer the following questions. Visit http://www.pearsonhighered.com/Horngren to view a link to Target Corporation’s annual report. Requir

> Abanaki Carpets reported the following amounts in its 2018 financial statements. The 2017 figures are given for comparison. Requirements: 1. Calculate Abanaki’s acid-test ratio for 2018. (Round to two decimals.) Determine whether Aban

> Professional Steam Cleaning performs services on account. When a customer account becomes four months old, Professional converts the account to a note receivable. During 2018, the company completed the following transactions: Record the transactions in

> The following selected transactions occurred during 2018 and 2019 for Baltic Importers. The company ends its accounting year on September 30. Journalize all required entries. Make sure to determine the missing maturity date. Round to the nearest dollar

> On September 30, 2018, Team Bank loaned $94,000 to Kendall Warner on a one-year, 6% note. Team’s fiscal year ends on December 31. Requirements: 1. Journalize all entries for Team Bank related to the note for 2018 and 2019. 2. Which party has a a. note r

> Endurance Running Shoes reports the following: Journalize all entries required for Endurance Running Shoes. 2018 May 6 Recorded credit sales of $102,000. Ignore Cost of Goods Sold. Jul. 1 Loaned $18,000 to Jerry Paul, an executive with the company,

> How is inventory turnover calculated, and what does it measure?

> During August 2018, Lima Company recorded the following: • Sales of $133,300 ($122,000 on account; $11,300 for cash). Ignore Cost of Goods Sold. • Collections on account, $106,400. • Write-offs of uncollectible receivables, $990. • Recovery of receivable

> At December 31, 2018, the Accounts Receivable balance of GPS Technology is $200,000. The Allowance for Bad Debts account has a $24,110 debit balance. GPS Technology prepares the following aging schedule for its accounts receivable: Requirements: 1. Jou

> At January 1, 2018, Hilltop Flagpoles had Accounts Receivable of $28,000, and Allowance for Bad Debts had a credit balance of $3,000. During the year, Hilltop Flagpoles recorded the following: a. Sales of $185,000 ($164,000 on account; $21,000 for cash).

> At January 1, 2018, Hilltop Flagpoles had Accounts Receivable of $28,000, and Allowance for Bad Debts had a credit balance of $3,000. During the year, Hilltop Flagpoles recorded the following: a. Sales of $185,000 ($164,000 on account; $21,000 for cash).

> On June 1, 2018, Best Performance Cell Phones sold $21,000 of merchandise to Anthony Trucking Company on account. Anthony fell on hard times and on July 15 paid only $5,000 of the account receivable. After repeated attempts to collect, Best Performance f

> Steller Corporation had the following transactions in June: Requirements: 1. Journalize the transactions. Ignore Cost of Goods Sold. Omit explanations. 2. Post the transactions to the general ledger and the accounts receivable subsidiary ledger. Assume

> Suppose The Right Rig Dealership is opening a regional office in Omaha. Cary Regal, the office manager, is designing the internal control system. Regal proposes the following procedures for credit checks on new customers, sales on account, cash collectio

> Unique Media Sign Incorporated sells on account. Recently, Unique reported the following figures: Requirements: 1. Compute Unique’s days’ sales in receivables for 2018. (Round to the nearest day.) 2. Suppose Unique&a

> Match the terms with their correct definition. Terms Definitions 1. Accounts receivable a. The party to a credit transaction who takes on an obligation/payable. b. The party who receives a receivable and will collect cash in the future. 2. Other rec

> Pauline’s Pottery has always used the direct write-off method to account for uncollectibles. The company’s revenues, bad debt write-offs, and year-end receivables for the most recent year follow: The business is appl

> When does an inventory error cancel out, and why?

> Weddings on Demand sells on account and manages its own receivables. Average experience for the past three years has been as follows: Sales ……………………………………….……..……………………………………..$ 350,000 Cost of Goods Sold …………………….…….…………………………………………210,000 Bad Debts Ex

> Canyon Canoe Company has experienced rapid growth in its first few months of operations and has had a significant increase in customers renting canoes and purchasing T-shirts. Many of these customers are asking for credit terms. Amber and Zack Wilson, st

> Buffalo Wild Wings, Inc. owns and operates more than 550 Buffalo Wild Wings, R Taco, and Pizza Rev restaurants. Additionally, the corporation has franchised restaurants in both the United States and Canada. The corporation takes internal control responsi

> Answer the following questions about the controls in bank accounts: Requirements: 1. Which bank control protects against forgery? 2. Which bank control reports the activity in the customer’s account each period? 3. Which bank control confirms the amount

> A purchasing agent for Franklin Office Supplies receives the goods that he purchases and also approves payment for the goods. Requirements: 1. How could this purchasing agent cheat his company? 2. How could Franklin avoid this internal control weakness?

> The Cash account of Guard Dog Security Systems reported a balance of $2,540 at December 31, 2018. There were outstanding checks totaling $400 and a December 31 deposit in transit of $100. The bank statement, which came from Park Cities Bank, listed the D

> Smythe Banners reported the following figures in its financial statements: Cash ……………………………………………………………………………..…………….. $ 26,500 Cash Equivalents ………………………………..………………………………………………5,000 Total Current Liabilities ………………………………………………………………….…30,000 Compute t

> Review your results from preparing Guard Dog Security System’s bank reconciliation in Short Exercise S7-9. Journalize the company’s transactions that arise from the bank reconciliation. Include an explanation with each entry.

> For each timing difference listed, identify whether the difference would be reported on the book side of the reconciliation or the bank side of the reconciliation. In addition, identify whether the difference would be an addition or subtraction. a. Depo

> Restaurants do a large volume of business by credit and debit cards. Suppose summer, Sand, and Castles Resort restaurant had these transactions on January 28, 2018: National Express credit card sales ………………………………………………………..$ 10,800 Value Card debit card

> What is the effect on cost of goods sold, gross profit, and net income if ending merchandise inventory is understated?

> Prepare the journal entries for the following petty cash transactions of Everly Gaming Supplies: Mar. 1 Established a petty cash fund with a $250 balance. 31 The petty cash fund has $24 in cash and $235 in petty cash tickets that were issued to pay

> Review the internal controls over cash receipts by mail presented in the chapter. Exactly what is accomplished by the final step in the process, performed by the controller?

> Sandra Kristof sells furniture for McKinney Furniture Company. Kristof is having financial problems and takes $650 that she received from a customer. She rang up the sale through the cash register. What will alert Megan McKinney, the controller, that som

> Internal controls are designed to safeguard assets, encourage employees to follow company policies, promote operational efficiency, and ensure accurate accounting records. Requirements: 1. Which objective do you think is most important? 2. Which objecti

> What are the steps taken to ensure control over purchases and payments by check?

> How do businesses control cash receipts by mail?

> How do businesses control cash receipts over the counter?

> What are some limitations of internal controls?