Question: Manning Company entered into these transactions

Manning Company entered into these transactions during May 2014, its first month of operations.

1. Stockholders invested $40,000 in the business in exchange for common stock of the company.

2. Purchased computers for office use for $30,000 from Dell on account.

3. Paid $4,000 cash for May rent on storage space.

4. Performed computer services worth $19,000 on account.

5. Performed computer services to Lawton Construction Company for $5,000 cash.

6. Paid Southern States Power Co. $8,000 cash for energy usage in May.

7. Paid Dell for the computers purchased in (2).

8. Incurred advertising expense for May of $1,300 on account.

9. Received $12,000 cash from customers for contracts billed in (4).

Instructions:

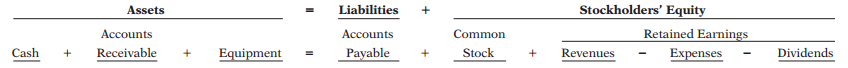

Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to Stockholders’ Equity in the right-hand margin.

Transcribed Image Text:

Assets Liabilities Stockholders' Equity Retained Earnings Expenses Accounts Accounts Common Cash + Receivable Equipment Payable Stock Revenues Dividends

> What would be the impact on Top-A1’s pro forma long-term debt if sales were to change to $200,000 and the age of payables were to change to 45 days?

> Identify the sources and uses of cash for Home Depot by comparing the 2011 and 2012 balance sheets.

> Smallco has cash from operating activities of $220 million, cash from investing activities of ($93 million), cash from financing activities of ($107 million), and a beginning cash balance of $27 million. What will Smallco’s ending cash balance be?

> Using Home Depot’s 2010 and 2011 balance sheets in Figure 3.2 and statements of earnings in Figure 3.3 in Chapter 3, set up the ratios presented in Figure 4.4 for Home Depot for 2010 and 2011, indicating the numerator and denominator of

> What would be the impact on Top-A1’s pro forma net earnings if sales were to change to $200,000?

> Star Inc. has year 1 revenues of $80 million, net income of $9 million, assets of $65 million, and equity of $40 million, as well as year 2 revenues of $87 million, net income of $22 million, assets of $70 million, and equity of $50 million. Calculate St

> The ledger of Columbia, Inc. on March 31, 2014, includes the following selected accounts before adjusting entries. An analysis of the accounts shows the following. 1. Insurance expires at the rate of $300 per month. 2. Supplies on hand total $900. 3. Th

> The accounting equation is Assets 5 Liabilities 1 Stockholders’ Equity. Appendix A, at the end of this textbook, reproduces Tootsie Roll’s financial statements. Replacing words in the equation with dollar amounts, what is Tootsie Roll’s accounting equati

> Selected transactions for Perez Company are presented below in journal form (without explanations). Post the transactions to T-accounts. Date Account Title Debit Credit May 5 Accounts Receivable 3,800 Service Revenue 3,800 12 Cash 1,600 Accounts Rece

> Joel Blocker recorded the following transactions during the month of April. Post these entries to the Cash account of the general ledger to determine the ending balance in cash. The beginning balance in cash on April 1 was $1,900. Apr. 3 Cash 3,400

> Foley Advertising Company’s trial balance at December 31 shows Supplies $8,800 and Supplies Expense $0. On December 31, there are $1,100 of supplies on hand. Prepare the adjusting entry at December 31 and, using T-accounts, enter the balances in the acco

> Use the data in BE3 and journalize the transactions. (You may omit explanations.) Data in BE-3: Transactions for Grover Company for the month of June are presented below. Identify the accounts to be debited and credited for each transaction. June 1 Iss

> Transactions for Grover Company for the month of June are presented below. Identify the accounts to be debited and credited for each transaction. June 1 Issues common stock to investors in exchange for $5,000 cash. 2 Buys equipment on account for $1,100

> During 2014, Comstock Company entered into the following transactions. 1. Purchased equipment for $286,176 cash. 2. Issued common stock to investors for $137,590 cash. 3. Purchased inventory of $68,480 on account. Using the following tabular analysis, sh

> Kathy Gannon is the new owner of Kathy’s Computer Services. At the end of July 2014, her first month of ownership, Kathy is trying to prepare monthly financial statements. She has the following information for the month. 1. At July 31, Kathy owed employe

> After closing revenues and expense, Alomar Company shows the following account balances. Dividends ………………………………………………………. $22,000 Retained Earnings ……………………………………………70,000 Income Summary ……………………36,000 (credit balance) Prepare the remaining closing entri

> At the beginning of the year, Goren Company had total assets of $800,000 and total liabilities of $500,000. (Treat each item independently.) (a) If total assets increased $150,000 during the year and total liabilities decreased $80,000, what is the amoun

> Use the basic accounting equation to answer these questions. (a) The liabilities of Jantz Company are $90,000 and the stockholders’ equity is $230,000. What is the amount of Jantz Company’s total assets? (b) The total assets of Foley Company are $170,000

> Transactions made by Huddleston Co. for the month of March are shown below. Prepare a tabular analysis that shows the effects of these transactions on the expanded accounting equation, similar to that shown in Illustration 3-3 (page 110). 1. The company

> The financial statements of Tootsie Roll are presented in Appendix A at the end of this textbook. Instructions: (a) Using the consolidated income statement and balance sheet, identify items that may result in adjusting entries for deferrals. (b) Using t

> Purpose: This activity provides information about career opportunities for CPAs. Address: www.startheregoplaces.com/why-accounting, or go to www.wiley.com/college/kimmel Steps 1. Go to the address shown above and click on Students/Educators. 2. Click on

> The financial statements of The Hershey Company appear in Appendix B, following the financial statements for Tootsie Roll in Appendix A. (b) Identify the other account ordinarily involved when: (1) Accounts Receivable is increased. (2) Notes Payable is

> The financial statements of Tootsie Roll in Appendix A at the back of this textbook contain the following selected accounts, all in thousands of dollars. Common Stock ………………………………………………………………$ 25,040 Accounts Payable ………………………………………………………………. 9,791 Accou

> The financial statements of The Hershey Company appear in Appendix B, following the financial statements for Tootsie Roll in Appendix A. Assume Hershey’s average number of shares outstanding was 227,514,000, and Tootsie Roll’s was 56,997,000. Instructio

> The financial statements of Tootsie Roll Industries, Inc., appear in Appendix A at the end of this textbook. Instructions: Answer the following questions using the financial statements and the notes to the financial statements. (a) What were Tootsie Rol

> The following information was reported by Gap, Inc. in its 2010 annual report. (a) Determine the overall percentage decrease in Gap’s total assets from 2006 to 2010. What was the average decrease per year? (b) Comment on the change in

> Tootsie Roll’s financial statements are presented in Appendix A. The financial statements of The Hershey Company are presented in Appendix B. Instructions: (a) Based on the information in these financial statements, determine the following for each comp

> The 2011 financial statements of Tootsie Roll Industries, Inc. are provided in Appendix A. Instructions: Refer to Tootsie Roll’s financial statements to answer the following questions. (a) What were Tootsie Roll’s total assets at December 31, 2011? At D

> The ledger of Beckett Rental Agency on March 31 of the current year includes the selected accounts below before adjusting entries have been prepared. An analysis of the accounts shows the following. 1. The equipment depreciates $280 per month. 2. Half o

> From the ledger balances below, prepare a trial balance for Yeager Company at June 30, 2014. All account balances are normal. Accounts Payable Cash $ 1,000 $8,600 3,000 4,000 1,000 Service Revenue Accounts Receivable 5,400 18,000 1,200 13,000 Salarie

> Kwun Company accumulates the following adjustment data at December 31. (a) Services performed but unbilled totals $600. (b) Store supplies of $160 are on hand. The supplies account shows a $1,900 balance. (c) Utility expenses of $275 are unpaid. (d) Serv

> VidGam, a consulting firm, has just completed its first year of operations. The company’s sales growth was explosive. To encourage clients to hire its services, VidGam offered 180-day financing—meaning its largest customers do not pay for nearly 6 months

> Kaffen Company, a ski tuning and repair shop, opened on November 1, 2013. The company carefully kept track of all its cash receipts and cash payments. The following information is available at the end of the ski season, April 30, 2014. The repair shop e

> In its first year of operations, Ramirez Company recognized $28,000 in service revenue, $6,000 of which was on account and still outstanding at year-end. The remaining $22,000 was received in cash from customers. The company incurred operating expenses o

> Your examination of the records of a company that follows the cash basis of accounting tells you that the company’s reported cash-basis earnings in 2014 are $33,640. If this firm had followed accrual-basis accounting practices, it would

> The adjusted trial balance for Bere Company is given in E4-16. Data given in E4-16: The trial balances shown below are before and after adjustment for Bere Company at the end of its fiscal year. Instructions: Prepare the closing entries for the tempora

> The adjusted trial balance for Bere Company is given in E4-16. Data given in E4-16: The trial balances shown below are before and after adjustment for Bere Company at the end of its fiscal year. Instructions: Prepare the income and retained earnings st

> Selected accounts of Castle Company are shown here. Instructions: After analyzing the accounts, journalize (a) the July transactions and (b) the adjusting entries that were made on July 31. (Hint: July transactions were for cash.) Supplies Expense

> A partial adjusted trial balance for Barone Company is given in E4-13. Data given in Exercise 10: This is a partial adjusted trial balance of Barone Company. Instructions: Prepare the closing entries at January 31, 2014. BARONE COMPANY Adjusted Tri

> This is a partial adjusted trial balance of Barone Company. Instructions: Answer these questions, assuming the year begins January 1. (a) If the amount in Supplies Expense is the January 31 adjusting entry, and $300 of supplies was purchased in January,

> The adjusted trial balance of Ravine Corporation at December 31, 2014, includes the following accounts: Retained Earnings $17,200; Dividends $6,000; Service Revenue $32,000; Salaries and Wages Expense $14,000; Insurance Expense $1,800; Rent Expense $3,90

> The following independent situations require professional judgment for determining when to recognize revenue from the transactions. (a) Southwest Airlines sells you an advance-purchase airline ticket in September for your flight home at Christmas. (b) Ul

> The May transactions of Hanschu Corporation were as follows. May 4 Paid $700 due for supplies previously purchased on account. 7 Performed advisory services on account for $6,800. 8 Purchased supplies for $850 on account. 9 Purchased equipment fo

> Transaction data for Crofoot Real Estate Agency are presented in E7. Data given in E-7: This information relates to Crofoot Real Estate Agency. Oct. 1 Stockholders invest $30,000 in exchange for common stock of the corporation. 2 Hires an administra

> This information relates to Crofoot Real Estate Agency. Oct. 1 Stockholders invest $30,000 in exchange for common stock of the corporation. 2 Hires an administrative assistant at an annual salary of $36,000. 3 Buys office furniture for $3,800, on a

> Selected transactions for Home Place, an interior decorator corporation, in its first month of business, are as follows. 1. Issued stock to investors for $15,000 in cash. 2. Purchased used car for $10,000 cash for use in business. 3. Purchased supplies o

> The tabular analysis of transactions for Colaw Company is presented in E4. Data given in E4: A tabular analysis of the transactions made during August 2014 by Colaw Company during its first month of operations is shown below. Each increase and decrease

> A tabular analysis of the transactions made during August 2014 by Colaw Company during its first month of operations is shown below. Each increase and decrease in stockholders’ equity is explained. Instructions (a) Describe each trans

> During 2014, its first year of operations as a delivery service, Persinger Corp. entered into the following transactions. 1. Issued shares of common stock to investors in exchange for $100,000 in cash. 2. Borrowed $45,000 by issuing bonds. 3. Purchased d

> The accounts in the ledger of Bastin Delivery Service contain the following balances on July 31, 2014. Instructions: (a) Prepare a trial balance with the accounts arranged as illustrated in the chapter, and fill in the missing amount for Cash. (b) Prepa

> The trial balance of Goodwin Company includes the following balance sheet accounts. Identify the accounts that might require adjustment. For each account that requires adjustment, indicate (1) the type of adjusting entry (prepaid expenses, unearned reve

> The bookkeeper for Willingham Corporation made these errors in journalizing and posting. 1. A credit posting of $400 to Accounts Receivable was omitted. 2. A debit posting of $750 for Prepaid Insurance was debited to Insurance Expense. 3. A collection on

> Selected transactions from the journal of Eberle Inc. during its first month of operations are presented here. Instructions: (a) Post the transactions to T-accounts. (b) Prepare a trial balance at August 31, 2014. Date Account Titles Debit Credit Au

> The T-accounts below summarize the ledger of Wheeling Gardening Company, Inc. at the end of the first month of operations. Instructions: (a) Prepare the journal entries (including explanations) that resulted in the amounts posted to the accounts. Presen

> Transaction data and journal entries for Crofoot Real Estate Agency are presented in E3-7 and E3-8. Data given in E-7: This information relates to Crofoot Real Estate Agency. Oct. 1 Stockholders invest $30,000 in exchange for common stock of the corpo

> Selected transactions for Warner Advertising Company, Inc., are listed here. 1. Issued common stock to investors in exchange for cash received from investors. 2. Paid monthly rent. 3. Received cash from customers when service was performed. 4. Billed cus

> Suppose the following data were taken from the 2014 and 2013 financial statements of American Eagle Outfitters. (All dollars are in thousands.) Instructions: Perform each of the following. (a) Calculate the current ratio for each year. (b) Calculate ear

> The chief financial officer (CFO) of Grienke Corporation requested that the accounting department prepare a preliminary balance sheet on December 30, 2014, so that the CFO could get an idea of how the company stood. He knows that certain debt agreements

> These financial statement items are for Barfield Corporation at year-end, July 31, 2014. Salaries and wages payable ………………………………. $ 2,080 Salaries and wages expense ………………………………. 57,500 Supplies expense ………………………………………………..15,600 Equipment …………………………………

> These items are taken from the financial statements of Donavan Co. at December 31, 2014. Buildings …………………………………………………. $105,800 Accounts receivable ………………………………………12,600 Prepaid insurance …………………………………………. 3,200 Cash ……………………………………………………………. 11,840 Equi

> Suppose the following items were taken from the December 31, 2014, assets section of the Boeing Company balance sheet. (All dollars are in millions.) Instructions: Prepare the assets section of a classified balance sheet, listing the current assets in o

> Upton Corporation has the following transactions during August of the current year. Indicate (a) the basic analysis and (b) the debit–credit. Aug. 1 Issues shares of common stock to investors in exchange for $10,000. 4 Pays insurance in advance for 3

> The major balance sheet classifications are listed in E2-1. Data given in E2-1: The following are the major balance sheet classifications. Current assets (CA) Current liabilities (CL) Long-term investments (LTI) Long-term liabilities (LTL)

> The summaries of data from the balance sheet, income statement, and retained earnings statement for two corporations, Colaw Corporation and Hunter Enterprises, are presented on the next page for 2014. Instructions: Determine the missing amounts. Assume

> Edward Waltz is the bookkeeper for Edminson Company. Edward has been trying to get the balance sheet of Edminson Company to balance. It finally balanced, but now he’s not sure it is correct. Instructions: Prepare a correct balance shee

> Suppose the following data are derived from the 2014 financial statements of Southwest Airlines. (All dollars are in millions.) Southwest has a December 31 year-end. Cash balance, January 1, 2014 …………………………………………$1,390 Cash paid for repayment of debt ………

> This information is for Dyckman Corporation for the year ended December 31, 2014. Cash received from lenders ………………………………. $20,000 Cash received from customers ……………………………. 50,000 Cash paid for new equipment ………………………………28,000 Cash dividends paid …………………

> Kellogg Company is the world’s leading producer of ready-to-eat cereal and a leading producer of grain-based convenience foods such as frozen waffles and cereal bars. Suppose the following items were taken from its 2014 income statement

> Flint Hills Park is a private camping ground near the Lathom Peak Recreation Area. It has compiled the following financial information as of December 31, 2014. Instructions: (a) Determine Flint Hills Park’s net income for 2014. (b) Pr

> Here are incomplete financial statements for Riedy, Inc. Income Statement Revenues $...........................................................85,000 Cost of goods sold …………

> The following items and amounts were taken from Motte Inc.’s 2014 income statement and balance sheet. Instructions: (a) In each, case, identify on the blank line whether the item is an asset (A), liability (L), stockholderâ€

> Presented here is information for DeVito Inc. for 2014. Retained earnings, January 1 ………………………………..$130,000 Service revenue ……………………………………………………400,000 Total expenses ……………………………………………………. 175,000 Dividends ……………………………………………………………. 65,000 Instructions:

> Rachelle Mohling, a fellow student, is unclear about the basic steps in the recording process. Identify and briefly explain the steps in the order in which they occur.

> Suppose the following information was taken from the 2014 financial statements of pharmaceutical giant Merck and Co. (All dollar amounts are in millions.) Retained earnings, January 1, 2014 ……………………………$43,698.8 Cost of goods sold ………………………………………………………. 9

> This information relates to Molina Co. for the year 2014. Retained earnings, January 1, 2014 …………………………………$67,000 Advertising expense …………………………………………………………..1,800 Dividends ………………………………………………………………………..6,000 Rent expense …………………………………………………………………10,400

> The Clear View Golf & Country Club details the following accounts in its financial statements. Instructions: (a) Classify each of the above accounts as an asset (A), liability (L), stockholders’ equity (SE), revenue (R), or expens

> The income statement of Garska Co. for the month of July shows net income of $2,000 based on Service Revenue $5,500; Salaries and Wages Expense $2,100; Supplies Expense $900; and Utilities Expense $500. In reviewing the statement, you discover the follow

> Jim Haught, D.D.S., opened an incorporated dental practice on January 1, 2014. During the first month of operations, the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31, $760 of such servic

> The following information is available for Benser Corporation. a. Compute earnings per share for 2014 and 2013 for Benser, and comment on the change. Benser’s primary competitor, Matile Corporation, had earnings per share of $1 per sha

> The following financial statement items were taken from the financial statements of Zheng Corp. ____ Trademarks ____ Inventory ____ Notes payable (current) ____ Accumulated depreciation ____ Interest revenue

> Marsh Corporation began operations on January 1, 2014. The following information is available for Marsh Corporation on December 31, 2014. Prepare an income statement, a retained earnings statement, and a balance sheet for Marsh Corporation. $ 5,000

> Classify each item as an asset, liability, common stock, revenue, or expense. (a) Issuance of ownership shares. (b) Land purchased. (c) Amounts owed to suppliers. (d) Bonds payable. (e) Amount earned from selling a product. (f) Cost of advertising.

> Lonyear Corporation has collected the following information related to its December 31, 2014, balance sheet. Prepare the assets section of Lonyear Corporation’s balance sheet. Accounts receivable Accumulated depreciation-equipment

> At the end of its first year, the trial balance of Boyer Company shows Equipment $22,000 and zero balances in Accumulated Depreciation—Equipment and Depreciation Expense. Depreciation for the year is estimated to be $2,750. Prepare the adjusting entry fo

> Joel Blocker engaged in the following activities in establishing his photography studio, Picture This!: 1. Opened a bank account in the name of Picture This! and deposited $8,000 of his own money into this account in exchange for common stock. 2. Purchas

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ascLogin.cfm to log in and prepare responses to the following. Instructions: Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition o

> Eaton Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Eaton’s chemical pesticides. During the coming year, Eaton will have environmentally safe and competitive

> Lincoln Park was organized on April 1, 2013, by Judy Tercek. Judy is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Judy prepared the following income statement for the quarter that ended March 31, 2014.

> Jennifer VanPelt is the assistant chief accountant at BIT Company, a manufacturer of computer chips and cellular phones. The company presently has total sales of $20 million. It is the end of the first quarter and Jennifer is hurriedly trying to prepare

> Clean Sweep Company offers home cleaning service. Two recurring transactions for the company are billing customers for services performed and paying employee salaries. For example, on March 15 bills totaling $6,000 were sent to customers, and $2,000 was

> Sally Saia operates Double S Riding Academy, Inc. The academy’s primary sources of revenue are riding fees and lesson fees, which are provided on a cash basis. Sally also boards horses for owners, who are billed monthly for boarding fee

> If your school has a subscription to the FASB Codification, go to http://aaahq.org/ ascLogin.cfm to log in and prepare responses to the following. Instructions: (a) Access the glossary (“Master Glossary”) at the FASB Codification website to answer the f

> F. P. Fernetti is the chief executive officer of Tomorrow’s Products. Fernetti is an expert engineer but a novice in accounting. Instructions: Write a letter to F. P. Fernetti that explains (a) the three main types of ratios; (b) examples of each, how

> The ledger of Berkman Company includes the following accounts. Explain why each account may require adjustment. (a) Prepaid Insurance. (b) Depreciation Expense. (c) Unearned Service Revenue. (d) Interest Payable.

> This chapter’s Feature Story discusses the fact that although Clif Bar & Company is not a public company, it does share its financial information with its employees as part of its openbook management approach. Further, although it does not publicly share

> As a financial analyst in the planning department for Shonrock Industries, Inc., you have been requested to develop some key ratios from the comparative financial statements. This information is to be used to convince creditors that Shonrock Industries,

> Lori Milner is the bookkeeper for Philco Company, Inc. Lori has been trying to get the company’s balance sheet to balance. She finally got it to balance, but she still isn’t sure that it is correct. Instructions: Expl

> Sue Hartley recently accepted a job in the production department at Tootsie Roll. Before she starts work, she decides to review the company’s annual report to better understand its operations. Instructions: Use the annual report provided in Appendix A t

> Cookie Creations is gearing up for the winter holiday season. During the month of December 2014, the following transactions occur. Dec. 1 Natalie hires an assistant at an hourly wage of $8 to help with cookie making and some administrative duties. 5

> In November 2014, after having incorporated Cookie Creations Inc., Natalie begins operations. She has decided not to pursue the offer to supply cookies to Biscuits. Instead, she will focus on offering cooking classes. The following events occur. Nov. 8