Question: Maple Products, Ltd., manufactures a super-strong

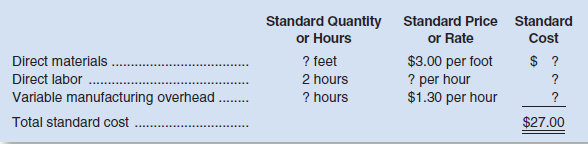

Maple Products, Ltd., manufactures a super-strong hockey stick. The standard cost of one hockey stick is:

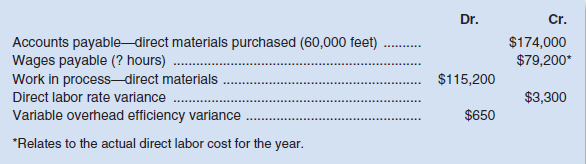

Last year, 8,000 hockey sticks were produced and sold. Selected cost data relating to last year’s operations follow:

The following additional information is available for last year’s operations:

a. No materials were on hand at the start of last year. Some of the materials purchased during the year were still on hand in the warehouse at the end of the year.

b. The variable manufacturing overhead rate is based on direct labor-hours. Total actual variable manufacturing overhead cost for last year was $19,800.

c. Actual direct materials usage for last year exceeded the standard by 0.2 feet per stick.

Required:

1. For direct materials:

a. Compute the price and quantity variances for last year.

b. Prepare journal entries to record all activities relating to direct materials for last year.

2. For direct labor:

a. Using the rate variance given on the prior page, calculate the standard hourly wage rate and compute the efficiency variance for last year.

b. Prepare a journal entry to record activity relating to direct labor for last year.

3. Compute the variable overhead rate variance for last year and verify the variable overhead efficiency variance given on the prior page.

4. State possible causes of each variance that you have computed.

5. Prepare a standard cost card for one hockey stick.

Transcribed Image Text:

Standard Quantity Standard Price Standard or Rate or Hours Cost $ ? $3.00 per foot ? per hour $1.30 per hour Direct materials ? feet Direct labor 2 hours ? Variable manufacturing overhead ? hours Total standard cost $27.00 Dr. Cr. Accounts payable direct materials purchased (60,000 feet) Wages payable (? hours) . Work in process-direct materials Direct labor rate variance Variable overhead efficiency variance $174,000 $79,200* $115,200 $3,300 $650 *Relates to the actual direct labor cost for the year.

> What is the difference between a contribution approach income statement and a traditional approach income statement?

> Lost Peak ski resort was for many years a small, family-owned resort serving day skiers from nearby towns. Lost Peak was recently acquired by Western Resorts, a major ski resort operator. The new owners have plans to upgrade the resort into a destination

> The contribution format income statement for Huerra Company for last year is given below: The company had average operating assets of $2,000,000 during the year. Required: 1. Compute the company’s return on investment (ROI) for the p

> Financial data for Joel de Paris, Inc., for last year follow: The company paid dividends of $15,000 last year. The “Investment in Buisson, S.A.” on the balance sheet represents an investment in the stock of another

> Comparative data on three companies in the same service industry are given below: Required: 1. What advantages are there to breaking down the ROI computation into two separate elements, margin and turnover? 2. Fill in the missing information above, and

> “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make any move. Our division’s return on investment (ROI) has led the company fo

> Posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $3,00

> Wingate Company, a wholesale distributor of videotapes, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement, which follows: Sales ..........................................................

> Raner, Harris, & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices—one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jo

> A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: Company A B C $9,000,000 $ ? $3,000,000 $7,000,000 $ 280,000 $ 14

> Ariel Tax Services prepares tax returns for individual and corporate clients. As the company has gradually expanded to 10 offices, the founder Max Jacobs has begun to feel as though he is losing control of operations. In response to this concern, he has

> Refer to the data in Exercise 10–13. Assume that Minneapolis’ sales by major market are: The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. T

> CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales .................................................................................. $3,000,000 Net operati

> Pecs Alley is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The Springfield Club reported the following results for the past year:

> Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Com

> Provide the missing data in the following table for a distributor of martial arts products: Divislon Alpha Bravo Charlie $ ? $ ? $800,000 $11,500,000 $ 920,000 $ $ ? $210,000 $ ? Sales.. Net operating income Average operating assets. Margin... ? 4%

> Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below (the currency is the Australian dollar, denoted here as $): Required: 1. Compute the rate of return for each division using the return on investment (ROI)

> Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow (in millions of yen, denoted by ¥): Required: 1. For each division, compute the return on investment (R

> Juniper Design Ltd. of Manchester, England, is a company specializing in providing design services to residential developers. Last year the company had net operating income of £600,000 on sales of £3,000,000. The company’s average operating assets for th

> Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Sales .....................................................

> Royal Lawncare Company produces and sells two packaged products, Weedban and Greengrow. Revenue and cost information relating to the products follow: Common fixed expenses in the company total $33,000 annually. Last year the company produced and sold 1

> ColdKing Company is a small producer of fruit-flavored frozen desserts. For many years, ColdKing’s products have had strong regional sales on the basis of brand recognition; however, other companies have begun marketing similar products in the area, and

> What is a plantwide overhead rate? Why are multiple overhead rates, rather than a plantwide overhead rate, used in some companies?

> Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given on the following page: Overhead is applied to production on the basis of direct labor-hours. During

> Sharp Company manufactures a product for which the following standards have been set: During March, the company purchased direct materials at a cost of $55,650, all of which were used in the production of 3,200 units of product. In addition, 4,900 hour

> Danson Company is a chemical manufacturer that supplies various products to industrial users. The company plans to introduce a new chemical solution, called Nysap, for which it needs to develop a standard product cost. The following information is availa

> John Fleming, chief administrator for Valley View Hospital, is concerned about the costs for tests in the hospital’s lab. Charges for lab tests are consistently higher at Valley View than at other hospitals and have resulted in many complaints. Also, bec

> Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The plant has been experiencing problems as shown by its June contribution format income statement below: Janet Dunn, who has just been appointed general manager of the West

> Define the following terms: (a) Cost behavior and (b) Relevant range.

> If a company fully allocates all of its overhead costs to jobs, does this guarantee that a profit will be earned for the period?

> What factors should be considered in selecting a base to be used in computing the predetermined overhead rate?

> Why do companies use predetermined overhead rates rather than actual manufacturing overhead costs to apply overhead to jobs?

> Explain why some production costs must be assigned to products through an allocation process.

> Explain how a sales order, a production order, a materials requisition form, and a labor time ticket are involved in producing and costing products.

> Mason Paper Company (MPC) manufactures commodity grade papers for use in computer printers and photocopiers. MPC has reported net operating losses for the last two years due to intense price pressure from much larger competitors. The MPC management team—

> Becton Labs, Inc., produces various chemical compounds for industrial use. One compound, called Fludex, is prepared using an elaborate distilling process. The company has developed standard costs for one unit of Fludex, as follows: During November, the

> What is a predetermined overhead rate, and how is it computed?

> What is the purpose of the job cost sheet in a job-order costing system?

> What effect does an increase in volume have on— a. Unit fixed costs? b. Unit variable costs? c. Total fixed costs? d. Total variable costs?

> How do the performance measurement and compensation systems of service companies compare with those of manufacturers? Ask the manager of your local McDonald’s, Wendy’s, Burger King, or other fast-food chain if he or she could spend some time discussing t

> Distinguish between (a) A variable cost, (b) A fixed cost, and (c) A mixed cost.

> In what way can the use of ROI as a performance measure for investment centers lead to bad decisions? How does the residual income approach overcome this problem?

> How is it possible for a cost that is traceable to a segment to become a common cost if the segment is divided into further segments?

> Why aren’t common costs allocated to segments under the contribution approach?

> Explain how the segment margin differs from the contribution margin.

> Distinguish between a traceable cost and a common cost. Give several examples of each.

> The auto repair shop of Quality Motor Company uses standards to control the labor time and labor cost in the shop. The standard labor cost for a motor tune-up is given below: The record showing the time spent in the shop last week on motor tune-ups has

> What benefits result from decentralization?

> Why does the balanced scorecard include financial performance measures as well as measures of how well internal business processes are doing?

> Trueform Products, Inc., produces a broad line of sports equipment and uses a standard cost system for control purposes. Last year the company produced 8,000 varsity footballs. The standard costs associated with this football, along with the actual costs

> Genola Fashions began production of a new product on June 1. The company uses a standard cost system and has established the following standards for one unit of the new product: During June, the following activity was recorded regarding the new product

> Bliny Corporation makes a product with the following standard costs for direct material and direct labor: Direct material: 2.00 meters at $3.25 per meter ..................... $6.50 Direct labor: 0.40 hours at $12.00 per hour ...........................

> Lane Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. Variable manufacturing overhead should be $2 per standard direct labor-hour and fixed manufacturing

> Chilczuk, S.A., of Gdansk, Poland, is a major producer of classic Polish sausage. The company uses a standard cost system to help control costs. Manufacturing overhead is applied to production on the basis of standard direct labor-hours. According to the

> “Wonderful! Not only did our salespeople do a good job in meeting the sales budget this year, but our production people did a good job in controlling costs as well,” said Kim Clark, president of Martell Company. “Our $18,300 overall manufacturing cost va

> Flandro Company uses a standard cost system and sets predetermined overhead rates on the basis of direct labor-hours. The following data are taken from the company’s budget for the current year: Denominator activity (direct labor-hours) ................

> Erie Company manufactures a small CD player called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate CD player are as follows: During August, 5,750 hours of direct labor time

> Selected information relating to Yost Company’s operations for the most recent year is given below: Activity: Denominator activity (machine-hours) ............ 45,000 Standard hours allowed per unit …………….................. 3 Number of units produced ....

> The standard cost card for the single product manufactured by Cutter, Inc., is given below: Standard Cost Card—per Unit Direct materials, 3 yards at $6.00 per yard .......................................... $ 18 Direct labor, 4 hours a

> Selected operating information on three different companies for a recent year is given below: Required: For each company, state whether the company would have a favorable or unfavorable volume variance and why. Company A B Full-capacity machine-hou

> Norwall Company’s variable manufacturing overhead should be $3.00 per standard machine-hour and its fixed manufacturing overhead should be $300,000 per period. The following information is available for a recent period: a. The denominator activity of 60,

> Operating at a normal level of 30,000 direct labor-hours, Lasser Company produces 10,000 units of product each period. The direct labor wage rate is $12 per hour. Two and one-half yards of direct materials go into each unit of product; the material costs

> Primara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhea

> Privack Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Variable overhead cost per d

> Only variable costs can be differential costs. Do you agree? Explain.

> Why can undue emphasis on labor efficiency variances lead to excess work in process inventories?

> Why do the measures used in a balanced scorecard differ from company to company?

> Refer to the data in Exercise 9–7. Assume that instead of producing 4,000 units during the month, the company produced only 3,000 units, using 14,750 pounds of material. (The rest of the material purchased remained in raw materials inve

> Define the following terms: differential cost, opportunity cost, and sunk cost.

> What is a statistical control chart, and how is it used?

> “The variable cost per unit varies with output, whereas the fixed cost per unit is constant.” Do you agree? Explain.

> If variable manufacturing overhead is applied to production on the basis of direct labor-hours and the direct labor efficiency variance is unfavorable, will the variable overhead efficiency variance be favorable or unfavorable, or could it be either? Exp

> What is meant by residual income?

> Is it possible for costs such as salaries or depreciation to end up as assets on the balance sheet? Explain.

> What is meant by the terms margin and turnover in ROI calculations?

> What effect, if any, would you expect poor-quality materials to have on direct labor variances?

> Why are product costs sometimes called inventoriable costs? Describe the flow of such costs in a manufacturing company from the point of incurrence until they finally become expenses on the income statement

> Lucido Products markets two computer games: Claim jumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Required: 1. Compute the overall contribution margin (CM) ratio for the company. 2. Comput

> Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: During the most recent month, the following activity was recorded: a. Twenty thousand pounds of m

> Distinguish between (a) A variable cost, (b) A mixed cost, and (c) A step-variable cost. Plot the three costs on a graph, with activity plotted horizontally and cost plotted vertically.

> “Our workers are all under labor contracts; therefore, our labor rate variance is bound to be zero.” Discuss.

> Engberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Required: 1. Compute the company’s degree of operating leverage. 2. Using the degree of

> Describe how the inventory accounts of a manufacturing company differ from the inventory account of a merchandising company.

> Explain how a shift in the sales mix could result in both a higher break-even point and a lower net income.

> Should standards be used to identify whom to blame for problems?

> Describe the schedule of cost of goods manufactured. How does it tie into the income statement?

> Watkins Trophies, Inc., produces thousands of medallions made of bronze, silver, and gold. The medallions are identical except for the materials used in their manufacture. What costing system would you advise the company to use?

> What is meant by the term sales mix? What assumption is usually made concerning sales mix in CVP analysis?

> Olongapo Sports Corporation is the distributor in the Philippines of two premium golf balls—the Flight Dynamic and the Sure Shot. Monthly sales, expressed in pesos (P), and the contribution margin ratios for the two products follow: F

> Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price ..................................................... $30 per unit Variable expenses ......................

> Dawson Toys, Ltd., produces a toy called the Maze. The company has recently established a standard cost system to help control costs and has established the following standards for the Maze toy: Direct materials: 6 microns per toy at $0.50 per micron Dir

> What are the major limitations of activity-based costing?

> If the materials price variance is favorable but the materials quantity variance is unfavorable, what might this indicate?

> Describe how the income statement of a manufacturing company differs from the income statement of a merchandising company.

> What is meant by the term equivalent units of production when the weighted-average method is used?

> What is meant by the margin of safety?

> The Hartford Symphony Guild is planning its annual dinner-dance. The dinner-dance committee has assembled the following expected costs for the event: Dinner (per person) ............................................................... $18 Favors and prog

> Mauro Products distributes a single product, a woven basket whose selling price is $15 and whose variable expense is $12 per unit. The company’s monthly fixed expense is $4,200. Required: 1. Solve for the company’s break-even point in unit sales using t

> What are the three major ways in which activity-based costing improves the accuracy of product costs?

> The materials price variance can be computed at what two different points in time? Which point is better? Why?