Question: Marjorie Jorgenson, CPA, is verifying the accuracy

Marjorie Jorgenson, CPA, is verifying the accuracy of outstanding accounts payable for Marygold Hardware, a large, single-location retail hardware store.

There are 650 vendors listed on the outstanding accounts payable list. She has eliminated from the population 40 vendors that have large ending balances and will audit them separately. There are now 610 vendors.

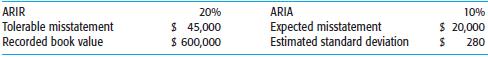

She plans to do one of three tests for each item in the sample: examine a vendor's statement in the client's hands, obtain a confirmation when no statement is on hand, or extensively search for invoices when neither of the first two is obtained. There is no accounts payable master file available, and a large number of misstatements are expected. Marjorie has obtained facts or made audit judgments as follows:

Required

a. Under what circumstances is it desirable to use difference estimation in the situation described? Under what circumstances is it undesirable?

b. Calculate the required sample size for the audit tests of accounts payable using difference estimation, assuming that ARIR is ignored.

c. Assume that the auditor selects exactly the sample size calculated in part b. The point estimate calculated from the sample results is $21,000 and the estimated population standard deviation is 267. Is the population fairly stated as defined by the decision rule? Explain what causes the result to be acceptable or unacceptable.

d. Calculate the required sample size for the audit tests of accounts payable, assuming that the ARIR is considered.

e. Explain the reason for the large increase of the sample size resulting from including ARIR in determining sample size.

Transcribed Image Text:

ARIR Tolerable misstatement 20% ARIA 10% $ 45,000 $ 600,000 Expected misstatement Estimated standard deviation $ 20,000 Recorded book value 280

> One of the firm's audit partners, Alice Goodwin, just had lunch with a good friend, Sara Hitchcock, who is president of Granger Container Corporation. Granger Container Corp. is a fast-growing company that has been in business for only a few years. Durin

> A CPA’s client, Boos & Baumkirchner, Inc., is a medium-size manufacturer of products for the leisure-time activities market (camping equipment, scuba gear, bows and arrows, and so forth). During the past year, a computer system was installed and inventor

> You are conducting an audit of sales for the James Department Store, a retail chain store with a computer-based sales system in which computer-based cash registers are integrated directly with accounts receivable, sales, perpetual inventory records, and

> During your audit of Wilcoxon Sports, Inc., a retail chain of stores, you learn that a programmer made an unauthorized change to the sales application program even though no work on that application had been approved by IT management. In order for the sa

> The following are various potential frauds in the sales and collection cycle: 1. The company engaged in channel stuffing by shipping goods to customers that had not been ordered. 2. The allowance for doubtful accounts was understated because the company

> The Meyers Pharmaceutical Company has the following system for billing and recording accounts receivable: 1. An incoming customer's purchase order is received in the order department by a clerk who prepares a prenumbered company sales order on which the

> You go through the drive-through window of a fast food restaurant and notice a sign that reads "your meal is free if we fail to give you a receipt." Why would the restaurant post this sign?

> You are doing the audit of Phelps College, a private school with approximately 2,500 students. With your firm's consultation, they have instituted an IT system that separates the responsibilities of the computer operator, systems analyst, librarian, prog

> The following are misstatements that can occur in the sales and collection cycle: 1. A customer number on a sales invoice was transposed and, as a result, charged to the wrong customer. By the time the error was found, the original customer was no longer

> The following questions concern auditing complex IT systems. Choose the best response. a. Which of the following client IT systems generally can be audited without examining or directly testing the computer programs of the system? (1) A system that perf

> The following questions concern the characteristics of IT systems. Choose the best response. a. Effective management of information technologies in an organization embraces the viewpoint that (1) Most technologies reduce existing risk conditions. (2) Te

> During audit planning, an auditor obtained the following information: 1. Management has a strong interest in employing inappropriate means to minimize reported earnings for tax-motivated reasons. 2. The company's board of directors includes a majority of

> Your client has outsourced the majority of the accounting information system to a third-party data center. What impact would that have on your audit of the financial statements?

> Describe risks that are associated with purchasing software to be installed on desktop computer hard drives. What precautions can clients take to reduce those risks?

> Explain what is meant by the test data approach. What are the major difficulties with using this approach? Define parallel simulation with audit software and provide an example of how it can be used to test a client's payroll system.

> The following are activities that occurred at Franklin Manufacturing, a nonpublic company. 1. Franklin's accountant did not record checks written in the last few days of the year until the next accounting period to avoid a negative cash balance in the fi

> Explain what is meant by auditing around the computer and describe what must be present for this approach to be effective when auditing clients who use IT to process accounting information.

> Explain the relationship between application controls and transaction-related audit objectives.

> Explain how the effectiveness of general controls affects the auditor's tests of automated application controls, including the auditor's ability to rely on tests done in prior audits.

> An audit client is in the process of creating an online Web-based sales ordering system for customers to purchase products using personal credit cards for payment. Identify three risks related to an online sales system that management should consider. Fo

> Identify the typical duties within an IT function and describe how those duties should be segregated among IT personnel.

> Distinguish between general controls and application controls and give two examples of each.

> Identify the traditionally segregated duties in noncomplex IT systems and explain how increases in the complexity of the IT function affect that separation.

> The following questions address fraud risks in specific audit areas and accounts. a. Cash receipts from sales on account have been misappropriated. Which of the following acts will conceal this embezzlement and be least likely to be detected by the audit

> Distinguish between random error resulting from manual processing and systematic error resulting from IT processing and give an example of each category of error.

> Define what is meant by an audit trail and explain how it can be affected by the client's integration of IT.

> Compare the risks associated with network systems to those associated with centralized IT functions.

> The sampling data sheet below is missing selected information for six attributes involving tests of transactions for the sales and collection cycle. a. Use Table 15-8and Table 15-9 to complete the missing information for each attribute. Table 15-8 Table

> For the audit of the financial statements of Mercury Fifo Company, Stella Mason, CPA, has decided to apply nonstatistical audit sampling in the tests of controls and substantive tests of transactions for sales transactions. Based on her knowledge of Merc

> Describe systematic sample selection and explain how an auditor will select 40 numbers from a population of 2,800 items using this approach. What are the advantages and disadvantages of systematic sample selection?

> The questions below relate to determining the CUER in audit sampling for tests of controls, using the following table: Required a. Calculate SER for each of columns 1 through 4 and use this to calculate the actual allowance for sampling risk. b. Explai

> The following are auditor judgments and attributes sampling results for six populations. Assume large population sizes. Required a. For each population, did the auditor select a smaller sample size than is indicated by using the attributes sampling table

> The questions below relate to determining the CUER in audit sampling for tests of controls, using the following table: Required a. Using nonstatistical sampling, calculate TER – SER for each of columns 1 through 8 and evaluate whether

> The following questions concern the determination of the proper sample size in audit sampling using the following table: Required a. Assume that the initial sample size for column 1 using nonstatistical sampling is 90 items. For each of columns 2 through

> The following is a partial audit program for the audit of sales transactions. 1. Foot the sales journal for one month and trace the postings to the general ledger. 2. Vouch entries in sales journal to sales invoice and shipping document. 3. Review the sa

> Lenter Supply Company is a medium-sized distributor of wholesale hardware supplies in the central Ohio area. It has been a client of yours for several years and has instituted excellent internal controls for sales at your recommendation. In providing con

> a. In each of the following independent problems, design an unbiased random sampling plan, using an electronic spreadsheet or a random number generator program. The plan should include defining the sampling unit and establishing a numbering system for th

> The following questions concern sampling for attributes. Choose the best response. a. An advantage of statistical sampling over nonstatistical sampling is that statistical sampling helps an auditor (1) Minimize the failure to detect errors and fraud. (2

> The following items concern determining exception rates using random sampling from large populations using attributes sampling. Select the best response. a. From a random sample of items listed from a client's inventory count, an auditor estimates with a

> The following items apply to determining sample sizes using random sampling from large populations for attributes sampling. Select the most appropriate response for each question. a. If all other factors specified in a sampling plan remain constant, chan

> What are the two types of simple random sample selection methods? Which of the two methods is used most often by auditors and why?

> List the major decisions that the auditor must make in using attributes sampling. State the most important considerations involved in making each decision.

> Distinguish between probabilistic selection and statistical measurement. State the circumstances under which one can be used without the other.

> When the CUER exceeds the TER, what courses of action are available to the auditor? Under what circumstances should each of these be followed?

> Explain what is meant by analysis of exceptions and discuss its importance.

> Assume that the auditor has selected 100 sales invoices from a population of 100,000 to test for an indication of internal verification of pricing and extensions. Determine the CUER at a 10% ARACR if four exceptions are found in the sample using attribut

> This problem requires the use of ACL software, which is included in the CD attached to the text. Information about installing and using ACL and solving this problem can be found in Appendix, pages 838-842. You should read all of the reference material, e

> You have just completed the accounts receivable confirmation process in the audit of Danforth Paper Company, a paper supplier to retail shops and commercial users. Following are the data related to this process: Accounts receivable recorded balance $

> You are doing the audit of Peckinpah Tire and Parts, a wholesale auto parts company. You have decided to use monetary unit sampling (MUS) for the audit of accounts receivable and inventory. The following are the recorded balances: Accounts receivable

> In auditing the valuation of inventory, the auditor, Claire Butler, decided to use difference estimation. She decided to select an unrestricted random sample of 80 inventory items from a population of 1,840 that had a book value of $175,820. Butler decid

> An audit partner is developing an office training program to familiarize her professional staff with audit sampling decision models applicable to the audit of dollar-value balances. She wishes to demonstrate the relationship of sample sizes to population

> You intend to use MUS as a part of the audit of several accounts for Roynpower Manufacturing Company. You have done the audit for the past several years, and there has rarely been an adjusting entry of any kind. Your audit tests of all tests of controls

> In the audit of Price Seed Company for the year ended September 30, the auditor set a tolerable misstatement of $50,000 at an ARIA of 10%. A PPS sample of 100 was selected from an accounts receivable population that had a recorded balance of $1,975,000.

> State the relationship between the following: a. ARACR and sample size b. Population size and sample size c. TER and sample size d. EPER and sample size

> The accounts receivable population for Jake's Bookbinding Company follows. This table is the same as Table 17-1, except that cumulative amounts are included to assist you in completing the problem. The population is smaller than is ordinarily the case fo

> You are evaluating the results of a nonstatistical sample of 85 accounts receivable confirmations for the Bohrer Company. Information on the sample and population are included below. An overstatement or understatement of more than $100,000 is considered

> You are planning to use nonstatistical sampling to evaluate the results of accounts receivable confirmation for the Meridian Company. You have already performed tests of controls for sales, sales returns and allowances, and cash receipts, and they are co

> The following relate to the use of statistical sampling for tests of details of balances. For each one, select the best response. a. When the auditor uses monetary unit statistical sampling to examine the total dollar value of invoices, each invoice (1)

> The following apply to evaluating results of audit sampling for tests of details of balances. For each one, select the best response. a. While performing a substantive test of details during an audit, the auditor determined that the sample results suppor

> The following questions relate to determining sample size in tests of details of balances. For each one, select the best response. a. Mr. Murray decides to use stratified sampling. The reason for using stratified sampling rather than unrestricted random

> Give an example of the use of attributes sampling, MUS, and variables sampling in the form of an audit conclusion.

> Explain why difference estimation is commonly used by auditors.

> An essential step in difference estimation is the comparison of each computed confidence limit with tolerable misstatement. Why this step so important, and what should the auditor do if one of the confidence limits is larger than the?

> Distinguish among difference estimation, ratio estimation, mean-per-unit estimation, and stratified mean-per-unit estimation. Give one example in which each can be used. When is MUS preferable to any of these?

> Identify the factors an auditor uses to decide the appropriate ARACR. Compare the sample size for an ARACR of 10% with that of 5%, all other factors being equal.

> In using difference estimation, an auditor took a random sample of 100 inventory items from a large population to test for proper pricing. Several of the inventory items were misstated, but the combined net amount of the sample misstatement was not mater

> Define what is meant by the population standard deviation and explain its importance in variables sampling. What is the relationship between the population standard deviation and the required sample size?

> What alternative courses of action are appropriate when a population is rejected using nonstatistical sampling for tests of details of balances? When should each option be followed?

> What is meant by a decision rule using difference estimation? State the decision rule.

> Why is it difficult to determine the appropriate sample size for MUS? How should the auditor determine the proper sample size?

> Assume that a sample of 100 units was obtained in sampling the inventory in Question 17-4. An auditor is determining the appropriate sample size for testing inventory valuation using MUS. The population has 2,620 inventory items valued at $12,625,000. Th

> What is meant by the "percent of misstatement assumption" for MUS in those population items that are misstated? Why is it common to use a 100% misstatement assumption when it is almost certain to be highly conservative?

> What is the relationship between ARIA and ARACR?

> Evaluate the following statement made by an auditor: "I took a random sample and derived a 90 percent confidence interval of $800,000 to $900,000. That means that the true population value will be between $800,000 and $900,000, 90 percent of the time."

> Explain what is meant by acceptable risk of incorrect acceptance. What are the major audit factors affecting ARIA?

> Identify the factors an auditor uses to decide the appropriate TER. Compare the sample size for a TER of 7% with that of 4%, all other factors being equal.

> Explain how the auditor determines tolerable misstatement for MUS.

> The 2,620 inventory items described in Question 17-14 are listed on 44 inventory pages with 60 lines per page. There is a total for each page. The client's data are not in machine-readable form. Describe how a monetary unit sample can be selected in this

> What major difference between (a) Tests of controls and substantive tests of transactions (b) Tests of details of balances makes attributes sampling inappropriate for tests of details of balances? SOLUTION The most important difference between (a) te

> Define what is meant by sampling risk. Does sampling risk apply to nonstatistical sampling, MUS, attributes sampling, and variables sampling? Explain.

> Define monetary unit sampling and explain its importance in auditing. How does it combine the features of attributes and variables sampling?

> Evaluate the following statement made by an auditor: "On every aspect of the audit where it is possible, I calculate the point estimate of the misstatements and evaluate whether the amount is material. If it is, I investigate the cause and continue to te

> Distinguish between the point estimate of the total misstatements and the true value of the misstatements in the population. How can each be determined?

> Define stratified sampling and explain its importance in auditing. How can an auditor obtain a stratified sample of 30 items from each of three strata in the confirmation of accounts receivable?

> Monetary unit sampling (MUS) is the most commonly used statistical method of sampling for tests of details because of its simplicity and its ability to provide statistical results in dollars. Read an article titled "Monetary-Unit Sampling Using Microsoft

> Explain the difference between replacement sampling and nonreplacement sampling. Which method do auditors usually follow? Why?

> Explain the difference between an attribute and an exception condition. State the exception condition for the audit procedure: The duplicate sales invoice has been initialed indicating the performance of internal verification.

> Explain the major difference between statistical and nonstatistical sampling. What are the three main parts of statistical and nonstatistical methods?

> Auditors have used samples to conduct audit tests for decades. Despite the frequent use of sampling, auditors often use nonstatistical sampling rather than statistical sampling. Visit the website for The CPA Journal (www.cpajournal.com) and use the searc

> Describe the nature of the following documents and records and explain their use in the sales and collection cycle: bill of lading, sales invoice, credit memo, remittance advice, monthly statement to customers.

> For this problem use the Metaphor-AR-2002 file in ACL-Demo. The suggested command or other source of information needed to solve the problem requirement is included at the end of each question. a. Determine the total number and amount of September 2002 t

> In Part III of this case study, you obtained an understanding of internal control and made an initial assessment of control risk for each transaction-related audit objective for acquisition and cash disbursement transactions. The purpose of Part V is to

> The Meyers Pharmaceutical Company, a drug manufacturer, has the following internal controls for billing and recording accounts receivable: 1. An incoming customer's purchase order is received in the order department by a clerk who prepares a prenumbered

> YourTeam.com is an online retailer of college and professional sports team memorabilia, such as hats, shirts, pennants and other sports logo products. Consumers select the college or professional team from a pull-down menu on the company's Web site. For

> Items 1 through 10 present various internal control strengths or internal control deficiencies. 1. Credit is granted by a credit department. 2. Once shipment occurs and is recorded in the sales journal, all shipping documents are marked "recorded" by the

> You have been asked by the board of trustees of a local church to review its accounting procedures. As part of this review you have prepared the following comments about the collections made at weekly services and record keeping for members' pledges and

> The following are a list of possible errors or fraud (1 through 5) involving cash receipts and controls (a through g) that may prevent or detect the errors or fraud: Possible Errors or Fraud 1. Customer checks are properly credited to customer accounts a

> What is meant by an attribute in sampling for tests of controls and substantive tests of transactions? What is the source of the attributes that the auditor selects?

> In recent years, several high-profile incidents of improper revenue recognition attracted the attention of the business media. The SEC has also expressed concerns about the number of instances of improper revenue recognition identified by SEC staff. One

> What major considerations should the auditor take into account in determining how extensive the review of subsequent events should be?