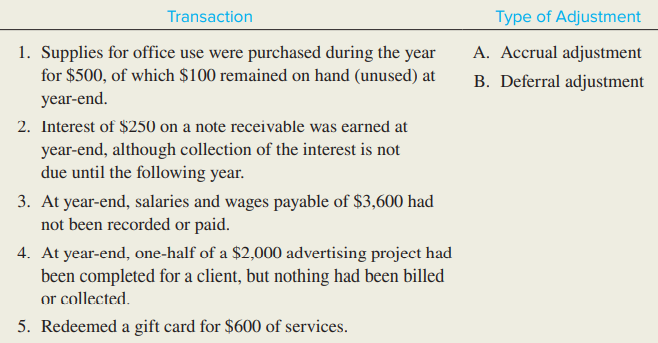

Question: Match each transaction with the type of

Match each transaction with the type of adjustment that will be required, by entering the appropriate letter in the space provided.

> During its first year of operations, Drone Zone Corporation (DZC) bought goods from a manufacturer on account at a cost of $50,000. DZC returned $8,000 of this merchandise to the manufacturer for credit on its account. DZC then sold $38,000 of the remain

> Inventory at the beginning of the year cost $13,400. During the year, the company purchased (on account) inventory costing $84,000. Inventory that had cost $80,000 was sold on account for $95,000. At the end of the year, inventory was counted and its cos

> Assume Anderson’s General Store bought, on credit, a truckload of merchandise from American Wholesaling costing $23,000. If Anderson’s paid National Trucking $650 cash for transportation, immediately returned goods to American Wholesaling costing $1,200,

> Dillard’s, Inc., operates department stores located primarily in the Southwest, Southeast, and Midwest. In its 2016 third-quarter report, the company reported Cost of Goods Sold of $880 million, ending inventory for the third quarter of $1,900 million, a

> XO Group sells merchandise to companies (and individuals) for significant milestones in life, such as getting married, moving in together, and having a baby. Indicate (yes/no) whether the following costs should be recorded in the Inventory account in XO

> Inventory that cost $500 is sold for $700, with terms of 2/30, n/60. Give the journal entries to record (a) the sale of merchandise and (b) collection of the accounts receivable. Assume the sales discount is taken and accounted for using the net method,

> Inventory that cost $500 is sold for $700, with terms of 2/30, n/60. Give the journal entries to record (a) the sale of merchandise and (b) collection of the accounts receivable. Assume the sales discount is taken and accounted for using the gross method

> Using the information in M6-9, prepare the journal entries needed at (a) time of sale and (b) collection of payment from the customer, assuming the company uses a perpetual inventory system with the net method of recording sales discounts. Data from M6-

> Using the information in M6-9, prepare the journal entries needed at (a) time of sale and (b) collection of payment from the customer, assuming the company uses a perpetual inventory system with the gross method of recording sales discounts.

> Using the information in M6-19, prepare the journal entries needed on October 5 and 20, assuming the company uses a perpetual system and records purchase discounts using the net method Data from M-19: On October 5, your company buys and receives invent

> Explain why stockholders’ equity is increased by revenues and decreased by expenses.

> Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on January 1, 2017. The annual reporting period ends December 31. The trial balance on January 1, 2018, was as follows (the amounts

> Corey’s Campus Store has $4,000 of inventory on hand at the beginning of the month. During the month, the company buys $41,000 of merchandise and sells merchandise that had cost $30,000. At the end of the month, $13,000 of inventory is on hand. How much

> On October 5, your company buys and receives inventory costing $5,000, on terms 2/30, n/60. On October 20, your company pays the amount owed relating to the October 5 purchase. Prepare the journal entries needed on October 5 and 20, assuming the company

> If net sales are $300,000, cost of goods available for sale is $280,000, and gross profit percentage is 35%, what is the amount of ending inventory?

> Fortune Brands Home & Security, Inc., sells Master Lock padlocks. It reported an increase in net sales from $4.0 billion in 2014 to $4.6 billion in 2015, and an increase in gross profit from $1.4 billion in 2014 to $1.6 billion in 2015. Based on these nu

> Luxottica Group, the Italian company that sells Ray Ban and Oakley sunglasses, reported net sales of €8.8 billion in 2015 and €7.6 billion in 2014. Gross profit increased from €5.1 billion in 2014 to €6.0 billion in 2015. Was the increase in gross profit

> Ziehart Pharmaceuticals reported Net Sales of $178,000 and Cost of Goods Sold of $58,000. Candy Electronics Corp. reported Net Sales of $36,000 and Cost of Goods Sold of $26,200. Calculate the gross profit percentage for both companies (rounded to one de

> Using the information in M6-13, calculate the gross profit percentage (rounded to one decimal place). How has Sellall performed, relative to the gross profit percentages reported for Walmart in the chapter? Data from M6-13: Sellall Department Stores re

> Sellall Department Stores reported the following amounts in its adjusted trial balance prepared as of its December 31 year-end: Administrative Expenses, $2,400; Cost of Goods Sold, $22,728; Income Tax Expense, $3,000; Interest Expense, $1,600; Interest R

> A company that usually sells satellite TV equipment for $50 and two years of satellite TV service for $450 has a special, time-limited offer in which it sells the equipment for $300 and gives the two years of satellite service for “free.” If the company

> Nord Store’s perpetual accounting system indicated ending inventory of $20,000, cost of goods sold of $100,000, and net sales of $150,000. A year-end inventory count determined goods costing $15,000 were actually on hand. Calculate (a) the cost of shrink

> Show the income statement equation and define each element.

> In its annual report, American Eagle Outfitters states that its “e-commerce operation records revenue upon the estimated customer receipt date of the merchandise.” Is this FOB shipping point or FOB destination? If American Eagle were to change to the oth

> Identify the type of business as service (S), retail merchandiser (RM), or wholesale merchandiser (WM) for each of the following.

> Using the information in M5-8, prepare any journal entries needed to adjust the company’s books. Data 5-8 Indicate whether the following items would be added (+) or subtracted (−) from the companyâ&#

> Indicate whether the following items would be added (+) or subtracted (−) from the company’s books or the bank statement side of a bank reconciliation.

> Each situation below describes an internal control weakness in the cash payments process. Identify which of the five internal control principles is violated, explain the weakness, and then suggest a change that would improve internal control. a. The war

> Match each of the following cash payment activities to the internal control principle to which it best relates. Enter the appropriate letter in the space provided

> Each situation below describes an internal control weakness in the cash receipts process. Identify which of the five internal control principles is violated, explain the weakness, and then suggest a change that would improve internal control. a. Cashier

> Match each of the following cash receipt activities to the internal control principle to which it best relates. Enter the appropriate letter in the space provided

> Identify the internal control principle represented by each point in the following diagram.

> Fox Erasing has a system of internal control with the following procedures. Match the procedure to the corresponding internal control principle.

> What is a T-account? What is its purpose?

> On September 30, Hector’s petty cash fund of $100 is replenished. At the time, the cash box contained $18 cash and receipts for taxi fares ($40), delivery charges ($12), and office supplies ($30). Prepare the journal entry to record the replenishment of

> The petty cash custodian reported the following transactions during the month. Prepare the journal entry to record the replenishment of the fund. A $10 cash payment is made to Starbucks to purchase coffee for a business client, a $40 cash payment is made

> Indicate (Yes or No) whether each of the following is properly included in Cash and Cash Equivalents.

> Use your answer to M5-12 to prepare any journal entries needed as a result of the May 31 bank reconciliation. Data from M5-12: Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reco

> Use the information in M5-10 to prepare the May 31 bank reconciliation Data from M5-10: Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reconciliation.

> Use the information in M5-10 to identify outstanding deposits that should be included in the May 31 bank reconciliation. Data 5-10 Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank r

> Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reconciliation.

> Match each of the following circumstances to the corresponding element of the fraud triangle by entering the appropriate letter in the space provided.

> For each of the following independent situations, prepare journal entries to record the initial transaction on September 30 and the adjustment required on October 31. a. Hockey Helpers paid $4,000 cash on September 30 to rent an arena for the months of

> Using the information in M4-7, prepare the adjusting journal entries required on July 31. Data from M4-7: For each of the following transactions for New Idea Corporation, give the accounting equation effects of the adjustments required at the end of the

> What is a journal entry? What is the typical format of a journal entry?

> For each of the following transactions for New Idea Corporation, give the accounting equation effects of the adjustments required at the end of the month on July 31: a. Received a $600 utility bill for electricity usage in July to be paid in August. b.

> Using the information in M4-5, prepare the adjusting journal entries required on October 31. Data from M4-5: For each of the following transactions for the Sky Blue Corporation, give the accounting equation effects of the adjustments required at the en

> For each of the following transactions for the Sky Blue Corporation, give the accounting equation effects of the adjustments required at the end of the month on October 31: a. Collected $2,400 rent for the period October 1 to December 31, which was cred

> Using the information in M4-3, prepare the adjusting journal entries required. Data from M4-3: Match each transaction with the type of adjustment that will be required, by entering the appropriate letter in the space provided.

> Midwest Manufacturing purchased a three-year insurance policy for $30,000 on January 2, 2018. Prepare any journal entries, adjusting journal entries, and closing journal entries required on January 2, 2018, December 31, 2018, and December 31, 2019. Summa

> The adjusted trial balance for PI Detectives reported the following account balances: Accounts Receivable $500; Supplies $9,000; Prepaid Insurance $7,200; Equipment $28,000; Accumulated Depreciation $4,000; Accounts Payable $200; Deferred Revenue $5,000;

> At December 31, the unadjusted trial balance of H&R Tacks reports Software of $25,000 and zero balances in Accumulated Amortization and Amortization Expense. Amortization for the period is estimated to be $5,000. Prepare the adjusting journal entry on De

> At December 31, the unadjusted trial balance of H&R Tacks reports Interest Payable of $0 and Interest Expense of $0. Interest incurred and owed in December totals $500. Prepare the adjusting journal entry on December 31. In separate T-accounts for each a

> At December 31, the unadjusted trial balance of H&R Tacks reports Salaries and Wages Payable of $0 and Salaries and Wages Expense of $20,000. Employees have been paid for work done up to December 27, but the $1,200 they have earned for December 28–31 has

> What two different accounting equalities must be maintained in transaction analysis and recording?v

> At December 31, the unadjusted trial balance of H&R Tacks reports Deferred Revenue of $5,000 and Service Revenues of $33,800. Obligations for one-half of the deferred revenue have been fulfilled as of December 31. Prepare the adjusting journal entry on D

> At December 31, the unadjusted trial balance of H&R Tacks reports Prepaid Insurance of $7,200 and Insurance Expense of $0. The insurance was purchased on July 1 and provides coverage for 24 months. Prepare the adjusting journal entry on December 31. In s

> Match each situation below to two applicable reasons that require an adjustment to be made

> At December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $30,000 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $6,000. Prepare the adjusting journal entry on D

> At December 31, the unadjusted trial balance of H&R Tacks reports Supplies of $9,000 and Supplies Expense of $0. On December 31, supplies costing $7,700 are on hand. Prepare the adjusting journal entry on December 31. In separate T-accounts for each acco

> Refer to the adjusted trial balance in M4-14. Prepare closing journal entries on December 31. Data from M4-14: The Sky Blue Corporation has the following adjusted trial balance at December 31 Prepare an income statement for the year ended December 31.

> Refer to M4-14. Prepare a classified balance sheet at December 31. Are the Sky Blue Corporation’s assets financed primarily by debt or equity? Data from M4-14: The Sky Blue Corporation has the following adjusted trial balance at Dece

> Refer to M4-14. Prepare a statement of retained earnings for the year. Data from M4-14: The Sky Blue Corporation has the following adjusted trial balance at December 31. Prepare an income statement for the year ended December 31. How much net income d

> The Sky Blue Corporation has the following adjusted trial balance at December 31. Prepare an income statement for the year ended December 31. How much net income did the Sky Blue Corporation generate during the year?

> Macro Company has the following adjusted accounts and balances at (June 30): Required: Prepare an adjusted trial balance for Macro Company at June 30.

> Briefly explain what is meant by transaction analysis. What are the two principles underlying transaction analysis?

> Indicate whether each of the following accounts would be reported on the balance sheet (B/S) or income statement (I/S) of Home Repair Company. Further, if the account is reported on the balance sheet, indicate whether it would be classified with current

> Service Pro Corp. (SPC) is preparing adjustments for its September 30 year-end. For the following transactions and events, show the September 30 adjusting entries SPC would make. a. Prepaid Insurance shows a balance of zero at September 30, but Insuranc

> For each of the following independent situations, prepare journal entries to record the initial transaction on December 31 and the adjustment required on January 31. a. Magnificent Magazines received $12,000 on December 31, 2018, for subscription servic

> Match each situation below to two applicable reasons that require an adjustment to be made

> Given the transactions in M3-7 and M3-8 (including the examples), prepare an income statement for Bill’s Extreme Bowling, Inc., for the month ended July 31. (This income statement would be considered â€

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. For each of the following transactions, complete the spreadsheet, indicating the amount and effect (+ for increase a

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. For each of the following transactions, complete the spv indicating the amount and effect (+ for increase and â

> For each of the transactions in M3-4, write the journal entry using the format shown in the chapter Data from M3-4: The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers.

> For each of the transactions in M3-3, write the journal entry using the format shown in the chapter. Data from M3-3: The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. If an expense is to be recognized in July, indicate the amount. If an expense is not to be recognized in July, expla

> Explain what debit and credit mean.

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. If revenue is to be recognized in July, indicate the amount. If revenue is not to be recognized in July, explain why

> Kijijo Auctions runs an online auction company. Its end-of-year financial statements indicate the following results. Calculate the company’s net profit margin expressed as a percent (to one decimal place) and indicate whether it represe

> Expedia and Priceline compete as online travel agencies. Historically, Expedia has focused more on flights, whereas Priceline has focused on hotel bookings. The following amounts were reported by the two companies in 2015. Calculate each companyâ&#

> For each of the following items in Old Time Cable, Inc.’s financial statements, indicate (1) whether it is reported in the income statement (I/S) or balance sheet (B/S) and (2) whether it is an asset (A), liability (L), stoc

> The following accounts are taken from Equilibrium Riding, Inc., a company that specializes in occupational therapy and horseback riding lessons, as of December 31. Required: Using the unadjusted trial balance provided, create a classified Balance Sheet

> Given the transactions in M3-18 and M3-19 (including the examples), prepare an income statement for Swing Hard Incorporated for the month ended February 28. (This income statement would be considered “preliminary

> Mostert Music Company had the following transactions in March: a. Sold music lessons to customers for $10,000; received $6,000 in cash and the rest on account. b. Paid $600 in wages for the month. c. Received a $200 bill for utilities that will be pai

> The following transactions are February activities of Swing Hard Incorporated, which offers golfing lessons in the northeastern United States. For each of the following transactions, complete the spreadsheet, indicating the amount and effect (+ for incre

> The following transactions are February activities of Swing Hard Incorporated, which offers golfing lessons in the northeastern United States. For each of the following transactions, complete the spreadsheet, indicating the amount and effect (+ for incre

> Andy’s Autobody Shop has the following balances at the beginning of September: Cash, $10,000; Accounts Receivable, $1,450; Equipment, $40,000; Accounts Payable, $2,000; Common Stock, $20,000; and Retained Earnings, $29,450. Prepare journal entries for th

> What is the basic accounting equation?

> An international children’s charity collects donations, which are used to buy clothing and toys for children in need. The charity records donations of cash and other items as Donations Revenue when received. Prepare journal entries for the following tran

> Junktrader is an online company that specializes in matching buyers and sellers of used items. Buyers and sellers can purchase a membership with Junktrader, which provides them advance notice of potentially attractive offers. Prepare journal entries for

> Quick Cleaners, Inc. (QCI), has been in business for several years. It specializes in cleaning houses but has some small business clients as well. Prepare journal entries for the following transactions, which occurred during a recent month, and determine

> For each of the transactions in M3-11, write the journal entry using the format shown in the chapter. Data from M3-11: The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern

> For each of the transactions in M3-10, write the journal entry using the format shown in the chapter. Data from M3-10: The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern

> The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern United States. If an expense is to be recognized in February, indicate the amount. If an expense is not to be recognize

> The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern United States. If revenue is to be recognized in February, indicate the amount. If revenue is not to be recognized in F

> Lakeside Indoor Tennis Club (LITC) sells a tennis membership for $2,400 per year, which entitles members to 50 “free” court bookings. The price for nonmembers is $40 per court booking. LITC’s membership also allows members to participate in a competitive

> For each of the following transactions of Spotlighter, Inc., for the month of January, indicate the accounts, amounts, and direction of the effects on the accounting equation. A sample is provided. a. (Sample) Borrowed $3,940 from a local bank on a not

> Half Price Books is the country’s largest family-owned new and used bookstore chain. Do the following events result in a recordable transaction for Half Price Books? Answer yes or no for each.

> For accounting purposes, what is an account? Explain why accounts are used in an accounting system.

> Do the following events result in a recordable transaction for The Toro Company? Answer yes or no for each.