Question: The following transactions are February activities

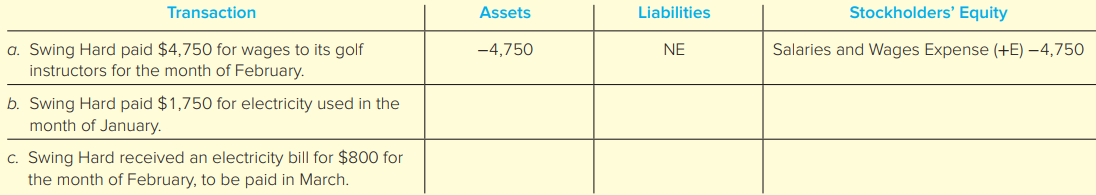

The following transactions are February activities of Swing Hard Incorporated, which offers golfing lessons in the northeastern United States. For each of the following transactions, complete the spreadsheet, indicating the amount and effect (+ for increase and − for decrease) of each transaction under the accrual basis. Write NE if there is no effect on the category. Indicate +/− if the effects offset within a category. Include expenses as a subcategory of stockholders’ equity, as shown for the first transaction, which is provided as an example.

> Indicate (Yes or No) whether each of the following is properly included in Cash and Cash Equivalents.

> Use your answer to M5-12 to prepare any journal entries needed as a result of the May 31 bank reconciliation. Data from M5-12: Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reco

> Use the information in M5-10 to prepare the May 31 bank reconciliation Data from M5-10: Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reconciliation.

> Use the information in M5-10 to identify outstanding deposits that should be included in the May 31 bank reconciliation. Data 5-10 Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank r

> Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reconciliation.

> Match each of the following circumstances to the corresponding element of the fraud triangle by entering the appropriate letter in the space provided.

> For each of the following independent situations, prepare journal entries to record the initial transaction on September 30 and the adjustment required on October 31. a. Hockey Helpers paid $4,000 cash on September 30 to rent an arena for the months of

> Using the information in M4-7, prepare the adjusting journal entries required on July 31. Data from M4-7: For each of the following transactions for New Idea Corporation, give the accounting equation effects of the adjustments required at the end of the

> What is a journal entry? What is the typical format of a journal entry?

> For each of the following transactions for New Idea Corporation, give the accounting equation effects of the adjustments required at the end of the month on July 31: a. Received a $600 utility bill for electricity usage in July to be paid in August. b.

> Using the information in M4-5, prepare the adjusting journal entries required on October 31. Data from M4-5: For each of the following transactions for the Sky Blue Corporation, give the accounting equation effects of the adjustments required at the en

> For each of the following transactions for the Sky Blue Corporation, give the accounting equation effects of the adjustments required at the end of the month on October 31: a. Collected $2,400 rent for the period October 1 to December 31, which was cred

> Using the information in M4-3, prepare the adjusting journal entries required. Data from M4-3: Match each transaction with the type of adjustment that will be required, by entering the appropriate letter in the space provided.

> Match each transaction with the type of adjustment that will be required, by entering the appropriate letter in the space provided.

> Midwest Manufacturing purchased a three-year insurance policy for $30,000 on January 2, 2018. Prepare any journal entries, adjusting journal entries, and closing journal entries required on January 2, 2018, December 31, 2018, and December 31, 2019. Summa

> The adjusted trial balance for PI Detectives reported the following account balances: Accounts Receivable $500; Supplies $9,000; Prepaid Insurance $7,200; Equipment $28,000; Accumulated Depreciation $4,000; Accounts Payable $200; Deferred Revenue $5,000;

> At December 31, the unadjusted trial balance of H&R Tacks reports Software of $25,000 and zero balances in Accumulated Amortization and Amortization Expense. Amortization for the period is estimated to be $5,000. Prepare the adjusting journal entry on De

> At December 31, the unadjusted trial balance of H&R Tacks reports Interest Payable of $0 and Interest Expense of $0. Interest incurred and owed in December totals $500. Prepare the adjusting journal entry on December 31. In separate T-accounts for each a

> At December 31, the unadjusted trial balance of H&R Tacks reports Salaries and Wages Payable of $0 and Salaries and Wages Expense of $20,000. Employees have been paid for work done up to December 27, but the $1,200 they have earned for December 28–31 has

> What two different accounting equalities must be maintained in transaction analysis and recording?v

> At December 31, the unadjusted trial balance of H&R Tacks reports Deferred Revenue of $5,000 and Service Revenues of $33,800. Obligations for one-half of the deferred revenue have been fulfilled as of December 31. Prepare the adjusting journal entry on D

> At December 31, the unadjusted trial balance of H&R Tacks reports Prepaid Insurance of $7,200 and Insurance Expense of $0. The insurance was purchased on July 1 and provides coverage for 24 months. Prepare the adjusting journal entry on December 31. In s

> Match each situation below to two applicable reasons that require an adjustment to be made

> At December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $30,000 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $6,000. Prepare the adjusting journal entry on D

> At December 31, the unadjusted trial balance of H&R Tacks reports Supplies of $9,000 and Supplies Expense of $0. On December 31, supplies costing $7,700 are on hand. Prepare the adjusting journal entry on December 31. In separate T-accounts for each acco

> Refer to the adjusted trial balance in M4-14. Prepare closing journal entries on December 31. Data from M4-14: The Sky Blue Corporation has the following adjusted trial balance at December 31 Prepare an income statement for the year ended December 31.

> Refer to M4-14. Prepare a classified balance sheet at December 31. Are the Sky Blue Corporation’s assets financed primarily by debt or equity? Data from M4-14: The Sky Blue Corporation has the following adjusted trial balance at Dece

> Refer to M4-14. Prepare a statement of retained earnings for the year. Data from M4-14: The Sky Blue Corporation has the following adjusted trial balance at December 31. Prepare an income statement for the year ended December 31. How much net income d

> The Sky Blue Corporation has the following adjusted trial balance at December 31. Prepare an income statement for the year ended December 31. How much net income did the Sky Blue Corporation generate during the year?

> Macro Company has the following adjusted accounts and balances at (June 30): Required: Prepare an adjusted trial balance for Macro Company at June 30.

> Briefly explain what is meant by transaction analysis. What are the two principles underlying transaction analysis?

> Indicate whether each of the following accounts would be reported on the balance sheet (B/S) or income statement (I/S) of Home Repair Company. Further, if the account is reported on the balance sheet, indicate whether it would be classified with current

> Service Pro Corp. (SPC) is preparing adjustments for its September 30 year-end. For the following transactions and events, show the September 30 adjusting entries SPC would make. a. Prepaid Insurance shows a balance of zero at September 30, but Insuranc

> For each of the following independent situations, prepare journal entries to record the initial transaction on December 31 and the adjustment required on January 31. a. Magnificent Magazines received $12,000 on December 31, 2018, for subscription servic

> Match each situation below to two applicable reasons that require an adjustment to be made

> Given the transactions in M3-7 and M3-8 (including the examples), prepare an income statement for Bill’s Extreme Bowling, Inc., for the month ended July 31. (This income statement would be considered â€

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. For each of the following transactions, complete the spreadsheet, indicating the amount and effect (+ for increase a

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. For each of the following transactions, complete the spv indicating the amount and effect (+ for increase and â

> For each of the transactions in M3-4, write the journal entry using the format shown in the chapter Data from M3-4: The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers.

> For each of the transactions in M3-3, write the journal entry using the format shown in the chapter. Data from M3-3: The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. If an expense is to be recognized in July, indicate the amount. If an expense is not to be recognized in July, expla

> Explain what debit and credit mean.

> The following transactions are July activities of Bill’s Extreme Bowling, Inc., which operates several bowling centers. If revenue is to be recognized in July, indicate the amount. If revenue is not to be recognized in July, explain why

> Kijijo Auctions runs an online auction company. Its end-of-year financial statements indicate the following results. Calculate the company’s net profit margin expressed as a percent (to one decimal place) and indicate whether it represe

> Expedia and Priceline compete as online travel agencies. Historically, Expedia has focused more on flights, whereas Priceline has focused on hotel bookings. The following amounts were reported by the two companies in 2015. Calculate each companyâ&#

> For each of the following items in Old Time Cable, Inc.’s financial statements, indicate (1) whether it is reported in the income statement (I/S) or balance sheet (B/S) and (2) whether it is an asset (A), liability (L), stoc

> The following accounts are taken from Equilibrium Riding, Inc., a company that specializes in occupational therapy and horseback riding lessons, as of December 31. Required: Using the unadjusted trial balance provided, create a classified Balance Sheet

> Given the transactions in M3-18 and M3-19 (including the examples), prepare an income statement for Swing Hard Incorporated for the month ended February 28. (This income statement would be considered “preliminary

> Mostert Music Company had the following transactions in March: a. Sold music lessons to customers for $10,000; received $6,000 in cash and the rest on account. b. Paid $600 in wages for the month. c. Received a $200 bill for utilities that will be pai

> The following transactions are February activities of Swing Hard Incorporated, which offers golfing lessons in the northeastern United States. For each of the following transactions, complete the spreadsheet, indicating the amount and effect (+ for incre

> Andy’s Autobody Shop has the following balances at the beginning of September: Cash, $10,000; Accounts Receivable, $1,450; Equipment, $40,000; Accounts Payable, $2,000; Common Stock, $20,000; and Retained Earnings, $29,450. Prepare journal entries for th

> What is the basic accounting equation?

> An international children’s charity collects donations, which are used to buy clothing and toys for children in need. The charity records donations of cash and other items as Donations Revenue when received. Prepare journal entries for the following tran

> Junktrader is an online company that specializes in matching buyers and sellers of used items. Buyers and sellers can purchase a membership with Junktrader, which provides them advance notice of potentially attractive offers. Prepare journal entries for

> Quick Cleaners, Inc. (QCI), has been in business for several years. It specializes in cleaning houses but has some small business clients as well. Prepare journal entries for the following transactions, which occurred during a recent month, and determine

> For each of the transactions in M3-11, write the journal entry using the format shown in the chapter. Data from M3-11: The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern

> For each of the transactions in M3-10, write the journal entry using the format shown in the chapter. Data from M3-10: The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern

> The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern United States. If an expense is to be recognized in February, indicate the amount. If an expense is not to be recognize

> The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern United States. If revenue is to be recognized in February, indicate the amount. If revenue is not to be recognized in F

> Lakeside Indoor Tennis Club (LITC) sells a tennis membership for $2,400 per year, which entitles members to 50 “free” court bookings. The price for nonmembers is $40 per court booking. LITC’s membership also allows members to participate in a competitive

> For each of the following transactions of Spotlighter, Inc., for the month of January, indicate the accounts, amounts, and direction of the effects on the accounting equation. A sample is provided. a. (Sample) Borrowed $3,940 from a local bank on a not

> Half Price Books is the country’s largest family-owned new and used bookstore chain. Do the following events result in a recordable transaction for Half Price Books? Answer yes or no for each.

> For accounting purposes, what is an account? Explain why accounts are used in an accounting system.

> Do the following events result in a recordable transaction for The Toro Company? Answer yes or no for each.

> Netflix, Inc., is the world’s leading Internet subscription service for movies and TV shows. The following are several of the accounts included in a recent balance sheet: 1. Accrued Liabilities 2. Prepaid Rent 3. Cash 4. Common Stock 5. Notes Payable (l

> Hasbro, Inc., produces products under several brands including Transformers, Nerf, My Little Pony, and Monopoly. The following are several of the accounts from a recent balance sheet: 1. Accounts Receivable 2. Notes Payable (short-term) 3. Common Stock

> The following are a few of the accounts of Aim Delivery Corporation: In the space provided, classify each as it would be reported on a balance sheet. Use the following codes: CA = Current Asset CL = Current Liability SE = Stockholders’

> Match each term with its related definition by entering the appropriate letter in the space provided. There should be only one definition per term. (That is, there are more definitions than terms.)

> BSO, Inc., has current assets of $1,000,000 and current liabilities of $500,000, resulting in a current ratio of 2.0. For each of the following transactions, determine whether the current ratio will increase, decrease, or remain the same. Consider each i

> Refer to M2-23. Evaluate whether the current ratio of Mister Ribs Restaurant will increase or decrease as a result of the following transactions. Consider each item, (a)–(d), independent of the others. a. Paid $2,000 cash for a new oven. b. Received a

> The balance sheet of Mister Ribs Restaurant reports current assets of $30,000 and current liabilities of $15,000. Calculate and interpret the current ratio. Does it appear likely that Mister Ribs will be able to pay its current liabilities as they come d

> The following accounts are taken from the financial statements of Facebook Inc. at September 30, 2016. (Amounts are in millions.) Required: 1. Prepare a classified balance sheet at September 30, 2016. TIP: This exercise requires you to remember material

> Charlie’s Crispy Chicken (CCC) operates a fast-food restaurant. When accounting for its first year of business, CCC created several accounts. Using the following descriptions, prepare a classified balance sheet at September 30. Are CCC&

> Define a transaction and give an example of each of the two types of events that are considered transactions.

> Analyze the accounting equation effects of the transactions in M2-19 using the format shown in the chapter and compute total assets, total liabilities, and total stockholders’ equity. Data from M2-19: a. Blue Light Arcade received $50 cash on account f

> Complete the following table by entering either the word debit or credit in each column.

> Katy Williams is the manager of Blue Light Arcade. The company provides entertainment for parties and special events. Prepare journal entries for the following events relating to the year ended December 31. If the event is not a transaction, write “no tr

> Analyze the accounting equation effects of the transactions in M2-17 using the format shown in the chapter and compute total assets, total liabilities, and total stockholders’ equity Data from M2-17: a. Ordered and received $12,000 worth of cotton candy

> Sweet Shop Co. is a chain of candy stores that has been in operation for the past 10 years. Prepare journal entries for the following events, which occurred at the end of the most recent year. If the event is not a transaction, write “no transaction.” a.

> Analyze the accounting equation effects of the transactions in M2-15 using the format shown in the chapter and compute total assets, total liabilities, and total stockholders’ equity. Data from M2-15: a. The company purchased equipment for $4,000 cash.

> At the beginning of August, Joel Henry founded Bookmart.com, which sells new and used books online. He is passionate about books but does not have a lot of accounting experience. Help Joel by preparing journal entries for the following events. If the e

> Analyze the accounting equation effects of the transactions in M2-13 using the format shown in the chapter and compute total assets, total liabilities, and total stockholders’ equity Data from M2-13: J.K. Builders was incorporated on July 1. Prepare jo

> J.K. Builders was incorporated on July 1. Prepare journal entries for the following events from the first month of business. If the event is not a transaction, write “no transaction.” a. Received $70,000 cash invested by owners and issued common stock. b

> Given the transactions in M2-9 (including the sample), prepare a classified balance sheet for Spotlighter, Inc., as of January 31.

> To obtain financing for her hair salon, Valeri asked you to prepare a balance sheet for her business. When she sees it, she is disappointed that the assets exclude a value for her list of loyal customers. What can you tell her to explain why this “asset”

> Explain the concept of the time value of money.

> For each of the transactions in M2-9 (including the sample), post the effects to the appropriate T-accounts and determine ending account balances. Show a beginning balance of zero.

> For each of the transactions in M2-9 (including the sample), write the journal entry using the format shown in this chapter (omit explanations)

> Complete the following table by entering either the word increases or decreases in each column.

> Match each element with its financial statement by entering the appropriate letter in the space provided.

> Oakley, Inc., reported the following items in its financial statements. For each item, indicate (1) the type of account (A = asset, L = liability, SE = stockholders’ equity, R = revenue, E = expense, D = dividend) and (2) whether it is reported on the in

> General Mills is a manufacturer of food products, such as Lucky Charms cereal, Pillsbury crescent rolls, and Green Giant vegetables. The following items were presented in the company’s financial statements. For each item, indicate (1) the type of account

> Tootsie Roll Industries manufactures and sells more than 64 million Tootsie Rolls each day. The following items were listed on Tootsie Roll’s recent income statement and balance sheet. For each item, indicate (1) the type of account (A = asset, L = liabi

> For each item, indicate (1) whether it is reported on the income statement (I/S) or balance sheet (B/S) and (2) the type of account (A = asset, L = liability, SE = stockholders’ equity, R = revenue, E = expense).

> For each of the following items in Procter & Gamble’s financial statements, indicate (1) whether it is reported in the income statement (I/S) or balance sheet (B/S) and (2) whether it is an asset (A), liability (L), stockholders&aci

> Match each definition with its related term by entering the appropriate letter in the space provided.

> Explain the cost principle.

> Match each definition with its related term or abbreviation by entering the appropriate letter in the space provided.

> The following information was reported in the December 31, 2017, financial statements of National Airways, Inc. (listed alphabetically, amounts in millions). 1. Prepare an income statement for the year ended December 31, 2017. 2. Prepare a statement of

> Items from the 2015 income statement, statement of retained earnings, and balance sheet of Activision Blizzard, Inc., are listed below in alphabetical order. Solve for the missing amounts, and explain whether the company was profitable. TIP: Use Exhibit