Question: Mortonson Company has not yet prepared a

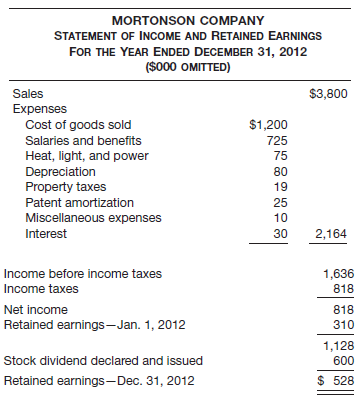

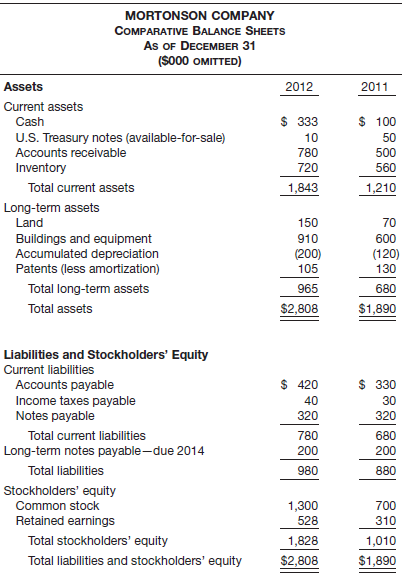

Mortonson Company has not yet prepared a formal statement of cash flows for the 2012 fiscal year. Comparative balance sheets as of December 31, 2011 and 2012, and a statement of income and retained earnings for the year ended December 31, 2012, are presented below and on page 1492.

Instructions

Prepare a statement of cash flows using the direct method. Changes in accounts receivable and accounts payable relate to sales and cost of goods sold. Do not prepare a reconciliation schedule.

Transcribed Image Text:

MORTONSON COMPANY STATEMENT OF INCOME AND RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2012 ($000 OMITTED) Sales $3,800 Expenses Cost of goods sold $1,200 Salaries and benefits 725 Heat, light, and power Depreciation Property taxes 75 80 19 Patent amortization 25 Miscellaneous expenses 10 Interest 30 2,164 Income before income taxes 1,636 Income taxes 818 Net income 818 Retained earnings-Jan. 1, 2012 310 1,128 Stock dividend declared and issued 600 Retained earnings-Dec. 31, 2012 $ 528 MORTONSON COMPANY COMPARATIVE BALANCE SHEETS As OF DECEMBER 31 (S000 OMITTED) Assets 2012 2011 Current assets Cash $ 333 $ 100 U.S. Treasury notes (available-for-sale) Accounts receivable 10 50 780 500 Inventory 720 560 Total current assets 1,843 1,210 Long-term assets Land 150 70 600 Buildings and equipment Accumulated depreciation Patents (less amortization) 910 (200) (120) 105 130 Total long-term assets 965 680 Total assets $2,808 $1,890 Liabilities and Stockholders' Equity Current liabilities $ 420 $ 330 Accounts payable Income taxes payable Notes payable 40 30 320 320 Total current liabilities 780 680 Long-term notes payable-due 2014 200 200 Total liabilities 980 880 Stockholders' Equity Common stock 1,300 700 Retained earnings 528 310 Total stockholders' equity 1,828 1,010 Total liabilities and stockholders' equity $2,808 $1,890

> Stan Conner and Mark Stein were discussing the statement of cash flows of Bombeck Co. In the notes to the statement of cash flows was a schedule entitled “Noncash investing and financing activities.” Give three examples of significant non-cash transactio

> How are deferred tax assets and deferred tax liabilities reported on the statement of financial position under IFRS?

> Bill Haley is learning about pension accounting. He is convinced that, regardless of the method used to recognize actuarial gains and losses, total comprehensive income will always be the same. Is Bill correct? Explain.

> Keystone Corporation’s financial statements for the year ended December 31, 2012, were authorized for issue on March 10, 2013. The following events took place early in 2013. (a) On January 10, 10,000 ordinary shares of $5 par value were issued at $66 per

> At December 31, 2012, Coburn Corp. has assets of $10,000,000, liabilities of $6,000,000, common stock of $2,000,000 (representing 2,000,000 shares of $1 par common stock), and retained earnings of $2,000,000. Net sales for the year 2012 were $18,000,000,

> On February 1, 2012, Hewitt Construction Company obtained a contract to build an athletic stadium. The stadium was to be built at a total cost of $5,400,000 and was scheduled for completion by September 1, 2014. One clause of the contract stated that Hew

> Gordon Company sponsors a defined benefit pension plan. The following information related to the pension plan is available for 2012 and 2013. Instructions (a) Compute pension expense for 2012 and 2013. (b) Prepare the journal entries to record the pens

> Presented below are comparative balance sheets for the Gilmour Company. Instructions (Round to two decimal places.) (a) Prepare a comparative balance sheet of Gilmour Company showing the percent each item is of the total assets or total liabilities and

> Starfleet Corporation has one temporary difference at the end of 2012 that will reverse and cause taxable amounts of $55,000 in 2013, $60,000 in 2014, and $75,000 in 2015. Starfleet’s pretax financial income for 2012 is $400,000, and the tax rate is 30%

> Michaels Company had available at the end of 2012 the information shown below. Instructions Prepare a statement of cash flows for Michaels Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are c

> Aston Corporation performs year-end planning in November of each year before its calendar year ends in December. The preliminary estimated net income is $3 million. The CFO, Rita Warren, meets with the company president, J. B. Aston, to review the projec

> The following facts pertain to a noncancelable lease agreement between Alschuler Leasing Company and McKee Electronics, a lessee, for a computer system. Inception date …………&a

> The accounting records of Shinault Inc. show the following data for 2012. 1. Life insurance expense on officers was $9,000. 2. Equipment was acquired in early January for $300,000. Straight-line depreciation over a 5-year life is used, with no salvage va

> Havaci Company reports pretax financial income of $80,000 for 2012. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by $16,000.

> As loan analyst for Madison Bank, you have been presented the following information. Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered. In as much as your bank has reached its quota for loans of this type,

> Linden Company started operations on January 1, 2008, and has used the FIFO method of inventory valuation since its inception. In 2014, it decides to switch to the average cost method. You are provided with the following information. Instructions (a) W

> Krauss Leasing Company signs a lease agreement on January 1, 2012, to lease electronic equipment to Stewart Company. The term of the noncancelable lease is 2 years, and payments are required at the end of each year. The following information relates to t

> The following facts apply to the pension plan of Boudreau Inc. for the year 2012. Plan assets, January 1, 2012 ………………………………… $490,000 Projected benefit obligation, January 1, 2012 …….……. 490,000 Settlement rate …….…….…….…….…….…….…….…….…….……. 8% Service

> Data for the Rodriquez Company are presented in E23-3. In E23-3 The income statement of Rodriquez Company is shown below. Additional information: 1. Accounts receivable decreased $310,000 during the year. 2. Prepaid expenses increased $170,000 during

> Keystone Corporation issued its financial statements for the year ended December 31, 2012, on March 10, 2013. The following events took place early in 2013. (a) On January 10, 10,000 shares of $5 par value common stock were issued at $66 per share. (b) O

> Tedesco Company changed depreciation methods in 2012 from double-declining-balance to straight-line. Depreciation prior to 2012 under double-declining-balance was $90,000, whereas straight-line depreciation prior to 2012 would have been $50,000. Tedesco’

> Aamodt Music sold CDs to retailers and recorded sales revenue of $700,000. During 2012, retailers returned CDs to Aamodt and were granted credit of $78,000. Past experience indicates that the normal return rate is 15%. Prepare Aamodt’s entries to record

> At December 31, 2012, Appaloosa Corporation had a deferred tax liability of $25,000. At December 31, 2013, the deferred tax liability is $42,000. The corporation’s 2013 current tax expense is $48,000. What amount should Appaloosa report as total 2013 inc

> When is revenue recognized in the following situations: (a) Revenue from selling products? (b) Revenue from services rendered? (c) Revenue from permitting others to use enterprise assets? (d) Revenue from disposing of assets other than products?

> What type of disclosure or accounting do you believe is necessary for the following items? (a) Because of a general increase in the number of labor disputes and strikes, both within and outside the industry, there is an increased likelihood that a compan

> Identify and describe the approach the FASB requires for reporting changes in accounting principles.

> Ballard Company rents a warehouse on a month-to-month basis for the storage of its excess inventory. The company periodically must rent space whenever its production greatly exceeds actual sales. For several years, the company officials have discussed bu

> The meaning of the term “fund” depends on the context in which it is used. Explain its meaning when used as a noun. Explain its meaning when it is used as a verb.

> Explain the meaning of a temporary difference as it relates to deferred tax computations, and give three examples.

> If an SEC-registered company uses the gross profit method to determine cost of goods sold for interim periods, would it be acceptable for the company to state that it’s not practicable to determine components of inventory at interim periods? Why or why n

> Cherokee Construction Company began operations in 2011 and changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2012. For tax purposes, the company employs the completed cont

> Do companies need to disclose information about investing and financing activities that do not affect cash receipts or cash payments? If so, how should such information be disclosed?

> If a company registered with the SEC justifies a change in accounting method as preferable under the circumstances, and the circumstances change, can that company switch back to its prior method of accounting before the change? Why or why not?

> How should a lessor measure its initial gross investment in either a sales-type lease or a direct financing lease?

> What information about its pension plan must a publicly traded company disclose in its interim financial statements?

> When is a company allowed to initially recognize the financial statement effects of a tax position?

> When would a construction company be allowed to use the completed-contract method?

> What are some of the key obstacles for the FASB and IASB within its accounting guidance in the area of cash flow reporting? Explain.

> Livesey Company has signed a long-term contract to build a new basketball arena. The total revenue related to the contract is $120 million. Estimated costs for building the arena are $40 million in the first year and $30 million in both the second and th

> Describe the immediate recognition approach for unrecognized actuarial gains and losses.

> Morlan Corporation is preparing its December 31, 2012, financial statements. Two events that occurred between December 31, 2012, and March 10, 2013, when the statements were authorized for issue, are described below. 1. A liability, estimated at $160,000

> On January 1, 2012, Adams Corporation signed a 5-year noncancelable lease for a machine. The terms of the lease called for Adams to make annual payments of $9,968 at the beginning of each year, starting January 1, 2012. The machine has an estimated usefu

> The asset-liability approach for recording deferred income taxes is an integral part of generally accepted accounting principles. Instructions (a) Indicate whether each of the following independent situations should be treated as a temporary difference

> Ashley Company is a young and growing producer of electronic measuring instruments and technical equipment. You have been retained by Ashley to advise it in the preparation of a statement of cash flows using the indirect method. For the fiscal year ended

> Listed below and on the next page are three independent, unrelated sets of facts relating to accounting changes. Situation 1 Sanford Company is in the process of having its first audit. The company has used the cash basis of accounting for revenue recog

> On January 1, Santiago Company, a lessee, entered into three noncancelable leases for brand-new equipment, Lease L, Lease M, and Lease N. None of the three leases transfers ownership of the equipment to Santiago at the end of the lease term. For each of

> On March 1, 2012, Chance Company entered into a contract to build an apartment building. It is estimated that the building will cost $2,000,000 and will take 3 years to complete. The contract price was $3,000,000. The following information pertains to th

> Penn Company is in the process of adjusting and correcting its books at the end of 2012. In reviewing its records, the following information is compiled. 1. Penn has failed to accrue sales commissions payable at the end of each of the last 2 years, as fo

> Bradburn Corporation was formed 5 years ago through a public subscription of common stock. Daniel Brown, who owns 15% of the common stock, was one of the organizers of Bradburn and is its current president. The company has been successful, but it current

> The following information has been obtained for the Gocker Corporation. 1. Prior to 2012, taxable income and pretax financial income were identical. 2. Pretax financial income is $1,700,000 in 2012 and $1,400,000 in 2013. 3. On January 1, 2012, equipment

> Brennan Corporation began 2012 with a $90,000 balance in the Deferred Tax Liability account. At the end of 2012, the related cumulative temporary difference amounts to $350,000, and it will reverse evenly over the next 2 years. Pretax accounting income f

> The following information is available for the pension plan of Radcliffe Company for the year 2012. Actual and expected return on plan assets ………………………….……………………. $ 15,000 Benefits paid to retirees …………………………………………………………………………….. 40,000 Contributions (fu

> LaGreca Company is involved in four separate industries. The following information is available for each of the four industries. Instructions Determine which of the operating segments are reportable based on the: (a) Revenue test. (b) Operating profit

> Ramirez Co. decides at the beginning of 2012 to adopt the FIFO method of inventory valuation. Ramirez had used the LIFO method for financial reporting since its inception on January 1, 2010, and had maintained records adequate to apply the FIFO method re

> Assume that on January 1, 2012, Kimberly-Clark Corp. signs a 10-year noncancelable lease agreement to lease a storage building from Trevino Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal renta

> Using the information in E20-2, prepare a pension worksheet inserting January 1, 2012, balances, showing December 31, 2012, balances, and the journal entry recording pension expense. In E20-2 Veldre Company provides the following information about its d

> The income statement of Rodriquez Company is shown below. Additional information: 1. Accounts receivable decreased $310,000 during the year. 2. Prepaid expenses increased $170,000 during the year. 3. Accounts payable to suppliers of merchandise decreas

> At January 1, 2012, Beaty Company had plan assets of $280,000 and a projected benefit obligation of the same amount. During 2012, service cost was $27,500, the settlement rate was 10%, actual and expected return on plan assets were $25,000, contributions

> Morlan Corporation is preparing its December 31, 2012, financial statements. Two events that occurred between December 31, 2012, and March 10, 2013, when the statements were issued, are described below. 1. A liability, estimated at $160,000 at December 3

> Using the information from BE19-2, assume this is the only difference between Oxford’s pretax financial income and taxable income. Prepare the journal entry to record the income tax expense, deferred income taxes, and income taxes payable, and show how t

> What is the revenue recognition principle?

> Identify the two recognized lease-accounting methods for lessees and distinguish between them.

> Manual Company sells goods to Nolan Company during 2012. It offers Nolan the following rebates based on total sales to Nolan. If total sales to Nolan are 10,000 units, it will grant a rebate of 2%. If it sells up to 20,000 units, it will grant a rebate o

> How should cash flows from purchases, sales, and maturities of available-for-sale securities be classified and reported in the statement of cash flows?

> What are the quantitative thresholds that would require a public company to report separately information about an operating segment?

> What reporting requirements does retrospective application require?

> What information should a lessee disclose about its capital leases in its financial statements and footnotes?

> If an employer has a defined benefit pension plan, what components would make up its net periodic pension cost?

> A company wishes to conduct business in a foreign country that attracts businesses by granting “holidays” from income taxes for a certain period of time. Would the company have to disclose this “holiday” to the SEC? If so, what information must be disclo

> Is the installment-sales method of recognizing revenue generally acceptable? Why or why not?

> IFRS prohibits the use of the completed-contract method in accounting for long-term contracts. If revenues and costs are difficult to estimate, how must companies account for long-term contracts?

> In this simulation, you are asked to address questions related to the accounting for leases. Prepare responses to all parts. (Round amounts to the nearest cent.) KWW_Professional_Simulation Accounting for Leases Time Remaining 1 hour 40 minutes Unap

> Wertz Construction Company decided at the beginning of 2012 to change from the completed contract method to the percentage-of-completion method for financial reporting purposes. The company will continue to use the completed-contract method for tax purpo

> Access the glossary (“Master Glossary”) to answer the following. (a) What is a deferred tax asset? (b) What is taxable income? (c) What is the definition of valuation allowance? (d) What is a deferred tax liability?

> Ray Bond, from Problem 1-16, is trying to find a new supplier that will reduce his variable cost of production to $15 per unit. If he was able to succeed in reducing this cost, what would the break-even point be? Problem 1-16: Ray Bond sells handcrafte

> Ray Bond sells handcrafted yard decorations at county fairs. The variable cost to make these is $20 each, and he sells them for $50. The cost to rent a booth at the fair is $150. How many of these must Ray sell to break even?

> Gina Fox has started her own company, Foxy Shirts, which manufactures imprinted shirts for special occasions. Since she has just begun this operation, she rents the equipment from a local printing shop when necessary. The cost of using the equipment is $

> A card is drawn from a standard deck of playing cards. For each of the following pairs of events, indicate if the events are mutually exclusive, and indicate if the events are exhaustive. (a) Draw a spade and draw a club. (b) Draw a face card and draw a

> The Webster Manufacturing Company produces a popular type of serving cart. This product, the SL72, is made from the following parts: 1 unit of part A, 1 unit of part B, and 1 unit of subassembly C. Each subassembly C is made up of 2 units of part D, 4 un

> Jerry Smith is thinking about opening a bicycle shop in his hometown. Jerry loves to take his own bike on 50-mile trips with his friends, but he believes that any small business should be started only if there is a good chance of making a profit. Jerry c

> A group of medical professionals is considering the construction of a private clinic. If the medical demand is high (i.e., there is a favorable market for the clinic), the physicians could realize a net profit of $100,000. If the market is not favorable,

> Refer to Problem 3-33 for details about the game of roulette. Another bet in a roulette game is called a “straight up” bet, which means that the player is betting that the winning number will be the number that she chose. In a game with 0 and 00, there i

> Megley Cheese Company is a small manufacturer of several different cheese products. One of the products is a cheese spread that is sold to retail outlets. Jason Megley must decide how many cases of cheese spread to manufacture each month. The probability

> Today’s Electronics specializes in manufacturing modern electronic components. It also builds the equipment that produces the components. Phyllis Weinberger, who is responsible for advising the president of Today’s Ele

> What is the variance, and what does it measure? How is it computed for a discrete probability distribution?

> Allen Young has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the stock market. Over the past several months, however, Allen has become very concerned about the stock m

> Develop an opportunity loss table for the investment problem that Mickey Lawson faces in Problem 3-20. What decision would minimize the expected opportunity loss? What is the minimum EOL? Problem 3-20: Mickey Lawson is considering investing some money

> Kenneth Brown is the principal owner of Brown Oil, Inc. After quitting his university teaching job, Ken has been able to increase his annual salary by a factor of over 100. At the present time, Ken is forced to consider purchasing some more equipment for

> The computer output given below is for Problem 7-31. Use this to answer the following questions. Problem 7-31: Consider the following LP problem: Maximize profit = 5X + 6 Y subject to 2X + Y ≤ 120 2X + 3Y ≤ 240 X, Y ≥ 0 (a) How much coul

> Teresa Granger is the manager of Chicago Cheese, which produces cheese spreads and other cheese-related products. E-Z Spread Cheese is a product that has always been popular. The probability of sales, in cases, is as follows: A case of E-Z Spread Chees

> Use the F table in Appendix D to find the value of F for the upper 1% of the F distribution with The F table in Appendix D: Continue to next page… // // (a) df1 = 15, df2 = 6 (b) df1 = 12, df2 = 8 (c) df1 = 3, df2 = 5 (d) df1 = 9, df2 =

> Use the F table in Appendix D to find the value of F for the upper 5% of the F distribution with The F table in Appendix D: Continue to next page… // // (a) df1 = 5, df2 = 10 (b) df1 = 8, df2 = 7 (c) df1 = 3, df2 = 5 (d) df1 = 10, df2 =

> Examine the LP formulation in Problem 7-29. The problem’s second constraint reads 6X + 4Y ≤ 24 hours 1time available on machine 22 If the firm decides that 36 hours of time can be made available on machine 2 (namely, an additional 12 hours) at an additio

> Georgia Products offers the following discount schedule for its 4- by 8-foot sheets of good-quality plywood: ORDER UNIT COST ($) 9 sheets or less ………………………………….. 18.00 10 to 50 sheets …………………………………… 17.50 More than 50 sheets …………………………… 17.25 Home S

> Graphically analyze the following problem: Maximize profit = $4X + $6Y subject to X + 2Y ≤ 8 hours 6X + 4Y ≤ 24 hours (a) What is the optimal solution? (b) If the first constraint is altered to X + 3Y ≤ 8, does the feasible region or optimal

> What is the expected value, and what does it measure? How is it computed for a discrete probability distribution?

> For the data in Problem 5-44, develop an exponential smoothing model with a smoothing constant of 0.3. Using the MSE, compare this with the model in Problem 5-44. Problem 5-44: The following table gives the average monthly exchange rate between the U.S.

> The following table gives the average monthly exchange rate between the U.S. dollar and the euro for 2009. It shows that 1 euro was equivalent to 1.289 U.S. dollars in January 2009. Develop a trend line that could be used to predict the exchange rate for

> Cars arrive at Carla’s Muffler Shop for repair work at an average of 3 per hour, following an exponential distribution. (a) What is the expected time between arrivals? (b) What is the variance of the time between arrivals?

> Using the data in Problem 2-43, determine the probability of more than 3 visits for emergency room service on any given day. Problem 2-43: Patients arrive at the emergency room of Costa Valley Hospital at an average of 5 per day. The demand for emergen