Question: Ms. Seagram paid $155,000 for a

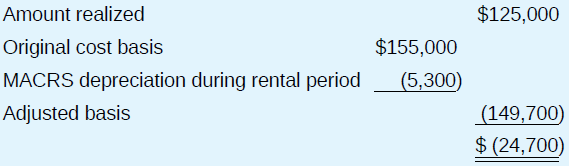

Ms. Seagram paid $155,000 for a house that she occupied as her principal residence until February 1, when she moved out and converted the house to rental property. The appraised FMV of the house was $140,000. She leased the house to tenants who purchased it on November 18. Her realized loss on the sale was $24,700, computed as follows.

> Refer to the facts in the preceding problem. a. Complete Schedule K, Form 1065, for the partnership. b. Complete Schedule K-1, Form 1065, for Jayanthi. Problem 21: Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership.

> Ms. S is the sole shareholder and chief executive officer of SMJ Corporation. Ms. S’s college roommate recently lost her job, is in financial difficulty, and has asked Ms. S for a loan. Instead of a loan, Ms. S offered the roommate a job with SMJ at a $3

> DLT’s chief operating officer is negotiating the acquisition of a controlling interest in the stock of AA, Inc. from Mr. and Mrs. A. The director of tax suggested that the acquisition be structured as a nontaxable transaction to Mr. and Mrs. A. The CEO r

> Firm UW is about to enter into a venture that will generate taxable income for the next six to eight years. The director of tax has come up with an idea to restructure the venture in a way that will reduce tax costs by at least 5 percent.

> Earlier in the year, Mrs. G, a business manager for Company RW, evaluated a prospective opportunity that could generate $20,000 additional taxable income. Mrs. G determined that the company’s marginal tax rate on this income would be 25 percent. Later in

> Ms. O is the chief financial officer for Firm XYZ. The marketing department requested approval for an $80,000 cash expenditure. The request points out that the expenditure would be deductible. Therefore, the marketing department concludes that Ms. O shou

> Refer to the facts in problem 3. Company WB is considering engaging a CPA to prepare a request for a private letter ruling from the IRS concerning the tax consequences of the business opportunity. Problem 3: Company WB is evaluating a business opportuni

> Company WB is evaluating a business opportunity with uncertain tax consequences. If the company takes a conservative approach by assuming the least beneficial tax consequences, the tax cost is $95,000. If the company takes an aggressive approach by assum

> Firm V must choose between two alternative investment opportunities. On the basis of current tax law, the firm projects that the NPV of Opportunity 1 is significantly less than the NPV of Opportunity 2. The provisions in the tax law governing the tax con

> Mr. and Mrs. J’s taxable income from their business has been stable for the past five years, and their average federal income tax rate has ranged between 22 and 24 percent. Because of a boom in the local economy, the couple estimates that their business

> Jurisdiction J decides to clean up its streets, parks, and waterways by providing a tax break for businesses that assign employees to pick up trash for a minimum number of hours each month. The annual revenue loss from this tax break is $1.9 million.

> Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnership’s 2018 activities. a. Calculate the partnership’s ordinary (no

> Two years ago, the government of State P decided to improve the horizontal equity of its individual income tax by allowing families to deduct the cost of heating and air conditioning their homes. This modification necessitated an additional tax form and

> Four years ago, the citizens of Country C complained that the national tax system was too uncertain because the government changed the tax laws so frequently. In response to this criticism, the government enacted a 10-year moratorium on change: No existi

> Mrs. K is completely blind, while Mr. L is paralyzed from the waist down. Both individuals have the same income. The Internal Revenue Code provides a preferential deduction for individuals who are blind, and as a result, Mrs. K’s income tax liability is

> County M imposes a 1 percent tax on the gross receipts earned by firms operating within its jurisdiction. For the past year, gross receipts subject to tax totaled $400 million. The county government is considering raising the tax rate to 2 percent becaus

> Country O imposes just two taxes on its citizens. The first tax is a 20 percent excise tax on motor fuel and motor oil. This tax is earmarked for Country O’s Highway Improvement Trust Fund, and the revenues can’t be spent for any other purpose. The secon

> Mr. Imhoff, age 72, has lived in Los Angeles his entire life. His net worth is estimated at $95 million. Mr. Imhoff is considering renouncing his U.S. citizenship, selling his home in Los Angeles, and permanently relocating to the Cayman Islands. The Cay

> Dempsey Corporation is organized under Canadian law and has its corporate headquarters in Montreal. This year, Dempsey sold $28 million of goods to customers who live in the United States. However, Dempsey doesn’t maintain any type of office in the Unite

> Eighteen months ago, BBB Company opened a manufacturing facility in County K. As an incentive for BBB to locate within its jurisdiction, County K abated all local property taxes for the first two years of operation. BBB recently announced that it will sh

> Mr. Wycomb is a professional golfer who played 23 tournaments in 14 different states and earned $893,000 total prize money for the year. When he is not traveling, Mr. Wycomb lives with his family in Tucson, Arizona.

> Acme Corporation was formed under the laws of State X and has its corporate headquarters in that state. Acme operates a manufacturing plant in State Y and sells goods to customers in States X, Y, and Z. All three states have a corporate income tax. This

> Western Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its 2019 financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: * Western’

> James Jones is the owner of a small retail business operated as a sole proprietorship. During 2018, his business recorded the following items of income and expense. Revenue from inventory sales ……….…………………. $147,000 Cost of goods sold ……………………….……………………

> Yarrow Company orders $500,000 of office furniture from Vendor V, which ships the furniture by rail from its manufacturing facility in State V to Yarrow’s corporate headquarters in State Q. State V imposes a 6.5 percent sales tax, while State Q imposes o

> For the past 22 years, Mrs. Otis contributed part of her salary to a retirement plan sponsored by her corporate employer. Under federal law, Mrs. Otis did not pay tax on the income she contributed. She will, however, pay federal income tax on the distrib

> Bailey Company, which has offices in six states, owns an airplane that company executives use to travel from office to office. When the plane is not in use, it is stored in a hangar located in a jurisdiction that doesn’t levy a personal property tax on b

> Firtex Company operates in a jurisdiction that levies real property tax but no personal property tax. This year, the company spent $6 million to add an exterior lighting system and security fences to the parking lot adjacent to its corporate headquarters

> A local government levies an annual real property tax on the personal residence located at 123 Maple Drive. This tax is assessed on a calendar-year basis, and the homeowner must pay the tax before December 31. In November, Mr. and Mrs. Julius received th

> Mr. Martinez died and left all his property to his only grandson. After the estate was settled, the grandson received his $942,000 inheritance. Nine months later, the IRS audited Mr. Martinez’s final Form 1040 and discovered that he underpaid his income

> Mrs. Luce died on February 12 and left her entire estate (including her marketable securities) to her son. After the end of the year, the son received 14 Form 1099s showing his mother’s name and Social Security number. These 1099s reported $29,788 divide

> Mr. Barlow, a self-employed consultant, charged a client a $15,000 fee plus $3,900 reimbursable business expenses. The client paid the $18,900 bill and sent a Form 1099 reporting $18,900 income. When Mr. Barlow prepared his Schedule C, he simply reported

> KP, a calendar year corporation, filed its 2015 return on May 1, 2016. On February 19, 2019, it filed an amended 2015 return reflecting $2.61 million less taxable income than the original return and requesting a $913,000 tax refund.

> Mr. Tillotson has not paid income tax or filed a tax return for the last eight years. He believes that the IRS can no longer assess back taxes for the first five of those years.

> Rochelle is a limited partner in Megawatt Partnership. For 2019, her schedule K-1 from the partnership reported the following share of partnership items. Ordinary income …………………………. $25,000 Section 1231 loss ………………………….. (3,000) Nondeductible expense ……

> Nunoz Inc., a calendar year taxpayer, incurred a net operating loss in 2018 that it carried back as a deduction against 2016 income. Nunoz’s treasurer filed a claim for a $712,600 refund of 2016 tax and expects to receive a check from the government any

> On April 13, Mr. Price applied for an automatic extension of time to file his Form 1040. He estimated that the balance of tax due was $3,800, which he paid with the extension request. He filed his return on June 20. The actual balance of tax due was $6,9

> On July 2, Mrs. Nation received a notice assessing a $10,861 tax deficiency. She was short of funds, so she did not pay her tax bill within 10 days as required by the notice. Instead, she waited until September 29 to mail a check for $10,861 to the IRS.

> On April 3, Mr. and Mrs. Rath traveled to Japan. They made the trip because their son, who lives in Tokyo, was injured in an accident and needed their care. After nursing their son back to health, they returned home on June 11. On June 17, Mrs. Rath mail

> Mr. Tahoma, who is a member of the Navajo tribe of Native Americans, developed severe arthritis this year. He paid $1,100 to a tribal medicine man who performed a series of traditional Navajo healing ceremonies called “sings.”

> Mrs. Newton, who is a self-employed author, paid $3,200 for a new computer system. She uses the system to write her books, and her two children use it for their schoolwork and video games.

> Mrs. Overton, age 60, won an age discrimination suit against her former employer. The court awarded her $100,000 in damages for mental anguish and $200,000 for the violation of her civil rights.

> The pilots of Skyway Airlines have been on strike for four months. Ms. Biggs received a $2,700 benefit from her union, the Airline Pilots Association International. The union funded the benefits for Skyway pilots through a solicitation from union members

> On a recent scuba dive, Mr. Underhill located a shipwreck and recovered a Spanish sword inlaid with precious stones. The sword’s appraised value is $11,500. Mr. Underhill mounted the sword over his fireplace.

> Ms. Lewis, a bartender and aspiring actress, won a statewide beauty pageant and was awarded a $15,000 cash scholarship to further her education and career goals. She used the money to pay for private acting lessons.

> On January 10, 2017, a fire destroyed a warehouse owned by NP Company. NP’s adjusted basis in the warehouse was $530,000. On March 12, 2017, NP received a $650,000 reimbursement from its insurance company. In each of the following cases, determine NP’s r

> Mr. Tinsler was a contestant on a game show and won a vacuum cleaner with a retail price of $365. Three months later, he sold the unused appliance in a garage sale for $275.

> Mr. Saul, a real estate broker, just negotiated the sale of a home for a wealthy client. Two days after the sale closed, he received a beautiful leather briefcase from the client with a card reading: “In grateful appreciation of your efforts over the pas

> Mr. and Mrs. Ayala purchased their home one year ago. This year, a local government attempted to seize the home because the former residents had failed to pay their property taxes for 12 years. Mr. and Mrs. Ayala paid $1,700 to an attorney who resolved t

> For the past 10 years, Mr. Bianco lived on his sailboat for five months of the year and spent the other seven months living in his daughter’s home. This year, he realized a $35,200 gain on sale of the boat and moved into his own apartment.

> Mr. Dix borrowed $600,000 to purchase 62 acres of undeveloped land and secured the debt with the land. He converted a three-room log cabin on the land to his principal residence. This year, he paid $39,910 interest on the mortgage.

> Mr. and Mrs. Fitch bought $500 worth of Girl Scout cookies from their godchild. Because they don’t eat sweets, they gave away every box to various friends and family members.

> Mr. Ruskin, a CPA who charges $150 per hour for his professional services, keeps the financial records for a local charity. Although he spends at least 10 hours each month at this task, he doesn’t charge the charity a fee for his services.

> Mr. Sheraton suffers from severe arthritis. His physician advised him to swim for at least one hour every day in a heated pool. Because such a facility is not conveniently located in his area, he paid $25,000 to build a heated lap pool in his backyard.

> A local radio station offers a $5,000 reward for information leading to the arrest of vandals and other petty criminals. Mr. Jenks received the reward for identifying three people who spray-painted graffiti on a public building.

> On June 2, 2019, a tornado destroyed the building in which FF operated a fast-food franchise. FF’s adjusted basis in the building was $214,700. In each of the following cases, determine FF’s recognized gain or loss on this property disposition and FF’s b

> Ms. Nassam has $60,000 suspended passive activity losses from her interest in the EZ Limited Partnership. In December, she sold this interest to N Inc., a regular corporation in which she is the sole shareholder.

> This year, Ms. Tan had a $29,000 capital loss carryforward and an $8,200 suspended passive activity loss carryforward. She died on September 12 and didn’t recognize any capital gain or passive activity income during the year.

> Mr. Morales was a 25 percent partner in MNOP Partnership, which operated a gift and souvenir shop. He materially participated in the partnership business. Several years ago, Mr. Morales loaned $10,000 to MNOP in return for a written interest-bearing note

> Two years ago, Ms. Eager loaned $3,500 to her 20-year-old daughter, who used the loan proceeds to buy a used car. This year, the daughter informed her mother that she could not repay the debt.

> Three years ago, Mrs. Best purchased 1,000 shares of NN stock from an page 16-43 unrelated party for $12 per share. After her purchase, the value of the shares steadily declined. Two weeks ago, an unrelated party offered to buy the shares for 30 cents pe

> Mr. and Mrs. Gamble paid $53,000 for a corporate bond with a $50,000 stated redemption value. They paid the $3,000 premium because the bond’s annual interest rate is higher than the market interest rate.

> In 1993, Mr. Lloyd paid $18,000 for a newly issued BN bond with a $30,000 stated redemption value. He has recognized $6,000 of the original issue discount (OID) as ordinary interest income. This year, BN went bankrupt and informed Mr. Lloyd that his bond

> At the beginning of the year, Ms. Alston owned 2,900 shares of SBS stock with a basis of $32 per share. SBS paid a 50 percent stock dividend, and Ms. Alston received 1,450 additional SBS shares. Before this dividend, the market price per share was $90. A

> Mrs. Allen died on June 1. She and her surviving husband were co-owners of real property with a $200,000 adjusted basis and a $1.6 million FMV. Mr. Allen inherited his wife’s half of the property.

> Mr. Durst died on March 8. His taxable estate includes a traditional IRA with a $140,000 balance. Mr. Durst’s contributions to this IRA were fully deductible. His son is the beneficiary of the IRA.

> Cramer Corporation, a calendar year, accrual basis corporation, reported $1 million of net income after tax on its 2019 financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: * Cramer’

> Mr. Oakem, a 66-year-old divorced individual, has two children with his former wife. He recently married a 45-year-old woman with no property of her own. Therefore, Mr. Oakem plans to change his will to provide that when he dies, his fortune will be plac

> Mr. Pugh has a $7,900 adjusted basis in his limited interest in PKO Partnership. He also has $22,000 suspended passive activity losses from PKO. Mr. Pugh recently sent a letter to PKO’s corporate general partner formally abandoning his equity in the part

> Mr. Clem invests in Series EE savings bonds. He projects that his sole proprietorship will generate a sizeable loss, and he wants to accelerate income from other sources to offset it. He could elect to recognize $28,000 accrued interest on the savings bo

> Mr. and Mrs. Schill are CPAs. Mr. Schill is an employee of a national accounting firm, while Mrs. Schill operates her own professional practice. Each year, the couple pays approximately $1,300 to subscribe to professional publications and research servic

> Six years ago, Ms. Prevost paid $20 per share for 1,000 shares of her employer’s stock. This stock is now worth $58 per share. Ms. Prevost wants to exercise a stock option to buy 1,000 more shares at a strike price of $29 per share. Because she doesn’t h

> GHK recently granted a stock option to an employee to purchase 20,000 shares of stock for $11 per share. On the date of grant, GHK stock was selling for $12 on the NYSE.

> Mr. Granger was employed by a closely held corporation that issued him a year-end bonus of 50 shares of stock worth $200 per share. Mr. Granger’s ownership of the stock was nontransferable and restricted. If he resigned from his job within four years of

> Ms. Larrick is employed at VD’s corporate headquarters and often works late hours. The headquarters building is located in a high-crime urban area. As a result, corporate policy is that any employee leaving the premises after 7:00 p.m. must take a cab ho

> Mr. Donde has the full-time use of an automobile owned and maintained by his employer. This year, Mr. Donde drove this company car 48,000 miles on business and 22,000 for personal reasons. He is not required to page 15-42 report this information to his e

> Mr. Keach is a professor at a private university. The university waives the tuition for a faculty member’s child who meets the entrance requirements. Mr. Keach’s two children are enrolled in degree programs at the university. If not for the waiver, Mr. K

> Herelt Inc., a calendar year taxpayer, purchased equipment for $383,600 and placed it in service on April 1, 2019. The equipment was seven-year recovery property, and Herelt used the half-year convention to compute MACRS depreciation. a. Compute Herelt’s

> Ms. Bourne is an executive with GG Inc., an international business operation. She flies more than 150,000 business miles each year and accumulates considerable frequent-flier points from the airlines. GG allows its employees to use their frequent-flier p

> Mr. Norby, age 53, owns a traditional IRA with a $215,000 current balance. Mr. Norby recently divorced his wife and transferred this IRA to her as part of the property settlement.

> Mr. and Mrs. Vishnu are the sole shareholders of VC Enterprises. They are also employed by VC and participate in its qualified pension plan. VC is experiencing cash flow difficulties. To ease the strain, Mr. and Mrs. Vishnu voluntarily forfeited their ve

> Mr. McNeil, age 50, is a self-employed writer who published 11 novels in the past 20 years. Each year, he makes the maximum contribution to his Keogh plan. This year, he borrowed $200,000 from the plan to finance the construction of a new home. Under the

> Corporation J sponsors a qualified profit-sharing plan for its employees. Three years ago, Ms. Purdy, a participant in the plan for more than 12 years, quit her job and left town without leaving a forwarding address. The corporation has tried to locate M

> This year, TT Corporation agreed to defer $100,000 compensation owed to Ms. Blass, the director of research. TT funded its obligation by transferring $100,000 cash to a trust administered by a local bank. TT can’t reclaim these funds. However, the trust

> Ms. Jorgen recently moved from Boston to Pittsburgh to take a job with OP Inc. She sold her home in Boston, and OP paid the $14,500 realtor’s commission on the sale.

> Mr. Trudel and Mr. Varga founded TV Corporation six years ago and have devoted every waking hour to the corporate business. During the first four years, neither shareholder received a salary. During the last two years, each shareholder received a $400,00

> Mr. Severson, a self-employed attorney, has sole custody of his nineyear- old daughter. This year she spent eight weeks during the summer at a recreational camp. The total cost was $3,800.

> Mr. and Mrs. Wynne have full-time jobs. They employ Mrs. Wynne’s 18-year-old sister as an after-school babysitter for their 10-year-old son.

> Warren Company is a calendar year, cash basis firm. On December 6, 2019, Warren paid $7,200 cash to a landscape service business that maintains the lawns and gardens around Warren’s headquarters. How much of this expenditure can Warren deduct in 2019 ass

> Mr. Pitcock’s AGI includes an $8,700 dividend paid by a German corporation and $11,600 interest paid by a Canadian bank. He paid $3,000 foreign income tax this year.

> Mr. Glenn, age 90, lives in a nursing home. He has no gross income and is financially dependent on his four adult children, each of whom pays 25 percent of the cost of the home.

> Mr. and Mrs. Bosco have an 11-year-old child. The couple is divorced, and Mrs. Bosco has sole custody of the child. However, Mr. Bosco pays his former wife $1,200 child support each month.

> Mr. Tilton is a 20-year-old college student. This year he lived on campus for nine months and in his parents’ home during the summer. His parents paid for all Mr. Tilton’s living expenses, but a scholarship paid for his $22,000 college tuition.

> Until March of this year, Mr. George took care of his invalid mother in his own home and provided 100 percent of her financial support. In March, she became eligible for Medicaid, and Mr. George moved her into a state-provided room in a nursing home.

> Mr. and Mrs. Johnson were married in 2001. This year they traveled to Reno, Nevada, immediately after Christmas and obtained a divorce on December 29. They spent two weeks vacationing in California, returned to their home in Texas on January 13, and rema

> In November, Mr. Kurk discovered that his combined income tax withholding and estimated tax payments would be less than his prior year tax and, therefore, would not be a safe-harbor estimate. He immediately requested that his employer withhold enough tax

> Mr. and Mrs. Marceleno own a sole proprietorship that generates approximately $60,000 annual net profit. This business is the couple’s only source of income. In April, June, and September, they paid their estimated tax payments. In December, they won $25

> During the first eight months of the year, Ms. Layne was self-employed and earned $63,200 net income. In September, she accepted a job with MW Company and earned $75,000 salary through the end of the year.

> Mr. Leonard died on April 16. Mr. and Mrs. Leonard had been married for 11 years and had always filed a joint return. Mrs. Leonard remarried on December 21.

> LSG Company is a calendar year, cash basis taxpayer. On November 1, 2019, LSG paid $9,450 cash to the janitorial service firm that cleans LSG’s administrative offices and retail stores. How much of this expenditure can LSG deduct in 2019 assuming that: a