Question: Refer to the facts in the preceding

Refer to the facts in the preceding problem.

a. Complete Schedule K, Form 1065, for the partnership.

b. Complete Schedule K-1, Form 1065, for Jayanthi.

Problem 21:

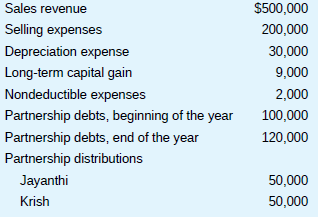

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnership’s 2018 activities.

a. Calculate the partnership’s ordinary (nonseparately stated) income, and indicate which items must be separately stated.

b. Calculate Jayanthi’s allocable share of partnership items.

c. If Jayanthi has no other sources of taxable income, what is her total gross income for 2018?

d. At the beginning of the year, Jayanthi’s adjusted tax basis in her partnership interest was $25,000. Calculate her ending adjusted tax basis in her partnership interest.

> In its first taxable year, Corporation NM generated a $25,000 net operating loss and recognized an $8,000 net capital loss. The corporation’s tax return for its second year reported $15,000 taxable income, $10,000 of which was capital gain.

> Two years ago, Corporation M loaned $80,000 to its employee Mr. E. The corporation received Mr. E’s properly executed note in which he promised to repay the loan at the end of seven years and to pay annual interest of 9 percent (the market interest rate

> Company LR owns a commercial office building. Four years ago, LR entered into a long-term lease with Lessee M for 2,400 square feet of office space. LR spent $13,600 to finish out the space to meet Lessee M’s requirements. The leasehold improvements incl

> A fire damaged industrial equipment used by Firm L in its manufacturing process. Immediately before the fire, the equipment was worth $40,000. After the fire, the equipment was worth only $15,000. Firm L’s adjusted basis in the equipment was $14,000, and

> Firm LD, a calendar year taxpayer, owns 20,000 shares of MXP stock with a $160,000 basis. In November, LD’s chief financial officer learned that MXP had just declared bankruptcy. The CFO was unable to determine if MXP’s board of directors intend to try t

> Ernlo is an accrual basis corporation with a June 30 fiscal year-end. On June 2, 2019, Ernlo entered into a binding contract to purchase a sixmonth supply of heating oil from a local distributor at the current market price of $12,450. This price is guara

> At the beginning of the year, Firm GH owned 8,200 shares of common stock in LSR, a publicly held corporation. GH’s basis in these shares was $290,000. On a day when LSR stock was trading at $1.14 per share, GH delivered the 8,200 shares to its broker wit

> Corporation TJ ceased business operations and was dissolved under state law. On the last day of its existence, TJ’s balance sheet showed $2,200 unamortized organizational costs and $12,000 unamortized goodwill.

> On March 1, DS Company, a calendar year taxpayer, recognized a $15,000 loss on sale of marketable securities. On May 12, it recognized an $85,000 Section 1231 gain on sale of an office building. In forecasting current taxable income, DS’s chief financial

> TCJ bought a 10-acre tract of undeveloped land that it intends to improve and subdivide for sale to real estate customers. This year, TCJ paid $4,300 to a local company to clean up the land by hauling away trash, cutting down dead trees, and spraying for

> Company JJ, a calendar year corporation, bought an airplane for use in its oil and gas business in December. The manufacturer delivered the plane to the company’s hangar on December 19. Because of severe winter weather, JJ’s pilot was unable to fly the p

> In 2017, Firm Z elected to expense the $8,000 cost of a machine, which it reported as the only item of equipment placed in service that year. This year, the IRS audited Firm Z’s 2017 return and discovered that it had incorrectly deducted a $10,000 expend

> WRT owns a chain of retail bookstores. It recently decided to add coffee bars in each store to sell gourmet coffee drinks and pastries to the bookstore customers. WRT has not yet obtained the necessary licenses required under local law to serve food to t

> Firm PY purchased industrial equipment from a Canadian vendor. The firm paid $12,800 to transport the equipment to its manufacturing plant in Florida and a $1,700 premium for insurance against casualty or theft of the equipment while en route.

> ROJ Inc. purchased a 20-acre industrial complex consisting of three warehouses and two office buildings surrounded by parking lots. About 12 acres of the land is undeveloped. ROJ paid a lump-sum purchase price of $19.4 million.

> Mrs. K owns her own consulting firm, and her husband, Mr. K, owns a printing business. This year, Mrs. K’s consulting business generated $89,000 taxable income. Mr. K’s business operated at a loss. In July, Mr. K bought new office furniture for $16,000.

> In 2019, Firm L purchased machinery costing $21,300 and elected to expense the entire cost under Section 179. How much of the expense can Firm L deduct in each of the following cases? a. Its taxable income before the deduction was $58,000. b. Its taxable

> Mr. R lived in a two-bedroom, one-bath residence until August when he moved to a new home and converted his old residence into residential rent property. He had no trouble finding tenants who signed a one-year lease and moved in on September 1. As of thi

> Firm D paid a $500,000 lump-sum price for a commercial office building. A local consulting company approached Firm D with a proposal. For a $15,000 fee, the company would analyze the components of the building (shelving, lighting fixtures, floor covering

> Corporation J paid $500,000 for six acres of land on which it plans to build a new corporate headquarters. Four months after the purchase, Corporation J paid $20,000 to a demolition company to tear down an old warehouse located on the land and haul away

> ABC Partnership owns 100 percent of the stock of two corporations, HT (an advertising firm) and LT (a commercial real estate development firm). HT is in a 35 percent marginal tax bracket. LT has an NOL carryforward deduction and will pay no tax this year

> In 2018, Firm K paid $129,000 real property tax to Jurisdiction J and deducted the payment. In 2019, it successfully contested the property tax assessment. As a result, Jurisdiction J refunded $18,000 of the property tax.

> Every December, Maxo Inc., an accrual basis, calendar year corporation, purchases 3,500 calendars from a publisher and mails them to its customers as a holiday gift. This year, Maxo received a $14,420 bill from the publisher, which represented a sizeable

> Mr. RJ owns a consulting firm that uses a calendar year and the cash method. In November, Mr. RJ billed a client $3,500 for services performed in September. After waiting several weeks, he called the client to remind her of the bill. The embarrassed clie

> Company A, a calendar year taxpayer, has always used the cash method of accounting. It completed an engagement for a major client in November 2019 and submitted a bill for its $160,000 fee. Because Company A didn’t receive payment before year-end, it rec

> BL Inc. has been in business since 2000. This year BL’s new CPA discovered that it is using an incorrect accounting method for a certain page 6-39 expense. BL is willing to change to the correct accounting method recommended by the CPA.

> Two years ago, a professional theater company paid $300 to an antique dealer for an old oil painting that the company used as a prop. This year, the company’s prop manager was cleaning the painting and discovered an older painting hidden beneath the top

> In 2018, Company W elected under Section 179 to expense $19,300 of the cost of qualifying property. However, it could deduct only $15,000 of the expense because of the taxable income limitation. In 2019, Company W’s taxable income before any Section 179

> Corporation DS owns assets worth $550,000 and has $750,000 outstanding debts. One of DS’s creditors just informed DS that it is writing off a $15,000 account receivable from DS because it believes the receivable is uncollectible. However, even with this

> BL and TM are both calendar year corporations. On January 1, 2019, BL purchased TM’s entire business (all TM’s balance sheet assets), and TM’s shareholders dissolved the corporation under state law. As of January 1, TM had a $190,000 NOL carryforward. BL

> Corporation WJ began business in 2019 and elected S corporation status. This year, it operated at a significant loss, flowing through $(624,000) of ordinary business loss to its sole shareholder, William Jones.

> In October 2017, Firm G completed a consulting engagement and received a $200,000 cash payment for its services. In December, the client notified Firm G that it was unsatisfied with the work and demanded that Firm G refund $50,000 of the payment. Firm G

> Natalie appeared on a game show last year and won a car valued at $30,000. After driving it for six months, she sold it for $24,000.

> Argonaut Corporation sustained considerable damage to one of its warehouses during a recent hurricane. It expects to pay $200,000 to replace the roof of the building and repair other damage. It is unclear at this point whether any of the loss will be com

> Marybeth works as a financial analyst at a brokerage firm. At night, she is taking courses to complete her MBA degree. Her firm pays 50 percent of her tuition cost for these courses, and Marybeth pays the remainder personally.

> John is a dentist. His neighbor Wade is a carpenter. John has agreed to perform dental work for Wade and his wife in exchange for Wade’s installing a new laminate floor in John’s dental office.

> Allison works full time as a dental hygienist. She devotes her spare time to designing and creating stained glass pieces. During the past year, she has sold 10 of her pieces at local craft fairs and was recently commissioned to create three stained glass

> Marvin is researching the tax rules related to Individual Retirement Accounts. He is very confused by the information he has found in the IRC and Treasury regulations regarding deductibility of IRA contributions. However, he has found an IRS publication

> GreenUp, a calendar year, accrual basis taxpayer, provides landscaping installation and maintenance services to its customers. In August 2019, GreenUp contracted with a university to renovate its lawns and gardens. GreenUp agreed to complete the entire r

> Guenther is researching a tax issue involving the deductibility of costs to remodel an office building. He has found several authorities permitting such costs to be deducted, and several others requiring that remodeling costs be capitalized and depreciat

> In researching the taxability of noncash compensation, a tax researcher identifies a judicial decision that seems to address the issue at hand. However, the decision was rendered in 1978, and the researcher knows that the tax law has changed many times i

> Firm HR is about to implement an aggressive long-term strategy consisting of three phases. It is crucial to the success of the strategy that the IRS accepts Firm HR’s interpretation of the tax consequences of each distinct phase. The firm could implement

> Ms. LG plans to structure a transaction as a legal sale of property, even though the economic substance of the transaction is a lease of the property. In her current position, the tax consequences of a sale are much more favorable than those of a lease.

> Firm Z is considering implementing a long-term tax strategy to accelerate the deduction of certain business expenses. The strategy has an opportunity cost because it decreases before-tax cash flows, but the tax savings from the strategy should be greater

> Mr. and Mrs. TR own an investment yielding a 4.25 percent after-tax return. Their friend Ms. K is encouraging them to sell this investment and invest the proceeds in her business, which takes advantage of several favorable tax preferences. Consequently,

> Company QP must decide whether to build a new manufacturing plant in Country B or Country C. Country B has no income tax. However, its political regime is unstable and its currency has been devalued four times in three years. Country C has both a 20 perc

> Mrs. Y owns 1,800 shares of Acme common stock, which she purchased for $10 per share in 2002. In October of this year, she decides to sell her Acme stock for the market price of $27 per share, the highest price at which the stock has traded in the past 2

> Mr. and Mrs. K own rental property that generates $4,000 monthly revenue. The couple is in the highest marginal tax bracket. For Christmas, Mr. and Mrs. K give the uncashed rent checks for October, November, and December to their 19-year-old grandson as

> Dr. P is a physician with his own medical practice. For the past several years, his marginal income tax rate has been 37 percent. Dr. P’s daughter, who is a college student, has no taxable income. During the last two months of the year, Dr. P instructs h

> Ms. S is the sole shareholder and chief executive officer of SMJ Corporation. Ms. S’s college roommate recently lost her job, is in financial difficulty, and has asked Ms. S for a loan. Instead of a loan, Ms. S offered the roommate a job with SMJ at a $3

> DLT’s chief operating officer is negotiating the acquisition of a controlling interest in the stock of AA, Inc. from Mr. and Mrs. A. The director of tax suggested that the acquisition be structured as a nontaxable transaction to Mr. and Mrs. A. The CEO r

> Firm UW is about to enter into a venture that will generate taxable income for the next six to eight years. The director of tax has come up with an idea to restructure the venture in a way that will reduce tax costs by at least 5 percent.

> Earlier in the year, Mrs. G, a business manager for Company RW, evaluated a prospective opportunity that could generate $20,000 additional taxable income. Mrs. G determined that the company’s marginal tax rate on this income would be 25 percent. Later in

> Ms. O is the chief financial officer for Firm XYZ. The marketing department requested approval for an $80,000 cash expenditure. The request points out that the expenditure would be deductible. Therefore, the marketing department concludes that Ms. O shou

> Refer to the facts in problem 3. Company WB is considering engaging a CPA to prepare a request for a private letter ruling from the IRS concerning the tax consequences of the business opportunity. Problem 3: Company WB is evaluating a business opportuni

> Company WB is evaluating a business opportunity with uncertain tax consequences. If the company takes a conservative approach by assuming the least beneficial tax consequences, the tax cost is $95,000. If the company takes an aggressive approach by assum

> Firm V must choose between two alternative investment opportunities. On the basis of current tax law, the firm projects that the NPV of Opportunity 1 is significantly less than the NPV of Opportunity 2. The provisions in the tax law governing the tax con

> Mr. and Mrs. J’s taxable income from their business has been stable for the past five years, and their average federal income tax rate has ranged between 22 and 24 percent. Because of a boom in the local economy, the couple estimates that their business

> Jurisdiction J decides to clean up its streets, parks, and waterways by providing a tax break for businesses that assign employees to pick up trash for a minimum number of hours each month. The annual revenue loss from this tax break is $1.9 million.

> Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnership’s 2018 activities. a. Calculate the partnership’s ordinary (no

> Two years ago, the government of State P decided to improve the horizontal equity of its individual income tax by allowing families to deduct the cost of heating and air conditioning their homes. This modification necessitated an additional tax form and

> Four years ago, the citizens of Country C complained that the national tax system was too uncertain because the government changed the tax laws so frequently. In response to this criticism, the government enacted a 10-year moratorium on change: No existi

> Mrs. K is completely blind, while Mr. L is paralyzed from the waist down. Both individuals have the same income. The Internal Revenue Code provides a preferential deduction for individuals who are blind, and as a result, Mrs. K’s income tax liability is

> County M imposes a 1 percent tax on the gross receipts earned by firms operating within its jurisdiction. For the past year, gross receipts subject to tax totaled $400 million. The county government is considering raising the tax rate to 2 percent becaus

> Country O imposes just two taxes on its citizens. The first tax is a 20 percent excise tax on motor fuel and motor oil. This tax is earmarked for Country O’s Highway Improvement Trust Fund, and the revenues can’t be spent for any other purpose. The secon

> Mr. Imhoff, age 72, has lived in Los Angeles his entire life. His net worth is estimated at $95 million. Mr. Imhoff is considering renouncing his U.S. citizenship, selling his home in Los Angeles, and permanently relocating to the Cayman Islands. The Cay

> Dempsey Corporation is organized under Canadian law and has its corporate headquarters in Montreal. This year, Dempsey sold $28 million of goods to customers who live in the United States. However, Dempsey doesn’t maintain any type of office in the Unite

> Eighteen months ago, BBB Company opened a manufacturing facility in County K. As an incentive for BBB to locate within its jurisdiction, County K abated all local property taxes for the first two years of operation. BBB recently announced that it will sh

> Mr. Wycomb is a professional golfer who played 23 tournaments in 14 different states and earned $893,000 total prize money for the year. When he is not traveling, Mr. Wycomb lives with his family in Tucson, Arizona.

> Acme Corporation was formed under the laws of State X and has its corporate headquarters in that state. Acme operates a manufacturing plant in State Y and sells goods to customers in States X, Y, and Z. All three states have a corporate income tax. This

> Western Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its 2019 financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: * Western’

> James Jones is the owner of a small retail business operated as a sole proprietorship. During 2018, his business recorded the following items of income and expense. Revenue from inventory sales ……….…………………. $147,000 Cost of goods sold ……………………….……………………

> Yarrow Company orders $500,000 of office furniture from Vendor V, which ships the furniture by rail from its manufacturing facility in State V to Yarrow’s corporate headquarters in State Q. State V imposes a 6.5 percent sales tax, while State Q imposes o

> For the past 22 years, Mrs. Otis contributed part of her salary to a retirement plan sponsored by her corporate employer. Under federal law, Mrs. Otis did not pay tax on the income she contributed. She will, however, pay federal income tax on the distrib

> Bailey Company, which has offices in six states, owns an airplane that company executives use to travel from office to office. When the plane is not in use, it is stored in a hangar located in a jurisdiction that doesn’t levy a personal property tax on b

> Firtex Company operates in a jurisdiction that levies real property tax but no personal property tax. This year, the company spent $6 million to add an exterior lighting system and security fences to the parking lot adjacent to its corporate headquarters

> A local government levies an annual real property tax on the personal residence located at 123 Maple Drive. This tax is assessed on a calendar-year basis, and the homeowner must pay the tax before December 31. In November, Mr. and Mrs. Julius received th

> Mr. Martinez died and left all his property to his only grandson. After the estate was settled, the grandson received his $942,000 inheritance. Nine months later, the IRS audited Mr. Martinez’s final Form 1040 and discovered that he underpaid his income

> Mrs. Luce died on February 12 and left her entire estate (including her marketable securities) to her son. After the end of the year, the son received 14 Form 1099s showing his mother’s name and Social Security number. These 1099s reported $29,788 divide

> Mr. Barlow, a self-employed consultant, charged a client a $15,000 fee plus $3,900 reimbursable business expenses. The client paid the $18,900 bill and sent a Form 1099 reporting $18,900 income. When Mr. Barlow prepared his Schedule C, he simply reported

> KP, a calendar year corporation, filed its 2015 return on May 1, 2016. On February 19, 2019, it filed an amended 2015 return reflecting $2.61 million less taxable income than the original return and requesting a $913,000 tax refund.

> Mr. Tillotson has not paid income tax or filed a tax return for the last eight years. He believes that the IRS can no longer assess back taxes for the first five of those years.

> Rochelle is a limited partner in Megawatt Partnership. For 2019, her schedule K-1 from the partnership reported the following share of partnership items. Ordinary income …………………………. $25,000 Section 1231 loss ………………………….. (3,000) Nondeductible expense ……

> Nunoz Inc., a calendar year taxpayer, incurred a net operating loss in 2018 that it carried back as a deduction against 2016 income. Nunoz’s treasurer filed a claim for a $712,600 refund of 2016 tax and expects to receive a check from the government any

> On April 13, Mr. Price applied for an automatic extension of time to file his Form 1040. He estimated that the balance of tax due was $3,800, which he paid with the extension request. He filed his return on June 20. The actual balance of tax due was $6,9

> On July 2, Mrs. Nation received a notice assessing a $10,861 tax deficiency. She was short of funds, so she did not pay her tax bill within 10 days as required by the notice. Instead, she waited until September 29 to mail a check for $10,861 to the IRS.

> On April 3, Mr. and Mrs. Rath traveled to Japan. They made the trip because their son, who lives in Tokyo, was injured in an accident and needed their care. After nursing their son back to health, they returned home on June 11. On June 17, Mrs. Rath mail

> Mr. Tahoma, who is a member of the Navajo tribe of Native Americans, developed severe arthritis this year. He paid $1,100 to a tribal medicine man who performed a series of traditional Navajo healing ceremonies called “sings.”

> Mrs. Newton, who is a self-employed author, paid $3,200 for a new computer system. She uses the system to write her books, and her two children use it for their schoolwork and video games.

> Mrs. Overton, age 60, won an age discrimination suit against her former employer. The court awarded her $100,000 in damages for mental anguish and $200,000 for the violation of her civil rights.

> The pilots of Skyway Airlines have been on strike for four months. Ms. Biggs received a $2,700 benefit from her union, the Airline Pilots Association International. The union funded the benefits for Skyway pilots through a solicitation from union members

> On a recent scuba dive, Mr. Underhill located a shipwreck and recovered a Spanish sword inlaid with precious stones. The sword’s appraised value is $11,500. Mr. Underhill mounted the sword over his fireplace.

> Ms. Lewis, a bartender and aspiring actress, won a statewide beauty pageant and was awarded a $15,000 cash scholarship to further her education and career goals. She used the money to pay for private acting lessons.

> On January 10, 2017, a fire destroyed a warehouse owned by NP Company. NP’s adjusted basis in the warehouse was $530,000. On March 12, 2017, NP received a $650,000 reimbursement from its insurance company. In each of the following cases, determine NP’s r

> Mr. Tinsler was a contestant on a game show and won a vacuum cleaner with a retail price of $365. Three months later, he sold the unused appliance in a garage sale for $275.

> Mr. Saul, a real estate broker, just negotiated the sale of a home for a wealthy client. Two days after the sale closed, he received a beautiful leather briefcase from the client with a card reading: “In grateful appreciation of your efforts over the pas

> Mr. and Mrs. Ayala purchased their home one year ago. This year, a local government attempted to seize the home because the former residents had failed to pay their property taxes for 12 years. Mr. and Mrs. Ayala paid $1,700 to an attorney who resolved t

> Ms. Seagram paid $155,000 for a house that she occupied as her principal residence until February 1, when she moved out and converted the house to rental property. The appraised FMV of the house was $140,000. She leased the house to tenants who purchased

> For the past 10 years, Mr. Bianco lived on his sailboat for five months of the year and spent the other seven months living in his daughter’s home. This year, he realized a $35,200 gain on sale of the boat and moved into his own apartment.

> Mr. Dix borrowed $600,000 to purchase 62 acres of undeveloped land and secured the debt with the land. He converted a three-room log cabin on the land to his principal residence. This year, he paid $39,910 interest on the mortgage.