Question: Near the end of 2013, the management

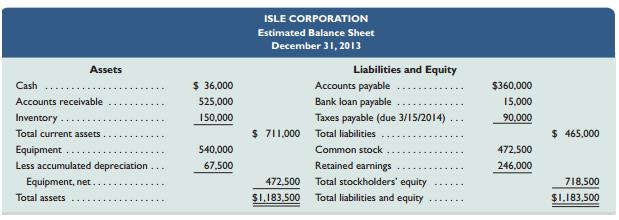

Near the end of 2013, the management of Isle Corp., a merchandising company, prepared the following estimated balance sheet for December 31, 2013.

To prepare a master budget for January, February, and March of 2014, management gathers the following information.

a. Isle Corp.’s single product is purchased for $30 per unit and resold for $45 per unit. The expected inventory level of 5,000 units on December 31, 2013, is more than management’s desired level for 2014, which is 25% of the next month’s expected sales (in units). Expected sales are: January, 6,000 units; February, 8,000 units; March, 10,000 units; and April, 9,000 units.

b. Cash sales and credit sales represent 25% and 75%, respectively, of total sales. Of the credit sales, 60% is collected in the first month after the month of sale and 40% in the second month after the month of sale. For the $525,000 accounts receivable balance at December 31, 2013, $315,000 is collected in January 2014 and the remaining $210,000 is collected in February 2014.

c. Merchandise purchases are paid for as follows: 20% in the first month after the month of purchase and 80% in the second month after the month of purchase. For the $360,000 accounts payable balance at December 31, 2013, $72,000 is paid in January 2014 and the remaining $288,000 is paid in February 2014.

d. Sales commissions equal to 20% of sales are paid each month. Sales salaries (excluding commissions) are $90,000 per year.

e. General and administrative salaries are $144,000 per year. Maintenance expense equals $3,000 per month and is paid in cash.

f. Equipment reported in the December 31, 2013, balance sheet was purchased in January 2013. It is being depreciated over 8 years under the straight-line method with no salvage value. The following amounts for new equipment purchases are planned in the coming quarter: January, $72,000; February, $96,000; and March, $28,800. This equipment will be depreciated using the straight-line method over 8 years with no salvage value. A full month’s depreciation is taken for the month in which equipment is purchased.

g. The company plans to acquire land at the end of March at a cost of $150,000, which will be paid with cash on the last day of the month.

h. Isle Corp. has a working arrangement with its bank to obtain additional loans as needed. The interest rate is 12% per year, and interest is paid at each month-end based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. Isle has agreed to maintain a minimum ending cash balance of $36,000 in each month.

i. The income tax rate for the company is 40%. Income taxes on the first quarter’s income will not be paid until April 15.

RequiredPrepare a master budget for each of the first three months of 2014; include the following component budgets (show supporting calculations as needed, and round amounts to the nearest dollar):1. Monthly sales budgets (showing both budgeted unit sales and dollar sales).

2. Monthly merchandise purchases budgets.

3. Monthly selling expense budgets.

4. Monthly general and administrative expense budgets.

5. Monthly capital expenditures budgets.

6. Monthly cash budgets.

7. Budgeted income statement for the entire first quarter (not for each month).

8. Budgeted balance sheet as of March 31, 2014.

Transcribed Image Text:

ISLE CORPORATION Estimated Balance Sheet December 31, 2013 Assets Liabilities and Equity Cash $ 36,000 Accounts payable $360,000 Accounts receivable 525,000 Bank loan payable 15,000 Inventory 150,000 Taxes payable (due 3/15/2014) 90,000 Total current assets $ 71,00 Total liabilities $ 465,000 Equipment . Less accumulated depreciation. 540,000 Common stock 472,500 67,500 Retained earnings 246,000 Equipment, net. 472,500 Total stockholders' equity 718,500 Total assets $1,183,500 Total liabilities and equity $1.183,500 ...

> How does budgeting help management coordinate and plan business activities?

> Raider-X Company forecasts sales of 18,000 units for April. Beginning inventory is 3,000 units. The desired ending inventory is 30% higher than the beginning inventory. How many units should Raider-X purchase in April?

> Gordands purchased $600,000 of merchandise in August and expects to purchase $720,000 in September. Merchandise purchases are paid as follows: 25% in the month of purchase and 75% in the following month. Compute cash disbursements for merchandise for Sep

> Wells Company reports the following sales forecast: September, $55,000; October, $66,000; and November, $80,000. All sales are on account. Collections of credit sales are received as follows: 20% in the month of sale, 70% in the first month after sale, a

> The Candle Shoppe reports the following sales forecast: August, $150,000; September, $170,000. Cash sales are normally 40% of total sales and all credit sales are expected to be collected in the month following the date of sale. Prepare a schedule of cas

> Following are selected accounts for a company. For each account, indicate whether it will appear on a budgeted income statement (BIS) or a budgeted balance sheet (BBS). If an item will not appear on either budgeted financial statement, label it NA. Sales

> Refer to information from QS 7-10. Grace pays a sales manager a monthly salary of $6,000 and a commission of 8% of camera sales (in dollars). Prepare a selling expense budget for the month of June. In QS 7-10 Grace sells miniature digital cameras for $2

> Grace sells miniature digital cameras for $250 each. 1,000 units were sold in May, and it forecasts 4% growth in unit sales each month. Determine (a) the number of camera sales and (b) the dollar amount of camera sales for the month of June.

> Oakwood Company produces maple bookcases to customer order. It received an order from a customer to produce 5,000 bookcases. The following information is available for the production of the bookcases. Process time . . . . . . . . . . 6.0 days Inspection

> Refer to information from QS 7-8. Forrest Company assigns variable overhead at the rate of $1.50 per unit of production. Fixed overhead equals $4,600,000 per month. Prepare a factory overhead budget for November. In QS 7-8 Forrest Company manufactures w

> Forrest Company manufactures watches and has a JIT policy that ending inventory must equal 10% of the next month’s sales. It estimates that October’s actual ending inventory will consist of 40,000 watches. November and December sales are estimated to be

> Use the following information to prepare a cash budget for the month ended on March 31 for Gado Merchandising Company. The budget should show expected cash receipts and cash disbursements for the month of March and the balance expected on March 31. a. Be

> Why should each department participate in preparing its own budget?

> Lighthouse Company anticipates total sales for June and July of $420,000 and $398,000, respectively. Cash sales are normally 60% of total sales. Of the credit sales, 20% are collected in the same month as the sale, 70% are collected during the first mont

> Montel Company’s July sales budget calls for sales of $600,000. The store expects to begin July with $50,000 of inventory and to end the month with $40,000 of inventory. Gross margin is typically 40% of sales. Determine the budgeted cost of merchandise p

> The motivation of employees is one goal of budgeting. Identify three guidelines that organizations should follow if budgeting is to serve effectively as a source of motivation for employees.

> Which one of the following sets of items are all necessary components of the master budget? 1. Operating budgets, historical income statement, and budgeted balance sheet. 2. Prior sales reports, capital expenditures budget, and financial budgets. 3. Sale

> Identify at least three roles that budgeting plays in helping managers control and monitor a business.

> Refer to Exercise 7-27. For April, May, and June, prepare (1) a direct labor budget and (2) a factory overhead budget. In Exercise 7-27 Rad Co. provides the following sales forecast and production budget for the next four months: The company plans for

> Pirate Seafood Company purchases lobsters and processes them into tails and flakes. It sells the lobster tails for $21 per pound and the flakes for $14 per pound. On average, 100 pounds of lobster are processed into 52 pounds of tails and 22 pounds of fl

> Rad Co. provides the following sales forecast and production budget for the next four months: The company plans for finished goods inventory of 120 units at the end of June. In addition, each finished unit requires five pounds of raw materials and the

> Refer to Exercise 7-25. For the second quarter, prepare (1) a direct labor budget and (2) a factory overhead budget. In Exercise 7-25 Rida, Inc., a manufacturer in a seasonal industry, is preparing its direct materials budget for the second quarter. It

> Rida, Inc., a manufacturer in a seasonal industry, is preparing its direct materials budget for the second quarter. It forecasts sales of 225,000 units in the second quarter and 262,500 units in the third quarter. It also plans production of 52,500 units

> Render Co. CPA is preparing activity-based budgets for 2013. The partners expect the firm to generate billable hours for the year as follows: Data entry . . . . . . . . . 2,200 hours Auditing . . . . . . . . . . . 4,800 hours Tax . . . . . . . . . . . .

> The management of Nabar Manufacturing prepared the following estimated balance sheet for June, 2013: To prepare a master budget for July, August, and September of 2013, management gathers the following information: a. Sales were 20,000 units in June. F

> Participatory budgeting can sometimes lead to negative consequences. Identify three potential negative outcomes that can arise from participatory budgeting.

> Match the definitions 1 through 9 with the term or phrase a through i. A. Budget B. Merchandise purchases budget C. Cash budget D. Safety stock E. Budgeted income statement F. General and administrative expense budget G. Sales budget H. Master budget I.

> Refer to the information in Exercise 7-20. In addition, assume each finished unit requires five pounds of raw materials and the company wants to end each month with raw materials inventory equal to 30% of next month’s production needs.

> Hospitable Co. provides the following sales forecast for the next four months: The company wants to end each month with ending finished goods inventory equal to 25% of next month’s sales. Finished goods inventory on April 1 is 190 uni

> The production budget for Manner Company shows units to be produced as follows: July, 620; August, 680; September, 540. Each unit produced requires two hours of direct labor. The direct labor rate is currently $20 per hour but is predicted to be $21 per

> Heart & Home Properties is developing a subdivision that includes 600 home lots. The 450 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 150 lots in the Hilltop section offer unobstructed views

> What is the difference between direct and indirect expenses?

> Fortune, Inc., is preparing its master budget for the first quarter. The company sells a single product at a price of $25 per unit. Sales (in units) are forecasted at 45,000 for January, 55,000 for February, and 50,000 for March. Cost of goods sold is $1

> The following information is available for Zetrov Company: a. The cash budget for March shows an ending bank loan of $10,000 and an ending cash balance of $50,000. b. The sales budget for March indicates sales of $140,000. Accounts receivable are expecte

> Kelsey is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for merchandise for the next three months follow: Sales are 20% cash and 80% on credit. All credit sales are collected in the month following the

> Castor, Inc. is preparing its master budget for the quarter ended June 30. Budgeted sales and cash payments for merchandise for the next three months follow: Sales are 50% cash and 50% on credit. All credit sales are collected in the month following th

> Assume that Polaris’s snowmobile division is charged with preparing a master budget. Identify the participants—for example, the sales manager for the sales budget—and describe the information each person provides in preparing the master budget.

> NSA Company produces baseball bats. Each bat requires 3 pounds of aluminum alloy. Management predicts that 8,000 bats and 15,000 pounds of aluminum alloy will be in inventory on March 31 of the current year and that 250,000 bats will be sold during this

> Does the manager of a Arctic Cat distribution center participate in long-term budgeting? Explain.

> Would a manager of an Apple retail store participate more in budgeting than a manager at the corporate offices? Explain.

> KTM regularly uses budgets. What is the difference between a production budget and a manufacturing budget?

> Piaggio prepares a cash budget. What is a cash budget? Why must operating budgets and the capital expenditures budget be prepared before the cash budget?

> The Trailer department of Baxter Bicycles makes bike trailers that attach to bicycles and can carry children or cargo. The trailers have a retail price of $200 each. Each trailer incurs $80 of variable manufacturing costs. The Trailer department has capa

> Access KTM’s income statement (in Appendix A) for the business year 2011. Required 1. Is KTM’s infrastructure and administration expense budget likely to be an important budget in its master budgeting process? Explain. 2. Identify three types of expense

> To help understand the factors impacting a sales budget, you are to visit three businesses with the same ownership or franchise membership. Record the selling prices of two identical products at each location, such as regular and premium gas sold at Chev

> Freshiisells fresh foods with a focus on healthy fare. Company founder Matthew Corrin stresses the importance of planning and budgeting for business success. Required 1. How can budgeting help Matthew Corrin efficiently develop and operate his business?

> Your team is to prepare a budget report outlining the costs of attending college (full- time) for the next two semesters (30 hours) or three quarters (45 hours). This budget’s focus is solely on attending college; do not include personal items in the tea

> Access information on e-budgets through The Manage Mentor: http://www.themanagementor.com/kuniverse/kmailers_universe/finance_kmailers/cfa/budgeting2.htmRead the information provided. Required 1. Assume the role of a senior manager in a large, multidivi

> The sales budget is usually the first and most crucial of the component budgets in a master budget because all other budgets usually rely on it for planning purposes. Required Assume that your company’s sales staff provides information on expected sales

> Both the budget process and budgets themselves can impact management actions, both positively and negatively. For instance, a common practice among not-for-profit organizations and government agencies is for management to spend any amounts remaining in a

> One source of cash savings for a company is improved management of inventory. To illustrate, assume that Polaris and Arctic Catboth have $1,000,000 per month in sales of one model of snowmobiles in Canada, and both forecast this level of sales per month

> Financial statements often serve as a starting point in formulating budgets. Review Polaris’s financial statements to determine its cash paid for acquisitions of property and equipment in the current year and the budgeted cash needed for such acquisition

> Refer to information in Exercise 9-8. Compute profit margin and investment turnover for each department. Which department generates the most net income per dollar of sales? Which department is most efficient at generating sales from average invested asse

> Adria Lopez is considering the purchase of equipment for Success Systems that would allow the company to add a new product to its computer furniture line. The equipment is expected to cost $300,000 and to have a six-year life and no salvage value. It wil

> If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an extra $6,000 at the end of the seventh year. What is the net present value of this investment assuming a required 10% retur

> Park Company is considering two alternative investments. The payback period is 3.5 years for investment A and 4 years for investment B. (1) If management relies on the payback period, which investment is preferred? (2) Why might Park’s analysis of thes

> Heels, a shoe manufacturer, is evaluating the costs and benefits of new equipment that would custom fit each pair of athletic shoes. The customer would have his or her foot scanned by digital computer equipment; this information would be used to cut the

> Siemens AG invests €80 million to build a manufacturing plant to build wind turbines. The company predicts net cash flows of €16 million per year for the next 8 years. Assume the company requires an 8% rate of return from its investments. (1) What is th

> Tinto Company is planning to invest in a project at a cost of $135,000. This project has the following expected cash flows over its three-year life: Year 1, $45,000; Year 2, $52,000; and Year 3, $78,000. Management requires a 10% rate of return on its in

> A company is considering investing in a new machine that requires a cash payment of $47,946 today. The machine will generate annual cash flows of $21,000 for the next three years. What is the internal rate of return if the company buys this machine?

> Comp-Media buys its product for $60 and sells it for $130 per unit. The sales staff receives a 10% commission on the sale of each unit. Its June income statement follows. COMP- MEDIA COMPANY Income Statement For Month Ended June 30, 2013 Sales . . . . .

> Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a net present value of cash flows of $1,100,000. Project 2 requires an initial investment of $3,500,000 and has a net present value of cas

> Peng Company is considering an investment expected to generate an average net income after taxes of $1,950 for three years. The investment costs $45,000 and has an estimated $6,000 salvage value. Compute the accounting rate of return for this investment;

> Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). (1) Compute return on investment for each department. Using return on investment, which department is most effi

> Freeman Brothers Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. What is the investment’s payback period?

> Retsa Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $800,000 and will yield the following expected cash flows. Management requires investments to have a payback period of tw

> Aster Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $800,000 and yield the following expected cash flows. Management requires investments to have a payback period of two yea

> Archer Foods has a freezer that is in need of repair and is considering whether to replace the old freezer with a new freezer or have the old freezer extensively repaired. Information about the two alternatives follows. Management requires a 10% rate of

> Grossman Corporation is considering a new project requiring a $30,000 investment in an asset having no salvage value. The project would produce $12,000 of pretax income before depreciation at the end of each of the next six years. The companyâ€

> Aikman Company has an opportunity to invest in one of two projects. Project A requires a $240,000 investment for new machinery with a four-year life and no salvage value. Project B also requires a $240,000 investment for new machinery with a three-year l

> Cortino Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $300,000 cost with an expected four-year life and a $20,000 salvage value. All sales are for cash and all costs are out

> Lenitnes Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $250,000 and will yield the following expected cash flows. Management requires investments to have a payback period of

> Connick Company sells its product for $22 per unit. Its actual and projected sales follow. All sales are on credit. Recent experience shows that 40% of credit sales is collected in the month of the sale, 35% in the month after the sale, 23% in the seco

> Sentinel Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $250,000 and will yield the following expected cash flows. Management requires investments to have a payback period of

> Hector Company reports the following: Payments for purchases are made in the month after purchase. Selling expenses are 10% of sales, administrative expenses are 8% of sales, and both are paid in the month of sale. Rent expense of $7,400 is paid monthl

> Interstate Manufacturing is considering either replacing one of its old machines with a new machine or having the old machine overhauled. Information about the two alternatives follows. Management requires a 10% rate of return on its investments. Altern

> Manning Corporation is considering a new project requiring a $90,000 investment in test equipment with no salvage value. The project would produce $66,000 of pretax income before depreciation at the end of each of the next six years. The companyâ&#

> Most Company has an opportunity to invest in one of two new projects. Project Y requires a $350,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $350,000 investment for new machinery with a three-year life

> Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $480,000 cost with an expected four-year life and a $20,000 salvage value. All sales are for cash, and all costs are out

> Refer to the information in Exercise 11-8. Create an Excel spreadsheet to compute the internal rate of return for each of the projects. Round the percentage return to two decimals. In Exercise 11-8 Following is information on two alternative investments

> Following is information on two alternative investments being considered by Jolee Company. The company requires a 10% return from its investments. For each alternative project compute the (a) net present value, and (b) profitability index. If the compa

> Phoenix Company can invest in each of three cheese-making projects: C1, C2, and C3. Each project requires an initial investment of $228,000 and would yield the following annual cash flows. (1) Assuming that the company requires a 12% return from its in

> B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $360,000 with a 6-year life and no salvage value. It will be depreciated on a straight-line basis. The compa

> Compute the payback period for each of these two separate investments (round the payback period to two decimals): a. A new operating system for an existing machine is expected to cost $520,000 and have a useful life of six years. The system yields an inc

> During the last week of March, Sony Stereo’s owner approaches the bank for a $80,000 loan to be made on April 1 and repaid on June 30 with annual interest of 12%, for an interest cost of $2,400. The owner plans to increase the store&aci

> You must prepare a return on investment analysis for the regional manager of Fast & Great Burgers. This growing chain is trying to decide which outlet of two alternatives to open. The first location (A) requires a $1,000,000 investment and is expected to

> Identify three usual time horizons for short-term planning and budgets.

> A machine can be purchased for $150,000 and used for 5 years, yielding the following net incomes. In projecting net incomes, double-declining balance depreciation is applied, using a 5-year life and a zero salvage value. Compute the machineâ€&

> Beyer Company is considering the purchase of an asset for $180,000. It is expected to produce the following net cash flows. The cash flows occur evenly throughout each year. Compute the payback period for this investment (round years to two decimals).

> This chapter explained two methods to evaluate investments using recovery time, the payback period and break-even time (BET). Refer to QS 11-8 and (1) compute the recovery time for both the payback period and break-even time, (2) discuss the advantage(

> After evaluating the risk of the investment described in Exercise 11-5, B2B Co. concludes that it must earn at least a 8% return on this investment. Compute the net present value of this investment. (Round the net present value to the nearest dollar.) I

> A machine costs $700,000 and is expected to yield an after-tax net income of $52,000 each year. Management predicts this machine has a 10-year service life and a $100,000 salvage value, and it uses straight-line depreciation. Compute this machine’s accou

> Polaris managers must select depreciation methods. Why does the use of the accelerated depreciation method (instead of straight line) for income tax reporting increase an investment’s value?

> Why is the present value of $100 that you expect to receive one year from today worth less than $100 received today? What is the present value of $100 that you expect to receive one year from today, discounted at 12%?

> If the present value of the expected net cash flows from a machine, discounted at 10%, exceeds the amount to be invested, what can you say about the investment’s expected rate of return? What can you say about the expected rate of return if the present v

> Why is an investment more attractive to management if it has a shorter payback period?

> Jessica Porter works in both the jewelry department and the hosiery department of a retail store. Porter assists customers in both departments and arranges and stocks merchandise in both departments. The store allocates Porter’s $30,000

> The management of Piaggio is planning to invest in a new companywide computerized inventory tracking system. What makes this potential investment risky?

> H20 Sports Company is a merchandiser of three different products. The company’s March 31 inventories are water skis, 40,000 units; tow ropes, 90,000 units; and life jackets, 150,000 units. Management believes that excessive inventories

> KTM is considering expanding a store. Identify three methods management can use to evaluate whether to expand.