Question: Net Play Company uses a job order

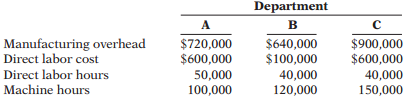

Net Play Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department A, direct labor hours in Department B, and machine hours in Department C.

In establishing the predetermined overhead rates for 2014, the following estimates were made for the year

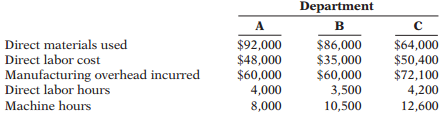

During January, the job cost sheets showed the following costs and production data.

Instructions:

(a) Compute the predetermined overhead rate for each department.

(b) Compute the total manufacturing costs assigned to jobs in January in each department.

(c) Compute the under- or overapplied overhead for each department at January 31.

Transcribed Image Text:

Department A B Manufacturing overhead Direct labor cost $720,000 $600,000 50,000 100,000 $640,000 $100,000 40,000 120,000 $900,000 $600,000 Direct labor hours Machine hours 40,000 150,000 Department А B $92,000 $48,000 $60,000 4,000 Direct materials used Direct labor cost $86,000 $35,000 $60,000 3,500 $64,000 $50,400 $72,100 4,200 Manufacturing overhead incurred Direct labor hours Machine hours 8,000 10,500 12,600

> What is the relevance of the classification of levels of activity to ABC?

> In what ways is the application of ABC to service industries the same as its application to manufacturing companies?

> Matt Litkee is confused about under- and overapplied manufacturing overhead. Define the terms for Matt, and indicate the balance in the manufacturing overhead account applicable to each term.

> Under what conditions is ABC generally the superior overhead costing system?

> How can the agreement of Work in Process Inventory and job cost sheets be verified?

> Peggy Turnbull asks your help in constructing a CVP graph. Explain to Peggy (a) how the break-even point is plotted, and (b) how the level of activity and dollar sales at the break-even point are determined.

> What is the theory of constraints? Provide some examples of possible constraints for a manufacturer.

> Explain the purpose and use of a “materials requisition slip” as used in a job order cost system.

> Adam Antal is confused. He does not understand why rent on his apartment is a fixed cost and rent on a Hertz rental truck is a mixed cost. Explain the difference to Adam.

> Faune Furniture Co. consists of two divisions, Bedroom Division and Dining Room Division. The results of operations for the most recent quarter are: (a) Determine the company’s sales mix. (b) Determine the company’s

> Huegel Hollow Resort has ordered 20 rotomolded kayaks from Current Designs. Each kayak will be formed in the rotomolded oven, cooled, and then the excess plastic trimmed away. Then, the hatches, seat, ropes, and bungees will be attached to the kayak. Dav

> J. P. Alexander claims that the relevant range concept is important only for variable costs. (a) Explain the relevant range concept. (b) Do you agree with J. P.’s claim? Explain.

> John Harbeck is confused about computing physical units. Explain to John how physical units to be accounted for and physical units accounted for are determined.

> Explain the preparation and use of a value-added/ non–value-added activity flowchart in an ABC system.

> What steps are involved in developing an activity based costing system?

> (a) What source documents are used in assigning (1) materials and (2) labor to production in a process cost system? (b) What criterion and basis are commonly used in allocating overhead to processes?

> (a) Scott Winter asks your help in understanding the term “activity index.” Explain the meaning and importance of this term for Scott. (b) State the two ways that variable costs may be defined.

> What has happened in recent industrial history to reduce the usefulness of direct labor as the primary basis for allocating overhead to products?

> What type of industry is likely to use a job order cost system? Give some examples.

> (a) Distinguish between the two types of cost accounting systems. (b) Can a company use both types of cost accounting systems?

> (a) Mary Barett is not sure about the difference between cost accounting and a cost accounting system. Explain the difference to Mary. (b) What is an important feature of a cost accounting system?

> Presented on the next page are variable costing income statements for Logan Company and Morgan Company. They are in the same industry, with the same net incomes, but different cost structures. Compute the break-even point in dollars for each company an

> Electricoil is a division of Meier Products Corporation. The division manufactures and sells an electric coil used in a wide variety of applications. During the coming year, it expects to sell 200,000 units for $9 per unit. Mark Barnes is the division ma

> FAB produces fabrics that are used for clothing and other applications. In 2013, the first year of operations, FAB produced 500,000 yards of fabric and sold 400,000 yards. In 2014, the production and sales results were exactly reversed. In each year, sel

> Peaches and Cream Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 16.25% of sales. The income statement for the year ending December 31, 2014, is shown below. The company i

> The following variable costing income statements are available for Lyte Company and Darke Company. Instructions: (a) Compute the break-even point in dollars and the margin of safety ratio for each company. (b) Compute the degree of operating leverage f

> The Eatery is a restaurant in DeKalb, Illinois. It specializes in deluxe sandwiches in a moderate price range. Michael Raye, the manager of The Eatery, has determined that during the last 2 years the sales mix and contribution margin ratio of its offerin

> Keppel Corporation manufactures and sells three different models of exterior doors. Although the doors vary in terms of quality and features, all are good sellers. Keppel is currently operating at full capacity with limited machine time. Sales and produc

> Huber Corporation has collected the following information after its first year of sales. Sales were $1,000,000 on 40,000 units; selling expenses $200,000 (30% variable and 70% fixed); direct materials $327,000; direct labor $190,000; administrative expen

> McCure Corporation had a bad year in 2013, operating at a loss for the first time in its history. The company’s income statement showed the following results from selling 200,000 units of product: net sales $2,400,000; total costs and e

> Mega Electronix carries no inventories. Its product is manufactured only when a customer’s order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2014, Mega’s break-even point was $2.4 million. On sales

> Isaac Corporation has collected the following information after its first year of sales. Sales were $1,800,000 on 100,000 units; selling expenses $400,000 (30% variable and 70% fixed); direct materials $456,000; direct labor $250,000; administrative expe

> Production costs chargeable to the Finishing Department in May at Kim Company are materials $8,000, labor $20,000, overhead $18,000, and transferred-in costs $67,000. Equivalent units of production are materials 20,000 and conversion costs 19,000. Kim us

> Alma Ortiz is the advertising manager for CostLess Shoe Store. She is currently working on a major promotional campaign. Her ideas include the installation of a new lighting system and increased display space that will add $18,000 in fixed costs to the $

> Olgivie Company had a bad year in 2013. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 60,000 units of product: sales $1,800,000; total costs and expens

> The Sasoon Barber Shop employs four barbers. One barber, who also serves as the manager, is paid a salary of $3,000 per month. The other barbers are paid $1,500 per month. In addition, each barber is paid a commission of $3 per haircut. Other monthly cos

> Smith and Jones is a law firm that serves both individuals and corporations. A controversy has developed between the partners of the two service lines as to who is contributing the greater amount to the bottom line. The area of contention is the assignme

> Merando Corporation produces two grades of wine from grapes that it buys from California growers. It produces and sells roughly 600,000 gallon jugs per year of a low-cost, high-volume product called Valley Fresh. Merando also produces and sells roughly 2

> Luxury Furniture designs and builds factory-made, premium, wood armoires for homes. All are of white oak. Its budgeted manufacturing overhead costs for the year 2014 are as follows. Overhead Cost Pools

> VideoPlus, Inc. manufactures two types of DVD players, a deluxe model and a standard model. The deluxe model is a multi-format progressive-scan DVD player with networking capability, Dolby digital, and DTS decoder. The standard model’s

> Swinn Company manufactures bicycles. Materials are added at the beginning of the production process, and conversion costs are incurred uniformly. Production and cost data for the month of May are as follows. Instructions: (a) Calculate the following. (

> Luxman Company has several processing departments. Costs charged to the Assembly Department for October 2014 totaled $1,298,400 as follows. Production records show that 25,000 units were in beginning work in process 40% complete as to conversion cost,

> Borman Corporation manufactures in separate processes refrigerators and freezers for homes. In each process, materials are entered at the beginning and conversion costs are incurred uniformly. Production and cost data for the first process in making two

> Using the data in BE16-10, prepare the cost section of the production cost report for Sanderson Company. Data in BE16-10: Sanderson Company has the following production data for March: no beginning work in process, units started and completed 30,000, an

> Steiner Corporation manufactures water skis through two processes: Molding and Packaging. In the Molding Department, fiberglass is heated and shaped into the form of a ski. In the Packaging Department, the skis are placed in cartons and sent to the finis

> Wilbury Company manufactures a nutrient, Everlife, through two manufacturing processes: Blending and Packaging. All materials are entered at the beginning of each process. On August 1, 2014, inventories consisted of Raw Materials $5,000, Work in Process—

> Holiday Company manufactures basketballs and soccer balls. For both products, materials are added at the beginning of the production process and conversion costs are incurred uniformly. Holiday uses the FIFO method to compute equivalent units. Production

> Venuchi Cleaner Company uses a weighted-average process cost system and manufactures a single product—an all-purpose liquid cleaner. The manufacturing activity for the month of March has just been completed. A partially completed produc

> Bell Company’s fiscal year ends on June 30. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1. On July 1, two jobs were in process: Job No. 4085 and Job

> Robert Perez is a contractor specializing in custom-built jacuzzis. On May 1, 2014, his ledger contains the following data. Raw Materials Inventory ……………

> For the year ended December 31, 2014, the job cost sheets of Dosey Company contained the following data. Other data: 1. Raw materials inventory totaled $20,000 on January 1. During the year, $100,000 of raw materials were purchased on account. 2. Finis

> Pedriani Company uses a job order cost system and applies overhead to production on the basis of direct labor hours. On January 1, 2014, Job No. 25 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct mat

> Dilithium Batteries is a division of Enterprise Corporation. The division manufactures and sells a long-life battery used in a wide variety of applications. During the coming year, it expects to sell 60,000 units for $30 per unit. Nyota Uthura is the div

> Sanderson Company has the following production data for March: no beginning work in process, units started and completed 30,000, and ending work in process 5,000 units that are 100% complete for materials and 40% complete for conversion costs. Sanderson

> Gardner Company produces plastic that is used for injection-molding applications such as gears for small motors. In 2013, the first year of operations, Gardner produced 4,000 tons of plastic and sold 2,500 tons. In 2014, the production and sales results

> Bonita Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 18% of sales. The income statement for the year ending December 31, 2014, is as follows. The company is consid

> The following CVP income statements are available for Viejo Company and Nuevo Company. Instructions: (a) Compute the break-even point in dollars and the margin of safety ratio for each company. (b) Compute the degree of operating leverage for each comp

> The Hillside Inn is a restaurant in Flagstaff, Arizona. It specializes in southwestern style meals in a moderate price range. Phil Weld, the manager of Hillside, has determined that during the last 2 years the sales mix and contribution margin ratio of i

> Tanek Industries manufactures and sells three different models of wet-dry shop vacuum cleaners. Although the shop vacs vary in terms of quality and features, all are good sellers. Tanek is currently operating at full capacity with limited machine time. S

> Lorge Corporation has collected the following information after its first year of sales. Sales were $1,500,000 on 100,000 units; selling expenses $250,000 (40% variable and 60% fixed); direct materials $511,000; direct labor $290,000; administrative expe

> Fredonia Inc. had a bad year in 2013. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 80,000 units of product: net sales $2,000,000; total costs and expe

> Kaiser Industries carries no inventories. Its product is manufactured only when a customer’s order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2014, Kaiser’s break-even point was $1.3 million. On sa

> Mozena Corporation has collected the following information after its first year of sales. Sales were $1,500,000 on 100,000 units; selling expenses $250,000 (40% variable and 60% fixed); direct materials $511,000; direct labor $290,000; administrative exp

> Dousmann Corp.’s sales slumped badly in 2014. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 500,000 units of product: sales $2,500,00

> Peine Candle Supply makes candles. The sales mix (as a percentage of total dollar sales) of its three product lines is birthday candles 30%, standard tapered candles 50%, and large scented candles 20%. The contribution margin ratio of each candle type is

> Telly Savalas owns the Bonita Barber Shop. He employs four barbers and pays each a base rate of $1,000 per month. One of the barbers serves as the manager and receives an extra $500 per month. In addition to the base rate, each barber also receives a com

> Polk and Stoneman is a public accounting firm that offers two primary services, auditing and tax-return preparation. A controversy has developed between the partners of the two service lines as to who is contributing the greater amount to the bottom line

> Benton Corporation produces two grades of wine from grapes that it buys from California growers. It produces and sells roughly 3,000,000 liters per year of a low-cost, high-volume product called CoolDay. It sells this in 600,000 5-liter jugs. Benton also

> Thakin Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are of white oak wood.

> Morse Company manufactures basketballs. Materials are added at the beginning of the production process and conversion costs are incurred uniformly. Production and cost data for the month of July 2014 are as follows. Instructions: (a) Calculate the foll

> Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2014 totaled $2,280,000 as follows. Production records show that 35,000 units were in beginning work in process 30% complete as to conversion costs

> Seagren Industries Inc. manufactures in separate processes furniture for homes. In each process, materials are entered at the beginning, and conversion costs are incurred uniformly. Production and cost data for the first process in making two products in

> Rosenthal Company manufactures bowling balls through two processes: Molding and Packaging. In the Molding Department, the urethane, rubber, plastics, and other materials are molded into bowling balls. In the Packaging Department, the balls are placed in

> Conwell Company manufactures its product, Vitadrink, through two manufacturing processes: Mixing and Packaging. All materials are entered at the beginning of each process. On October 1, 2014, inventories consisted of Raw Materials $26,000, Work in Proces

> Rondeli Company manufactures bicycles and tricycles. For both products, materials are added at the beginning of the production process, and conversion costs are incurred uniformly. Rondeli Company uses the FIFO method to compute equivalent units. Product

> Curtis Rich, the cost accountant for Hi-Power Mower Company, recently installed activitybased costing at Hi-Power’s St. Louis lawn tractor (riding mower) plant where three models—the 8-horsepower Bladerunner, the 12-horsepower Quickcut, and the 18-horsep

> Hamilton Processing Company uses a weighted-average process cost system and manufactures a single product—a premium rug shampoo and cleaner. The manufacturing activity for the month of October has just been completed. A partially comple

> Rodman Corporation’s fiscal year ends on November 30. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1. On December 1, two jobs were in process: Job No.

> Agassi Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department D, direct labor hours in Department E, and machine hours in Department K

> Stellar Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2014, the general ledger for Stellar Inc. contains the following d

> For the year ended December 31, 2014, the job cost sheets of Cinta Company contained the following data Other data: 1. Raw materials inventory totaled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account. 2. Finis

> Degelman Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2014, Job No. 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct mat

> The June 8, 2009, edition of the Wall Street Journal has an article by JoAnn Lublin entitled “Smart Balance Keeps Tight Focus on Creativity.” Instructions: Read the article and answer the following questions. (a) Describe Smart Balance’s approach to emp

> The external financial statements published by publicly traded companies are based on absorption cost accounting. As a consequence, it is very difficult to gain an understanding of the relative composition of the companies’ fixed and variable costs. It i

> In a recent report, the Del Monte Foods Company reported three separate operating segments: consumer products (which includes a variety of canned foods including tuna, fruit, and vegetables); pet products (which includes pet food and snacks and veterinar

> For nearly 20 years, Specialized Coatings has provided painting and galvanizing services for manufacturers in its region. Manufacturers of various metal products have relied on the quality and quick turnaround time provided by Specialized Coatings and it

> Hamby Inc. has sales of $2,000,000 for the first quarter of 2014. In making the sales, the company incurred the following costs and expenses. Prepare a CVP income statement for the quarter ended March 31, 2014. Variable Fixed Cost of goods sold Sel

> E-Z Seats manufactures swivel seats for customized vans. It currently manufactures 10,000 seats per year, which it sells for $500 per seat. It incurs variable costs of $200 per seat and fixed costs of $2,000,000. It is considering automating the upholste

> Current Designs manufactures two different types of kayaks, rotomolded kayaks and composite kayaks. The following information is available for each product line. The company’s fixed costs are $820,000. An analysis of the sales mix identifies that rotomol

> The May 21, 2010, edition of the Wall Street Journal includes an article by Jeffrey Trachtenberg entitled “E-Books Rewrite Bookselling.” Instructions: Read the article and answer the following questions. (a) What aspect of Barnes and Noble’s current str

> The Coca-Cola Company hardly needs an introduction. A line taken from the cover of a recent annual report says it all: If you measured time in servings of Coca-Cola, “a billion CocaCola’s ago was yesterday morning.” On average, every U.S. citizen drinks

> The condensed income statement for the Peri and Paul partnership for 2014 is as follows. A cost behavior analysis indicates that 75% of the cost of goods sold are variable, 42% of the selling expenses are variable, and 40% of the administrative expense

> Creative Ideas Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufa

> Bill Johnson, sales manager, and Diane Buswell, controller, at Current Designs are beginning to analyze the cost considerations for one of the composite models of the kayak division. They have provided the following production and operational costs neces

> Activity-based costing methods are constantly being improved upon, and many websites discuss suggestions for improvement. The article in this activity outlines an alternative perspective on activity-based costing. Address: http://hbswk.hbs.edu/item/4587.

> An article in Cost Management, by Kocakulah, Bartlett, and Albin entitled “ABC for Calculating Mortgage Loan Servicing Expenses” (July/August 2009, p. 36), discusses a use of ABC in the financial services industry. Instructions: Read the article and ans

> Ideal Manufacturing Company of Sycamore, Illinois, has supported a research and development (R&D) department that has for many years been the sole contributor to the company’s new farm machinery products. The R&D activity is an

> Weisman, Inc. uses activity-based costing as the basis for information to set prices for its six lines of seasonal coats. Compute the activity-based overhead rates using the following budgeted data for each of the activity cost pools. Expected Use o

> East Valley Hospital is a primary medical care facility and trauma center that serves 11 small, rural midwestern communities within a 40-mile radius. The hospital offers all the medical/surgical services of a typical small hospital. It has a staff of 18

> As you learned in previous chapters, Current Designs has two main product lines— composite kayaks, which are handmade and very labor-intensive, and rotomolded kayaks, which require less labor but employ more expensive equipment. Current