Question: NIU Company's budgeted sales and direct

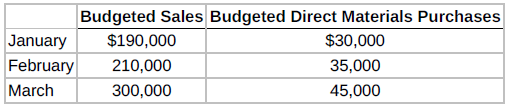

NIU Company's budgeted sales and direct materials purchases are as follows:

Prepare schedules of expected collections and payments.

NIU's sales are 40% cash and 60% credit. It collects credit sales 10% in the month of sale, 50% in the month following sale, and 36% in the second month following sale; 4% are uncollectible. NIU's purchases are 50% cash and 50% on account. It pays purchases on account 60% in the month of purchase, and 40% in the month following purchase.

Instructions

a. Prepare a schedule of expected collections from customers for March.

b. Prepare a schedule of expected payments for direct materials for March.

Transcribed Image Text:

Budgeted Sales Budgeted Direct Materials Purchases January $190,000 $30,000 February 210,000 35,000 March 300,000 45,000

> Milberg Co. uses absorption costing and standard costing to improve cost control. Calculate variances. In 2020, the total budgeted overhead rate was $1.55 per direct labour hour. When preparing the budget, Milberg expected a monthly activity level of 10,

> Sasha Clothiers is a small company that manufactures oversize suits. The company uses a standard cost accounting system. In May 2020, it produced 11,200 suits. Calculate variances and identify significant variances. The following standard and actual cost

> Ranier Corporation manufactures a single product. The standard cost per unit of the product is shown below: Calculate variances. Direct materials—1.5 kg of plastic at $8 per kilogram ………….. $12.00 Direct labour—2 hours at $15 per hour ………………………………... 30

> Finesse Company manufactures tablecloths. Sales have grown rapidly over the past two years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget

> Oakley Company estimates that 360,000 direct labour hours will be worked in the packaging department during 2020. Based on that, it has calculated the following budgeted manufacturing overhead cost data for the year. Prepare a flexible budget and budget

> Return on investment is often expressed as follows: Compare and contrast performances under ROI and residual income. Instructions a. Explain the advantages of breaking down the ROI calculation into two separate components. 1. Comparative data on three c

> The Big Boy Company is in a seasonal business and prepares quarterly budgets. Its fiscal year runs from July 1 through June 30. Production occurs only in the first quarter (July to September), but sales take place throughout the year. The sales forecast

> The following data are for the operations of Zoë's Fashion Footwear Ltd., a retail store: Prepare a merchandise purchases budget and a budgeted income statement. 1. Sales Forecast—2020 April …………………. $70,000 May …………………… 60,000 June …………………. 80,000 July

> Litwin Industries had sales in 2019 of $5.6 million (800,000 units) and a gross profit of $1,344,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Prepare sales and production budgets and calculate the cost

> Mega Company is considering the purchase of a new machine. The invoice price of the machine is $75,000, freight charges are estimated to be $4,000, and installation costs are expected to be $6,000. The annual cost savings are expected to be $20,000 for 1

> Quinn Ltd. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants provide the following data: Prepare sales, production, direct materials, direct labour, and income statement budgets.. An accounting assistant has p

> Wahlen Farm Supply Company manufactures and sells a pesticide called Basic II. The following data are available for preparing budgets for Basic II for the first two quarters of 2020. Prepare a budgeted income statement and supporting budgets. 1. Sales: Q

> Platteville Eye Clinic is considering investing in new optical-scanning equipment. It has two options: Option A would have an initial lower cost but would require a significant expenditure for rebuilding after three years. Option B would require no rebui

> ICA Corporation is reviewing an investment proposal. The schedule below presents the initial cost and estimates of the investment’s book value at the end of each year, the net cash flows for each year, and the net income for each year.

> Aqua Tech Testing is considering investing in a new testing device. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after five years. Option B would require no rebuilding expenditur

> Benjamin Corp. is thinking about opening a hockey camp in Barrie, Ontario. In order to start the camp, the company would need to purchase land and build four ice rinks and a dormitory-type sleeping and dining facility to house 110 players. Each year, the

> The Fort McMurchy Sanitation Company is considering the purchase of a garbage truck. The $77,000 price tag for a new truck would represent a major expenditure for the company. Kalia Vang, owner of the company, has compiled the following estimates in tryi

> Vorteck Inc. manufactures snowsuits. Vorteck is considering purchasing a new sewing machine at a cost of $2.5 million. Its existing machine was purchased five years ago at a price of $1.8 million, and six months ago Vorteck spent $55,000 to keep it opera

> A company currently sells 850,000 units per year of a product to one customer at a price of $0.80 per unit. The customer requires that the product be exclusive and expects no increase in sales during the next year. The product is manufactured with a mach

> K&M International is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Depreciation is $20,000 per year for the old equipmen

> Pagley Company’s standard labour cost of producing one unit of product DD is four hours at the rate of $12.00 per hour. During August, 40,800 hours of labour are incurred at a cost of $12.10 per hour to produce 10,000 units of product DD. Calculate labou

> Biotec Inc. wants to replace its R&D equipment with new high-tech equipment. The existing equipment was purchased five years ago at a cost of $150,000. At that time, the equipment had an expected life of 10 years, with no expected salvage value. The equi

> The partnership of Lou and Bud is considering three long-term capital investment proposals. Relevant data on each project are as follows: The salvage value is expected to be zero at the end of each project. Depreciation is calculated by the straight-li

> Azim Electronics Inc. reported a cost of goods sold of $900,000 last year, when it produced and sold 25,000 units. The cost of goods sold was 25% materials, 65% direct labour, and 10% overhead. The company is considering the purchase of a machine costing

> Bonita Corp. is thinking about opening a soccer camp in southern Ontario. In order to start the camp, the company would need to purchase land and build four soccer fields and a dormitory-type sleeping and dining facility to house 150 soccer players. Each

> Berens River Clinic is considering investing in new heart monitoring equipment. It has two options: Option A would have an initial lower cost but would require a significant expenditure for rebuilding after four years. Option B would require no rebuildin

> Prestige Auto Care is considering the purchase of a new tow truck. The garage currently has no tow truck, and the $60,000 price tag for a new truck would be a major expenditure for it. Jenna Lind, owner of the garage, has compiled the following estimates

> MCA Corporation is reviewing an investment proposal. The schedule below presents the initial cost and estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year. All cash flow

> Magenta Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Calculate the payback period, annual rate of return, and net pre

> ALGS Ltd. wants to purchase a new machine for $30,000, excluding $1,500 in installation costs. The old machine was bought five years ago and had an expected economic life of 10 years without salvage value. This old machine now has a book value of $2,000

> The Three Stages partnership is considering three long term capital investment proposals. Each investment has a useful life of five years. Relevant data on each project are as follows: Calculate the annual rate of return and net present value, and apply

> The standard cost of product B manufactured by Bhaskara Company includes three units of direct materials at $5.00 per unit. During June, the company purchases 29,000 units of direct materials at a cost of $4.70 per unit and uses 29,000 units of direct ma

> K&G Company currently sells 1 million units per year of a product to one customer at a price of $3.80 per unit. The customer requires that the product be exclusive and expects no increase in sales during the five year contract. The company manufactures t

> Madden Limited is the largest Canadian producer of dairy products. The company needs to replace its equipment. The current equipment was purchased 18 years ago at a cost of $2 million, and it was depreciated over a 20-year period using the straight-line

> Saskatoon First Company must expand its manufacturing capabilities to meet the growing demand for its products. The first alternative is to expand its current manufacturing facility, which is located next to a vacant lot in the heart of the city. The sec

> The Taylor Company Limited reported a cost of goods sold of $640,000 last year, when 20,000 units were produced and sold. The cost of goods sold was 35% materials, 42% direct labour, and 23% overhead. The company is considering the purchase of a machine

> BioFarm Inc. wants to replace its current equipment with new high-tech equipment. The existing equipment was purchased five years ago at a cost of $120,000. At that time, the equipment had an expected life of 10 years, with no expected salvage value. The

> Pronto Plumbing Company is a newly formed company that specializes in plumbing services for home and business. The owner, Paul Pronto, had divided the company into two segments: home plumbing services and business plumbing services. Each segment is run b

> As sales manager, Kajsa Keyser was given the following static budget report for selling expenses in the clothing department of Dunham Company for the month of October: Prepare and discuss a flexible budget report. / / As a result of this budget report,

> Sublette Company's manufacturing overhead budget for the first quarter of 2020 contained the following data: Prepare a flexible budget report and a responsibility report for manufacturing overhead. Actual variable costs were as follows: indirect materi

> The actual selling expenses incurred in March 2020 by Vincent Company are as follows: Prepare flexible budget reports for selling expenses. / / Instructions a. Prepare a flexible budget performance report for March using the budget data in E11.21, assu

> Vincent Company uses flexible budgets to control its selling expenses. Monthly sales are expected to range from $170,000 to $200,000. Variable costs and their percentage relationship to sales are as follows: sales commissions 6%; advertising 4%; travelli

> Muhsin Company has gathered the following information about its product: Direct materials: Each unit of product contains 4.5 kg of materials. The average waste and spoilage per unit produced under normal conditions is 0.5 kg. Materials cost $5 per kilogr

> Using the information in E11.19, assume that in July 2020, Raney Company incurs the following manufacturing overhead costs: Prepare flexible budget reports for manufacturing overhead costs, and comment on findings. Instructions a. Prepare a flexible bu

> Raney Company uses a flexible budget for manufacturing overhead that is based on direct labour hours. The variable manufacturing overhead costs per direct labour hour are as follows: Prepare flexible budget reports for manufacturing overhead costs. Indi

> Pargo Company budgeted selling expenses of $30,000 in January, $35,000 in February, and $40,000 in March. Actual selling expenses were $31,200 in January, $34,525 in February, and $46,000 in March. Prepare and evaluate a static budget report. Instructio

> Jim Thome has prepared the following list of statements about budgetary control. Understand the concept of budgetary control. 1. Budget reports compare actual results with planned objectives. 2. All budget reports are prepared on a weekly basis. 3. Manag

> In May 2020, the budget committee of Big Jim Stores assembles the following data for preparing the merchandise purchases budget for the month of June: Prepare a purchases budget and budgeted income statement for a merchandiser. 1. Expected sales: June $5

> Pisani Dental Clinic is a medium-sized dental service specializing in family dental care. The clinic is currently preparing the budget for the first two quarters of 2020. It still needs to do only the cash budget. It has collected the following informati

> Lockwood Company combines its operating expenses for budget purposes in a selling and administrative expenses budget. For the first six months of 2020, the following data are available: Prepare a selling and administrative expenses budget for two quarter

> Keyser Company is preparing its manufacturing overhead budget for 2020. Relevant data are as follows: Prepare a manufacturing overhead budget for the year. 1. Units to be produced (by quarters): 10,000, 12,000, 15,000, 18,000 2. Direct labour: 1.5 hours

> Pacer Inc. is preparing its direct labour budget for 2020 from the following production budget for a full calendar year: Prepare a direct labour budget. Each unit requires 1.5 hours of direct labour. Instructions Prepare a direct labour budget for 202

> Raul Mondesi manufactures and sells homemade wine, and he wants to develop a standard cost per litre. The following are required for production of a 200-litre batch: 90 litres of grape concentrate at $1.35 per litre 27 kg of granulated sugar at $0.60 per

> Marley Company installed a standard cost system on January 1. Selected transactions for the month of January are as follows: 1. Purchased 24,000 units of raw materials on account at a cost of $4.50 per unit. Standard cost was $4.30 per unit. 2. Issued 24

> Data for Rondell Company are given in E12.30. Instructions a. Journalize the incurrence of the overhead costs and the application of overhead to the job, assuming a standard cost accounting system is used. b. Prepare the adjusting entry for the overhead

> Data for Kopecky Inc. are given in E12.23. Instructions Journalize the entries to record the materials and labour variances. Data from E12.23: Kopecky Inc., which produces a single product, has prepared the following standard cost sheet for one unit of

> Tovar Company uses a standard cost accounting system. Some of the ledger accounts have been destroyed in a fire. The controller asks for your help in reconstructing some missing entries and balances. Instructions a. Materials Price Variance shows a $3,0

> The following is a list of terms related to performance evaluation: 1. Balanced scorecard 2. Variance 3. Learning and growth perspective 4. Non-financial measures 5. Customer perspective 6. Internal process perspective 7. Ideal standards 8. Normal standa

> Carlos Company uses a standard cost accounting system. During January, the company reported the following manufacturing variances: In addition, 8,000 units of product were sold at $8 per unit. Each unit sold had a standard cost of $5. Selling and admin

> Archangel Corporation prepared the following variance report. / / Instructions Fill in the appropriate amounts or letters for the question marks in the report. Prepare an income statement for management.

> Imperial Landscaping plants grass seed as basic landscaping for business terrains. During a recent month, the company worked on three projects (Ames, Korman, and Stilles). The company is interested in controlling its material costs—grass seed costs—for t

> Jay Levitt Company budgeted the following cost standards for the current year: Direct materials (2 kg of plastic at $5 per kilogram) ………….. $10.00 Direct labour (2 hours at $12 per hour) ………………………………. 24.00 Variable manufacturing overhead ……………………………………

> Environmental Landscaping Inc. is preparing its budget for the first quarter of 2020. The next step is to prepare a cash receipts schedule and a cash payments schedule. The following information has been collected: Prepare schedules for cash receipts and

> Lovitz Company is planning to produce 2,000 units of a product in 2020. Each unit requires 3 kg of materials at $5 per kilogram and a half hour of labour at $15 per hour. The overhead rate is 70% of direct labour. Calculate budgeted amounts and standard

> Rondell Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labour hour. The overhead rate is based on 10,000 hours. Actual results were: Standard direct labour hours allowed …... 9,000 Actual direct labour

> Jackson Company’s overhead rate was based on estimates of $200,000 for overhead costs and 20,000 direct labour hours. Jackson’s standards allow two hours of direct labour per unit produced. Production in May was 900 units, and actual overhead incurred i

> Pink Martini Corporation is projecting a cash balance of $30,000 in its December 31, 2019, balance sheet. Pink Martini's schedule of expected collections from customers for the first quarter of 2020 shows total collections of $180,000. The schedule of ex

> The loan department of Your Local Bank uses standard costs to determine the overhead cost of processing loan applications. During the current month, a fire occurred, and the accounting records for the department were mostly destroyed. The following data

> Nunez Company expects to have a cash balance of $45,000 on January 1, 2020. Relevant monthly budget data for the first two months of 2020 are as follows: Prepare a cash budget for two months. 1. Collections from customers: January $100,000; February $160

> The following information was taken from the annual manufacturing overhead cost budget of Fernetti Company: Variable manufacturing overhead costs …………………………. $34,650 Fixed manufacturing overhead costs ……………………………. $19,800 Normal production level in labo

> Haven Company has accumulated the following budget data for the year 2020: Prepare a budgeted income statement for the year. 1. Sales: 30,000 units; unit selling price $80 2. Cost of one unit of finished goods: direct materials, 2 kg at $5 per kilogram;

> The following direct materials and direct labour data are for the operations of Batista Manufacturing Company for the month of August: Instructions a. Calculate the total, price, and quantity variances for materials and labour. b. Provide two possible

> Tyson Chandler Company's sales budget projects unit sales of part 198Z of 10,000 units in January, 12,000 units in February, and 13,000 units in March. Each unit of part 198Z requires 2 kg of materials, which cost $3 per kilogram. Tyson Chandler Company

> During March 2020, Garner Tool & Die Company worked on four jobs. A review of the direct labour costs reveals the following summary data: Prepare a variance report for direct labour. Analysis reveals that Job A257 was a repeat job. Job A258 was a r

> Black Rose Company has always done some planning for the future, but the company has never prepared a formal budget. Now that the company is growing larger, it is considering preparing a budget. Explain the concept of budgeting. Instructions Write a mem

> Buerhle Company purchased (at a cost of $12,800) and used 3,300 kg of materials during May. Buerhle’s standard cost of materials per unit produced is based on 2 kg per unit at a cost $4 per kilogram. Production in May was 1,540 units. Instructions a. Ca

> Kopecky Inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product: Direct materials (6 kg at $2.50 per kilogram) ……………………… $15.00 Direct labour (3.1 hours at $12 per hour) …………………………….. $37.20 Dur

> Rapid Repair Services Inc. is trying to establish the standard labour cost of a typical oil change. The following data have been collected from time and motion studies conducted over the past month: Actual time spent on the oil change …………………………. 1.0 ho

> Électronique Instruments, a rapidly expanding electronic parts distributor, is formulating its plans for 2020. John Kedrowski, the firm's director of marketing, has completed his 2020 forecast and is confident that the company will meet or exceed sales e

> You have received a promotion and are now the manager of the Lakeview Lounge at the hotel where you have been working for some time. The Lakeview Lounge provides alcoholic and non-alcoholic drinks, plus a range of light snacks during the day when the hot

> Canadian Products Corporation participates in a highly competitive industry. To compete successfully and reach its profit goals, the company has chosen the decentralized form of organization. The company evaluates each manager of a decentralized investme

> A company operates five different plants, located in Vancouver, Edmonton, Toronto, Montreal, and Halifax. The total company operating income is $1,900,275. The following information was collected for each location: Instructions a. Determine which plant

> The performance of the division manager of Rarewood Furniture is measured by the ROI, defined as divisional segment income divided by the gross book value of total divisional assets. For existing operations, the division's projections for the coming year

> Raddington Industries produces tool and die machinery for manufacturers. In 2010, the company acquired one of its suppliers of alloy steel plates, Reigis Steel Company. In order to manage the two separate businesses, the operations of Reigis are reported

> Madison Company purchased the Tek Company three years ago. Before the acquisition, Tek manufactured and sold plastic products to various customers. Tek has since become a division of Madison and now manufactures plastic Tek products only for products mad

> On January 1, 2021, the Chinlee Company budget committee reached agreement on the following data for the six months ending June 30, 2021: Prepare production and direct materials budgets by quarters for six months. 1. Sales units: First quarter 5,000; sec

> In this chapter, you learned about the benefits of budgeting for a business. It is also important for individuals, especially students. Jo is an accounting major. Jo's estimate of expenses for the next eight-month academic year (September to May) are giv

> You are an accountant in the budgetary, projections, and special projects department of Cross Canada Inc., a large manufacturing company. The president, Karim Bousalloum, asks you on very short notice to prepare some sales and income projections covering

> In 2013, CPA Canada was established with the goal of uniting the three accounting designations—CA, CGA, and CMA—into one designation: the CPA, or Chartered Professional Accountant. Each province and territory has the authority to regulate the accounting

> At Camden Manufacturing Company, production workers in the painting department are paid based on productivity. The labour time standard for a unit of production is established through periodic time studies conducted by Foster Management Inc. In a time st

> Delta Manufacturing Company uses a standard cost system in accounting for the cost of its main product. The following standards have been established for the direct manufacturing costs per unit: Direct materials (2 kg at $7.50 per kilogram) …………… $15.00

> The Kohler Chemical Manufacturing Company produces two primary chemical products to be used as base ingredients for a variety of products. The 2020 budget for the two products (in thousands) was as follows: // The following planning assumptions were us

> You have started working as a cost accountant for a firm that has only been in business for one month. The firm is able to buy a new type of biodegradable plastic at a fixed price of $100 per roll. The plastic is then cut and sealed to make garbage bags.

> Mo Coughlin and Associates is a medium-sized company located near a large metropolitan area in the Prairies. The company manufactures cabinets of mahogany, oak, and other fine woods for use in expensive homes, restaurants, and hotels. Although some of th

> Agmar Professionals, a management consulting firm, specializes in strategic planning for financial institutions. Tim Agler and Padmasree Marlin, partners in the firm, are assembling a new strategic planning model for clients to use. The model is designed

> The manufacturing overhead budget for Dillons Company contains the following items: Variable expenses ……………………………………. Indirect materials …………………….. $24,000 Indirect labour ……………………………. 12,000 Maintenance expenses ……………….. 10,000 Manufacturing supplies …

> Samano Industries has adopted the following production budget for the four quarters of 2020: Prepare a direct materials purchases budget. Each unit requires 4 kg of raw materials costing $6 per kilogram. On December 31, 2019, the ending raw materials i

> At the end of June, the manager of the B.C. manufacturing plant was provided with the following variance analysis report. The manager immediately called the production supervisor, demanding an explanation for the large unfavourable variance for the qua

> In 2013, only 26% of Americans had confidence in U.S. banks, which is still far below the pre-recession level of 41% reported in June 2007 (www.gallup.com, June 26, 2014). a. What is the probability that fewer than half of four Americans in 2013 have con

> The director of graduate admissions at a large university is analyzing the relationship between scores on the math portion of the Graduate Record Examination (GRE) and subsequent performance in graduate school, as measured by a student’s grade point aver