Question:

(Note: This is the same Problem as Problem 7-4, but assuming the use of the partial equity method.)

Prout Company owns 80% of the common stock of Sexton Company. The stock was purchased for $1,600,000 on January 1, 2012, when Sexton Company’s retained earnings were $800,000. On January 1, 2014, Prout Company sold fixed assets to Sexton Company for $360,000. These assets were originally purchased by Prout Company for $400,000 on January 1, 2004, at which time their estimated depreciable life was 25 years. The straight-line method of depreciation is used.

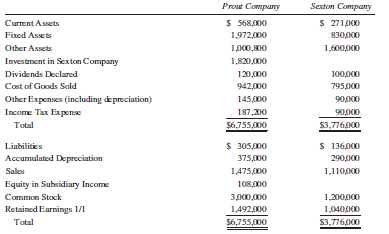

On December 31, 2015, the trial balances of the two companies were as shown here:

Required:

A. Prepare a consolidated statements workpaper for the year ended December 31, 2015.

B. Assuming that on January 1, 2016, Sexton Company sells the fixed assets purchased from Prout Company to a party outside the affiliated group for $300,000:

(1) Prepare the entry that would have been entered on the books of Sexton Company to record the sale.

(2) Prepare entries for the December 31, 2016, consolidated statements workpaper necessitated by the sale of the assets.

(3) Prepare any workpaper entries that will be needed in the December 31, 2017, consolidated statements workpaper in regard to these fixed assets.

Transcribed Image Text:

Prout Company Sexton Company $ 568,(00 S 271,000 Current Assets Fixed Asets 1,972,000 830,000 Other Assets 1,000,800 1,600,000 Investment in Sexton Company 1,820,000 Dividends Declared 120,000 100,000 Cost of Goods Sold 942,000 795,000 Other Expenses (including de preciation) Income Tax Expense 145,000 90,000 187,200 $6,755,000 90,000 $3.776000 Total $ 305,000 S 136,000 Liabilities Accumulated Depreciation 37500 290,000 Sales 1,475,000 1,110,000 Equity in Subsidiary Income 108,000 Common Stock 3,000,000 1,200,000 Retained Earnings 1/1 1,492,000 $6,755000 1,040,000 $3,776000 Total

> Define the controlling interest in consolidated net income using the t-account or analytical approach.

> What is the essential procedural difference between workpaper eliminating entries for unrealized intercompany profit made when the selling affiliate is a less than wholly owned subsidiary and those made when the selling affiliate is the parent company or

> From a consolidated point of view, when should profit be recognized on intercompany sales of depreciable assets? Nondepreciable assets?

> A balance sheet for Bran Company on June 30, 2015, the date Jim Brown was appointed trustee, is presented here: The following information concerning the period from June 30, 2015, to December 31, 2015, is also available: 1. All Bran Companyâ€

> Why are adjustments made to the calculation of the noncontrolling interest for the effects of intercompany profit in upstream but not in downstream sales?

> Are the adjustments to the noncontrolling interest for the effects of intercompany profit eliminations illustrated in this text necessary for fair presentation in accordance with generally accepted accounting principles? Explain.

> What is the essential procedural difference between workpaper eliminating entries for unrealized intercompany profit when the selling affiliate is a less than wholly owned subsidiary and such entries when the selling affiliate is the parent company or a

> Why is the gross profit on intercompany sales, rather than profit after deducting selling and administrative expenses, ordinarily eliminated from consolidated inventory balances?

> Does the elimination of the effects of intercompany sales of merchandise always affect the amount of reported consolidated net income? Explain.

> Parson Industries purchased 80% of the common stock of Succo Company on January 1, 2013, for $300,000 when Succo Company’s capital consisted of common stock of $200,000, preferred stock of $100,000, other contributed capital of $50,000, and retained earn

> P Company owns 80% of S Company’s common stock (cost $650,000) and 20% of its preferred stock (cost $50,000). Both interests were acquired on January 1, 2012. On the date of purchase, S Company’s stockholdersâ

> PAL Corporation acquired 40% of the outstanding preferred stock of Saltz, Inc. for $60,000 and 90% of that firm’s outstanding common stock for $600,000 on January 1, 2013. On the date that the controlling interest was acquired, the stoc

> On January 1, 2009, Pabst Company acquired 80% of Secor Company’s common stock and 30% of Secor Company’s 10% preferred stock. Pabst Company paid $680,000 for the common stock and $135,000 for the preferred stock. The

> Prost Company has filed a bankruptcy petition. Its account balances at December 31, 2015, are presented here: The following additional information is available: 1. All notes receivable with the exception of one for $2,500 are expected to be collected.

> Condensed financial information for Prince Company and South Company follows: Prince Company purchased 80% of South Company’s common stock for $1,000,000 at the beginning of 2013 and uses the partial equity method to account for the i

> On January 1, 2013, Pasta Company purchased an 80% interest in Salsa Company for $152,000. On this date, Salsa Company reported capital stock and retained earnings of $100,000 and $90,000, respectively. During 2013, Salsa Company reported net income of $

> Prezo Company purchased 80% of Satz Company’s common stock for $880,000 on January 2, 2012. Condensed financial information for Prezo Company and Satz Company is given below. // On July 1, 2012, Prezo Company purchased 60% of Satz Company’s bonds for $

> Prezo Company purchased 80% of Satz Company’s common stock for $880,000 on January 2, 2014. Condensed financial information for Prezo Company and Satz Company is given below. On July 1, 2014, Prezo Company purchased 60% of Satz Compan

> On January 1, 2009, Pace Corporation issued $500,000 par value, 10-year, 15% bonds. Interest is payable each June 30 and December 31. On January 1, 2012, Supra Corporation, a 90%-owned subsidiary, purchased on the open market all of the parent company bo

> On January 1, 2013, Purdy Company acquired 84% of the capital stock of Sally Company for $840,000. On that date, Sally Company’s stockholders’ equity was: Capital Stock, $20 par $600,000 Other Contributed Capital 200,000 Retained Earnings 160,000 Total $

> Pryor Company acquired 51,000 shares of Spero Company’s common stock on January 1, 2013, for $400,000 when Spero Company had common stock ($5 par) of $300,000 and retained earnings of $200,000. On January 1, 2015, Spero Company issued 7,500 additional s

> On January 1, 2014, Plum Company made an open-market purchase of 30,000 shares of Spivey Company common stock for $122,000. At that time, Spivey Company had common stock ($2 par) of $600,000 and retained earnings of $240,000. On July 1, 2014, an addition

> (Note: This is the same problem as Problem 8-4, but assuming use of the complete or the partial equity method.) Trial balances for Porter Company and its subsidiary, Spitz Company, as of December 31, 2014, follow: Porter Company made the following open

> (Note: This is the same problem as Problem 8-3, but assuming use of the complete or the partial equity method.) The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the followin

> On February 1, 2015, Clover Company filed a petition for reorganization under the bankruptcy statutes. The court approved the plan on September 1, 2015, including the following provisions: 1. Unsecured creditors of open accounts amounting to $71,600 are

> Trial balances for Porter Company and its subsidiary, Spitz Company, as of December 31, 2014, follow: Porter Company made the following open-market purchase and sale of Spitz Company common stock: January 1, 2010, purchased 45,000 shares for $135,000;

> The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2012, purchased 51,000 shares, cost $5

> The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2012, purchased 51,000 shares (85% of

> This is a continuation of Problem 8-14. Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2014, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Requ

> Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2013, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Any difference between implied and book val

> This is a continuation of Problem 8-12. Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2014, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Requ

> Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2013, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Any difference between implied and book valu

> The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2012, purchased 51,000 shares (85% of

> On January 2, 2013, Pullen Company purchased, on the open market, 135,000 shares of Souza Company common stock for $665,000. At that time, Souza Company had common stock ($2 par value) of $300,000 and retained earnings of $400,000. On May 1, 2014, Pullen

> Sarko Company had 300,000 shares of $10 par value common stock outstanding at all times, and retained earnings balances as indicated here: Pelzer Company acquired Sarko Company stock through open-market purchases as follows: Sarko Company declared no

> A receiver was appointed by the court to manage the affairs of Davis Manufacturing Company on March 31, 2015. On this date, the following balance sheet applied: Additional Information: 1. The cash account includes a $500 travel advance that has been sp

> Using the information presented in Problem 7-4, prepare a consolidated financial statements workpaper for the year ended December 31, 2015, using the trial balance format. Prout Company Sexton Company $ 568,000 $ 271,000 Cument Assets Fixed Assets 1

> Prout Company owns 80% of the common stock of Sexton Company. The stock was purchased for $1,600,000 on January 1, 2012, when Sexton Company’s retained earnings were $800,000. On January 1, 2014, Prout Company sold fixed assets to Sexton Company

> On January 1, 2015, P Company purchased equipment from its 80% owned subsidiary for $600,000. The carrying value of the equipment on the books of S Company was $450,000. The equipment had a remaining useful life of six years on January 1, 2015. On Januar

> Pico Company, a truck manufacturer, owns 90% of the voting stock of Seward Company. On January 1, 2014, Pico Company sold trucks to Seward Company for $350,000. The trucks, which represented inventory to Pico Company, had a cost to Pico Company of $260,0

> Powell Company owns 80% of the outstanding common stock of Sullivan Company. On June 30, 2014, Sullivan Company sold equipment to Powell Company for $500,000. The equipment cost Sullivan Company $780,000 and had accumulated depreciation of $400,000 on th

> Padilla Company acquired 90% of the outstanding common stock of Sanchez Company on June 30, 2014, for $426,000. On that date, Sanchez Company had retained earnings in the amount of $60,000, and the fair value of its recorded assets and liabilities was eq

> (This is the same problem as Problem 7-12, but assuming the complete equity method.) Prather Company owns 80% of the common stock of Stone Company. The stock was purchased for $960,000 on January 1, 2012, when Stone Company’s retained

> (Note: This is the same Problem as Problems 7-4 and 7-10, but assuming the use of the complete equity method.) Prout Company owns 80% of the common stock of Sexton Company. The stock was purchased for $1,600,000 on January 1, 2012, when Sexton Company&ac

> Platt Company acquired an 80% interest in Sloane Company when the retained earnings of Sloane Company were $300,000. On January 1, 2014, Sloane Company recorded a $250,000 gain on the sale to Platt Company of equipment with a remaining life of five years

> Padilla Company acquired 90% of the outstanding common stock of Sanchez Company on June 30, 2014, for $426,000. On that date, Sanchez Company had retained earnings in the amount of $60,000, and the fair value of its recorded assets and liabilities was eq

> Miner Company is being forced into bankruptcy. The company’s creditors and stockholders have requested an estimate of the results of a liquidation of the company. Miner’s trial balance follows: The assets are expecte

> Prather Company owns 80% of the common stock of Stone Company. The stock was purchased for $960,000 on January 1, 2012, when Stone Company’s retained earnings were $675,000. On January 1, 2014, Stone Company sold fixed assets to Prather

> Using the information presented in Problem 7-10 prepare a consolidated financial statements workpaper for the year ended December 31, 2015, using the trial balance format. Prout Company Sexton Company $ 568,(00 S 271,000 Current Assets Fixed Asets 1

> Pierce Company acquired a 90% interest in Sanders Company on January 1, 2014, for $1,480,000. At this time, Sanders Company’s common stock and retained earnings balances were $1,000,000 and $500,000, respectively. An examination of the

> On January 1, 2013, Phelps Company purchased an 85% interest in Sloane Company for $955,000 when the retained earnings of Sloane Company were $150,000. The difference between implied and book value was assigned as follows: Inventory â€&brvba

> Parsons Company acquired 90% of the outstanding common stock of Shea Company on June 30, 2014, for $426,000. On that date, Shea Company had retained earnings in the amount of $60,000, and the fair value of its recorded assets and liabilities was equal to

> Pitts Company owns 80% of the common stock of Shannon Company. The stock was purchased for $960,000 on January 1, 2012, when Shannon Company’s retained earnings were $675,000. On January 1, 2014, Shannon Company sold fixed assets to Pit

> Pruitt Corporation owns 90% of the common stock of Sedbrook Company. The stock was purchased for $625,500 on January 1, 2012, when Sedbrook Company’s retained earnings were $95,000. Preclosing trial balances for the two companies at Dec

> Pace Company owns 85% of the outstanding common stock of Sand Company and all the outstanding common stock of Star Company. During 2015, the affiliates engaged in intercompany sales as follows: The following amounts of intercompany profits were include

> Peer Company owns 80% of the common stock of Seacrest Company. Peer Company sells merchandise to Seacrest Company at 25% above its cost. During 2014 and 2015 such sales amounted to $265,000 and $475,000, respectively. The 2014 and 2015 ending inventories

> Use the data provided in Problem 10-5. Required: Prepare a realization and liquidation account for Plum Company to cover the five-month period of receivership (June 1, 2015, to October 31, 2015). Use the alternate approach to present the components of th

> Shell Company, an 85% owned subsidiary of Plaster Company, sells merchandise to Plaster Company at a markup of 20% of selling price. During 2014 and 2015, intercompany sales amounted to $442,500 and $386,250, respectively. At the end of 2014, Plaster had

> Peel Company owns 90% of the common stock of Seacore Company. Seacore Company sells merchandise to Peel Company at 20% above cost. During 2014 and 2015, such sales amounted to $436,000 and $532,000, respectively. At the end of each year, Peel Company had

> Use the information relating to Weber Company and Fairfield Company in Exercise 9-3. Required: Prepare in general journal form the intercompany bond elimination entries for the consolidated statements workpapers prepared on December 31, 2014, December

> Weber Company issued five-year, 10% bonds on January 2, 2014, for 105. Par value is $850,000. Interest is paid semiannually on June 30 and December 31. Weber Company is a 90%-owned subsidiary of Fairfield Company. On December 31, 2014, Fairfield Company

> Refer to the data provided in Exercise 9-1. Required: Prepare in general journal form the intercompany bond elimination entries required in the preparation of the December 31, 2014, December 31, 2015, and December 31, 2016, consolidated statements workpa

> Refer to the data provided in Exercise 9-12. Required: Prepare in general journal form the intercompany bond elimination entries required in the preparation of the December 31, 2013, December 31, 2014, and December 31, 2015, consolidated statements work

> Pacman Company issued 5-year, 8% bonds with a par value of $100,000 on December 31, 2012, for $92,278 (sold to yield 10%). Interest is paid semiannually on June 30th and December 31st. On December 31, 2013, $80,000 of the par value bonds were purchased b

> On January 1, 2014, Perez Company acquired 80% of Serrano Company’s $300,000 par value common stock for $200,000 and 40% of Serrano Company’s 8%, $100,000 par value preferred stock for $86,000. During 2014, Serrano Company reported net income of $80,000

> Pacelli Company issued 10-year, 10% bonds with a par value of $1,000,000 on January 2, 2013, for $940,000. Interest is paid semiannually on June 30 and December 31. On December 31, 2014, $800,000 of the par value bonds were purchased by Salez Company for

> Padilla Company acquired 80% of the outstanding common stock of Skon Company on January 1, 2012, for $132,000. At the date of purchase, Skon Company had a balance in its $2 par value common stock account of $120,000 and retained earnings of $30,000. On

> Plum Company has been in receivership for the past five months. At the beginning of this period, the following trial balance was taken from Plum Company’s books. The trustee, P. Smith, who was appointed to manage the debtorâ

> P Company owns 80% of the outstanding stock of S Company. During 2014, S Company reported net income of $525,000 and declared no dividends. At the end of the year, S Company’s inventory included $487,500 in unrealized profit on purchases from P Company.

> On January 1, 2017, the City of Graf pays $60,000 for a work of art to display in the local library. The city will take appropriate measures to protect and preserve the piece. However, if the work is ever sold, the money received will go into unrestricte

> What are the two fund types within the proprietary funds? What types of events does each report?

> The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally appr

> What are the three categories of funds? What funds are included in each of these three?

> Which of the following statements is correct about the reporting of governmental funds? a. Fund financial statements measure revenues and expenditures based on modified accrual accounting. b. Government-wide financial statements measure revenues and ex

> Which of the following statements is correct about the reporting of governmental funds? a. Fund financial statements measure economic resources. b. Government-wide financial statements measure only current financial resources. c. Fund financial stateme

> A citizen of the City of Townsend makes a donation of $22,000 in investments. The citizen has stipulated that the investments be held. Any resulting income must be used to help maintain the city’s cemetery. In which fund should this asset be reported? a

> Which of the following statements is true? a. There are three different types of proprietary funds. b. There are three different types of fiduciary funds. c. There are five different types of fiduciary funds. d. There are five different types of gove

> The City of Danmark is preparing financial statements. Officials are currently working on the statement of activities within the government-wide financial statements. A question has arisen as to whether a particular revenue should be identified on govern

> Officials for the City of Artichoke, West Virginia, have recently formed a transit authority to create a public transportation system for the community. These same officials are now preparing the city’s CAFR for the most recent year. The transit authorit

> The City of Hampshore is currently preparing financial statements for the past fiscal year. The city manager is concerned because the city encountered some unusual transactions during the current fiscal period and is unsure as to their handling. Require

> A city orders a new computer for its general fund at an anticipated cost of $88,000. Its actual cost when received is $89,400. Payment is subsequently made. Prepare all required journal entries for both fund and government-wide financial statements. What

> The City of Abernethy has three large bridges built in the later part of the 1980s that were not capitalized at the time. In creating government-wide financial statements, the city’s accountant is interested in receiving suggestions as to how to determin

> Search the Internet for the official website of one or more state or local governments. On this website, determine whether the latest comprehensive annual financial report (CAFR) is available. For example, a recent comprehensive annual financial report f

> Obtain a copy of the original version of GASB Statement 34. Read paragraphs 239 through 277. Required Write a report describing alternatives that the GASB considered when it created Statement 34. Indicate the alternative that you would have viewed as m

> The City of Larissa recently opened a solid waste landfill to serve the area’s citizens and businesses. The city’s accountant has gone to city officials for guidance as to whether to record the landfill within the general fund or as a separate enterprise

> Go to the website www.gasb.org and click on “About Us” included in the list that runs across the top of the page. Then click on “Mission, Vision, and Core Values.” Read the information provided by GASB. Required Assume that a financial analyst with who

> Read the following articles and any other papers that are available on setting governmental accounting standards: “The Governmental Accounting Standards Board: Factors Influencing Its Operation and Initial Technical Agenda,” Government Accountants Journa

> Go to the website www.gasb.org and click on “Projects” included in the list that runs across the top of the page. Then click on “Current Projects & Pre-Agenda Research.” Click on one of the current projects that is listed. Read the sections that are titl

> Search the Internet for the official website of one or more state or local governments. After reviewing this website, determine whether the latest comprehensive annual financial report (CAFR) is available on the site. For example, the most recent compreh

> Go to www.phoenix.gov and do a search for the term “CAFR.” Those results should lead to the latest CAFR for the City of Phoenix, Arizona. The financial statements for a state and local government must include a Management’s Discussion and Analysis of the

> Read the following journal article: “25 Years of State and Local Governmental Financial Reporting— An Accounting Standards Perspective,” The Government Accountants Journal, Fall 1992. Or, as an alternative possibility, do a search of books in the college

> The board of commissioners of the City of Hartmoore adopted a general fund budget for the year ending June 30, 2017, that included revenues of $1,000,000, bond proceeds of $400,000, appropriations of $900,000, and operating transfers out of $300,000. If

> At what point in time does a governmental fund report an expenditure?

> A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and pos

> A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and pos

> A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and pos

> A city creates a solid waste landfill. It assesses a charge to every person or company that uses the landfill based on the amount of materials contributed. In which of the following will the landfill probably be recorded? a. General fund. b. Special re

> Which of the following is most likely to be true about the financial reporting of a public college or university? a. It resembles the financial reporting of private colleges and universities. b. It will continue to use its own unique style of financial

> Which of the following is true about the statement of cash flows for the proprietary funds of a state or local government? a. The indirect method of reporting cash flows from operating activities is allowed although the direct method is recommended. b.

> Government-wide financial statements make a distinction between program revenues and general revenues. How is that difference shown? a. Program revenues are offset against the expenses of a specific function; general revenues are assigned to governmenta