Question:

(Note: This is the same problem as Problem 8-4, but assuming use of the complete or the partial equity method.)

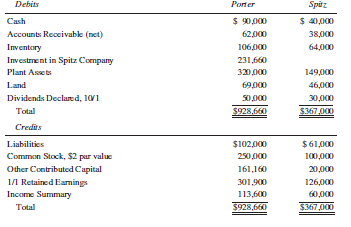

Trial balances for Porter Company and its subsidiary, Spitz Company, as of December 31, 2014, follow:

Porter Company made the following open-market purchase and sale of Spitz Company common stock: January 1, 2010, purchased 45,000 shares for $135,000; May 1, 2014, sold 4,500 shares for $28,000.

The book value of Spitz Company’s net assets on January 1, 2010 was $140,000; the excess of cost over net assets acquired relates to land. Subsequent changes in the book value of Spitz Company’s net assets are entirely attributable to earnings retained in the business. Spitz Company earns its income evenly throughout the year.

Required:

Prepare a consolidated financial statements workpaper as of December 31, 2014. Begin the income statement section of the workpaper with “Net Income before equity in subsidiary Income and Gain on Sale of Investment,†which is $63,200 for Porter Company and $60,000 for Spitz Company.

Transcribed Image Text:

Debits Porter Spüz $ 90,000 $ 40,000 Cash Accounts Rececivabk (net) 62,000 38,000 Inventory 106,000 64,000 Investment in Spitz Company 231,660 Plant Assets 320,000 149,000 Land 69,000 46,000 Dividends Declare d, 101 30,000 Total $928,660 $367,000 Credits Liabilities $102,000 $61,000 Common Stock, $2 par value 250 D00 100,000 Other Contributed Capital 161,160 20,000 1/1 Retained Eamings 301,900 126,000 Income Summary 113,600 60,000 $928,660 $367 000 Total

> What effect does a stock dividend have on the consolidated statements workpaper in the year of declaration? In subsequent periods?

> In what period and in what manner should profits relating to the intercompany sale of merchandise be recognized in the consolidated financial statements?

> P Company owns 80% of the outstanding stock of S Company. The 2015 sales of S Company included revenue of $390,000 consisting of consulting services billed to P Company at cost plus 30%. P Company was billed the full $390,000; of this amount, $260,000 wa

> Cash dividends are viewed as a distribution of the most recent earnings. How are stock dividends viewed?

> In what period and in what manner should profits relating to the intercompany sale of depreciable property and equipment be recognized in the consolidated financial statements?

> What procedure is used in the consolidated statements workpaper to adjust the noncontrolling interest in consolidated net assets at the beginning of the year for the effects of intercompany profits?

> Why is it important to distinguish between upstream and downstream sales in the analysis of intercompany profit eliminations?

> P Company sells inventory costing $100,000 to its subsidiary, S Company, for $150,000. At the end of the current year, one-half of the goods remains in S Company’s inventory. Applying the lower of cost or market rule, S Company writes down this inventory

> Why is the date of acquisition of subsidiary stock important under the purchase method?

> Select the best answer for each of the following: 1. Johnson joined other creditors of Alpha Company in a composition agreement seeking to avoid the necessity of a bankruptcy proceeding against Alpha. Which statement describes the composition agreement?

> What are the duties of a trustee in a liquidation proceeding?

> What is the purpose of a Statement of Affairs?

> For each of the following debt restructurings, indicate whether a gain is recognized and, if so, how the gain is measured and reported. (a) Transfer of assets by the debtor to the creditor. (b) Grant of an equity interest by the debtor to the creditor. (

> Five priority categories of unsecured claims must be paid before general unsecured creditors are paid. Briefly describe what makes up each category.

> Distinguish among fully secured, partially secured, and unsecured claims of creditors.

> Distinguish between a voluntary and involuntary bankruptcy petition.

> What is the purpose of a realization and liquidation account?

> List the primary types of contractual agreements between a debtor company and its creditors and briefly explain what is involved in each of them.

> Under the allocation method followed in this text, how is the noncontrolling interest in consolidated income affected by intercompany bondholdings?

> Identify three types of transactions that result in a change in a parent company’s ownership interest in its subsidiary.

> Give the primary argument(s) in favor of assigning the total gain or loss on constructive bond retirement to the company that issued the bonds.

> Allocating the gain or loss on constructive bond retirement between the purchasing and issuing companies is preferred conceptually. Describe how this allocation would be made.

> The gain or loss on the constructive retirement of debt is recognized subsequently by the individual companies. Explain.

> Define “constructive retirement of debt.” How is the total constructive gain or loss computed?

> Define consolidated retained earnings using the analytical approach.

> Define the controlling interest in consolidated net income using the t-account approach.

> In what circumstances might a consolidated gain be recognized on the sale of assets to a nonaffiliate when the selling affiliate recognizes a loss?

> Define the controlling interest in consolidated net income using the t-account or analytical approach.

> What is the essential procedural difference between workpaper eliminating entries for unrealized intercompany profit made when the selling affiliate is a less than wholly owned subsidiary and those made when the selling affiliate is the parent company or

> From a consolidated point of view, when should profit be recognized on intercompany sales of depreciable assets? Nondepreciable assets?

> A balance sheet for Bran Company on June 30, 2015, the date Jim Brown was appointed trustee, is presented here: The following information concerning the period from June 30, 2015, to December 31, 2015, is also available: 1. All Bran Companyâ€

> Why are adjustments made to the calculation of the noncontrolling interest for the effects of intercompany profit in upstream but not in downstream sales?

> Are the adjustments to the noncontrolling interest for the effects of intercompany profit eliminations illustrated in this text necessary for fair presentation in accordance with generally accepted accounting principles? Explain.

> What is the essential procedural difference between workpaper eliminating entries for unrealized intercompany profit when the selling affiliate is a less than wholly owned subsidiary and such entries when the selling affiliate is the parent company or a

> Why is the gross profit on intercompany sales, rather than profit after deducting selling and administrative expenses, ordinarily eliminated from consolidated inventory balances?

> Does the elimination of the effects of intercompany sales of merchandise always affect the amount of reported consolidated net income? Explain.

> Parson Industries purchased 80% of the common stock of Succo Company on January 1, 2013, for $300,000 when Succo Company’s capital consisted of common stock of $200,000, preferred stock of $100,000, other contributed capital of $50,000, and retained earn

> P Company owns 80% of S Company’s common stock (cost $650,000) and 20% of its preferred stock (cost $50,000). Both interests were acquired on January 1, 2012. On the date of purchase, S Company’s stockholdersâ

> PAL Corporation acquired 40% of the outstanding preferred stock of Saltz, Inc. for $60,000 and 90% of that firm’s outstanding common stock for $600,000 on January 1, 2013. On the date that the controlling interest was acquired, the stoc

> On January 1, 2009, Pabst Company acquired 80% of Secor Company’s common stock and 30% of Secor Company’s 10% preferred stock. Pabst Company paid $680,000 for the common stock and $135,000 for the preferred stock. The

> Prost Company has filed a bankruptcy petition. Its account balances at December 31, 2015, are presented here: The following additional information is available: 1. All notes receivable with the exception of one for $2,500 are expected to be collected.

> Condensed financial information for Prince Company and South Company follows: Prince Company purchased 80% of South Company’s common stock for $1,000,000 at the beginning of 2013 and uses the partial equity method to account for the i

> On January 1, 2013, Pasta Company purchased an 80% interest in Salsa Company for $152,000. On this date, Salsa Company reported capital stock and retained earnings of $100,000 and $90,000, respectively. During 2013, Salsa Company reported net income of $

> Prezo Company purchased 80% of Satz Company’s common stock for $880,000 on January 2, 2012. Condensed financial information for Prezo Company and Satz Company is given below. // On July 1, 2012, Prezo Company purchased 60% of Satz Company’s bonds for $

> Prezo Company purchased 80% of Satz Company’s common stock for $880,000 on January 2, 2014. Condensed financial information for Prezo Company and Satz Company is given below. On July 1, 2014, Prezo Company purchased 60% of Satz Compan

> On January 1, 2009, Pace Corporation issued $500,000 par value, 10-year, 15% bonds. Interest is payable each June 30 and December 31. On January 1, 2012, Supra Corporation, a 90%-owned subsidiary, purchased on the open market all of the parent company bo

> On January 1, 2013, Purdy Company acquired 84% of the capital stock of Sally Company for $840,000. On that date, Sally Company’s stockholders’ equity was: Capital Stock, $20 par $600,000 Other Contributed Capital 200,000 Retained Earnings 160,000 Total $

> Pryor Company acquired 51,000 shares of Spero Company’s common stock on January 1, 2013, for $400,000 when Spero Company had common stock ($5 par) of $300,000 and retained earnings of $200,000. On January 1, 2015, Spero Company issued 7,500 additional s

> On January 1, 2014, Plum Company made an open-market purchase of 30,000 shares of Spivey Company common stock for $122,000. At that time, Spivey Company had common stock ($2 par) of $600,000 and retained earnings of $240,000. On July 1, 2014, an addition

> (Note: This is the same problem as Problem 8-3, but assuming use of the complete or the partial equity method.) The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the followin

> On February 1, 2015, Clover Company filed a petition for reorganization under the bankruptcy statutes. The court approved the plan on September 1, 2015, including the following provisions: 1. Unsecured creditors of open accounts amounting to $71,600 are

> Trial balances for Porter Company and its subsidiary, Spitz Company, as of December 31, 2014, follow: Porter Company made the following open-market purchase and sale of Spitz Company common stock: January 1, 2010, purchased 45,000 shares for $135,000;

> The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2012, purchased 51,000 shares, cost $5

> The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2012, purchased 51,000 shares (85% of

> This is a continuation of Problem 8-14. Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2014, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Requ

> Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2013, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Any difference between implied and book val

> This is a continuation of Problem 8-12. Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2014, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Requ

> Trial balances for Phan Company and its subsidiary Sato Company on December 31, 2013, are as follows: Phan Company acquired its investment in Sato Company through open-market purchases of stock as follows: Any difference between implied and book valu

> The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2014: Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2012, purchased 51,000 shares (85% of

> On January 2, 2013, Pullen Company purchased, on the open market, 135,000 shares of Souza Company common stock for $665,000. At that time, Souza Company had common stock ($2 par value) of $300,000 and retained earnings of $400,000. On May 1, 2014, Pullen

> Sarko Company had 300,000 shares of $10 par value common stock outstanding at all times, and retained earnings balances as indicated here: Pelzer Company acquired Sarko Company stock through open-market purchases as follows: Sarko Company declared no

> A receiver was appointed by the court to manage the affairs of Davis Manufacturing Company on March 31, 2015. On this date, the following balance sheet applied: Additional Information: 1. The cash account includes a $500 travel advance that has been sp

> Using the information presented in Problem 7-4, prepare a consolidated financial statements workpaper for the year ended December 31, 2015, using the trial balance format. Prout Company Sexton Company $ 568,000 $ 271,000 Cument Assets Fixed Assets 1

> Prout Company owns 80% of the common stock of Sexton Company. The stock was purchased for $1,600,000 on January 1, 2012, when Sexton Company’s retained earnings were $800,000. On January 1, 2014, Prout Company sold fixed assets to Sexton Company

> On January 1, 2015, P Company purchased equipment from its 80% owned subsidiary for $600,000. The carrying value of the equipment on the books of S Company was $450,000. The equipment had a remaining useful life of six years on January 1, 2015. On Januar

> Pico Company, a truck manufacturer, owns 90% of the voting stock of Seward Company. On January 1, 2014, Pico Company sold trucks to Seward Company for $350,000. The trucks, which represented inventory to Pico Company, had a cost to Pico Company of $260,0

> Powell Company owns 80% of the outstanding common stock of Sullivan Company. On June 30, 2014, Sullivan Company sold equipment to Powell Company for $500,000. The equipment cost Sullivan Company $780,000 and had accumulated depreciation of $400,000 on th

> Padilla Company acquired 90% of the outstanding common stock of Sanchez Company on June 30, 2014, for $426,000. On that date, Sanchez Company had retained earnings in the amount of $60,000, and the fair value of its recorded assets and liabilities was eq

> (This is the same problem as Problem 7-12, but assuming the complete equity method.) Prather Company owns 80% of the common stock of Stone Company. The stock was purchased for $960,000 on January 1, 2012, when Stone Company’s retained

> (Note: This is the same Problem as Problems 7-4 and 7-10, but assuming the use of the complete equity method.) Prout Company owns 80% of the common stock of Sexton Company. The stock was purchased for $1,600,000 on January 1, 2012, when Sexton Company&ac

> Platt Company acquired an 80% interest in Sloane Company when the retained earnings of Sloane Company were $300,000. On January 1, 2014, Sloane Company recorded a $250,000 gain on the sale to Platt Company of equipment with a remaining life of five years

> Padilla Company acquired 90% of the outstanding common stock of Sanchez Company on June 30, 2014, for $426,000. On that date, Sanchez Company had retained earnings in the amount of $60,000, and the fair value of its recorded assets and liabilities was eq

> Miner Company is being forced into bankruptcy. The company’s creditors and stockholders have requested an estimate of the results of a liquidation of the company. Miner’s trial balance follows: The assets are expecte

> Prather Company owns 80% of the common stock of Stone Company. The stock was purchased for $960,000 on January 1, 2012, when Stone Company’s retained earnings were $675,000. On January 1, 2014, Stone Company sold fixed assets to Prather

> Using the information presented in Problem 7-10 prepare a consolidated financial statements workpaper for the year ended December 31, 2015, using the trial balance format. Prout Company Sexton Company $ 568,(00 S 271,000 Current Assets Fixed Asets 1

> (Note: This is the same Problem as Problem 7-4, but assuming the use of the partial equity method.) Prout Company owns 80% of the common stock of Sexton Company. The stock was purchased for $1,600,000 on January 1, 2012, when Sexton Companyâ€&

> Pierce Company acquired a 90% interest in Sanders Company on January 1, 2014, for $1,480,000. At this time, Sanders Company’s common stock and retained earnings balances were $1,000,000 and $500,000, respectively. An examination of the

> On January 1, 2013, Phelps Company purchased an 85% interest in Sloane Company for $955,000 when the retained earnings of Sloane Company were $150,000. The difference between implied and book value was assigned as follows: Inventory â€&brvba

> Parsons Company acquired 90% of the outstanding common stock of Shea Company on June 30, 2014, for $426,000. On that date, Shea Company had retained earnings in the amount of $60,000, and the fair value of its recorded assets and liabilities was equal to

> Pitts Company owns 80% of the common stock of Shannon Company. The stock was purchased for $960,000 on January 1, 2012, when Shannon Company’s retained earnings were $675,000. On January 1, 2014, Shannon Company sold fixed assets to Pit

> Pruitt Corporation owns 90% of the common stock of Sedbrook Company. The stock was purchased for $625,500 on January 1, 2012, when Sedbrook Company’s retained earnings were $95,000. Preclosing trial balances for the two companies at Dec

> Pace Company owns 85% of the outstanding common stock of Sand Company and all the outstanding common stock of Star Company. During 2015, the affiliates engaged in intercompany sales as follows: The following amounts of intercompany profits were include

> Peer Company owns 80% of the common stock of Seacrest Company. Peer Company sells merchandise to Seacrest Company at 25% above its cost. During 2014 and 2015 such sales amounted to $265,000 and $475,000, respectively. The 2014 and 2015 ending inventories

> Use the data provided in Problem 10-5. Required: Prepare a realization and liquidation account for Plum Company to cover the five-month period of receivership (June 1, 2015, to October 31, 2015). Use the alternate approach to present the components of th

> Shell Company, an 85% owned subsidiary of Plaster Company, sells merchandise to Plaster Company at a markup of 20% of selling price. During 2014 and 2015, intercompany sales amounted to $442,500 and $386,250, respectively. At the end of 2014, Plaster had

> Peel Company owns 90% of the common stock of Seacore Company. Seacore Company sells merchandise to Peel Company at 20% above cost. During 2014 and 2015, such sales amounted to $436,000 and $532,000, respectively. At the end of each year, Peel Company had

> Use the information relating to Weber Company and Fairfield Company in Exercise 9-3. Required: Prepare in general journal form the intercompany bond elimination entries for the consolidated statements workpapers prepared on December 31, 2014, December

> Weber Company issued five-year, 10% bonds on January 2, 2014, for 105. Par value is $850,000. Interest is paid semiannually on June 30 and December 31. Weber Company is a 90%-owned subsidiary of Fairfield Company. On December 31, 2014, Fairfield Company

> Refer to the data provided in Exercise 9-1. Required: Prepare in general journal form the intercompany bond elimination entries required in the preparation of the December 31, 2014, December 31, 2015, and December 31, 2016, consolidated statements workpa

> Refer to the data provided in Exercise 9-12. Required: Prepare in general journal form the intercompany bond elimination entries required in the preparation of the December 31, 2013, December 31, 2014, and December 31, 2015, consolidated statements work

> Pacman Company issued 5-year, 8% bonds with a par value of $100,000 on December 31, 2012, for $92,278 (sold to yield 10%). Interest is paid semiannually on June 30th and December 31st. On December 31, 2013, $80,000 of the par value bonds were purchased b

> On January 1, 2014, Perez Company acquired 80% of Serrano Company’s $300,000 par value common stock for $200,000 and 40% of Serrano Company’s 8%, $100,000 par value preferred stock for $86,000. During 2014, Serrano Company reported net income of $80,000

> Pacelli Company issued 10-year, 10% bonds with a par value of $1,000,000 on January 2, 2013, for $940,000. Interest is paid semiannually on June 30 and December 31. On December 31, 2014, $800,000 of the par value bonds were purchased by Salez Company for

> Padilla Company acquired 80% of the outstanding common stock of Skon Company on January 1, 2012, for $132,000. At the date of purchase, Skon Company had a balance in its $2 par value common stock account of $120,000 and retained earnings of $30,000. On

> Plum Company has been in receivership for the past five months. At the beginning of this period, the following trial balance was taken from Plum Company’s books. The trustee, P. Smith, who was appointed to manage the debtorâ

> P Company owns 80% of the outstanding stock of S Company. During 2014, S Company reported net income of $525,000 and declared no dividends. At the end of the year, S Company’s inventory included $487,500 in unrealized profit on purchases from P Company.

> On January 1, 2017, the City of Graf pays $60,000 for a work of art to display in the local library. The city will take appropriate measures to protect and preserve the piece. However, if the work is ever sold, the money received will go into unrestricte

> What are the two fund types within the proprietary funds? What types of events does each report?

> The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally appr

> What are the three categories of funds? What funds are included in each of these three?