Question: On January 1, 2014, assume that Turner

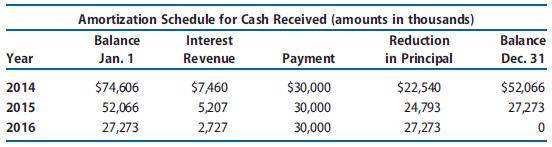

On January 1, 2014, assume that Turner Construction Company agreed to construct an observatory for Dartmouth College for $120 million. Dartmouth College must pay $30 million upon signing and $30 million at the end of 2014, 2015, and 2016. Expected construction costs are $10 million for 2014, $60 million for 2015, and $30 million for 2016. Assume that these cash flows occur at the end of each year. Also assume that an appropriate interest rate for this contract is 10%. Amortization schedules for the deferred cash flows follow.

REQUIRED

a. Indicate the amount and nature of income (revenue and expense) that Turner would recognize during 2014, 2015, and 2016 if it uses the completed-contract method. Ignore income taxes.

b. Repeat Requirement a using the percentage-of-completion method.

c. Repeat Requirement a using the installment method.

d. Indicate the balance in the Construction in Process account on December 31, 2014, 2015, and 2016, (just prior to completion of the contract) under the completed-contract and the percentage-of-completion methods.

Transcribed Image Text:

Amortization Schedule for Cash Received (amounts in thousands) Balance Interest Reduction Balance Year Jan. 1 Revenue Payment in Principal Dec. 31 2014 $74,606 $7 460 $30,000 $22,540 $52,066 2015 52,066 5,207 30,000 24,793 27,273 2016 27,273 2,727 30,000 27,273

> Suppose an analyst reformulates financial statements to prepare the alternative decomposition of ROCE for a firm with no debt. The analyst determines that the company holds excess cash as large marketable equity securities. The result will be net financi

> The chapter states that forecasts of financial statements should rely on the additivity within financial statements and the articulation across financial statements to avoid internal inconsistencies in forecasts. Explain how the concepts of additivity an

> For this exercise, use the preceding data for Schwartz Company. Now assume that Schwartz pays common shareholders a dividend of $25 in Year +1. Also assume that Schwartz uses long-term debt as a flexible financial account, increasing borrowing when it ne

> The following data for Schwartz Company represent a summary of your first-iteration forecast amounts for Year +1. Schwartz uses dividends as a flexible financial account. Compute the amount of dividends you can assume that Schwartz will pay in order to b

> The chapter describes how firms must use flexible financial accounts to maintain equality between assets and claims on assets from liabilities and equities. Chapter 1 describes how some firms progress through different life-cycle stages—from introduction

> Assume Walmart acquires a tract of land on January 1, 2009, for $100,000 cash. On December 31, 2009, the current market value of the land is $150,000. On December 31, 2010, the current market value of the land is $120,000. The firm sells the land on Dece

> Effective financial statement analysis requires an understanding of a firm’s economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.24 pres

> Use the following hypothetical data for Walgreens in Years 11 and 12 to project revenues, cost of goods sold, and inventory for Year þ1. Assume that Walgreens’s Year þ1 revenue growth rate, gross profit mar

> AK Steel is an integrated manufacturer of high-quality steel and steel products in capital-intensive steel mills. AK Steel produces flat-rolled carbon, stainless and electrical steel products, and carbon and stainless tubular steel products for automotiv

> Intel is a global leader in manufacturing microprocessors, which is very capital-intensive. The production processes in microprocessor manufacturing require sophisticated technology, and the technology changes rapidly, particularly with each new generati

> The Home Depot is a leading specialty retailer of hardware and home improvement products and is the second-largest retail store chain in the United States. It operates large warehouse-style stores. Despite declining sales and difficult economic condition

> Walmart Stores, Inc. (Walmart) is the largest retailing firm in the world. Building on a base of discount stores, Walmart has expanded into warehouse clubs and Supercenters, which sell traditional discount store items and grocery products. Exhibits 10.11

> Effective financial statement analysis requires an understanding of a firm’s economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.23 (pag

> Partial forecasts of financial statements for Watson Corporation appear in Exhibit 10.8 (income statement), Exhibit 10.9 (balance sheet), and Exhibit 10.10 (statement of cash flows). Selected amounts have been omitted, as have all totals (indicated by XX

> Barnes & Noble sells books, magazines, music, and videos through retail stores and online. For a retailer like Barnes & Noble, inventory is a critical element of the business, and it is necessary to carry a wide array of titles. Inventories const

> Hasbro designs, manufactures, and markets toys and games for children and adults in the United States and in international markets. Hasbro’s portfolio of brands and products contains some of the most well-known toys and games under famo

> Sony Corporation manufactures and markets consumer electronics products. Assume the following are selected income statement data for 20X1 and 20X2 (amounts in billions of yen): REQUIRED a. Estimate the variable cost as a percentage of sales for the cost

> Visa Inc., a credit card company, reported income tax expense of $1,648 million for Year 1, comprising $1,346 million of current taxes and $302 million of deferred taxes. The balance sheet showed income taxes payable of $122 million at the beginning of Y

> Software companies often bundle upgrades and technical support services with their software. Assume that a software company promises to automatically deliver upgrades for two years when a customer purchases software costing $100. Describe how the softwar

> Using the analytical framework, indicate the effect of each of the three independent sets of transactions described next. (1) a. January 15, 2014: Purchased marketable equity securities for $100,000. b. December 31, 2014: Revalued the marketable securi

> The notes to a firm’s financial statements reveal that the obligations for postretirement health care benefits at the end of 2014 total $2.1 billion. The fair value of plan assets for these benefits at the end of 2014 is reported at zero, with an unrecog

> Pension expense typically consists of five components. Answer the following questions related to each component. a. Service cost: Is it possible for the service cost component to reduce pension expense for the year? Explain your answer. b. Interest cost:

> Using the following key, identify the effects of the following transactions or conditions on the various financial statement elements: I ¼ increases; D ¼ decreases; NE ¼ no effect. Note that the questions per

> Given the following information, compute December 31, 2014, projected benefit obligation (PBO) and fair market value (FMV) of plan assets for Lee Company. What amount of asset or liability will be reported on the balance sheet at December 31, 2014? Pri

> Obtain the latest Form 10-K for Facebook, Inc. (www.investor.fb.com). Locate and describe the significant risks the company identifies. Are any of these unexpected based on your previous familiarity with the company?

> The weighted-average cost-flow assumption is a common technique used to value inventory and determine cost of goods sold. It falls between LIFO and FIFO as to the differential effect on inventory and cost of goods sold amounts, although normally it is mo

> What is a LIFO layer liquidation? How does it affect the prediction of future earnings?

> The acquisition cost of inventory remaining at the end of a period is measured using LIFO, FIFO, or average cost. a. Rank cost of goods sold, gross profit, and ending inventory from highest to lowest under the three cost-flow assumptions when input price

> Assume Boeing sold a 767 aircraft to American Airlines on January 1, 2009. The sales agreement required American Airlines to pay $10 million immediately and $10 million on December 31 of each year for 20 years, beginning on December 31, 2009. Boeing and

> Using the following key, identify the effects of the following transactions or conditions on the various financial statement elements: I ¼ increases; D ¼ decreases; NE ¼ no effect. Assets Liabilities Shareh

> Provide three examples of expense recognition justified by (a) A direct relation with revenue (cause and effect) and (b) An indirect relation with revenue (the consumption of an asset or an increase in a liability during a period in which revenue is re

> Identify the working capital accounts related to (a) Revenues recognized and deferred, (b) Cost of goods sold, (c) Employee salary and wages, and (d) Income tax expense. For each account, indicate whether an increase in the working capital asset or l

> Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for $50,000. b. January 1: Acquired a building costing $35,000, paying $5,000 in cash and borrowing th

> Apply the economic attributes framework discussed in the chapter to the specialty retailing apparel industry, which includes such firms as Gap, Limited Brands, and Abercrombie & Fitch. (Hint: Access Gale’s Business & Company Resource Center, Global Busin

> Three alternative revenue recognition methods are available to long-term contractors when cash inflows are probable: percentage of completion, completed contract, and cost recovery. Assuming that the contract price is known, discuss the appropriate metho

> Revenues are at the core of a firm’s ability to grow and prosper; thus, they are central to the analysis of a firm’s profitability. Although the time-of-sale method is the most common technique employed to recognize revenues, in some instances, a strong

> Altman’s bankruptcy risk model utilizes the values of the variables at a particular point in time (balance sheet variables) or for a period of time (income statement values). An alternative would be to use changes in balance sheet or income statement amo

> Canadian National Railway Company (CN) spans Canada and mid-America and provides freight transport services from the Atlantic Ocean to the Pacific Ocean and to the Gulf of Mexico. It is currently the largest private rail system in Canada and was privatiz

> Sanders Company is a technology consultancy firm. Sanders disclosures in a recent Form 10-K filing provided an extensive discussion of its revenue recognition policies, excerpts of which follow: We recognize revenue from the provision of professional ser

> Lowe’s Companies, a retailer of home improvement products, reported cost of goods sold of $31,729 million for Year 1. It reported merchandise inventories of $7,611 million at the beginning of Year 1 and $8,209 million at the end of Year 1. It reported ac

> DataTech (DT) is a software manufacturer. It develops, markets, and supports software that helps manufacturers improve the competitiveness of their products. DT provides a detailed description of its revenue streams in its SEC 10-K filing, excerpts of wh

> Discuss when each of the following types of businesses is likely to recognize revenues and expenses. a. A bank lends money for home mortgages. b. A travel agency books hotels, transportation, and similar services for customers and earns a commission from

> Excerpts from the disclosures on derivatives made by a large beverage manufacturer in Year 4 appear below: Our Company uses derivative financial instruments primarily to reduce our exposure to adverse fluctuations in interest rates and foreign exchange r

> Kentucky Gold (KG) holds 10,000 gallons of whiskey in inventory on October 31, 2013, that costs $225 per gallon. KG contemplates selling the whiskey on March 31, 2014, when it completes the aging process. Uncertainty about the selling price of whiskey on

> Lynn Construction enters into a firm purchase commitment for equipment to be delivered on June 30, 2013, for a price of 10,000 GBP. It simultaneously signs a forward foreign exchange contract for 10,000 GBP. The forward rate on June 30, 2013, for settlem

> The following information relates to a firm’s pension plan. Prior service cost due to 2013 amendment................ $ 60,000 PBO, January 1, 2013................................................ 1,000,000 FMV, January 1, 2013.............................

> Market equity beta measures the covariability of a firm’s returns with all shares traded on the market (in excess of the risk-free interest rate). We refer to the degree of covariability as systematic risk. The market prices securities so that the expect

> A large manufacturer of truck and car tires recently changed its cost flow assumption method for inventories at the beginning of 2014. The manufacturer has been in operation for almost 40 years, and for the last decade it has reported moderate growth in

> Deere & Company manufactures agricultural and industrial equipment and provides financing services for its independent dealers and their retail customers. In Note 2 to its October 31, 2012, 10K, Deere discloses the following revenue recognition policy: S

> Caterpillar manufactures heavy machinery and equipment and provides financing for purchases by its customers. Caterpillar reported sales and interest revenues of $51,324 million for Year 1. The balance sheet showed current and noncurrent receivables of $

> Assume that a company needs to acquire a large special-purpose materials handling facility. Given that no outside vendor exists for this type of facility and that the company has available engineering, management, and productive capacity, the company bor

> The three types of costs incurred in oil production are acquisition costs (costs to acquire the oil fields, minus the cost of the land, plus the present value of future cash flows necessary to restore the site), exploration costs (costs of drilling), and

> When a firm incurs costs on an item to be used in operations, management must decide whether to treat the cost as an asset or an expense. Assume that a company used cash to acquire machinery expected to contribute to the generation of revenues over a thr

> Identify the exchange rates used to translate income statement and balance sheet items when the foreign currency is defined as the functional currency. Discuss the logic for the use of the exchange rates you identified.

> Choosing the functional currency is a key decision for translating the financial statements of foreign entities of U.S. firms into U.S. dollars. Qing Corporation, a U.S. firm that sells car batteries, formed a wholly owned subsidiary in Mexico to manufac

> Some accounting theorists propose that firms should consolidate any entity in which they have a ‘‘controlling financial interest.’’ Typically, the percentage of equity ownership that one firm has in another entity determines whether consolidation is appr

> Prepaid Legal Services (PPD) is a company that sells insurance for legal expenses. Customers pay premiums in advance for coverage over some specified period. Thus, PPD obtains cash but has unearned revenue until the passage of time over the specified per

> Altman’s bankruptcy prediction model places a coefficient of 3.3 on the earnings before interest and taxes divided by total assets variable but a coefficient of only 1.0 on the sales to total assets variable. Does this mean that the earnings variable is

> U.S. GAAP requires firms to account for equity investments in which ownership is between 20% and 50% using the equity method. Ace Corporation owns 35% of Spear Corporation during 2014. Spear Corporation reported net income of $100.4 million for 2014 and

> Firms invest in marketable securities for a variety of reasons. One of the most common reasons is to temporarily invest excess cash. Securities that qualify for the available for sale reporting classification are accounted for differently from those that

> The acquisition of equipment by assuming a mortgage is a transaction that firms cannot report in their statement of cash flows but must report in a supplemental schedule or note. Of what value is information about this type of transaction? What is the re

> Often the application of the acquisitions method entails establishing one or more acquisition reserves. Define an acquisition reserve, provide several examples of such reserves, and discuss how the quality of accounting information can be diminished as a

> Not every acquisition results in goodwill reported in the consolidated balance sheet. Describe the valuation procedures followed by the acquiring firms to determine whether any goodwill should be recorded as a result of an acquisition and the circumstanc

> Earnings management entails managers using judgment and reporting estimates in such a way as to alter reported earnings to their favor. a. Discuss the three factors that must be estimated in measuring depreciation. b. Provide an illustration as to how ea

> Goodwill is an intangible asset that firms report on their balance sheets as a result of acquiring other firms. Goodwill generally has an indefinite life and should not be amortized, but should be tested for impairment at least annually. Describe the pro

> In practice, very few firms capitalize costs of developing computer software. However, U.S. GAAP requires that firms capitalize (and subsequently amortize) development costs once the ‘‘technological feasibility’’ stage of a product is reached. Review the

> U.S. GAAP requires firms to expense immediately all internal expenditures for R&D costs. Alternatively, U.S. GAAP could require firms to capitalize and subsequently amortize all internal expenditures on R&D that have future potential. Why have standard s

> Nonrelated scenarios for Hammerhead Paper Company and Sterling Company follow: Scenario 1: Hammerhead Paper Company owns a press used in the production of fine paper products. The press originally cost $2,000,000, and it has a current carrying amount of

> Exhibit 8.24 presents selected financial statement data for three chemical companies: Monsanto Company, Olin Corporation, and New Market Corporation. (New Market was formed from a merger of Ethyl Corporation and Afton Chemical Corporation.). REQUIRED a

> In what sense is the interest coverage ratio more a measure for assessing short-term liquidity risk than it is a measure for assessing long-term solvency risk?

> The financial statements of ABC Corporation, a retail chain, reveal the information for income taxes shown in Exhibit 2.15. REQUIRED a. Assuming that ABC had no significant permanent differences between book income and taxable income, did income before

> One reason companies use stock options to compensate employees is to conserve cash. Under current tax law, companies get to deduct compensation when the employees actually exercise options. Explain how the cash flow savings from stock option exercises af

> Alpha Computer Systems (ACS) designs, manufactures, sells, and services networked computer systems; associated peripheral equipment; and related network, communications, and software products. Exhibit 8.35 presents geographic segment data. ACS conducts s

> Refer to Problem 8.25 for Stebbins Corporation for Year 1, its first year of operations. Exhibit 8.34 shows the amounts for the Canadian subsidiary for Year 2. The average exchange rate during Year 2 was C$1: US$0.82, and the exchange rate on December 31

> Stebbins Corporation established a wholly owned Canadian subsidiary on January 1, Year 1, by contributing US$500,000 for all of the subsidiary’s common stock. The exchange rate on that date was C$1: US$0.90 (that is, one Canadian dollar

> Foreign Sub is a wholly owned subsidiary of U.S. Domestic Corporation. U.S. Domestic Corporation acquired the subsidiary several years ago. The financial statements for Foreign Sub for 2014 in its own currency appear in Exhibit 8.32. The exchange rates

> Exhibit 8.29 presents the separate financial statements at December 31, 2015, of Prestige Resorts and its 80%-owned subsidiary Booking, Inc. Two years earlier on January 1, 2014, Prestige acquired 80% of the common shares of Booking for $1,170 million in

> On December 31, 2014, Pace Co. paid $3,000,000 to Sanders Corp. shareholders to acquire 100% of the net assets of Sanders Corp. Pace Co. also agreed to pay former Sanders shareholders $200,000 in cash if certain earnings projections were achieved over th

> Molson Coors Brewing Company (Molson Coors) is the fifth-largest brewer in the world. It is one of the leading brewers in the United States and Canada; the company’s brands include Coors, Molson Canadian, Carling, and Killian’s Irish Red. Molson and Adol

> Ormond Co. acquired all of the outstanding common stock of Daytona Co. on January 1, 2014. Ormond Co. gave shares of its common stock with a fair value of $312 million in exchange for 100% of the Daytona Co. common stock. Daytona Co. will remain a legall

> Lexington Corporation acquired all of the outstanding common stock of Chalfont, Inc., on January 1, 2013. Lexington gave shares of its no par common stock with a market value of $504 million in exchange for the Chalfont common stock. Chalfont will remain

> Identify the assumptions underlying the interest coverage ratio needed to make it an appropriate measure for analyzing long-term solvency risk.

> The statement of cash flows classifies changes in accounts payable as an operating activity but classifies changes in short-term borrowing as a financing activity. Explain this apparent paradox.

> SunTrust Banks, Inc., owns a large block of The Coca-Cola Company (Coke) common stock that it has held for many years. SunTrust indicates in a note to its financial statements that all equity securities held by the bank, including its investment in Coke

> Components of the deferred tax asset of Biosante Pharmaceuticals, Inc., are shown in Exhibit 2.14. The company had no deferred tax liabilities. REQUIRED a. At the end of 2008, the largest deferred tax asset is for net operating loss carryforwards. (Net

> Bed and Breakfast (B&B), an Italian company operating in the Tuscany region, follows IFRS and has made the choice to remeasure long-lived assets at fair value. B&B purchased land in 2013 for €150,000. At December 31 of the next four years, the land is wo

> Assume that on December 31, 2013, The Coca-Cola Company borrows money from a consortium of banks by issuing a $900 million promissory note. The note matures in four years on December 31, 2017, and pays 3% interest once a year on December 31. The consorti

> Identify where the cash flow effect of each of the following transactions is reported in the statement of cash flows: operating, investing, or financing section. State the direction of each change. State none if there is no cash flow effect. a. Issuance

> Following is the shareholders’ equity section of All-Wood Doors on a day its common stock is trading at $130 per share. Common stock ($2 par value, 40,000 shares issued and outstanding) $ 80,000 Additional paid-in capital on common stoc

> Assume that a start-up manufacturing company raises capital through a series of equity issues. a. Using the financial statement template below, summarize the financial statement effects of the following transactions. Identify the account affected and use

> Describe the directional effect (increase, decrease, or no effect) of each transaction on the components of the book value of common shareholders’ equity shown in the chart below. a. Issuance of $1 par value common stock at an amount gr

> Financial reporting classifies derivatives as (a) Speculative investments, (b) Fair value hedges, or (c) Cash flow hedges. However, firms revalue all derivatives to market value each period regardless of the firm’s reason for acquiring the derivatives

> Historically, technology firms have been the most aggressive users of stock-based compensation in the form of stock options granted to almost all employees of the firms. What is the rationale for offering stock options as compensation? Why has this form

> Under U.S. GAAP, the statement of cash flows classifies cash expenditures for interest expense on debt as an operating activity but classifies cash expenditures for dividends to shareholders as a financing activity. Explain this apparent paradox.

> Combined data for three years for two firms follows (in millions). One of these firms is Amazon.com, a rapidly growing Internet retailer, and the other is Kroger, a retail grocery store chain growing at approximately the same rate as the population. Iden

> Disclosures related to income taxes for The Coca-Cola Company (Coca-Cola) for 2006–2008 appear in Exhibit 9.13. REQUIRED a. Why are Coca-Cola’s average tax rates so low? b. Is it likely that Coca-Cola has recognized

> The financial statements of Nike, Inc., reveal the information regarding income taxes shown in Exhibit 2.17. REQUIRED a. Assuming that Nike had no significant permanent differences between book income and taxable income, did income before taxes for fina

> ‘‘They don’t just sell coffee; they sell the Starbucks Experience,’’ remarked Deb Mills while sitting down to enjoy a cup of Starbucks cappuccino with her friend K

> In Example 2.8 (below), we discussed the recent increase in world demand for copper, due in part to China’s rising consumption. a.Using the original elasticities of demand and supply (i.e. ES = 1.5 and ED = –0.5), cal

> By observing an individual’s behavior in the situations outlined below, determine the relevant income elasticities of demand for each good (i.e., whether the good is normal or inferior).If you cannot determine the income elasticity, what additional infor