Question:

‘‘They don’t just sell coffee; they sell the Starbucks Experience,’’ remarked Deb Mills while sitting down to enjoy a cup of Starbucks cappuccino with her friend Kim Shannon. Kim, an investment fund manager for a large insurance firm, reflected on that observation and what it might mean for Starbucks as a potential investment opportunity. Glancing around the store, Kim saw a number of people sitting alone or in groups, lingering over their drinks while chatting, reading, or checking e-mail and surfing the Internet through the store’s Wi-Fi network. Kim noted that in addition to the wide selection of hot coffees, French and Italian style espressos, teas, and cold coffee blended drinks, Starbucks also offered food items and baked goods, packages of roasted coffee beans, coffee-related accessories and equipment, and even its own line of CDs. Intrigued, Kim made a mental note to do a full financial statement and valuation analysis of Starbucks to evaluate whether its business model and common equity shares were as good as their coffee.

Growth Strategy

Kim’s research quickly confirmed her friend’s observation that Starbucks is about the experience of enjoying a good cup of coffee. The Starbucks 2012 Form 10-K asserts the following: Our retail objective is to be the leading retailer and brand of coffee in each of our target markets by selling the finest quality coffee and related products, and by providing each customer a unique Starbucks Experience. The Starbucks Experience is built upon superior customer service as well as clean and well-maintained company operated stores that reflect the personalities of the communities in which they operate, thereby building a high degree of customer loyalty.

The Starbucks experience strives to create a ‘‘third place’’—somewhere besides home and work where a customer can feel comfortable and welcome—through friendly and skilled customer service in clean and personable retail store environments. This approach enabled Starbucks to grow rapidly from just a single store near Pike’s Place Market in Seattle to a global company with 18,066 locations worldwide at the end of fiscal 2012. Of that total, Starbucks owned and operated 9,405 stores (7,857 stores in the Americas; 882 stores in the Europe, Middle East & Africa (EMEA) region; and 666 stores in the China and Asia Pacific (CAP) region). In addition, licensees owned and operated a total of 8,661 stores (5,046 stores in the Americas; 987 stores in the EMEA region; and 2,628 stores in the CAP region).

Most of Starbucks’ stores at the end of fiscal 2012 were located in the United States, amounting to one Starbucks retail location for every 28,000 U.S. residents. However, Starbucks was clearly not a company content to focus simply on the U.S. market, as it was extending the reach of its stores globally, with thousands of stores outside the United States. At the end of fiscal 2012, Starbucks owned and operated stores in a number of countries around the world, including 878 stores in Canada, 593 stores in the United Kingdom, and 408 stores in China.

Starbucks’ success can be attributed in part to its successful development and expansion of European idea—enjoying a fine coffee-based beverage and sharing that experience with others in a comfortable, friendly environment with pleasant, competent service. Starbucks imported the idea of the French and Italian cafe´ into the busy North American lifestyle. Ironically, Starbucks successfully extended its brand and style of a cafe´ into the European continent. On January 16, 2004, Starbucks opened its first coffeehouse in France—in the heart of Paris at26 Avenue de l’Opera—and had a total of 67 stores in France by the end of 2012. The success of Starbucks’ retail coffeehouse concept is illustrated by the fact that by the end of 2012, Starbucks had opened over 1,100 company-operated and licensed locations in Europe, with the majority of them in the United Kingdom…………

REQUIRED

Respond to the following questions relating to Starbucks.

Industry and Strategy Analysis

a. Apply Porter’s five forces framework to the specialty coffee retail industry.

b. How would you characterize the strategy of Starbucks? How does Starbucks create value for its customers? What critical risk and success factors must Starbucks manage? Balance Sheet

c. Describe how ‘‘cash’’ differs from ‘‘cash equivalents.’’

d. Why do investments appear on the balance sheet under both current and noncurrent assets?

e. Accounts receivable are reported net of allowance for uncollectible accounts. Why? Identify the events or transactions that cause accounts receivable to increases and decrease. Also identify the events or transactions that cause the allowance account to increase and decrease.

f. How does accumulated depreciation on the balance sheet differ from depreciation expense on the income statement?

g. Deferred income taxes appear as a current asset on the balance sheet. Under what circumstances will deferred income taxes give rise to an asset?

h. Accumulated other comprehensive income includes unrealized gains and losses from marketable securities and investments in securities as well as unrealized gains and losses from translating the financial statements of foreign subsidiaries into U.S. dollars. Why are these gains and losses not included in net income on the income statement? When, if ever, will these gains and losses appear in net income?

income statement

i. Starbucks reports three principal sources of revenues:

(1) Company-operated stores,

(2) Licensing, and

(3) Foodservice and other consumer products. Using the narrative information provided in this case, describe the nature of each of these three sources of revenue.

j. What types of expenses does Starbucks likely include in

(1) Cost of sales,

(2) Occupancy costs, and

(3) Store operating expenses?

k. Starbucks reports income from equity investees on its income statement. Using the narrative information provided in this case, describe the nature of this type of income.

Statement of Cash Flows

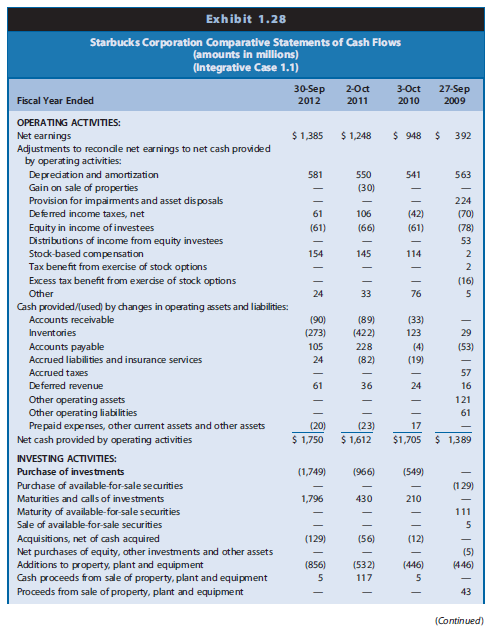

l. Why does net income differ from the amount of cash flow from operating activities?

m. Why does Starbucks add the amount of depreciation and amortization expense to net income when computing cash flow from operating activities?

n. Why does Starbucks show an increase in inventory as a subtraction when computing cash flow from operations?

o. Why does Starbucks show a decrease in accounts payable as a subtraction when computing cash flow from operations?

p. Starbucks includes short-term investments in current assets on the balance sheet, yet it reports purchases and sales of investment securities as investing activities on the statement of cash flows. Explain why changes in investment securities are investing activities while changes in most other current assets (such as accounts receivable and inventories) are operating activities.

q. Starbucks includes changes in short-term borrowings as a financing activity on the statement of cash flows. Explain why changes in short-term borrowings are a financing activity when most other changes in current liabilities (such as accounts payable and other current liabilities) are operating activities. Relations between financial statements

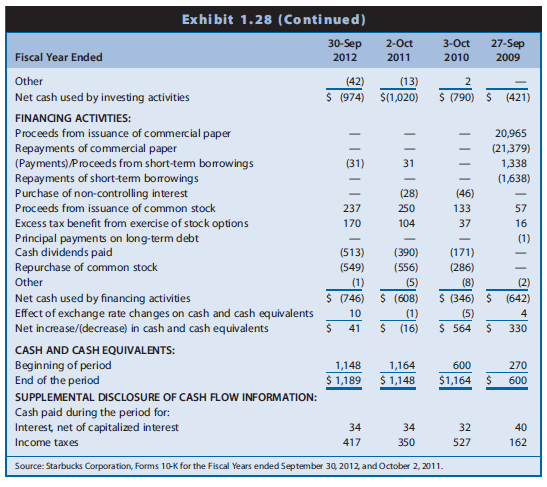

r. Prepare an analysis that explains the change in retained earnings from $4,297 at the end of fiscal 2011 to $5,046 at the end of fiscal 2012.

s. Prepare an analysis that explains the changes in property, plant, and equipment from $6,163 at the end of fiscal 2011 to $6,903 at the end of fiscal 2012 and accumulated depreciation from $3,808 at the end of fiscal 2011 to $4,244 at the end of fiscal 2012. You may need to deduce certain amounts that Starbucks does not disclose. For simplicity, assume that all of the depreciation and amortization expense is depreciation.

Interpreting Financial Statement Relations

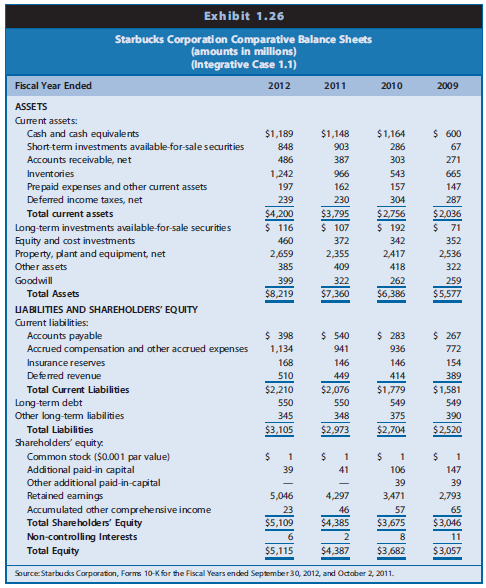

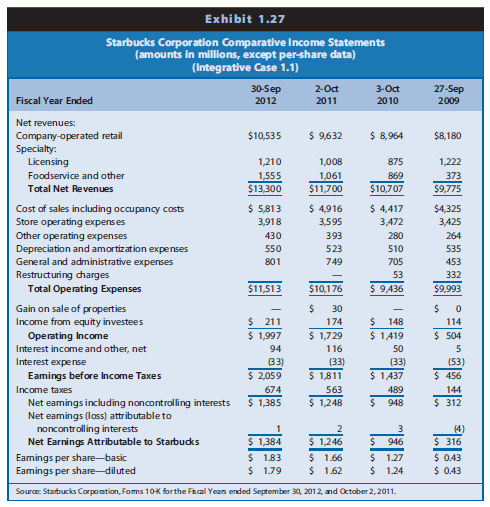

Exhibit 1.29 presents common-size and percentage change balance sheets and Exhibit 1.30 (page 81) presents common-size and percentage change income statements for Starbucks for 2009–2012. The percentage change statements report the annual percentage change in each account from 2010 through 2012. Respond to the following questions.

t. The dollar amount shown for cash and cash equivalents (see Exhibit 1.26) increased between the end of fiscal 2011 and the end of fiscal 2012, yet the percentage of total assets comprising these assets declined (see Exhibit 1.29). Explain.

u. From 2009 through 2012, the proportion of total liabilities declined while the proportion of shareholders’ equity increased. What are the likely explanations for these changes?

v. How has the revenue mix of Starbucks changed from 2009 to 2012? Relate these changes to Starbucks’ business strategy.

w. Net earnings as a percentage of total revenues increased from 3.2% in fiscal 2009 to 10.4% in fiscal 2012. Identify the most important reasons for this change.

Transcribed Image Text:

Exhibit 1.26 Starbucks Corporati on Comparative Balance Sheets (amounts in millions) (Integrative Case 1.1) Fiscal Year Ended 2012 2011 2010 2009 ASSETS Current assets: Cash and cash equivalents $1,189 $1,148 $1,164 $ 600 Short-term investments available-for-sale securities 848 903 286 67 Accounts receivable, net 486 387 303 271 Inventories 1,242 966 543 665 Prepaid expenses and other current assets Deferred income taxes, net 197 162 157 147 239 230 304 287 $4,200 $3,795 $ 107 Total current assets $2,756 $2,036 Long-term investments available-for-sale securities Equity and cost investments Property, plant and equipment, net Other assets $ 116 $ 192 $ 71 460 372 342 352 2,659 2,355 2,417 2,536 385 409 418 322 Goodwill 399 322 262 259 Total Assets $8,219 $7,360 $6,386 $5,577 UABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued compensation and other acarued expenses $ 398 $ 540 $ 283 $ 267 1,134 941 936 772 Insurance reserves 168 146 146 154 Deferred revenue 510 449 414 389 Total Current liabilities $2,210 $2,076 $1,779 $1,581 Long-term debt Other long-term liabilities 550 550 549 549 345 348 375 390 Total Liabilities $3,105 $2,973 $2,704 $2,520 Shareholders' equity. Common stock ($0.001 par value) Additional paid-in capital Other additional paid-in-capital Retained eamings 1 1 $ 1 1 39 41 106 147 39 39 5,046 4,297 3,471 2,793 Accumulated other comprehensive income Total Shareholders' Equity 23 $5,109 46 57 65 $4,385 $3,675 $3,046 Non-controlling Interests 2 8. 11 Total Equity $5,115 $4,387 $3,682 $3,057 Source: Starbucks Corporation, Forms 10-Kfor the Fiscal Years ended September30, 2012, and October 2, 2011. Exhibit 1.27 Starbucks Corporation Comparative Income Statements (amounts in millions, except per-share data) (Integrative Case 1.1) 30-Sep 2-Oct 3-Oct 27-Sep Fiscal Year Ended 2012 2011 2010 2009 Net revenues: Company-operated retail Specialty: Licensing Foodservice and other $10,535 $ 9,632 $ 8,964 $8,180 1,210 1,008 875 1,222 1,555 1,061 869 373 Total Net Revenues $13,300 $11,700 $10,707 $9,775 $ 4,916 3,595 $ 4,417 3472 $4,325 Cost of sales including occupancy costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring charges $ 5,813 3,918 3,425 430 393 280 264 550 523 510 535 801 749 705 453 53 332 Total Operating Expenses $11,513 $10,176 $ 9,436 $9,993 Gain on sale of properties Income from equity investees 30 $ 211 $ 1,997 174 148 114 $ 1,729 $ 1419 $ 504 Operating Income Interest income and other, net 94 116 50 Interest expense 33) (33) (33) (53) Eamings before Income Taxes $ 2,059 $ 1,811 $ 1,437 $ 456 Income taxes 674 563 489 144 $ 1,385 $ 1,248 $ 312 Net eamings including noncontrolling interests Net eamings (loss) attributable to noncontrolling interests Net Earnings Attributable to Starbucks 948 2 (4) $ 1,384 $ 1,246 $ 1.66 $ 1.62 946 $ 316 Eamings per share-basic Eamings per share-diluted $ 1.83 $ 1.79 $ 1.27 $ 1.24 $ 043 $ 0.43 Source Starbucks Corpostion, Foms 10K for the Fscal Yeas ended September 30, 2012, and October 2,2011. Exhibit 1.28 Starbucks Corporation Comparative Statements of Cash Flows (amounts in millions) (Integrative Case 1.1) 30-Sep 2012 2-0ct 2011 3-Oct 27-Sep 2009 Fiscal Year Ended 2010 OPERATING ACTIMITIES: $ 1,385 $1,248 $ 948 Net earnings Adjustments to reconaile net earnings to net cash provided by operating activities: Deprediation and amortization Gain on sale of properties Provision for impaiments and asset disposals Deferred income taxes, net Equity in income of investees Distributions of income from equity investees Stock-based compensation Tax benefit from exercise of stock options Excess tax benefit from exerdise of stock options 392 581 550 541 563 (30) 224 61 106 (42) (70) (61) (66) (61) (78) 53 154 145 114 2 2 (16) Other 24 33 76 5 Cash provided/(used) by changes in oprating assets and liabilities: Accounts receivable (90) (89) (33) (422) 228 Inventories (273) 123 29 Accounts payable 105 (4) (53) Accrued liabilities and insurance services 24 (82) (19) Accrued taxes 57 Deferred revenue 61 36 24 16 Other operating assets 121 Other operating liabilities Prepaid expenses, other current assets and other assets 61 (20) (23) 17 Net cash provided by operating activities $ 1,750 $ 1,612 $1,705 $ 1,389 INVESTING ACTIVITIES: Purchase of investments (1,749) (966) (549) Purchase of available-for-sale securities (1 29) Maturities and calls of investments 1,796 430 210 Maturity of available-for-sale securities Sale of available-for-sale securities 111 5 Acquisitions, net of cash acquired Net purchases of equity, other investments and other assets Additions to pr operty, plant and equipment Cash proceeds from sale of property, plant and equipment Proceeds from sale of property, plant and equipment (129) (56) (12) (5) (856) (532) (446) (446) 5 117 5 43 (Continued) Exhibit 1.28 (Continued) 2-Oct 3-Oct 27-Sep 30-Sep 2012 Fiscal Year Ended 2011 2010 2009 Other (42) (13) 2 Net cash used by investing activities $ (974) $(1,020) $ (790) $ (421) FINANCING ACTIMTIES: Proceeds from issuance of commercial paper Repayments of commercial paper (Payments)/Proceeds from short-tem borrowings Repayments of short-tem borrowings Purchase of non-controlling interest 20,965 (21,379) 1,338 (1,638) (31) 31 - (28) (46) Proceeds from issuance of common stock 237 250 133 57 Excess tax benefit from exercise of stock options Principal payments on long-term debt Cash dividends paid 170 104 37 16 (1) (513) (390) (171) Repurchase of common stock (549) (556) (286) Other (1) (5) (8) (2) $ (746) $ (608) $ (346) $ (642) Net cash used by financing activities Effect of exchange rate changes on cash and cash equivalents Net increase/(decrease) in cash and cash equivalents 10 (1) (16) (5) $ 564 4 41 330 CASH AND CASH EQUIVALENTS: Beginning of period End of the period 1,148 $ 1,189 1,164 $ 1,148 600 270 $1,164 600 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the period for: Interest, net of capitalized interest 34 34 32 40 Income taxes 417 350 527 162 Source: Starbucks Corporation, Forms 10-K for the Fiscal Years ended September 30, 2012, and October 2, 2011.

> Disclosures related to income taxes for The Coca-Cola Company (Coca-Cola) for 2006–2008 appear in Exhibit 9.13. REQUIRED a. Why are Coca-Cola’s average tax rates so low? b. Is it likely that Coca-Cola has recognized

> The financial statements of Nike, Inc., reveal the information regarding income taxes shown in Exhibit 2.17. REQUIRED a. Assuming that Nike had no significant permanent differences between book income and taxable income, did income before taxes for fina

> In Example 2.8 (below), we discussed the recent increase in world demand for copper, due in part to China’s rising consumption. a.Using the original elasticities of demand and supply (i.e. ES = 1.5 and ED = –0.5), cal

> By observing an individual’s behavior in the situations outlined below, determine the relevant income elasticities of demand for each good (i.e., whether the good is normal or inferior).If you cannot determine the income elasticity, what additional infor

> Describe the indifference curves associated with two goods that are perfect substitutes.What if they are perfect complements?

> At the beginning of the twentieth century, there were many small American automobile manufacturers.At the end of the century, there were only three large ones.Suppose that this situation is not the result of lax federal enforcement of antimonopoly laws.H

> What is an endowment effect?Give an example of such an effect.

> In 1983, the Reagan Administration introduced a new agricultural program called the Payment-in-Kind Program.To see how the program worked, let’s consider the wheat market. a.Suppose the demand function is QD = 28 – 2P and the supply function is QS = 4 +

> Explain which of the following items in each pair is more price elastic. a. The demand for a specific brand of toothpaste and the demand for toothpaste in general b. The demand for gasoline in the short run and the demand for gasoline in the long run

> Judy has decided to allocate exactly $500 to college textbooks every year, even though she knows that the prices are likely to increase by 5 to 10 percent per year and that she will be getting a substantial monetary gift from her grandparents next year.W

> What does it mean to say that a person is risk averse?Why are some people likely to be risk averse while others are risk lovers?

> The owner of a small retail store does her own accounting work.How would you measure the opportunity cost of her work?

> Refer to Example 2.10 (below), which analyzes the effects of price controls on natural gas. a.Using the data in the example, show that the following supply and demand curves describe the market for natural gas in 2005 – 2007: Supply:

> Suppose the economy takes a downturn, and that labor costs fall by 50 percent and are expected to stay at that level for a long time.Show graphically how this change in the relative price of labor and capital affects the firm’s expansion path.

> Which of the following three groups is likely to have the most, and which the least, price-elastic demand for membership in the Association of Business Economists? a.students b. junior executives c. senior executives

> Why would a firm that incurs losses choose to produce rather than shut down?

> Suppose that the average household in a state consumes 800 gallons of gasoline per year.A 20-cent gasoline tax is introduced, coupled with a $160 annual tax rebate per household.Will the household be better or worse off under the new program?

> For which of the following goods is a price increase likely to lead to a substantial income (as well as substitution) effect? a. salt b. housing c. theater tickets d. food

> Which of the following events would cause a movement along the demand curve for U.S. produced clothing, and which would cause a shift in the demand curve? a. the removal of quotas on the importation of foreign clothes b. an increase in the income of U.S

> The government passes a law that allows a substantial subsidy for every acre of land used to grow tobacco.How does this program affect the long-run supply curve for tobacco?

> Explain why an MRS between two goods must equal the ratio of the price of the goods for the consumer to achieve maximum satisfaction.

> Suppose that a consumer spends a fixed amount of income per month on the following pairs of goods: a. tortilla chips and salsa b. tortilla chips and potato chips c. movie tickets and gourmet coffee d.travel by bus and travel by subway If the price of

> Why is the variance a better measure of variability than the range?

> a. Fill in the blanks in the table on page 262 of the textbook. b.Draw a graph that shows marginal cost, average variable cost, and average total cost, with cost on the vertical axis and quantity on the horizontal axis. FIXED UNITS OF OUTPUT VARIABLE

> Which of the following combinations of goods are complements and which are substitutes?Can they be either in different circumstances?Discuss. a.a mathematics class and an economics class b.tennis balls and a tennis racket c.steak and lobster d.a plane t

> The price of DVDs (D) is $20 and the price of CDs (C) is $10.Philip has a budget of $100 to spend on the two goods.Suppose that he has already bought one DVD and one CD.In addition there are 3 more DVDs and 5 more CDs that he would really like to buy. a

> Each week, Bill, Mary, and Jane select the quantity of two goods, X1 and X2, that they will consume in order to maximize their respective utilities.They each spend their entire weekly income on these two goods. a.Suppose you are given the following infor

> Suppose the demand curve for a product is given by Q = 300 – 2P + 4I, where I is average income measured in thousands of dollars.The supply curve is Q = 3P – 50. a.If I = 25, find the market clearing price and quantity for the product. b.If I = 50, find

> Draw a utility function over income u(I) that describes a man who is a risk lover when his income is low but risk averse when his income is high.Can you explain why such a utility function might reasonably describe a person’s preferences?

> Of the following production functions, which exhibit increasing, constant, or decreasing returns to scale? a. F(K, L) = K2 L b. F(K, L) = 10K + 5L c. F(K, L) = (KL).5

> Jennifer is shopping and sees an attractive shirt.However, the price of $50 is more than she is willing to pay.A few weeks later, she finds the same shirt on sale for $25 and buys it.When a friend offers her $50 for the shirt, she refuses to sell it.Expl

> What is the difference between economic profit and producer surplus?

> Explain why two indifference curves cannot intersect.

> A firm pays its accountant an annual retainer of $10,000.Is this an economic cost?

> If a firm enjoys economies of scale up to a certain output level, and cost then increases proportionately with output, what can you say about the shape of the long-run average cost curve?

> a. Orange juice and apple juice are known to be perfect substitutes.Draw the appropriate price-consumption curve (for a variable price of orange juice) and incomeconsumption curve. b.Left shoes and right shoes are perfect complements.Draw the appropriate

> What happens to the marginal rate of substitution as you move along a convex indifference curve?A linear indifference curve?

> Janelle and Brian each plan to spend $20,000 on the styling and gas mileage features of a new car.They can each choose all styling, all gas mileage, or some combination of the two.Janelle does not care at all about styling and wants the best gas mileage

> If Jane is currently willing to trade 4 movie tickets for 1 basketball ticket, then she must like basketball better than movies.True or false?Explain.

> In a discussion of tuition rates, a university official argues that the demand for admission is completely price inelastic.As evidence, she notes that while the university has doubled its tuition (in real terms) over the past 15 years, neither the number

> Explain why the industry supply curve is not the long-run industry marginal cost curve.

> Suppose that Bridget and Erin spend their incomes on two goods, food (F) and clothing (C).Bridget’s preferences are represented by the utility function U(F,C)=10FC, while Erin’s preferences are represented by the utility function U(F,C)= 20F2C2. a.With f

> A recent issue of Business Week reported the following: During the recent auto sales slump, GM, Ford, and Chrysler decided it was cheaper to sell cars to rental companies at a loss than to lay off workers.That’s because closing and reopening plants is e

> Why do some investors put a large portion of their portfolios into risky asset, while others invest largely in risk-free alternatives?

> What does it mean for consumers to maximize expected utility?Can you think of a case in which a person might not maximize expected utility?

> In 2007, Americans smoked 19.2 billion packs of cigarettes.They paid an average retail price of $4.50 per pack. a. Given that the elasticity of supply is 0.5 and the elasticity of demand is –0.4, derive linear demand and supply curves for cigarettes. b.

> Jon is always willing to trade one can of Coke for one can of Sprite, or one can of Sprite for one can of Coke. a. What can you say about Jon’s marginal rate of substitution? b. Draw a set of indifference curves for Jon. c. Draw two budget lines with dif

> Suppose an investor is concerned about a business choice in which there are three prospects, the probability and returns are given below: Probability………………Return 0.4…………...$100

> Suppose that an individual allocates his or her entire budget between two goods, food and clothing.Can both goods be inferior?Explain.

> Upon merging with the West German economy, East German consumers indicated a preference for Mercedes-Benz automobiles over Volkswagens.However, when they converted their savings into deutsche marks, they flocked to Volkswagen dealerships.How can you expl

> What is the difference between economies of scale and returns to scale?

> A competitive firm has the following short-run cost function: C(q)= q3 −8q2 +30q+5. a.Find MC, AC, and AVC and sketch them on a graph. b. At what range of prices will the firm supply zero output? c. Identify the firm’s supply curve on your graph. d. At w

> Two individuals, Sam and Barb, derive utility from the hours of leisure (L) they consume and from the amount of goods (G) they consume.In order to maximize utility, they need to allocate the 24 hours in the day between leisure hours and work hours.Assume

> Joe quits his computer programming job, where he was earning a salary of $50,000 per year, to start .He opens his own computer software business store in a building that he owns and was previously renting out for $24,000 per year.In his first year of bus

> If a 3-percent increase in the price of corn flakes causes a 6-percent decline in the quantity demanded, what is the elasticity of demand?

> Explain why for many goods, the long-run price elasticity of supply is larger than the short-run elasticity.

> An increase in the demand for video films also increases the salaries of actors and actresses.Is the long-run supply curve for films likely to be horizontal or upward sloping?Explain.

> What is the difference between a production function and an isoquant?

> In this chapter, consumer preferences for various commodities did not change during the analysis.Yet in some situations, preferences do change as consumption occurs.Discuss why and how preferences might change over time with consumption of these two comm

> Suppose the government regulates the prices of beef and chicken and sets them below their market-clearing levels.Explain why shortages of these goods will develop and what factors will determine the sizes of the shortages.What will happen to the price of

> Draw indifference curves that represent the following individuals’ preferences for hamburgers and soft drinks.Indicate the direction in which the individuals’ satisfaction (or utility) is increasing. a.Joe has convex preferences and dislikes both hamburg

> Suppose that the Japanese yen rises against the U.S. dollar – that is, it will take more dollars to buy any given amount of Japanese yen.Explain why this increase simultaneously increases the real price of Japanese cars for U.S. consumers and lowers the

> A certain brand of vacuum cleaners can be purchased from several local stores as well as from several catalogue or website sources. a.If all sellers charge the same price for the vacuum cleaner, will they all earn zero economic profit in the long run? b.

> Faced with constantly changing conditions, why would a firm ever keep any factors fixed?What criteria determine whether a factor is fixed or variable?

> Suppose the price of regular-octane gasoline were 20 cents per gallon higher in New Jersey than in Oklahoma.Do you think there would be an opportunity for arbitrage (i.e., that firms could buy gas in Oklahoma and then sell it at a profit in New Jersey)?W

> Is the firm’s expansion path always a straight line?

> Explain the difference between a shift in the supply curve and a movement along the supply curve.

> How can a price ceiling make consumers better off?Under what conditions might it make them worse off?

> Use supply and demand curves to illustrate how each of the following events would affect the price of butter and the quantity of butter bought and sold: a.An increase in the price of margarine. b.An increase in the price of milk. c.A decrease in average

> What is meant by deadweight loss?Why does a price ceiling usually result in a deadweight loss?

> The price of long-distance telephone service fell from 40 cents per minute in 1996 to 22 cents per minute in 1999, a 45-percent (18 cents/40 cents) decrease.The Consumer Price Index increased by 10 percent over this period.What happened to the real price

> Suppose you are in charge of a toll bridge that costs essentially nothing to operate.The demand for bridge crossings Q is given by P=15− 1/2 Q. a.Draw the demand curve for bridge crossings. b.How many people would cross the bridge if there were no toll?

> What is a production function?How does a long-run production function differ from a short-run production function?

> Why is an insurance company likely to behave as if it were risk neutral even if its managers are risk-averse individuals?

> Why does a tax create a deadweight loss?What determines the size of this loss?

> Fill in the gaps in the table below. Quantity of Variable Input Marginal Product of Variable Input Average Product of Variable Input Total Output 1 225 300 300 1140 225 225 2.

> The burden of a tax is shared by producers and consumers.Under what conditions will consumers pay most of the tax?Under what conditions will producers pay most of it?What determines the share of a subsidy that benefits consumers?

> Suppose the government wants to limit imports of a certain good.Is it preferable to use an import quota or a tariff?Why?

> You know that if a tax is imposed on a particular product, the burden of the tax is shared by producers and consumers.You also know that the demand for automobiles is characterized by a stock adjustment process.Suppose a special 20-percent sales tax is s

> At the time this book went to print, the minimum wage was $5.85.To find the current value of the CPI, go to http://www.bls.gov/cpi/home.htm.Click on Consumer Price Index- All Urban Consumers (Current Series) and select U.S. All items.This will give you t

> Why are isocost lines straight lines?

> Can a set of indifference curves be upward sloping?If so, what would this tell you about the two goods?

> How does a change in the price of one input change the firm’s long-run expansion path?

> Suppose the government wants to increase farmers’ incomes.Why do price supports or acreage-limitation programs cost society more than simply giving farmers money?

> Jane always gets twice as much utility from an extra ballet ticket as she does from an extra basketball ticket, regardless of how many tickets of either type she has.Draw Jane’s income-consumption curve and her Engel curve for ballet tickets.

> Are the following statements true or false?Explain your answers. a.The elasticity of demand is the same as the slope of the demand curve. b.The cross-price elasticity will always be positive. c.The supply of apartments is more inelastic in the short run

> Jane receives utility from days spent traveling on vacation domestically (D) and days spent traveling on vacation in a foreign country (F), as given by the utility function U(D,F) = 10DF.In addition, the price of a day spent traveling domestically is $10

> Antonio buys five new college textbooks during his first year at school at a cost of $80 each.Used books cost only $50 each.When the bookstore announces that there will be a 10 percent increase in the price of new books and a 5 percent increase in the pr

> The menu at Joe’s coffee shop consists of a variety of coffee drinks, pastries, and sandwiches.The marginal product of an additional worker can be defined as the number of customers that can be served by that worker in a given time period.Joe has been em

> The domestic supply and demand curves for hula beans are as follows: Supply:P = 50 + Q Demand:P = 200 – 2Q where P is the price in cents per pound and Q is the quantity in millions of pounds.The U.S. is a small producer in the world hula bean market, whe

> What are the four basic assumptions about individual preferences?Explain the significance or meaning of each.

> A vegetable fiber is traded in a competitive world market, and the world price is $9 per pound.Unlimited quantities are available for import into the United States at this price.The U.S. domestic supply and demand for various price levels are shown as fo

> Suppose a firm must pay an annual tax, which is a fixed sum, independent of whether it produces any output. a.How does this tax affect the firm’s fixed, marginal, and average costs? b. Now suppose the firm is charged a tax that is proportional to the num

> You are an employer seeking to fill a vacant position on an assembly line.Are you more concerned with the average product of labor or the marginal product of labor for the last person hired?If you observe that your average product is just beginning to de

> a. Suppose that a firm’s production function is q= 9x1/2 in the short run, where there are fixed costs of $1000, and x is the variable input whose cost is $4000 per unit.What is the total cost of producing a level of output q?In other words, identify the

> Example 9.5 describes the effects of the sugar quota.In 2005, imports were limited to 5.3 billion pounds, which pushed the domestic price to 27 cents per pound.Suppose imports were expanded to 10 billion pounds. a.What would be the new U.S. domestic pri

> When is it worth paying to obtain more information to reduce uncertainty?

> Why do long-run elasticities of demand differ from short-run elasticities? Consider two goods: paper towels and televisions.Which is a durable good?Would you expect the price elasticity of demand for paper towels to be larger in the short run or in the l

> In Example 9.1, we calculated the gains and losses from price controls on natural gas and found that there was a deadweight loss of $5.68 billion.This calculation was based on a price of oil of $50 per barrel. a.If the price of oil were $60 per barrel, w

> Among the tax proposals regularly considered by Congress is an additional tax on distilled liquors.The tax would not apply to beer.The price elasticity of supply of liquor is 4.0, and the price elasticity of demand is –0.2.The cross-elasticity of demand